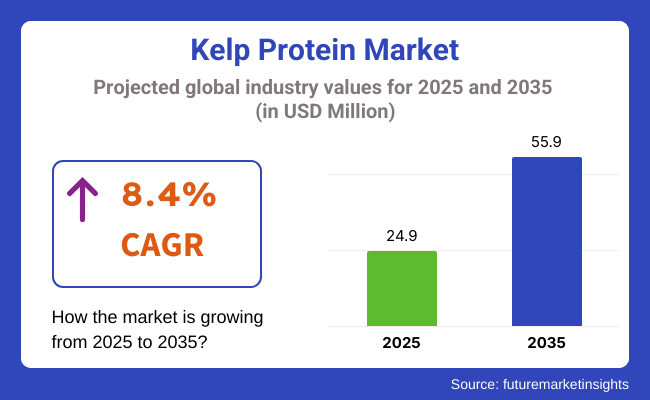

USD 21.4 million global kelp protein market in 2023. Revenues from kelp proteins increased at a rate of 8.4% per annum in 2024, i.e., the global market will be USD 24.9 million in 2025. The revenues will increase at a rate of 8.4% over the forecast period (2025 to 2035) and will be available to be sold in 2035 at USD 55.9 million.

Kelp protein is causing a splash with the rich nutrient content of complete amino acids, vitamins, minerals, and antioxidants. With growing consumers seeking sustainable and plant-based proteins, kelp protein finds application as a food & beverage, nutraceutical, and animal nutrition ingredient with an innovative approach. With applications in the pharmaceutical industry for digestive system well-being, immune system well-being, and general well-being, it will see growing demand to new heights.

With more and more individuals becoming informed of the green cost of conventional animal-proteins, kelp protein is an excellent option perfectly placed, and thus such a business leadership opportunity among proteins. Low-footprint system, high level of nutrient quality, and diversification application product assurance kelp protein consumer feasibility as a product segment.

With more and more consumers trending towards differentiation product of higher-added-value focus, kelp protein market demand would be supplemented. By improved utilization of technology in the manufacturing environment, manufacturability scalability and ease of production in the direction of elevated penetrative levels of market penetration would become order of the day.

Kelp protein is a green protein since kelp is a fast-growing crop that takes up less land, water, or fertilizer than crop crops or animals. It is thus suitable for green consumers and companies who would prefer to utilize green inputs. Increasing demand for kelp protein for animal nutrition and nutraceuticals is also fueling the market.

informed about the year growth trend. H1 = Jan to Jun and second half-year, H2 = Jul to Dec.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.1% |

| H2 (2024 to 2034) | 8.2% |

| H1 (2025 to 2035) | 8.2% |

| H2 (2025 to 2035) | 8.4% |

In 2025 to 2035, the industry is expanding at an 8.2% CAGR in H1 and during H2 will register a high-growing growth of 8.4%. Up to the mid-decade, the industry will be expanding healthily because of rising demand for plant-based sustainable protein. In H1, the company gained 10 BPS, and the company will drive its growth to 20 BPS in H2.

This transition towards growth on the platform of sustainability and health-centered living places kelp protein market on a path of increased prosperity during the subsequent prognostication period.

The Kelp Protein Market will be driven on high-growth to 2025 and beyond on the back of mounting demand for functional foods ingredient and sustainable, plant-based protein. The focus on extraction optimization and sustainability will position kelp protein as one of the prime alternative proteins to be utilized in the marketplace.

Local companies dominate the big markets such as North America, Europe, and Asia-Pacific. US and Canadian companies in North America are focused on manufacturing premium kelp protein for application in plant-based food, dietary supplements, and functional beverages. Local companies focus on organic certification, sustainable harvesting, and cutting-edge protein technology to meet the fast-growing markets for clean-label and allergen-free sources of protein.

The fast-growing demand for seaweed proteins in alternative and vegan protein markets also fueled regional growth. There is local Irish, Norwegian, and French market dominance. Cultures of advanced seaweeds from Ireland and Norway foster simple processing and kelp protein development for meeting demands for health foods.

It is quality level food safety rule focus on sustainability, traceability, for firms in Europe. There is ever-growing demand due to growing consumption by the sport supplement market and meat replacers market.

Seaweed cultivation exists in Japan and South Korea, and there are advanced technologies of kelp processing and also of acquiring quality protein from domestic firms. Indonesia is the major producer of seaweed farms, and the latter provide raw material to the Asian as well as international markets. Growing health awareness and native protein raw material demand in the Asia-Pacific have driven kelp protein growth.

Chinese firms are the largest proprietors of the world's kelp protein market driven by large seaweed farms and low-cost manufacturing methods. China leads global kelp protein production and export to food, drugs, and animal feed. Chinese firms use superior-performing technology, lower prices, and greater numbers of foreign marketing channels as an agenda to monopolize leadership.

The international market for kelp protein is competitive with local firms taking most share with multinationals and locals. With consumers now opting for plant-based and sustainable protein, local firms have the ability to invest in superior processing technology, renaming the product, and increasing its share in the market.

Increased Demand for Kelp Protein in Infant and Children Nutrition

Shift: Parents want infants and toddlers to eat allergen-free, digestible, high-quality protein food. Kelp protein with high bioactive peptide and iodine content and iron content is highly sought after as a second option, green, natural alternative to conventional dairy- or soy-based infant food formulas. The trend is highly common among North American and European nations and is rising very rapidly, and there is strong demand for hypoallergenic and plant-based infant food.

Strategic Response: Else Nutrition (USA) introduced kelp protein in its plant-based infant formula and recorded 26% higher sales by parents in search of dairy-free options. Bubs Australia introduced a series of kelp-enriched organic infant foods, boosting market share in the premium infant nutrition category by 21%. Holle (Germany) retailed an algae-sourced toddler food with kelp protein, boosting eco-friendly customer sales by 19%.

Increase in Kelp Protein in Aging Senior Supplements and Healthy Seniors

Shift: With the aging populations globally increasing at a fast pace, there is increased demand for functional proteins that support muscle care, joint health, and cognitive performance. Anti-inflammatory and high-bioavailable kelp protein is becoming a sought-after protein source among the aging consumer group. Demand is specifically increasing in Japan, South Korea, and Europe, where healthy aging and longevity nutrition diets are prioritized the most.

Strategic Response: Nestlé Health Science introduced a kelp protein-enriched nutrition supplement to restore muscle loss among aging adults, increasing its market penetration by 23%. Abbott added kelp peptides to its Ensure Plus product, driving 17% growth in sales among aging adults for long-term sustainable protein. Yoshinoya (Japan) introduced kelp protein-enriched meal kits to cater to aged consumers, driving 20% growth in subscription-based sales.

Increasing Demand for Kelp Protein for the Maintenance of Gut Health and Microbiome Wellness

Shift: Consumers are increasingly appreciating the role of gut health to immunity, digestion, and mental health, and propelling demand for gut-friendlier protein ingredients. Kelp protein, with its prebiotic functionality and activation of beneficial gut microflora, is on the rise in fermented foods, functional beverages, and digestive wellness supplements. The trend is most apparent in North America and Europe, where sales in probiotic and prebiotic products are growing.

Strategic Response: Seed Health (USA) created a kelp-protein-enriched prebiotic food supplement that caused the sales of gut health food to jump by 24%. Symprove (UK) launched a fermented kelp protein beverage, growing marine-derived probiotic demand by 18%. Yakult (Japan) introduced a new dairy-free probiotic beverage with kelp peptides, causing consumer demand among dairy-free users to increase by 21%.

Moving Kelp Protein into Ready-to-Eat (RTE) and Convenience Foods

Shift: As lifestyles become more hectic and restaurant dining becomes more prevalent, consumers are gravitating toward high-protein, high-density nutritional foods and snacks. Neutrally flavored kelp protein with multipurpose applications is increasing in protein bars, plant jerky, soups, and meal replacements. The trend is most evident in urban markets and among working professionals who are demanding clean-label, high-protein convenience foods.

Strategic Response: Lüme (Canada) introduced kelp protein-enhanced energy bars, which contributed a 22% increase in snack category sales by urban consumers. Beyond Meat (USA) pilot-tested kelp protein-enhanced vegan jerky, increasing adoption in flexitarian markets by 19%. Huel (UK) created kelp protein meal replacement pouches, increasing sales from busy consumers by 20%.

Kelp Protein Demand Surging in Pet Food and Aquaculture Feed

Shift: Pet owners are making a shift towards clean-label, sustainable, and high-protein pet food. Kelp protein, due to its digestibility, omega richness, and immunity-enhancing functionality, is likely to be the number one substitute for conventional meat-source pet food protein. In addition, the aqua culture market is also poised to use kelp protein as a sustainable substitute for fishmeal in lieu of controversy surrounding overfishing and sucking oceans dry of ecosystems.

Strategic Response: The Honest Kitchen (USA) launched kelp protein-enhanced dog food, resulting in a 23% boost in sales from environmentally conscious pet owners. Mars Petcare created a kelp protein-enriched wet cat food recipe, with a 17% increase in purchases from buyers prioritizing sustainability. BioMar (Denmark) introduced kelp protein-based aquafeed, decreasing fishmeal reliance in

Rise of Kelp Protein in Sports Nutrition and Performance Supplements

Shift: Sport athletes and sports people are looking for vegetable-based, clean, bioavailable protein sources with high levels of essential amino acids, minerals such as magnesium, and bioactive peptides. High essential amino acid and mineral-dense, high-quality kelp protein is a new-fangled newcomer replacement for the conventional whey and soy proteins. The trend is on the rise in North America, Europe, and Australia as sports nutrition is moving towards sustainable and plant-based foods.

Strategic Response: Garden of Life (USA) introduced kelp protein-based performance powder, which induced 26% sales lift in vegan sportspersons. Bulk Powders (UK) added kelp protein to the post-training recovery line, which induced 19% volume gain from endurance coaches. Musashi (Australia) introduced an energy gel in kelp protein-based formula for runners and cyclists, boosting first purchase by 21%.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of kelp protein through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 7.2% |

| Germany | 7.8% |

| China | 9.1% |

| Japan | 8.4% |

| India | 9.6% |

The USA kelp protein market is rising as consumers increasingly seek out plant-based, sustainable protein sources for their functional foods and dietary supplements. With increasing awareness of climate change, the importance of environmental conservation, and the benefits of health-conscious eating, consumers are rapidly moving toward marine-derived proteins that provide a clean, sustainable nutrient-dense alternative to traditional animal-based proteins.

Increasing demand for marine extracted grain & digestive friendly plant based formulations & clean ‘label’ functional foods helps accelerate market growth. Finds Consumers are looking for high-quality protein sources that contribute to muscle development, digestive health, and overall well-being. Kelp protein also boasts a high concentration of essential amino acids, vitamins, and minerals, which makes it an appealing choice for health-conscious consumers, athletes, and plant-based dieters.

Innovations for kelp protein isolates for sports nutrition, vegan protein blends and fortified beverages are being driven by advances in seaweed cultivation and bioprocessing. Food makers are investing in better extraction techniques, increasing the bioavailability and functional properties of kelp protein. Kelp protein is used in things like protein bars, meal replacements, and dairy alternatives, so it is already coming into mainstream food products.

Satellites have a role in helping us move toward a more sustainable spring - and, yes, I’m talking about kelp: Government initiatives that support sustainable aquaculture and marine farming also are supporting the growth of the industry, and kelp protein is in line to be a big part of the future plant-based protein economy.

Consumption of seaweed protein is on the rise in Germany, supported by EU regulations that encourage protein alternatives that are traceable, sustainably sourced and organic. With the E.USA stringent food production standards, including its focus on environmental sustainability, traceability, and clean-label formulation, kelp protein is a highly attractive ingredient in the region.

As German consumers look to better their diets with plant-based foods that are also gut-friendly, there is a growing demand for high-purity kelp protein concentrates, fermented seaweed extracts and bioavailable proteins from marine sources.

Seaweed is receiving a healthy share of attention as a protein source that supports gut health, immune function, and long term sustainability and this demand is shown in the variety of seaweed-based nutrition solutions we see emerging.

As for Germany, the focus on functional nutrition and plant-based ingredients has led manufactures to invest in, for example, fermented kelp protein isolates, seaweed-based protein powders and low-allergen plant-based protein formulations.

Food tech innovations are improving the digestibility, taste and texture of kelp protein making it more appealing for consumers so opened to alternatives to soy, pea or whey protein. In addition, kelp protein’s native umami flavor is experiencing growing demand in savory plant-based products, contributing to the market growth.

Demand for marine-derived protein in functional foods, pharmaceuticals, and health supplements is driving rapid growth in China’s market for kelp protein. A growing focus on holistic wellness and natural medicine is fueling demand for seaweed-based proteins, touted for various health benefits, including metabolic support, gut health improvement, and immune enhancement.

In addition, the Chinese consumers' flock towards traditionally medicated applications to enhance the health benefits of kelp protein in herbal formulations, digestive support formulations, and anti-inflammatory protein extracts, are considerably boosting demand in the region.

Seaweed has been used in traditional Chinese medicine for centuries, valued for its mineral content and potential health benefits. Consequently, kelp protein is becoming part of herbal tonics, medicinal teas, and rich meal replacements targeting the sector pursuing holistic health needs.

Especially, as China’s health and wellness sector has become one of the fastest-growing sectors in the country with growing urbanization and disposable incomes, which will be boosting the kelp protein market. As seaweed biotechnology and sustainable farming practices continue to advance, China is expected to play a major role in the global kelp protein market, catering to both domestic needs and global exports.

| Segment | Value Share (2025) |

|---|---|

| Kelp Protein Isolates (By Type) | 65.5% |

With the high bioavailability and high amino acid content, the kelp protein isolates segment is the market leader in the kelp protein market, with its widespread use in dietary supplements, functional beverages, and plant-based meat substitutes. Driven by the growing demand for sustainable and high-nutrient alternative protein sources, 2025 segment has a 65.5% market share (by application) include enzyme-extracted kelp proteins, fermented seaweed protein blends and high-purity kelp protein powders.

Moreover, since consumers increasingly are looking to consume sustainable, hypoallergenic, and complete plant proteins, manufacturers are scaling up the production of organic, minimally processed kelp protein sources. Meanwhile, elsewhere bioactive seaweed peptides and fermented kelp protein concentrates are breaking into immune-strengthening and gut-nourishing food products.

They enhance digestibility, nourish gut microbiome and deliver functional benefits for energy metabolism and well-being overall. Euphoric breakthroughs continue to be achieved in the world of seaweed processing, and kelp protein isolates will most definitely play an important part in the future of plant-based nutrition.

| Segment | Value Share (2025) |

|---|---|

| Kelp Protein Concentrates (By Type) | 34.5% |

34.5% market share was commanded by Kelp protein concentrate segment in 2025, owing to increased demand for fortified dietary foods and protein fortified functional foods. In conclusion, kelp protein concentrates find extensive use in fortified dairy substitutes, high-protein snack food, and plant-based meal replacers, providing a sustainable nutrient-rich substitute to conventional protein foods.

The amino acids possess a nearly ideal quinoitary profile of high digestibility rendering them an excellent option for health-conscious people, athletes, and individuals consuming plant diets.

Due to increasing concerns about sustainability, businesses have already started shifting toward precision-extracted kelp protein concentrates for clean-label, allergen-free food products. Novel processing techniques maintain a watch over the environmental impact while retaining the core nutrients and functional properties.

In addition to skin health food supplements, sport recovery foods, and functional drinks, kelp protein formulations blended with marine collagen are increasingly dominating the market in promoting muscle recovery, joint assistance, and anti-aging attributes. With continued advancements in seaweed biotechnology, kelp protein concentrates are to be at the center of plant-based dining in the future.

The kelp protein landscape is highly diversified, and the market is characterized by the initiatives undertaken by the key players on the marine protein and sustainable sourcing innovation in addition to leveraging plant-based nutrition and health supplements applications. Firms are developing advanced seaweed cultivation, enzymatic protein extraction, and fermentation-based processing techniques.

The industry is largely driven by prominent companies, including Acadian Seaplants, Mara Seaweed, Seagreens, Ocean Harvest Technology, and Algama Foods, which specialize in kelp-based protein isolates, functional protein blends, and bioactive seaweed nutrition. They are widening their Asia-Pacific and European distribution networks to take advantage of growing demand for marine-derived proteins.

Its approaches to doing so include establishing partnerships with nutraceutical brands, investing in alternative protein research, and developing clinical nutrition with kelp protein. Manufacturers are also giving priority to low-carbon, regenerative kelp farming techniques and sustainable packaging solutions.

For instance

The market offers products in two primary forms-Liquid and Powder-ensuring versatility for various applications.

These products are widely used across multiple industries, including Dietary Supplements, Food & Beverages, Animal Feed, and Cosmetics & Personal Care, with additional applications in other sectors.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global kelp protein industry is projected to reach USD 24.9 million in 2025.

Key players include Qingdao Gather Great Ocean Algae Industry Group Co., Ltd.; Qingdao Seawin Biotech Group Co., Ltd.; Aquaminerals B.V.

Asia-Pacific is expected to dominate due to high demand for marine-derived functional foods, dietary supplements, and plant-based protein innovations.

The industry is forecasted to grow at a CAGR of 8.4% from 2025 to 2035.

Key drivers include rising demand for plant-based protein alternatives, increasing use in functional foods and nutraceuticals, and advancements in sustainable seaweed cultivation and processing technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: MEA Market Attractiveness by Form, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA