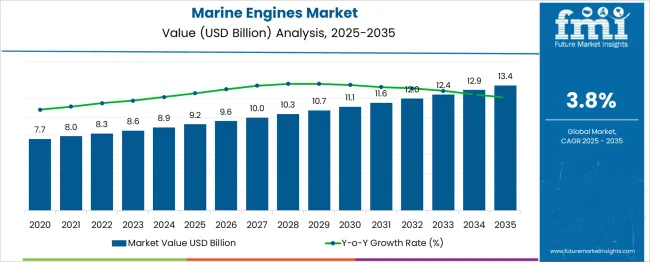

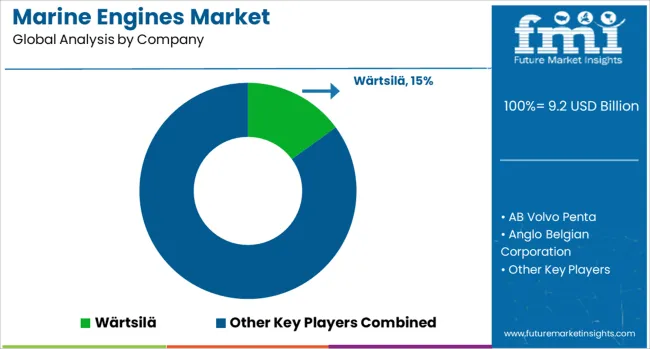

The Marine Engines Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Marine Engines Market Estimated Value in (2025 E) | USD 9.2 billion |

| Marine Engines Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The marine engines market is witnessing steady growth, fueled by rising global maritime trade, increasing vessel modernization programs, and stringent emission norms driving demand for efficient propulsion technologies. Fleet expansions across commercial shipping, naval defense, and offshore oil and gas operations are contributing to sustained demand for reliable marine power systems.

The integration of digital monitoring, condition-based maintenance, and automation has further accelerated investment in advanced engine platforms. In parallel, regulatory frameworks such as IMO Tier III and decarbonization initiatives are reshaping propulsion technology selection, favoring engines compatible with cleaner fuels and hybrid configurations.

Shipbuilders and operators are increasingly aligning procurement strategies with lifecycle efficiency, fuel flexibility, and operational range requirements, which is expected to support continued growth across both OEM and retrofit markets.

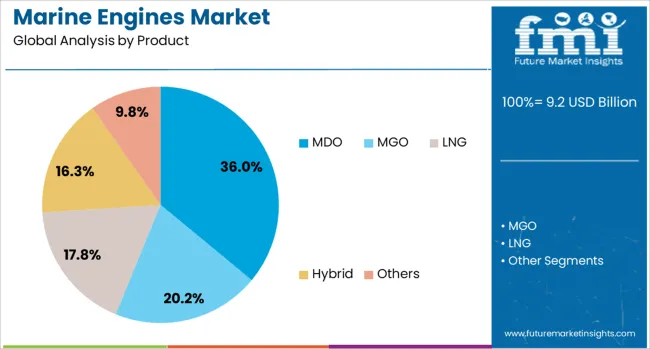

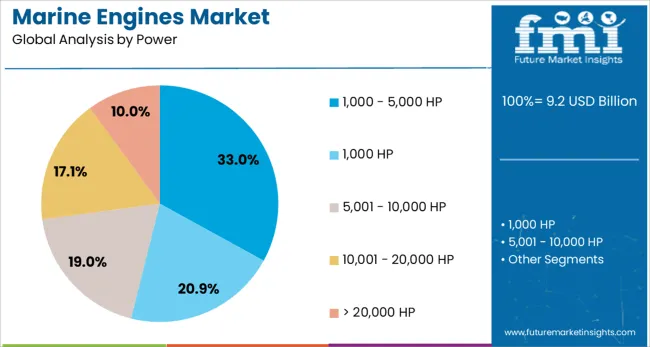

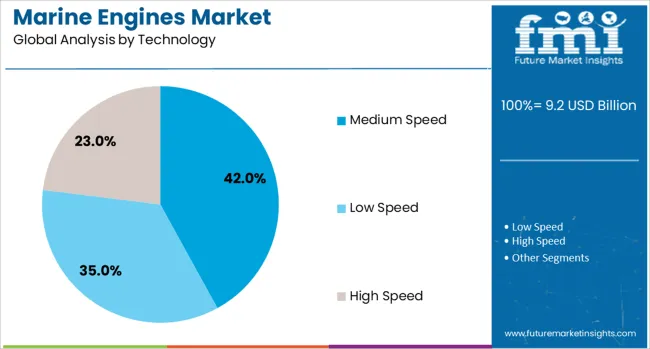

The marine engines market is segmented by product, power, technology, propulsion application, and geographic regions. The marine engines market is divided into MDO, MGO, LNG, Hybrid, and Others. In terms of power of the marine engines market is classified into 1,000 - 5,000 HP, 1,000 HP, 5,001 - 10,000 HP, 10,001 - 20,000 HP> 20,000 HP. The marine engines market is segmented into Medium Speed, Low Speed, and High Speed. The propulsion of the marine engines market is segmented into two-stroke. The marine engines market is segmented into Merchant, Offshore, Cruise & Ferry, Navy, and Others. Regionally, the marine engines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Marine diesel oil (MDO) is projected to account for 36.0% of total market revenue in 2025, making it the leading product segment. This position is being supported by MDO’s balance between performance, availability, and compliance with evolving emission standards.

Its lower sulfur content relative to heavy fuel oil aligns with international regulatory demands, particularly in emission control areas (ECAs). MDO also enables flexible engine tuning, offering smoother operations for medium and high-speed applications.

The fuel’s wide compatibility across different engine platforms has increased its adoption in both commercial and auxiliary marine vessels. Additionally, the expanding focus on transitioning from residual fuels to cleaner alternatives without significant retrofitting has reinforced MDO’s status as the preferred conventional fuel type across global fleets.

Engines within the 1,000-5,000 horsepower range are expected to generate 33.0% of the market’s revenue in 2025, ranking as the top power segment. Their dominance is attributed to their optimal balance between power output and fuel efficiency, making them ideal for mid-sized commercial vessels, patrol craft, and offshore service ships.

This range supports a broad operational spectrum, offering flexibility for applications requiring both propulsion and auxiliary functions. The rise in inter-island shipping, harbor logistics, and coastal surveillance operations has further accelerated demand for engines in this class.

Their compatibility with dual-fuel and hybrid drive systems also enhances adoption prospects under decarbonization roadmaps. Manufacturers are investing in modular engine designs within this power range to simplify integration, improve maintenance, and support future fuel adaptability.

Medium speed marine engines are forecast to command 42.0% of the overall market share in 2025, leading the technology segment. These engines are favored for their balance between operational efficiency and lower lifecycle costs, particularly in commercial and offshore fleets.

Medium speed engines provide strong thermal efficiency, reduced vibration, and robust durability, which collectively contribute to extended service intervals and reliable load response. Their adaptability for generator sets and propulsion makes them valuable across a diverse vessel portfolio.

Increasing demand for engines supporting LNG and biofuel capabilities is further reinforcing their strategic importance. As shipowners seek compliance with evolving marine fuel regulations without compromising uptime or maintenance overhead, medium speed engines remain the preferred technology choice for scalable, long-haul marine operations.

Marine engine demand is shaped by commercial shipping growth, regulatory compliance needs, offshore and defense requirements, and rising recreational applications. Manufacturers are focusing on efficiency, compliance, and tailored solutions to capture these varied market opportunities.

Commercial shipping continues to be the primary driver for marine engine demand, with global trade expansion and containerized cargo transport requiring dependable propulsion solutions. Operators seek engines that can handle long-haul operations with high fuel efficiency and low maintenance intervals. Bulk carriers, tankers, and container ships rely on large two-stroke and medium-speed engines for consistent performance under heavy loads. Fleet expansions in Asia-Pacific shipyards and modernization programs in Europe are increasing order volumes for both main propulsion and auxiliary engines. Engine manufacturers are enhancing durability and optimizing fuel burn to meet operational targets. Retrofit demand is also rising as older vessels upgrade to comply with evolving emission and efficiency standards in international waters.

Tightening global maritime emission regulations, particularly IMO Tier III standards, is pushing vessel owners to invest in compliant marine engines. Manufacturers are offering dual-fuel and LNG-capable engines to reduce NOx, SOx, and particulate emissions without sacrificing power output. Retrofitting older fleets with exhaust aftertreatment systems or replacing engines entirely has become common in both commercial and passenger shipping segments. Ports in emission control areas (ECAs) have strict compliance requirements, influencing engine selection for newbuilds. Shipowners increasingly opt for engines that balance regulatory compliance with lifecycle cost advantages. This regulatory environment is encouraging a shift toward cleaner fuel options and advanced combustion technologies across global fleets.

The offshore energy sector, including oil, gas, and wind power projects, is fueling demand for specialized marine engines capable of operating in harsh environments. Offshore support vessels, drill ships, and service boats require engines with high torque and reliability for extended deployment periods. Similarly, naval modernization programs are prompting defense agencies to procure advanced marine propulsion systems that meet specific performance and stealth requirements. The need for dependable engines in patrol boats, frigates, and amphibious vessels is boosting demand in defense shipbuilding. These sectors prioritize operational readiness, endurance, and rapid deployment capabilities, creating steady business opportunities for engine manufacturers that can meet customized performance specifications.

The recreational boating and passenger ferry segments are experiencing increasing demand for efficient and quiet marine engines. Tourism growth, marina development, and water-based leisure activities are prompting sales of outboard and inboard engines for yachts, speedboats, and ferries. In densely trafficked coastal and inland waterways, operators seek engines that combine low noise with smooth operation to enhance passenger experience. Hybrid propulsion options are gaining attention in this segment for their fuel savings and reduced operational costs. The refit market for luxury vessels is also strong, as owners invest in performance upgrades and emission-compliant engines. These trends are diversifying the marine engine market beyond traditional commercial and industrial use cases.

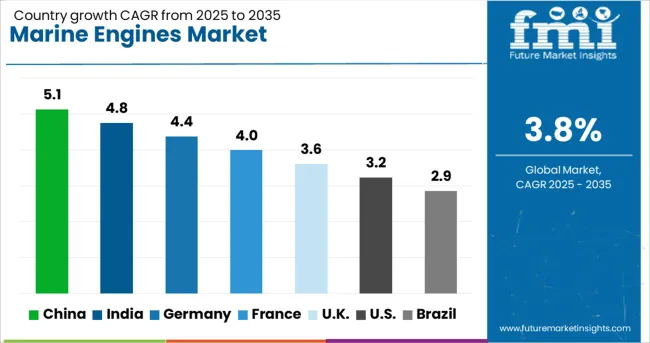

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The marine engines market is projected to grow globally at a CAGR of 3.8% between 2025 and 2035, supported by commercial shipping expansion, stricter emission regulations, and growing demand from offshore energy and passenger vessel segments. China leads with a CAGR of 5.1%, driven by its dominant shipbuilding capacity, strong export programs, and increased adoption of dual-fuel and LNG-capable engines. India follows at 4.8%, fueled by port infrastructure expansion, inland waterway development, and growth in coastal shipping operations. France grows at 4.0%, benefitting from naval modernization programs, passenger ferry upgrades, and compliance with EU maritime emission targets. The United Kingdom posts 3.6%, influenced by defense vessel procurement, offshore wind farm support vessels, and refit activities. The United States records 3.2%, reflecting steady demand from defense fleets, recreational boating, and inland waterway operators. The analysis spans over 40 countries, with these markets serving as strategic indicators for capacity planning, compliance-driven engine development, and investment priorities in the global marine engines industry.

China is projected to register a CAGR of 5.1% for 2025–2035, well above the global baseline of 3.8%. Between 2020–2024, growth near 3.9% was supported by its strong shipbuilding capacity, commercial fleet expansions, and consistent government support for port infrastructure. The next period is expected to benefit from higher adoption of LNG and dual-fuel propulsion in large container ships, bulk carriers, and tankers to meet IMO compliance. Shipyards in coastal provinces are scaling capacity for both main engines and auxiliary power units, while component suppliers are localizing key parts to reduce import reliance. Demand for repowering older vessels is also climbing as operators seek efficiency gains and emission compliance.

India is expected to post a 4.8% CAGR in 2025–2035, outpacing the global rate. Between 2020–2024, CAGR was around 3.6%, driven by moderate growth in coastal shipping and gradual adoption of higher-efficiency marine engines in government ferry and patrol fleets. The next decade’s acceleration is linked to major port capacity upgrades, inland waterway cargo initiatives, and rising coastal trade volumes under Sagarmala projects. Indigenous shipyards are expanding their capacity to supply both defense and commercial vessels, boosting orders for domestically assembled propulsion units. Demand for auxiliary engines is also rising with offshore energy projects and inter-island transport networks, particularly in the Andaman and Nicobar region.

France is projected to post a CAGR of 4.0% during 2025-2035, slightly above the global 3.8% baseline. Between 2020–2024, growth averaged about 3.1%, supported by passenger ferry upgrades, naval procurement, and compliance-led engine replacements in ECAs. The forecasted acceleration is driven by ongoing naval modernization programs, increased demand for low-emission propulsion in ferries, and stronger investments in offshore wind support vessels. French shipyards along the Atlantic and Mediterranean coasts are receiving higher orders for specialized vessels, prompting steady marine engine installations. Tourism-driven demand for passenger boats in Brittany and Corsica also supports auxiliary engine sales and maintenance contracts.

The United Kingdom is expected to post a CAGR of 3.6% during 2025-2035, just below the global 3.8% rate. For 2020-2024, the UK marine engines CAGR is estimated at about 2.4%, reflecting slower procurement cycles in commercial shipping and naval projects, along with extended service life of existing fleets. The rise toward 3.6% in the next period is due to renewed naval procurement programs, offshore wind vessel construction, and increased retrofitting to meet ECA standards. Shipbuilders on the Clyde and in the South Coast are gaining more orders for patrol boats, service vessels, and ferries, creating consistent propulsion system demand. The fishing fleet is also upgrading to fuel-efficient engines for operational cost control.

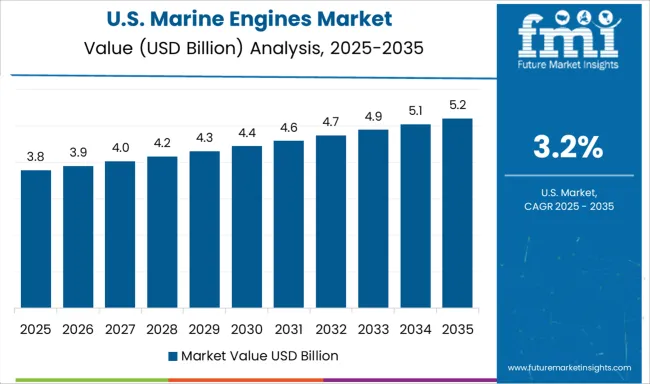

The United States is projected to record a CAGR of 3.2% for 2025-2035, slightly below the global average. Between 2020–2024, growth averaged around 2.5%, shaped by steady defense orders, inland waterway transport activity, and sporadic demand in the recreational boating segment. The upcoming period benefits from modernization of the Coast Guard fleet, increased offshore wind projects along the East Coast, and higher investment in LNG-capable engines for harbor tugs and ferries. Gulf Coast shipyards continue to secure contracts for offshore supply vessels and patrol craft, sustaining propulsion system installations. Retrofit activity is also climbing as older vessels are upgraded to meet Tier III requirements.

The marine engines arena is shaped by global primes and regional specialists competing on fuel flexibility, lifecycle efficiency, and service reach. Wärtsilä is positioned across two-stroke and medium-speed domains with strong dual-fuel offerings and deep maintenance programs. AB Volvo Penta focuses on high-speed propulsion for commercial workboats and leisure craft with integrated driveline packages. Anglo Belgian Corporation serves niche medium-speed segments with heavy-fuel and dual-fuel options for inland and coastal fleets. Brunswick Corporation, through Mercury Marine, dominates outboards for recreational and light commercial usage. Caterpillar and Cummins maintain wide dealer footprints in high-speed and auxiliary roles, prized for uptime in harsh duty cycles. Daihatsu Diesel targets coastal cargo and ferries with compact medium-speed units, while DEUTZ supplies high-speed power for smaller vessels. Deere & Company supports utility boats and government craft with reliable marine derivatives.

Hyundai Heavy Industries and IHI Corporation field medium-speed lines for newbuilds across Asia yards. MAN Energy Solutions leads in large bore two-stroke propulsion and efficient medium-speed gensets. Mitsubishi Heavy Industries spans a broad displacement range for commercial shipping and naval projects. Rolls-Royce, through mtu, emphasizes high-speed power for defense and fast ferries. Société Internationale des Moteurs Baudouin provides high-speed engines tailored to fishing and patrol craft. Scania supplies compact high-speed blocks for workboats. Shanghai Diesel Engine, STX Engines, Weichai Holding, Yamaha, Yanmar, and Yuchai International strengthen regional coverage with competitive price-performance, localized parts, and flexible aftersales programs. Strategic priorities center on fuel-versatile platforms, longer overhaul intervals, digital monitoring for planned maintenance, and retrofit packages that reduce operating costs across cargo, offshore, patrol, and passenger vessels.

In February 2024, Brunswick Corporation announced record-breaking sales and outboard engine market share at the Miami International Boat Show. Launches included Mercury’s Avator electric outboards among other products.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 Billion |

| Product | MDO, MGO, LNG, Hybrid, and Others |

| Power | 1,000 - 5,000 HP, 1,000 HP, 5,001 - 10,000 HP, 10,001 - 20,000 HP, and > 20,000 HP |

| Technology | Medium Speed, Low Speed, and High Speed |

| Propulsion | 2 Stroke and 4 Stroke |

| Application | Merchant, Offshore, Cruise & Ferry, Navy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wärtsilä, AB Volvo Penta, Anglo Belgian Corporation, Brunswick Corporation, Caterpillar, Cummins, Daihatsu Diesel, DEUTZ, Deere & Company, Hyundai Heavy Industries, IHI Corporation, MAN Energy Solutions, Mitsubishi Heavy Industries, Rolls-Royce, Société Internationale des Moteurs Baudouin, Scania, Shanghai Diesel Engine, STX Engines, Weichai Holding, Yamaha, Yanmar, and Yuchai International |

| Additional Attributes | Dollar sales, share, competitive positioning, regional demand trends, fuel type adoption rates, regulatory impact, technology shifts, customer preferences, key growth sectors, and aftermarket service opportunities for strategic planning. |

The global marine engines market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the marine engines market is projected to reach USD 13.4 billion by 2035.

The marine engines market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in marine engines market are mdo, mgo, lng, hybrid and others.

In terms of power, 1,000 - 5,000 hp segment to command 33.0% share in the marine engines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA