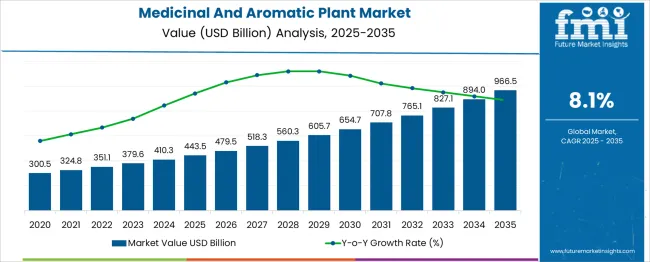

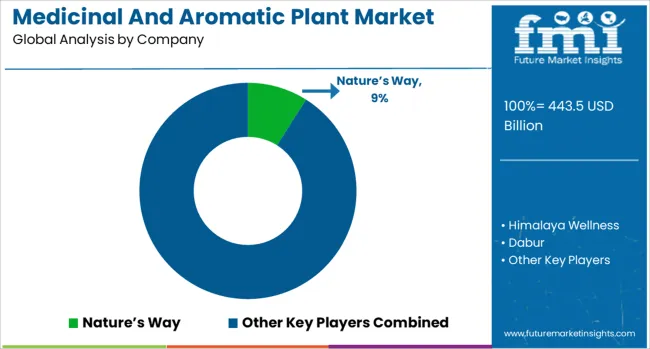

The medicinal and aromatic plant market is estimated to be valued at USD 443.5 billion in 2025 and is projected to reach USD 966.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

The medicinal and aromatic plant market is projected to grow steadily from USD 300.5 billion in 2020 to approximately USD 966.5 billion by 2035, marking a substantial expansion over the 16 years. Between 2020 and 2030, the market value rises from USD 300.5 billion to around USD 560.3 billion, reflecting an average annual growth rate close to 7.1%. This growth phase is driven by increasing demand for natural and herbal products across pharmaceutical, cosmetic, and food sectors. Rising consumer preference for organic and plant-derived ingredients supports market expansion, while regulatory encouragement for the use of traditional and alternative medicines further propels growth. Efforts to expand cultivation areas, alongside advancements in extraction and processing technologies, contribute to improved product quality and supply reliability.

From 2030 to 2035, the market accelerates further from USD 605.7 billion to USD 966.5 billion, fueled by heightened investments in research, biotechnology, and sustainable harvesting practices. Growing incorporation of medicinal and aromatic plant extracts in personal care, nutraceutical, and pharmaceutical formulations drives demand. Emerging economies demonstrate rapid uptake due to expanding healthcare infrastructure and increasing disposable incomes. The rise in international trade of these products strengthens market dynamics. The market is evolving to meet shifting consumer preferences and regulatory frameworks, with innovation, sustainable sourcing, and diversified industrial applications expected to sustain growth through 2035.

| Metric | Value |

|---|---|

| Medicinal And Aromatic Plant Market Estimated Value in (2025 E) | USD 443.5 billion |

| Medicinal And Aromatic Plant Market Forecast Value in (2035 F) | USD 966.5 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The medicinal and aromatic plant (MAP) market holds a significant position within the global herbal and botanical products landscape, accounting for approximately 35–38% of the overall herbal raw material supply chain due to its critical role in pharmaceuticals, nutraceuticals, and essential oil production. Within the broader natural health and wellness industry, MAP contributes around 28–30%, driven by rising consumer demand for herbal supplements, functional foods, and plant-based cosmetics.

In the essential oils and fragrance sector, MAP represents nearly 32–34%, as these plants serve as the primary source for aroma compounds used in perfumery, personal care, and aromatherapy applications. In the global pharmaceutical botanical ingredient market, medicinal plants alone account for 25–27%, owing to their therapeutic applications in traditional and modern medicine. Growth is supported by increasing preference for natural remedies, strong integration into Ayurveda, Traditional Chinese Medicine, and other ethnomedicinal systems, alongside rising clinical research validating bioactive compounds. Additionally, expanding applications in food flavoring, natural preservatives, and organic formulations amplify demand across multiple industries.

Competitive dynamics are driven by quality control, traceability, and compliance with global standards such as WHO-GACP and ISO certifications. Despite regulatory complexities and challenges in sustainable sourcing, the MAP segment retains a robust growth trajectory, reinforced by ongoing R&D, clean-label trends, and rising consumer inclination toward plant-based healthcare alternatives. This positioning makes MAP an indispensable component of the global natural products value chain.

Increased demand for natural and holistic treatments has been observed across the pharmaceutical, cosmetic, and nutraceutical industries, leading to the expansion of cultivation and processing capacities. The rising cost of synthetic drugs and a growing preference for clean-label ingredients have contributed to the popularity of botanically sourced compounds.

Scientific validation of bioactive components found in various plant species has enhanced their credibility, prompting greater institutional and commercial investment. Favorable regulatory frameworks and government-supported initiatives for traditional medicine have reinforced market expansion.

The scalability of plant-based production processes and the ability to tailor extracts for targeted formulations have further improved the commercial viability of medicinal plants. As chronic diseases continue to rise globally, and patients increasingly seek alternative or complementary therapies, the medicinal plants market is expected to witness consistent demand and innovation across core segments..

The medicinal and aromatic plant market is segmented by plant type, product form, application, and cultivation method and geographic regions. By plant type of the medicinal and aromatic plant market is divided into Medicinal Plants and Aromatic Plants. In terms of product form of the medicinal and aromatic plant market is classified into Raw materials, Extracts and concentrates, Essential oils, and Finished products. Based on application of the medicinal and aromatic plant market is segmented into Pharmaceutical industry, Cosmetics and personal care, Food and beverage industry, Aromatherapy and wellness, and Agriculture and veterinary. By cultivation method of the medicinal and aromatic plant market is segmented into Conventional cultivation, Organic cultivation, Wild harvesting, and Controlled environment agriculture. Regionally, the medicinal and aromatic plant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

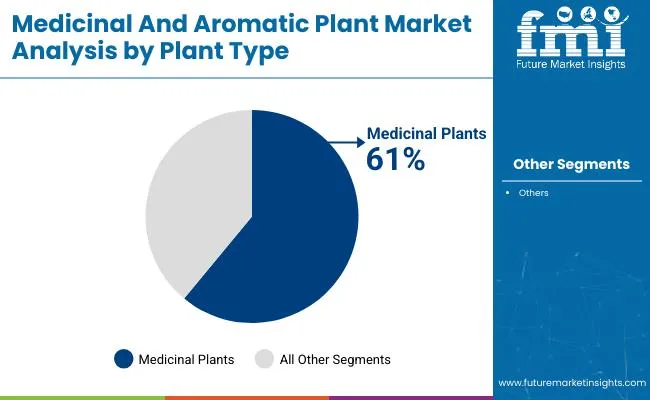

The medicinal plants segment within the plant type category is expected to account for 61% of the total market revenue in 2025, making it the leading plant type. This growth has been driven by the increased integration of botanical sources in modern pharmaceutical and therapeutic product development. Medicinal plants have been recognized for their diverse pharmacological properties, offering naturally occurring compounds that support a wide range of therapeutic applications.

Their prominence has also been attributed to rising consumer confidence in traditional medicine systems that rely heavily on herbal formulations. Cultivation of these plant types has expanded significantly in response to sustainable sourcing practices and rising global trade in botanical extracts.

Furthermore, standardized cultivation techniques and advanced extraction technologies have enhanced both quality and yield, making medicinal plants a preferred choice among formulators and product developers. The segment continues to benefit from a favorable ecosystem involving growers, processors, and research institutions, ensuring steady growth in the years ahead..

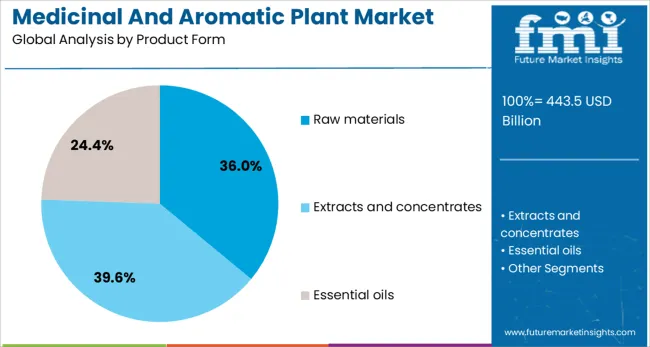

The raw materials segment is projected to hold 36% of the product form revenue share in the medicinal plants market by 2025, emerging as the dominant product form. The segment's growth has been influenced by increasing demand from manufacturers who require unprocessed or semi-processed botanical inputs for diverse formulations. Raw materials have been widely utilized across pharmaceutical, nutraceutical, and cosmetic industries for their adaptability and cost-effectiveness.

Their preference has been sustained by the flexibility they offer in terms of customization during downstream processing. Furthermore, advancements in harvesting, drying, and preservation methods have improved the stability and bioactivity of raw plant materials, making them viable for global trade and large-scale applications.

Quality assurance protocols and origin traceability have further reinforced buyer confidence in this product form. As the supply chain for botanical inputs becomes more structured and regulated, raw materials are expected to remain a foundational element in the commercial utilization of medicinal plants..

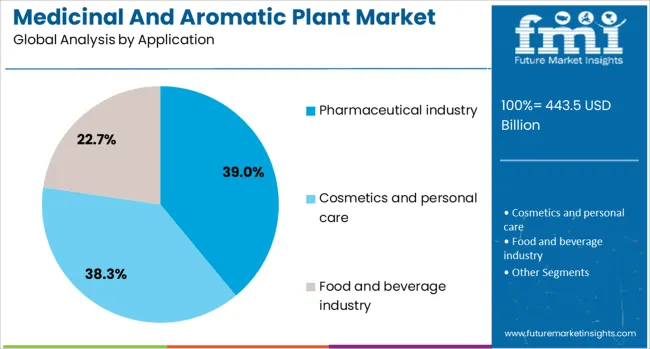

The pharmaceutical industry segment is anticipated to capture 39% of the medicinal plants market revenue in 2025, establishing itself as the leading application segment. This growth has been enabled by the increasing incorporation of botanical actives into prescription and over-the-counter pharmaceutical products. Plant-derived ingredients have been actively explored for their bioactive potential in managing chronic conditions, inflammatory disorders, and metabolic syndromes.

Their use has been validated through growing clinical evidence supporting safety, efficacy, and reduced side effects compared to synthetic compounds. Pharmaceutical companies have accelerated R&D efforts to isolate and standardize active compounds from plant sources, enabling precise dosage formulations. Regulatory agencies across major markets have created pathways for botanical drug approvals, encouraging further investment in this segment.

Additionally, the global shift toward preventive healthcare and wellness has encouraged pharmaceutical firms to integrate medicinal plants into therapeutic portfolios. This strategic shift is expected to continue shaping market dynamics in favor of plant-based pharmaceutical innovations..

The MAP market is driven by rising use in pharmaceuticals, cosmetics, and food products, supported by consumer demand for natural ingredients. Challenges in sourcing, quality assurance, and regulatory compliance shape industry strategies for future growth.

The medicinal and aromatic plant market is witnessing robust demand due to growing interest in natural remedies and botanical extracts for preventive healthcare. Pharmaceutical companies increasingly use MAP-based compounds in herbal formulations and modern drug development. This trend is supported by consumer preferences for plant-derived solutions over synthetic alternatives, influenced by perceptions of safety and wellness. Integration of MAP ingredients in functional foods and nutraceuticals further strengthens their relevance in health-focused products. Traditional medicine systems such as Ayurveda and Traditional Chinese Medicine are gaining global acceptance, reinforcing large-scale procurement of medicinal plants for standardized formulations that meet evolving therapeutic and lifestyle needs across multiple geographies.

Essential oils derived from aromatic plants have become key components in cosmetics, personal care, and aromatherapy products. Manufacturers are leveraging unique aroma profiles and therapeutic benefits to cater to consumers seeking natural fragrance alternatives in premium formulations. MAP extracts are also utilized in spa treatments and wellness therapies, where demand for stress relief and mood-enhancing products is increasing. The rising popularity of natural perfumery and chemical-free fragrance solutions amplifies adoption across luxury and mass-market segments. Additionally, the integration of essential oils in functional home care products such as candles and diffusers supports steady growth, further diversifying end-use opportunities for aromatic plant derivatives.

The food and beverage sector has emerged as a significant consumer of MAP-based extracts, primarily for natural flavoring and preservation. Plant-derived bioactives offer unique taste profiles and functional benefits, making them suitable for clean-label formulations. Aromatic plants like basil, rosemary, and mint are widely incorporated into seasonings, beverages, and health drinks to meet the demand for organic and additive-free products. Manufacturers are developing concentrated extracts to enhance shelf stability and ensure consistent quality in processed food applications. The preference for herbal teas and fortified beverages enriched with bioactive compounds continues to shape market dynamics, as consumers prioritize immunity-boosting and digestive health solutions.

Despite promising growth, the MAP market faces challenges linked to raw material sourcing, quality control, and compliance with international regulatory frameworks. Variability in plant yield due to climate conditions impacts cost and availability, while the risk of adulteration requires stringent authentication processes. Global trade regulations and certifications such as WHO-GACP and ISO standards impose additional compliance costs for exporters and manufacturers. The fragmented nature of cultivation practices in developing regions also hinders scalability and consistency in supply. Addressing these constraints through contract farming, traceability solutions, and advanced testing methodologies remains a strategic imperative for industry stakeholders to maintain competitiveness and ensure long-term reliability.

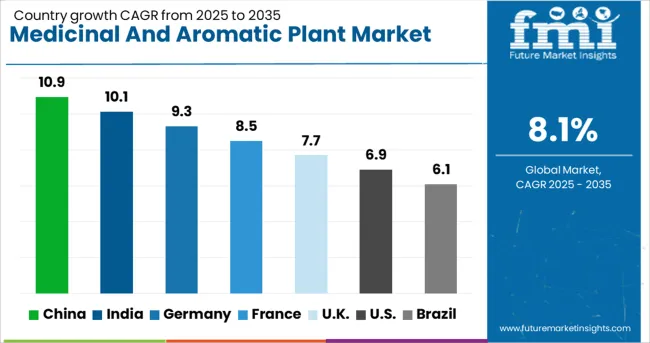

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The medicinal and aromatic plant (MAP) market is projected to grow at a global CAGR of 8.1% between 2025 and 2035, driven by the rising demand for herbal medicines, essential oils, and natural ingredients across pharmaceuticals, cosmetics, and food sectors. China leads with a CAGR of 10.9%, supported by large-scale cultivation, government-backed herbal medicine programs, and strong export demand for essential oils and plant extracts. India follows at 10.1%, propelled by the integration of Ayurveda in modern healthcare, contract farming models, and expanding nutraceutical applications. Germany posts a CAGR of 9.3%, reflecting increased consumer inclination toward natural wellness products and essential oil-based formulations in aromatherapy and cosmetics. The United Kingdom grows at 7.7%, influenced by herbal supplement trends and a rising preference for functional teas, while the United States records 6.9%, shaped by higher adoption of herbal dietary supplements and rising clinical validation for plant-derived bioactives. The report features an analysis of more than 40 countries, with these five serving as benchmarks for strategic market positioning and future investment opportunities in the MAP sector.

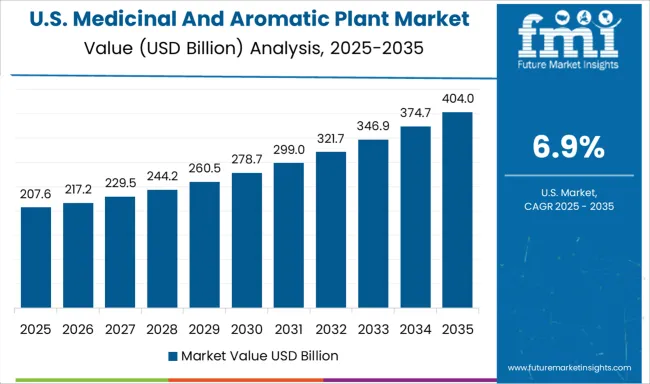

The CAGR of the U.S. medicinal and aromatic plant market was nearly 5.8% during 2020–2024 and is projected to rise to 6.9% between 2025 and 2035. This growth acceleration is driven by higher adoption of herbal dietary supplements, increased consumer trust in plant-based ingredients, and clinical research validating therapeutic benefits. While earlier demand was concentrated in herbal teas and traditional remedies, the next decade shows expansion toward nutraceuticals, organic skincare, and aromatherapy applications. Digital wellness trends and clean-label formulations have reinforced adoption across premium consumer segments. Investments in local cultivation projects and import diversification strategies strengthen long-term supply reliability for U.S. manufacturers.

The CAGR for the U.K. medicinal and aromatic plant market averaged 6.3% during 2020–2024 and is expected to advance to 7.7% in 2025–2035. The earlier growth phase was limited by dependence on imports and moderate consumer awareness. Post-2024, the momentum improved due to rising demand for herbal teas, essential oils in personal care, and therapeutic applications in wellness centers. Expansion of organic farming initiatives and improved logistics for botanical imports contributed to stable supply chains. Compliance with EU-equivalent safety standards and increased penetration of aromatherapy products across premium retail channels support growth in the next decade.

China posted a CAGR of about 9.6% during 2020–2024, which escalates to 10.9% for 2025–2035, cementing its position as a global leader. The early phase was supported by robust domestic demand for traditional Chinese medicine and exports of essential oils. The upcoming decade reflects structural growth fueled by industrial-scale herbal processing units, state incentives for green health products, and integration into global nutraceutical and cosmetic supply chains. Partnerships between pharmaceutical giants and MAP growers have accelerated innovation in plant-based formulations.

India’s CAGR improved from 8.7% during 2020–2024 to 10.1% during 2025–2035, supported by domestic herbal medicine consumption and rising global exports. Earlier growth relied on Ayurveda-linked products, while future trends emphasize plant-derived nutraceuticals and essential oils for wellness and personal care. Government-backed cultivation incentives and contract farming have ensured steady raw material availability, reducing reliance on fragmented sourcing models. Enhanced R&D in bioactive extraction further positions India as a major MAP supplier to Europe and North America.

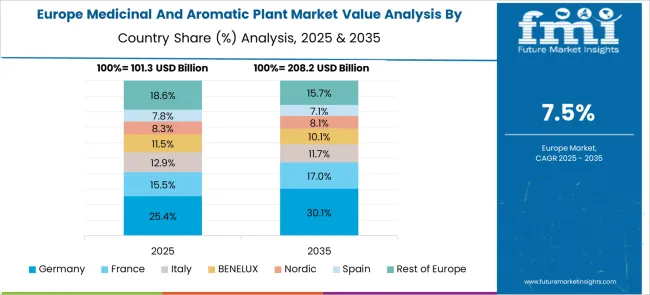

Germany achieved a CAGR of 8.1% during 2020–2024, climbing to 9.3% from 2025–2035 with strong growth in herbal supplements, aromatherapy oils, and natural personal care products. Consumer inclination toward clean-label and organic options has shaped procurement strategies, leading to increased reliance on certified MAP imports. Domestic processing industries have scaled up bioactive standardization for pharmaceutical applications, ensuring higher adoption across therapeutic categories. Strategic alliances with Asian MAP suppliers and integration of traceability platforms highlight Germany’s role as a premium MAP hub in Europe.

The medicinal and aromatic plant (MAP) market is driven by global leaders and specialized firms delivering herbal extracts, essential oils, and nutraceutical ingredients for diverse applications. Nature’s Way stands out as a leading player in the natural supplements space, focusing on plant-based formulations for wellness and immunity. Himalaya Wellness combines traditional Ayurveda with scientific validation to offer herbal healthcare solutions across multiple regions. Dabur commands strong brand equity in the herbal personal care and nutrition segments, leveraging an extensive distribution network. Arjuna Natural specializes in bioactive extracts, curcumin-based formulations, and clinically validated nutraceutical ingredients for global markets.

Givaudan, a major force in flavors and fragrances, strengthens the MAP value chain with premium essential oil production and botanical innovations for cosmetics and personal care. doTERRA and Young Living dominate the essential oils segment through robust direct-selling networks and exclusive product portfolios targeting aromatherapy and lifestyle wellness. Sami-Sabinsa Group plays a key role in standardized herbal extracts and functional ingredients, ensuring compliance with international regulatory frameworks. Stringent quality standards, traceability requirements, and growing demand for clean-label products shape competition in this sector. Strategic priorities for market leaders include sourcing transparency, clinical research investments, and partnerships with contract farmers to ensure sustainable raw material supply. Expansion into nutraceuticals, personal care, and functional foods remains central to long-term growth. Future opportunities lie in scaling digital retail, leveraging global wellness trends, and innovating high-potency botanical blends tailored for immunity, stress management, and metabolic health.

Key strategies and drivers for 2024 and 2025 in the medicinal and aromatic plant market include expanding contract farming programs to ensure raw material consistency, investing in advanced extraction techniques for high-purity actives, and focusing on clean-label, plant-based product formulations.

Growing demand for herbal supplements, essential oils, and natural cosmetic ingredients remains a major growth catalyst. Strategic alliances with nutraceutical and pharmaceutical companies, coupled with traceability and compliance with WHO-GACP standards, are critical for market penetration. Rising consumer preference for holistic health solutions and functional foods reinforces innovation and regional expansion plans across Asia-Pacific, Europe, and North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 443.5 Billion |

| Plant Type | Medicinal Plants and Aromatic Plants |

| Product Form | Raw materials, Extracts and concentrates, Essential oils, and Finished products |

| Application | Pharmaceutical industry, Cosmetics and personal care, Food and beverage industry, Aromatherapy and wellness, and Agriculture and veterinary |

| Cultivation Method | Conventional cultivation, Organic cultivation, Wild harvesting, and Controlled environment agriculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nature’s Way, Himalaya Wellness, Dabur, Arjuna Natural, Givaudan, doTERRA, Young Living, and Sami-Sabinsa Group |

| Additional Attributes |

The global medicinal and aromatic plant market is estimated to be valued at USD 443.5 billion in 2025.

The market size for the medicinal and aromatic plant market is projected to reach USD 966.5 billion by 2035.

The medicinal and aromatic plant market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in medicinal and aromatic plant market are medicinal plants, _adaptogenic plants, __ashwagandha (withania somnifera), __ginseng (panax species), __rhodiola (rhodiola rosea), _anti-inflammatory plants, __turmeric (curcuma longa), __ginger (zingiber officinale), __boswellia (boswellia serrata), _digestive health plants, __aloe vera (aloe barbadensis), __peppermint (mentha piperita), __chamomile (matricaria chamomilla), _respiratory health plants, __eucalyptus (eucalyptus globulus), __thyme (thymus vulgaris), __licorice (glycyrrhiza glabra), _cardiovascular health plants, _immune support plants, _cognitive health plants, aromatic plants, _essential oil plants, __lavender (lavandula angustifolia), __tea tree (melaleuca alternifolia), __rosemary (rosmarinus officinalis), __oregano (origanum vulgare), _fragrance plants, __rose (rosa species), __jasmine (jasminum species), __sandalwood (santalum album), _culinary herbs, __basil (ocimum basilicum), __sage (salvia officinalis) and __cinnamon (cinnamomum species).

In terms of product form, raw materials segment to command 36.0% share in the medicinal and aromatic plant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA