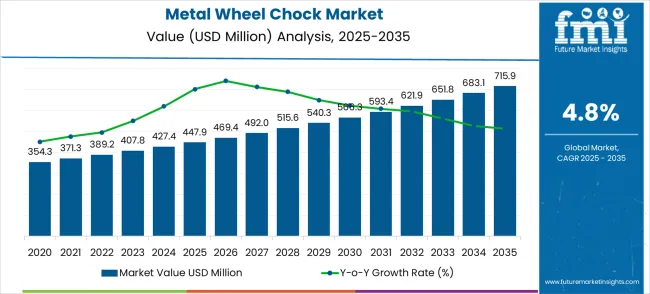

The metal wheel chock market is anticipated to grow from USD 447.9 million in 2025 to USD 715.9 million by 2035, with a CAGR of 4.8%. In the early phase, from 2025 to 2030, the market experiences gradual growth, advancing from USD 354.3 million in 2025 to USD 447.9 million by 2030. During this period, the market increases steadily, with annual increments from USD 371.3 million in 2026, USD 389.2 million in 2027, USD 407.8 million in 2028, and USD 427.4 million in 2029.

The steady growth is driven by the rising demand for durable, high-quality wheel chocks in the transportation and logistics sectors, with increased adoption across industries requiring heavy-duty equipment.

From 2030 to 2035, the market growth accelerates, moving from USD 447.9 million to USD 715.9 million. During this period, the market sees a more rapid rise with values progressing from USD 469.4 million in 2031 to USD 492.0 million in 2032, and USD 515.6 million in 2033. By 2035, the market reaches USD 715.9 million, fueled by the growing emphasis on safety in industrial and logistics operations, along with the expansion of the e-commerce sector requiring enhanced material handling solutions. The late growth phase is marked by the widespread adoption of innovative, high-performance wheel chocks, driven by stricter safety regulations and technological advancements in product design.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 447.9 million |

| Forecast Value in (2035F) | USD 715.9 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The metal wheel chock market is a niche segment within the broader industrial and automotive safety sectors, driven by the growing need for durable and reliable vehicle safety solutions. In the automotive market, metal wheel chocks account for about 6-8% of the market share, driven by their crucial role in securing parked commercial vehicles, trucks, and heavy-duty machinery. They are used extensively in fleet management, transport, and maintenance to prevent accidental movement of vehicles during loading or unloading. In the construction equipment market, metal wheel chocks represent around 4-6%, as they are critical for preventing equipment rollaways on construction sites, particularly when machinery is parked on uneven or sloped surfaces.

In the logistics and transportation market, metal wheel chocks hold a share of about 5-7%, as these products are essential for securing trucks, trailers, and shipping containers in warehouses, docks, and shipping yards. They help ensure that vehicles remain stationary during loading and unloading processes, reducing the risk of accidents. In the aerospace and aviation market, metal wheel chocks contribute around 3-5%, as they are used to secure aircraft during ground operations, fueling, and maintenance, where safety is critical. In the marine market, metal wheel chocks account for 2-4%, helping secure docked vessels during repairs and cargo handling.

Market expansion is being supported by the increasing emphasis on workplace safety regulations and the corresponding demand for reliable vehicle securing equipment that can prevent unintended vehicle movement in various operational environments. Modern fleet operators and industrial facilities are increasingly focused on safety solutions that can provide consistent performance while meeting stringent regulatory compliance requirements. The proven capability of metal wheel chocks to deliver superior durability, load-bearing capacity, and weather resistance makes them essential components of comprehensive vehicle safety programs.

The growing emphasis on professional safety standards and liability reduction is driving demand for high-quality securing equipment that can support extended service life and reliable performance across diverse applications. Industry preference for safety solutions that combine effectiveness with durability and ease of use is creating opportunities for advanced metal wheel chock development. The rising influence of eCommerce and logistics operations requiring frequent vehicle loading and unloading is also contributing to increased demand for professional-grade vehicle securing equipment across different operational scenarios and fleet types.

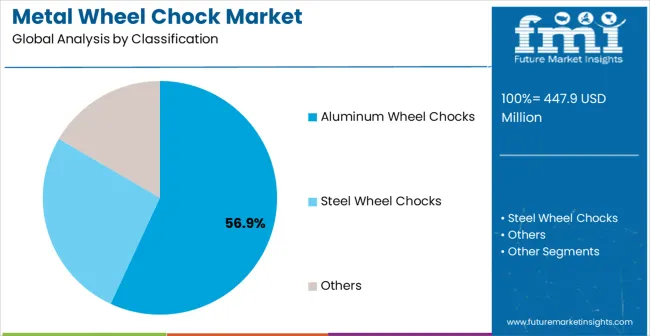

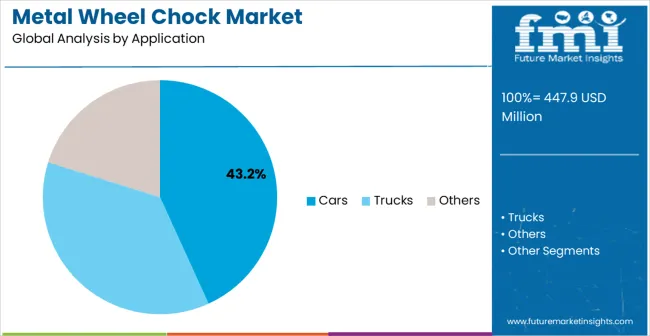

The market is segmented by classification, application, and region. By classification, the market is divided into aluminum wheel chocks, steel wheel chocks, and others. Based on application, the market is categorized into cars, trucks, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

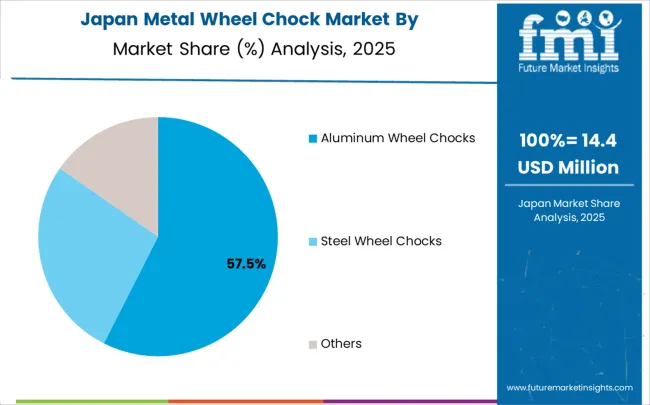

The aluminum wheel chocks classification is projected to account for 56.9% of the metal wheel chock market in 2025, reaffirming its position as the category's dominant material type. Fleet operators and safety managers increasingly recognize the optimal balance of strength, weight, and corrosion resistance provided by aluminum wheel chock designs for most vehicle securing applications. This classification addresses the majority of current vehicle safety requirements while providing essential durability and portability characteristics.

This classification forms the foundation of most professional vehicle safety programs, as it represents the most practical and versatile approach for vehicle securing equipment. Materials development and manufacturing optimization continue to strengthen confidence in aluminum wheel chock performance. With increasing recognition of the importance of lightweight yet durable safety equipment, aluminum formulations align with both operational efficiency requirements and long-term reliability objectives. Their broad compatibility across multiple vehicle types ensures market dominance, making them the central growth driver of metal wheel chock adoption.

Cars are projected to represent 43.2% of metal wheel chock demand in 2025, underscoring their role as the primary application driving market development. Fleet operators and service facilities recognize that passenger vehicle applications require reliable and easy-to-use securing equipment to ensure safety during maintenance, loading, and parking operations. Car applications demand exceptional convenience and effectiveness that metal wheel chocks are uniquely positioned to deliver.

The segment is supported by the continuous growth of passenger vehicle fleets requiring comprehensive safety equipment and the increasing adoption of professional-grade securing solutions across automotive service facilities. Car rental companies and fleet operators are increasingly implementing standardized safety protocols that include reliable wheel chock systems. As understanding of vehicle safety requirements advances, car applications will continue to serve as a primary commercial driver, reinforcing their essential position within the vehicle safety equipment market.

The metal wheel chock market is advancing steadily due to increasing emphasis on workplace safety and growing adoption of professional-grade safety equipment across various industries. The market faces challenges including competition from alternative materials, price sensitivity in some market segments, and varying regulatory requirements across different regions. Innovation in materials technology and ergonomic design continue to influence product development and market expansion patterns.

The growing expansion of e-commerce and logistics operations is creating increased demand for reliable vehicle securing equipment across distribution centers, loading docks, and delivery operations. Advanced logistics facilities offer comprehensive safety protocols, including vehicle securing requirements, that are particularly important for high-volume operations. Professional logistics operations provide opportunities for standardized safety equipment that can optimize operational efficiency and regulatory compliance.

Modern safety equipment companies are incorporating lightweight alloy materials, ergonomic handle designs, and enhanced visibility features to improve metal wheel chock performance and user experience. These technologies improve portability, enable easier handling characteristics, and provide enhanced safety through better visibility and positioning. Advanced design integration also enables optimized load distribution and improved durability characteristics.

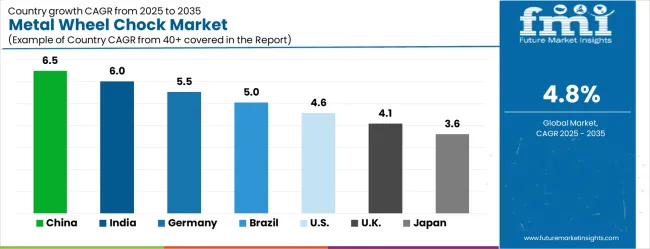

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

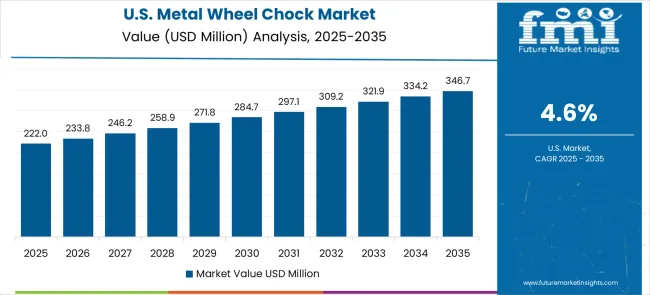

The metal wheel chock market is experiencing moderate growth globally, with China leading at a 6.5% CAGR through 2035, driven by expanding automotive industry, growing emphasis on industrial safety, and increasing adoption of professional safety equipment across manufacturing and logistics sectors. India follows at 6.0%, supported by rapidly growing vehicle fleet sizes, increasing awareness of workplace safety, and expanding commercial vehicle operations. Germany shows growth at 5.5%, emphasizing precision manufacturing excellence and comprehensive safety standards. Brazil records 5.0% growth, focusing on expanding automotive sector and growing adoption of safety regulations. The USA shows 4.6% growth, representing steady demand from established fleet operations and safety equipment markets.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from metal wheel chocks in China is projected to exhibit solid growth with a CAGR of 6.5% through 2035, driven by expanding automotive manufacturing sector and comprehensive growth in logistics and industrial operations requiring professional safety equipment. The country's rapidly developing industrial ecosystem and increasing emphasis on workplace safety standards are creating substantial opportunities for safety equipment adoption. Major domestic and international safety equipment companies are establishing comprehensive manufacturing and distribution facilities to serve the growing industrial safety market.

The metal wheel chocks market in India is expanding at a CAGR of 6.0%, supported by rapidly growing commercial vehicle fleet, increasing adoption of safety protocols, and rising investment in logistics and transportation infrastructure. The country's expanding transportation sector and commitment to safety improvement are driving demand for professional safety equipment. International safety equipment companies and domestic manufacturers are establishing partnerships to serve the growing demand for vehicle safety solutions.

Demand for metal wheel chocks in Germany is projected to grow at a CAGR of 5.5%, supported by the country's leadership in automotive technology and comprehensive expertise in industrial safety equipment. German automotive and manufacturing companies consistently invest in high-quality safety equipment and comprehensive safety protocols. The market is characterized by technical excellence, comprehensive regulatory standards, and established relationships between safety equipment suppliers and industrial users.

Revenue from metal wheel chocks in Brazil is anticipated to expand at a CAGR of 5.0% through 2035, driven by automotive sector expansion, increasing emphasis on workplace safety, and growing adoption of professional safety equipment across industrial applications. Brazilian fleet operators and industrial facilities are increasingly implementing comprehensive safety protocols to support operational excellence and regulatory compliance.

Demand for metal wheel chocks in the USA is expected to grow at a CAGR of 4.6%, supported by established safety equipment markets, comprehensive workplace safety regulations, and continued investment in fleet safety systems. American fleet operators and industrial facilities maintain consistent adoption of professional safety equipment through established procurement relationships and regulatory compliance requirements.

The metal wheel chocks market in the UK is projected to expand at a CAGR of 4.1% through 2035, supported by established safety regulations and comprehensive workplace safety frameworks. British fleet operators and industrial facilities emphasize professional safety equipment within established operational frameworks that prioritize regulatory compliance and worker safety.

Revenue from metal wheel chocks in Japan is forecasted to increase at a CAGR of 3.6% through 2035, supported by the country's leadership in precision manufacturing and comprehensive approach to industrial safety equipment. Japanese industrial facilities and transportation companies emphasize quality-driven adoption of safety equipment within established frameworks that prioritize technical excellence and operational reliability.

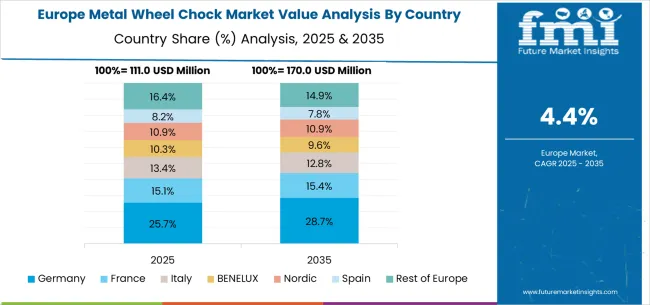

The metal wheel chock market in Europe is projected to expand steadily through 2035, supported by established automotive industries, comprehensive safety regulations, and ongoing focus on workplace safety standards. Germany will continue to lead the regional market, accounting for 29.8% in 2025 and rising to 30.5% by 2035, supported by strong automotive industry integration, advanced manufacturing capabilities, and comprehensive safety equipment standards. The United Kingdom follows with 18.9% in 2025, maintaining 19.0% by 2035, driven by established safety regulations, comprehensive fleet operations, and consistent demand patterns.

France holds 16.7% in 2025, edging up to 16.9% by 2035 as industrial facilities expand safety protocols and demand grows for professional safety equipment. Italy contributes 12.4% in 2025, remaining stable at 12.5% by 2035, supported by automotive industry strength and growing adoption of safety standards. Spain represents 9.3% in 2025, moving upward to 9.4% by 2035, underpinned by expanding logistics operations and increasing investment in safety equipment.

Nordic countries together account for 7.8% in 2025, maintaining their position at 7.9% by 2035, supported by advanced safety initiatives and consistent demand from established industrial operations. The Rest of Europe represents 5.1% in 2025, declining slightly to 3.8% by 2035, as larger markets capture greater focus and established safety infrastructure advantages.

The metal wheel chock market is characterized by competition among established safety equipment manufacturers, specialized industrial safety companies, and innovative materials technology firms. Companies are investing in advanced materials development, ergonomic design enhancement, strategic partnerships, and market development to deliver high-performance, durable, and cost-effective wheel chock solutions. Technology development, quality assurance, and customer service strategies are central to strengthening competitive advantages and market presence.

Durable Corporation leads the market with significant expertise in industrial safety equipment development, offering comprehensive metal wheel chock solutions with focus on durability optimization and professional application support. Loading Systems provides established safety equipment capabilities with emphasis on logistics and industrial applications. Expresso France focuses on European market development with comprehensive safety solution expertise. Vestil Manufacturing delivers advanced safety equipment technologies with a strong focus on industrial and commercial applications.

Polestar operates with a focus on specialized safety equipment manufacturing and quality assurance systems. Trimax provides comprehensive safety solutions with emphasis on automotive and recreational vehicle applications. FSP specializes in professional safety equipment with a focus on commercial and industrial markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 447.9 million |

| Classification | Aluminum Wheel Chocks, Steel Wheel Chocks, Others |

| Application | Cars, Trucks, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Durable Corporation, Loading Systems, Expresso France, Vestil Manufacturing, Polestar, Trimax, FSP, Buyers Products, TOPSAFE, Checkers Safety, Sarveshwari, Qingdao Runbell |

| Additional Attributes | Dollar sales by material type and application, regional adoption trends, competitive landscape, fleet operator partnerships, integration with safety systems, innovations in materials and ergonomic design, durability analysis, and regulatory compliance optimization strategies |

The global metal wheel chock market is estimated to be valued at USD 447.9 million in 2025.

The market size for the metal wheel chock market is projected to reach USD 715.9 million by 2035.

The metal wheel chock market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in metal wheel chock market are aluminum wheel chocks, steel wheel chocks and others.

In terms of application, cars segment to command 43.2% share in the metal wheel chock market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA