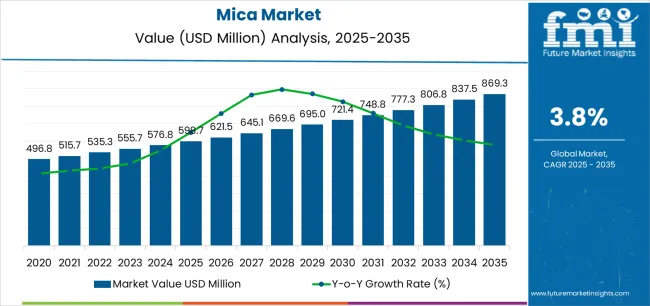

The global mica market is valued at USD 598.7 million in 2025. It is slated to reach USD 869.3 million by 2035, recording an absolute increase of USD 272.0 million over the forecast period. This translates into a total growth of 45.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.45 times during the same period, supported by increasing demand for electrical insulation materials, growing adoption of mica in electronics manufacturing, and a rising emphasis on functional fillers across diverse electronics, paints & coatings, construction, and cosmetics applications.

Between 2025 and 2030, the mica market is projected to expand from USD 598.7 million to USD 722.4 million, resulting in a value increase of USD 123.7 million, which represents 45.5% of the total forecast growth for the decade. The expansion of electronics manufacturing capacity will shape this phase of development, the rising adoption of advanced insulation materials, and the growing demand for functional mineral additives that ensure product performance and regulatory compliance. Electronics manufacturers and specialty chemicals producers are expanding their mica procurement capabilities to address the growing demand for reliable insulation solutions and high-performance mineral fillers.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 598.7 million |

| Forecast Value in (2035F) | USD 869.3 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

From 2030 to 2035, the market is forecast to grow from USD 722.4 million to USD 869.3 million, adding another USD 148.3 million, which constitutes 54.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of electric vehicle electrification and renewable energy integration, the development of advanced synthetic mica technologies and heavy-metal-free formulations, and the growth of specialized applications for 5G infrastructure and high-voltage electrical systems. The growing adoption of sustainable mineral solutions and clean-label cosmetics principles will drive demand for mica with enhanced purity and environmental performance features.

Between 2020 and 2025, the mica market experienced steady growth, driven by increasing electronics manufacturing infrastructure development and growing recognition of mica as an essential mineral for reliable electrical insulation and functional performance in diverse industrial applications. The market developed as electrical engineers and formulation chemists recognized the potential for mica to enhance product performance while supporting thermal management and dielectric strength requirements. Technological advancements in beneficiation processes and synthetic mica production have emphasized the critical importance of maintaining material purity and operational consistency in demanding electronics and cosmetics applications.

Market expansion is being supported by the increasing global demand for electrical insulation infrastructure and the corresponding need for reliable mineral materials that can provide excellent dielectric properties, ensure thermal stability, and maintain product integrity across various electronics, electrical equipment, and specialty coatings applications. Modern electronics manufacturers and industrial formulators are increasingly focused on implementing mineral additives that can deliver superior insulation performance, withstand high temperatures, and provide consistent properties in demanding operating conditions.

The growing emphasis on electric vehicle adoption and renewable energy systems is driving demand for mica that can support effective electrical insulation, enable high-voltage applications, and ensure comprehensive safety compliance. Electronics producers' preference for mineral materials that combine thermal stability with dielectric strength and processing versatility is creating opportunities for innovative mica implementations. The rising influence of clean-label cosmetics and sustainable formulations is also contributing to increased adoption of high-purity natural and synthetic mica that can provide functional performance without compromising product safety or environmental considerations.

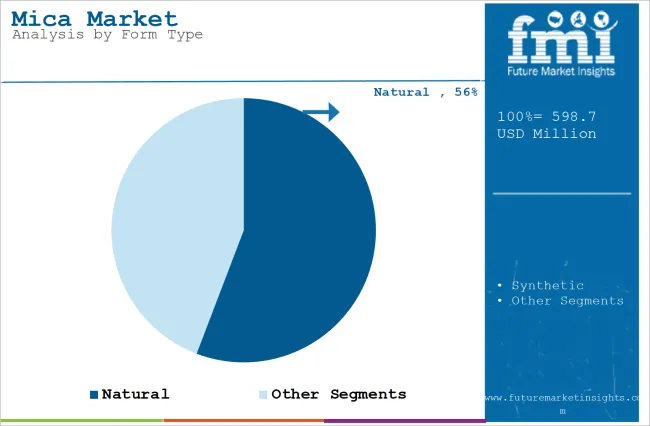

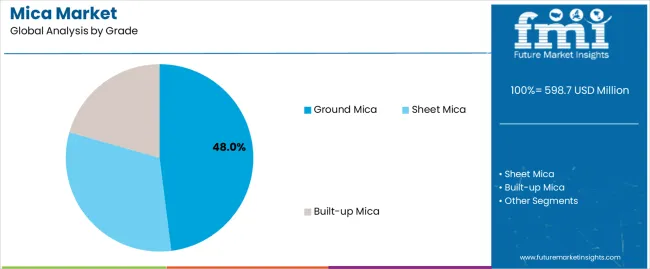

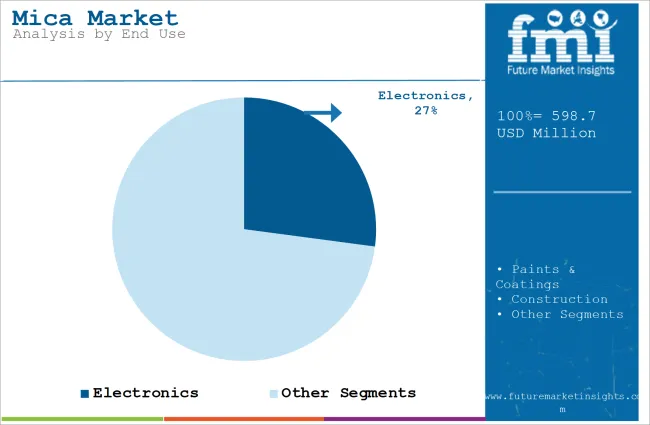

The market is segmented by form type, grade, end-use, and region. By form type, the market is divided into natural and synthetic. Based on grade, the market is categorized into ground mica, sheet mica, and built-up mica. By end-use, the market includes electronics, paints & coatings, construction, cosmetics, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

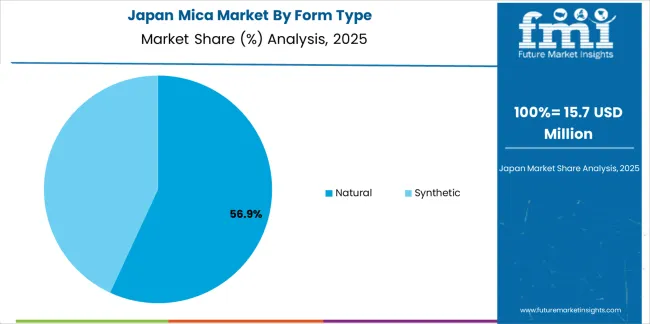

The natural form type segment is projected to maintain its leading position in the mica market in 2025 with 56.0% market share, reaffirming its role as the preferred material category for electrical insulation, functional fillers, and decorative applications. Electronics manufacturers and formulation specialists increasingly utilize natural mica for its excellent dielectric properties, thermal stability characteristics, and cost-effective performance across various industrial and consumer product applications. Natural mica's proven effectiveness and widespread availability directly address the industrial requirements for reliable insulation materials and consistent functional performance in diverse electronics and coatings applications.

This form type segment forms the foundation of modern mica supply chains, as it represents the material with the greatest application versatility and established performance record across multiple industrial processes and manufacturing applications. Industrial investments in natural mica sourcing continue to strengthen adoption among electronics producers and formulation teams. With electrical applications requiring superior dielectric strength and thermal resistance, natural mica aligns with both performance objectives and cost requirements, making it the central component of comprehensive material selection strategies. The segment benefits from established mining operations and well-developed beneficiation infrastructure that ensures consistent material quality and reliable supply availability.

The ground mica grade segment is projected to represent the largest share of mica demand in 2025 with 48.0% market share, underscoring its critical role as the primary driver for mineral filler adoption across paints, coatings, plastics, and specialty applications. Formulation chemists prefer ground mica for product development due to its excellent aspect ratio, reinforcement properties, and ability to enhance product performance while supporting processing efficiency and cost-effectiveness. Positioned as essential functional filler for modern manufacturing operations, ground mica offers both technical advantages and economic benefits.

The segment is supported by continuous innovation in milling technologies and the growing availability of specialized particle size distributions that enable precise performance optimization with enhanced dispersion and application versatility. Additionally, formulators are investing in comprehensive evaluation programs to support diverse product requirements and performance objectives. As product formulations become more sophisticated and functional requirements increase, the ground mica grade will continue to dominate the market while supporting advanced filler utilization and product optimization strategies. The availability of various mesh sizes and surface treatments enables customized solutions for specific application needs across industries.

The electronics end-use segment is projected to represent the largest share of mica demand in 2025 with 27.0% market share, reflecting its critical role as the primary driver for high-performance insulation material adoption across electrical components, capacitors, and thermal management applications. Electronics manufacturers prefer mica for component production due to its exceptional dielectric strength, thermal conductivity properties, and ability to maintain dimensional stability while ensuring product reliability and safety specifications. Positioned as essential insulation material for modern electronics manufacturing, mica offers both technical advantages and processing benefits.

This end-use segment drives innovation in material specifications and quality requirements, as electronics applications demand increasingly stringent dielectric properties for miniaturized components and high-voltage systems. The segment is supported by the growing electrification trend and continuous technological advancement in power electronics manufacturing. Additionally, electronics manufacturers are investing in comprehensive material qualification programs to support high-reliability production requirements and product safety objectives. With electrical applications requiring superior insulation performance and consistent properties, mica aligns with both technical requirements and regulatory standards, ensuring continued market leadership throughout the forecast period.

The mica market is advancing steadily due to increasing demand for electrical insulation infrastructure and growing adoption of functional mineral additives that provide enhanced product performance and processing efficiency across diverse electronics, coatings, construction, and cosmetics applications. However, the market faces challenges, including supply chain concerns related to ethical sourcing and child labor issues in certain mining regions, quality variability between different mica deposits and processing methods, and competition from alternative insulation materials and synthetic substitutes. Innovation in synthetic mica production technologies and heavy-metal-free formulations continues to influence product development and market expansion patterns.

The growing adoption of electric vehicles and renewable energy infrastructure is creating substantial demand for high-performance electrical insulation materials that can operate reliably in high-voltage environments with superior thermal management capabilities. Electric vehicle manufacturers and power electronics producers require mica-based insulation systems that provide exceptional dielectric strength while ensuring component reliability in demanding automotive and grid-scale applications. Advanced mica formulations with enhanced thermal conductivity and voltage resistance enable improved system performance while supporting miniaturization trends and efficiency objectives. Manufacturers are increasingly recognizing the competitive advantages of premium mica grades for power electronics differentiation and performance optimization in next-generation electrical systems.

Modern mica suppliers are addressing ethical sourcing concerns and supply chain transparency requirements through responsible mining programs, synthetic mica development, and comprehensive certification systems that enhance supply security, reduce environmental impact, and support comprehensive sustainability management. Synthetic mica technologies, particularly fluorphlogopite production, provide consistent quality and heavy-metal-free alternatives that meet stringent regulatory requirements while enabling new applications in cosmetics and food-contact materials. Advanced synthetic production also allows manufacturers to support clean-label formulation objectives and regulatory compliance beyond traditional natural mica mining approaches. Investment in synthetic mica capacity expansion and responsible sourcing programs continues to address market concerns while enabling premium positioning in regulated consumer applications.

Mica processing companies are investing in sophisticated beneficiation processes, particle size optimization, and surface modification technologies that enhance material performance, improve dispersion characteristics, and enable specialized applications across electronics and coatings markets. Advanced milling technologies provide precise particle size control and aspect ratio optimization while allowing more consistent quality and application-specific customization. Surface treatment chemistries enhance compatibility with polymeric matrices and improve processing efficiency in manufacturing operations. These processing innovations improve functional performance while enabling new market segments and premium product positioning. Continued investment in processing technology development supports product differentiation and competitive advantage in specialized mica applications requiring superior quality and consistency.

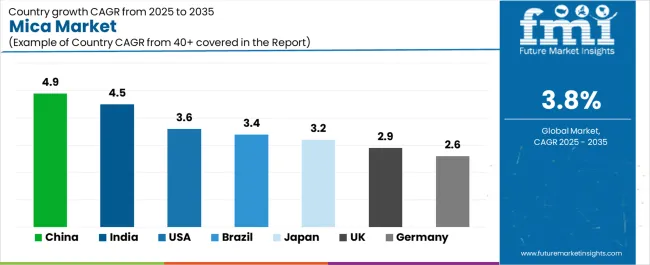

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| USA | 3.6% |

| Brazil | 3.4% |

| Japan | 3.2% |

| UK | 2.9% |

| Germany | 2.6% |

The mica market is experiencing solid growth globally, with China leading at a 4.9% CAGR through 2035, driven by the expanding 5G infrastructure development, growing electric vehicle supply chain, and significant investment in solar energy manufacturing and electronics insulation capacity. India follows at 4.5%, supported by rapid electronics assembly growth, increasing construction activity, and growing adoption of mica in paints & coatings and cosmetics manufacturing. The United States shows growth at 3.6%, emphasizing aerospace electronics insulation and premium cosmetics applications using synthetic mica. Brazil records 3.4%, focusing on building materials market recovery and automotive refinish coatings expansion. Japan demonstrates 3.2% growth, supported by high-reliability electronics and automotive electrical system sophistication. The United Kingdom exhibits 2.9% growth, emphasizing specialty cosmetics and architectural coatings market niches. Germany shows 2.6% growth, supported by automotive electrification component development and industrial insulation retrofit programs.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

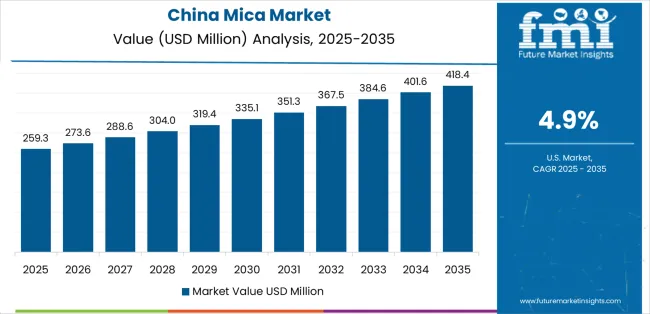

Revenue from mica in China is projected to exhibit exceptional growth with a CAGR of 4.9% through 2035, driven by expanding 5G telecommunications infrastructure and rapidly growing electric vehicle production capacity supported by government technology advancement initiatives and manufacturing competitiveness programs. The country's massive electronics manufacturing base and increasing investment in renewable energy systems are creating substantial demand for high-performance insulation materials. Major electronics manufacturers and specialty mineral suppliers are establishing comprehensive mica processing capabilities to serve both domestic technology markets and international electronics supply chains.

Revenue from mica in India is expanding at a CAGR of 4.5%, supported by the country's rapid electronics assembly sector development, increasing construction infrastructure investment, and rising demand for functional minerals in paints & coatings and cosmetics manufacturing facilities. The country's position as a major mica producing nation and expanding industrial base are driving domestic consumption growth. International electronics manufacturers and domestic mineral processors are establishing extensive processing and distribution capabilities to address the growing demand for mica products.

Revenue from mica in the United States is expanding at a CAGR of 3.6%, supported by the country's advanced aerospace and defense electronics sector, established premium cosmetics industry, and growing adoption of synthetic mica formulations for clean-label applications. The nation's sophisticated electronics infrastructure and emphasis on high-reliability applications are maintaining steady demand for premium-grade mica products. Aerospace manufacturers and cosmetics formulators are investing in specialized mica grades to serve both performance-critical and consumer-facing applications.

Revenue from mica in Brazil is growing at a CAGR of 3.4%, driven by recovering construction sector activity, increasing automotive refinish coatings demand, and growing investment in decorative paints and industrial coatings manufacturing. The country's developing infrastructure and modernization of building materials production are supporting demand for functional mineral additives across major consumption regions. Coatings manufacturers and construction materials suppliers are establishing comprehensive capabilities to serve both residential and commercial building markets.

Revenue from mica in Japan is expanding at a CAGR of 3.2%, supported by the country's focus on high-reliability electronics manufacturing, precision automotive electrical systems, and strong emphasis on quality control and technological innovation in specialty insulation applications. Japan's sophisticated electronics infrastructure and automotive engineering expertise are driving demand for premium-grade mica products and specialized insulation systems. Leading electronics companies are investing in specialized capabilities to serve advanced power electronics, automotive components, and precision equipment applications.

Revenue from mica in the United Kingdom is growing at a CAGR of 2.9%, driven by the country's emphasis on specialty cosmetics formulation, premium architectural coatings development, and strong focus on sustainable sourcing and ethical mineral procurement in consumer-facing applications. The UK's established cosmetics industry and focus on high-value coatings segments are supporting investment in premium mica grades throughout major consumption centers. Industry leaders are establishing specialized sourcing programs to serve both cosmetics and architectural coatings requirements.

Revenue from mica in Germany is growing at a CAGR of 2.6%, driven by the country's emphasis on automotive electrification technology, industrial insulation applications, and strong focus on engineering excellence in power electronics and electrical system components. Germany's established automotive industry and focus on electric vehicle development are supporting steady demand for high-performance insulation materials throughout major industrial regions. Automotive suppliers are establishing specialized capabilities to serve both electric vehicle and industrial electrical applications.

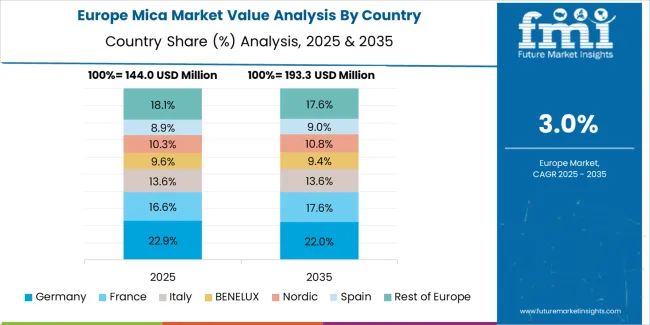

The mica market in Europe demonstrates steady demand patterns, with Western Europe accounting for the largest regional consumption. Germany leads European mica demand with approximately 22% of regional consumption, driven by automotive electrical insulation applications and premium coatings formulations that support the country's advanced manufacturing base. The automotive sector's transition to electric vehicles and ongoing industrial insulation retrofit programs sustain consistent demand for high-performance mica grades across diverse electrical and coatings applications.

France follows with about 15% of European mica consumption, benefiting from balanced demand across cosmetics formulation, architectural coatings production, and industrial applications. The country's established cosmetics industry and emphasis on premium decorative finishes support steady mica procurement across consumer and industrial segments. The United Kingdom represents approximately 13% of European demand, driven by specialty cosmetics manufacturing and industrial insulation applications that emphasize ethical sourcing and premium product positioning.

Italy accounts for about 12% of European mica consumption, balancing paints and coatings applications with appliance insulation and consumer electronics manufacturing that support the country's diversified industrial base. Spain represents approximately 10% of European demand, growing with decorative paints production and automotive refinish coatings that serve construction and aftermarket segments.

The Nordic region (Sweden, Finland, Denmark, and Norway combined) accounts for about 9% of European consumption, characterized by high-specification industrial insulation applications and forest-industry coatings that require premium functional properties. The Benelux countries (Belgium, Netherlands, and Luxembourg) maintain approximately 8% market share, supported by chemical logistics infrastructure and specialty coatings converter operations serving European markets.

The remaining approximately 11% of European mica demand is distributed across Central and Eastern Europe, notably Poland, Czech Republic, and Hungary, where automotive wire-harness insulation applications and green-building coatings development are steadily lifting consumption. These emerging European markets are experiencing increasing electrical component production and expanding construction activity that supports growing mica utilization in diverse applications.

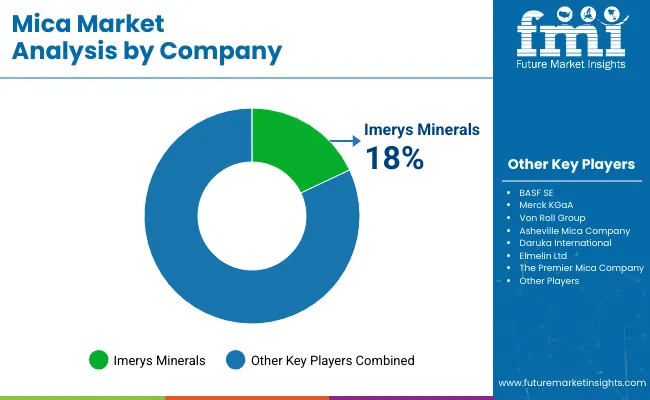

The mica market is characterized by competition among established mineral producers, specialty chemical companies, and integrated mining and processing operators. Imerys S.A. leads the market with a 12.5% share, offering comprehensive natural mica solutions with a focus on electronics insulation, cosmetics applications, and functional additives across diverse industrial segments. Companies are investing in advanced processing technology research, sustainable sourcing programs, quality enhancement, and comprehensive product portfolios to deliver reliable, high-purity, and application-optimized mica solutions. Innovation in synthetic mica production, ethical sourcing systems, and advanced beneficiation technologies is central to strengthening market position and competitive advantage.

Merck KGaA provides high-purity synthetic mica and specialty pigments with emphasis on cosmetics and industrial applications; following the sale of its Surface Solutions pigments business to Global New Material International for €665 million in July 2024, the business operates as "Susonity" since July 31, 2025. Von Roll Group offers specialized electrical insulation solutions with a focus on high-temperature applications and industrial electrical systems. Asheville Mica Company delivers natural sheet mica with emphasis on electrical and thermal insulation applications for aerospace and industrial markets. Daruka International focuses on ground mica products with emphasis on paints, coatings, and plastics applications. Elmelin Ltd. specializes in mica-based thermal insulation and electrical insulation products for industrial applications. The Premier Mica Company provides natural mica products for diverse industrial applications. Micafab India Pvt. Ltd. offers mica processing and fabrication services for electrical insulation applications. CQV Co., Ltd. delivers ground mica products for industrial applications. Fujian Kuncai Material Technology Co., Ltd. specializes in synthetic mica production with emphasis on cosmetics applications.

Mica represents a specialized, naturally occurring silicate mineral group used in functional materials and electrical insulation, projected to grow from USD 598.7 million in 2025 to USD 869.3 million by 2035 at a 3.8% CAGR. These are versatile aluminosilicate minerals. Available in natural sheet and ground forms, plus synthetic alternatives, provide exceptional dielectric strength, thermal stability, and functional properties for electrical insulation in electronics and power systems, decorative and functional additives in paints and coatings, reinforcing fillers in construction materials, and effect pigments in cosmetics applications. Market expansion is driven by increasing electronics manufacturing capacity, growing electric vehicle electrification, expanding construction activity in emerging markets, and rising demand for sustainable and ethically sourced mineral materials in consumer-facing applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 598.7 million |

| Form Type | Natural, Synthetic |

| Grade | Ground Mica, Sheet Mica, Built-up Mica |

| End-Use | Electronics, Paints & Coatings, Construction, Cosmetics, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, the United States, Brazil, Japan, the United Kingdom, Germany, and 40+ countries |

| Key Companies Profiled | Imerys S.A., Merck KGaA / Susonity, Von Roll Group, Asheville Mica Company, Daruka International, and Elmelin Ltd. |

| Additional Attributes | Dollar sales by form type, grade, and end-use category, regional demand trends, competitive landscape, technological advancements in processing methods, sustainable sourcing development, synthetic mica innovation, and ethical supply chain optimization |

The global mica market is estimated to be valued at USD 598.7 million in 2025.

The market size for the mica market is projected to reach USD 869.3 million by 2035.

The mica market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in mica market are natural and synthetic.

In terms of grade, ground mica segment to command 48.0% share in the mica market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remicade Biosimilar Market Analysis - Demand & Forecast 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA