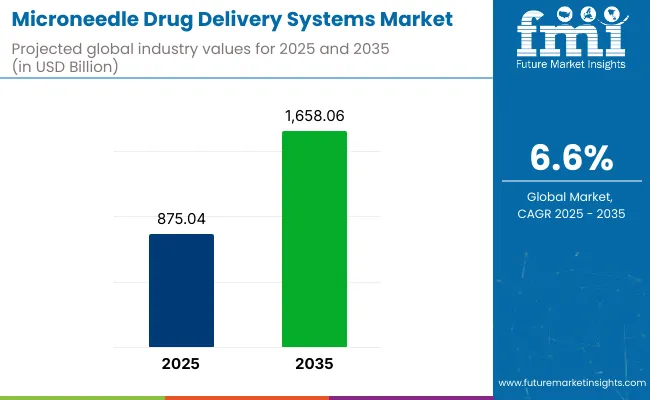

The global microneedle drug delivery systems market is projected to grow from USD 875.04 million in 2025 to USD 1,658.06 million by 2035, expanding at a CAGR of 6.6% over the forecast period. This growth is being driven by the increasing adoption of minimally invasive drug delivery methods that enhance patient comfort, improve therapeutic efficiency, and reduce healthcare costs.

Microneedle systems are gaining traction in applications such as vaccine delivery, pain management, diabetes care, and dermatological treatments. These systems enable precise, painless, and targeted administration of drugs through the skin, making them highly suitable for chronic and self-administered treatments, especially in the context of aging populations and rising demand for at-home care.

Technological advancements are playing a crucial role in expanding the scope of microneedle systems. Innovations in biodegradable polymers, dissolvable microneedles, and microneedle patches are helping improve drug absorption rates, stability, and ease of use. Pharmaceutical companies are exploring microneedle platforms to deliver biologics, insulin, and even cancer therapeutics.

The convenience and compliance advantages offered by these systems are also attracting attention from public health organizations, particularly for vaccine programs in resource-constrained settings. As manufacturers scale up production and refine formulations, microneedle delivery is emerging as a strategic alternative to conventional injections, addressing issues of needle phobia, medical waste, and cold-chain dependency.

Regulatory support is contributing to market growth, with agencies such as the USA, FDA and EMA establishing pathways for clinical approval and commercialization of microneedle-based therapeutics. These systems are being incorporated into drug development pipelines and combination product approvals, enabling pharmaceutical firms to introduce differentiated offerings in competitive therapy areas.

In parallel, emerging markets in Asia-Pacific and Latin America are witnessing rising investments in transdermal drug delivery infrastructure. With strong clinical potential, favorable regulatory trends, and growing patient acceptance, the microneedle drug delivery systems market is expected to expand significantly from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 875.04 million |

| Industry Value (2035F) | USD 1,658.06 million |

| CAGR (2025 to 2035) | 6.6% |

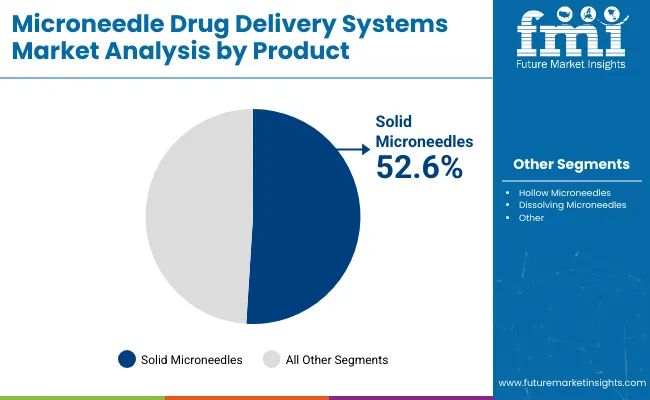

The market is segmented based on product, end use, and region. By product, the market is divided into solid microneedles, hollow microneedles, and dissolving microneedles. Solid microneedles are further segmented into silicon, metal, and polymer types.

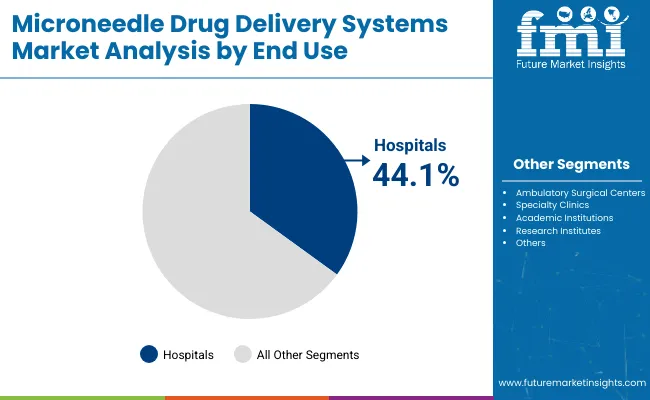

Based on end use, the market is categorized into hospitals, ambulatory surgical centers, specialty clinics, academic institutions, and research institutes. Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The solid microneedles segment is projected to dominate the microneedle drug delivery systems market, accounting for 52.6% share in 2025. These systems are widely used for their structural reliability and versatility across research and clinical settings.

Solid microneedles, often made from silicon, metal, or polymer, are currently undergoing optimization to improve their consistency, cost-efficiency, and biocompatibility. Increasing research in microneedle arrays is expanding their applicability in transdermal drug delivery, vaccine administration, and cosmetic treatments. Their mechanical strength and controlled penetration depth make them a reliable choice for large-scale clinical trials and chronic care.

Hollow microneedles are gaining notable momentum, especially in applications that require controlled fluid delivery into the dermis. These are increasingly being used in the administration of insulin, hormonal therapies, and emergency medications due to their precision and responsiveness. Their adoption is growing steadily in both hospital-based and at-home treatment formats, particularly where conventional needles pose usability or safety challenges.

Dissolving microneedles offer unique benefits due to their biodegradable nature and elimination of needle waste. They are increasingly favored in patient-centric care models, such as self-administered vaccines and long-term therapeutic regimens. As innovation in bioresorbable polymers continues, dissolving microneedles are poised to expand rapidly across preventive, pediatric, and chronic disease applications. The hollow microneedles segment accounts for 26.7% share.

| Product | Share (2025) |

|---|---|

| Solid Microneedles | 52.6% |

The hospitals segment is projected to dominate the market, accounting for a 44.1% share in 2025. Hospitals remain the largest end users due to their advanced infrastructure, specialist personnel, and regulatory oversight required for drug delivery innovations. Solid microneedle systems are commonly adopted in hospitals for transdermal drug administration, vaccine delivery, and cosmetic procedures.

Hospitals are also primary sites for early adoption of microneedle-based technologies during clinical trials, ensuring a steady flow of new applications as R&D progresses. Specialty clinics are witnessing increasing demand, particularly in dermatology, aesthetic medicine, and pain management. These clinics are adopting microneedle systems for minimally invasive treatments such as wrinkle reduction, scar treatment, and hair restoration.

As procedures become more personalized and outpatient-focused, clinics are expected to gain more relevance in microneedle application. Ambulatory surgical centers and academic institutions continue to play pivotal roles in device evaluation and pilot testing.

Research institutes are also playing an essential role in the market's evolution by supporting fundamental innovations in microneedle structure, delivery methods, and patient compliance. Their involvement is helping bridge the gap between early-phase clinical investigation and mainstream commercialization, contributing to broader adoption across healthcare ecosystems and enabling the microneedle market to mature in both high- and low-resource settings. The ambulatory surgical centers segment occupies 25% share.

| End Use | Share (2025) |

|---|---|

| Hospitals | 44.1% |

Nevertheless, constraints to market expansion are anticipated to include high costs associated with research and development capabilities, a lack of adequate infrastructure, unequal access to medical services, growing interest in alternative drug delivery methods like transdermal and intradermal systems, and a lack of awareness in developing nations.

Besides, it is anticipated that the absence of a favorable reimbursement scenario, a lack of technology penetration in developing economies, poor absorption and variation in absorption, a lack of adequate infrastructure in low- and middle-income groups, limited insurance coverage, and a lack of regulatory compliance is anticipated to pose challenges to the market during the forecast period.

The emergence of safer substitutes for traditional hypodermic injections is the main factor behind the expansion of microneedle drug delivery systems.

The popularity of safety concerns is another primary trend boosting the development of microneedle drug delivery systems.

The launch of a new microneedle patch is expected to make it simpler to vaccinate people in the event of preventable diseases as percenters for disease control and prevention.

Consequently, the need for microneedle drug delivery systems is increasing as a result of vaccines against numerous diseases like measles.

Besides this, the microneedle patch can be given by medical professionals with little training.

The most significant factor driving the market for microneedle drug delivery systems is the high adoption of emerging safety issues that have short- and long-term implications for clinicians, patients, health workers, and regulators, growing research and development measures, and increasing demands for a safer alternative to traditional hypodermic injections.

According to the WHO, new instances of cancer are anticipated to increase by roughly 70% over the following 20 years, which may lead to a need for microneedle patches as a drug delivery method.

The market for microneedle drug delivery systems is expected to be driven by advances in technology like microneedle patches and an increase in transdermal drug delivery applications for pain treatment, congestive heart failure, and hormone replacement.

The market expansion for microneedle drug delivery systems is anticipated to be hampered by drug degradation, local discomfort, poor absorption, and variability in absorption.

The Centers for Disease Control and Prevention claim that a new microneedle patch might make it simpler to immunize people against measles and other diseases that can be prevented by vaccination.

Due to the highly contagious nature of the measles virus, measures should be taken throughout the production and administration of the vaccine. Every year, measles affects over 25 million people, and sadly, the global measles vaccination rate has been hovering around 85% for the past few years, which is below the target level.

| Particulars | Details |

|---|---|

| H2, 2023 | 7.01% |

| H1, 2024 Projected | 7.25% |

| H1, 2024 Outlook | 6.80% |

| BPS Change - H1, 2024 (O) - H1, 2024 (P) | (-)45 ↓ |

| BPS Change - H1, 2024 (O) - H2, 2023 | (-) 21 ↓ |

The comparative analysis and market growth rate of the global microneedle drug delivery systems market as studied by Future Market Insights shows a negative BPS growth in the H1-2024 outlook as compared to H1-2024 projected period by 45 BPS, and a decline in the BPS growth is expected in H1-2024 over H2-2023 duration with 21 basis point share (BPS).

The expensive costs of creating a reproducible microneedle patch as well as the high expenses of storing and packaging microneedles for safe distribution are also factors that have been cited as limiting the decline in BPS levels.

The market is expected to gain momentum towards expansion over the anticipated years (2025 to 2035) thanks to the advantages of microneedles in advanced transdermal drug administration, including enhanced bioavailability of pharmaceuticals, reduced side effects, and rapid beginning of therapeutic action.

The introduction of solid, dissolving, and coated microneedles for efficient transdermal drug administration is one of the market's major advances. With regard to medication safety and product licensing operations, the market for microneedle drug delivery systems is subject to changes based on regulatory and industry dynamics.

The Demand for Microneedles for Drug Delivery is Being Driven by an Increase in Cancer Patients

The demand for innovative and efficient drug delivery methods to enhance therapy is being driven by the rising prevalence of chronic diseases in the United States, including diabetes and cancer. As a result, businesses and research organizations are bringing new product development to the nation, establishing it as a profitable segment.

In 2022, the United States witnessed 1.9 million new cancer cases diagnosed and 609,360 cancer deaths, according to Cancer Facts & Figures (2022), an educational companion to Cancer Statistics (2022), an article published in the American Cancer Society journal.

This is expected to encourage the development of new oncology treatments, driving the market for microneedle drug delivery systems in the country.

Demand for High-Quality Drugs & Access to Low-Cost Raw Ingredients Allows China to Expand its Industry

China is anticipated to hold a significant position in the East Asia market over the projection period. China's government organizations are investing more money in developing the healthcare industry, which is fostering the production of novel pharmaceuticals therein.

Several international pharmaceutical companies are looking to expand their operations in China due to the abundance of low-cost raw materials and the increased demand for generic medicines.

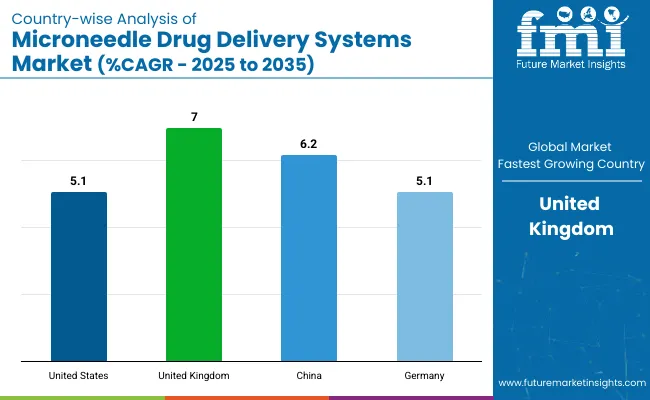

| Country | United States |

|---|---|

| CAGR (2020 to 2024) | 5.1% |

| CAGR (2025 to 2035) | 5.7% |

| Valuation (2035) | USD 528.6 million |

| Country | United Kingdom |

|---|---|

| CAGR (2020 to 2024) | 6.4% |

| CAGR (2025 to 2035) | 7.0% |

| Valuation (2035) | USD 84.4 million |

| Country | China |

|---|---|

| CAGR (2020 to 2024) | 5.7% |

| CAGR (2025 to 2035) | 6.2% |

| Valuation (2035) | USD 77.1 million |

| Country | Germany |

|---|---|

| CAGR (2020 to 2024) | 4.7% |

| CAGR (2025 to 2035) | 5.1% |

| Valuation (2035) | USD 79.3 million |

The global microneedle drug delivery systems market is dominated by large- and medium-sized companies. However, it is led by a few important companies that, as part of their marketing strategy, are focusing on their market and value chain positions.

Prominent market players use a range of tactics, such as early market entry, deep market penetration, as well as exclusive marketing and distribution licensing. Product innovation and differentiation, however, are essential market strategies for both mid-size and large businesses due to the diversity of market players.

Regardless of their size, companies use distribution rights acquisition and exclusive technology licensing as core strategies. In particular, a few businesses are focusing on strategic alliances in order to get a competitive edge.

Leading companies that sell microneedle drug delivery equipment are concentrating on Research and Development to introduce cutting-edge items in the market. In order to obtain a competitive edge in the market, firms are also engaging in mergers, acquisitions, and collaborations.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 875.04 million |

| Projected Market Size (2035) | USD 1,658.06 million |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value and thousand units for volume |

| By Product | Solid Microneedles (Silicon, Metal, Polymer), Hollow Microneedles, Dissolving Microneedles |

| By End Use | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Academic Institutions, Research Institutes |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, United Kingdom, China, Germany |

| Key Players | 3M Company, Becton, Dickinson and Company, Zosano Pharma Corporation, RAPHAS Co., Ltd., Nanopass Tech, Corium International Inc., Valeritas Inc., Nitto Denko Corporation, Microdermics Inc., TheraJect Inc., Vaxxas Pty Ltd., Endoderma Ltd., QuadMedicine, SNvia Co., Ltd. |

| Additional Attributes | Dollar sales by product and end use, analysis of solid vs. dissolving microneedle trends, regulatory insights on clinical approval pathways, penetration in self-administered therapeutics and emerging market healthcare systems |

The global microneedle drug delivery systems market is projected to reach USD 1,658.06 million by 2035, up from USD 875.04 million in 2025, growing at a CAGR of 6.6% over the forecast period.

Solid microneedles are expected to lead the market with a 52.6% share in 2025, driven by their structural durability and widespread use in transdermal drug delivery, vaccine administration, and cosmetic procedures.

Hospitals are anticipated to account for 44.1% of market share in 2025, due to their robust infrastructure, clinical trial involvement, and adoption of microneedle technology in advanced therapeutic care.

Despite a short-term decline in basis point share in 2024, the market is expected to grow due to increasing use of biodegradable microneedles, reduced side effects, enhanced patient compliance, and expanding use in chronic disease and vaccine delivery.

Major players include 3M Company, Becton, Dickinson and Company, Zosano Pharma Corporation, Corium International Inc., Nanopass Tech, RAPHAS Co., Ltd., and Vaxxas Pty Ltd., actively developing microneedle-based platforms across therapeutic areas.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Product, 2023 to 2033

Figure 14: Global Market Attractiveness by End Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Product, 2023 to 2033

Figure 29: North America Market Attractiveness by End Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product, 2023 to 2033

Figure 59: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dissolving Microneedle Market Analysis - Size, Share, and Forecast 2025 to 2035

Botulinum Toxin-coated Microneedles Market Size and Share Forecast Outlook 2025 to 2035

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA