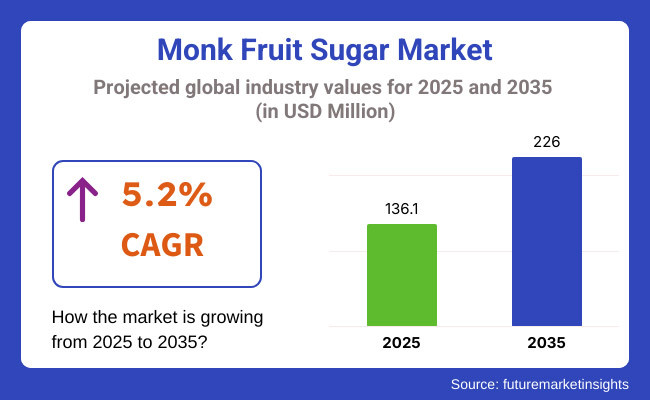

The global market size of the world monk fruit sugar in 2023 was USD 124 million. The 2024 sales of monk fruit sugar grew year by year by 5.2%, and therefore the world market will be USD 136.1 million in 2025. World revenue will have a 5.2% CAGR from 2025 to 2035 in the forecast period and will be the size of USD 226 million in 2035.

Monk fruit sugar from the monk fruit is picking up pace as a zero-calorie all-natural sweetener. It is being demanded as a substitute for normal sugars and artificial sweeteners because of its zero-calorie status and ability to preserve food and drinks' natural sweetness without adding any calories to blood. Demand for low-carb, low-sugar, and keto food products is the major trend driving market growth.

Due to the customers' penchant for healthier options for weight management, diabetes, and general well-being, consumption of monk fruit sugar as a natural, clean-label sweetener should drive fair growth over the forecast period. Increasing application of monk fruit sugar in food and beverage categories such as baked goods, beverages, dairy, and dietary supplements is also exhibiting this growth.

Monk sugar fruit is gaining momentum as it also carries its health allure, i.e., as one who wishes to reduce sugars. It is unlike the rest of the sweeteners since monk sugar fruit does not cause a spike in blood sugar, and it is therefore eagerly sought after by diabetics or low-carb consumers. It is antioxidant, and as such, it is eagerly sought after by the health-conscious buyer.

The market is also spurred by increased consumer demand for natural and organic sweeteners. With clean eating on the rise and consumers seeking greater health awareness, consumers are embracing monk fruit sugar in their lives more and more. Additionally, monk fruit sugar is also being used in other consumer goods such as soft drinks, dietary supplements, and cosmetics and is stimulating growth. The increasing need for low-calorie, gluten-free, and vegetarian food items will propel the growth over the next few years of the market.

The below is six months’ comparison between base year (2024) and current year (2025) variation in the CAGR variation of the global monk fruit sugar market. Based on the report, the enormous differences exist in performance and charts trends in the realization of revenue, hence providing stakeholders with a clear picture of the trend of development in a span of one year. H1 represents January to June, and H2 represents July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.8% |

| H2 (2024 to 2034) | 4.9% |

| H1 (2025 to 2035) | 5.0% |

| H2 (2025 to 2035) | 5.2% |

The market will survive a CAGR of 5.0% during the first half (H1) of the period 2025 to 2035 and a slightly increased rate of 5.2% during the second half (H2) of the period. The market will be driven by increasing demand for healthy low-calorie alternatives to sugar and artificial sweeteners. In the period's first half (H1), the market increased by 20 BPS, while in the second half (H2), the company will be in a position to post improved growth by 20 BPS.

The upward trend driven by increasing demand for natural, clean-label, and lower-calorie food puts monk fruit sugar on growth track for the forecast period.

Tier 1 Players, They are world-class leaders with large-scale monk fruit plantation and processing units, predominantly in China where the majority of the monk fruits are grown. Tier 1 companies possess effective global distribution networks, including big food and beverage, nutritional supplement firms, North American, European, and Asia-Pacific chains.

Tier 1 companies invest heavily in R&D that is particularly directed towards the optimization of extraction processes as well as sweet character of sweeteners produced from monk fruit. They have sufficient finances to invest themselves in the long term with big customers and also remain sensitive to regulation matters in various markets.

Tier 2 Players, These players are based within their respective regions and cater to the business of monk fruit sweetener manufacturing for medium-sized food and health product companies. They would likely be headquartered out of Asia-Pacific, North America, and certain European countries. Tier 2 competitors are surfing low prices and competing in niche consumer segments, for example, organic and non-GMO monk fruit sugar. Tier 2 players are expanding most by creating strategic alliances and local distributors, surfing natural sugar alternative's boom.

Tier 3 Players, Tier 3 players include independent players, cooperatives at local scales, and small-scale players for artisanal and organic monk fruit sugar production. These sorts of players are tapping into health-conscious consumers directly through specialty health food stores, online sales, and direct-to-consumer channels.

They operate on low volumes and employ traditional forms of farming and extraction. Although volume-wise small, Tier 3 players deliver value to the market in terms of high-quality, low-processed Monk Fruit sugar with robust traceability and sustainability platforms.

While demand for natural sweeteners is in increasing momentum, local players are venturing out and increasing their scopes by innovating, ethically sourcing, and remaining niche, hence further driving monk fruit sugar market growth.

Increase in Demand for Natural Substitute of Sugar

Shift: Triggered demand for natural substitutes of man-made sweeteners with health issues associated with use of man-made substitutes like aspartame and sucralose. Monk sugar, cultivated from fruit of luo han guo plant, is rapidly becoming popular as a zero-calorie, plant-based substitute for sugar without influencing blood sugar. Consumer statistics indicate a 42% increase in demand for natural sweetener substitutes over the past three years, of which monk fruit sugar is most in demand.

Strategic Response: Packaged food and beverage manufacturers replace monk fruit sugar with artificial sweeteners due to this trend. PepsiCo re-formulated some of its low-calorie beverages, replacing aspartame with monk fruit sugar, and achieving a 9% sales boost among health-conscious consumers.

Halo Top launched a series of monk fruit-sweetened ice cream and won over fitness-oriented consumers, expanding its market share by 15%. Starbucks started selling a syrup made from monk fruit to flavor drinks as demand for clean-label naturally sweetened beverages picked up.

Boom in the Diabetic and Keto-Friendly Segment

Shift: With the incidence of diabetes and keto diets, demand for low-glycemic sweeteners has increased. Monk fruit sugar is zero GI and thus ideal for diabetics, keto dieters, and patients of blood sugar level management. Low-carb or keto diets are being eaten by over 68 million USA consumers, which has increased the consumption of monk fruit sugar as a healthy alternative to sugar tremendously.

Strategic Response: Diabetic-friendly and keto-friendly product lines are emerging with monk fruit sugar. ChocZero introduced monk fruit-sweetened keto chocolate bars, increasing customer base by 26%. General Mills re-launched its sugar-free yogurt line, containing monk fruit sugar, which saw greater repeat purchase by diabetic consumers. Lily's Sweets introduced monk fruit-based baking chips, becoming a top keto dessert brand.

Growing Plant-Based and Clean-Label Sweetener Trends

Shift: Consumers are scanning ingredient labels more than ever before, looking for clean-label, lightly processed sweeteners. Monk fruit sugar, as a natural, chemical-free, preservative-free, artificial-additive-free sweetener, is right in line with the trend. In a recent consumer survey, 57% of global consumers actively look for products that contain simple, recognizable ingredients, which has driven the trend of monk fruit sugar in snacks, beverages, and meal alternatives.

Strategic Response: Leading brands are leaping on the clean-label tag of monk fruit sugar. KIND Bars replaced monkey fruit sweetener with table sugar, and sales increased 12% among label-conscious consumers. Coca-Cola launched a low-calorie iced tea sweetened with monk fruit to attract health-food shoppers and contribute to its portfolio of lower-calorie beverages. RXBAR extended into a series of monk fruit-sweetened protein bars for clean-food fitness enthusiasts.

Adoption in the Functional Beverage Category

Shift: Functional beverages such as sports beverages, energy beverages, and immune boosters are also increasing at a rapid rate, and businesses look for natural and low-calorie sweeteners that will not profane the taste. Monk fruit sugar, which is 100-250 times sweeter than sugar, allows businesses to create naturally sweet and low-calorie beverages without chemicals. Customers are increasingly looking for functional beverages rather than the usual sweetened drinks, and thus the utilization of monk fruit sugar is also increasing.

Strategic Response: Food and beverage companies are incorporating monk fruit sugar to enhance products. Gatorade launched a monk fruit-sweetened electrolyte drink, responding to clean-hydrating-product-needs athletes. Red Bull launched a monk fruit-spiked energy drink to respond to low-calorie, naturally sweetened energy drinks demand. Herbalife launched a monk fruit-sweetened meal replacement shake, boosting sales by 14% among health-conscious consumers.

Infant and Children Nutrition Product inclusion

Shift: Parents are now more worried than ever about kids' food having too much sugar, and too much sugar has been found in research to be the cause of obesity, diabetes, and behavioral issues. As it is a natural product and non-caloric-based, monk fruit sugar is under research and review as the most appropriate sweetener for baby food, toddler food, and children's beverages. According to studies, 42% of parents will go out of their way to seek out natural sugar alternatives when purchasing children's food.

Strategic Response: Infant food businesses and children's snack food businesses are introducing monk fruit-sweetened products to capitalize on that interest. Gerber introduced a monk fruit-sweetened organic infant formula, which is gaining steam with health-conscious mothers and fathers. GoGo SqueeZ introduced a monk fruit-sweetened fruit puree pouch with fewer added sugars and much kid appeal. Happy Family Organics revamped toddler cereals by replacing added sugars with monk fruit and saw a 21% increase in parent purchase.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of monk fruit sugar through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.5% |

| Germany | 3.9% |

| China | 5.3% |

| Japan | 5.6% |

| India | 7.8% |

The USA market for monk fruit sugar is growing because the consumers are interested in organic, non-GMO, and low-calorie sweeteners. Monk fruit sugar substitutes also end up being used in baking, beverages and an increasing variety of dietary supplements consumed by health-conscious individuals and diabetic-friendly food producers respective.

The growing trend towards obesity and diabetes is promoting consciousness about the reduction in sugar, hence growing the need for monk fruit extract, being a healthy replacement to artificial sweeteners and pure sugar.

The FDA's GRAS approval of monk fruit has further encouraged market acceptance in the USA. Clean-label trends are also driving adoption, with consumers increasingly seeking plant-based, minimally processed ingredients used in formulations for sugar-free foods. Food and beverage companies are responding with monk fruit-infused products, including sodas, protein bars, yogurt and even condiments, further propelling monk fruit's position as a major player in the natural sweetener category.

Europe is experiencing stable growth of monk fruit sugar in Germany, primarily attributed to EU legislation encouraging the use of natural ingredients as well as sugar reduction. Monk fruit is emerging in the functional foods, confectionery, and dietary supplements due to the growing consumer demand for organic-certified and minimally processed alternatives to sugar. Monk fruit sweeteners are of particular interest to consumers and manufacturers in Germany because they provide sweetness without the glycaemic effect of conventional sugar, and with "clean-label" appeal.

To balance flavors and retard crystallization, growing numbers of German-based products develop blends of monk fruit sugar with stevia, erythritol, or other natural sweeteners. The blends are designed to provide an optimal sweetness profile for various applications such as baked foods, sugar-free confectionery, plant-based protein drinks, and others. With an increased emphasis on health-conscious & environmentally friendly food production in Germany, monk fruit sugar is expected to see high adoption in premium organic and allagnic food products.

The monk fruit that is commonly utilized in traditional Chinese medicine and functional foods has transformed China into the biggest monk fruit sugar market and the fastest-growing category in the world. Increasing health issues related to sugar have led to increased use of sugar substitutes based on monk fruit across beverages, herbal supplements, and sugar-free confectionery.

Government-supported programs encouraging plant-based sweeteners further supported China's monk fruit business, enhancing extract production and high-purity processing methods. Learning more: Chinese manufacturers are investing in advanced extraction technologies to produce concentrated monk fruit sweeteners with enhanced flavor and stability. China is certainly the world's largest producer of Monk Fruit, even with increasing domestic and international demand.

| Segment | Value Share (2025) |

|---|---|

| Pure Monk Fruit Extract (By Type) | 61.4% |

In 2025, the monk fruit sugar market is dominated by pure monk fruit extract segment, which possesses colossal 61.4% share of the total monk fruit sugar market. Thanks to the super-high sweetness intensity, natural zero-calories properties, and increasing number of formulations for health-related products. The segment includes 100% monk fruit powder, concentrated monk fruit juice extracts, and high-purity mogroside V formulations, which are widely used in sugar-free and low-calorie foods and beverages.

As consumers demand more for natural, intense sweeteners, producers are investing in cutting-edge purification technologies to enhance taste, solubility and stability. Improvements in enzymatic processing and nano-filtration allow monk fruit extracts to be upgraded to remove any aftertaste and improve usage compatibility across a wide range of food and beverage applications. The increase in sustainable sourcing and large-scale cultivation of monk fruit is also helping to ensure a steady supply to meet increasing market demand around the world.

| Segment | Value Share (2025) |

|---|---|

| Monk Fruit Sugar Blends (By Type) | 38.6% |

As consumers increasingly seek well-balanced sweetness and natural sugar replacement solutions, the monk fruit sugar blend category holds a considerable 38.6% market share in 2025. These blends find usage in low-calorie baked goods, flavored beverages, and diabetic applications, delivering a taste closer to sucrose with a similar mouthfeel while exerting a low glycemic response.

Meanwhile, with the development of monk fruit coinciding with advances in erythritol, stevia and allulose, makers are now working on smoother-tasting, high-performing sweeteners for both commercial and home baking. And thus, these blends are in high demand by both food manufacturers and health-oriented consumers as they improve product stability, minimize after taste and provide enhanced overall sensory performance.

In addition, the growing demand for sugar alternatives, and fermentation-based monk fruit production is emerging as a promising economic and scalable process. This advanced technology ensures high purity monk fruit sweeteners that reduces reliance on conventional agriculture-based production processes thus propelling the growth of the market.

The monk fruit sugar market is a highly competitive market, with significant players engaged in the extraction of high-purity monk fruit, natural sugar reduction solutions and growing applications in food and beverage. Corporations are spending on advanced filtration techniques, sustainable monk fruit farming, and organic sugar alternative development.

Role of market players - Stakeholders namely Guilin Layn Natural Ingredients, Monk Fruit Corp, Tate & Lyle, Archer Daniels Midland (ADM), Apura Ingredients are top notch players in the arena with knowledge in monk fruit extract uniformity, clean-label options and exclusive mogroside V processing; the companies are players in monk fruit extract manufacturing. Numerous companies have even moved to expand their presence in North America and Europe to meet growing demands for natural sweeteners.

These strategies include collaborating with functional food brands, investing in monk fruit fermentation technology, and developing monk fruit sugar alcohol alternatives. Manufacturers are also focusing on calorie-free, low-calorie, keto, and diabetic-safe sugar substitutes.

For instance:

The market offers products in both Natural and Organic varieties, catering to consumers seeking high-quality and sustainable options.

These products are available in Powder and Liquid forms, ensuring versatility for different applications across industries.

They are widely used in various sectors, including Industrial applications, the Food & Beverage Industry (such as Bakery, Dairy & Ice Cream, Chocolate & Confectionery, Breakfast Cereals, and Beverages), the Pharmaceutical Industry, Commercial (HoReCa), and Household (Retail) consumption.

The products are packaged in different formats, including Bags & Sacs, Pouches, Folding Cartons, and Jars, ensuring convenience and extended shelf life.

Distribution occurs through both Direct (B2B) and Indirect (B2C) channels, including Store-Based Retailing in Hypermarkets/Supermarkets, Convenience Stores, Food & Drink Specialty Stores, and other retail outlets, as well as Online Retailing for broader accessibility.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global monk fruit sugar industry is projected to reach USD 136.1 million in 2025.

Key players include Archer Daniels Midland Company; Monk Fruit Corp.; Apura Ingredients; Guilin Layn Natural Ingredients Corp.

Asia-Pacific is expected to dominate due to high production of monk fruit in China and increasing demand for natural sugar alternatives.

The industry is forecasted to grow at a CAGR of 5.2% from 2025 to 2035.

Key drivers include rising demand for natural sweeteners, increasing adoption in sugar-free product formulations, and advancements in monk fruit extraction technology.

Table 01: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 03: Global Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 04: Global Volume (MT) Forecast by Nature, 2018 to 2033

Table 05: Global Value (US$ Million) Forecast by Form, 2018 to 2033

Table 06: Global Volume (MT) Forecast by Form, 2018 to 2033

Table 07: Global Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 08: Global Volume (MT) Forecast by End Use, 2018 to 2033

Table 09: Global Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 10: Global Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 11: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Volume (MT) Forecast by End Use, 2018 to 2033

Table 21: North America Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 22: North America Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 23: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Latin America Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Latin America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Latin America Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: Latin America Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 34: Latin America Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 35: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Europe Volume (MT) Forecast by Nature, 2018 to 2033

Table 41: Europe Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Europe Volume (MT) Forecast by Form, 2018 to 2033

Table 43: Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 44: Europe Volume (MT) Forecast by End Use, 2018 to 2033

Table 45: Europe Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 46: Europe Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 47: Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: East Asia Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: East Asia Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: East Asia Volume (MT) Forecast by Form, 2018 to 2033

Table 55: East Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Volume (MT) Forecast by End Use, 2018 to 2033

Table 57: East Asia Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 58: East Asia Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 59: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: East Asia Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: South Asia Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: South Asia Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: South Asia Volume (MT) Forecast by Form, 2018 to 2033

Table 67: South Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: South Asia Volume (MT) Forecast by End Use, 2018 to 2033

Table 69: South Asia Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 70: South Asia Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 71: South Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 73: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 75: Oceania Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: Oceania Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Oceania Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: Oceania Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Oceania Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Oceania Volume (MT) Forecast by End Use, 2018 to 2033

Table 81: Oceania Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 82: Oceania Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 83: Oceania Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: Oceania Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East & Africa Monk Fruit Sugar Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East & Africa Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Middle East & Africa Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 88: Middle East & Africa Volume (MT) Forecast by Nature, 2018 to 2033

Table 89: Middle East & Africa Value (US$ Million) Forecast by Form, 2018 to 2033

Table 90: Middle East & Africa Monk Fruit Sugar Volume (MT) Forecast by Form, 2018 to 2033

Table 91: Middle East & Africa Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 92: Middle East & Africa Volume (MT) Forecast by End Use, 2018 to 2033

Table 93: Middle East & Africa Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 94: Middle East & Africa Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 95: Middle East & Africa Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East & Africa Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 01: Global Value (US$ Million) by Nature, 2023 to 2033

Figure 02: Global Value (US$ Million) by Form, 2023 to 2033

Figure 03: Global Value (US$ Million) by End Use, 2023 to 2033

Figure 04: Global Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 05: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 06: Global Value (US$ Million) by Region, 2023 to 2033

Figure 07: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 08: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 09: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 12: Global Volume (MT) Analysis by Nature, 2018 to 2033

Figure 13: Global Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 14: Global Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 15: Global Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Global Volume (MT) Analysis by Form, 2018 to 2033

Figure 17: Global Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Global Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Global Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 20: Global Volume (MT) Analysis by End Use, 2018 to 2033

Figure 21: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 22: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 23: Global Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 24: Global Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 25: Global Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 26: Global Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 27: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Attractiveness by Nature, 2023 to 2033

Figure 32: Global Attractiveness by Form, 2023 to 2033

Figure 33: Global Attractiveness by End Use, 2023 to 2033

Figure 34: Global Attractiveness by Packaging Type, 2023 to 2033

Figure 35: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Attractiveness by Region, 2023 to 2033

Figure 37: North America Value (US$ Million) by Nature, 2023 to 2033

Figure 38: North America Value (US$ Million) by Form, 2023 to 2033

Figure 39: North America Value (US$ Million) by End Use, 2023 to 2033

Figure 40: North America Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 41: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 48: North America Volume (MT) Analysis by Nature, 2018 to 2033

Figure 49: North America Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 50: North America Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 51: North America Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 52: North America Volume (MT) Analysis by Form, 2018 to 2033

Figure 53: North America Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: North America Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: North America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: North America Volume (MT) Analysis by End Use, 2018 to 2033

Figure 57: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 58: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 59: North America Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 60: North America Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 61: North America Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 62: North America Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 63: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Attractiveness by Nature, 2023 to 2033

Figure 68: North America Attractiveness by Form, 2023 to 2033

Figure 69: North America Attractiveness by End Use, 2023 to 2033

Figure 70: North America Attractiveness by Packaging Type, 2023 to 2033

Figure 71: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Latin America Value (US$ Million) by Form, 2023 to 2033

Figure 75: Latin America Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Latin America Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 77: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 84: Latin America Volume (MT) Analysis by Nature, 2018 to 2033

Figure 85: Latin America Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 86: Latin America Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 87: Latin America Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Latin America Volume (MT) Analysis by Form, 2018 to 2033

Figure 89: Latin America Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Latin America Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Latin America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 92: Latin America Volume (MT) Analysis by End Use, 2018 to 2033

Figure 93: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 94: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 95: Latin America Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 96: Latin America Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 97: Latin America Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 98: Latin America Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 99: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Attractiveness by Nature, 2023 to 2033

Figure 104: Latin America Attractiveness by Form, 2023 to 2033

Figure 105: Latin America Attractiveness by End Use, 2023 to 2033

Figure 106: Latin America Attractiveness by Packaging Type, 2023 to 2033

Figure 107: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Attractiveness by Country, 2023 to 2033

Figure 109: Europe Value (US$ Million) by Nature, 2023 to 2033

Figure 110: Europe Value (US$ Million) by Form, 2023 to 2033

Figure 111: Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 112: Europe Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 113: Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 120: Europe Volume (MT) Analysis by Nature, 2018 to 2033

Figure 121: Europe Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 122: Europe Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 123: Europe Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 124: Europe Volume (MT) Analysis by Form, 2018 to 2033

Figure 125: Europe Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Europe Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 128: Europe Volume (MT) Analysis by End Use, 2018 to 2033

Figure 129: Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 130: Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 131: Europe Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 132: Europe Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 133: Europe Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 134: Europe Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 135: Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Attractiveness by Nature, 2023 to 2033

Figure 140: Europe Attractiveness by Form, 2023 to 2033

Figure 141: Europe Attractiveness by End Use, 2023 to 2033

Figure 142: Europe Attractiveness by Packaging Type, 2023 to 2033

Figure 143: Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ Million) by Nature, 2023 to 2033

Figure 146: East Asia Value (US$ Million) by Form, 2023 to 2033

Figure 147: East Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 149: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 151: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: East Asia Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 156: East Asia Volume (MT) Analysis by Nature, 2018 to 2033

Figure 157: East Asia Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 158: East Asia Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 159: East Asia Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: East Asia Volume (MT) Analysis by Form, 2018 to 2033

Figure 161: East Asia Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: East Asia Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: East Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 164: East Asia Volume (MT) Analysis by End Use, 2018 to 2033

Figure 165: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 166: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 167: East Asia Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 168: East Asia Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 169: East Asia Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 170: East Asia Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 171: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: East Asia Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 173: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: East Asia Attractiveness by Nature, 2023 to 2033

Figure 176: East Asia Attractiveness by Form, 2023 to 2033

Figure 177: East Asia Attractiveness by End Use, 2023 to 2033

Figure 178: East Asia Attractiveness by Packaging Type, 2023 to 2033

Figure 179: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 180: East Asia Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Value (US$ Million) by Nature, 2023 to 2033

Figure 182: South Asia Value (US$ Million) by Form, 2023 to 2033

Figure 183: South Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 184: South Asia Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 185: South Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 192: South Asia Volume (MT) Analysis by Nature, 2018 to 2033

Figure 193: South Asia Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 194: South Asia Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 195: South Asia Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 196: South Asia Volume (MT) Analysis by Form, 2018 to 2033

Figure 197: South Asia Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: South Asia Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: South Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 200: South Asia Volume (MT) Analysis by End Use, 2018 to 2033

Figure 201: South Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 202: South Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 203: South Asia Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 204: South Asia Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 205: South Asia Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 206: South Asia Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 207: South Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia Attractiveness by Nature, 2023 to 2033

Figure 212: South Asia Attractiveness by Form, 2023 to 2033

Figure 213: South Asia Attractiveness by End Use, 2023 to 2033

Figure 214: South Asia Attractiveness by Packaging Type, 2023 to 2033

Figure 215: South Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia Attractiveness by Country, 2023 to 2033

Figure 217: Oceania Value (US$ Million) by Nature, 2023 to 2033

Figure 218: Oceania Value (US$ Million) by Form, 2023 to 2033

Figure 219: Oceania Value (US$ Million) by End Use, 2023 to 2033

Figure 220: Oceania Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 221: Oceania Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 223: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: Oceania Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: Oceania Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 228: Oceania Volume (MT) Analysis by Nature, 2018 to 2033

Figure 229: Oceania Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 230: Oceania Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 231: Oceania Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 232: Oceania Volume (MT) Analysis by Form, 2018 to 2033

Figure 233: Oceania Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 234: Oceania Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 235: Oceania Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 236: Oceania Volume (MT) Analysis by End Use, 2018 to 2033

Figure 237: Oceania Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 238: Oceania Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 239: Oceania Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 240: Oceania Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 241: Oceania Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 242: Oceania Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 243: Oceania Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: Oceania Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 245: Oceania Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: Oceania Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: Oceania Attractiveness by Nature, 2023 to 2033

Figure 248: Oceania Attractiveness by Form, 2023 to 2033

Figure 249: Oceania Attractiveness by End Use, 2023 to 2033

Figure 250: Oceania Attractiveness by Packaging Type, 2023 to 2033

Figure 251: Oceania Attractiveness by Sales Channel, 2023 to 2033

Figure 252: Oceania Attractiveness by Country, 2023 to 2033

Figure 253: Middle East & Africa Value (US$ Million) by Nature, 2023 to 2033

Figure 254: Middle East & Africa Value (US$ Million) by Form, 2023 to 2033

Figure 255: Middle East & Africa Value (US$ Million) by End Use, 2023 to 2033

Figure 256: Middle East & Africa Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 257: Middle East & Africa Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East & Africa Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East & Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East & Africa Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: Middle East & Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East & Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East & Africa Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 264: Middle East & Africa Volume (MT) Analysis by Nature, 2018 to 2033

Figure 265: Middle East & Africa Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 266: Middle East & Africa Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 267: Middle East & Africa Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 268: Middle East & Africa Volume (MT) Analysis by Form, 2018 to 2033

Figure 269: Middle East & Africa Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 270: Middle East & Africa Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 271: Middle East & Africa Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 272: Middle East & Africa Volume (MT) Analysis by End Use, 2018 to 2033

Figure 273: Middle East & Africa Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 274: Middle East & Africa Monk Fruit Sugar Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 275: Middle East & Africa Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 276: Middle East & Africa Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 277: Middle East & Africa Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 278: Middle East & Africa Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 279: Middle East & Africa Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East & Africa Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East & Africa Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East & Africa Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East & Africa Attractiveness by Nature, 2023 to 2033

Figure 284: Middle East & Africa Attractiveness by Form, 2023 to 2033

Figure 285: Middle East & Africa Attractiveness by End Use, 2023 to 2033

Figure 286: Middle East & Africa Attractiveness by Packaging Type, 2023 to 2033

Figure 287: Middle East & Africa Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East & Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monkeypox Treatment Market - Drug Developments & Demand Forecast 2025 to 2035

Monk Fruit Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Fruit Punnet Market Trends – Growth & Forecast 2024-2034

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA