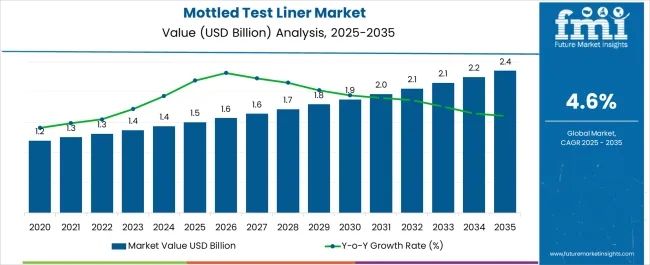

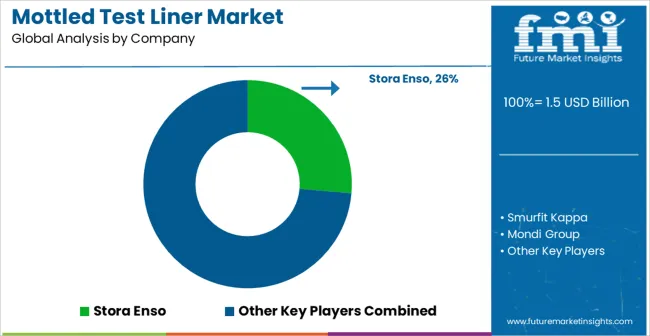

The Mottled Test Liner Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Mottled Test Liner Market Estimated Value in (2025 E) | USD 1.5 billion |

| Mottled Test Liner Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The Mottled Test Liner market is positioned for strong growth as the packaging industry continues to emphasize cost efficiency, sustainability, and adaptability. Current demand is being supported by rising consumption of corrugated packaging across diverse industries such as food and beverages, e commerce, retail, and industrial goods. The use of recycled materials has enhanced the value proposition of mottled test liners, aligning with global sustainability goals and circular economy initiatives.

The ability of these liners to provide strength, printability, and visual appeal while maintaining cost competitiveness has reinforced their adoption. Market expansion is further influenced by the increasing requirement for lightweight yet durable packaging solutions that reduce transportation costs and environmental impact.

Investments in recycling infrastructure and technological innovations in paper processing are expected to create additional opportunities Looking ahead, the future outlook is shaped by consumer demand for eco friendly packaging, regulatory push toward sustainable practices, and the strategic shift of companies toward greener supply chains, all of which are supporting continued market momentum.

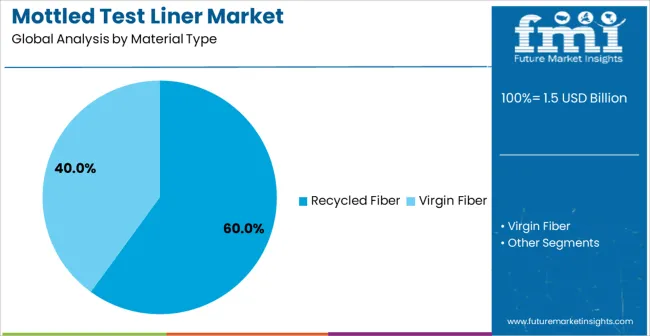

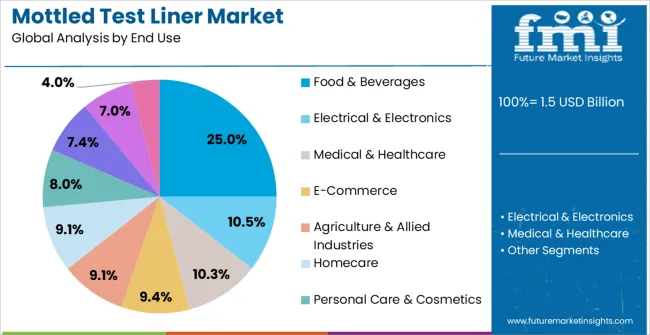

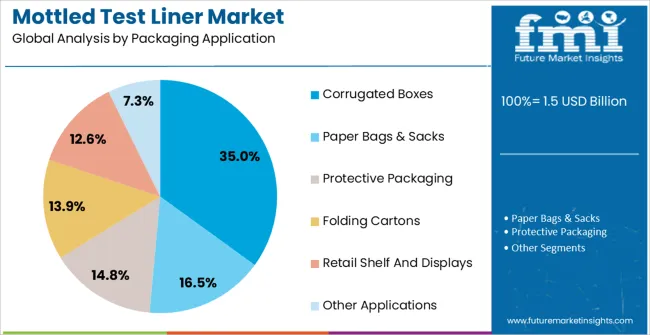

The mottled test liner market is segmented by material type, thickness, packaging application, end use, and geographic regions. By material type, mottled test liner market is divided into Recycled Fiber and Virgin Fiber. In terms of thickness, mottled test liner market is classified into 70 GSM to 150 GSM, Up to 70 GSM, 150 GSM to 200 GSM, 200 GSM to 300 GSM, and More Than 300 GSM. Based on packaging application, mottled test liner market is segmented into Corrugated Boxes, Paper Bags & Sacks, Protective Packaging, Folding Cartons, Retail Shelf And Displays, and Other Applications.

By end use, mottled test liner market is segmented into Food & Beverages, Electrical & Electronics, Medical & Healthcare, E-Commerce, Agriculture & Allied Industries, Homecare, Personal Care & Cosmetics, Automotive & Allied Industries, Chemicals & Fertilizers, and Others (Textiles, Etc.). Regionally, the mottled test liner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Recycled Fiber segment is expected to account for 60.00% of the overall Mottled Test Liner market revenue in 2025, making it the leading material type. This position is being driven by the rising focus on environmentally responsible production methods and the growing acceptance of recycled paper in premium and industrial packaging applications. Adoption has been reinforced by cost effectiveness, as recycled fiber offers a lower production cost while delivering adequate strength and quality for corrugated packaging.

The shift toward sustainability in global packaging standards has further accelerated demand, as companies are actively seeking to reduce carbon footprints and demonstrate commitment to circular economy practices. Additionally, advancements in paper recycling technologies have improved the quality of recycled fiber, reducing performance gaps compared to virgin fiber.

This has encouraged its use across a wide variety of industries The preference for recycled fiber is also influenced by regulatory pressures and consumer awareness regarding eco friendly packaging, ensuring this segment’s continued dominance.

The 70 GSM to 150 GSM thickness segment is projected to represent 40.00% of the Mottled Test Liner market revenue in 2025, making it the most significant category under thickness. Growth in this segment is being attributed to its versatility and ability to meet a wide spectrum of packaging requirements across industries. This thickness range offers a balance between durability and cost efficiency, making it suitable for manufacturing lightweight corrugated packaging that does not compromise on performance.

Its widespread adoption has been supported by increased demand for packaging formats that can withstand shipping, handling, and storage pressures while maintaining structural integrity. Additionally, its print compatibility has enabled better brand visibility and design options, which are increasingly valued in consumer facing packaging.

The preference for this category is further influenced by its scalability in high volume production processes, providing manufacturers with operational flexibility With sustainability and lightweighting trends gaining momentum, this thickness range is anticipated to maintain its leadership in the market.

The Corrugated Boxes application segment is anticipated to hold 35.00% of the Mottled Test Liner market revenue in 2025, making it the leading packaging application. This dominance is being supported by the global expansion of e commerce, retail distribution, and logistics operations, where corrugated boxes are extensively used for safe and cost effective transportation. The segment’s growth is also being propelled by the increasing need for sustainable packaging materials that are recyclable and compliant with international standards.

Corrugated boxes made with mottled test liners are favored for their strength, printability, and ability to enhance the visual presentation of packaged goods. Demand is further reinforced by manufacturers prioritizing eco friendly options in supply chains and aligning with consumer preferences for sustainable packaging.

Additionally, the ability of corrugated boxes to be customized in various sizes and formats has broadened their applicability across diverse industries With global trade and e commerce volumes expected to rise further, this segment is projected to sustain its leadership position.

In recent years, paper packaging is growing significantly on the backdrop of environmental concerns regarding the usage of plastic and its disposal. Paperboard or paper which contains no less than 80% recycled fiber content is termed as mottled test liner.

Mottled test liner is primarily a raw materials for corrugated board. Mostly the grammage for mottled test liner are ranging between 100 to 220 gm per sq meter. The mottled test liner is used as outer and intermediate layer of a containerboard which is used to manufacture products such as corrugated boxes, folding cartons, retail shelf & displays, etc.

However, the mottled test liner can also be used to manufacture paper bags & sacks, pallet slip sheets, protective packaging products, among others. Furthermore, mottled test liner can be recycled and are environmental friendly as compared to other packaging applications. Mottled test liner can be used for several end use applications like food & beverages, e-commerce, healthcare, automotive, etc.

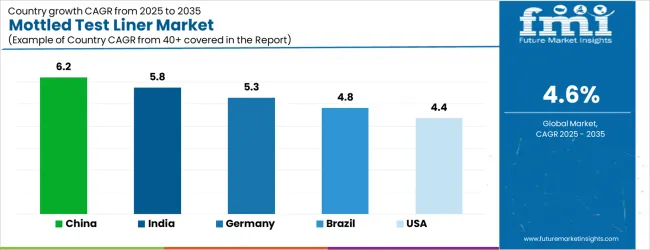

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

The Mottled Test Liner Market is expected to register a CAGR of 4.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.2%, followed by India at 5.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 3.5%, yet still underscores a broadly positive trajectory for the global Mottled Test Liner Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.3%.

The USA Mottled Test Liner Market is estimated to be valued at USD 549.2 million in 2025 and is anticipated to reach a valuation of USD 549.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 82.1 million and USD 37.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Material Type | Recycled Fiber and Virgin Fiber |

| Thickness | 70 GSM to 150 GSM, Up to 70 GSM, 150 GSM to 200 GSM, 200 GSM to 300 GSM, and More Than 300 GSM |

| Packaging Application | Corrugated Boxes, Paper Bags & Sacks, Protective Packaging, Folding Cartons, Retail Shelf And Displays, and Other Applications |

| End Use | Food & Beverages, Electrical & Electronics, Medical & Healthcare, E-Commerce, Agriculture & Allied Industries, Homecare, Personal Care & Cosmetics, Automotive & Allied Industries, Chemicals & Fertilizers, and Others (Textiles, Etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stora Enso, Smurfit Kappa, Mondi Group, DS Smith, Svenska Cellulosa, NorPaper, Saica Paper, and Asia Pulp and Paper |

The global mottled test liner market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the mottled test liner market is projected to reach USD 2.4 billion by 2035.

The mottled test liner market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in mottled test liner market are recycled fiber and virgin fiber.

In terms of thickness, 70 gsm to 150 gsm segment to command 40.0% share in the mottled test liner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testliner Market

White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Liner Hanger Market

Testosterone Injectable Market

Test Tube Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA