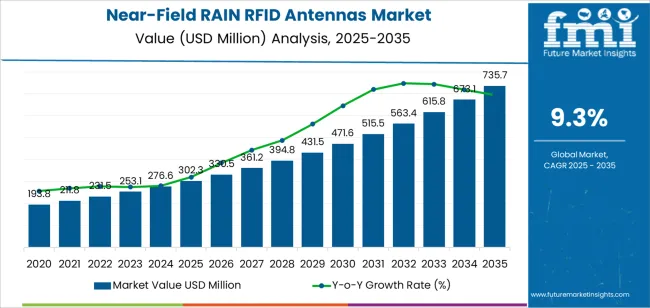

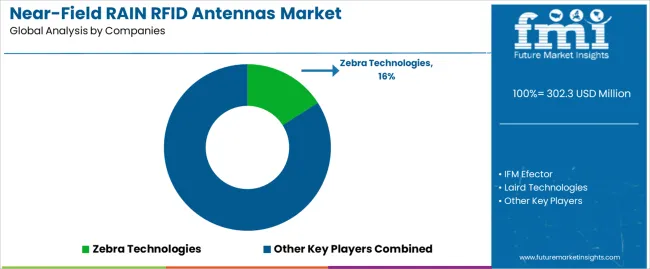

The global near-field RAIN RFID antennas market is projected to reach USD 735.7 million by 2035, reflecting an absolute increase of USD 433.4 million over the forecast period. The market is valued at USD 302.3 million in 2025 and is expected to grow at a robust CAGR of 9.3%. This growth is driven by the increasing adoption of RAIN RFID (Radio Frequency Identification) technology in various industries, including retail, logistics, healthcare, and manufacturing, where the need for efficient, real-time tracking and inventory management is rising. Near-field RFID antennas are critical in enabling short-range communication between RFID tags and readers, providing enhanced tracking capabilities in environments that require high precision and reliability.

Near-field RAIN RFID antennas are designed to operate at close proximity to RFID tags, offering a key advantage in applications requiring precise reading, such as inventory management in retail or asset tracking in healthcare. Their ability to provide accurate, short-range communication makes them ideal for industries looking to enhance operational efficiency and streamline their supply chain processes. As the demand for smart inventory systems and IoT-enabled devices increases, these antennas are becoming essential components of modern RFID systems, driving market growth.

The rise in e-commerce, coupled with the increasing need for real-time supply chain visibility, is another key factor contributing to the expansion of the near-field RAIN RFID antennas market. Advancements in RAIN RFID technology, such as improved antenna designs for better read range and sensitivity, are further boosting adoption across a wide range of applications. The growing trend of smart logistics, inventory management, and asset tracking is set to propel this market in the coming years.

Between 2025 and 2030, the near-field RAIN RFID antennas market is projected to grow from USD 302.3 million to approximately USD 442.7 million, adding USD 140.4 million, which accounts for about 32.4% of the total forecasted growth for the decade. This period will be characterized by an increased adoption of RAIN RFID technology in key sectors such as retail, healthcare, and logistics. The demand for efficient tracking and inventory management systems is expected to rise, driven by the need for real-time data and operational efficiency. Advancements in RAIN RFID solutions, including improved antenna designs, will enable better sensitivity, read range, and reliability, further driving market growth.

From 2030 to 2035, the market is expected to expand from approximately USD 442.7 million to USD 735.7 million, adding USD 293.0 million, which constitutes about 67.6% of the overall growth. This phase will be marked by increased integration of RAIN RFID antennas in smart logistics, supply chain optimization, and automation systems. As e-commerce continues to grow and businesses place greater emphasis on streamlining operations, the demand for precise, real-time tracking solutions will intensify. This will lead to broader adoption of RAIN RFID technology across various industries, including logistics and manufacturing, where automation and smart systems are increasingly becoming a priority.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 302.3 million |

| Market Forecast Value (2035) | USD 735.7 million |

| Forecast CAGR (2025 to 2035) | 9.3% |

The near-field RAIN RFID antennas market is expanding due to the increasing adoption of RAIN RFID (Radio Frequency Identification) technology in various industries, including retail, logistics, healthcare, and supply chain management. Near-field RAIN RFID antennas enable efficient and accurate data transmission over short distances, facilitating real-time tracking and inventory management. These antennas are crucial for applications such as asset tracking, item-level identification, and contactless payments, where speed, accuracy, and reliability are critical.

The growing demand for automation and smart systems in supply chain and inventory management is a significant driver for the market. Near-field RAIN RFID technology allows businesses to streamline operations by improving visibility across their supply chains, reducing human errors, and optimizing inventory processes. As the retail and logistics sectors increasingly implement RFID technology to enhance operational efficiency, the demand for near-field RFID antennas is expected to grow.

The market is also being driven by the rise in the use of smart devices and the IoT (Internet of Things), where NFC-enabled devices are widely used for a variety of applications, including secure access control and asset tracking. As more businesses and consumers embrace RFID technology, the need for efficient and cost-effective RFID solutions, including near-field antennas, continues to rise. Challenges related to privacy concerns and security risks, as well as the high initial cost of deployment, may affect market growth in some regions. Despite these challenges, the market for near-field RAIN RFID antennas is set to continue expanding due to technological advancements and broader adoption across industries.

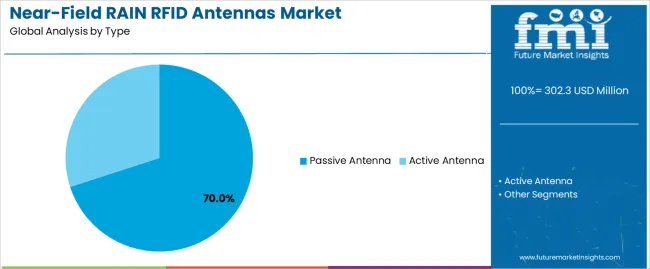

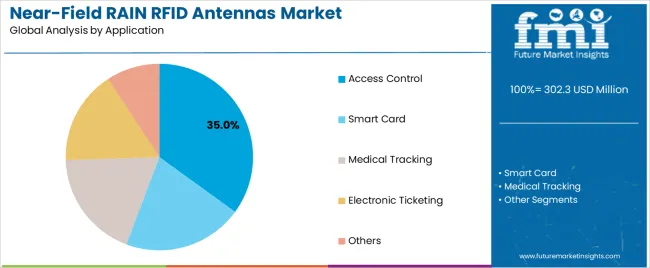

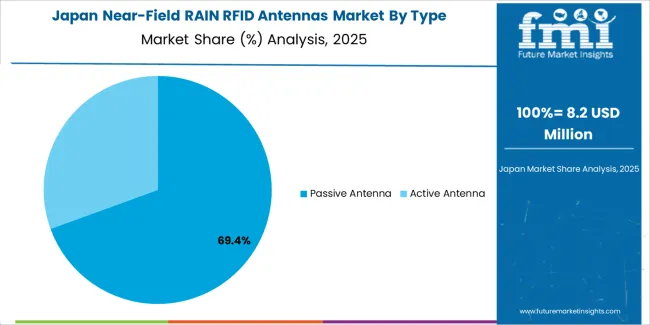

The market is segmented by type, application, and region. By type, the market is divided into passive antenna and active antenna, with passive antenna leading the market. Based on application, the market is categorized into access control, smart card, medical tracking, electronic ticketing, and others, with access control representing the largest segment in terms of market share. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The passive antenna segment dominates the near-field RAIN RFID antennas market, accounting for approximately 70.0% of the total market share. Passive antennas are preferred due to their cost-effectiveness, simplicity, and low power consumption compared to active antennas. These antennas do not require an external power source, as they draw energy from the RFID reader’s signal, making them ideal for a wide range of compact and low-cost RFID applications. Their reliability and long operational life make them particularly attractive for large-scale deployments in access control systems, inventory management, and smart card applications.

Another major factor driving the growth of the passive antenna segment is the increasing adoption of RAIN RFID technology in industries such as retail, logistics, and healthcare. The need for accurate and efficient item-level tracking has boosted the demand for passive RFID systems, which offer high read accuracy and cost efficiency. Advancements in near-field antenna design have enhanced signal precision and tag readability, improving performance in densely tagged environments. As organizations continue to focus on automation and asset visibility, passive antennas are expected to maintain their dominance due to their scalability, affordability, and suitability for multiple commercial and industrial use cases.

The access control application leads the near-field RAIN RFID antennas market, holding 35.0% of the total market share. This growth is driven by the increasing demand for secure and efficient identification systems across sectors such as corporate offices, transportation hubs, government institutions, and educational facilities. Near-field RAIN RFID antennas are integral to access control systems, enabling rapid and contactless authentication, which enhances both security and convenience. Their ability to accurately read tags within a short range ensures reliable identity verification, reducing the risk of unauthorized entry.

The global shift towards digital identity management and automation in security systems has propelled the use of RFID-based access control solutions. As organizations increasingly adopt contactless systems to improve operational efficiency and hygiene, particularly post-pandemic, the demand for RAIN RFID antennas in access control continues to rise. The integration of RFID antennas with smart card systems, biometric technologies, and IoT-enabled platforms further strengthens their utility in modern access management. With technological advancements improving read precision and data encryption, the access control segment is expected to sustain its leading position in the near-field RAIN RFID antennas market over the coming years.

The market is growing due to increased demand for precise short range tracking in retail, logistics, and manufacturing. These antennas offer high read accuracy, minimal interference, and compact designs. Key drivers include the rise of IoT, asset tracking, and RAIN RFID adoption in supply chains. Restraints include the higher cost of advanced antennas, standardization challenges, and integration issues with legacy systems.

Near‑field RAIN RFID antennas are gaining popularity due to their ability to address challenges where traditional far‑field antennas fall short. These antennas are especially useful in metal‑rich environments, dense tag populations, and applications that require precise read zones, such as shelf‑level retail, device tracking, and small item logistics. Operating at UHF (860‑960 MHz), near‑field antennas provide tight field control, reducing tag collisions and improving read reliability. They enable new use cases like handheld scanning and embedded tracking in constrained spaces. As businesses seek enhanced asset visibility, higher inventory accuracy, and faster throughput, near‑field RAIN antennas play a crucial role in meeting these needs. Their ability to deliver more accurate, reliable, and efficient tracking solutions makes them an indispensable component of modern inventory management and logistics systems.

Technological innovations are driving growth in the near‑field RAIN RFID antenna market by enhancing their design, performance, and integration capabilities. Advances in compact “on‑metal” designs, dense‑tag environment tuning, and multi‑protocol support (including RAIN RFID, NFC, and other RFID frequencies) are increasing the versatility of these antennas. Improvements in materials, embedded electronics, and firmware allow the antennas to operate reliably in harsh, cluttered environments.The integration of analytics platforms and IoT edge‑devices provides smarter tracking solutions. These innovations also allow for more flexible deployment, such as modular and handheld antenna systems, ideal for retail, manufacturing, and logistics applications. The ability to provide enhanced functionality and scalability drives the adoption of near‑field RFID antennas, enabling more effective and efficient tracking and data collection in various industries.

Despite their advantages, several challenges are limiting the widespread adoption of near‑field RAIN RFID antennas. The most significant barrier is the cost of advanced antennas, which come with special shielding, metal‑tolerant designs, and multi‑protocol capabilities, making them more expensive than traditional far‑field antennas. Standardization and compatibility issues also pose a challenge, as differences in tag protocols, frequencies, and regional regulations complicate global deployment. Integrating these antennas into existing infrastructure, such as store shelves, conveyors, and handheld devices, often requires customized solutions, adding complexity to adoption. Awareness and education remain a concern, as some end‑users may not fully understand the specific benefits of near‑field antennas compared to traditional far‑field solutions, limiting their broader implementation across industries. These challenges must be addressed for near‑field RAIN RFID antennas to achieve broader market penetration.

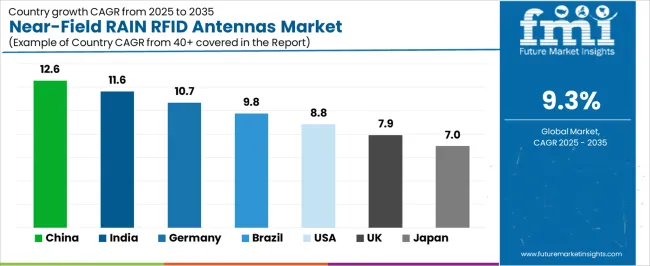

| Country | CAGR (%) |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| Brazil | 9.8% |

| USA | 8.8% |

| UK | 7.9% |

| Japan | 7.0% |

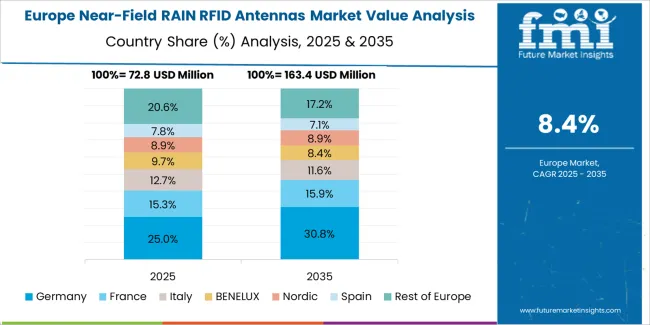

The near-field RAIN RFID antennas market is witnessing strong growth globally, with China leading at a 12.6% CAGR, driven by its rapidly expanding RFID adoption in sectors like logistics, retail, and manufacturing. India follows with an 11.6% CAGR, supported by the country’s push for digital transformation and adoption of RFID solutions in supply chain and retail. Germany shows a 10.7% CAGR, backed by its advanced industrial automation and smart manufacturing sectors. Brazil is experiencing a 9.8% CAGR, driven by increasing demand for RFID technologies in logistics and retail. The USA grows at 8.8%, fueled by its robust e-commerce industry and RFID adoption in various sectors like healthcare and retail. The UK records a 7.9% CAGR, supported by growing retail adoption and logistics applications. Japan has a 7.0% CAGR, with RFID gaining traction in retail, automotive, and logistics.

China is leading the near-field RAIN RFID antennas market with a significant 12.6% CAGR, driven by the country’s rapid adoption of RFID technology across a variety of industries, including retail, logistics, manufacturing, and automotive. As the world's largest manufacturing hub, China is leveraging RFID to enhance supply chain efficiency, inventory tracking, and product management. The integration of RFID technology into logistics and e-commerce platforms, particularly in warehousing and real-time product tracking, is one of the key drivers for market growth. China's smart city initiatives and investments in automation are pushing the adoption of RFID for intelligent transportation systems, retail management, and healthcare.

The government’s support for digital transformation and Industry 4.0 initiatives further fuels the demand for near-field RFID antennas. RFID solutions are essential in China's expansive retail sector, with the technology being used to manage inventory, track shipments, and enable self-checkout systems. The ongoing development of the country’s infrastructure and growing e-commerce market are key factors driving RFID adoption. With the increasing push for smart manufacturing, logistics, and digital supply chains, China’s demand for near-field RAIN RFID antennas continues to rise, making it a key global market for this technology.

India is experiencing strong growth in the near-field RAIN RFID antennas market, with an 11.6% CAGR, largely driven by the country’s rapid adoption of RFID technology across logistics, retail, and supply chain management. As India’s e-commerce sector continues to expand, the need for effective inventory management, real-time product tracking, and efficient supply chain solutions becomes increasingly critical. RFID technology, especially near-field RAIN RFID, plays a crucial role in automating these processes, enabling businesses to improve operational efficiency and reduce manual errors. India’s push for digital transformation and smart city initiatives has also fostered growth in RFID adoption in industries such as manufacturing, transportation, and healthcare.

The government’s focus on improving infrastructure and digitizing logistics and retail operations is also driving RFID adoption. India’s growing retail sector, particularly in organized retail and e-commerce, has led to the increased demand for RFID systems to track products, manage inventories, and enhance customer experiences. The logistics industry, too, benefits from RFID technology for improving supply chain visibility and reducing delays. With India’s booming manufacturing sector, RFID’s integration into production lines for asset tracking and quality control is also gaining momentum. As RFID technology continues to evolve and support India’s digital growth, the market for near-field RAIN RFID antennas will continue to expand.

Germany is contributing significantly to the near-field RAIN RFID antennas market, with a 10.7% CAGR, driven by its strong industrial and manufacturing base and a robust push toward Industry 4.0. Germany’s emphasis on digitalization, automation, and supply chain optimization has led to a rapid adoption of RFID technology across several sectors, including logistics, automotive, and retail. With a focus on operational efficiency, German manufacturers and logistics providers have embraced near-field RFID antennas to automate inventory tracking, monitor assets, and improve product quality control. The country’s high-tech manufacturing sector and innovation in smart manufacturing systems make it a key adopter of RFID technology.

The retail sector in Germany also increasingly relies on RFID technology to enhance customer experience, improve stock management, and streamline supply chains. Germany’s automotive industry, known for its advanced production systems, uses RFID for precision in assembly lines, part tracking, and inventory management. Moreover, as Germany is a leader in environmental sustainability, RFID’s ability to help companies track products and materials in a more sustainable manner is contributing to the demand for near-field RFID antennas. With strong industrial adoption and a focus on digital transformation, Germany remains a key market for near-field RAIN RFID antennas, contributing to its growth across Europe.

Brazil is experiencing solid growth in the near-field RAIN RFID antennas market with a 9.8% CAGR, driven by the increasing adoption of RFID technology in logistics, retail, and manufacturing. Brazil’s retail industry, particularly in e-commerce and organized retail, is increasingly relying on RFID to improve inventory management, streamline logistics, and reduce theft. As the country’s logistics sector modernizes and adapts to global best practices, the demand for real-time tracking and efficient supply chain solutions is driving the adoption of RFID systems. RFID technology, particularly near-field RAIN RFID, provides an effective solution for automating warehouse management, improving stock accuracy, and enabling faster product retrieval.

The Brazilian government’s initiatives to improve infrastructure and its growing manufacturing sector are also pushing the adoption of RFID solutions for supply chain optimization. As Brazil continues to develop its digital infrastructure, the integration of RFID technology into industries such as automotive, agriculture, and healthcare is gaining traction. The country’s large e-commerce market has created a significant demand for RFID technology to manage logistics, improve delivery times, and enhance customer satisfaction. With the continued adoption of digital solutions and automation in industries across Brazil, the market for near-field RAIN RFID antennas will continue to experience growth.

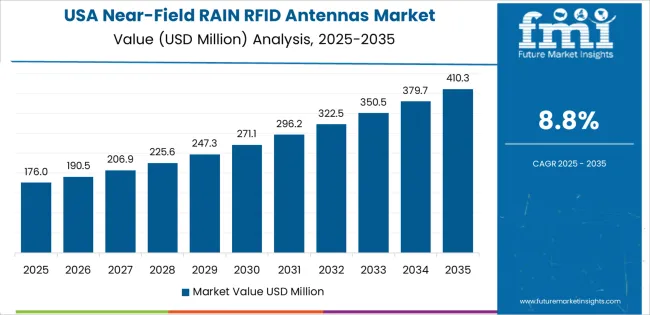

The USA is experiencing steady growth in the near-field RAIN RFID antennas market with an 8.8% CAGR, driven by the country’s well-established e-commerce industry and widespread adoption of RFID technology in supply chain management, retail, and healthcare. In the USA, RFID is increasingly used to track products, monitor inventory, and improve operational efficiency in retail and logistics. The growing shift toward digital and automated supply chains, especially in the e-commerce sector, has accelerated the adoption of RFID systems for real-time product tracking. RFID-enabled systems help USA businesses optimize their supply chains, reduce costs, and enhance delivery accuracy.

The USA healthcare industry has also been a key driver of RFID adoption, with near-field RAIN RFID antennas being used for tracking medical equipment, inventory management, and patient identification. The automotive industry is another major adopter, using RFID for asset tracking and production line management. The rise of IoT and the increasing demand for smart, connected systems are further promoting the use of RFID solutions in various sectors. With strong demand from retail, logistics, and healthcare, the market for near-field RAIN RFID antennas in the USA is poised to continue growing as industries embrace digital transformation.

The UK is seeing steady growth in the near-field RAIN RFID antennas sector with a 7.9% CAGR, driven by increasing demand in retail, logistics, and manufacturing industries. The UK’s retail sector, one of the largest in Europe, is adopting RFID technology to improve inventory management, enhance supply chain visibility, and reduce operational costs. With a focus on improving customer experience, retailers are leveraging RFID to enable self-checkout systems, automate stock replenishment, and ensure better product tracking across stores and warehouses. RFID’s role in improving operational efficiency in logistics is another major factor driving growth in the UK.

The UK’s growing automotive and manufacturing sectors are also adopting RFID technology to improve asset tracking, streamline production lines, and optimize logistics. As the country continues to embrace digitalization and Industry 4.0 initiatives, the demand for RFID solutions in manufacturing, particularly in precision and high-value industries like automotive, is expected to rise. The government’s push for sustainability and efficiency in industry also supports RFID adoption as part of broader smart manufacturing strategies. With increasing demand across various sectors, the UK’s market for near-field RAIN RFID antennas is set for constant growth.

Japan is experiencing steady growth in the near-field RAIN RFID antennas market with a 7.0% CAGR, supported by the country’s ongoing push for automation and innovation in logistics, retail, and manufacturing. Japan is known for its advanced manufacturing sector, and the adoption of RFID technology is crucial for improving efficiency and accuracy in production lines, inventory management, and product tracking. The country’s automotive industry, in particular, uses RFID to track parts throughout the supply chain, manage production workflows, and ensure just-in-time inventory. Japan’s retail sector, with its emphasis on customer service and automation, is increasingly turning to RFID solutions to improve stock management and streamline operations.

The government’s commitment to smart factory initiatives and the ongoing development of IoT-based solutions also contributes to the growth of RFID adoption in Japan. With strong investments in digital infrastructure, the demand for advanced RFID systems continues to rise across various industries. Japan’s e-commerce industry, alongside its rapidly evolving manufacturing and logistics sectors, supports the ongoing expansion of the market for near-field RAIN RFID antennas. As Japan continues to push the envelope on technological innovation, the demand for RFID systems will likely continue to grow, further driving market growth.

The near-field RAIN RFID antennas market is competitive, driven by several key players providing advanced solutions for radio frequency identification (RFID) systems used in a variety of industries, including logistics, retail, and healthcare. Zebra Technologies leads the market with a 16% share, recognized for its high-performance RFID antennas that offer reliable and efficient solutions for asset tracking, inventory management, and supply chain optimization. Zebra’s extensive portfolio and global presence make it a dominant player in this market.

Other major competitors include IFM Efector, Laird Technologies, and Harting, each offering specialized antennas for various industrial applications. IFM Efector is known for its high-quality sensors and RFID antennas, while Laird Technologies provides innovative antenna solutions designed for IoT applications, including RAIN RFID systems. Harting focuses on providing durable and reliable RFID antennas that cater to the needs of industrial automation and manufacturing industries.

Companies like Molex, Abracon, and Kathrein Solutions further strengthen the market with their advanced RFID antenna solutions. Molex offers a wide range of antennas for industrial and commercial RFID applications, while Abracon focuses on providing high-quality components, including RFID antennas, to meet the needs of specialized markets. Kathrein Solutions is known for offering high-performance antennas that support large-scale, high-frequency RFID systems.

Honeywell International, RFRain, PREMO USA, Impinj, and Invengo also contribute to the market by providing RFID antennas that emphasize efficiency, durability, and cost-effectiveness. Emerging players like RFID, Inc., Myers Engineering International, and Murata Electronics North America are developing innovative solutions to meet the evolving demands of the RFID market. The competition in this market is driven by the increasing adoption of RFID technology across industries, technological advancements, and the need for efficient, high-performance antenna solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Passive Antenna, Active Antenna |

| Application | Access Control, Smart Card, Medical Tracking, Electronic Ticketing, Others |

| Regions Covered | Asia Pacific, Europe |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe |

| Key Companies Profiled | Zebra Technologies, IFM Efector, Laird Technologies, Harting, Molex, Abracon, Kathrein Solutions, Honeywell International, RFRain, PREMO USA, Tec Tus, Impinj, Invengo, RFID, Inc., Myers Engineering International, Murata Electronics North America, Alien Technology, TagItron GmbH, Times 7 |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in RAIN RFID antenna technologies, integration with smart applications. |

The global near-field RAIN RFID antennas market is estimated to be valued at USD 302.3 million in 2025.

The market size for the near-field RAIN RFID antennas market is projected to reach USD 735.7 million by 2035.

The near-field RAIN RFID antennas market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in near-field RAIN RFID antennas market are passive antenna and active antenna.

In terms of application, access control segment to command 35.0% share in the near-field RAIN RFID antennas market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Near-Field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Rain Barrels Market Size and Share Forecast Outlook 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Rainbow Flatware Market Trends - Growth & Forecast 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Rain Barrel Manufacturers

Grain Hardness Meter Market Size and Share Forecast Outlook 2025 to 2035

Grain Cooling Spear Market Size and Share Forecast Outlook 2025 to 2035

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Grain Roller Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA