The opaque polymer market is expanding steadily, supported by the rising demand for cost-effective and sustainable alternatives to titanium dioxide in coatings and paint formulations. Opaque polymers enhance opacity, brightness, and gloss while improving film durability and environmental performance.

The market is benefiting from increasing architectural coatings consumption, particularly in emerging economies with strong infrastructure growth. Manufacturers are investing in product innovation to improve compatibility with waterborne systems and achieve higher hiding power at lower dosages.

Growing awareness of volatile organic compound (VOC) reduction and environmental compliance has further propelled demand. With expanding applications in decorative coatings, industrial finishes, and paper coatings, the opaque polymer market is positioned for sustained growth driven by both cost and performance advantages..

| Metric | Value |

|---|---|

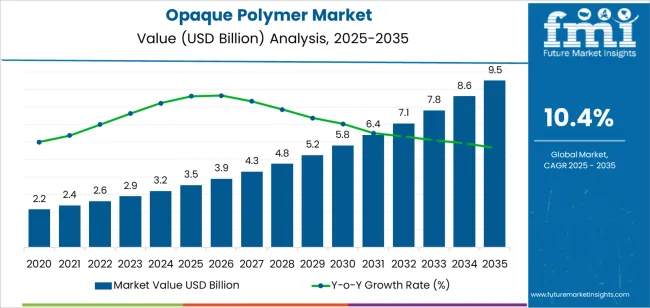

| Opaque Polymer Market Estimated Value in (2025 E) | USD 3.5 billion |

| Opaque Polymer Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

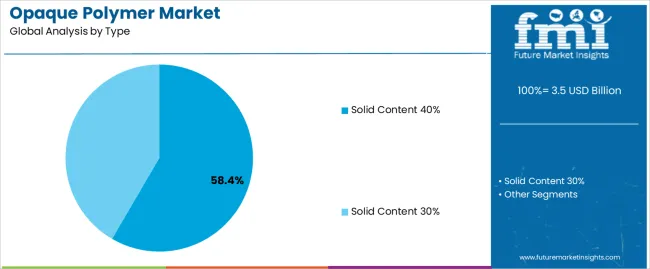

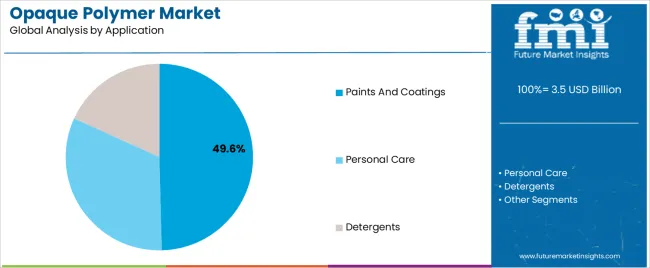

The market is segmented by Type and Application and region. By Type, the market is divided into Solid Content 40% and Solid Content 30%. In terms of Application, the market is classified into Paints And Coatings, Personal Care, and Detergents. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid content 40% segment dominates the type category, accounting for approximately 58.40% share. This segment’s leadership is attributed to its optimal balance between opacity performance and cost-efficiency.

The 40% solid content formulations provide superior hiding power and film integrity while maintaining flow and leveling properties in coating applications. Manufacturers prefer this concentration due to its compatibility with a wide range of waterborne and solvent-based systems.

Demand is further reinforced by the ongoing shift toward low-VOC and eco-friendly coatings, where high solids contribute to compliance and durability. With continued adoption in decorative paints and industrial coatings, the solid content 40% segment is expected to retain its prominent position in the global opaque polymer market..

The paints and coatings segment holds approximately 49.60% share of the application category, reflecting its dominant role as the primary consumer of opaque polymers. The segment benefits from rapid urbanization, rising residential and commercial construction, and growing renovation activities.

Opaque polymers enhance opacity and color uniformity while reducing dependence on expensive titanium dioxide, offering economic and performance advantages. The segment’s growth is supported by increased demand for waterborne coatings and innovations in polymer design improving weather resistance.

As sustainability becomes a key purchasing factor, the use of opaque polymers in eco-friendly paint formulations is expected to expand further, securing this segment’s leading share over the forecast horizon..

| Historical CAGR | 11.2% |

|---|---|

| Forecast CAGR | 10.4% |

The historical performance of the opaque polymer market has exhibited a commendable CAGR of 11.2%, indicating robust growth and significant market expansion over the specified period.

This high CAGR can be attributed to several factors, including increasing demand from key end-use industries such as paints and coatings, adhesives, and personal care products. Additionally, technological advancements in polymer chemistry and formulations have contributed to the development of innovative opaque polymer solutions, further driving market growth.

The forecasted CAGR of 10.4% suggests a slight decrease in growth momentum compared to the historical performance. Several factors may contribute to this deceleration, including market saturation in some regions, economic uncertainties, and evolving regulatory landscapes impacting the use of certain polymer ingredients.

Moreover, intensifying competition within the opaque polymer market could lead to pricing pressures and margin compression for manufacturers, affecting overall market growth.

Shift towards Water-Based Formulations

With growing concerns about solvent emissions and volatile organic compounds (VOCs), there is a significant shift towards water-based formulations in various industries. Opaque polymers are compatible with water-based systems, making them an attractive choice for environmentally conscious consumers and manufacturers.

Demand for Light-Blocking Properties

In industries like packaging and printing, there is a growing need for materials with excellent light-blocking properties to protect sensitive contents from degradation. Opaque polymers fulfill this requirement by providing effective light-blocking capabilities, driving their adoption in these sectors.

Opaque Polymer Nanocomposites

The incorporation of nanomaterials into opaque polymer matrices is emerging as a trend to enhance mechanical strength, thermal stability, and barrier properties, catering to diverse industry needs.

Shift towards High-Performance Coatings

Growing demand for high-performance coatings in automotive, aerospace, and industrial applications is fueling the adoption of opaque polymers with superior durability, weather resistance, and UV protection properties.

This section provides detailed insights into specific categories in the opaque polymer industry.

| Top Type | Solid Content 30% |

|---|---|

| CAGR % 2020 to 2025 | 11.1% |

| CAGR % 2025 to 2035 | 10.2% |

The solid content 30% category is poised to dominate the opaque polymer market, boasting an impressive 10.2% CAGR through 2035.

| Dominating Application Segment | Paints and Coatings |

|---|---|

| CAGR % 2020 to 2025 | 11.0% |

| CAGR % 2025 to 2035 | 10.1% |

The paints and coatings segment is expected to lead the opaque polymer industry in 2025, with a CAGR of 10.1% through 2035.

The country-wise analysis of the opaque polymer market focuses on key countries, including the United States, United Kingdom, China, Japan, and South Korea. The analysis aims to explore key factors driving the demand, adoption, and sales of opaque polymers in these countries.

| Countries | CAGR |

|---|---|

| United States | 10.6% |

| United Kingdom | 11.2% |

| China | 11% |

| Japan | 11.5% |

| South Korea | 12.8% |

The opaque polymer industry in the United States is anticipated to rise at a CAGR of 10.6% through 2035.

The opaque polymer industry in the United Kingdom is projected to rise at a CAGR of 11.2% through 2035.

China’s opaque polymer industry is likely to witness expansion at a CAGR of 11% through 2035.

Japan's opaque polymer industry is projected to rise at a CAGR of 11.5% through 2035.

South Korea emerges as a dominant force in the opaque polymer market, boasting a robust CAGR of 12.8% through 2035.

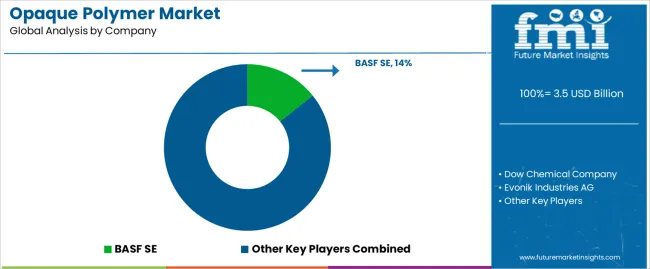

With increasing demand, competition intensifies among manufacturers and suppliers striving to meet evolving customer needs and technological advancements. Factors such as product quality, pricing strategies, distribution channels, and customer service play pivotal roles in determining competitive advantage.

Companies invest in research and development to enhance product performance and differentiate themselves in the market. Additionally, branding and marketing initiatives are crucial to building brand recognition and loyalty amidst intense competition.

As the opaque polymer industry expands globally, competition among market players is expected to intensify. Companies focus on expanding their geographical presence, entering new markets, and strengthening their production capabilities to stay ahead of competitors.

Recent Developments in the Opaque Polymer Industry

The global opaque polymer market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the opaque polymer market is projected to reach USD 9.5 billion by 2035.

The opaque polymer market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in opaque polymer market are solid content 40% and solid content 30%.

In terms of application, paints and coatings segment to command 49.6% share in the opaque polymer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA