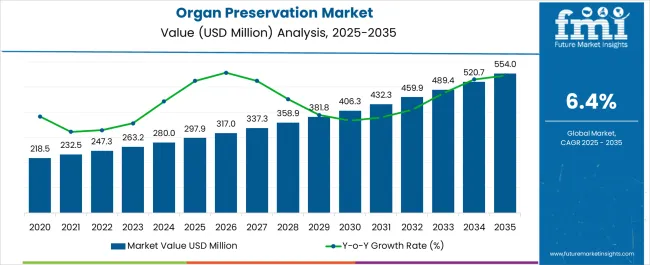

The Organ Preservation Market is estimated to be valued at USD 297.9 million in 2025 and is projected to reach USD 554.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Organ Preservation Market Estimated Value in (2025 E) | USD 297.9 million |

| Organ Preservation Market Forecast Value in (2035 F) | USD 554.0 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The organ preservation market is expanding steadily, influenced by rising organ transplantation procedures, increased awareness of donation programs, and improvements in healthcare infrastructure. The growing incidence of chronic diseases and organ failures has heightened the demand for preservation technologies that extend viability during transport and storage.

Innovations in preservation solutions, temperature regulation systems, and perfusion techniques have contributed to better transplant outcomes. Government initiatives to strengthen organ donation networks and improve donor-recipient matching have further enhanced procedural volumes.

As regulatory authorities emphasize safety protocols and quality control, the adoption of advanced preservation methods is increasing across both developed and developing nations. Going forward, investments in next-generation perfusion systems and bio-preservative formulations are expected to accelerate, addressing unmet clinical needs in multi-organ preservation and long-distance transplants.

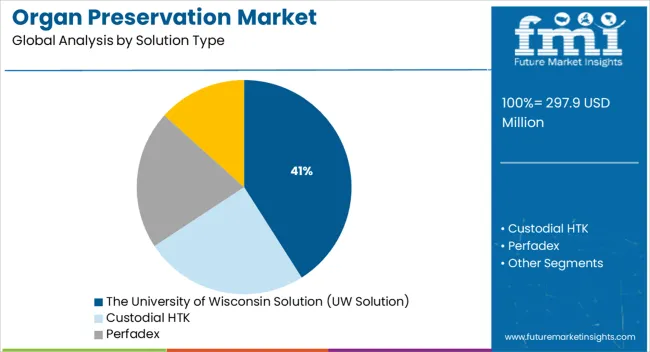

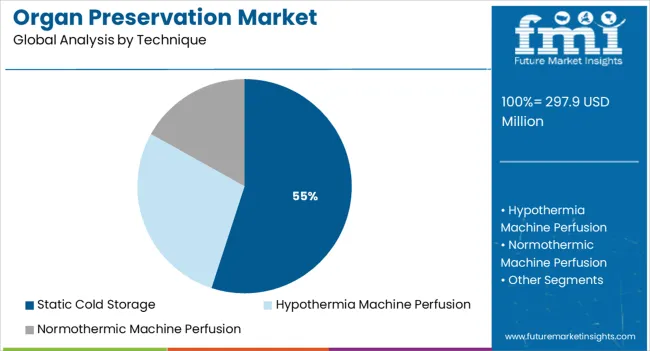

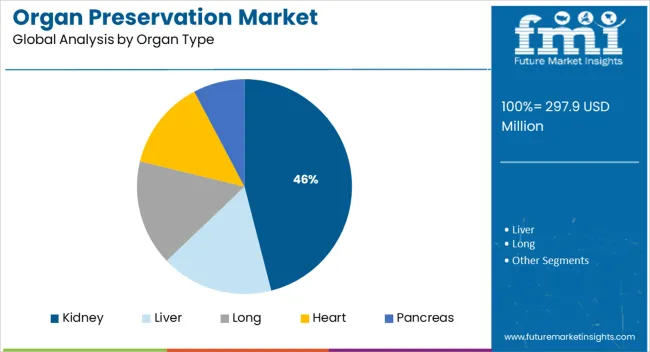

The market is segmented by Solution Type, Technique, Organ Type, and End User and region. By Solution Type, the market is divided into The University of Wisconsin Solution (UW Solution), Custodial HTK, Perfadex, and Other Solutions. In terms of Technique, the market is classified into Static Cold Storage, Hypothermia Machine Perfusion, and Normothermic Machine Perfusion. Based on Organ Type, the market is segmented into Kidney, Liver, Long, Heart, and Pancreas. By End User, the market is divided into Organ Transplant Centres, Hospitals, and Specialty Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The University of Wisconsin (UW) solution is projected to account for 41.0% of the total revenue in the organ preservation market by 2025, making it the most widely used preservation solution. This dominance is driven by the solution’s proven efficacy in extending cold ischemia time and maintaining cellular integrity across various organ types.

It offers optimal buffering capacity and metabolic support during static preservation, which has contributed to its clinical acceptance. Its composition allows for reduced vascular resistance and improved organ perfusion post-transplant, resulting in favorable graft outcomes.

Due to these performance characteristics, UW solution continues to be the preferred choice in both high-volume transplant centers and emerging regional facilities. Its established clinical track record and wide compatibility with preservation techniques have reinforced its position in routine and emergency transplantation workflows.

Static cold storage is expected to capture 55.0% of the organ preservation market share in 2025, establishing it as the leading preservation technique. Its dominance is attributed to the simplicity, cost-effectiveness, and long-standing clinical familiarity associated with this method.

Cold storage reduces metabolic activity, minimizes cellular degradation, and is easily adaptable across healthcare settings with varying levels of infrastructure. Its portability and low operational requirement make it especially viable in geographically dispersed donor-recipient transfer scenarios.

While dynamic perfusion systems are gaining traction, static cold storage remains the primary method used globally due to logistical ease, regulatory approvals, and its compatibility with major preservation solutions such as UW and HTK. As access to transplantation expands, especially in emerging economies, the static method’s reliability and scalability are expected to support continued market leadership.

The kidney segment is anticipated to account for 46.0% of total market revenue in 2025, positioning it as the largest organ type within preservation applications. This leadership is due to the high volume of kidney transplant procedures performed globally, driven by the prevalence of end-stage renal disease and diabetes-related complications.

Kidneys are relatively more resilient to ischemic conditions, allowing for extended preservation durations compared to other organs. The widespread use of cold storage and established protocols for kidney handling have contributed to procedural standardization and improved transplant outcomes.

Moreover, national and regional organ-sharing networks prioritize kidney transplants due to demand-supply imbalances, further elevating their share in preservation solutions. As waitlist times and donor registrations increase, the focus on extending kidney viability through optimized preservation is expected to remain a critical market driver.

With the largest population seeking better treatments, including organ transplantation preservation, the Asia Pacific region is expected to be the fastest-growing region as a whole in the industry. Asian countries are seeing an increase in awareness about organ donation, which has led to a rise in the market for organ preservation solutions.

Developing nations such as India and China are experiencing an increase in eye, cardiac, and kidney diseases. Technology advancement and emerging markets will offer profitable opportunities for the market. The government has also taken several initiatives to promote organ donation as part of its efforts to further expand the market growth. For instance,

Organ donation and transplantation are promoted by the Indian government through its National Organ Transplant Programme (NOTP). Several regional and state organ and tissue transplant organizations have been established under this initiative: one at the highest level in New Delhi, five at the regional level, and sixteen at the state level.

The National Organ Transplant Programme provides financial assistance to States for the establishment of Biomaterial Centers. Various IEC activities are being organized to raise public awareness and impart training to physicians and transplant coordinators to facilitate the acceptance of transplants.

With targeted radiotherapy and chemotherapy, medical professionals aim to preserve a surgically removed organ by preventing the particular cell from multiplying as a result of targeting radiotherapy and chemotherapy. As part of UICC's Access to Oncology Medicines (ATOM) initiative, multiple stakeholders were invited to the table to find ways of making cancer medicines more accessible and affordable especially in India.

An exciting development in health care has been the development of xenotransplantation - the ability to use a genetically modified organ from an animal to be used in humans after genetic modification. As gene editing techniques are developed and new knowledge is gained about the immunology of animals and its differences from the immune system of humans, it will probably continue to be a field that sees many advancements in the near future.

The geriatric population count is increasing day by day, leading to increased incidents of multi-organ failures and organ transplant surgeries worldwide. The requirement for efficient management of organ transfer from donors is driving the organ preservation market.

In 2020, the Health Resources and Services Administration reported about a rise in death cases due to multiple organ failures in the USA. The major treatment for such types of patients is organ replacement facilitated by human organ transplantation surgeries.

The organs obtained from donors require the appropriate handling and care achieved through the proper organ storage in cryogenic systems. The companies providing organic preservation solutions to hold and carry organs from donors to patients have experienced exponential growth these days.

Organ procurement and transplant network have expanded many folds making it easier for patients suffering from organ disorders. Organ preservation chemicals used for the storage of such organs obtained from companies dealing in the medical sector have benefitted immensely in recent years.

Diabetes and Chronic diseases have increased in frequency in the recent past resulting in severe medical conditions for multiple organ failures. Cardiovascular disorders and obesity have escalated the condition of patients to undertake the replacement of organs providing a huge impetus for the growth of the organ preservation market across the globe.

Solid-Organ transplant procedures have become more successful and safer in the 21st century owing to considerable advancement in surgical procedures and knowledge about the function of different organs.

But the healthcare sector is still struggling to meet the demands for organ transplantation due to the unavailability of sufficient organ donors or the limited supply of organ preservation fluids required to store and transport the organs already donated.

What are the Recent Developments Providing Better Opportunities for the Growth of the Organ Preservation Market?

Over the past years, there have been some major advancements in medical science, particularly in the field of organ preservation techniques and transplantation procedures, creating a huge demand for organ transplants in the global market. Coupled with the rising burden of diabetes patients, the demand for static cold storage organ preservation requirements during these years.

Encouragement for organ donations by various national and international NGOs has spurred the demand for organ preservation chemicals in the lesser-known regions of the world.

Improving health infrastructure across all countries has resulted in increased cases of patient termination in healthcare and medical facilities. The growing supply of organ preservation solutions in such major institutions has made it easier for the collection and preservation of human organs to be utilized by the organ preservation market.

What are Some of the Major Challenges faced by the Global Organ Preservation Market Players in Different Regions?

The development of cryogenic facilities for the maintenance of organ preservation fluid quality during transportation is a major challenge for the global organ preservation market, particularly in developing countries of the Asia Pacific and the Middle East and Africa (MEA).

The cost incurred during organ transplant surgeries and higher expenditure on inpatient care provided by healthcare facilities has remained the major constraint for the growth of the organ preservation and transplantation market. Patients in low-income countries require low-budget healthcare facilities to contribute more to the organ preservation market.

What are the Limitations in the Adoption of Organ Preservation Techniques in Recent Periods?

Availability of skilled personnel or surgery doctors at the healthcare centers is pride predicted to be the major challenge for the growth of the organ preservation and transplantation market during the forecast period at a higher scale.

Availability of suitable donors can be another major hindrance in the development of organ preservation techniques reducing the investment in research and advancement of organ preservation procedures by government institutions and private firms.

The most adopted technique is the static cold storage organ preservation method, commonly referred to as the gold standard technique of Organ preservation. This technique is very convenient to reduce metabolic activities and increase the self-life of the organs. This technique is popular for lung, heart, pancreas, and kidney preservation.

Hypothermia Machine Perfusion and Normothermic Machine Perfusion are some of the other techniques that need some research and technological advancements to compete with the static cold storage technique segment.

By the previous market analysis report, kidney preservation was the segment holding the largest share of the global organ preservation market. The escalating cases of ESRD with kidney transplantation have emerged as the major driver for this segment of the market and are predicted to be leading in the forthcoming years.

The other segment based on organ type having the highest potential of growth is liver preservation during the forecast period of 2025 to 2035. Lung, heart, and pancreas preservation are the other segments contributing to the growing trend of organ preservation.

By 2024, organ transplant centers were the dominating end users of the organ preservation market providing kidney preservation and liver preservation in different regions of the world. The better healthcare facilities and the increasing success rate has made it a popular choice for patients seeking organ replacement around the world. This segment is expected to remain at the forefront of organ preservation and transplantation during the forecast years.

Hospitals and other end users will also contribute significantly to the global organ preservation market, as per the report of the market analysis.

North America, comprising a higher proportion of the elder population and advanced Healthcare facilities, is poised to remain the most attractive region for organ storage and transplantation services.

The rising demand for technologically advanced treatment methods, government support, and reimbursements have fuelled the market for preserved human organs in recent times.

As per the report provided by the American Heart Association and National Chronic Kidney Disease Report, 31% of the total deaths in the USA occurred due to cardiovascular disorders in 2014 and in 2020, 15% of USA adults were subject to chronic kidney diseases.

Due to rising cases of alcoholic fatty liver diseases, Liver failures have positioned the Europe region as the second-largest market for organ preservation and transplantation, following North America. The healthcare expenditure in European countries has further fuelled the market for lever preservation for transplant facilities.

The prevalence of other serious diseases related to cardiovascular and renal will further supplement the demand for organ transplantation surgeries in this region.

Asia Pacific region is predicted to be the fastest-growing region for having the largest population count seeking better treatment methods, including organ transplantation preservation

services. The rising awareness about organ donations has boosted the organ preservation solution market in Asian countries.

Lack of awareness and affordability constraints for organ preservation techniques could render the Middle East and African countries the least attractive region for the global organ preservation market in the coming years.

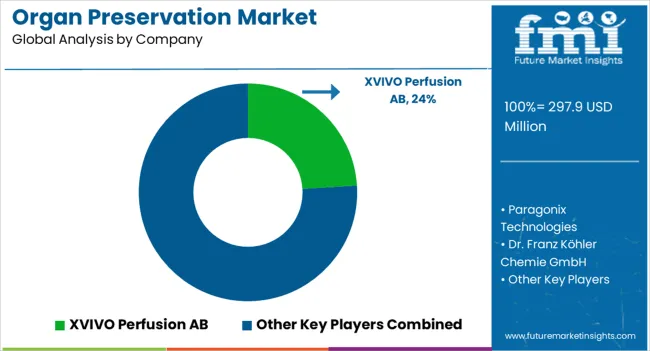

The key players in the organ preservation driving the global market are XVIVO Perfusion AB, Dr. Franz Kohler Chemie GmbH, Essential Pharmaceuticals LLC, Trans Medics, Organ Ox Limited, Shanghai Genext Medical Technology, Bridge to Life Limited, Waters Medical Systems, Preservation Solutions, Carnamedica, and Transplant Biomedicals.

All the prominent players dealing in organ preservation have continually adopted the advancing technologies and have changed the course of organ preservation from the past to the future to provide the best service for patients in need.

In recent years they have been focusing on mergers and collaboration to expand the customer base in traditionally less popular regions.

Some of the Recent Developments in the Organ Preservation Market:

The global organ preservation market is estimated to be valued at USD 297.9 million in 2025.

The market size for the organ preservation market is projected to reach USD 554.0 million by 2035.

The organ preservation market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in organ preservation market are the university of wisconsin solution (uw solution), custodial htk, perfadex and other solutions.

In terms of technique, static cold storage segment to command 55.0% share in the organ preservation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organ Preservation Solution Market Size and Share Forecast Outlook 2025 to 2035

Organ Preservation & Perfusion Products Market Size and Share Forecast Outlook 2025 to 2035

Organ Static Cold Storage (SCS) Solution Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organoids LNP Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organoids Market Size and Share Forecast Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organometallics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organ Support Supplements Market Analysis Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA