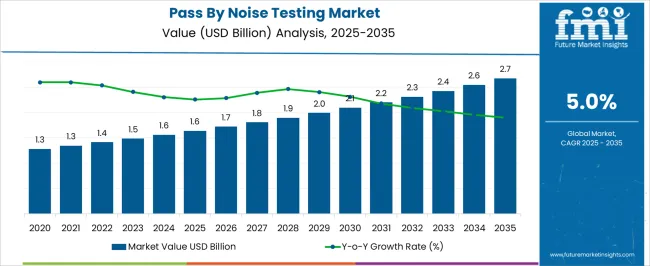

The pass-by noise testing market is expected to grow from USD 1.6 billion in 2025 to USD 2.7 billion by 2035, with a CAGR of 5%. The market growth curve shows a gradual, consistent increase, with values moving from 1.6 billion in 2025 to 1.9 billion by 2028 and 2.1 billion by 2030. This steady growth reflects the ongoing demand for accurate noise testing in automotive and industrial sectors, where regulatory standards and consumer expectations for quieter, more efficient vehicles are driving adoption.

The curve should be read as stable and rooted in increasing compliance with noise control regulations. By 2031, the market is expected to reach 2.2 billion, progressing to 2.4 billion in 2033 and closing at 2.7 billion in 2035. The curve highlights predictable expansion, supported by heightened attention to vehicle noise reduction and stricter environmental standards across various markets. Market observers suggest that the growing need for reliable and efficient noise testing solutions in automotive design, as well as the push for quieter industrial machinery, will continue to propel the sector forward.

| Metric | Value |

|---|---|

| Pass By Noise Testing Market Estimated Value in (2025 E) | USD 1.6 billion |

| Pass By Noise Testing Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The pass by noise testing market constitutes a smaller yet crucial segment within the larger automotive testing and noise/vibration testing sectors. It holds approximately 4-5% of the automotive testing market, which is expansive due to its inclusion of various vehicle testing methods like crash, emission, and durability tests. In the noise and vibration testing market, the share of pass by noise testing rises to around 12-15%, as noise compliance becomes a focal point for vehicle manufacturers. Within the acoustic testing market, it accounts for roughly 10-12%, driven by stricter regulations on noise emissions in both urban and rural settings. The environmental testing market shows a similar trend, with the pass by noise testing sector contributing about 6-7%, as it plays a vital role in monitoring noise pollution levels in various environments.

In the broader automotive industry market, pass by noise testing holds a modest 2-3% share, as it is a niche focus area within the overall automotive manufacturing and testing ecosystem. The consistent growth of the pass by noise testing market is influenced by rising consumer demand for quieter, more comfortable vehicles, alongside regulatory pressures that continue to shape the industry's noise emission standards. These percentages underscore the market's importance in meeting both consumer preferences and environmental noise control standards.

The pass by noise testing market is experiencing consistent growth driven by stringent regulatory standards aimed at reducing vehicular noise emissions and improving environmental quality. Increasing adoption of advanced testing systems by automotive and transportation manufacturers is being fueled by compliance requirements across North America, Europe, and Asia Pacific.

Technological advancements in acoustic sensors, real time data acquisition systems, and automated analysis platforms are enabling more accurate and efficient testing processes. The rise in electric and hybrid vehicle production has also influenced testing protocols, with manufacturers seeking to meet both legal thresholds and consumer expectations for quiet yet safe operation.

Investments in modern testing facilities and integration of outdoor and laboratory testing solutions are reinforcing market expansion. The outlook remains positive as industries continue to balance performance, compliance, and environmental considerations in vehicle development.

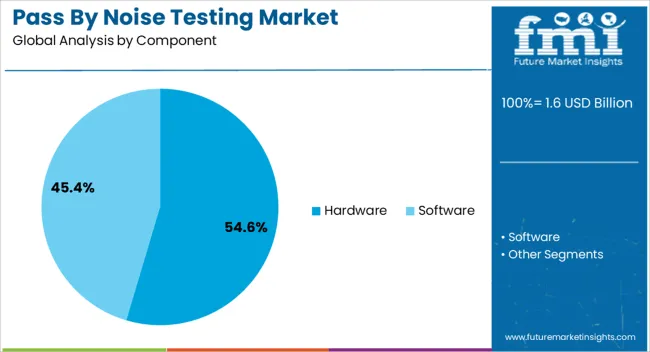

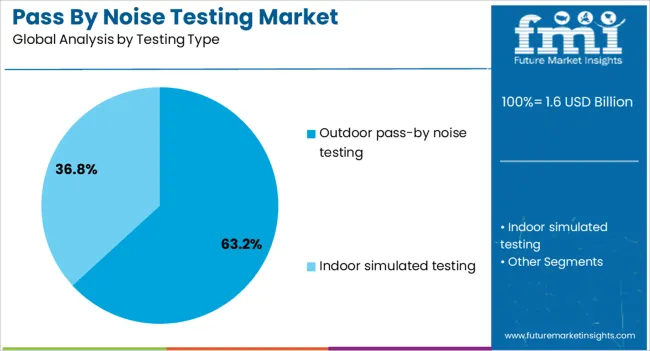

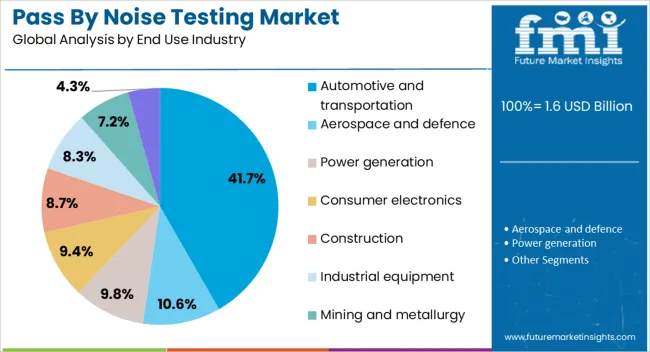

The pass by noise testing market is segmented by component, testing type, end use industry, and geographic regions. By component, pass by noise testing market is divided into Hardware and Software. In terms of testing type, pass by noise testing market is classified into Outdoor pass-by noise testing and Indoor simulated testing. Based on end use industry, pass by noise testing market is segmented into Automotive and transportation, Aerospace and defence, Power generation, Consumer electronics, Construction, Industrial equipment, Mining and metallurgy, and Others. Regionally, the pass by noise testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to hold 54.60% of total market revenue by 2025 within the component category, making it the leading segment. This growth is being supported by the critical role of high precision microphones, data loggers, and analyzers in ensuring accurate measurement of vehicle noise levels.

Demand for durable and weather resistant hardware capable of functioning in varied environmental conditions has strengthened adoption. Continuous upgrades in sensor technology and the integration of wireless connectivity have improved data reliability and operational efficiency.

The essential nature of these hardware components in both outdoor and controlled testing environments has cemented their position as the primary revenue contributor in the component segment.

The outdoor pass by noise testing segment is expected to contribute 63.20% of total market revenue by 2025 within the testing type category, positioning it as the dominant approach. Its leadership is driven by regulatory mandates that require real world measurement of vehicle noise under standardized driving conditions.

Outdoor testing captures the combined effect of engine, exhaust, and tire noise, providing a comprehensive assessment of vehicle acoustic performance. Advancements in mobile test units and automated measurement systems have enhanced testing efficiency and compliance verification.

The continued emphasis on replicating real life driving environments has reinforced the demand for outdoor pass by noise testing as the preferred methodology.

The automotive and transportation segment is projected to account for 41.70% of the total market revenue by 2025 within the end use industry category, making it the leading segment. This dominance is fueled by the sector’s ongoing focus on meeting global noise emission standards and enhancing passenger comfort.

Increased production of electric and hybrid vehicles, which have unique noise characteristics, has necessitated updated testing protocols. Collaboration between manufacturers, testing service providers, and regulatory bodies has accelerated the adoption of advanced testing systems.

With vehicle performance, brand reputation, and compliance all closely linked to noise testing outcomes, the automotive and transportation industry remains the primary driver of market demand.

The pass-by noise testing market is projected to grow as noise regulations in urban planning, automotive, and transportation industries become more stringent. Demand is being reinforced by the need for compliance with environmental laws and consumer awareness around noise pollution. Opportunities are arising in electric vehicle testing, where quieter operations must meet legal limits. Trends are focusing on the integration of automated testing systems and advanced acoustic measurement tools. Challenges include high testing costs, complex regulatory standards, and the need for advanced equipment to manage new testing protocols.

Demand for pass-by noise testing has been strengthened by increasingly strict environmental regulations in the automotive, transportation, and urban development sectors. Governments and regulatory bodies are placing more emphasis on controlling noise pollution from vehicles, machinery, and infrastructure projects. Automotive manufacturers are prioritizing noise testing to ensure compliance with noise emission standards in markets such as Europe and North America. The greatest demand will be from electric vehicle manufacturers, where quieter vehicles must meet established noise limits to ensure compliance with emerging global standards.

Opportunities are emerging in the electric vehicle (EV) segment, where the quieter nature of electric propulsion systems requires testing to ensure they do not exceed noise limits set by regulators. Manufacturers are investing in pass-by noise testing to ensure their EVs meet these standards, opening new markets for testing services. Furthermore, automated testing systems that allow for more efficient and accurate measurements are becoming increasingly sought after. The most attractive opportunities will come from the continued rise of electric mobility and the integration of automated acoustic testing technologies.

Trends are pointing toward automation in pass-by noise testing, with manufacturers seeking automated systems that can streamline the testing process and improve accuracy. Advanced measurement tools, such as high-precision microphones and sophisticated acoustic sensors, are being developed to capture detailed sound profiles and ensure compliance with noise regulations. Noise testing is also becoming more integrated with digital platforms, allowing for real-time data collection and analysis. Automated testing systems will become the standard, as they help reduce human error and improve the efficiency of testing operations.

Challenges in the pass-by noise testing market include the high costs associated with testing equipment, installation, and maintenance. Testing facilities and equipment for noise measurement can be expensive, especially for companies operating in multiple regions with varying regulatory requirements. Compliance with different noise standards, such as those for vehicles, industrial machinery, and infrastructure, adds to the complexity of the market. The key to overcoming these challenges lies in the development of cost-efficient, flexible testing solutions that meet a wide range of regulatory requirements while maintaining accurate results.

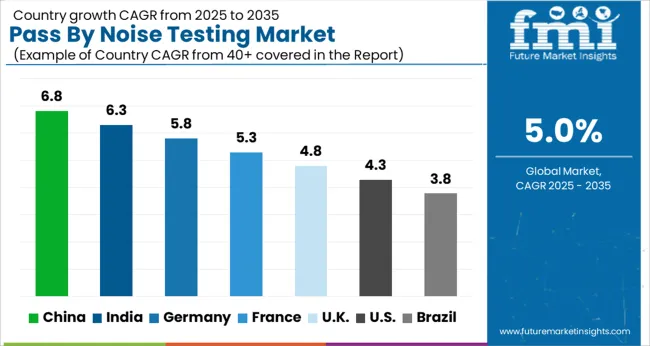

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global pass-by noise testing market is projected to grow at 5% from 2025 to 2035. China leads at 6.8%, followed by India 6.3% and France 5.3%; the United Kingdom 4.8% and United States 4.3% follow. Demand is driven by stricter noise regulations, increasing urbanization, and the rise in electric and hybrid vehicle testing. As noise pollution becomes a growing concern, governments are enforcing noise limits on vehicles to improve public health and environmental conditions. The market growth is supported by advancements in testing technology and equipment that enhance accuracy and efficiency. The Asia-Pacific region will continue to lead the market in terms of volume, while Europe and North America will focus on regulatory compliance and premium testing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

Trends Favor Water-Based Formulations And Performance

The pass-by noise testing market in China is expected to expand at 6.8%. As vehicle production and sales continue to increase, especially in electric and hybrid vehicle segments, there is growing demand for accurate pass-by noise testing to comply with stringent environmental regulations. Chinese authorities are enforcing noise pollution control measures, which is fueling the need for advanced noise testing systems in automotive manufacturing. With increased focus on electric vehicles (EVs) and their quieter operation, the market is seeing a rise in testing solutions that measure noise levels specific to EVs and hybrids. Local manufacturers are scaling up their capabilities to meet the growing demand for pass-by noise testing equipment and systems.

The pass-by noise testing market in India is projected to grow at 6.3%. As India's automotive industry continues to grow, there is an increasing demand for vehicles that comply with global and local noise standards. Pass-by noise testing is becoming a standard part of vehicle certification, particularly with the rise in electric vehicle adoption. The growing focus on improving air quality and reducing urban noise pollution is driving the adoption of noise testing systems in both government and private sectors. Manufacturers and testing facilities are adopting advanced testing technologies to meet stricter noise limits. India's market will see strong growth due to the increasing number of vehicles on the road and tightening regulations on noise emissions.

The pass-by noise testing market in France is expected to rise at 5.3%. France has stringent noise regulations in place, particularly for passenger vehicles, which are pushing the need for precise and reliable pass-by noise testing. The market growth is driven by the rise in electric vehicle (EV) production, as these vehicles produce significantly less noise than traditional combustion-engine vehicles, requiring specialized testing to ensure they meet noise standards. France’s commitment to reducing environmental pollution, coupled with stricter European Union regulations, is accelerating the demand for advanced noise testing equipment. The French market will see steady growth as manufacturers focus on developing and testing quieter vehicles to comply with regulatory frameworks.

The pass-by noise testing market in the UK is projected to expand at 4.8%. As noise pollution becomes an increasing concern in urban areas, the UK is tightening regulations surrounding vehicle noise emissions. The market growth is driven by the need for manufacturers to ensure compliance with both local and EU noise standards. In particular, the rise in electric vehicle production is leading to a shift toward more precise testing methods as EVs produce less noise than traditional vehicles. The UK government’s focus on sustainability and clean air initiatives is encouraging the automotive industry to adopt more advanced noise testing systems. The UK market will see steady adoption of pass-by noise testing as regulations become more stringent.

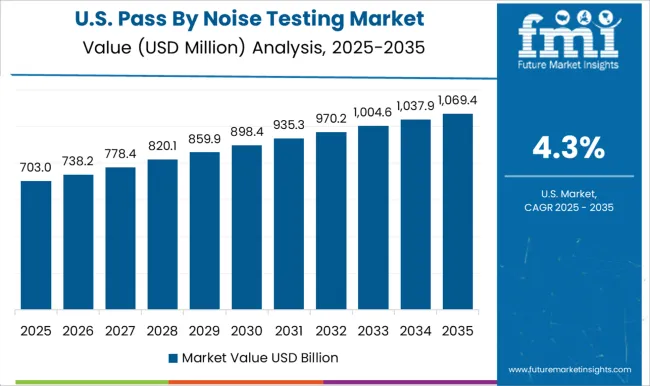

The pass-by noise testing market in the United States is projected to grow at 4.3%. The USA market is witnessing rising adoption of electric and hybrid vehicles, which require advanced noise testing to meet federal and state regulations. As noise pollution becomes an increasing concern in cities and residential areas, regulatory authorities are enforcing stricter pass-by noise emission standards. Manufacturers are investing in advanced noise testing technologies to ensure compliance with these regulations. The growing demand for safer and quieter vehicles is driving innovation in noise reduction technologies, while vehicle manufacturers are adopting more efficient testing procedures to meet the regulatory requirements.

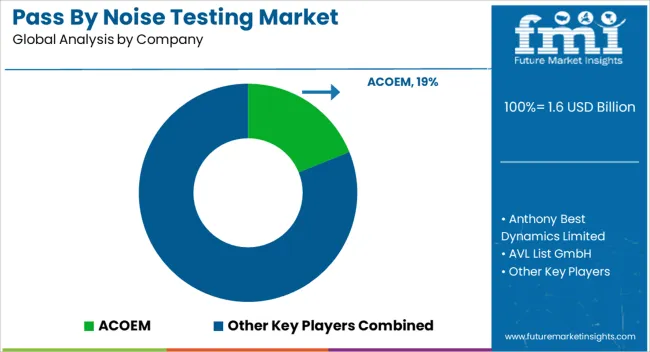

The pass by noise (PBN) testing market is moderately competitive, driven by global automotive testing service providers, specialized acoustics laboratories, and regional engineering firms. Leading players such as AVL, Horiba, TÜV SÜD, DEKRA, Applus+, and Intertek maintain strong market positions through advanced testing equipment, comprehensive service portfolios, and international testing certifications. Competition is largely based on testing accuracy, compliance with regulatory standards, turnaround time, and the ability to provide end-to-end solutions for passenger vehicles, commercial vehicles, and electric mobility platforms.

Regional and smaller service providers intensify competition by offering cost-effective solutions, flexible testing schedules, and localized expertise to meet country-specific noise emission regulations. Technological advancements in real-time monitoring, data analytics, and automated testing systems are emerging as key differentiators among leading companies. Strategic partnerships with automotive OEMs, component suppliers, and research institutions help firms expand market reach and strengthen credibility. Overall, companies that combine cutting-edge instrumentation, regulatory compliance, and rapid reporting capabilities are best positioned to secure significant share in the pass by noise testing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Component | Hardware and Software |

| Testing Type | Outdoor pass-by noise testing and Indoor simulated testing |

| End Use Industry | Automotive and transportation, Aerospace and defence, Power generation, Consumer electronics, Construction, Industrial equipment, Mining and metallurgy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ACOEM, Anthony Best Dynamics Limited, AVL List GmbH, Brüel & Kjær, Dewesoft, Endevco, GRAS Sound & Vibration, HBK, HEAD acoustics GmbH, HORIBA, imc Test & Measurement GmbH, Kistler Group, Larson Davis, m+p international, Microflown AVISA, Microtech Gefell, National Instruments, Norsonic, Prosig Ltd., Siemens, and VBOX Automotive |

| Additional Attributes | Dollar sales by component (hardware, software), Dollar sales by testing type (outdoor, indoor simulated), Dollar sales by end-use (automotive, aerospace, consumer electronics, construction), Trends in AI-driven acoustic analysis, Role in regulatory compliance, Growth from EV adoption and stricter noise standards, Regional demand across North America, Europe, Asia Pacific. |

The global pass by noise testing market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pass by noise testing market is projected to reach USD 2.7 billion by 2035.

The pass by noise testing market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in pass by noise testing market are hardware, _sensors & transducers, _analyzers, _meters, _data acquisition systems, _signal conditioners, _shakers & controllers and software.

In terms of testing type, outdoor pass-by noise testing segment to command 63.2% share in the pass by noise testing market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA