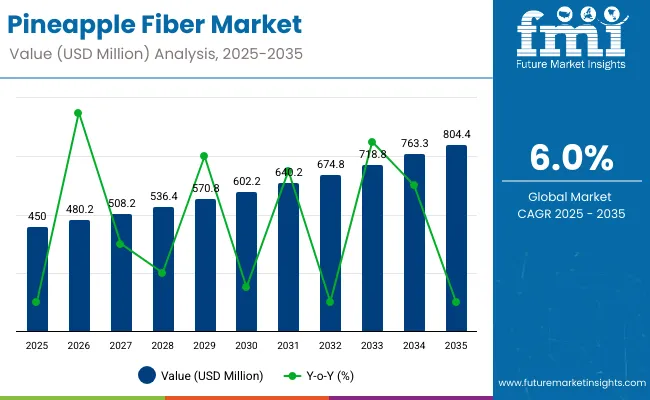

The pineapple fiber market is valued at USD 450 million in 2025 and is projected to reach USD 804.4 million by 2035, advancing at a CAGR of 6.0%. Growth is driven by escalating environmental concerns about synthetic fiber production, regulatory pressures to use biodegradable materials, and the textile industry's transformation toward plant-based fiber alternatives across the global fashion and composite material sectors. Pineapple fiber offers agricultural waste valorization, circular economy implementation, and enhanced environmental compliance, making it suitable for fashion and apparel manufacturing, automotive composites, and paper packaging applications.

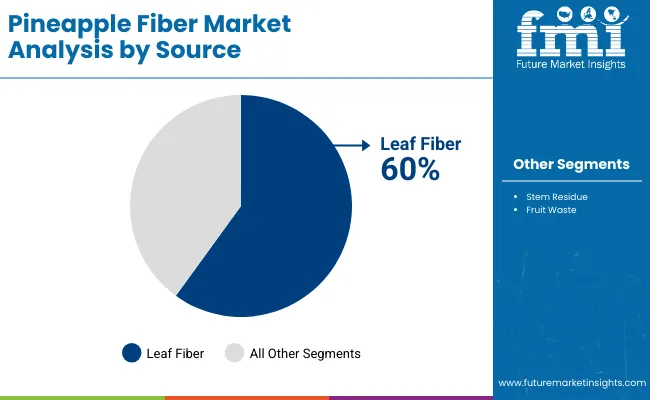

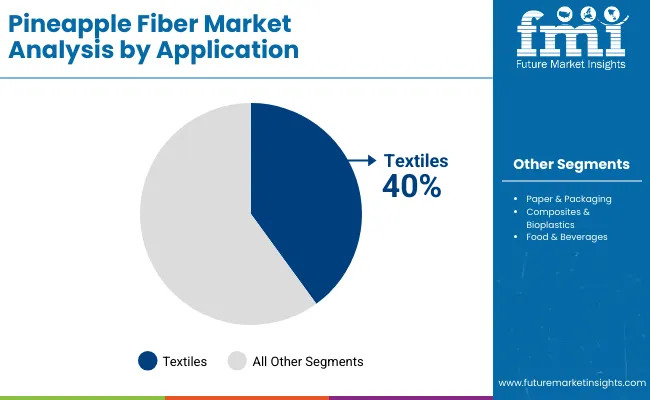

Leaf fiber accounts for the largest share at 60% due to optimal fiber quality, reliable processing characteristics, and compatibility with standard textile production infrastructure, while stem residue and fruit waste support specialized processing applications. Textile applications represent the dominant share of demand at 40%, followed by composites and packaging programs as manufacturers expand sustainable material offerings.

Pineapple Fiber Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 450.0 million |

| Forecast Value in (2035F) | USD 804.4 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

Europe and North America, particularly the UK and the USA, lead growth due to fashion industry modernization and environmental regulations, while the Asia Pacific shows steady demand supported by established textile operations in China and India. Competition in the pineapple fiber market remains moderately consolidated, with key companies such as AnanasAnam, Nanollose Ltd, and TjeerdVeenhoven Studio focusing on advanced extraction technologies, processing optimization systems, and sustainable supply chain capabilities to strengthen market positioning.

The market dynamics driving pineapple fiber adoption are fundamentally shaped by escalating environmental concerns about synthetic fiber production, regulatory pressures to use biodegradable materials, and the textile industry's transformation toward plant-based fiber alternatives. Climate change has intensified focus on the utilization of agricultural waste and resource efficiency across major pineapple-growing regions, compelling manufacturers and brand owners to implement more sophisticated waste-to-value strategies.

Simultaneously, government regulations and consumer preferences in many jurisdictions increasingly incentivize natural fiber adoption through product labeling requirements, import restrictions on synthetic materials, and environmental compliance mandates, making pineapple fiber systems economically attractive investments.

Technological advancement in fiber extraction methods, processing equipment, and application development has dramatically enhanced the capabilities and commercial viability of pineapple fiber production systems. Modern processing facilities leverage mechanical extraction, enzymatic processing, and chemical treatment technologies to provide consistent fiber quality and performance characteristics from agricultural waste streams, enabling immediate integration into existing textile and composite manufacturing processes. The integration of quality control systems, standardized grading protocols, and performance testing enables these facilities to optimize fiber specifications based on end-use requirements rather than solely on basic processing parameters, resulting in significant improvements in material performance and expanded application possibilities.

The textile sector's increasing adoption of circular economy principles has created substantial demand for integrated pineapple fiber solutions that complement existing fashion industry supply chains. Pineapple fiber processors now interface seamlessly with garment manufacturing systems, enabling comprehensive traceability and quality assurance that supports broader brand authenticity and environmental compliance processes. This integration capability has proven particularly valuable for large-scale fashion brands, where coordinated management of multiple fiber sources and product lines requires sophisticated supply chain management and sustainability verification.

From 2030 to 2035, the market is forecast to grow from USD 602.2 million to USD 804.4 million, adding another USD 202.2 million, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced fiber processing infrastructure, the integration of cutting-edge extraction technologies, and the development of customized pineapple fiber systems for specific textile applications. The growing adoption of circular economy standards and waste valorization practices will drive demand for ultra-high-efficiency pineapple fiber processing systems with enhanced quality specifications and consistent performance.

Market expansion is being supported by the increasing demand for eco-friendly textile infrastructure and the corresponding need for high-performance natural fiber systems in fashion applications across global apparel and composite material operations. Modern textile operators are increasingly focused on advanced natural fiber technologies that can improve environmental compliance, reduce synthetic material dependency, and enhance product performance while meeting stringent quality requirements. The proven efficacy of pineapple fiber processing in various textile applications makes them an essential component of comprehensive circular economy strategies and brand differentiation programs.

The growing emphasis on agricultural waste valorization and advanced processing optimization is driving demand for ultra-efficient pineapple fiber systems that meet stringent performance specifications and quality requirements for specialized applications. Textile operators' preference for reliable, high-performance natural fiber systems that can ensure consistent material properties is creating opportunities for innovative processing technologies and customized textile solutions. The rising influence of environmental compliance protocols and circular economy standards is also contributing to increased adoption of premium-grade pineapple fiber processing across different textile applications and manufacturing systems requiring advanced natural fiber technology.

The pineapple fiber market represents a specialized growth opportunity, expanding from USD 450 million in 2025 to USD 804.4 million by 2035 at a 6.0% CAGR. As manufacturers prioritize environmental compliance, waste reduction, and product differentiation in complex textile processes, pineapple fiber has evolved from a niche agricultural waste product to an essential component enabling circular economy implementation, quality optimization, and multi-stage textile production across fashion operations and specialized material applications.

The convergence of environmental awareness expansion, increasing natural fiber adoption, specialized processing infrastructure growth, and regulatory requirements creates momentum in demand. High-performance formulations offering superior fiber quality, cost-effective leaf fiber systems balancing performance with economics, and specialized enzymatic processing variants for premium applications will capture market premiums, while geographic expansion into high-growth European textile markets and emerging market penetration will drive volume leadership. Industry emphasis on environmental compliance and performance provides structural support.

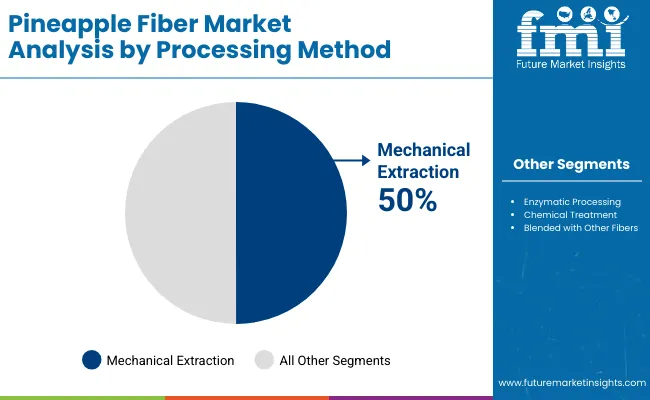

The market is segmented by source, processing method, application, product form, end use industry, sales channel, and region. By source, the market is divided into leaf fiber, stem residue, and fruit waste. Based on processing method, key segments include mechanical extraction, enzymatic processing, chemical treatment, and blended with other fibers. By application, the market is divided into textiles, paper and packaging, composites and bioplastics, food and beverages, personal care and cosmetics, and animal feed.

By product form, the market is categorized into raw fiber, yarn, non-woven sheets, powdered fiber, and fiber pellets. By end use industry, the market is divided into fashion and apparel, automotive, food & beverage, paper & packaging, agriculture, and cosmetics & personal care. In terms of sales channel, the market is divided into direct (B2B), distributors, online retail, and specialty stores. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The leaf fiber segment is projected to account for 60.0% of the pineapple fiber market in 2025, reaffirming its position as the category's dominant source. Textile operators increasingly recognize the optimal balance of fiber quality and processing reliability offered by leaf fiber pineapple fiber for most premium applications, particularly in fashion and composite material processes. This source addresses both performance requirements and long-term quality considerations while providing reliable fiber characteristics across diverse textile applications.

This source forms the foundation of most textile protocols for natural fiber applications, as it represents the most widely accepted and commercially viable level of pineapple fiber technology in the industry. Quality standards and extensive processing testing continue to strengthen confidence in leaf fiber pineapple fiber formulations among fashion and textile providers. With increasing recognition of the performance-quality optimization requirements in natural fiber production, leaf fiber systems align with both environmental compliance and processing goals, making them the central growth driver of comprehensive textile infrastructure strategies.

Mechanical extraction is projected to represent 50.0% of pineapple fiber demand in 2025, underscoring its role as the primary processing method segment driving market adoption and growth. Manufacturers recognize that textile production requirements, including complex fiber extraction operations, specialized quality control needs, and multi-stage processing systems, often require advanced mechanical extraction systems that standard processing technologies cannot adequately provide. Mechanical extraction offers enhanced fiber consistency and operational compliance in textile production applications.

The segment is supported by the growing complexity of fiber processing operations, requiring sophisticated extraction systems, and the increasing recognition that advanced processing technologies can improve textile performance and quality outcomes. Additionally, manufacturers are increasingly adopting evidence-based processing guidelines that recommend specific mechanical extraction systems for optimal fiber quality. As understanding of processing complexity advances and textile requirements become more stringent, mechanical extraction will continue to play a crucial role in comprehensive natural fiber production strategies within the textile market.

Textiles are projected to represent 40.0% of pineapple fiber demand in 2025, demonstrating their critical role as the primary application segment driving market expansion and adoption. Fashion operators recognize that textile production requirements, including complex apparel manufacturing processes, specialized fabric development needs, and multi-level fashion systems, often require advanced pineapple fiber systems that standard natural fiber technologies cannot adequately provide. Textile-focused pineapple fiber offers enhanced material properties and environmental compliance in fashion production applications.

Within the textiles segment, apparel manufacturing commands the largest subsegment with 55% of textile applications, driven by fashion brands seeking eco-friendly alternatives to synthetic fabrics for clothing production. The growing consumer demand for environmentally responsible fashion has prompted major apparel manufacturers to integrate pineapple fiber into garments, accessories, and fashion products.

Upholstery applications represent 25% of the textiles segment, supported by furniture manufacturers adopting natural fiber alternatives for sustainable interior design solutions. The segment benefits from pineapple fiber's durability characteristics and aesthetic appeal in commercial and residential furniture applications. Footwear applications account for 20% of textile demand, with shoe manufacturers utilizing pineapple fiber leather alternatives in premium footwear lines targeting environmentally conscious consumers.

The pineapple fiber market is advancing steadily due to increasing recognition of agricultural waste valorization's importance and growing demand for high-performance natural fiber systems across the textile and fashion sectors. However, the market faces challenges, including complex processing requirements, potential for quality variations during extraction and treatment, and concerns about supply chain consistency for specialized fiber applications. Innovation in processing technologies and customized textile protocols continues to influence product development and market expansion patterns.

Expansion of Advanced Textile Facilities and Processing Technologies

The growing adoption of advanced textile facilities is enabling the development of more sophisticated pineapple fiber production and quality control systems that can meet stringent operational requirements. Specialized textile facilities offer comprehensive processing services, including advanced extraction and treatment processes that are particularly important for achieving high-quality requirements in fashion applications. Advanced textile infrastructure provides access to premium services that can optimize fiber performance and reduce processing costs while maintaining cost-effectiveness for large-scale fashion operations.

Integration of Circular Economy Systems and Waste Management Systems

Modern textile organizations are incorporating digital technologies such as real-time quality monitoring, automated processing systems, and supply chain integration to enhance pineapple fiber deployment and distribution processes. These technologies improve fiber performance, enable continuous operational monitoring, and provide better coordination between processors and textile operators throughout the production cycle. Advanced digital platforms also enable customized quality specifications and early identification of potential processing deviations or supply disruptions, supporting reliable textile production.

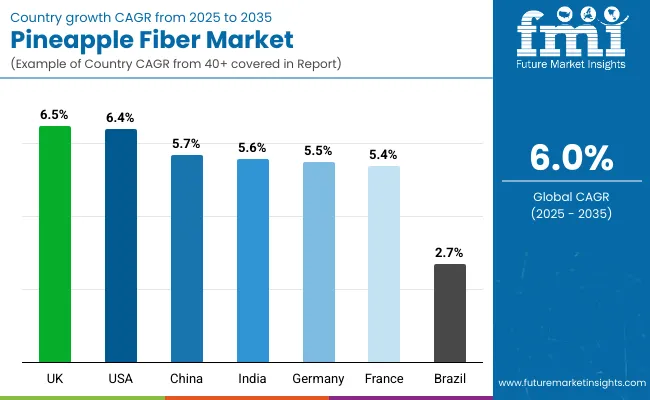

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.7% |

| India | 5.6% |

| Germany | 5.5% |

| France | 5.4% |

| UK | 6.5% |

| USA | 6.4% |

| Brazil | 2.7% |

The pineapple fiber market is experiencing varied growth globally, with UK leading at 6.5% CAGR through 2035, driven by the expansion of fashion infrastructure development, increasing textile processing capabilities, and growing domestic demand for high-performance natural fiber systems. China follows at 5.7%, supported by textile expansion, growing recognition of agricultural waste valorization importance, and expanding processing capacity.

India records 5.6% growth, with a focus on developing the textile infrastructure and natural fiber industries. Germany shows 5.5% growth, representing an established market with expanding fashion frameworks. France demonstrates 5.4% growth with focus on advanced textile adoption. Brazil demonstrates 2.7% growth, emphasizing textile infrastructure expansion and systematic processing approaches.

Revenue from pineapple fiber in China is projected to exhibit robust growth with a CAGR of 5.7% through 2035, driven by ongoing textile expansion and increasing recognition of high-performance natural fiber systems as essential waste valorization components for complex fashion processes. The country's expanding textile infrastructure and growing availability of specialized processing capabilities are creating significant opportunities for pineapple fiber adoption across both domestic and export-oriented textile facilities. Major international and domestic fiber companies are establishing comprehensive processing and distribution networks to serve the growing population of manufacturers and textile facilities requiring high-performance natural fiber systems across fashion and composite applications throughout China's major textile hubs.

The Chinese government's strategic emphasis on textile infrastructure modernization and circular economy advancement is driving substantial investments in specialized processing capabilities. This policy support, combined with the country's large domestic textile market and expanding fashion requirements, creates a favorable environment for the pineapple fiber market development. Chinese manufacturers are increasingly focusing on high-value natural fiber technologies to improve textile capabilities, with pineapple fiber representing a key component in this industrial transformation.

Revenue from pineapple fiber in India is expanding at a CAGR of 5.6%, supported by increasing textile accessibility, growing natural fiber infrastructure awareness, and developing processing market presence across the country's major fashion clusters. The country's large textile sector and increasing recognition of advanced natural fiber systems are driving demand for effective high-performance processing solutions in both apparel production and textile applications. International fashion companies and domestic providers are establishing comprehensive distribution channels to serve the growing demand for quality natural fiber systems while supporting the country's position as an emerging textile technology market.

India's textile sector continues to benefit from favorable processing policies, expanding fashion capabilities, and cost-competitive natural fiber infrastructure development. The country's focus on becoming a global textile technology hub is driving investments in specialized processing technology and waste management infrastructure. This development is particularly important for pineapple fiber applications, as manufacturers seek reliable domestic sources for critical natural fiber technologies to reduce import dependency and improve supply chain security.

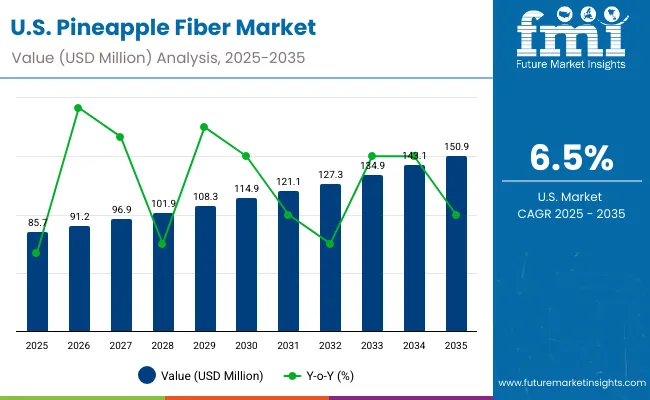

USA's advanced natural fiber market demonstrates sophisticated textile infrastructure deployment with documented pineapple fiber effectiveness in fashion departments and textile centers through integration with existing processing systems and quality control infrastructure. The country leverages textile expertise in natural fiber technology and waste management systems integration to maintain a 6.4% CAGR through 2035. Textile centers, including major fashion areas, showcase premium installations where pineapple fiber integrates with comprehensive quality information systems and processing platforms to optimize fiber consistency and operational workflow effectiveness.

American manufacturers prioritize system reliability and environmental compliance in infrastructure development, creating demand for premium systems with advanced features, including performance validation and integration with US textile standards. The market benefits from established fashion industry infrastructure and a willingness to invest in advanced natural fiber technologies that provide long-term operational benefits and compliance with environmental regulations.

UK's market expansion benefits from diverse textile demand, including fashion infrastructure modernization in London and Manchester, processing development programs, and government textile programs that increasingly incorporate pineapple fiber solutions for infrastructure enhancement applications. The country maintains a 6.5% CAGR through 2035, driven by rising fashion awareness and increasing adoption of processing benefits, including superior fiber capabilities and reduced environmental impact.

Market dynamics focus on cost-effective natural fiber solutions that balance advanced processing features with affordability considerations important to British textile operators. Growing fashion infrastructure creates demand for modern natural fiber systems in new textile facilities and fashion equipment modernization projects.

Strategic Market Considerations:

Germany demonstrates steady market development with a 5.5% CAGR through 2035, distinguished by textile operators' preference for high-quality natural fiber systems that integrate seamlessly with existing fashion equipment and provide reliable long-term operation in specialized textile applications. The market prioritizes advanced features, including precision processing algorithms, performance validation, and integration with comprehensive fiber platforms that reflect German textile expectations for technological advancement and operational excellence.

Strategic Market Indicators:

France demonstrates strong market development with a 5.6% CAGR through 2035, driven by advanced textile infrastructure and fashion preference for technology-integrated pineapple fiber systems. The country's sophisticated fashion ecosystem and high automation adoption rates are creating significant opportunities for pineapple fiber adoption across both domestic and technology-driven textile facilities. French fashion houses and luxury brands are increasingly incorporating pineapple fiber into premium product lines, leveraging the material's unique aesthetic properties and environmental credentials to appeal to luxury consumers seeking exclusivity and responsibility.

Strategic Market Considerations:

Brazil demonstrates steady market development with a 2.7% CAGR through 2035, distinguished by textile operators' preference for high-quality natural fiber systems that integrate seamlessly with existing fashion equipment and provide reliable long-term operation in specialized processing applications. The market prioritizes advanced features, including precision extraction algorithms, performance validation, and integration with comprehensive fiber platforms that reflect Brazilian textile expectations for technological advancement and operational excellence.

Strategic Market Indicators:

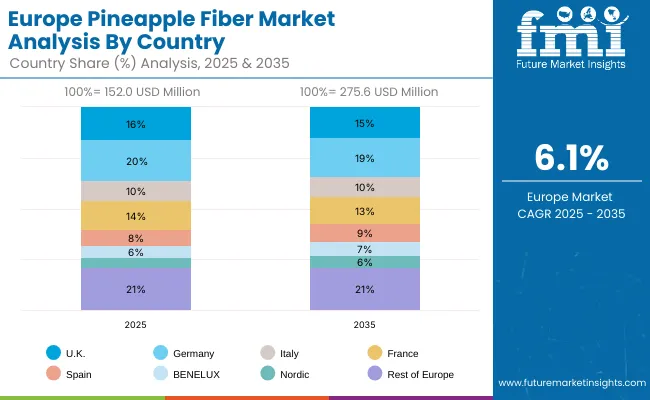

The pineapple fiber market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market value of USD 30.4 million in 2025, supported by its advanced textile infrastructure, precision quality management capabilities, and strong fashion presence throughout major textile regions.

UK follows with USD 24.3 million in 2025, driven by advanced processing protocols, natural fiber innovation integration, and expanding textile networks serving both domestic and international markets. France holds USD 21.3 million in 2025, supported by fashion infrastructure expansion and growing adoption of high-efficiency natural fiber systems. Italy commands USD 15.2 million in 2025, while Spain accounts for USD 12.2 million in 2025. The Rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, holds USD 31.9 million in 2025, representing diverse market opportunities with established textile and fashion infrastructure capabilities.

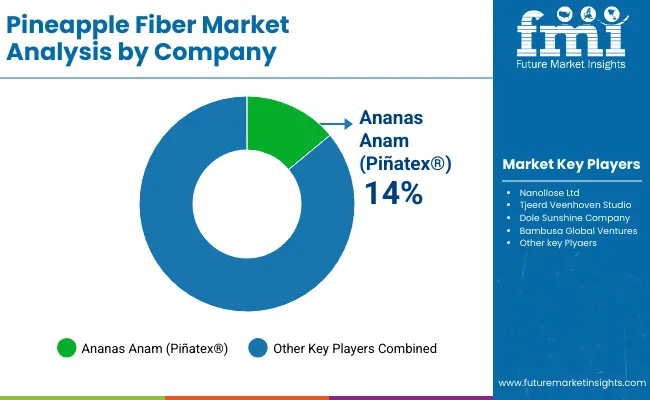

The pineapple leaf fibre (PALF) market is still relatively small and fragmented, dominated by a handful of innovators and a long tail of regional producers. Ananas Anam, a UK-based company behind the Piñatex® and Piñayarn® materials, is one of the most visible commercial suppliers of pineapple-leaf-based textiles for footwear, fashion and accessories. It sources fibre from farmer networks in the Philippines and converts it into non-woven and yarn products for global brands.

Upstream, agrifood companies such as Dole Sunshine Company are partnering with textile innovators to valorise pineapple leaf waste from large plantations, supplying feedstock and participating in pilot projects that convert leaves into traceable, higher-value fibres.

Beyond these pioneers, PALF production is dispersed across smaller extraction units and textile mills in pineapple-growing regions of Asia, including the Philippines, India, Indonesia and Taiwan, where local firms and research institutions are experimenting with PALF yarns, blends and composites for apparel, home textiles and technical applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 450.0 Million |

| Source | Leaf Fiber, Stem Residue, Fruit Waste |

| Processing Method | Mechanical Extraction, Enzymatic Processing, Chemical Treatment, Blended with Other Fibers |

| Application | Textiles, Paper and Packaging, Composites and Bioplastics, Food and Beverages, Personal Care and Cosmetics, Animal Feed |

| Product Form | Raw Fiber, Yarn, Non-Woven Sheets, Powdered Fiber, Fiber Pellets |

| End Use Industry | Fashion and Apparel, Automotive, Food & Beverage, Paper & Packaging, Agriculture, Cosmetics & Personal Care |

| Sales Channel | Direct (B2B), Distributors, Online Retail, Specialty Stores |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | China, USA, Germany, Japan, India, South Korea, Brazil, UK, France, and 40+ countries |

| Key Companies Profiled | Ananas Anam, Nanollose Ltd, Tjeerd Veenhoven Studio, Dole Sunshine Company, and Bambusa Global Ventures |

| Additional Attributes | Dollar sales by source and processing method, regional demand trends, competitive landscape, textile provider preferences for specific natural fiber systems, integration with specialty fashion supply chains, innovations in processing technologies, quality monitoring, and waste optimization |

The global pineapple fiber market is estimated to be valued at USD 450.0 million in 2025.

The pineapple fiber market is projected to reach USD 804.4 million by 2035.

The pineapple fiber market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key sources in the pineapple fiber market are leaf fiber, stem residue, and fruit waste.

In terms of source, the leaf fiber segment is expected to command 60.0% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA