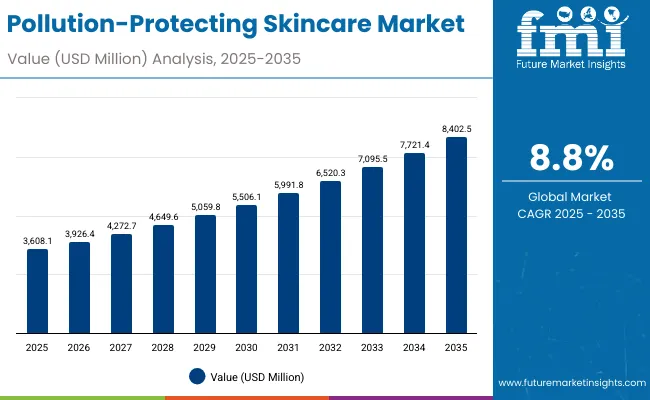

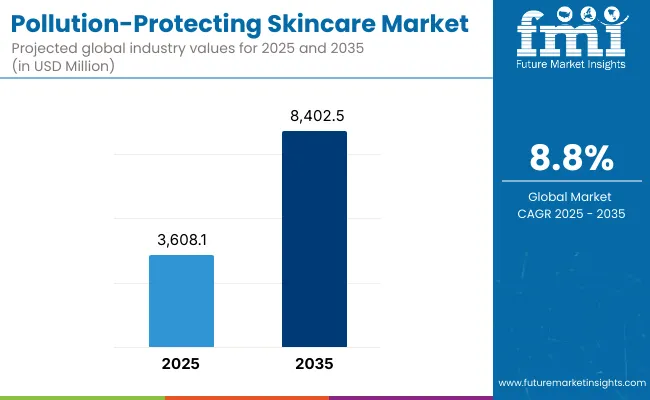

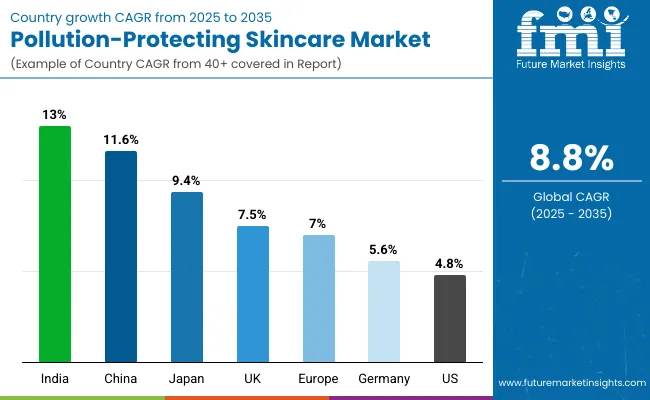

The Global Pollution-Protecting Skincare Market is expected to record a valuation of USD 3,608.1 million in 2025 and USD 8,402.5 million in 2035, with an increase of USD 4,794.4 million, which equals a growth of 133% over the decade. The overall expansion represents a CAGR of 8.8% and more than a 2X increase in market size.

Global Pollution-Protecting Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global Pollution-Protecting Skincare Market Estimated Value in (2025E) | USD 3,608.1 million |

| Global Pollution-Protecting Skincare Market Forecast Value in (2035F) | USD 8,402.5 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

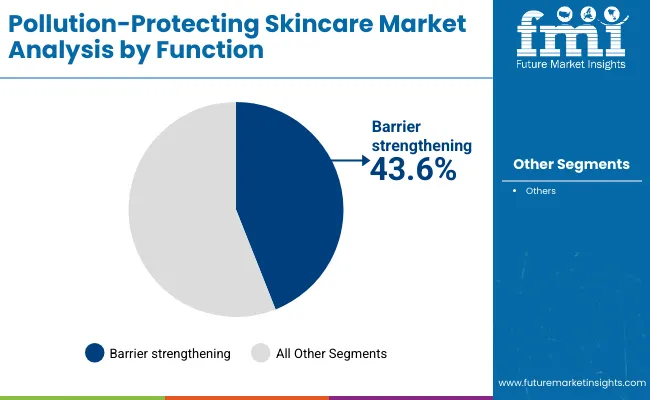

During the first five-year period from 2025 to 2030, the market increases from USD 3,608.1 million to USD 5,506.1 million, adding USD 1,898 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption across urban centers, where air pollution, vehicular emissions, and lifestyle stressors heighten consumer demand for protective skincare. Anti-pollution moisturizers and serums gain traction, as they cater to urban professionals and commuters requiring daily defense. Barrier-strengthening functions dominate this period, accounting for more than 43% of functional demand, as consumers prioritize skin resilience against free radicals, particulate matter, and urban dust exposure.

The second half from 2030 to 2035 contributes USD 2,896.4 million, equal to nearly 60% of total growth, as the market jumps from USD 5,506.1 million to USD 8,402.5 million. This acceleration is powered by the widespread adoption of advanced SPF creams with pollution shields, serums enriched with marine algae and niacinamide, and multifunctional cleansers combining detox and hydration. E-commerce channels expand rapidly in this phase, particularly in Asia and Europe, as consumer education on pollution-linked skin damage becomes mainstream. Software-like digital skin assessment platforms and AI-based dermatology apps integrate into retail, driving a larger role for personalized regimens. Ingredients such as Vitamin C and green tea antioxidants command premium pricing due to their proven ability to neutralize oxidative stress, reinforcing their long-term dominance.

From 2020 to 2024, the Global Pollution-Protecting Skincare Market grew steadily from a smaller base, largely driven by niche launches and urban consumer awareness in premium markets like Japan, China, and the U.S. During this period, multinational beauty brands dominated, controlling nearly 80% of revenue, with leaders such as Clinique and Shiseido emphasizing anti-pollution serums and creams. Competitive differentiation relied heavily on claims such as “anti-dust,” “free-radical neutralization,” and “pollution shield,” while functional skincare was often bundled into anti-aging or sun-care lines rather than positioned as standalone categories. Mass-market traction was limited, with pharmacies and specialty beauty retailers acting as primary distribution channels.

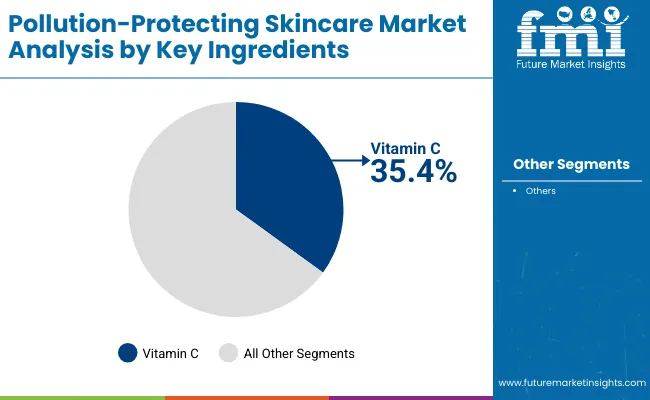

Demand for pollution-protecting skincare expands to USD 3,608.1 million in 2025, and the revenue mix begins to diversify as Vitamin C, niacinamide, and marine algae-based formulations grow to over 35% share of ingredient demand. Traditional beauty leaders face rising competition from digitally native brands that market urban lifestyle defense as a core proposition, integrating AI-led skin mapping, AR-based try-ons, and subscription-driven regimens. Major global players are pivoting to hybrid models, combining offline retail presence with D2C e-commerce platforms to retain consumer loyalty. Emerging entrants, especially in Asia, specialize in green formulations, eco-friendly packaging, and multifunctional protection, gaining share from legacy players. The competitive advantage is moving away from branding alone to ecosystem strength, personalization, and consumer engagement across digital platforms.

Advances in skincare formulations have improved efficacy against urban pollutants, enabling more effective free-radical neutralization and barrier repair. Anti-pollution moisturizers are the preferred format due to their ability to combine hydration with daily protective layers, while serums deliver concentrated ingredients like Vitamin C and niacinamide for targeted results. The rise of SPF creams with built-in pollution shields reflects growing demand for multifunctional products that combine sun protection with environmental defense.

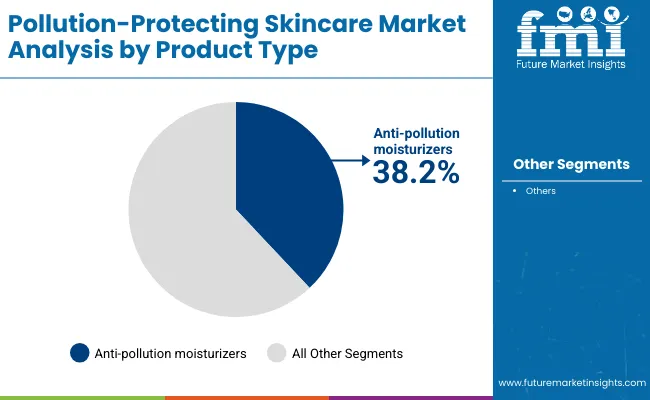

Expansion of awareness campaigns linking pollution to premature aging, pigmentation, and sensitivity has fueled adoption. Innovations in cleansing systems, such as micellar water and detox balms with activated charcoal, are expected to broaden application areas. Segment growth is led by anti-pollution moisturizers in product type, Vitamin C in ingredient categories, and barrier strengthening in functions, reflecting consumer priorities of resilience and skin health.

The market is segmented by product type, key ingredients, function, channel, end user, and region. Product types include anti-pollution moisturizers, serums & ampoules, SPF creams with pollution shield, and cleansing balms & micellar water, highlighting the formats that dominate consumer adoption. Key ingredient classification covers activated charcoal, Vitamin C, niacinamide, green tea & antioxidants, and marine algae to address the diverse range of protective and corrective needs in skincare. Based on function, the segmentation includes free-radical neutralization, barrier strengthening, and deep detox & cleansing, representing the primary skin benefits demanded by urban consumers exposed to high levels of pollution. In terms of channel, categories encompass e-commerce, specialty beauty retail, pharmacies, and mass retail, reflecting the variety of distribution pathways that ensure accessibility across premium and mainstream price points. End users include urban professionals, commuters, outdoor workers, and unisex consumers, which together represent the core demographics driving adoption of pollution-protecting skincare. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, capturing the growth opportunities across both developed beauty markets and emerging urban centers where air pollution is becoming a significant lifestyle concern.

| Product Type | Value Share % 2025 |

|---|---|

| Anti-pollution moisturizers | 38.2% |

| Others | 61.8% |

The anti-pollution moisturizers segment is projected to contribute 38.2% of the Global Pollution-Protecting Skincare Market revenue in 2025, maintaining its lead as the dominant product type. This leadership is driven by growing consumer preference for daily-use formats that combine hydration with pollution protection. Anti-pollution moisturizers have become essential in urban skincare routines, providing defense against particulate matter, dust, and oxidative stress while also strengthening the skin barrier.

The segment’s growth is further supported by multifunctional innovations such as moisturizers with built-in SPF and antioxidant blends. As pollution levels in urban centers continue to rise, demand for protective hydration solutions is increasing among professionals, commuters, and outdoor workers. With brands expanding their moisturizer portfolios to include Vitamin C, niacinamide, and algae extracts, the segment is expected to retain its position as the backbone of the pollution-protection skincare category.

| Key Ingredients | Value Share % 2025 |

|---|---|

| Vitamin C | 35.4% |

| Others | 64.6% |

The Vitamin C segment is forecasted to hold 35.4% of the market share in 2025, led by its application in neutralizing free radicals and combating pollution-induced oxidative stress. Vitamin C has become the hero ingredient for consumers seeking both protective and corrective benefits, as it brightens skin tone while reducing the appearance of pigmentation caused by environmental aggressors.

Its popularity has been bolstered by a surge of launches across serums, ampoules, and moisturizers that highlight Vitamin C’s antioxidant strength. Dermatologists and skincare professionals frequently recommend Vitamin C as a first line of defense in polluted environments, reinforcing consumer trust. As scientific validation of its role in reducing pollution-linked premature aging continues to grow, Vitamin C is expected to maintain its dominance across pollution-protecting skincare formulations.

| Function | Value Share % 2025 |

|---|---|

| Barrier strengthening | 43.6% |

| Others | 56.4% |

The barrier strengthening function segment is projected to account for 43.6% of the Global Pollution-Protecting Skincare Market revenue in 2025, establishing it as the leading functional category. Consumers are increasingly aware that pollution weakens the skin’s natural defenses, leading to sensitivity, dryness, and accelerated aging. Products focusing on barrier repair and resilience have therefore become top priorities in both premium and mass-market skincare portfolios.

This dominance is further supported by formulations enriched with niacinamide, green tea antioxidants, and marine algae, which work together to restore the skin’s protective layer. The segment benefits from growing demand among urban professionals and outdoor workers who are regularly exposed to high levels of environmental stressors. With long-term skin health becoming a central theme in consumer skincare, barrier strengthening is expected to remain the most influential functional driver throughout the forecast period.

Rising Urbanization and High Exposure to Air Pollution in Asia-Pacific

One of the strongest drivers is the rapid urbanization in East Asia and South Asia & Pacific, particularly in China and India, which show double-digit growth (CAGR 11.6% and 13% respectively from 2025-2035). Rising vehicular emissions, industrial activity, and poor air quality indices are directly linked to skin problems such as premature aging, pigmentation, and sensitivity. Consumers in Beijing, Shanghai, and Delhi are increasingly aware of the need for daily defense skincare. This translates into higher demand for barrier-strengthening moisturizers and Vitamin C-based serums, which dominate ingredient and function segments. The urban professional and commuter end-user segments are especially driving this demand, making pollution-protecting skincare a necessity rather than a luxury in these regions.

Ingredient-Led Premiumization and Scientific Validation

Another key driver is the scientific positioning of antioxidants like Vitamin C (35.4% share in 2025), niacinamide, and marine algae. These ingredients are backed by clinical studies showing efficacy against oxidative stress and pollutant-triggered inflammation. Premium brands such as Clinique, Shiseido, and Lancôme have built consumer trust by marketing these claims aggressively, while dermatologists frequently recommend Vitamin C serums for polluted environments. This has created a “premiumization loop” where consumers are willing to pay more for formulations with science-backed protective ingredients, thereby expanding revenue faster than volume growth.

Consumer Skepticism about Pollution-Specific Claims

Despite rising awareness, a significant portion of consumersespecially in the USA and parts of Europeremain skeptical about “pollution-protection” claims. Unlike sun protection, which has measurable SPF ratings, there is no universal benchmark to certify efficacy against particulate matter or free radicals. As a result, many consumers perceive anti-pollution labels as marketing-driven rather than clinically proven, which limits mainstream adoption. This skepticism restrains growth in mature markets, where CAGR figures (USA at 4.8%, Germany at 5.6%) are notably lower compared to Asia.

High Cost of R&D and Ingredient Sourcing

Pollution-protecting skincare relies on specialized actives like marine algae, encapsulated Vitamin C, and next-generation antioxidants, which are expensive to formulate and stabilize. Maintaining efficacy while ensuring long shelf life poses technical challenges, increasing production costs. Mid-tier and mass brands struggle to compete with premium players due to these cost barriers, restraining their ability to scale in mass retail and pharmacy channels. This cost-intensive structure slows down penetration in price-sensitive regions, particularly Latin America and parts of South Asia, despite rising awareness.

Multi-Functional Protection: SPF + Pollution Shield as Standard

The convergence of sun protection and pollution defense is emerging as a strong trend, especially in Europe and Asia-Pacific markets. SPF creams with pollution shields are becoming a baseline expectation, blending UV filters with antioxidants like green tea and Vitamin C. Consumers no longer want separate products for UV and pollution; instead, they demand hybrid formulations that save time while offering comprehensive defense. This trend also supports higher price positioning, as multi-functional products are perceived as delivering more value.

Digital Skin Diagnostics and Personalization in E-Commerce

With e-commerce as a leading channel, digital dermatology and AI-driven personalization are transforming how pollution-protecting skincare is marketed. Platforms now offer skin assessment tools that measure pollution damage, recommending customized regimens with serums, moisturizers, and cleansers. This trend is especially visible in China and India, where mobile-first consumers embrace apps and AR try-ons. Personalization is also enabling the rise of niche D2C brands that compete with global giants by offering curated “urban defense kits” tailored to local pollution conditions.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 11.6% |

| USA | 4.8% |

| India | 13.0% |

| UK | 7.5% |

| Germany | 5.6% |

| Japan | 9.4% |

| Europe | 7.0% |

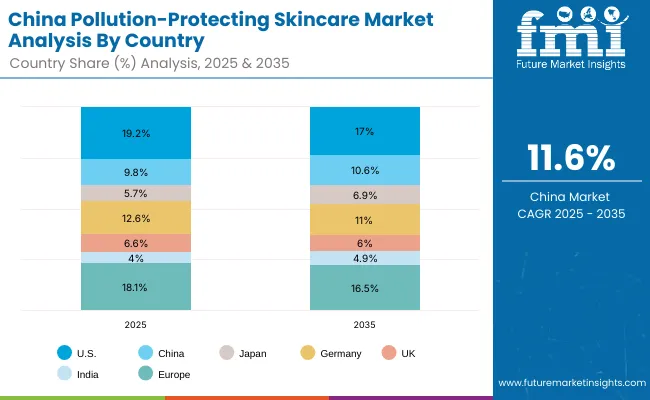

China and India are projected to be the fastest-growing markets, with CAGRs of 11.6% and 13.0% respectively from 2025 to 2035. This surge is fueled by escalating urban air pollution, rising disposable incomes, and a younger demographic that is highly aware of pollution-linked skin damage. In India, the commuter and outdoor worker segments are driving adoption, as mass-market and premium brands alike introduce pollution-defense lines with Vitamin C, niacinamide, and activated charcoal. China, on the other hand, benefits from a mature e-commerce ecosystem, where digitally savvy consumers adopt barrier-strengthening moisturizers and serums as part of daily routines. Both markets are also influenced by government-led air quality monitoring campaigns, which indirectly raise consumer awareness and reinforce skincare demand linked to environmental protection.

By contrast, growth in the USA and Western Europe is steadier, with CAGRs of 4.8% in the USA, 7.5% in the UK, and 5.6% in Germany. These mature skincare markets face consumer skepticism regarding “pollution-protection” claims, as standardized efficacy benchmarks are still lacking. However, demand is being supported by premium positioning, particularly in SPF creams with pollution shields and high-antioxidant serums. Japan shows higher momentum at 9.4% CAGR, driven by its strong tradition of functional skincare and consumer receptivity to innovative anti-aging and pollution-protection hybrids. Europe as a whole maintains a CAGR of 7.0%, sustained by regulatory push toward clean-label formulations and consumer interest in multifunctional, eco-friendly products. Overall, while Asia drives volume-led expansion, Western markets rely more on premium innovation and scientific validation to capture growth.

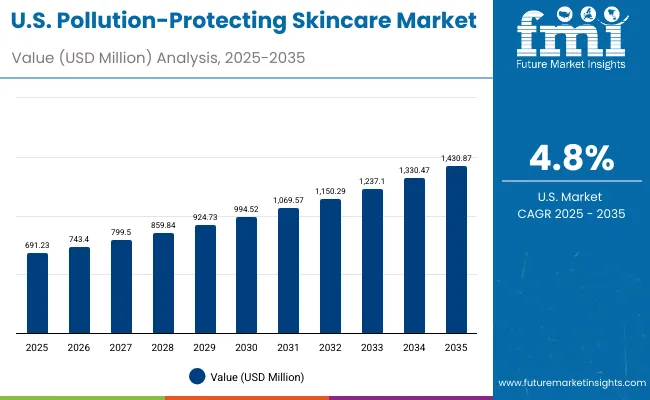

| Year | USA Pollution-Protecting Skincare Market (USD Million) |

|---|---|

| 2025 | 691.23 |

| 2026 | 743.40 |

| 2027 | 799.50 |

| 2028 | 859.84 |

| 2029 | 924.73 |

| 2030 | 994.52 |

| 2031 | 1069.57 |

| 2032 | 1150.29 |

| 2033 | 1237.10 |

| 2034 | 1330.47 |

| 2035 | 1430.87 |

The Global Pollution-Protecting Skincare Market in the United States is projected to grow at a CAGR of 4.8%, supported by rising demand for barrier-strengthening moisturizers and SPF creams with pollution shield. Urban professionals and commuters remain the core consumer groups, particularly in metropolitan areas with higher smog exposure such as Los Angeles and New York. While consumer skepticism about pollution-specific claims continues to restrain mass adoption, premium brands such as Clinique and Kiehl’s are expanding their USA portfolios by integrating Vitamin C and niacinamide into serums and moisturizers. Growth is further supported by the pharmacy and specialty retail channels, which emphasize dermatologist-backed anti-pollution claims.

The Global Pollution-Protecting Skincare Market in the United Kingdom is expected to grow at a CAGR of 7.5%, supported by demand from urban commuters and eco-conscious consumers. London, Manchester, and Birmingham are leading consumption hubs due to high air quality concerns and growing adoption of sustainable beauty. Premium brands such as Lancôme and The Body Shop dominate distribution through specialty retail, while D2C startups promote clean-label, pollution-protective serums online. Institutions and advocacy groups in the UK have also raised awareness of links between pollution and premature aging, creating long-term growth opportunities.

India is witnessing rapid growth in the Global Pollution-Protecting Skincare Market, forecast to expand at a CAGR of 13.0% through 2035, the highest among major markets. Rising awareness of air quality issues in cities like Delhi, Mumbai, and Bangalore is fueling demand for Vitamin C serums and anti-pollution cleansers. Tier-2 cities are also contributing as mid-priced products gain acceptance through pharmacies and mass retail. Local and multinational brands are tailoring products for commuters and outdoor workers, integrating affordable formulations with charcoal, niacinamide, and algae extracts.

The Global Pollution-Protecting Skincare Market in China is expected to grow at a CAGR of 11.6%, one of the fastest globally. Growth is powered by urban pollution challenges, government-led air quality campaigns, and consumer reliance on e-commerce platforms. Premium skincare players and local innovators alike are emphasizing Vitamin C, which holds a 37.1% share of the Chinese market in 2025. Digital-first brands are leveraging live-streaming, AI-driven personalization, and mobile apps to expand adoption in younger demographics. Affordable pollution-protection kits combining moisturizers, serums, and SPF creams are further broadening reach across tier-2 and tier-3 cities.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.2% |

| China | 9.8% |

| Japan | 5.7% |

| Germany | 12.6% |

| UK | 6.6% |

| India | 4.0% |

| Europe | 18.1% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.0% |

| China | 10.6% |

| Japan | 6.9% |

| Germany | 11.0% |

| UK | 6.0% |

| India | 4.9% |

| Europe | 16.5% |

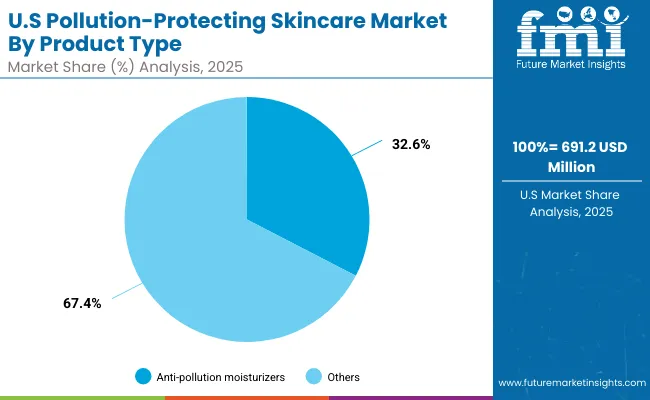

| USA By Product Type | Value Share % 2025 |

|---|---|

| Anti-pollution moisturizers | 32.6% |

| Others | 67.4% |

The Global Pollution-Protecting Skincare Market in the United States is valued at USD 691.2 million in 2025, with anti-pollution moisturizers contributing 32.6% of total revenue. This reflects strong consumer preference for daily-use moisturizers that combine hydration with pollution defense, especially in metropolitan areas such as New York and Los Angeles where smog and environmental stressors are prominent. However, unlike Asian markets, USA growth is tempered by skepticism around anti-pollution claims, with many consumers perceiving them as “marketing-driven” due to lack of standardized testing benchmarks.

Despite this, premium and dermatologist-backed brands such as Clinique, Kiehl’s, and Murad are sustaining demand by positioning their products around barrier strengthening and Vitamin C-based free-radical neutralization. Pharmacies and specialty beauty retailers dominate distribution, while e-commerce platforms are expanding influence through AI-driven personalization and digital skin analysis tools. Over time, SPF creams with integrated pollution shields are expected to capture greater share as multifunctional demand rises.

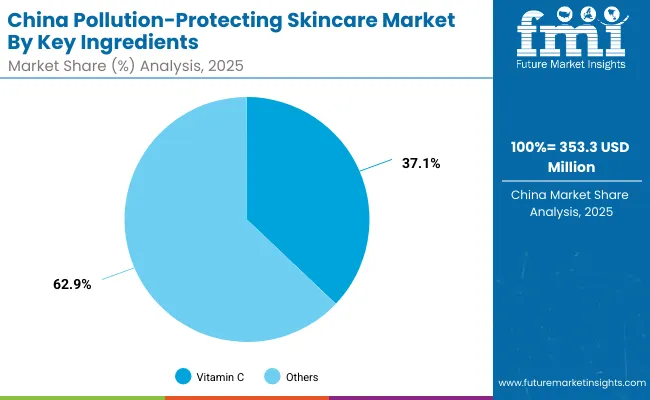

| China By Key Ingredients | Value Share % 2025 |

|---|---|

| Vitamin C | 37.1% |

| Others | 62.9% |

The Global Pollution-Protecting Skincare Market in China is valued at USD 353.3 million in 2025, with Vitamin C-based formulations contributing 37.1% of total ingredient demand. This dominance stems from rising consumer awareness of Vitamin C’s antioxidant benefits in combating oxidative stress, pigmentation, and premature aging caused by heavy urban air pollution. Tier-1 cities such as Beijing, Shanghai, and Guangzhou are at the forefront of adoption, while tier-2 and tier-3 cities are rapidly catching up through affordable local product lines distributed online.

E-commerce is the strongest growth driver in China, with live-streaming sales and AI-powered personalization shaping consumer engagement. Domestic brands are increasingly competitive, offering affordable anti-pollution moisturizers and serums bundled into “urban defense kits,” which appeal to younger demographics. Meanwhile, global brands like Shiseido, Lancôme, and Dr.Jart+ continue to leverage premium positioning and R&D-driven claims. As awareness grows, pollution-protecting skincare is transitioning from a premium lifestyle product to an everyday necessity in China.

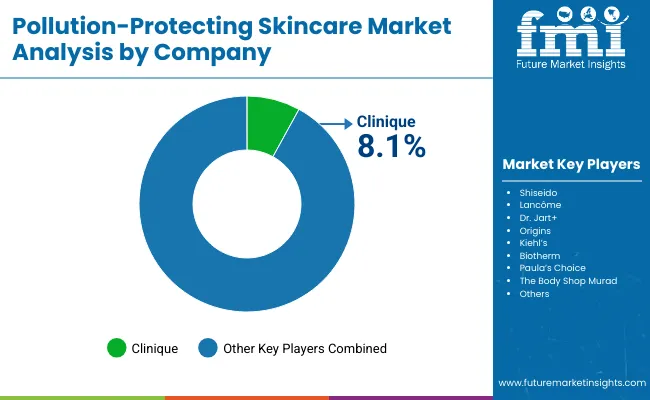

| Company | Global Value Share 2025 |

|---|---|

| Clinique | 8.1% |

| Others | 91.9% |

The Global Pollution-Protecting Skincare Market is moderately fragmented, with multinational leaders, regional players, and niche eco-focused brands competing across diverse product formats. Global leaders such as Clinique, Shiseido, and Lancôme hold significant market share, leveraging their premium portfolios of moisturizers, serums, and SPF creams with pollution shields. Their strategies increasingly emphasize science-backed ingredient claims, dermatologist endorsements, and multifunctional hybrids combining UV protection with anti-pollution defense. Established premium skincare brands including Dr.Jart+, Kiehl’s, and Origins cater to the demand for barrier-strengthening and antioxidant-rich solutions. These players are accelerating adoption through digital-first campaigns, D2C models, and collaborations with dermatology clinics to validate efficacy. Meanwhile, niche brands such as Paula’s Choice, Biotherm, and The Body Shop are building traction by positioning themselves on clean-label, vegan, and eco-friendly pollution protection, appealing strongly to Gen Z and sustainability-conscious consumers. Competitive differentiation is shifting away from brand heritage alone toward ecosystem-driven engagement that combines AI-based personalization, subscription-based regimens, and AR-enabled product trials. As pollution becomes a mainstream beauty concern, the winners will be those capable of merging strong R&D with consumer trust and digital retail innovation.

Key Developments in Global Pollution-Protecting Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Anti-pollution moisturizers, Serums & ampoules, SPF creams with pollution shield, Cleansing balms & micellar water |

| Key Ingredients | Activated charcoal, Vitamin C, Niacinamide , Green tea & antioxidants, Marine algae |

| Function | Free-radical neutralization, Barrier strengthening, Deep detox & cleansing |

| Channel | E-commerce, Specialty beauty retail, Pharmacies, Mass retail |

| End User | Urban professionals, Commuters, Outdoor workers, Unisex consumers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clinique, Shiseido, Lancôme, Dr. Jart +, Origins, Kiehl’s , Biotherm , Paula’s Choice, The Body Shop, Murad |

| Additional Attributes | Dollar sales by product type and key ingredient, adoption trends in Vitamin C and niacinamide -based formulations, rising demand for barrier-strengthening moisturizers and multifunctional SPF creams, sector-specific growth in premium skincare, expansion of e-commerce and digital-first channels, software-like personalization platforms in beauty tech, regional trends influenced by urbanization and pollution exposure, and innovations in antioxidant blends, algae extracts, and detox cleansers. |

The Global Pollution-Protecting Skincare Market is estimated to be valued at USD 3,608.1 million in 2025.

The market size for the Global Pollution-Protecting Skincare Market is projected to reach USD 8,402.5 million by 2035.

The Global Pollution-Protecting Skincare Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Global Pollution-Protecting Skincare Market are anti-pollution moisturizers, serums & ampoules, SPF creams with pollution shield, and cleansing balms & micellar water.

In terms of function, the barrier strengthening segment is expected to command 43.6% share in the Global Pollution-Protecting Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA