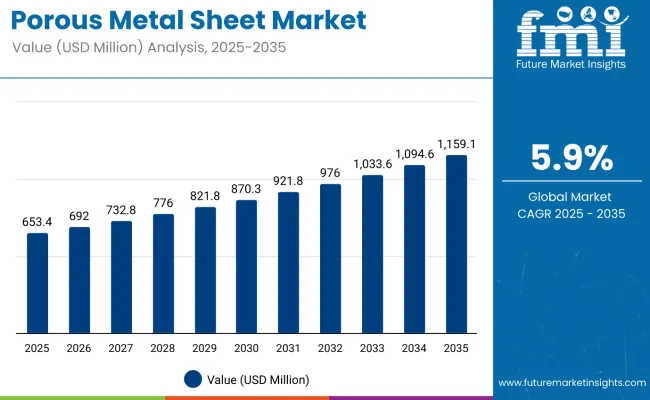

The global porous metal sheet market is estimated to reach USD 653.4 million in 2025 and is projected to expand to approximately USD 1,159.1 million by 2035, marking an absolute dollar growth of USD 505.7 million and a 77.4% increase over the assessment period. The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.9%, with the industry forecast to grow by nearly 1.77X over the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 653.4 million |

| Industry Value (2035F) | USD 1,159.1 million |

| CAGR (2025 to 2035) | 5.9% |

Demand is being shaped by increased utilization of porous metal sheets in advanced filtration systems, noise reduction modules, structural reinforcements, and high-temperature gas diffusion applications across chemical processing, automotive, aerospace, and energy sectors.

Between 2025 and 2030, the market is projected to increase from USD 653.4 million to USD 870.3 million, generating an incremental opportunity of USD 216.9 million. Growth in this period is being propelled by stronger regulatory enforcement around particulate filtration, increased replacement of polymer and ceramic materials with metal-based porous alternatives, and expanded use of structured metal meshes in electrochemical and catalytic reactors.

From 2030 to 2035, market value is forecast to grow from USD 870.3 million to USD 1,159.1 million, accounting for a further addition of USD 288.8 million. Key contributors to this growth include rising adoption in hydrogen fuel cell support plates, battery thermal barriers, biomedical implants, and waste heat recovery units. Innovation in powder metallurgy, additive manufacturing, and sintering technologies is enhancing the structural precision, porosity control, and application compatibility of porous metal sheet formats.

Material suppliers and OEMs are expected to benefit from improved product customization, modularity, and regulatory compliance, particularly in industries prioritizing durability, corrosion resistance, and thermal conductivity. The porous metal sheet market is evolving as a critical enabler of multi-functional design in next-generation energy systems, clean-tech platforms, and sustainable infrastructure projects.

Between 2020 and 2025, the porous metal sheet market recorded steady expansion, with the global value rising from USD 490.6 million in 2020 to USD 653.4 million in 2025, registering an absolute gain of USD 162.8 million over the five-year period. This growth was primarily supported by the resurgence of industrial filtration demand across chemical, petrochemical, and food processing sectors, alongside accelerated adoption of metallic meshes for noise dampening, heat shielding, and gas-liquid separation.

Product usage intensified in oil mist eliminators, self-cleaning filters, and degassing units, where polymer-based membranes were increasingly replaced by corrosion-resistant porous metal media due to their longer service life, mechanical strength, and resistance to thermal degradation. The period also saw OEMs integrating porous sheets into automotive exhaust components, fluid power systems, and metal-air battery enclosures.

The porous metal sheet market is expanding due to technological differentiation, performance-driven end-use demand, and rising industrial preference for reusable filtration media. Increasing global focus on process reliability, equipment longevity, and contamination control has elevated the importance of metallic porous structures across sectors.

Industrial filtration and separation applications are a primary growth lever. Porous metal sheets are being selected for backflushable filter systems, fluidizing beds, and multiphase reactors, particularly in the chemical, oil & gas, and pharmaceutical industries, where polymer alternatives cannot withstand high temperatures, pressure fluctuations, or corrosive streams. Their resistance to cracking, fouling, and delamination under cyclic operations makes them essential for critical systems that demand zero compromise on flow consistency and purity.

The market is also benefitting from advances in powder metallurgy, sintering control, and multi-layer lamination, which are enabling custom porosity profiles, gradient density zones, and optimized flow paths. These innovations are allowing manufacturers to meet application-specific permeability, strength, and thermal requirements without excessive weight or material wastage.

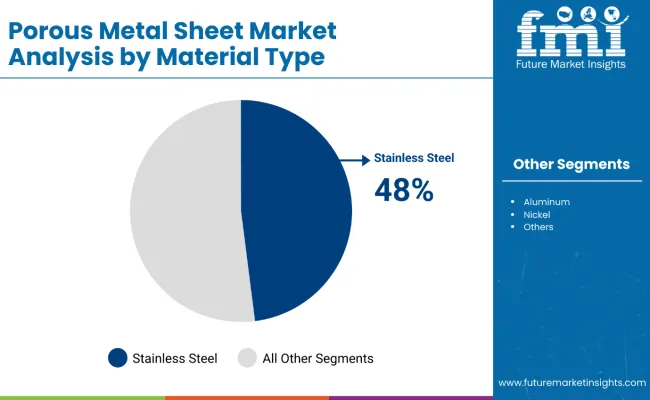

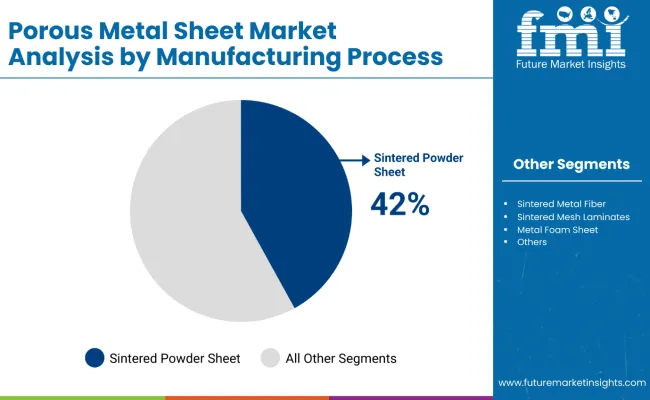

The market is segmented by material type into stainless steel, aluminum, nickel, bronze, titanium & alloys, and others, reflecting varied corrosion resistance, strength, and cost considerations. Manufacturing processes include sintered powder sheets, metal fibers, mesh laminates, and metal foam sheets, each offering distinct porosity and mechanical properties.

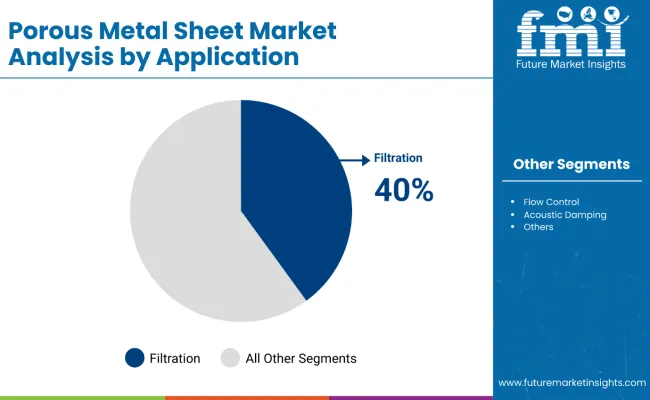

Key application areas span filtration, flow control, acoustic damping, medical implants, electronics shielding, and others, supporting use across industrial, healthcare, and electronic sectors. Regional analysis covers North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa to track growth differentials and emerging demand centers.

Stainless steel is estimated to hold a 48% share in the material type segment in 2025 and is projected to maintain dominance throughout the forecast period. Its widespread use is supported by excellent corrosion resistance, mechanical strength, and compatibility with multiple fabrication techniques.

Stainless steel porous sheets are extensively adopted in chemical processing, food and beverage, pharmaceutical, and filtration systems where durability under high pressure and temperature is required. The ability to produce fine pores and high structural integrity further reinforces its preference over alternatives like bronze or titanium.

Sintered powder sheets are expected to account for 42% of the manufacturing process segment in 2025 and remain the most utilized fabrication technique through 2035. Their adoption is driven by the ability to achieve uniform porosity, tailored flow rates, and controlled permeability for filtration and diffusion applications.

The sintering of metal powders enables production of robust and corrosion-resistant sheets with precision thickness, which makes them suitable for use in aerospace, industrial gas filtration, and catalyst support structures. Manufacturers continue to favor this process for its cost-effectiveness in volume production.

Filtration is projected to represent 40% share in the application segment in 2025 and is likely to remain the most prominent usage area over the next decade. Porous metal sheets serve as key media for fluid and gas filtration in sectors such as petrochemical, pharmaceuticals, power generation, and water treatment.

The combination of high temperature resistance, cleanability, and mechanical strength makes them suitable for aggressive operating environments. Demand is being reinforced by stricter industry regulations, emphasis on process purity, and the need for long-life filter media in critical operations.

The porous metal sheet market is being driven by increased demand for durable, high-performance filtration and flow control solutions across chemical processing, clean energy, and life sciences. These sheets offer long service life, corrosion resistance, and thermal stability which is critical in systems exposed to aggressive media, high temperatures, or dynamic pressures.

However, growth is moderated by high production costs, limited global manufacturing capacity, and the precision engineering required to maintain consistent porosity and mechanical integrity. The adoption curve remains steep for price-sensitive industries where polymer or ceramic alternatives are still viable.

Hydrogen Economy Accelerates Adoption in Energy and Transportation

As hydrogen fuel systems scale globally, porous metal sheets are being integrated into fuel cells, hydrogen separators, and moisture traps due to their permeability control and pressure handling capabilities. Their role as support structures in bipolar plates and diffusion layers is enabling better heat dissipation and structural resilience in mobile and stationary hydrogen systems.

Process-Specific Customization Enhances Competitive Differentiation

Demand is rising for customized porosity gradients, multi-layer mesh laminates, and hybrid metal-fiber constructions. These configurations allow process designers to fine-tune flow uniformity, acoustic absorption, and chemical resistance based on exact operating requirements. OEMs and system integrators are increasingly turning to porous metal sheet suppliers with advanced sintering, layering, and bonding technologies to meet application-specific performance benchmarks.

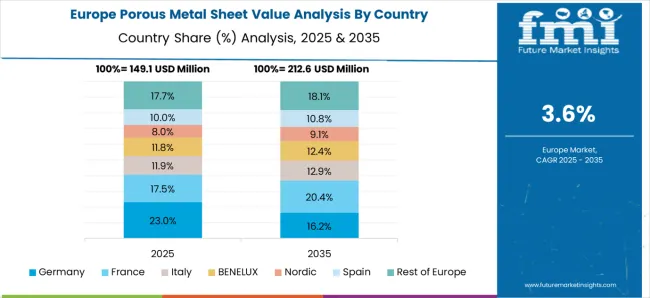

The porous metal sheet market in Europe is projected to expand from USD 149.1 million in 2025 to USD 212.6 million by 2035, reflecting a CAGR of 3.6%. Germany will continue to lead in absolute terms but its market share is expected to decline from 23.0% to 16.2% due to saturation in traditional applications like automotive filtration.

Spain is poised for strong growth, increasing its share from 17.5% to 20.4%, supported by industrial air treatment and filtration projects. Italy’s share is expected to grow from 11.9% to 12.9%, aided by the country’s strength in stainless steel production and medical-grade filter systems. France and the BENELUX region are likely to experience steady gains driven by pharmaceutical, cleanroom, and precision engineering uses.

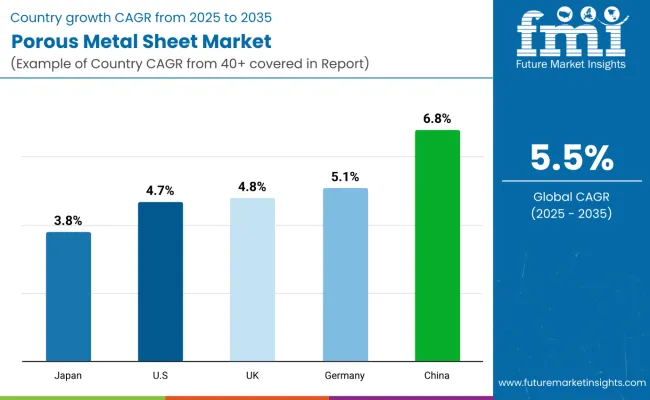

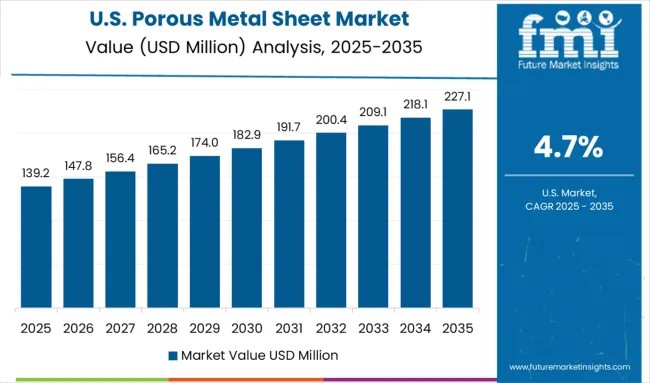

The USA porous metal sheet market is projected to grow at a CAGR of 4.7% between 2025 and 2035. Demand is driven by stringent EPA and FDA requirements for advanced filtration in food processing, pharmaceuticals, and chemical industries. Retrofitting of industrial HVAC and gas filtration systems is expanding the application base of sintered metal sheets.

The UK is expected to grow at a CAGR of 4.8%, supported by government incentives for smart factories and industrial modernization. Sintered metal sheets are increasingly used in air and gas filtration systems, particularly in electronics, battery storage, and chemical sectors.

Germany’s market is forecast to grow at a CAGR of 5.1% through 2035, led by high-precision applications in industrial filtration, automotive exhaust control, and chemical reactors. The country's dominance in manufacturing equipment is reinforcing usage of metal mesh laminates and foam sheets.

China is projected to lead the global market with a CAGR of 6.8% from 2025 to 2035. The country is experiencing strong demand for porous metal components in wastewater treatment, construction equipment, and chemical filtration. Local manufacturing of sintered products is expanding due to cost and logistics advantages.

Japan is expected to grow at a CAGR of 3.8%, supported by niche applications in precision medical implants, acoustic control systems, and compact electronics cooling. Stainless steel and titanium porous sheets are being used in advanced surgical tools, implantable devices, and precision filters.

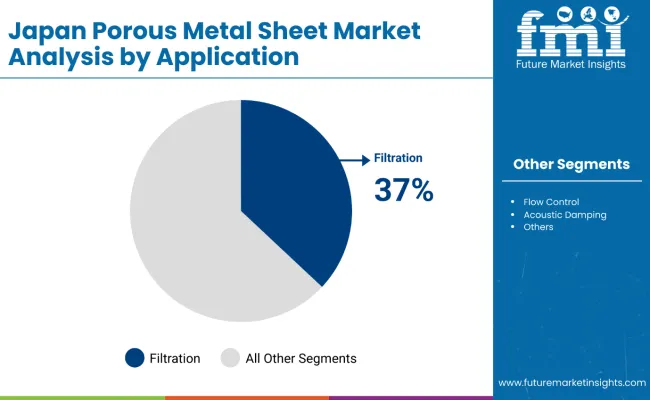

In Japan, filtration is estimated to hold a 37% share in porous metal sheet applications by 2025. The dominance of this segment is attributed to the country's strong base of high-precision industries, including medical devices, electronics, and pharmaceuticals, where fine particulate removal and fluid purity are critical. Flow control accounts for 18%, driven by usage in microfluidic systems and process control valves.

Acoustic damping and electronics shielding each hold 12%, reflecting applications in compact consumer electronics, automotive infotainment, and high-end industrial systems. Medical implants represent 14% of demand, where titanium- and nickel-based porous sheets are used in orthopedic and surgical implants due to their biocompatibility and strength-to-weight performance.

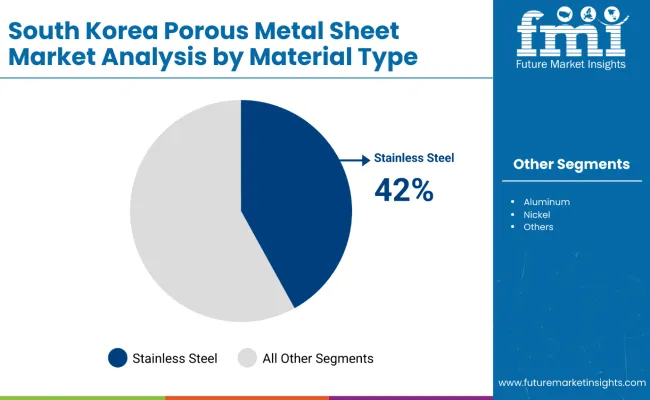

In South Korea, stainless steel is expected to lead material adoption for porous metal sheets with a 42% share in 2025. Its durability, corrosion resistance, and suitability for precision filtration make it ideal for high-spec industrial and medical applications. Nickel contributes 14%, favored in high-temperature and chemically reactive environments such as fuel cells, hydrogen filtration, and specialty electronics.

Aluminum holds 10% share, particularly in lightweight structural and energy storage applications. Titanium and alloys (8%) are increasingly utilized in aerospace and surgical tool segments, while bronze (6%) finds niche use in marine, fluid control, and vibration dampening components. Others, accounting for 20%, include hybrid metal composites and localized alloy variants tailored for export-grade product specifications.

The porous metal sheet market is evolving with a focus on high-performance, application-specific solutions across filtration, aerospace, automotive, and energy sectors. Manufacturers are investing in advanced fabrication techniques, including precision perforation, sintering, and additive manufacturing, to enhance porosity control, strength, and durability. Developments in corrosion-resistant and lightweight alloys are enabling expanded use in harsh operating environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 653.4 Million (2025) |

| Material Type | Stainless Steel, Aluminum, Nickel, Bronze, Titanium & Alloys, Others |

| Manufacturing Process | Sintered Powder Sheets, Sintered Metal Fiber, Sintered Mesh Laminates, Metal Foam Sheet, Others |

| Application | Filtration, Flow Control, Acoustic Damping, Medical Implants, Electronics Shielding, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China |

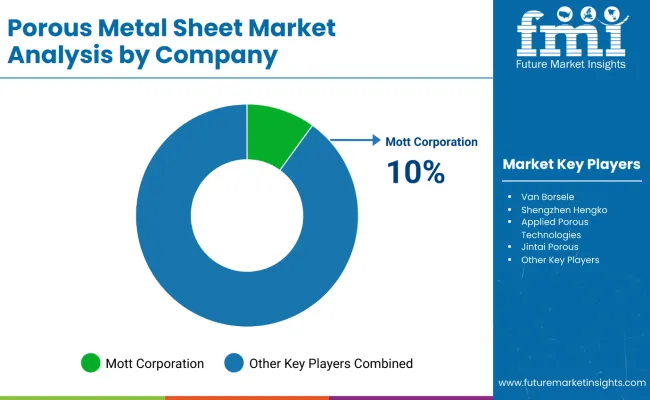

| Key Companies Profiled | Mott Corporation, GKN Powder Metallurgy, Porvair plc, Baoji Fitow Metal Co., Ltd., SINTO Group, HENGKO Technology Co., Ltd., Filtration Group |

The global porous metal sheet market is estimated to reach USD 653.4 million in 2025.

The market is projected to reach USD 1,159.1 million by 2035.

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035.

Stainless steel leads with a 48% share due to its corrosion resistance and strength.

Filtration is the leading application, accounting for 40% of the total market in 2025.

Sintered powder sheets represent the dominant manufacturing method, holding a 42% share in 2025.

China is expected to register the fastest CAGR at 6.8% between 2025 and 2035.

Rising demand for advanced filtration systems, lightweight acoustic materials, and biocompatible implants are key growth drivers. Material innovations and miniaturized component design are also shaping market evolution.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sheet Metal Market Size, Growth, and Forecast 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Porous Plastic Tubes Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA