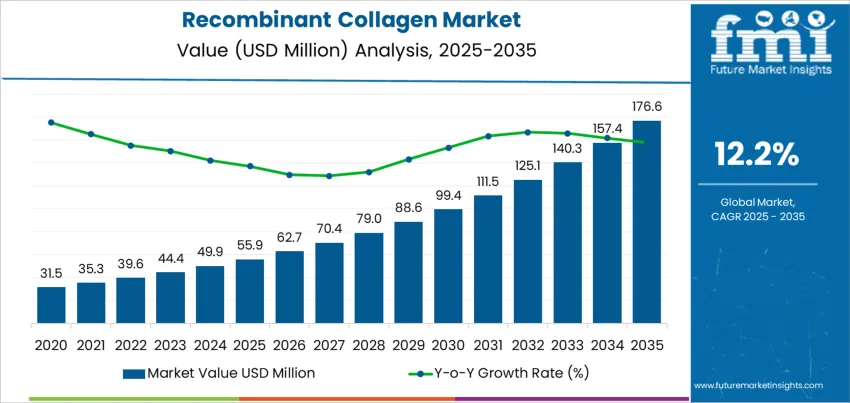

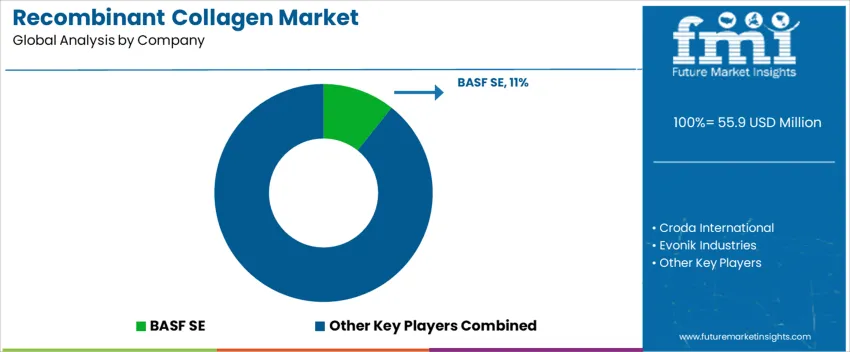

The global demand for recombinant collagen is expected to grow from USD 55.9 million in 2025 to USD 176.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 12.2%. Recombinant collagen, produced through biotechnology, is gaining traction in the healthcare, pharmaceutical, and cosmetic industries due to its ability to mimic natural collagen's benefits, including promoting skin regeneration, healing, and anti-aging effects. As demand for effective, sustainable, and bio-identical collagen solutions rises, recombinant collagen is expected to gain adoption across a range of applications, including wound healing, tissue engineering, and cosmetic procedures.

The market will experience consistent growth, starting at USD 55.9 million in 2025 and rising to USD 62.7 million in 2026, USD 70.4 million in 2027, and USD 79.0 million in 2028. By 2029, demand for recombinant collagen will rise to USD 88.6 million, continuing its upward trajectory throughout the 2030s. By 2035, the demand for recombinant collagen is projected to reach USD 176.6 million, supported by continued advancements in collagen-based technologies, an increasing focus on regenerative medicine, and the growing demand for collagen-infused cosmetic products.

The market share erosion or gain analysis for the recombinant collagen market shows an overall gain in market share over the next decade. This is driven by the growing adoption of recombinant collagen in diverse industries such as healthcare, cosmetics, and pharmaceuticals, where it is seen as a more sustainable and bio-identical alternative to animal-derived collagen. As biotechnology advances and recombinant collagen becomes more widely available, it is expected that market share for recombinant collagen will grow substantially across these sectors.

The increasing awareness of the benefits of recombinant collagen, along with ongoing product development, will allow it to gain market share from traditional collagen products. As the global demand for bio-based, sustainable ingredients rises, recombinant collagen is positioned to take a larger share of the market, especially as it becomes more widely accepted in both medical and cosmetic applications. However, this growth may come with some challenges as competition from alternative collagen sources or other biomaterials could influence the overall market share dynamics. Nonetheless, the strong demand for high-quality, sustainable collagen products will likely lead to a significant market share gain for recombinant collagen over the next decade.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 55.9 million |

| Industry Forecast Value (2035) | USD 176.6 million |

| Industry Forecast CAGR (2025-2035) | 12.2% |

Demand for recombinant collagen is rising globally as industries seek safer, more consistent, and ethical alternatives to traditional animal derived collagen. Recombinant collagen is produced using biotechnology, often via genetically engineered microorganisms or plant cells, ensuring high purity, reduced risk of contamination, and the absence of animal derived components. Its applications span cosmetics, wound healing, tissue engineering, and medical devices. In the cosmetics and personal care sector, recombinant collagen is increasingly seen as a premium ingredient for products aimed at improving skin elasticity, hydration, and overall skin health, especially in anti aging, regenerative, and skin repair formulations. As consumer demand grows for cruelty free, vegan, and high performance beauty products, the preference for recombinant collagen over animal derived sources strengthens.

In addition, broader market dynamics and technological advances support the expansion of the recombinant collagen market. According to recent market estimates, the global recombinant collagen market was valued around USD 265 million in 2024 and is projected to grow at a compound annual growth rate of about 11.3%, reaching roughly USD 504 million by 2030. Concurrently, the wider collagen market is expected to grow substantially from roughly USD 5.1 billion in 2023 to over USD 7.4 billion by 2030. On the medical side, recombinant collagen’s superior biocompatibility and customizable structure make it increasingly attractive for regenerative medicine, wound repair, and biomaterial applications. As regulatory acceptance, manufacturing scalability, and consumer preference continue to evolve, demand for recombinant collagen is expected to grow even more strongly over the coming decade.

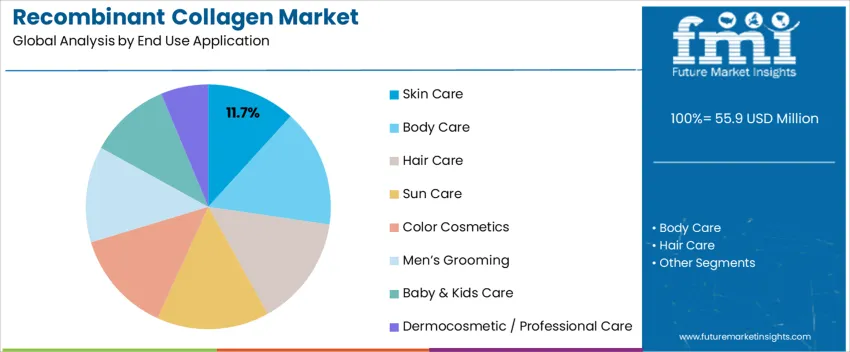

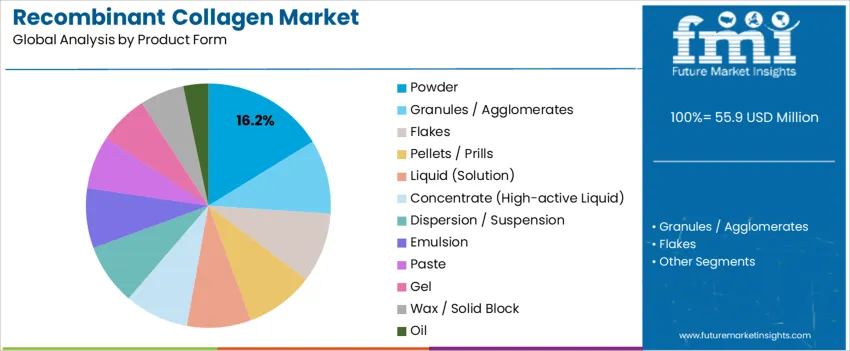

The global demand for recombinant collagen is primarily driven by application and product form. The leading end-use application is skin care, accounting for 11.7% of the market share, while powder holds the largest share in the product form segment, capturing 16.2%. Recombinant collagen, known for its ability to enhance skin elasticity, hydration, and repair, is widely incorporated into various personal care products. As consumer interest in anti-aging and skin regeneration solutions grows, recombinant collagen is becoming an increasingly popular ingredient in global skincare and cosmetic markets.

Skin care leads the end-use application demand for recombinant collagen, holding 11.7% of the market share. Recombinant collagen is highly sought after in skin care products for its ability to support the skin’s natural structure, boost collagen production, and improve skin elasticity and firmness. It is commonly included in anti-aging creams, serums, masks, and other skincare formulations aimed at reducing the appearance of wrinkles and fine lines.

The demand for recombinant collagen in skin care is driven by the increasing consumer preference for effective, scientific skincare solutions. As the awareness of collagen’s role in maintaining skin health and preventing signs of aging continues to grow, consumers are increasingly turning to collagen-based products. Recombinant collagen is particularly appealing due to its ability to provide a vegan, sustainable alternative to animal-derived collagen, making it a key ingredient in the growing clean beauty movement. The need for collagen-rich skincare products that deliver noticeable results in skin rejuvenation and elasticity is expected to drive the continued growth of recombinant collagen in the skin care sector.

Powder is the leading product form for recombinant collagen globally, holding 16.2% of the market share. Powdered recombinant collagen offers several advantages, including stability, ease of storage, and long shelf life. This form allows for precise dosing and is versatile in its application, being easily incorporated into a wide range of products such as creams, serums, and professional treatments. It also allows for higher concentrations of active ingredients, making it ideal for specialized formulations.

The demand for powdered recombinant collagen is driven by its flexibility and efficiency in product formulation. As the beauty industry continues to focus on personalized skincare solutions, powdered forms provide manufacturers with the ability to tailor products to meet specific needs. Moreover, the powdered form is often more cost-effective and easier to handle during manufacturing and shipping compared to liquids. The growing trend for high-performance, sustainable ingredients in skincare will further solidify the role of powdered recombinant collagen in the global market.

Demand for recombinant collagen is increasing worldwide as industries shift from animal-derived collagen to lab-engineered, biotechnology-based alternatives. Recombinant collagen is produced using genetically modified microorganisms, yeast, bacteria, or plant cells to yield human-like collagen that retains structural characteristics while reducing risks tied to animal-derived products. It finds applications across various fields, from medical and tissue engineering to cosmetics and personal care, due to its biocompatibility, purity, and versatility. As the global population ages, chronic disease burdens rise, and consumer interest grows in bioactive, science-backed wellness and beauty products, recombinant collagen is seeing increasing demand across regions.

What are the Drivers of Global Demand for Recombinant Collagen?

One key driver is the growing demand for advanced therapeutics with high target specificity. Recombinant collagen-based drugs are used in a variety of medical conditions, including metabolic diseases, cancer, cardiovascular conditions, and chronic illnesses. These drugs can precisely modulate biological pathways with lower toxicity than many small-molecule drugs. Research and development investments, combined with improved collagen synthesis and delivery technologies, are facilitating broader adoption. In cosmetics and personal care, there is a rising demand for effective, biologically active ingredients that deliver visible results, such as anti-aging, skin renewal, moisturizing, wrinkle reduction, and pigmentation correction. Growing consumer preference for science-backed, bio-derived, and multifunctional skincare is driving the shift toward recombinant collagen-infused products.

What are the Restraints on Global Demand for Recombinant Collagen?

Despite strong potential, there are several factors limiting the widespread adoption of recombinant collagen. One challenge is the relatively high production cost. Producing recombinant collagen with high purity and stability is complex and expensive, which can raise the final product price and limit accessibility in price-sensitive markets. For therapeutic recombinant collagen, stringent regulatory requirements and clinical trial processes can slow down approval, limiting availability in some regions. In cosmetics, the stability of recombinant collagen in formulations, the complexity of its integration into diverse products, and varying consumer responses depending on skin type and environmental conditions can reduce broader acceptance. Additionally, competition from alternative ingredients, such as collagen peptides from natural sources or synthetic actives, can constrain recombinant collagen's market share.

What are the Key Trends Influencing Global Demand for Recombinant Collagen?

A major trend is the increasing adoption of recombinant collagen in cosmetics and personal care as consumers demand vegan, cruelty-free, and sustainable ingredients. This trend aligns with the growing global interest in clean beauty and ethical sourcing. Additionally, recombinant collagen's use in medical applications, such as tissue engineering, wound healing, and regenerative medicine, is expanding as it is used for scaffolds, implants, dressings, and dermal fillers. Advancements in bioprocessing and molecular engineering are enabling the customization of collagen types, improving their performance and broadening their potential applications. The growth of emerging markets, particularly in Asia-Pacific, is also contributing to the demand for recombinant collagen as disposable incomes and awareness of biotechnology-based products rise.

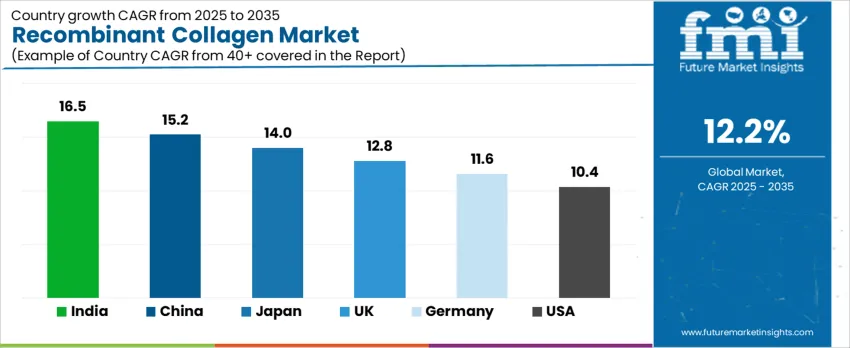

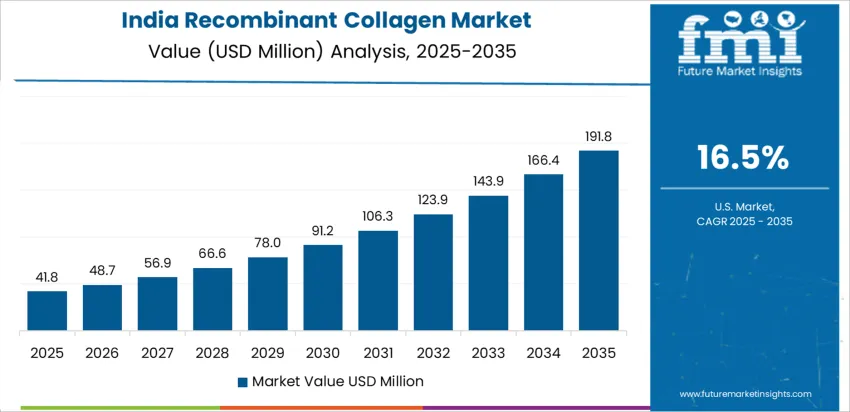

The demand for recombinant collagen is experiencing significant growth across the globe, with India leading the charge at a projected CAGR of 16.5%. Following India, China is expected to grow at 15.2%, Japan at 14%, the UK at 12.8%, Germany at 11.6%, and the USA at 10.4%. This rapid growth reflects the increasing demand for collagen-based products in the healthcare, cosmetics, and medical fields. Recombinant collagen is gaining popularity for its versatile applications, including anti-aging treatments, wound healing, and skin rejuvenation. As consumers increasingly seek effective, safe, and sustainable collagen sources, recombinant collagen is becoming a preferred option in the global market.

| Country | CAGR (%) |

|---|---|

| India | 16.5 |

| China | 15.2 |

| Japan | 14.0 |

| UK | 12.8 |

| Germany | 11.6 |

| USA | 10.4 |

In India, the projected CAGR of 16.5% for recombinant collagen reflects the country’s rapidly growing demand for skincare, anti-aging, and medical products. India’s beauty and personal care market is expanding, driven by a rising middle class, increasing disposable incomes, and greater awareness of skincare solutions. Consumers are increasingly turning to collagen-based products for their anti-aging, skin-rejuvenating, and moisturizing benefits, which are seen as effective in treating signs of aging, such as wrinkles and fine lines. The availability of recombinant collagen, which offers a more sustainable and ethical source compared to traditional animal-derived collagen, is particularly appealing to India’s growing health-conscious population. Additionally, the increasing number of aesthetic treatments, along with a rising preference for safe, natural ingredients, makes recombinant collagen a popular option in both cosmetic products and medical applications. With a growing focus on overall wellness and the rise of e-commerce platforms, the demand for recombinant collagen is expected to continue expanding in India.

In China, recombinant collagen is expected to grow at a CAGR of 15.2%, reflecting a rapid adoption of collagen-based products driven by a large and increasingly affluent consumer base. The Chinese market is witnessing rising demand for skincare and medical products that focus on anti-aging, skin rejuvenation, and improving skin health, all of which recombinant collagen supports. The growing awareness of the importance of collagen in maintaining youthful skin and its application in a variety of beauty treatments is leading to increased consumer interest. Additionally, China’s strong focus on sustainability and ethical sourcing contributes to the demand for recombinant collagen as a sustainable alternative to animal-derived collagen. As the cosmetic surgery and dermatology industries expand in China, the adoption of recombinant collagen for non-invasive treatments, such as injectables and topical creams, continues to rise. The combination of high consumer demand, increased purchasing power, and a growing skincare market positions China as one of the key drivers of recombinant collagen growth.

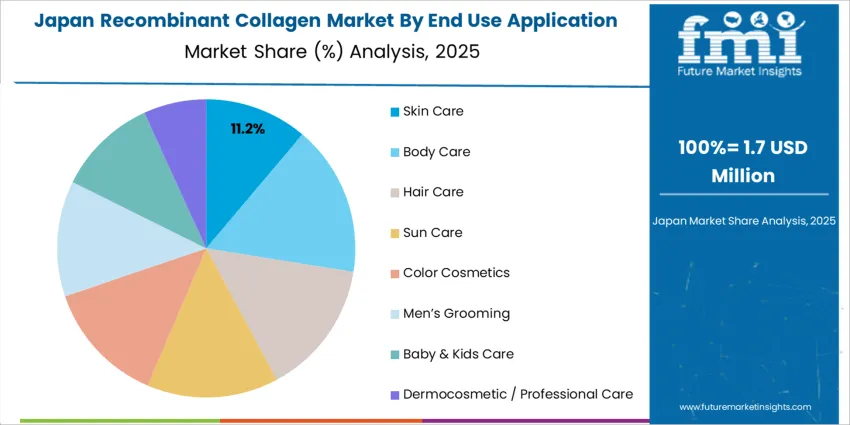

Japan’s projected CAGR of 14% for recombinant collagen reflects the country’s well-established beauty market, where collagen is widely recognized for its skin benefits. Japan’s focus on skincare innovation, coupled with a growing demand for anti-aging products, has positioned recombinant collagen as a key ingredient in many skincare and medical formulations. Japanese consumers have a long history of using collagen for both beauty and health purposes, and the demand for recombinant collagen is fueled by the desire for more sustainable, high-quality collagen sources. As the aging population in Japan seeks non-invasive treatments for skin rejuvenation and overall health, recombinant collagen is increasingly used in a variety of cosmetic applications, from creams to injectable fillers. Additionally, Japan’s strong emphasis on scientific research and innovation in skincare drives the continued adoption of recombinant collagen, with growing consumer confidence in its efficacy and safety.

In the UK, recombinant collagen is projected to grow at a CAGR of 12.8%, reflecting the country’s increasing demand for high-quality, sustainable skincare solutions. The UK’s well-established clean beauty market is increasingly moving toward natural and ethically sourced ingredients, making recombinant collagen a preferred choice for consumers seeking effective anti-aging and skin health solutions. As British consumers become more aware of the benefits of collagen in maintaining skin elasticity and reducing the appearance of wrinkles, the demand for recombinant collagen products, such as serums, creams, and supplements, has increased. The UK’s focus on sustainability and transparency in beauty products also supports the growth of recombinant collagen, as it offers an ethical alternative to traditional collagen derived from animal sources. With the rise of non-invasive cosmetic procedures and the growing acceptance of collagen as a skincare solution, recombinant collagen’s role in the UK market is expected to continue expanding.

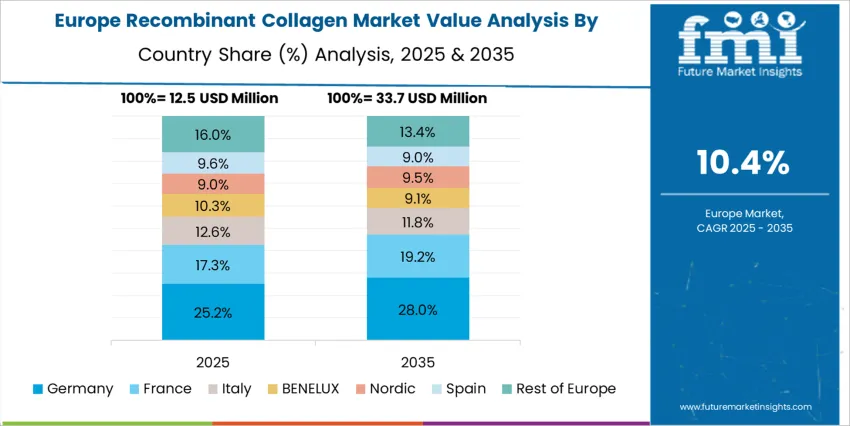

Germany is projected to see steady growth in the recombinant collagen market with a CAGR of 11.6%. The country’s robust skincare and medical industries are increasingly incorporating recombinant collagen due to its proven effectiveness and sustainable sourcing. As consumers in Germany continue to demand products that are both scientifically advanced and environmentally conscious, recombinant collagen is seen as a valuable alternative to traditional collagen sources. Known for its skin-rejuvenating and anti-aging properties, recombinant collagen is gaining popularity in both cosmetic and therapeutic products, including anti-wrinkle creams, skin fillers, and injectable treatments. Germany’s focus on high-quality, dermatologically tested skincare products ensures that recombinant collagen remains in demand for a variety of applications. As the market for natural and bioengineered ingredients grows, recombinant collagen is expected to play a larger role in Germany’s skincare and medical aesthetic industries.

In the USA, the demand for recombinant collagen is projected to grow at a CAGR of 10.4%. The USA skincare market is heavily driven by consumer interest in anti-aging and skin-rejuvenating products, which recombinant collagen supports by promoting collagen production and improving skin elasticity. Recombinant collagen is gaining popularity due to its ability to offer a sustainable and ethical alternative to animal-derived collagen. As American consumers increasingly seek products that combine high performance with sustainability, recombinant collagen fits perfectly into this demand for ethical beauty solutions. The rise of the clean beauty movement, growing awareness of skincare ingredients, and the popularity of non-invasive procedures, such as injectable collagen-based treatments, are all contributing factors to the growth of recombinant collagen in the USA As more consumers prioritize health-conscious beauty routines and advanced skincare treatments, recombinant collagen is expected to remain a key ingredient in the USA market.

Global demand for recombinant collagen has been growing as cosmetics, biomedical, and regenerative medicine sectors shift toward sustainable, safe, and high purity collagen sources. Recombinant collagen offers advantages over animal derived collagen because it can be generated via biotechnology without risks of animal derived contaminants or ethical concerns. Its properties such as biocompatibility, support for cell adhesion and tissue regeneration, and suitability for skin care and medical applications make it attractive for formulators and product developers. As interest in anti aging, skin repair, wound healing, and vegan or cruelty free beauty products rises globally, recombinant collagen finds increasing use in skincare, cosmetics, medical dressings, and aesthetic dermatology. Market reports note a rising adoption of recombinant collagen across cosmetics and medical segments.

Several global ingredient specialist firms lead supply of recombinant collagen. Among them your list includes firms such as BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant, and Seppic. These companies supply recombinant collagen in standardized, cosmetic or medical grade forms suitable for creams, serums, wound dressings, and other applications. Competition among these firms hinges on fermentation or cell culture technology, purity and biocompatibility of collagen, molecular structure accuracy, batch to batch consistency, and regulatory compliance. Some firms differentiate by offering high molecular weight or human type recombinant collagen, others by bundling collagen with other bio actives for multifunctional formulations. As demand grows for cruelty free, effective, and regulatory compliant collagen solutions in cosmetics and medical applications, suppliers that deliver consistent quality, scalability, and sustainable manufacturing have stronger competitive positioning.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America, Europe, Asia Pacific, The Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic |

| Additional Attributes | Dollar sales by end-use application and product form show strong demand for bifida ferment lysate, particularly in skin care and body care products. Liquid solutions and emulsions are the most popular product forms, with concentrate forms also growing in demand. Major companies like BASF, Evonik, and Ashland dominate the market, offering a range of active ingredients for the cosmetic and dermocosmetic industries. The market is expected to grow with rising demand for innovative skincare solutions and natural ingredients. |

The global recombinant collagen market is estimated to be valued at USD 55.9 million in 2025.

The market size for the recombinant collagen market is projected to reach USD 176.6 million by 2035.

The recombinant collagen market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in recombinant collagen market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 16.2% share in the recombinant collagen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Recombinant DNA Market Size and Share Forecast Outlook 2025 to 2035

Recombinant Human Serum Albumin Market Size and Share Forecast Outlook 2025 to 2035

Recombinant Human Oncostatin M Reagent Market Size and Share Forecast Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Collagen Casings Industry

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Market Share Insights for Collagen Peptide Providers

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

Collagen Casings Market Analysis - Product Type & End Use Trends

Recombinant Vaccines Market Analysis – Trends & Future Outlook 2018-2028

UK Collagen Peptide Market Analysis – Size, Share & Forecast 2025–2035

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA