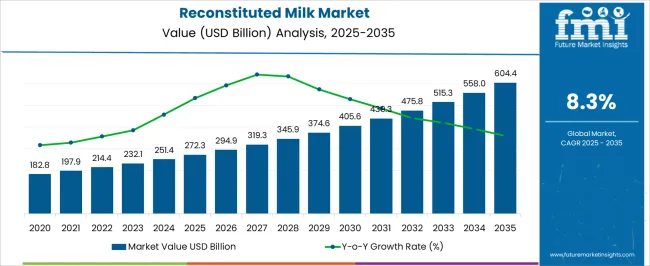

The reconstituted milk market is expected to expand from USD 272.3 billion in 2025 to USD 604.4 billion by 2035, reflecting a CAGR of 8.3%. During the early adoption phase (2020–2024), consumers and commercial buyers gradually embraced reconstituted milk due to its longer shelf life and ease of transportation. By 2025, growing acceptance in households, food service, and processed food industries will drive steady market expansion. This period marks the transition from limited niche adoption to broader market presence, as manufacturers increase production capacity and distribution reach, laying the groundwork for the scaling phase in the next decade.

From 2025 to 2030, the market enters a scaling phase, characterized by rapid uptake across retail and institutional segments. Market value rises from USD 272.3 billion in 2025 as increased consumption and widespread availability drive higher demand. By 2030, reconstituted milk becomes a standard ingredient in many food and beverage applications, setting the stage for consolidation. Between 2030 and 2035, the market reaches USD 604.4 billion, with steady CAGR-driven growth. Consolidation occurs as leading producers optimize supply chains and strengthen market presence, resulting in a mature and competitive market environment.

| Metric | Value |

|---|---|

| Reconstituted Milk Market Estimated Value in (2025 E) | USD 272.3 billion |

| Reconstituted Milk Market Forecast Value in (2035 F) | USD 604.4 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The reconstituted milk market forms a significant segment of the global dairy and dairy-based products market. In 2025, reconstituted milk accounts for approximately 22% of the overall dairy market, driven by its convenience, longer shelf life, and cost-effectiveness compared with fresh milk. The broader dairy market is projected to grow at a CAGR of around 4–5% during 2025–2035, supported by increasing demand from retail, processed foods, and institutional buyers.

Within processed dairy products, reconstituted milk holds an estimated 35% share in 2025, while the remainder is split among fluid milk, yogurt, cheese, and other products.

By 2030, the scaling of adoption is expected to increase the share of reconstituted milk in processed dairy to nearly 40%, reflecting its growing role in both commercial food production and household consumption. Between 2030 and 2035, market consolidation is likely to further stabilize its share, with leading players optimizing production efficiency and distribution networks. By 2035, reconstituted milk is projected to account for roughly 23–24% of the global dairy market and over 45% of processed dairy products, solidifying its position as a critical revenue driver within the parent market.

The reconstituted milk market is witnessing steady expansion, supported by increasing adoption in both household consumption and industrial food processing. Demand growth is being driven by its cost-effectiveness, extended shelf life, and adaptability across various culinary and manufacturing applications. The market is benefiting from rising penetration in regions with limited fresh milk availability, where it serves as a consistent and safe dairy source.

Additionally, advances in processing technology have enhanced the nutritional and sensory profile of reconstituted milk, improving consumer acceptance. The current scenario reflects strong uptake in the foodservice sector, infant nutrition products, and packaged beverages, with lactose-free and fortified variants further broadening appeal.

Competitive dynamics are shaped by producers' ability to innovate in formulations, improve solubility, and offer convenient packaging formats. Sustained urbanization, expanding retail distribution, and greater consumer awareness of nutritional benefits are expected to underpin stable market growth across diverse end-use segments.

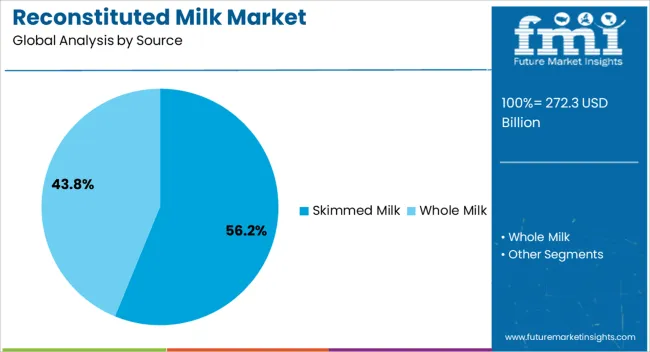

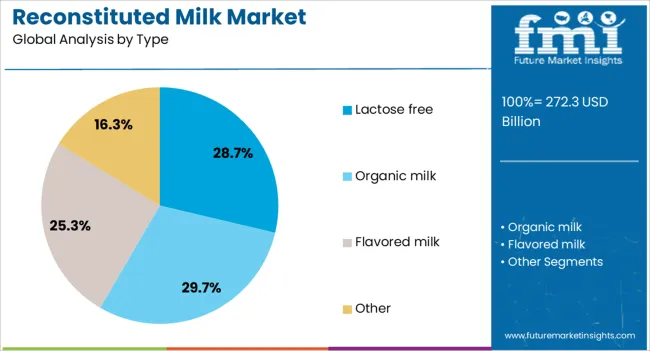

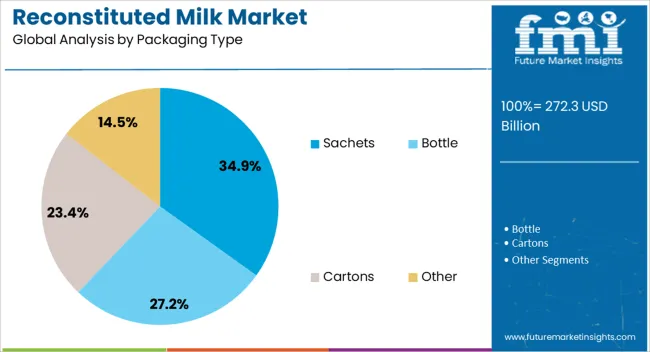

The reconstituted milk market is segmented by source, type, packaging type, application, distribution channel, and geographic regions. By source, reconstituted milk market is divided into Skimmed Milk and Whole Milk. In terms of type, the reconstituted milk market is classified into Lactose-free, Organic milk, Flavored milk, and Other. Based on packaging type, reconstituted milk market is segmented into Sachets, Bottle, Cartons, and Other.

By application, reconstituted milk market is segmented into Dairy Products Manufacturing, Food & Beverage, Dietary & Nutritional Supplements, Cosmetics & Personal Care, Infant Formula, and Other. By distribution channel, reconstituted milk market is segmented into B2B, B2C, Online sales, Supermarkets / Hypermarkets, Wholesale stores, and Other. Regionally, the reconstituted milk industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The skimmed milk segment accounts for approximately 56.2% of the source category, making it the leading contributor in the reconstituted milk market. This dominance is primarily due to its favorable nutritional profile, offering high protein content with reduced fat, which aligns with health-conscious consumer preferences. Skimmed milk powder is widely utilized in both retail and industrial formats, with significant demand from bakery, confectionery, and ready-to-drink beverage manufacturers.

Its lower fat content extends shelf stability and enhances blending properties, making it suitable for large-scale production and fortified formulations. The segment’s strong presence in markets with growing lifestyle-related health concerns further supports its leading position.

Additionally, the affordability and logistical advantages of skimmed milk powder in transportation and storage reinforce its widespread use. With ongoing innovation in instant and enriched variants, the skimmed milk segment is projected to maintain its market leadership over the forecast period.

The lactose-free segment holds a significant share of approximately 28.7% in the type category, reflecting the growing prevalence of lactose intolerance and rising consumer preference for easily digestible dairy products. This segment has been strengthened by advancements in enzymatic processing that improve taste and texture without compromising nutritional value. Increased awareness of digestive health, coupled with expanding availability in both developed and emerging markets, has further driven uptake.

In addition to health-related demand, lactose-free reconstituted milk appeals to a broader consumer base seeking functional and premium dairy options. Its application in ready-to-drink beverages, infant nutrition, and specialized dietary products continues to expand.

Strategic product launches and targeted marketing have enhanced visibility, while retail penetration has increased through supermarkets, convenience stores, and e-commerce channels. With sustained investment in product diversification and affordability, the lactose-free segment is expected to continue capturing an expanding share of the reconstituted milk market.

The sachets segment leads the packaging type category with a share of approximately 34.9%, driven by its cost efficiency, portability, and suitability for single-use consumption. Sachets offer significant advantages in markets with limited refrigeration infrastructure, enabling safe and convenient distribution of reconstituted milk products. Their compact format supports affordability and accessibility, particularly in emerging economies where smaller pack sizes are preferred.

For producers, sachets facilitate efficient transportation, lower packaging costs, and extended shelf life for powdered or concentrated milk products. The segment’s growth is further supported by its alignment with on-the-go consumption trends and retail penetration in rural and urban markets alike.

Additionally, sachets serve as an effective promotional packaging format, allowing brands to reach new consumers through sampling and trial offers. With sustainability considerations driving innovations in eco-friendly packaging materials, the sachets segment is expected to retain its leadership position while adapting to evolving environmental and consumer demands.

The reconstituted milk market is growing due to rising demand for dairy products with longer shelf life, convenience, and consistent quality. North America and Europe lead adoption in processed foods, beverages, and institutional catering, while Asia-Pacific shows rapid growth driven by expanding dairy consumption and population growth. Manufacturers differentiate through nutritional fortification, powder solubility, and hygiene standards. Regional differences in dairy infrastructure, consumer preferences, and regulatory requirements strongly influence product formulation, adoption, and competitive positioning in the global reconstituted milk market.

Rising demand for processed and packaged dairy products drives reconstituted milk adoption. North America and Europe prioritize convenience-oriented solutions in bakeries, beverages, and institutional catering, where milk powder is reconstituted for immediate use. Asia-Pacific markets show rapid growth due to increasing urbanization, rising household consumption, and expanding foodservice sectors. Differences in consumer preferences, cold chain infrastructure, and cost sensitivity influence product type, fortification levels, and packaging format. Leading suppliers provide high-quality, shelf-stable milk powders with optimized solubility and nutritional profiles, while regional manufacturers focus on affordable, locally adapted solutions. The contrast between convenience-driven Western markets and emerging regions’ cost-sensitive adoption shapes growth, product development, and competitive positioning globally.

Health-conscious consumers drive demand for nutritionally enhanced reconstituted milk. North America and Europe emphasize fortified milk with added vitamins, minerals, and protein to support wellness and specific dietary requirements. Asia-Pacific markets focus on fortified milk to address nutritional gaps in children and populations with higher protein demand. Differences in regulatory standards, labeling requirements, and dietary awareness influence formulation, fortification techniques, and marketing strategies. Leading suppliers invest in advanced drying, blending, and fortification technologies to ensure nutrient retention and solubility. Regional producers focus on cost-effective fortification while maintaining basic nutritional value. Nutritional trends contrasts drive product differentiation, adoption, and competitiveness in the global reconstituted milk market.

Reconstituted milk adoption is influenced by supply chain efficiency and storage considerations. North America and Europe benefit from robust cold chain and transportation infrastructure, enabling large-scale reconstitution and distribution in foodservice and industrial sectors. Asia-Pacific markets adopt powdered milk reconstitution to overcome storage limitations, reduce spoilage, and manage seasonal milk supply. Differences in storage capabilities, transport networks, and industrial processing facilities impact product format, packaging design, and batch consistency. Leading suppliers provide high-solubility, easy-to-reconstitute milk powders with extended shelf life, while regional producers focus on affordable, small-package solutions for local distribution. Supply chain and storage contrasts shape adoption, operational efficiency, and competitiveness globally.

Strict regulatory standards and quality assurance protocols drive reconstituted milk market adoption. North America and Europe enforce hygiene, labeling, and fortification regulations, requiring suppliers to comply with ISO, FDA, and EU food safety standards. Asia-Pacific markets vary; developed regions follow international norms, while emerging markets adopt local food safety standards with flexibility on fortification levels. Differences in compliance requirements, testing, and certification influence production practices, traceability, and product consistency. Leading suppliers offer fully certified, high-quality powders, while regional manufacturers focus on affordable compliance solutions. Regulatory contrasts shape adoption, trust in product quality, and competitive positioning across the global reconstituted milk market.

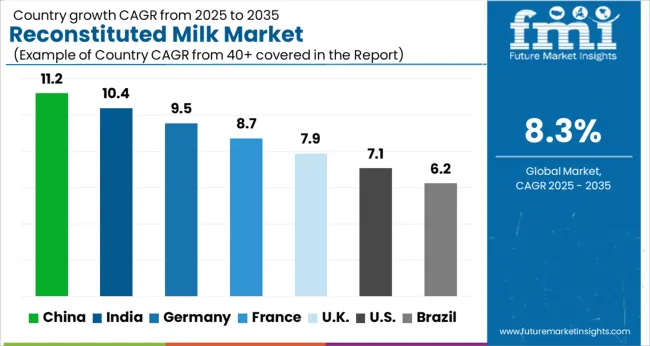

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global reconstituted milk market is projected to grow at an 8.3% CAGR through 2035, driven by demand in food processing, retail, and dairy-based products. Among BRICS nations, China led with 11.2% growth as large-scale production and distribution networks were expanded to meet rising consumer and industrial requirements, while India at 10.4% increased manufacturing and supply chain capacities for both domestic and export markets. In the OECD region, Germany at 9.5% maintained steady production under strict food safety and quality standards, while the United Kingdom at 7.9% implemented moderate-scale distribution to support commercial and household consumption. The USA, growing at 7.1%, supported consistent adoption in retail, food service, and processing applications, complying with federal and state-level dairy regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The reconstituted milk market in China is growing at an 11.2% CAGR, driven by rising demand for affordable and nutritious dairy products. Urban households, particularly young families, are increasingly seeking convenient milk options that maintain quality and safety standards. Local manufacturers are expanding production capacities and introducing fortified variants to meet nutritional needs. E-commerce platforms and modern retail stores are enhancing accessibility, allowing consumers in both urban and semi-urban areas to purchase reconstituted milk easily. Health-conscious buyers are showing interest in low-fat and fortified versions, reflecting a broader trend toward functional foods. Dairy companies are also promoting packaged powdered milk for household use and institutional supply, making it a staple in both domestic and commercial settings. Marketing campaigns emphasize the nutritional equivalence of reconstituted milk to fresh milk, reassuring consumers of its quality and versatility.

Reconstituted milk market in India is registering a 10.4% CAGR due to increasing demand for convenient, long shelf-life dairy products. Urbanization and growing disposable income have contributed to higher household consumption. Manufacturers are introducing fortified and flavored versions to appeal to children and health-conscious adults. Modern retail chains and online platforms are expanding availability, making reconstituted milk accessible even in tier-two and tier-three cities. Institutional consumption in schools, hotels, and restaurants is rising, supporting market growth. Public awareness campaigns emphasize hygiene and nutritional benefits of reconstituted milk. Brands are focusing on value-for-money options while maintaining safety and quality standards, addressing price-sensitive consumers. Subscription-based delivery models are also gaining traction in metropolitan areas, ensuring timely supply of reconstituted milk to households.

Reconstituted milk market in Germany is growing at a 9.5% CAGR, driven by convenience, long shelf life, and nutritional quality. Consumers are increasingly seeking products that fit busy lifestyles without compromising dietary standards. Packaged powdered milk is commonly used in households and foodservice settings. Manufacturers are developing fortified and organic variants to cater to health-conscious buyers. Retail chains and online stores are enhancing distribution and providing home delivery options. Seasonal demand rises during school periods and holidays when families require consistent milk supply. Regulatory standards ensure product safety, boosting consumer confidence. Environmental concerns are encouraging manufacturers to adopt eco-friendly packaging and sustainable production methods. The market is characterized by steady urban and rural adoption, reflecting Germany’s mature dairy consumption culture.

The United Kingdom reconstituted milk market is expanding at a 7.9% CAGR, supported by increasing demand for convenient and shelf-stable dairy products. Households with busy lifestyles are adopting powdered milk for daily consumption, cooking, and baking purposes. Manufacturers are offering fortified, flavored, and lactose-free options to appeal to diverse dietary needs. Supermarkets, convenience stores, and online platforms provide wide access to reconstituted milk products. Public awareness campaigns highlight the nutritional equivalence of powdered milk to fresh milk. Institutional buyers such as schools, hotels, and restaurants continue to drive demand. There is a trend toward environmentally responsible packaging and reduced waste, aligning with sustainability goals. Brand differentiation is increasingly based on nutritional value, quality assurance, and product convenience.

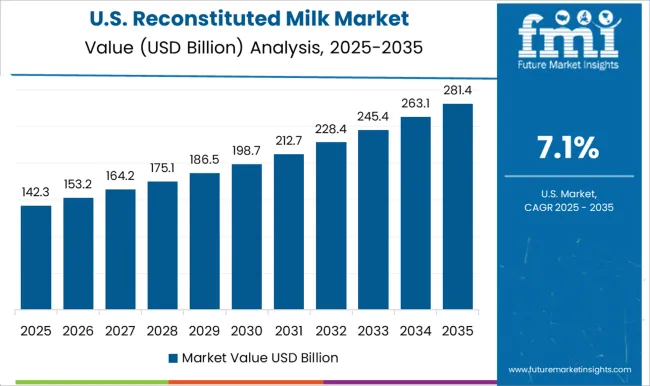

The United States reconstituted milk market is growing at a 7.1% CAGR, reflecting steady demand for shelf-stable, affordable dairy products. Urban and suburban households are using powdered milk for cooking, baking, and daily consumption. Manufacturers are introducing fortified and flavored versions to attract children and health-conscious adults. Online and offline retail networks provide widespread access, ensuring convenience and consistent supply. Schools, restaurants, and institutional buyers represent a significant portion of demand. Marketing strategies focus on nutritional quality and ease of storage. Sustainability initiatives, such as eco-friendly packaging, are becoming increasingly important to consumers. Seasonal spikes occur during school terms and holiday periods. Overall, the market growth is supported by convenience, affordability, and product versatility across diverse consumer segments.

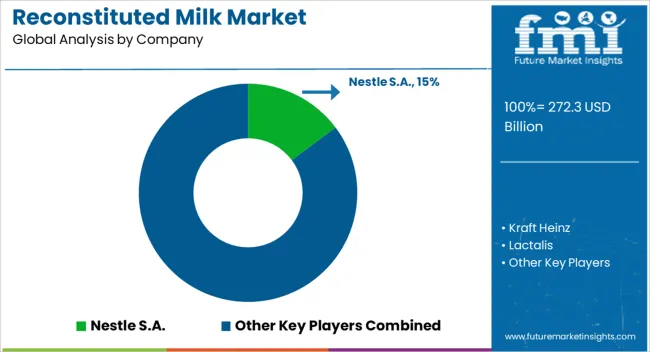

The reconstituted milk market is dominated by major global suppliers such as Nestle S.A., Kraft Heinz, Lactalis, Fonterra, Dairy Farmers of America, Arla Foods, Yili Group, Saputo, Pine Hill Dairy, DMK Group, Schreiber Foods, Mengniu Dairy, Meiji Holdings, Sodiaal, and China Modern Dairy. These companies provide high-quality milk products that are manufactured by reconstituting milk powders with water, catering to both retail and industrial demands. The growing global population, increasing preference for processed and convenient dairy products, and rising awareness about nutritional benefits are key drivers supporting market growth.

Leading suppliers are focusing on advanced processing technologies and strict quality controls to ensure safety, taste, and shelf stability. Sustainability and innovation are pivotal priorities for the top players in the reconstituted milk market. Companies like Nestle S.A., Fonterra, and Arla Foods are investing in sustainable sourcing of milk, eco-friendly packaging, and energy-efficient manufacturing processes. Simultaneously, suppliers such as Lactalis and Yili Group are developing fortified and functional milk variants enriched with vitamins, minerals, and probiotics to cater to the growing demand for health-oriented dairy products. Product diversification, including flavored and lactose-free reconstituted milk, is being emphasized to attract a broader consumer base and meet regional dietary preferences. Suppliers including Kraft Heinz, Saputo, and Mengniu Dairy are expanding their production capabilities through strategic partnerships, acquisitions, and regional expansions. By ensuring consistent product quality, compliance with international safety regulations, and investment in cold chain logistics, these companies are enhancing their market reach and reliability. The emphasis on nutritional value, convenience, and accessibility continues to strengthen the global presence of these leading suppliers. With continuous advancements in processing technology and growing consumer awareness, the reconstituted milk market is expected to witness sustained growth, driven by both urban and rural demand across emerging and developed regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 272.3 Billion |

| Source | Skimmed Milk and Whole Milk |

| Type | Lactose free, Organic milk, Flavored milk, and Other |

| Packaging Type | Sachets, Bottle, Cartons, and Other |

| Application | Dairy Products Manufacturing, Food & Beverage, Dietary & Nutritional Supplements, Cosmetics & Personal Care, Infant Formula, and Other |

| Distribution Channel | B2B, B2C, Online sales, Supermarkets / Hypermarkets, Wholesale stores, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestle S.A., Kraft Heinz, Lactalis, Fonterra, Dairy Farmers of America, Arla Foods, Yili Group, Saputo, Pine Hill Dairy, DMK Group, Schreiber Foods, Mengniu Dairy, Meiji Holdings, Sodiaal, and China Modern Dairy |

| Additional Attributes | Dollar sales vary by type, including single-pole, double-pole, and triple-pole MCBs; by application, such as residential, commercial, and industrial electrical distribution; by end-use, spanning utilities, construction, and manufacturing sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising electricity demand, safety regulations, and modernization of power distribution networks. |

The global reconstituted milk market is estimated to be valued at USD 272.3 billion in 2025.

The market size for the reconstituted milk market is projected to reach USD 604.4 billion by 2035.

The reconstituted milk market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in reconstituted milk market are skimmed milk and whole milk.

In terms of type, lactose free segment to command 28.7% share in the reconstituted milk market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reconstituted Juice Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Wood Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Meat Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA