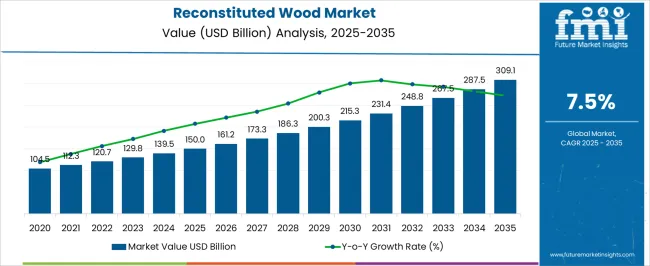

The reconstituted wood market is estimated to be valued at USD 150.0 billion in 2025 and is projected to reach USD 309.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

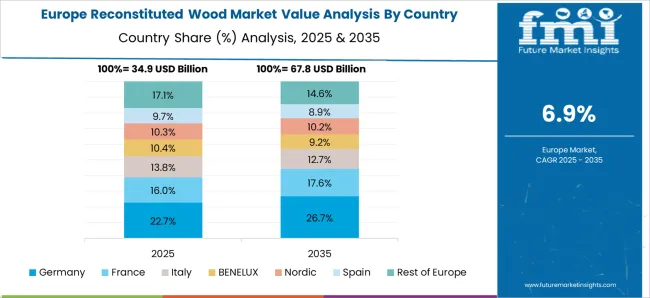

The data trend indicates consistent expansion, with values nearly doubling in the forecast period, though the drivers and pace vary significantly across Asia-Pacific, Europe, and North America. In Asia-Pacific, demand is advancing rapidly due to accelerated construction activities, rising demand for affordable housing, and expanding furniture manufacturing hubs. The region is projected to dominate the growth curve, supported by manufacturing scale and cost efficiencies. In Europe, the adoption of reconstituted wood is influenced by stricter environmental directives and the push for circular material use. While growth remains steady, it is more compliance-driven, positioning Europe in a mature phase with limited incremental volume gains compared to Asia-Pacific.

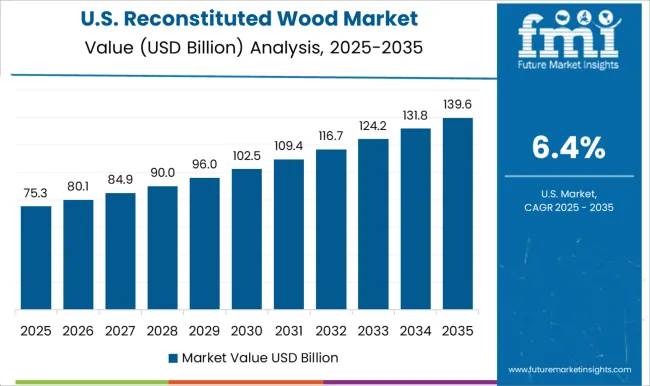

North America represents a balanced case where innovation in engineered panels, adoption in modular housing, and remodeling projects drive demand. The compared with Asia-Pacific, the region grows at a slower pace and aligns closer to European trends. The Asia-Pacific is expected to lead volume expansion, while Europe and North America contribute through quality upgrades, sustainability integration, and higher-value applications.

| Metric | Value |

|---|---|

| Reconstituted Wood Market Estimated Value in (2025 E) | USD 150.0 billion |

| Reconstituted Wood Market Forecast Value in (2035 F) | USD 309.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The reconstituted wood market has been gaining consistent traction across multiple industrial applications. It accounts for around 14.6% of the engineered wood products sector, where particleboard, fiberboard, and laminated composites dominate demand. Within the wider wood products market, a 7.8% share is estimated, underpinned by its cost efficiency and structural performance. In construction materials, the market contributes 3.5% as it supports sustainable housing and commercial building activities. Furniture manufacturing captures a 5.2% share, reflecting its use in cabinetry and paneling, while interior design and decorative materials stand at 4.1% due to growing demand for aesthetic finishes.

Recent industry trends in the reconstituted wood market have been influenced by technological advancements and changing design preferences. Ground breaking developments include the introduction of high density fiberboards with superior moisture resistance, as well as fire retardant and low emission boards. Industry leaders have focused on enhancing surface finishes with digital printing technologies to replicate natural wood aesthetics. Strategies have included partnerships with construction companies to promote prefabricated housing solutions, and investments in circular economy initiatives using recycled wood fibers. Automated manufacturing lines and resin innovations have further shaped competitiveness, reinforcing the role of reconstituted wood as a modern alternative to solid timber.

The market is experiencing consistent growth due to the rising demand for cost-effective, sustainable, and versatile wood-based materials in construction, furniture manufacturing, and interior applications. Technological advancements in processing techniques have enabled the production of high-performance reconstituted wood products with improved durability, moisture resistance, and aesthetic appeal. Increasing environmental concerns and regulatory measures aimed at reducing deforestation have further driven adoption, as these materials utilize recycled wood fibers and agricultural residues.

The market is also benefiting from urbanization trends, with infrastructure development and housing projects fueling large-scale consumption. Manufacturers are focusing on enhancing product quality through innovations in adhesives and surface treatments to meet evolving consumer and industry standards.

As supply chain efficiencies improve and production costs are optimized, the availability of competitively priced products is expanding With the growing emphasis on eco-friendly building materials and the integration of reconstituted wood into premium applications, the market is positioned for strong future growth.

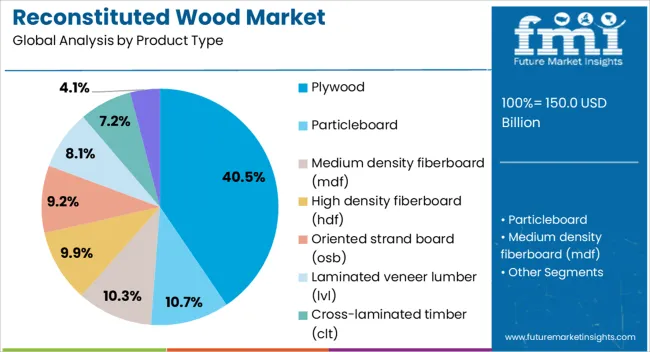

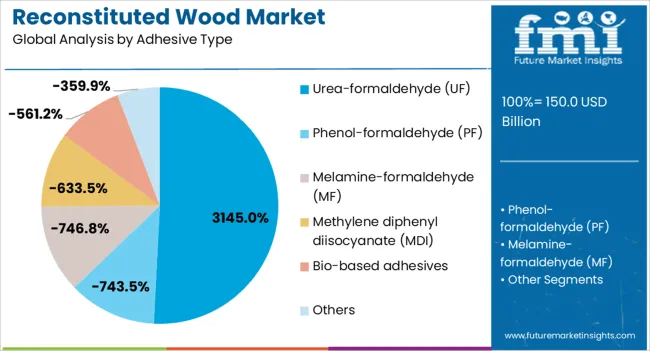

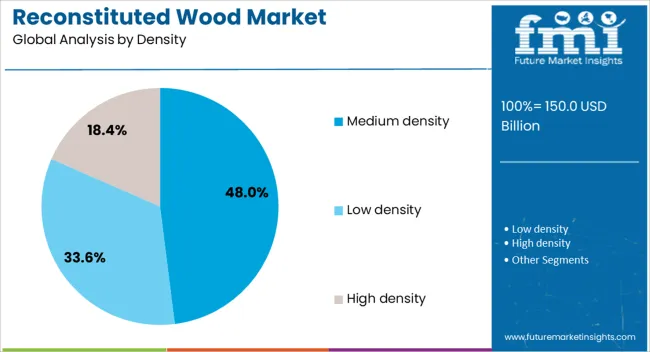

The reconstituted wood market is segmented by product type, adhesive type, density, surface treatment, end use, distribution channel, and geographic regions. By product type, reconstituted wood market is divided into plywood, particleboard, medium density fiberboard (mdf), high density fiberboard (hdf), oriented strand board (osb), laminated veneer lumber (lvl), cross-laminated timber (clt), and other reconstituted wood products. In terms of adhesive type, reconstituted wood market is classified into urea-formaldehyde (UF), phenol-formaldehyde (PF), melamine-formaldehyde (MF), methylene diphenyl diisocyanate (MDI), bio-based adhesives, and others. Based on density, reconstituted wood market is segmented into medium density, low density, and high density. By surface treatment, reconstituted wood market is segmented into laminated / melamine-faced, raw/unfinished, veneered, coated, and others. By end use, reconstituted wood market is segmented into furniture, construction, furniture manufacturing, flooring, packaging, transportation, and others. By distribution channel, reconstituted wood market is segmented into distributors / wholesalers, direct sales, retail stores, e-commerce, and others. Regionally, the reconstituted wood industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plywood segment is projected to hold 40.50% of the reconstituted wood market revenue share in 2025, making it the leading product type. This leadership is attributed to its superior strength, structural stability, and versatility in multiple applications including construction, cabinetry, and furniture. Plywood’s layered structure offers high resistance to warping, cracking, and shrinkage, making it a preferred choice in environments requiring durability and reliability. The segment’s growth has been further supported by its compatibility with advanced adhesive technologies, which enhance bonding strength and moisture resistance. The ability to produce plywood in various grades and finishes has expanded its adoption in both commercial and residential projects. Additionally, its sustainable manufacturing process, which maximizes the utilization of raw wood material, aligns with global environmental priorities Consistent demand from infrastructure projects and interior design applications continues to reinforce plywood’s dominant position in the overall market.

The urea formaldehyde adhesive type segment is expected to account for 31.45% of the market revenue share in 2025, making it a leading adhesive choice. Its dominance is driven by high bonding strength, rapid curing properties, and cost-effectiveness in large-scale wood panel production. Urea formaldehyde adhesives are widely used in manufacturing particleboards, plywood, and medium-density fiberboards due to their ability to deliver strong, durable joints. The segment’s growth has been supported by advancements in resin formulations that improve water resistance and reduce formaldehyde emissions, meeting stringent environmental regulations. Manufacturers value its fast-setting nature, which enables efficient production cycles and lower energy consumption. Additionally, its availability at competitive prices and established supply networks have ensured consistent demand across global markets As the construction and furniture industries expand, the application of urea formaldehyde adhesives in reconstituted wood production is expected to maintain a steady growth trajectory.

The medium density segment is anticipated to hold 48% of the market revenue share in 2025, making it the leading density category. This preference is largely due to its balance between strength, weight, and cost, which makes it suitable for a wide range of uses including furniture, flooring, and decorative panels. Medium density boards provide excellent machining properties, enabling precise shaping and finishing for customized applications. The segment has been supported by consistent demand from residential and commercial construction projects that require durable yet affordable materials. Medium density products also offer improved dimensional stability and smooth surfaces for lamination and veneering, enhancing aesthetic value. Technological improvements in manufacturing have enabled better consistency in density and quality, making these products highly reliable As industries prioritize cost efficiency without compromising performance, the medium density category is expected to retain its leading share in the market.

The market has evolved as a critical segment within engineered wood products, offering alternatives to solid timber through processes that rebind wood fibers, particles, or veneers using adhesives, heat, and pressure. Products such as particleboard, medium density fiberboard, oriented strand board, and laminated veneer lumber are widely adopted in furniture, flooring, cabinetry, and construction. Growth in this sector has been influenced by the efficiency of raw material utilization, cost advantages over solid wood, and adaptability to design requirements in residential and commercial projects.

Reconstituted wood products have been adopted because they maximize the use of wood residues, sawdust, and lower grade timber that would otherwise remain underutilized. By converting these resources into high performance panels, the industry has promoted efficient material utilization. Manufacturers have developed processes that ensure consistency in density and strength, allowing these boards to replace solid wood in many applications. The ability to customize thickness, finish, and dimensions has further improved flexibility for designers and builders. This efficiency in material use has positioned reconstituted wood as a sustainable and economical option compared to natural timber alternatives.

The construction industry has remained one of the largest end users of reconstituted wood due to its application in flooring, wall paneling, roofing, and structural components. The demand for cost effective and standardized building materials has been met by particleboard, MDF, and OSB, which provide uniform strength and easier installation. The rising need for prefabricated housing and modular construction has encouraged greater use of engineered wood panels. Their compatibility with laminates, veneers, and surface coatings has added aesthetic flexibility, making them suitable for both structural and decorative purposes. The construction sector’s reliance on consistent, durable, and scalable products has reinforced demand growth.

Furniture manufacturers have increasingly depended on reconstituted wood to balance durability and cost efficiency. Flat pack furniture, ready to assemble units, and customized modular furniture lines rely heavily on particleboard and MDF due to their machinability and surface compatibility with veneers or laminates. The uniform structure of reconstituted wood allows precise cutting, drilling, and shaping without the imperfections often present in natural timber. Global furniture retailers have supported widespread adoption by standardizing reconstituted wood in mass produced furniture. This integration has significantly expanded market penetration, particularly in residential and office furniture applications.

Technological developments in resins, adhesives, and surface finishes have elevated the performance of reconstituted wood products. Low formaldehyde and ecofriendly adhesive systems have reduced emissions, addressing safety and environmental concerns. Advances in coatings and laminates have improved moisture resistance, scratch resistance, and overall durability, expanding the use of reconstituted wood in kitchens, bathrooms, and flooring. Fire resistant and water resistant grades have also been introduced to meet stringent building codes. These innovations have allowed manufacturers to expand into higher value applications while addressing regulatory and consumer expectations for safety and longevity.

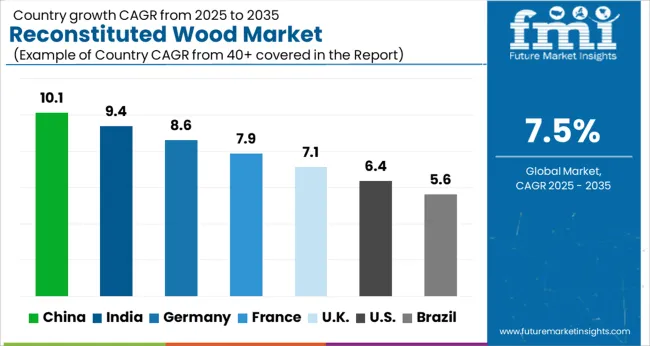

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

China recorded the strongest expansion in the market with a forecast growth rate of 10.1%, driven by large scale construction activities and demand for engineered panels. India followed with 9.4%, supported by rapid adoption in residential and commercial projects and a growing furniture manufacturing base. Germany secured 8.6%, where emphasis on engineered wood products and sustainable building practices ensured consistent growth. The United Kingdom registered 7.1%, benefiting from increased utilization of wood based composites in modular housing and interior applications. The United States stood at 6.4%, where steady demand in renovation and repair projects influenced market activity. Collectively, these countries illustrate the influence of construction trends, material innovation, and manufacturing strength in shaping the global market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 10.1% in the market, supported by increasing reliance on engineered wood panels for construction and furniture manufacturing. The shift from traditional solid wood to cost-effective reconstituted wood is evident across residential and commercial projects. Rising demand for sustainable and durable materials is reinforcing the adoption of particleboard, MDF, and oriented strand boards. Domestic manufacturers are scaling up production capacities while global players are strengthening their distribution networks. Innovation in finishes and surface treatments is further enhancing consumer appeal. With a strong real estate sector and rapid industrial applications, China is positioned as a leading contributor to global demand for reconstituted wood.

India is witnessing a CAGR of 9.4% in the market, driven by rising demand from the construction and modular furniture sectors. Rapid adoption of engineered panels is evident in urban centers where affordability and durability are prioritized. Medium-density fiberboards and particleboards are gaining acceptance as substitutes for natural wood due to their uniform texture and cost advantages. Local manufacturers are responding by improving product availability and introducing value-added surface finishes. Growing acceptance in offices, retail spaces, and residential interiors is broadening market potential. The preference for lightweight, easy-to-install, and moisture-resistant reconstituted wood panels is expected to accelerate further, positioning India as a high-growth market in the Asia-Pacific region.

Germany is advancing at a CAGR of 8.6% in the market, supported by strong demand for engineered wood in sustainable construction practices. German consumers and industries emphasize high-quality, eco-friendly materials, making reconstituted wood panels a preferred option. The furniture industry is a significant end-user, particularly for particleboard and fiberboard, which are increasingly used in cabinetry and modular systems. Producers are innovating with low-emission adhesives and enhanced durability features, aligning with stringent environmental standards. The construction sector is also adopting these products for structural and non-structural applications. With a mature but environmentally conscious market, Germany continues to lead in innovation and quality standards within the reconstituted wood segment.

The United Kingdom is projected to grow at a CAGR of 7.1% in the market, driven by increased use in residential and commercial developments. Demand is rising for versatile and affordable materials that support modern interior design trends. Engineered wood panels, especially MDF and particleboard, are being increasingly adopted for cabinetry, flooring, and decorative applications. The UK furniture industry is leveraging these materials for modular designs and cost-efficient production. Imports are supplementing domestic supply, with an emphasis on value-added finishes. With growing focus on efficiency and affordability, reconstituted wood products are expected to play a larger role in the UK’s evolving furniture and construction sectors.

The United States is registering a CAGR of 6.4% in the market, influenced by increasing demand from construction, furniture, and remodeling activities. Engineered panels are replacing solid wood in many applications due to cost efficiency and resource optimization. MDF, particleboard, and OSB are particularly prominent in residential construction and cabinetry. Rising demand for sustainable materials is supporting innovation in recycled wood composites and eco-friendly adhesives. Large-scale manufacturers are focusing on technological improvements to enhance strength, moisture resistance, and finish quality. The remodeling sector and rising interest in affordable yet durable furnishings are ensuring steady growth for reconstituted wood in the US market.

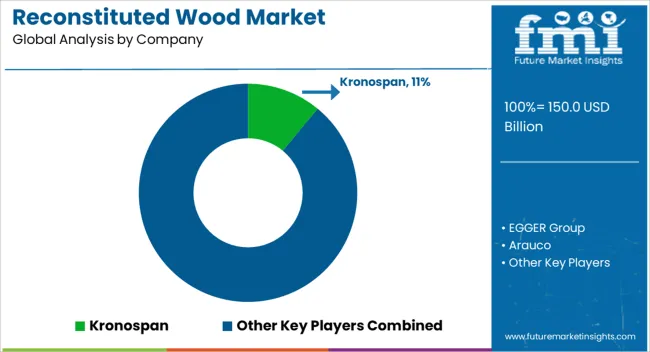

The market is shaped by the presence of major panel manufacturers and timber corporations that operate globally with extensive supply chains. Kronospan is among the most prominent players, known for its large-scale production of particleboard, MDF, and other engineered wood products that are widely used in furniture, flooring, and construction. EGGER Group plays a crucial role through its integrated operations, offering decorative wood-based panels that cater to interior design, joinery, and building applications while maintaining a strong footprint across Europe and beyond. Arauco, with its South American origins, has evolved into a multinational supplier, combining forestry operations with advanced panel manufacturing to deliver MDF, particleboard, and plywood for diverse industrial uses.

North American producers such as West Fraser and Weyerhaeuser influence the market significantly through their broad product portfolios and vertical integration from timber harvesting to engineered panel production. West Fraser emphasizes high-capacity operations in particleboard and MDF, while Weyerhaeuser leverages its extensive forest holdings and focus on sustainable forestry to supply engineered wood products at scale. Boise Cascade complements these leaders with its strong presence in building materials distribution, alongside engineered wood products that support residential and commercial construction markets. Collectively, these companies drive advancements in production efficiency, durability, and surface innovation, ensuring reconstituted wood products remain competitive against alternative building and decorative materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 150.0 billion |

| Product Type | Plywood, Particleboard, Medium density fiberboard (mdf), High density fiberboard (hdf), Oriented strand board (osb), Laminated veneer lumber (lvl), Cross-laminated timber (clt), and Other reconstituted wood products |

| Adhesive Type | Urea-formaldehyde (UF), Phenol-formaldehyde (PF), Melamine-formaldehyde (MF), Methylene diphenyl diisocyanate (MDI), Bio-based adhesives, and Others |

| Density | Medium density, Low density, and High density |

| Surface Treatment | Laminated / melamine-faced, Raw/unfinished, Veneered, Coated, and Others |

| End Use | Furniture, Construction, Furniture manufacturing, Flooring, Packaging, Transportation, and Others |

| Distribution Channel | Distributors / Wholesalers, Direct sales, Retail stores, E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kronospan, EGGER Group, Arauco, West Fraser, Weyerhaeuser, and Boise Cascade |

| Additional Attributes | Dollar sales by wood type and application, demand dynamics across construction, furniture, and interior design sectors, regional trends in engineered wood adoption, innovation in durability, aesthetics, and lightweight properties, environmental impact of wood sourcing and recycling, and emerging use cases in sustainable architecture and modular construction. |

The global reconstituted wood market is estimated to be valued at USD 150.0 billion in 2025.

The market size for the reconstituted wood market is projected to reach USD 309.1 billion by 2035.

The reconstituted wood market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in reconstituted wood market are plywood, particleboard, medium density fiberboard (mdf), high density fiberboard (hdf), oriented strand board (osb), laminated veneer lumber (lvl), cross-laminated timber (clt) and other reconstituted wood products.

In terms of adhesive type, urea-formaldehyde (uf) segment to command 3145.0% share in the reconstituted wood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reconstituted Milk Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Juice Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Meat Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA