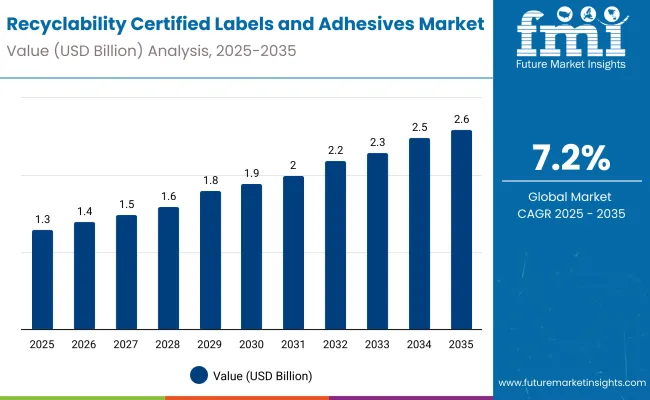

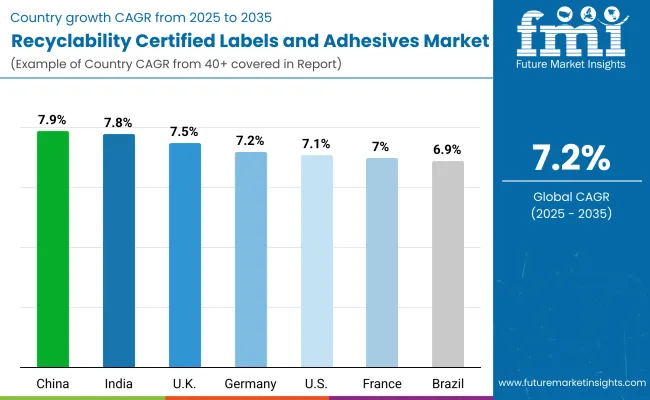

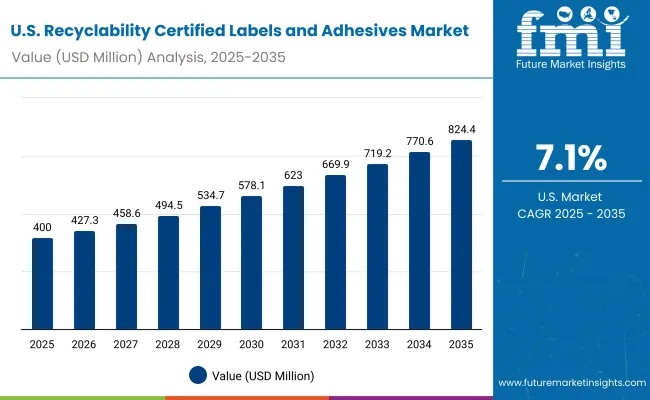

The recyclability certified labels and adhesives market is expected to grow from USD 1.3 billion in 2025 to USD 2.6 billion by 2035, resulting in a total increase of USD 1.3 billion over the forecast decade. This represents a 100.0% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.2%. Over ten years, the market grows by a 2.0 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 7.2% |

In the first five years (2025-2030), the market progresses from USD 1.3 billion to USD 1.8 billion, contributing USD 0.5 billion, or 38.5% of total decade growth. This phase is shaped by early adoption in food, beverage, and logistics sectors, where compliance with recycling standards is prioritized. Demand is reinforced by increasing use of paper-based and bio-based adhesives.

In the second half (2030-2035), the market grows from USD 1.8 billion to USD 2.6 billion, adding USD 0.8 billion, or 61.5% of the total growth. This acceleration is supported by advancements in water-based adhesives, compostable labels, and certification programs promoting circular economy goals. Expansion across e-commerce and personal care industries further strengthens demand, making recyclable labeling integral to sustainable packaging practices.

From 2020 to 2024, the recyclability certified labels and adhesives market expanded from USD 1.0 billion to USD 1.2 billion, supported by stricter recycling mandates and brand commitments to circular packaging. Nearly 70% of revenues came from major label and adhesive suppliers offering solutions compatible with PET, PE, and paper recycling streams. Leaders such as Avery Dennison, UPM Raflatac, and HERMA emphasized wash-off adhesives, compostable substrates, and certification compliance. Differentiation centered on recyclability performance, print durability, and material compatibility, while smart labeling features remained secondary. Service-driven offerings such as recyclability audits contributed less than 15% of revenue, with manufacturers favoring direct adoption of certified label solutions.

By 2035, the recyclability certified labels and adhesives market will reach USD 2.6 billion, growing at a CAGR of 7.20%, with sustainable label-adhesive systems representing more than 40% of value. Competitive intensity will rise as providers launch bio-based adhesives, solvent-free coatings, and IoT-enabled recyclability tracking. Established players are pivoting to hybrid models that combine physical label solutions with compliance-driven verification platforms. Emerging firms such as CCL Industries, Sappi, and Mondi are gaining traction with recyclable formats, modular label designs, and advanced adhesive technologies, aligning with global sustainability mandates and brand-owner requirements for packaging circularity.

The rising demand for sustainable packaging solutions is driving growth in the recyclability certified labels and adhesives market. These products ensure that packaging materials remain fully recyclable without contamination, supporting circular economy initiatives. Increasing regulatory pressures and brand commitments to eco-friendly practices are accelerating adoption across food, beverage, healthcare, and logistics sectors.

Labels and adhesives developed with water-based, compostable, and bio-based formulations are gaining popularity for their compatibility with recycling streams. Pressure-sensitive, shrink sleeve, and in-mold formats enhance versatility across applications. Their role in improving brand transparency, reducing environmental impact, and aligning with global sustainability standards is further reinforcing strong market expansion.

The market is segmented by material type, adhesive type, label format, end-use industry, and region. Material type includes paper-based labels, polyethylene (PE) labels, polypropylene (PP) labels, polyethylene terephthalate (PET) labels, and compostable/bio-based labels, supporting recyclable and sustainable packaging solutions. Adhesive type covers water-based adhesives, hot-melt adhesives, solvent-based adhesives, acrylic adhesives, and bio-based adhesives, ensuring compatibility with recycling processes.

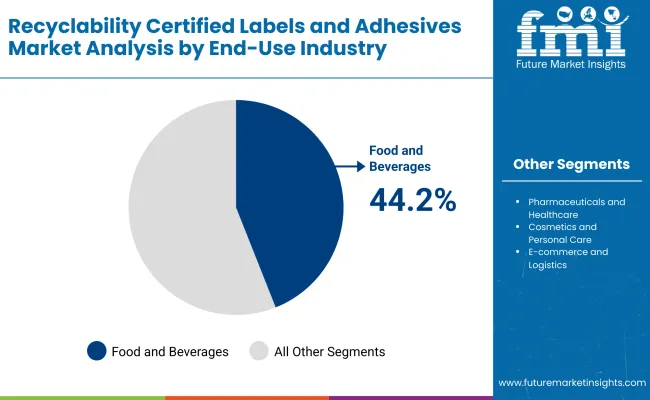

Label format includes pressure-sensitive labels, shrink sleeve labels, in-mold labels, and wraparound labels, offering versatile applications across industries. End-use industries include food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, household products, and e-commerce and logistics, addressing growing demand for sustainable labeling. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

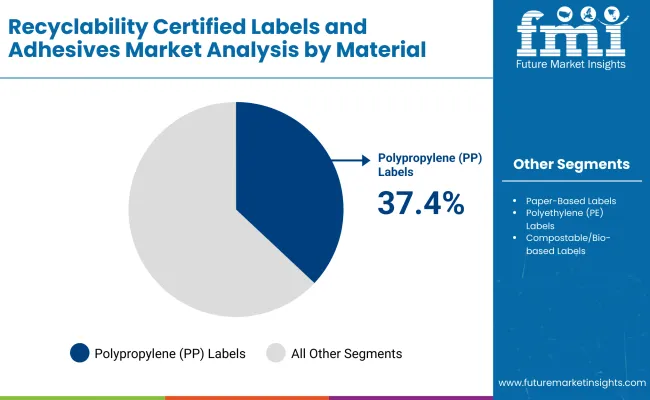

Polypropylene (PP) labels are projected to account for 37.4% of the market in 2025, supported by their balance of strength, moisture resistance, and recyclability. They perform well in demanding environments such as chilled foods, beverages, and household products, where durability is critical. Their printability also enhances branding opportunities for consumer-facing industries.

Adoption is reinforced by regulatory shifts encouraging recyclable plastics in packaging. PP labels’ compatibility with widely used recycling streams further strengthens their role. With expanding demand for cost-effective, high-performance labeling, polypropylene remains the preferred material choice across diverse sectors.

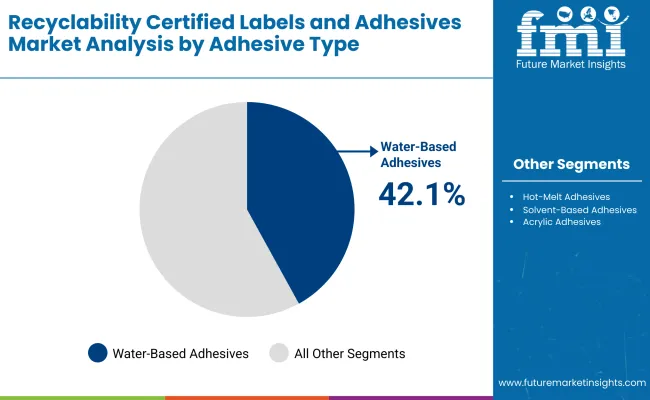

Water-based adhesives are expected to hold 42.1% of the market in 2025, driven by their low VOC emissions and compatibility with recycling processes. These adhesives ensure label removal without contaminating paper or plastic recycling streams, supporting circular economy initiatives. Their strong bonding strength makes them effective across food, beverage, and healthcare packaging.

Their adoption is supported by strict environmental regulations and brand sustainability goals. Continuous advancements in water-based formulations enhance resistance to moisture and temperature changes. As recyclability certification gains momentum, water-based adhesives dominate as the most compliant and eco-friendly solution.

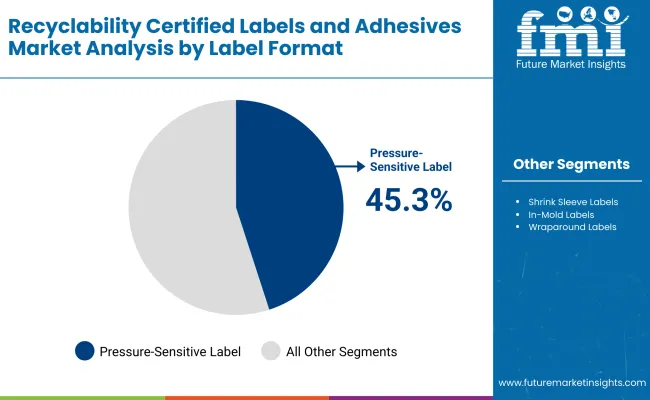

Pressure-sensitive labels are projected to represent 45.3% of the market in 2025, reflecting their versatility, ease of application, and compatibility with automated labeling systems. They are widely used across food, beverage, personal care, and logistics packaging due to their efficiency and adaptability.

Their recyclability certifications make them integral to sustainable packaging initiatives. The segment benefits from high-speed application capabilities, reducing downtime in production. With consumer goods industries prioritizing convenience and branding, pressure-sensitive labels remain the leading format.

The food and beverage industry is forecast to account for 44.2% of the market in 2025, as labeling ensures compliance, traceability, and strong shelf presence. Certified recyclable labels support sustainability goals while maintaining visual appeal for branding and consumer engagement.

High turnover of packaged foods and drinks sustains demand for efficient labeling solutions. Producers rely on certified adhesives and materials to meet both regulatory standards and consumer eco-preferences. As global packaged food consumption grows, this sector anchors demand for recyclable labels and adhesives.

The recyclability certified labels and adhesives market is expanding as industries prioritize sustainable packaging to meet regulatory mandates and consumer demand. Growth in food, beverage, and personal care sectors is fueling adoption of recyclable labeling solutions. However, high certification costs and technical challenges in adhesion restrain market penetration. Innovations in water-based adhesives, compostable substrates, and circular economy practices are shaping its growth trajectory.

Sustainability Goals, Regulations, and Brand Commitments Driving Adoption

Recyclability certified labels and adhesives enable brands to ensure packaging compatibility with recycling streams, reducing contamination. Food and beverage companies are adopting these solutions to align with global sustainability targets and plastic reduction mandates. Certification assures consumers of eco-friendly practices, enhancing brand image and trust. Personal care and e-commerce sectors also benefit from recyclable label formats that combine durability with environmental responsibility. These drivers make certified labeling solutions essential for brand competitiveness and compliance.

High Certification Costs, Technical Adhesion Issues, and Material Limits Restraining Growth

Despite rising demand, obtaining recyclability certification involves high testing, auditing, and compliance costs, challenging small and mid-sized companies. Technical issues arise in achieving strong adhesion while maintaining recyclability, especially on films and flexible substrates. Limitations in performance under extreme conditions, such as moisture or heat, further restrict adoption. Additionally, recycling infrastructures vary globally, affecting label recovery rates. These restraints slow scalability, despite sustainability-driven momentum in packaging industries.

Water-based Adhesives, Compostable Substrates, and Circular Practices Trends Emerging

Key trends include the rise of water-based and bio-based adhesives that enhance recyclability without compromising performance. Compostable and paper-based labels are gaining traction in food and retail packaging, reducing waste impact. Circular economy initiatives are encouraging closed-loop systems, where certified labels facilitate higher recovery rates. Smart printing technologies are enabling clearer recycling instructions on packaging. These innovations are positioning recyclability certified labels and adhesives as critical enablers of sustainable packaging ecosystems worldwide.

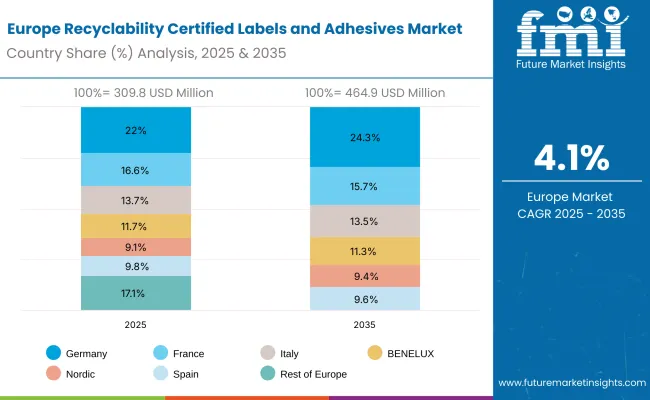

The global recyclability certified labels and adhesives market is expanding rapidly, driven by the transition to circular packaging, stricter regulations, and consumer demand for eco-friendly solutions. Asia-Pacific is emerging as a key growth region, with India and China leading adoption due to strong government sustainability initiatives and rising FMCG demand. Developed markets such as the USA, Germany, and Japan are focusing on advanced adhesive chemistries, water-based solutions, and certification compliance, ensuring performance while supporting recycling infrastructure and global sustainability goals.

The USA market is projected to grow at a CAGR of 7.5% from 2025 to 2035, fueled by rising demand from food, beverages, and pharmaceuticals. Companies are investing in water-based and biodegradable adhesives that maintain recyclability across packaging streams. Growth is also driven by e-commerce and logistics, where certified labels ensure sustainability compliance. OEMs are developing high-speed labeling systems compatible with eco-friendly adhesives to help USA industries meet federal packaging mandates and brand sustainability targets.

Germany’s market is expected to grow at a CAGR of 7.2%, supported by strict EU recycling targets and circular economy goals. German manufacturers are pioneering solvent-free adhesives and recyclable labels tailored for beverages, cosmetics, and consumer goods. Demand is strong for labels that ensure high optical quality while being fully recyclable. Export-oriented industries are driving innovation, with OEMs designing modular labeling systems that align with EU sustainability mandates and reduce environmental impact in large-scale operations.

The UK market is forecast to grow at a CAGR of 7.1%, driven by demand in FMCG, personal care, and e-commerce packaging. Rising pressure to meet packaging waste reduction targets is fueling adoption of certified recyclable labels and adhesives. SMEs are increasingly investing in cost-effective eco-label solutions to enhance compliance. Innovation is also focused on wash-off adhesives that maintain recyclability in PET and HDPE streams, supporting sustainability goals across UK industries.

China’s market is projected to grow at a CAGR of 7.9%, driven by rapid industrial growth, e-commerce expansion, and government-led plastic reduction mandates. Local manufacturers are producing cost-effective recyclable labels with water-based adhesives for mass adoption. Strong demand is emerging in food, beverage, and logistics industries. Export-oriented companies are increasingly adopting certified labels to meet international compliance requirements, reinforcing China’s position as a major hub for recyclable packaging solutions.

India is forecast to grow at a CAGR of 7.8%, supported by strong FMCG, pharmaceutical, and retail growth. Government sustainability initiatives and rising consumer preference for eco-friendly packaging are fueling demand. SMEs are adopting recyclable adhesive solutions to meet export requirements. Growth is also supported by domestic innovation in bio-based adhesives. The shift toward sustainable packaging formats across industries is making India a prominent growth hub for certified recyclable labels and adhesives.

Japan’s market is projected to grow at a CAGR of 7.0%, driven by demand in electronics, beverages, and healthcare. Manufacturers are focusing on recyclable adhesives with strong durability and optical clarity. Compact, high-performance labeling systems are being designed to meet Japan’s precision and quality standards. Demand for certified labels that ensure recyclability while maintaining premium product aesthetics is further reinforcing adoption, particularly in electronics and premium beverages.

South Korea’s market is expected to grow at a CAGR of 7.1%, supported by cosmetics, pharmaceuticals, and K-food exports. Companies are adopting recyclable adhesives and certified labels to comply with global export standards. Local OEMs are focusing on advanced eco-friendly labeling technologies compatible with automation. Rising demand for sustainable branding in cosmetics and packaged food is reinforcing adoption, positioning South Korea as a leader in recyclable labeling innovation across Asia-Pacific.

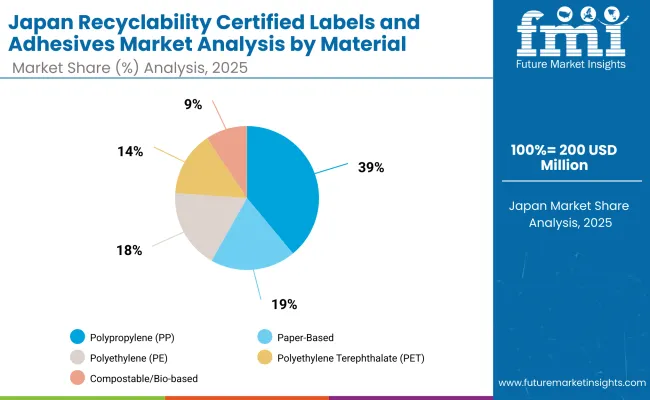

Japan’s recyclability certified labels and adhesives market, valued at USD 200 million in 2025, is dominated by polypropylene (PP) labels, holding 39.0% share for their durability and versatility in consumer and industrial packaging. Paper-based labels follow at 19.2%, driven by sustainability and cost-effectiveness. Polyethylene (PE) labels capture 17.9%, while polyethylene terephthalate (PET) labels hold 14.5%, known for strength and transparency. Compostable or bio-based labels, though smaller at 9.4%, are gaining traction as eco-friendly packaging alternatives. This mix highlights Japan’s dual focus on reliable plastic substrates and growing adoption of sustainable solutions, aligning with global packaging innovation trends and environmental targets.

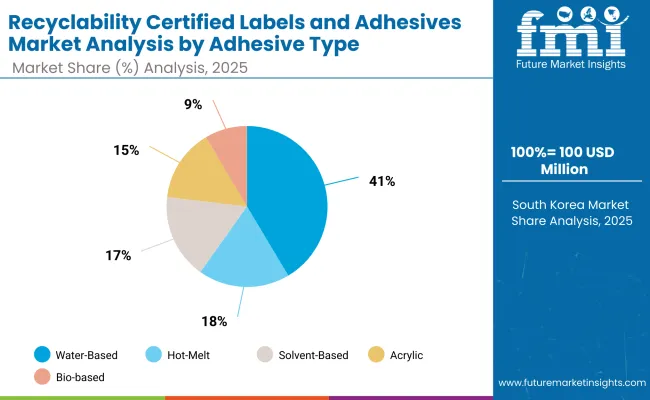

South Korea’s recyclability certified labels and adhesives market, worth USD 100 million in 2025, is led by water-based adhesives, commanding 41.4% share, reflecting their eco-friendly profile and regulatory compliance. Hot-melt adhesives hold 18.4%, offering efficiency in high-speed applications. Solvent-based adhesives account for 17.0%, valued for durability, though gradually declining due to environmental concerns. Acrylic adhesives represent 14.6%, supporting versatile consumer applications, while bio-based adhesives capture 8.5%, reflecting early adoption of greener solutions. This distribution demonstrates South Korea’s shift toward sustainable, water-based adhesives while maintaining diversity in adhesive technologies, balancing performance, cost, and sustainability in its growing packaging and labeling industries.

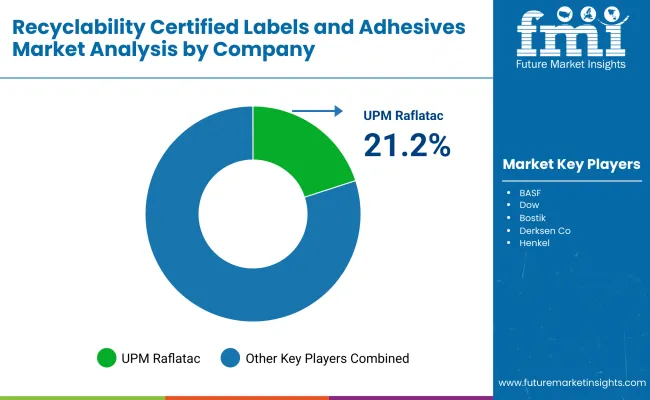

The recyclability certified labels and adhesives market is moderately fragmented, with chemical giants, label manufacturers, and adhesive technology providers competing across food, beverages, pharmaceuticals, and consumer goods sectors. Global leaders such as UPM Raflatac, BASF, and Dow hold notable market share, driven by pressure-sensitive labels, wash-off adhesives, and compliance with APR and EU recyclability guidelines. Their strategies increasingly emphasize circular economy solutions, low-migration adhesives, and compatibility with PET and paper recycling streams.

Established mid-sized players including Bostik, Derksen Co., and Henkel are supporting adoption of recyclable labeling formats featuring bio-based adhesives, solvent-free formulations, and high-performance bonding for multiple substrates. These companies are especially active in consumer packaging and healthcare, offering solutions that reduce contamination risks, enhance sustainability credentials, and deliver reliable adhesion without hindering recycling processes.

Specialized providers such as Avery Dennison/Sappi, Progressive Label, Penmar Industries, and August Faller GmbH & Co. KG focus on customized recyclable label solutions for regional and niche markets. Their strengths lie in sustainable facestock sourcing, eco-certified adhesives, and integration of smart features like traceability codes, enabling brands to meet regulatory demands while reinforcing environmental responsibility and brand differentiation.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material Type | Paper-Based Labels, Polyethylene (PE) Labels, Polypropylene (PP) Labels, Polyethylene Terephthalate (PET) Labels, Compostable/Bio-based Labels |

| By Adhesive Type | Water-Based Adhesives, Hot-Melt Adhesives, Solvent-Based Adhesives, Acrylic Adhesives, Bio-based Adhesives |

| By Label Format | Pressure-Sensitive Labels, Shrink Sleeve Labels, In-Mold Labels, Wraparound Labels |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Household Products, E-commerce and Logistics |

| Key Companies Profiled | UPM Raflatac, BASF, Dow, Bostik, Derksen Co., Henkel, Avery Dennison / Sappi, Progressive Label, Penmar Industries, August Faller GmbH & Co. KG |

| Additional Attributes | Rising adoption of water-based adhesives projected to dominate due to eco-friendly compliance, increasing demand for pressure-sensitive labels in food and beverage packaging, growing emphasis on compostable and bio-based labels supporting circular economy, enhanced recycling compatibility driving PET and PP label use, and regulatory shifts pushing brand owners to adopt certified recyclable adhesives and label formats across consumer goods, e-commerce, and healthcare applications. |

The global recyclability certified labels and adhesives market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the recyclability certified labels and adhesives market is projected to reach USD 2.6 billion by 2035.

The recyclability certified labels and adhesives market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The key adhesive types in the recyclability certified labels and adhesives market include water-based adhesives, hot-melt adhesives, solvent-based adhesives, acrylic adhesives, and bio-based adhesives.

The water-based adhesives segment is projected to account for the highest share of 42.3% in the recyclability certified labels and adhesives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Footwear Adhesives Market

Anaerobic Adhesives Market

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Automotive Adhesives & Sealants Market Size and Share Forecast Outlook 2025 to 2035

Laminating Adhesives Market Growth - Trends & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Lamination Adhesives Market

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA