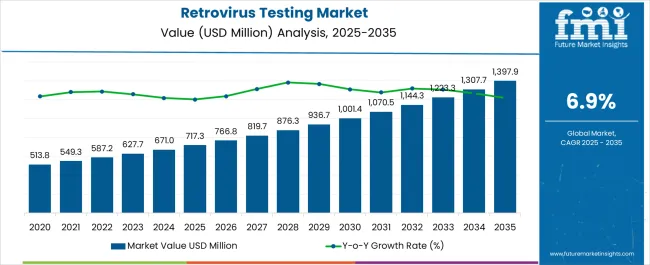

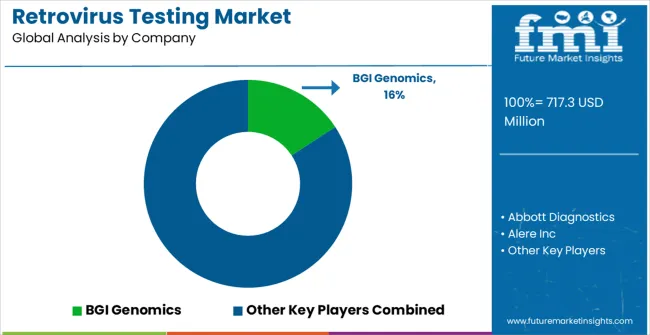

The Retrovirus Testing Market is estimated to be valued at USD 717.3 million in 2025 and is projected to reach USD 1397.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Retrovirus Testing Market Estimated Value in (2025 E) | USD 717.3 million |

| Retrovirus Testing Market Forecast Value in (2035 F) | USD 1397.9 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The Retrovirus Testing market is experiencing substantial growth, driven by the rising prevalence of retrovirus-related infections and the increasing need for accurate and timely diagnostic solutions. Growing focus on early detection, epidemiological surveillance, and screening of blood products is supporting market expansion. Technological advancements, including automated platforms, high-throughput assays, and sensitive detection techniques, are enhancing the accuracy and efficiency of retrovirus testing.

The integration of molecular biology tools and laboratory automation has enabled faster sample processing and improved reproducibility. Regulatory compliance requirements, particularly in blood safety and clinical diagnostics, are further encouraging the adoption of advanced testing methodologies. Increasing investments by healthcare providers, research institutions, and diagnostic laboratories in modern testing infrastructure are also contributing to market growth.

As awareness regarding retrovirus transmission and associated health risks continues to rise, demand for reliable testing solutions is expected to expand The market is being shaped by ongoing research initiatives, innovations in assay design, and growing emphasis on personalized patient care, positioning retrovirus testing as a critical component in clinical diagnostics and public health management.

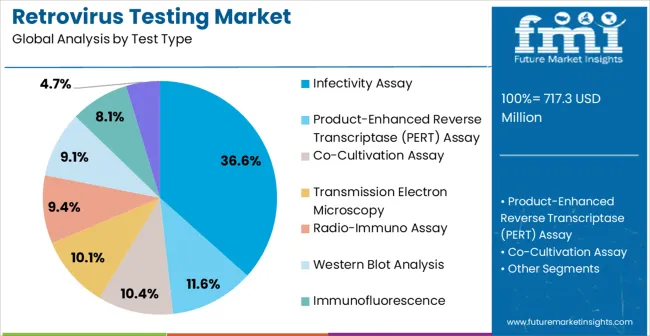

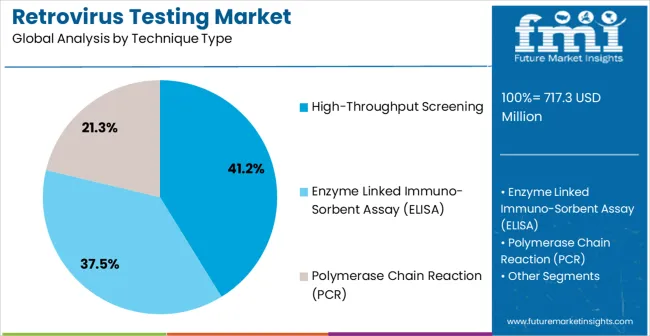

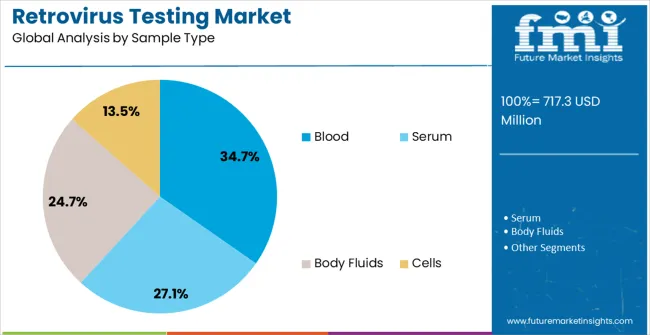

The retrovirus testing market is segmented by test type, technique type, sample type, end user, and geographic regions. By test type, retrovirus testing market is divided into Infectivity Assay, Product-Enhanced Reverse Transcriptase (PERT) Assay, Co-Cultivation Assay, Transmission Electron Microscopy, Radio-Immuno Assay, Western Blot Analysis, Immunofluorescence, and Serological Tests. In terms of technique type, retrovirus testing market is classified into High-Throughput Screening, Enzyme Linked Immuno-Sorbent Assay (ELISA), and Polymerase Chain Reaction (PCR). Based on sample type, retrovirus testing market is segmented into Blood, Serum, Body Fluids, and Cells. By end user, retrovirus testing market is segmented into Hospitals, Clinics, and Diagnostic Laboratories And Centers. Regionally, the retrovirus testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The infectivity assay segment is projected to hold 36.6% of the market revenue in 2025, making it the leading test type. Growth in this segment is being driven by its ability to directly assess viral replication and pathogenic potential, providing highly reliable data for both research and clinical diagnostics. Infectivity assays enable precise evaluation of antiviral agents and vaccine efficacy, supporting therapeutic development and safety monitoring.

Their high sensitivity and specificity make them essential for laboratories focusing on retrovirus screening and analysis. The adoption of standardized protocols and enhanced assay platforms has improved reproducibility and reduced turnaround time, encouraging broader use across academic, pharmaceutical, and clinical laboratories.

Continuous advancements in cell culture systems and detection reagents have further strengthened performance and scalability As the demand for accurate retrovirus assessment continues to rise, infectivity assays are expected to maintain their leading position, supported by regulatory compliance requirements and growing reliance on precise functional viral testing in research and clinical settings.

The high-throughput screening segment is anticipated to account for 41.2% of the market revenue in 2025, establishing it as the leading technique type. Its growth is driven by the increasing need for rapid, large-scale screening of retroviral samples in both research and clinical applications. High-throughput platforms enable parallel processing of multiple samples, reducing time and labor while maintaining accuracy and reproducibility.

Integration of automated liquid handling, robotics, and advanced data analytics has enhanced operational efficiency and scalability. Pharmaceutical companies and research institutions are leveraging these platforms to accelerate drug discovery, antiviral testing, and vaccine development. The ability to perform large-scale screening without compromising sensitivity or specificity makes this technique particularly valuable in high-demand settings.

Growing investment in laboratory automation and AI-assisted data analysis is further propelling adoption As demand for efficient, reliable, and scalable retrovirus testing solutions increases, high-throughput screening is expected to remain the primary technique type, supporting advancements in diagnostics, therapeutic research, and regulatory compliance.

The blood sample segment is projected to hold 34.7% of the market revenue in 2025, establishing it as the leading sample type. Growth in this segment is being driven by the widespread use of blood for retrovirus detection due to its high viral load concentration, which enhances sensitivity and reliability. Blood samples are critical for early diagnosis, routine screening, and post-treatment monitoring, ensuring timely intervention and improved patient outcomes.

Standardized collection, storage, and handling protocols have improved sample integrity and testing reproducibility, further encouraging adoption in clinical and research laboratories. Blood-based testing is also essential for evaluating transfusion safety and controlling retrovirus transmission in healthcare settings.

Technological improvements, including automated extraction methods and multiplexed detection, have enhanced throughput and data accuracy As healthcare providers and research institutions continue to prioritize early detection and monitoring of retroviral infections, the blood sample segment is expected to maintain its market leadership, supported by reliable performance, ease of integration into laboratory workflows, and critical relevance to both clinical and public health applications.

Retrovirus is a single stranded RNA virus that is composed of an enzyme called reverse transcriptase. With the help of reverse transcriptase, retroviral RNA gets transcribed into retroviral DNA once it enters into a host cell. The retrovirus then allows integration of its retroviral DNA into chromosomal DNA of host cell. This integration facilitates the replication of retrovirus into the host genome, thereby leading to its expression.

The most common type of retrovirus known in humans is HIV (Human Immunodeficiency Virus). Other type of retrovirus causing infection in humans include Human T-cell Lymphotropic Virus 1 (HTLV-1), Human T-cell Lymphotropic Virus 2 (HTLV-2), HIV 1, HIV 2, and others.

As retrovirus acts as a causative agent for a variety of life-threatening diseases such as HIV-AIDS, it has to be diagnosed in time and proper treatment should be given in order to treat this life-threatening infection. A wide range of diagnostic tests are available in the market to screen retrovirus.

The major type of diagnostic tests for detection of retrovirus includes assays and immunological tests such as infectivity assay, Product-enhanced reverse transcriptase (PERT) assay, Co-cultivation assay, Transmission Electron Microscopy (TEM), rapid diagnostic tests and thus contribute majorly to the revenue generation in retrovirus testing market.

Radioimmunoassay and Western blot analysis are other majorly utilized testing methods for detection of retrovirus. Infectivity assays are further classified as direct focus assays and extended assays in which initial cell line is used to amplify the retrovirus. Also, retrovirus testing is performed using advanced techniques such as PCR based amplification, high-throughput screening, non-radioactive ELISA and others.

In addition with blood and serum samples, cells and body fluids are other sample forms used to perform sensitive detection of retrovirus in the suspected genome. The retrovirus detection tests are usually applied on three main stages of a manufacturing process that consists of Master Cell Bank, End of Production (EOP) cell banks and Bulk Harvest.

The most common type of retrovirus assay performed to detect infectious retrovirus present in CHO cell lines is Mink or Feline S+L- assay. However, Product Enhanced Reverse Transcriptase (PERT) assay is carried out for detection of infectious retrovirus in the human cell lines. Retrovirus testing find vast applications in early stage diagnosis of various life-threatening infectious disease which increases the demand in retrovirus testing market.

The increasing usage of retrovirus testing generates large revenues in the retrovirus testing market owing to their increased demand in hospitals and diagnostic laboratories. On the other hand, retrovirus testing market is gaining profit due to rising incidence of HIV–infectious diseases, STDs and rising expenditure in research across the globe.

Increasing adoption of in-vitro assays to detect retrovirus infection in human system tends to propel the growth of retrovirus testing market over the globe and registers a significant revenue growth in the retrovirus testing market.

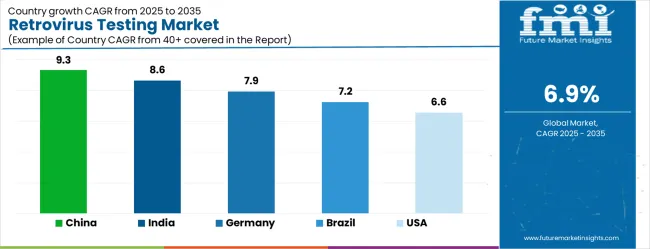

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| Brazil | 7.2% |

| USA | 6.6% |

| UK | 5.9% |

| Japan | 5.2% |

The Retrovirus Testing Market is expected to register a CAGR of 6.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.3%, followed by India at 8.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.2%, yet still underscores a broadly positive trajectory for the global Retrovirus Testing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.9%. The USA Retrovirus Testing Market is estimated to be valued at USD 256.0 million in 2025 and is anticipated to reach a valuation of USD 256.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 36.7 million and USD 23.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 717.3 Million |

| Test Type | Infectivity Assay, Product-Enhanced Reverse Transcriptase (PERT) Assay, Co-Cultivation Assay, Transmission Electron Microscopy, Radio-Immuno Assay, Western Blot Analysis, Immunofluorescence, and Serological Tests |

| Technique Type | High-Throughput Screening, Enzyme Linked Immuno-Sorbent Assay (ELISA), and Polymerase Chain Reaction (PCR) |

| Sample Type | Blood, Serum, Body Fluids, and Cells |

| End User | Hospitals, Clinics, and Diagnostic Laboratories And Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BGI Genomics, Abbott Diagnostics, Alere Inc, Hybribio Biotech, Roche Diagnostics Ltd, Tellgen Corporation, DiaSorin S.p.A., Dian Diagnostics, bioMerieux SA, Becton, Dickinson & Company, and Xilong Scientific |

The global retrovirus testing market is estimated to be valued at USD 717.3 million in 2025.

The market size for the retrovirus testing market is projected to reach USD 1,397.9 million by 2035.

The retrovirus testing market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in retrovirus testing market are infectivity assay, product-enhanced reverse transcriptase (pert) assay, co-cultivation assay, transmission electron microscopy, radio-immuno assay, western blot analysis, immunofluorescence and serological tests.

In terms of technique type, high-throughput screening segment to command 41.2% share in the retrovirus testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA