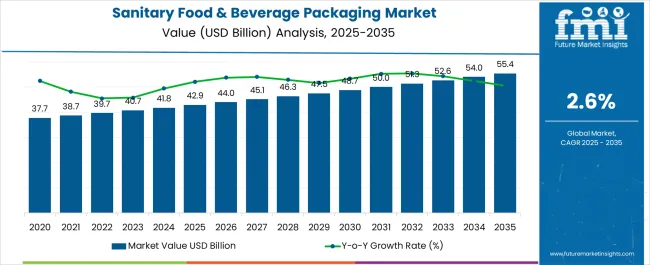

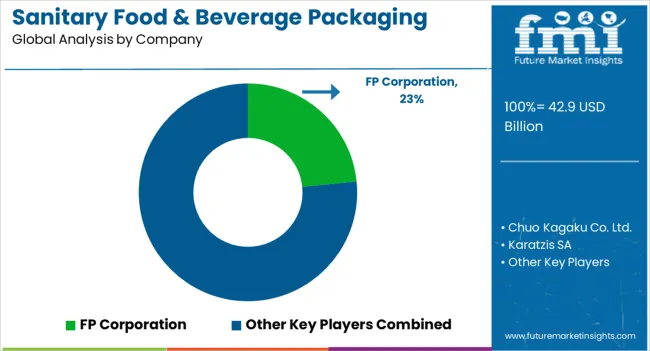

The sanitary food & beverage packaging market is estimated to be valued at USD 42.9 billion in 2025 and is projected to reach USD 55.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

The market reflects heightened consumer awareness regarding food safety and contamination prevention, driving sustained demand for advanced barrier technologies and sterile packaging solutions across diverse product categories. Manufacturing facilities implement stringent hygiene protocols that require specialized packaging materials capable of maintaining product integrity throughout extended supply chains while protecting against microbial contamination, moisture infiltration, and chemical migration. The industry's evolution toward clean-label products and extended shelf-life requirements creates demand for packaging systems that preserve nutritional content without compromising food safety standards.

Processing plant operations demonstrate increasing adoption of aseptic packaging technologies that enable ambient storage of perishable products without refrigeration requirements, reducing distribution costs while expanding market reach for manufacturers. Production managers balance material costs against product protection performance as consumer preferences shift toward minimally processed foods that require sophisticated barrier properties to maintain freshness and safety. Quality assurance departments implement rigorous testing protocols for packaging materials that must demonstrate compliance with food contact regulations while providing adequate protection against contamination during processing, storage, and transportation phases.

Regulatory compliance drives substantial market activity as food safety agencies implement updated standards for packaging materials that contact consumable products directly. Material suppliers invest heavily in testing facilities and documentation systems that support regulatory submissions for new barrier coatings, antimicrobial treatments, and modified atmosphere packaging configurations. Manufacturers face mounting pressure to demonstrate packaging safety through extensive migration testing and shelf-life validation studies that verify product protection capabilities under various storage conditions and temperature fluctuations.

Supply chain considerations impact packaging selection as food manufacturers seek solutions that optimize distribution efficiency while maintaining product safety standards across global logistics networks. Cold chain management requirements influence material specifications for temperature-sensitive products that require insulation properties and condensation resistance during transportation and storage. Packaging engineers develop integrated systems that combine multiple barrier functions within single-layer structures, reducing material costs while simplifying disposal and recycling processes that address environmental sustainability concerns.

Competitive dynamics reflect consolidation among major packaging material suppliers who acquire specialized technology companies to expand capabilities in high-performance barrier films and functional coatings. Contract packaging services demonstrate growth as food manufacturers outsource complex packaging operations to specialized facilities that maintain sterile processing environments and regulatory compliance expertise. Equipment manufacturers develop integrated packaging lines that combine filling, sealing, and sterilization processes within contained systems that minimize contamination risks during production.

| Metric | Value |

|---|---|

| Sanitary Food & Beverage Packaging Market Estimated Value in (2025 E) | USD 42.9 billion |

| Sanitary Food & Beverage Packaging Market Forecast Value in (2035 F) | USD 55.4 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

The sanitary food and beverage packaging market is experiencing robust growth driven by rising consumer demand for safe, sustainable, and convenient packaging formats. Heightened awareness around food hygiene and contamination risks has accelerated the adoption of packaging solutions that ensure product integrity across extended supply chains.

Regulatory frameworks promoting recyclable and eco friendly packaging materials are further supporting this transition. In addition, advancements in coating technologies, barrier materials, and tamper evident sealing mechanisms are improving the safety and shelf life of packaged goods.

Growing investments by food and beverage producers in premium and sustainable packaging are also reinforcing adoption trends. The market outlook remains optimistic as both brands and consumers prioritize safety, sustainability, and functionality, positioning sanitary packaging as an essential component in modern food systems.

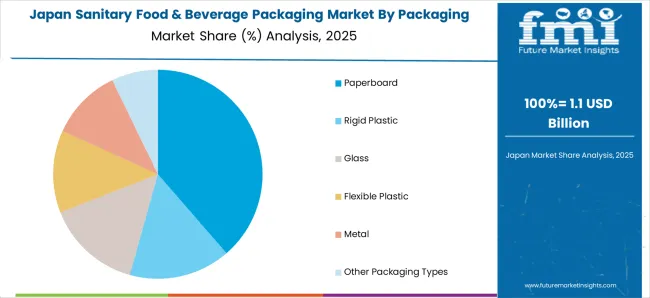

The paperboard segment is projected to hold 38.60% of the market share by 2025 within the packaging type category, making it the most significant contributor. This growth is being driven by strong demand for recyclable, lightweight, and biodegradable solutions that meet sustainability goals without compromising strength and durability.

Paperboard offers excellent printability and design flexibility, which enhances brand visibility on retail shelves. Its compatibility with advanced coating technologies has improved barrier properties, allowing for safer and longer storage of perishable food and beverages.

Increasing regulatory support for reduced plastic consumption has further reinforced the dominance of paperboard, establishing it as the preferred choice for eco conscious food and beverage packaging.

The milk and other beverage cartons segment is expected to account for 42.70% of total market revenue by 2025 within the product type category, making it the leading segment. This dominance is attributed to the widespread consumption of dairy products, juices, and ready to drink beverages, which require safe, tamper evident, and shelf stable packaging solutions.

Cartons provide superior protection against contamination, light, and oxygen, extending the freshness of liquid products. They are also lightweight and cost effective to transport, reducing the environmental footprint of logistics.

The segment has benefited from growing consumer preference for portion controlled packaging formats and the expanding reach of retail distribution channels. These advantages continue to position milk and other beverage cartons as the most prominent product type in the sanitary food and beverage packaging market.

Over the years, food & beverage packaging has acquired tremendous importance, prominently fuelled by increasing consumption in the wake of a significantly expanding population. This has also highlighted the importance of ensuring high food safety standards while packaging and transporting them to potential end-users. Hence, the popularity of sanitary packaging materials has been inclining considerably.

To that end, the International Food Standard (IFS) has been formulated. This is a common food standard with a uniform evaluation system used to qualify and select suppliers. It helps retailers ensure the food safety of their products and monitors the quality level of producers of retailer-branded food products. In addition to this, all countries have established their own regulations to ensure the availability of safe and certified food products.

For instance, the United States Food & Drug Administration (FDA) plays an instrumental role in ensuring the availability of safe and good quality food and beverage products across North America. As of 2020, the FDA regulates over USD 2.5 trillion in consumer food, medical products, and tobacco, respectively. The Food Safety and Inspection Service also plays an important role in this regard, while packaging regulations are taken care of by such entities as The Center for Food Safety and Applied Nutrition.

Statistics indicate that consumer packaging generates the maximum amount of plastic and paper waste, comprising about 20% of all waste in landfills. According to the United States Environmental Protection Agency (EPA), the total amount of Municipal Solid Waste (MSW) generated amount of ; 82,220 tons in 2020, with over 44,000 tons being recycled and over 30,000 tons being dumped in landfills.

Paper and paperboard packaging waste also amounted to nearly 42,000 tons in terms of generation, most of it originating from the food & beverage industry. Hence, various collaborative efforts are being undertaken to mitigate this incidence, for which incorporating sustainable materials is becoming highly important. Several food & beverage giants are thus incorporating eco-friendly materials, providing a tremendous boost to the market.

Manufacturers are increasingly experimenting with alternatives, including kraft paper, carton water bottles, mushroom packaging, recycled plastic, leaf plates, and a host of other naturally derived options. International coalitions at the institutional level are being extensively undertaken to promote the use of these materials. Additionally, manufacturers leverage smart packaging management solutions to mitigate wastage during the manufacturing cycle itself.

Although investment in sanitary food & beverage packaging is an important facet of prominent food & beverage manufacturers, several small and medium-sized corporations are unable to afford to do so owing to the voluminous expenditure it entails. Hence, penetration is likely to remain confined to large-scale multinational corporations.

Expenditure on sanitary packaging solutions not only involves purchasing lightweight and flexible material but also an integration of the entire supply chain of the business, which is an expensive process. Fortunately, leading packaging giants are making efforts to offer product lines that are affordable to all enterprises. Moreover, they are attempting to offer to consult and after-sales services to enhance the overall process, thus offsetting any shortfalls.

| Country | Market Value (2025) |

|---|---|

| United States | USD 7.99 billion |

| Germany | USD 2.99 billion |

| China | USD 3.78 billion |

| Japan | USD 1.78 billion |

| United Kingdom | USD 1.40 billion |

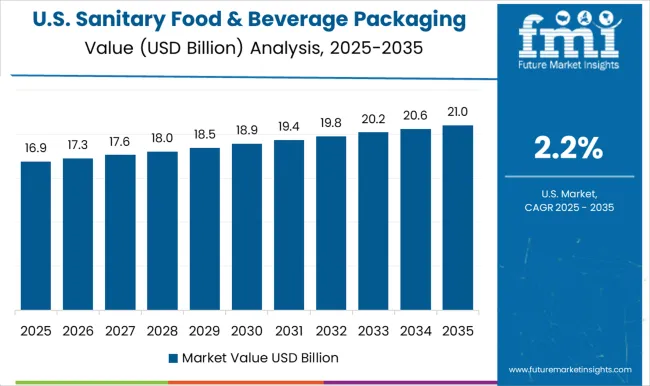

The United States sanitary food & beverage packaging market held a 20% share of the global market in 2025. Sanitary food & beverage packaging is expected to garner immense revenue generation opportunities across the United States market throughout North America. Stringent packaging regulations imposed by key regulatory authorities such as the Food & Drug Administration (FDA) are likely to be the chief growth driver for the regional market. As per its guidelines, it is the responsibility of the Office of Food Additive Safety and The Center for Food Safety and Applied Nutrition (CFSAN) to ensure the safety of food contact substances.

This means packaging materials like plastics, coatings, papers, food colorants, and adhesives must be regulated and deemed safe for use. The Environmental Protection Agency (EPA) requires that antimicrobial technology be built into plastic and textiles used in food packaging to prevent the growth of bacteria, mold, mildew, fungi, discoloration, and odor. Furthermore, allergen labeling is also an important part of packaging safety requirements, with The Food Allergen Labelling and Consumer Act being in prominence.

Owing to such stringent regulations, a number of regional packaging corporations have sprouted across the market. Prominent faces in the United States sanitary food & beverage packaging landscape include Owens-Illinois, Sealed Air, Ball Corporation, Crown Holdings Corporation, International Paper Company, and WestRock Company, to name a few. These companies are significantly focusing on incorporating sustainable packaging material, mostly paperboard and other eco-friendly substances, including high-grade plastics, in manufacturing their products.

The United Kingdom sanitary food & beverage packaging market is highly reliant on the government’s legal labelling requirements. According to United Kingdom law, all prepacked foods require a food label that displays certain mandatory information. All food is subject to general labelling requirements, and any labelling provided must be accurate and not misleading.

As per the United Kingdom Food Standards Agency, food manufacturers are required to clearly indicate the name of the food as prescribed under law. In the absence of a legal name, a customary name can be used. Furthermore, a list of ingredients must be clearly indicated in the order of weight, as well as information about potential allergens.

Recently, in April 2024, the British Soft Drinks Association (BSDA) reinforced its commitment to endorse regulatory provisions requiring energy drink companies to declare high caffeine content if present on their product containers.

Presently, a number of prominent manufacturers operate within the United Kingdom landscape. Ilpra S.p.A, for instance, is a prominent face that offers the Ilpra Foodpack Tray Sealer models, manufactured and ranging from table-top semi-automatic machines to fully in-line automated models.

The sealers usually permit the packing and sealing of products in preformed trays made from PP, APET, CPET, aluminum, and laminated carton through top sealing. Likewise, Flexipol offers lightweight, flexible, sustainable, and stronger packaging material.

By 2035, the United Kingdom sanitary food & beverage packaging market is projected to reach USD 1.89 billion, expanding at a CAGR of 3.4%.

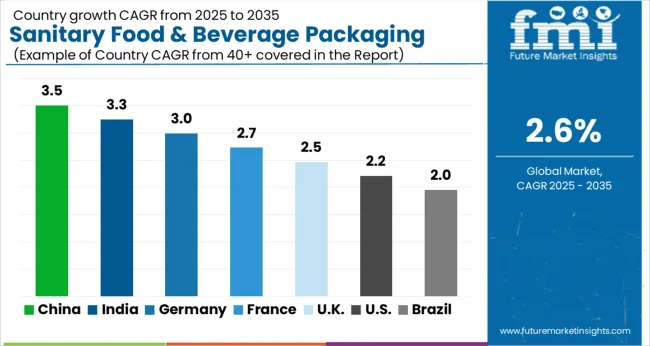

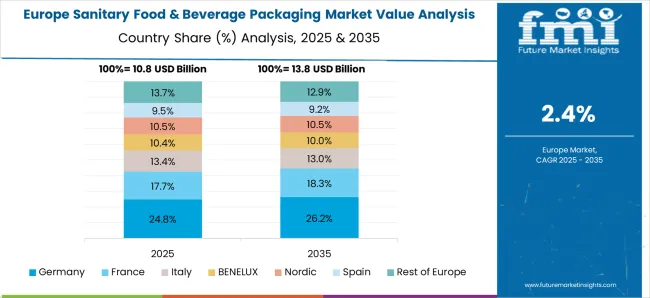

In 2025, the sanitary food & beverage packaging market in Germany held a 7.5% share of the global market. Germany's sanitary food & beverage packaging market is set to embark on a high growth path, mainly underpinned by a scramble to investigate sustainable alternatives. Beginning in 2020, the German Federal Ministry of Food and Agriculture (BMEL) published a call for projects on bio-based plastic food packaging. This has opened up significant growth avenues for the future.

This development follows a 2020 legislation by the Bundesrat, the upper house of the German parliament. This new law was approved in March of that year and assumed shape in 2020. The objective of this legislation was to set higher recycling targets for packaging waste by 2025, which includes a 63% rate for plastic material and 90% for metal, glass, and paper.

The legislation applies to all manufacturers, importers, distributors, and online retailers placing goods on the German market. To maintain market access, businesses have to register with the central packaging registry, with companies mandatorily needing to participate in a dual system to arrange for packaging recovery after use to continue trading. Consequently, a host of sanitary F&B packaging manufacturers are likely to enter the Germany market in the future.

Japan's sanitary food & beverage packaging market held 4.5% of the global market in 2025. Japan is expected to be a key beneficiary of the benefits accrued by the global sanitary food & beverage packaging market as its efforts to curb unwanted packaging waste continue to gather momentum. Despite the fact that 84% of Japan's plastic waste is recycled, microplastics are becoming more of a pressing issue, with the seas immediately surrounding the island nation containing 27 times more microplastics than the global average.

Japan is also responsible for dishing out around 41.8 billion plastic shopping bags every year. Hence, since July 2024, many retailers have started charging for single-use plastic carrier bags, with some levying small fees for recyclable paper versions to encourage the high uptake of reusable eco-bags.

Several retail outlets and key food corporations are thus playing their part in furthering sustainable packaging trends. For instance, beverage giant Asahi has pledged to boost its sustainability commitment by tackling plastic waste. This is doing so by introducing label-free bottles for all of its plastic-packaged drinks. The company has incorporated plant-based materials and changed the weight of plastic caps to render them more eco-friendly. To further this, Asahi initiated a Twitter campaign that offered 150 randomly selected customers a chance to win a case of 24 bottles if they tweeted using the hashtag # I'vestartedgoinglabelfree.

Akin to several other regions, health and wellness trends are significantly determining the growth of China's food packaging industry. Consumers are exhibiting a high inclination towards those packaging materials which are beneficial and conducive to the natural environment upon their disposal. Moreover, manufacturers are emphasizing mainly incorporating flexible packaging solutions.

Studies have concluded that food packaging from different materials is expected to surpass 42.9 billion units in 2025, with plastic packaging accounting for the bulk of all materials. This is expected to be followed by paper, metal, and glass, respectively. In addition, innovation is given top priority, keeping in mind the growing sustainability concerns being highlighted.

The city of Shanghai has made significant strides in ensuring increased sustainable packaging adoption across the food industry. With over 24 million residents, material sustainability, particularly plastics, is a significant issue. Food delivery services are especially common, representing the primary source of discarded plastic food waste. Hence, key delivery companies such as Saucepan have been combating the plastic usage of the online food delivery economy by encouraging customers to recycle their plastic bags and rewarding customers for every 10 bags they return to the company.

By registering a 6.1% CAGR over the forecast period, China's sanitary food & beverage packaging market is estimated to maintain its upward trend and cross USD 55.4 billion by 2035.

| Segment | Packaging Type |

|---|---|

| Attributes | Rigid Plastic |

| Details (Market Share in 2025) | 45.0% |

| Segment | Product Type |

|---|---|

| Attributes | Folding Food Containers |

| Details (Market Share in 2025) | 31.5% |

The rigid plastic packaging segment dominates the market due to several factors. Rigid plastic packaging provides a high level of protection against moisture, oxygen, and other contaminants that can spoil food and beverages.

This is because of its excellent barrier properties, which prevent the penetration of these elements. Rigid plastic packaging is also convenient to handle, transport, and store. Its lightweight and durable nature make it an attractive option for both manufacturers and consumers.

Rigid plastic packaging can be customized as well to meet specific packaging requirements such as size, shape, and color. This makes it a versatile option for the food and beverage industry. This type of packaging is also a sustainable option as it can be made from recycled materials.

This, in turn, reduces the overall carbon footprint. Moreover, rigid plastic packaging is cost-effective compared to other materials, which makes it a popular option for several food and beverage companies. All these factors make rigid plastic packaging type a dominant segment in the market.

The sanitary food & beverage packaging market is highly competitive, with numerous product types available to meet various packaging needs. However, within this market, folding food containers have dominated as the preferred product type for several reasons.

Folding containers offer a high degree of handiness to both manufacturers and consumers. They are easy to transport, store and assemble, making them an ideal choice for dynamic food and beverage operations. Additionally, folding containers are lightweight and durable, allowing for safe and secure transportation of food products.

Folding food containers are also highly customizable. This allows manufacturers to create unique packaging designs that enhance brand recognition and appeal. These containers are also environment-friendly as they are made from sustainable materials and are recyclable.

As consumers become increasingly eco-conscious, this factor has become a critical consideration in packaging selection. Thus, the combination of convenience, customization, durability, and sustainability has made folding food containers the dominant product type in the market.

The sanitary food and beverage packaging market is driven by global packaging manufacturers and material innovators focusing on safety, hygiene, and sustainability across diverse product categories. FP Corporation and Chuo Kagaku Co. Ltd. lead in Japan and Asia with advanced thermoformed plastic packaging designed for high sanitation standards in ready meals, fresh produce, and beverages. Their products emphasize lightweight materials, barrier protection, and recyclability to support food safety and shelf-life extension.

Crown Holdings Inc., Ball Corporation, and Silgan Containers LLC dominate the global metal packaging segment, providing hygienic, tamper-resistant cans and closures for beverages, dairy, and canned foods. These companies leverage cutting-edge coating technologies and aseptic sealing systems to prevent contamination and preserve flavor integrity. Karatzis SA contributes specialized net and flexible packaging solutions tailored for fresh produce and meat, focusing on high ventilation and hygiene compliance.

Kaira Can Company Limited and Canfab Packaging Inc. serve regional markets with sanitary metal and composite packaging options that meet strict food-grade standards. Berlin Packaging LLC offers a broad portfolio of glass, plastic, and metal containers with customized hygienic closures suited for both food and beverage sectors. Evanesce Packaging Solutions Inc. differentiates through compostable and biodegradable sanitary packaging materials, aligning with global sustainability and clean-label packaging trends.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 42.9 billion |

| Packaging Type | Paperboard; Rigid Plastic; Glass; Flexible Plastic; Metal; Other Packaging Types |

| Product Type | Milk & Other Beverage Cartons; Cups & Liquid-Tight Containers; Folding Food Containers; Boards & Trays; Other Product Types |

| Regions Covered | North America; Latin America; Europe; Japan; Asia Pacific Excl. Japan (APEJ); Middle East & Africa |

| Key Countries Covered | United States; Canada; Germany; United Kingdom; France; Italy; Spain; China; India; Japan; Malaysia; Thailand; Singapore; Australia; Brazil; Mexico; Argentina; South Africa; GCC; Nigeria; Israel; Rest of MEA |

| Key Companies Profiled | FP Corporation, Chuo Kagaku Co. Ltd., Karatzis SA, Crown Holdings Inc., Ball Corporation, Silgan Containers LLC, Kaira Can Company Limited, Canfab Packaging Inc., Berlin Packaging LLC, and Evanesce Packaging Solutions Inc. |

| Additional Attributes Included | Dollar sales by packaging type and product type; regional and country breakdowns; analysis of regulatory impact on materials adoption; pricing and cost drivers; sustainability benchmarking across regions |

The global sanitary food & beverage packaging market is estimated to be valued at USD 42.9 billion in 2025.

The market size for the sanitary food & beverage packaging market is projected to reach USD 55.4 billion by 2035.

The sanitary food & beverage packaging market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in sanitary food & beverage packaging market are paperboard, rigid plastic, glass, flexible plastic, metal and other packaging types.

In terms of product type, milk & other beverage cartons segment to command 42.7% share in the sanitary food & beverage packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sanitary Pump and Valve Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Cans Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Butterfly Valve Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA