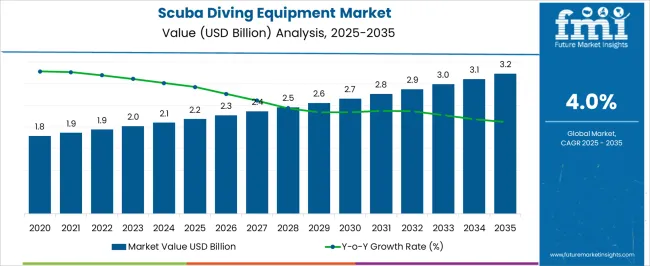

The scuba diving equipment market is projected to grow from USD 2.2 billion in 2025 to USD 3.2 billion in 2035, reflecting a CAGR of 4.0%. During the early adoption phase (2020–2024), the market grew steadily from USD 1.8 billion to USD 2.2 billion as recreational divers and adventure tourism operators began investing in modern diving gear. This period focused on improving safety, comfort, and accessibility while educating new divers about equipment use.

By 2025, the market will reach USD 2.2 billion, signaling readiness for broader adoption as more enthusiasts enter the market and established players expand product offerings. Between 2025 and 2035, the market moves through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market surpasses USD 2.6 billion, driven by growing participation in recreational diving, training programs, and tourism-linked equipment sales. During the consolidation phase, growth moderates toward USD 3.2 billion by 2035 as leading manufacturers strengthen their market position and smaller players align or exit. The 4.0% CAGR underscores steady, consistent growth, reflecting a transition from early adoption to widespread use, with scuba diving equipment becoming a standard choice for recreational and professional divers worldwide.

| Metric | Value |

|---|---|

| Scuba Diving Equipment Market Estimated Value in (2025 E) | USD 2.2 billion |

| Scuba Diving Equipment Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The scuba diving equipment market is influenced by multiple related sectors, each playing a role in overall growth. The recreational tourism market drives roughly 30%, as demand for diving gear is closely linked to the popularity of underwater experiences and adventure travel. Water sports and leisure activities account for 20%, providing opportunities for cross-selling equipment and attracting enthusiasts. The wetsuit and divewear industry contributes 15%, supplying essential apparel for comfort and safety in diverse water conditions. Marine safety and life-support systems influence around 10%, ensuring compliance and secure diving operations.

Training and certification services represent 8%, as professional courses drive equipment purchases and replacement cycles. Specialty retail and e-commerce platforms contribute 7%, enabling accessibility and wider distribution. Underwater photography and exploration tools account for 5%, as divers increasingly seek integrated gear for immersive experiences. Finally, boat and dive tour operators make up 5%, providing the infrastructure and guided experiences that encourage equipment adoption.

Growing interest in underwater exploration, marine tourism, and adventure sports has supported demand across both developed and emerging markets. Investments in safety standards, certification programs, and diving infrastructure have enhanced the adoption of advanced equipment.

Technological improvements in materials, ergonomics, and functionality are allowing scuba divers to experience higher comfort and better performance during dives. The rising availability of rental and guided diving services has further expanded the consumer base, while increasing awareness of ocean conservation and marine biodiversity has encouraged more individuals to explore diving activities.

As the leisure and tourism industries continue to expand, and as consumer preferences evolve toward high-quality, reliable equipment, the market is expected to grow consistently. Future opportunities are anticipated in innovative product designs, integration of smart wearable devices, and sustainable material adoption, ensuring continued growth in both recreational and professional segments.

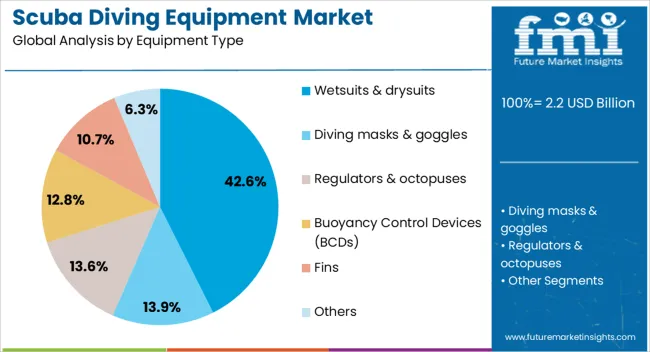

The scuba diving equipment market is segmented by equipment type, consumer group, distribution, price range, end user, and geographic regions. By equipment type, scuba diving equipment market is divided into Wetsuits & drysuits, Diving masks & goggles, Regulators & octopuses, Buoyancy Control Devices (BCDs), Fins, and Others.

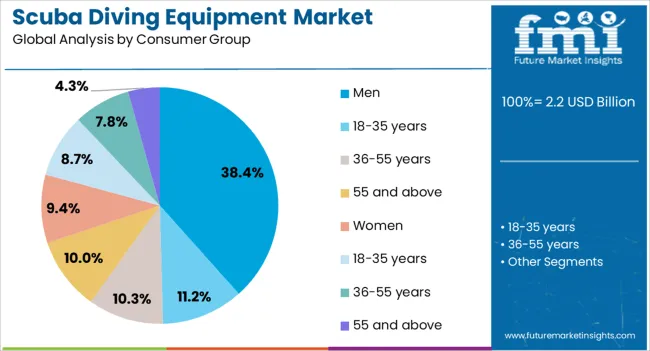

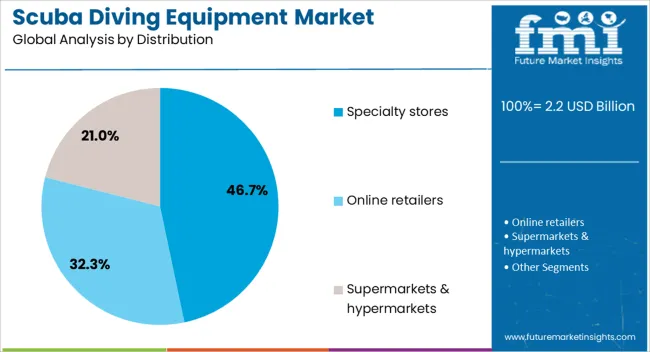

In terms of consumer group, scuba diving equipment market is classified into Men, 18-35 years, 36-55 years , 55 and above, Women, 18-35 years, 36-55 years , and 55 and above. Based on distribution, scuba diving equipment market is segmented into Specialty stores, Online retailers, and Supermarkets & hypermarkets. By price range, scuba diving equipment market is segmented into Low-mid end equipment and High-end equipment. By end user, scuba diving equipment market is segmented into Recreational divers, Professional divers, and Military and public safety divers. Regionally, the scuba diving equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wetsuits and drysuits equipment type is projected to account for 42.6% of the Scuba Diving Equipment market revenue in 2025, making it the leading product segment. This dominance is being attributed to the increasing focus on diver safety, thermal protection, and comfort during underwater activities.

The growth of this segment has been supported by advancements in materials that improve flexibility, durability, and resistance to varying underwater temperatures. The preference for wetsuits and drysuits is also influenced by the expanding recreational diving community, which requires reliable and adaptable gear for both casual and professional use.

The modular nature of these suits, which allows for customization according to environmental conditions and diving duration, has further reinforced their market position Additionally, as diving becomes more mainstream in both leisure and competitive spheres, demand for high-quality wetsuits and drysuits continues to grow, positioning this segment as the most significant contributor to overall market revenue.

The men consumer group is expected to hold 38.4% of the total Scuba Diving Equipment market revenue in 2025, establishing it as the leading demographic segment. This prominence is being driven by higher participation rates of male divers in recreational, technical, and professional diving activities. Market growth has been reinforced by the preference for advanced diving gear among men, who often invest in high-performance and specialized equipment for extended dives.

The segment has benefited from targeted marketing campaigns and product innovations designed to enhance comfort, durability, and safety, aligning with consumer expectations. Rising awareness of fitness and outdoor sports, coupled with disposable income trends in key regions, has further strengthened adoption.

The consistent interest in underwater adventure tourism and certification programs by male divers ensures sustained revenue contribution from this consumer group As scuba diving continues to attract enthusiasts seeking immersive experiences, the male consumer segment is anticipated to remain a primary driver of market growth.

Specialty stores are projected to account for 46.7% of the Scuba Diving Equipment market revenue in 2025, making them the dominant distribution channel. This leading position is being attributed to the personalized service, product expertise, and comprehensive selection of equipment offered in specialty retail environments. The growth of this segment has been driven by the preference of divers for in-person guidance, proper fitting, and expert advice when selecting high-performance wetsuits, drysuits, and other diving gear.

Specialty stores also provide opportunities for demonstrations, trials, and maintenance services, which enhance consumer confidence and loyalty. In addition, these stores often stock the latest innovations in diving technology, catering to both recreational and professional divers.

As the scuba diving market continues to expand and diversify, specialty stores remain critical for driving sales, building brand trust, and offering tailored solutions that meet the evolving needs of diving enthusiasts. The channel’s focus on customer experience and expertise ensures its continued prominence in equipment distribution.

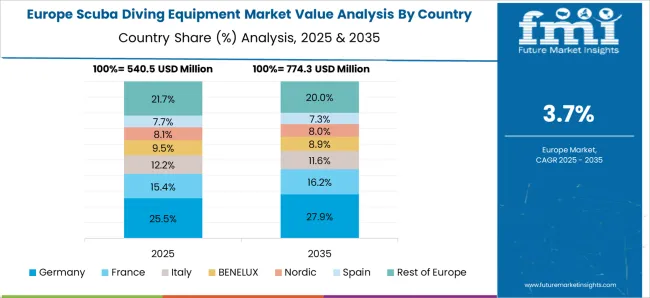

The scuba diving equipment market is expanding due to rising interest in recreational diving, underwater exploration, and adventure tourism. North America and Europe lead with advanced equipment for recreational, professional, and military divers, emphasizing quality, safety, and innovation. Asia-Pacific shows rapid growth driven by coastal tourism, diving schools, and increasing disposable incomes.

Manufacturers differentiate through lightweight materials, advanced breathing systems, diving computers, and modular accessories. Regional variations in safety regulations, tourism infrastructure, and consumer awareness influence adoption, product development, and competitive positioning globally.

Safety and reliability are critical for scuba diving equipment adoption. North America and Europe emphasize regulators, buoyancy control devices, dive computers, and high-quality tanks that meet stringent safety standards for recreational, professional, and military divers. Asia-Pacific adoption is growing, with emphasis on affordable yet reliable gear for training centers and recreational use. Differences in safety certification, material quality, and product testing directly affect user confidence, accident prevention, and repeat purchases. Leading suppliers invest in ISO-certified equipment, advanced sensors, and robust materials to meet premium safety standards, while regional manufacturers focus on cost-effective, functional solutions. Safety and reliability contrasts shape adoption, brand trust, and long-term competitiveness in global scuba diving equipment markets.

Advancements in breathing systems, rebreathers, regulators, and modular accessories enhance diving experiences. Europe and North America focus on high-performance rebreathers, multi-stage regulators, and advanced dive computers for technical, deep, and military diving, emphasizing precision and comfort. Asia-Pacific markets adopt affordable regulators, standard BCDs, and modular kits for recreational diving schools and tourism. Differences in equipment sophistication impact usability, diving depth, and mission flexibility. Premium suppliers invest in lightweight materials, ergonomic designs, and customizable accessories, while regional producers provide functional and cost-efficient systems. Innovation contrasts influence adoption, operational versatility, and differentiation across recreational, professional, and specialized diving applications globally.

The availability of dive sites, underwater attractions, and tourism infrastructure strongly affects scuba equipment demand. North America and Europe benefit from well-established dive schools, training centers, and certified dive operators that drive adoption of advanced gear. Asia-Pacific shows rapid growth with emerging tourist destinations, coastal resorts, and diving programs, emphasizing affordable entry-level equipment. Differences in infrastructure and destination accessibility impact purchasing behavior, training requirements, and equipment preference. Suppliers providing full-service packages, equipment rental, and integrated dive solutions gain adoption in mature markets, while regional providers focus on entry-level sales and rentals. Tourism and infrastructure contrasts shape adoption patterns, market penetration, and strategic positioning across global scuba diving markets.

Compliance with international safety standards, diving certifications, and local regulations is crucial for market growth. North America and Europe enforce strict ISO standards, safety inspections, and diver certification requirements, driving the adoption of certified high-quality equipment. Asia-Pacific markets vary; advanced tourist destinations implement global safety standards, while emerging regions rely on local regulations with flexible enforcement. Differences in regulatory compliance affect product approvals, consumer trust, and liability management. Suppliers providing certified, regulation-compliant gear gain market credibility, while regional players supply cost-effective, locally compliant solutions. Regulatory contrasts shape adoption, brand trust, and competitive positioning across global scuba diving equipment markets.

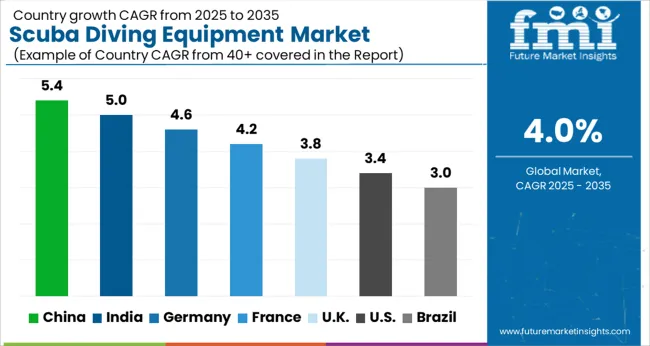

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global scuba diving equipment market was projected to grow at a 4.0% CAGR through 2035, driven by demand in recreational, commercial, and professional diving applications. Among BRICS nations, China recorded 5.4% growth as large-scale manufacturing and assembly facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 5.0% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 4.6% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 3.8% relied on moderate-scale operations for recreational and professional diving equipment. The USA, expanding at 3.4%, remained a mature market with steady demand across commercial, recreational, and professional diving segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The scuba diving equipment market in China is being driven at a CAGR of 5.4% by increasing recreational and professional diving activities. Advanced diving masks, regulators, and buoyancy control devices are being adopted by divers to enhance underwater safety and performance. Government initiatives to promote marine tourism are being supported, and water sports centers are being equipped with modern scuba gear. Manufacturers are focusing on high quality, durable, and ergonomic equipment to meet local demand. Distribution through specialty stores, e commerce platforms, and diving schools is being ensured. Awareness about diving safety and underwater exploration is being raised through training programs and workshops. The growing popularity of diving tourism and increasing disposable income are being considered major growth factors for the market in China.

In India, the scuba diving equipment market is being expanded at a CAGR of 5.0% as interest in recreational and professional diving rises. Advanced scuba masks, regulators, fins, and buoyancy devices are being adopted by diving enthusiasts to ensure safety and performance. Diving schools and resorts are being equipped with modern scuba equipment to meet increasing demand. Manufacturers are being encouraged to provide durable, comfortable, and certified equipment. Distribution is being maintained through specialty retailers and online channels. Awareness campaigns and training programs are being conducted to educate divers on safety and proper equipment usage. Growing interest in marine tourism, combined with rising disposable incomes, is being considered a key factor for market growth in India.

Scuba diving equipment market in Germany is being driven at a CAGR of 4.6% due to increasing participation in recreational diving and underwater sports. Diving masks, regulators, wetsuits, and other gear are being used to improve underwater performance and safety. Specialized diving shops and online platforms are being utilized for product distribution. Manufacturers are being focused on producing high quality, durable, and ergonomically designed equipment. Awareness about diving safety and proper gear usage is being promoted through clubs and training centers. The popularity of diving tourism in coastal and inland water locations is being considered a key growth factor. Research and development in equipment design and safety features is also being undertaken to meet consumer expectations.

The United Kingdom market is being expanded at a CAGR of 3.8% as recreational and professional diving activities continue to grow. Diving equipment such as regulators, masks, fins, and buoyancy devices is being adopted by enthusiasts and training schools. Manufacturers are being focused on producing reliable, comfortable, and safety certified equipment. Distribution is being maintained through specialized diving stores and e commerce platforms. Awareness programs and diving courses are being conducted to educate consumers about equipment usage and safety protocols. Coastal tourism and water sport activities are being considered key contributors to market growth in the United Kingdom. Research in material durability and ergonomics is also being carried out to enhance product quality and consumer satisfaction.

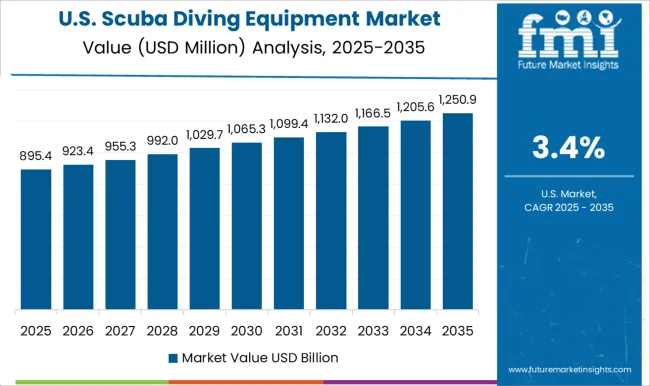

The United States market is being driven at a CAGR of 3.4% as participation in recreational and professional diving grows. Diving masks, regulators, fins, wetsuits, and buoyancy devices are being adopted to ensure safe and efficient underwater performance. Manufacturers are being encouraged to produce high quality, durable, and certified equipment. Distribution through diving specialty stores, online retailers, and training schools is being ensured. Awareness campaigns and training programs are being conducted to educate divers on safety and proper gear usage. Coastal and inland water sports tourism is being considered a key driver for market growth. Research and innovation in equipment design and material durability is being undertaken to meet consumer expectations and enhance overall diving experience in the United States.

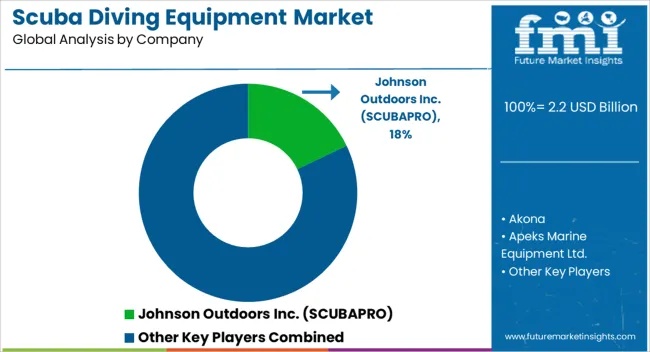

The scuba diving equipment market is recognized as a dynamic and specialized segment within the global recreational and professional underwater sports industry, where essential gear is provided for safe and enjoyable underwater exploration. Key suppliers in this market are represented by Johnson Outdoors Inc. (SCUBAPRO), Akona, Apeks Marine Equipment Ltd., Aqua Lung, Atomic Aquatics, Beuchat International S.A., Cressi Sub S.p.A., Dive Rite, Hollis, and Sherwood Scuba. A wide range of products, including regulators, buoyancy control devices (BCDs), dive computers, masks, fins, wetsuits, and underwater accessories, is manufactured by these companies to cater to both recreational divers and professional diving operations. High-quality regulators, BCDs, and advanced dive computers are provided by Johnson Outdoors Inc. (SCUBAPRO) and Aqua Lung, where durability and cutting-edge technology are combined. Precision-engineered premium diving gear is offered by Atomic Aquatics, while technical diving equipment suitable for deep and extended underwater missions is produced by Apeks Marine Equipment Ltd.. Comprehensive product ranges that emphasize user comfort, safety, and innovation in mask and snorkel technology are offered by Cressi Sub S.p.A. and Beuchat International S.A. Specialized technical diving equipment, rebreathers, and scuba accessories are produced by Dive Rite, Hollis, Akona, and Sherwood Scuba for professional divers, underwater photographers, and rescue operations. Market growth is driven by the rising popularity of recreational diving, marine tourism, and professional underwater applications, including research, conservation, and military operations. Continuous investments in research and development are made by these leading suppliers to improve safety, performance, and ergonomic design, ensuring compliance with international diving standards and meeting the evolving needs of divers worldwide. Innovation, quality assurance, and extensive global distribution networks are leveraged by these companies to maintain leadership in the competitive scuba diving equipment market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Equipment Type | Wetsuits & drysuits, Diving masks & goggles, Regulators & octopuses, Buoyancy Control Devices (BCDs), Fins, and Others |

| Consumer Group | Men, 18-35 years, 36-55 years , 55 and above, Women, 18-35 years, 36-55 years , and 55 and above |

| Distribution | Specialty stores, Online retailers, and Supermarkets & hypermarkets |

| Price Range | Low-mid end equipment and High-end equipment |

| End User | Recreational divers, Professional divers, and Military and public safety divers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Johnson Outdoors Inc. (SCUBAPRO), Akona, Apeks Marine Equipment Ltd., Aqua Lung, Atomic Aquatics, Beuchat International S.A., Cressi Sub S.p.A., Dive Rite, Hollis, and Sherwood Scuba |

| Additional Attributes | Dollar sales vary by equipment type, including regulators, dive computers, buoyancy control devices, wetsuits, and fins; by application, such as recreational diving, professional diving, and technical diving; by end-use, spanning individual divers, dive centers, and commercial operations; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising adventure tourism, water sports popularity, and increasing scuba certification programs. |

The global scuba diving equipment market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the scuba diving equipment market is projected to reach USD 3.2 billion by 2035.

The scuba diving equipment market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in scuba diving equipment market are wetsuits & drysuits, diving masks & goggles, regulators & octopuses, buoyancy control devices (bcds), fins and others.

In terms of consumer group, men segment to command 38.4% share in the scuba diving equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Scuba Gloves Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Diving Tourism Providers

Diving Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Diving Regulator Market Analysis – Trends, Growth & Forecast 2024-2034

Diving And Survival Equipment Market Size and Share Forecast Outlook 2025 to 2035

UK Diving Tourism Market Insights – Demand, Trends & Forecast 2025-2035

USA Diving Tourism Market Trends – Growth, Demand & Outlook 2025-2035

Japan Diving Tourism Market Analysis – Size, Share & Industry Trends 2025-2035

Germany Diving Tourism Market Report – Growth, Innovations & Forecast 2025-2035

GCC Countries Diving Tourism Market Analysis – Size, Share & Forecast 2025-2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA