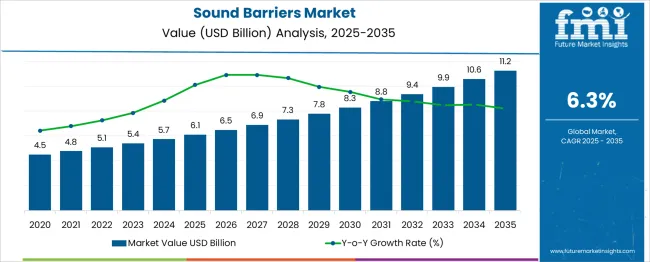

The Sound Barriers Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The growth pattern over the decade shows consistent annual expansion with a gradual increase in the size of yearly increments, signaling a stable but strengthening demand trajectory. Between 2025 and 2030, the market value is set to reach USD 8.3 billion, representing a five-year growth of USD 2.2 billion.

Annual growth during this phase remains steady at around USD 0.4–0.5 billion, supported by long-term infrastructure development projects, expansion of highway networks, and adherence to established noise mitigation requirements. Demand in this phase reflects predictable project pipelines and continuity in public and private sector investments.

From 2030 to 2035, the market adds USD 2.8 billion, with annual gains rising to nearly USD 0.6 billion by the end of the period. The acceleration is linked to new urban transport initiatives, stricter environmental noise control mandates, and the shift toward advanced composite materials offering improved performance and durability. The data suggests a smooth upward growth curve with greater value creation potential emerging in the later half of the forecast period, driven by regulatory and technological advancements.

| Metric | Value |

|---|---|

| Sound Barriers Market Estimated Value in (2025 E) | USD 6.1 billion |

| Sound Barriers Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The sound barriers market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.3% of the global noise control solutions market, driven by the need to mitigate noise pollution in urban and transport environments. Within the transportation infrastructure sector, a share of approximately 3.5% is assessed as highways, railways, and metro systems increasingly integrate noise mitigation structures.

In the construction materials industry, around 2.6% is observed reflecting the production of concrete, metal, and composite panels for acoustic applications. Within the environmental protection and urban planning market, about 2.1% is evaluated as part of regulatory compliance projects. In the industrial noise abatement sector, a contribution of roughly 2.8% is calculated due to adoption in manufacturing and energy facilities.

Market development has been influenced by expanding infrastructure projects and stricter noise regulation enforcement. Innovations have focused on lightweight composite panels, transparent acrylic barriers for visual aesthetics, and modular designs for faster installation. Interest has been growing in barriers with integrated greenery and solar panels, offering dual benefits of noise reduction and sustainability features.

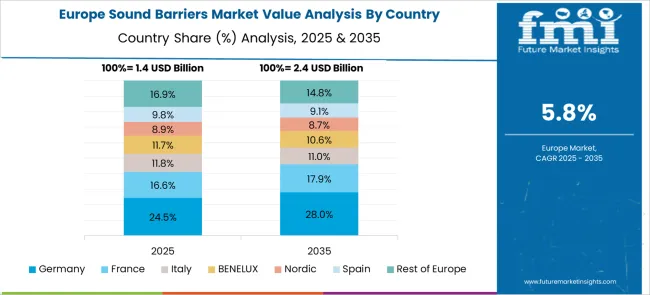

The Asia Pacific region has been observed to lead in deployment due to rapid transport network expansion, while Europe has maintained high adoption under stringent environmental laws. Strategic initiatives have included collaborations between civil engineering firms and material technology providers to deliver high performance sound barrier systems optimized for durability, weather resistance, and long term acoustic performance.

The sound barriers market is witnessing steady growth driven by rising urbanization, infrastructure expansion, and regulatory mandates on noise pollution control. Growing population density in urban centers has intensified the need for acoustic insulation in highways, rail corridors, and industrial zones.

Local authorities and transportation planners are integrating sound barriers as part of sustainable urban development projects, while noise ordinances are being tightened to protect public health. Adoption is further supported by advancements in modular noise attenuation technologies, easier installation protocols, and increasing investments in smart city initiatives.

As awareness rises around the environmental and health consequences of noise exposure, demand for both permanent and mobile sound mitigation systems is projected to increase. Future growth is likely to be influenced by innovations in material science, sustainability practices, and policy-driven infrastructure upgrades.

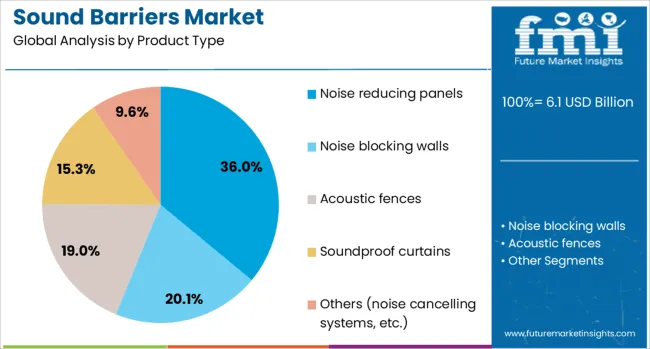

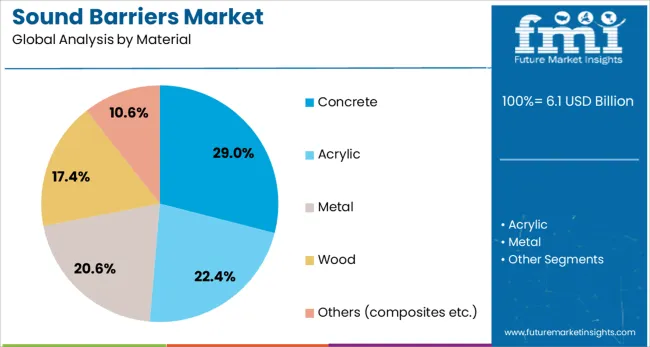

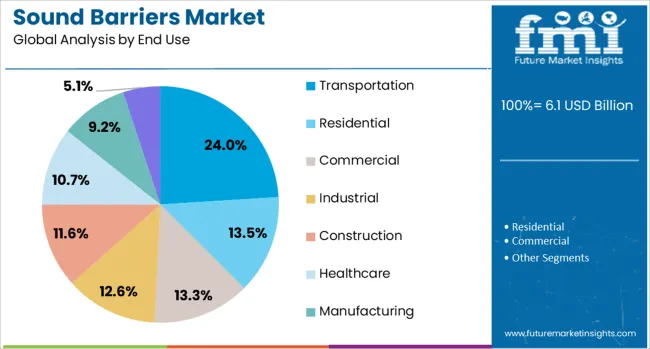

The sound barriers market is segmented by product type, material, end use, distribution channel, and geographic regions. By product type, the sound barriers market is divided into noise-reducing panels, noise-blocking walls, Acoustic fences, Soundproof curtains, and Others (noise-cancelling systems, etc.). In terms of material, the sound barriers market is classified into Concrete, Acrylic, Metal, Wood, and Others (composites, etc.). Based on end use, the sound barriers market is segmented into Transportation, Residential, Commercial, Industrial, Construction, Healthcare, Manufacturing, and Others (energy & utilities, etc.). The distribution channel of the sound barriers market is segmented into Direct sales and Indirect sales. Regionally, the sound barriers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Noise reducing panels are projected to account for 36.00% of the market revenue in 2025, establishing them as the dominant product type. Growth of this segment has been underpinned by its effectiveness in absorbing and deflecting sound across various infrastructure settings.

Their widespread use in urban planning and industrial zones is supported by modularity, ease of deployment, and compatibility with diverse surface finishes. Innovations in perforated metal and composite layering have enabled improved acoustic performance while reducing structure weight.

These panels are increasingly integrated into both temporary and long-term installations, offering flexibility to infrastructure operators seeking scalable and cost-effective solutions.

Concrete is expected to command 29.00% of the market share by 2025, making it the leading material used in sound barrier systems. This dominance is driven by its superior noise absorption, durability, and structural integrity in outdoor environments.

Concrete’s resistance to weather and vandalism makes it particularly suitable for high-traffic transport corridors and industrial sites. Precast concrete barriers are increasingly preferred due to reduced installation times and lower maintenance costs.

Furthermore, its ability to be molded into aesthetic forms and integrated with absorptive finishes supports urban beautification goals alongside noise mitigation.

The transportation sector is forecast to hold 24.00% of the total market share by 2025, positioning it as the largest end-use application. Expansion of highway networks, railway modernization, and airport infrastructure upgrades are key contributors to this segment’s leadership.

Regulatory compliance with environmental noise directives and growing public opposition to traffic noise have driven large-scale deployment along transit corridors. Governments and private contractors are investing in long-lasting, high-performance barriers that can withstand vehicular and environmental stress.

As smart transport planning emphasizes noise control as a quality-of-life factor, the adoption of sound barriers in transportation projects is anticipated to accelerate further.

Sound barriers have been widely deployed along highways, railways, industrial sites, and urban construction zones to reduce noise pollution and improve environmental quality. These structures have been engineered using materials such as concrete, metal, wood, and transparent acrylic panels to absorb or deflect sound waves. Demand has been influenced by expanding transportation networks, stricter noise control regulations, and increased public awareness of noise-related health concerns. Manufacturers have focused on modular designs, lightweight materials, and aesthetic integration to meet both functional and visual requirements in noise-sensitive areas.

The growth of road and rail infrastructure projects has been a major driver for sound barrier installations. Government agencies in North America, Europe, and Asia have enforced noise level limits near residential and sensitive zones, prompting highway authorities to include barriers in project plans. Rail operators have installed barriers along high-speed and freight lines to mitigate noise from passing trains. Urban development projects near transportation corridors have also incorporated sound barriers to maintain livability standards. Precast concrete panels, metal sheets, and composite materials have been selected based on project-specific acoustic performance needs. The integration of barriers into bridge and overpass designs has optimized land use while meeting regulatory compliance. The combination of infrastructure growth and policy enforcement has sustained consistent demand across regions.

Advancements in materials have improved the acoustic performance, durability, and appearance of sound barriers. Transparent acrylic and polycarbonate panels have been introduced to preserve visibility while reducing noise levels, particularly in scenic areas. Composite materials with sound-absorbing cores have reduced structure weight while maintaining high noise reduction coefficients. Manufacturers have applied anti-graffiti coatings and weather-resistant finishes to extend service life and minimize maintenance costs. In some cases, barriers have been combined with vegetation to create visually appealing green walls that also provide additional noise absorption. These innovations have helped address both technical and aesthetic considerations, making modern sound barriers more adaptable to diverse project environments.

Beyond transportation, sound barriers have been increasingly installed in urban construction zones, manufacturing facilities, and power plants to contain operational noise. Industrial users have sought barriers with higher durability and fire resistance to withstand harsh working conditions. Construction companies have adopted temporary and portable noise barriers to comply with municipal noise ordinances during building projects. In densely populated areas, barriers have been used to shield schools, hospitals, and residential complexes from adjacent noise sources. This diversification of applications has broadened the customer base for manufacturers and installation contractors, reducing reliance on government-funded transportation projects alone.

Sound barrier projects have often involved high material, transportation, and labor costs, especially for large-scale installations along extended road or rail corridors. Complex site conditions, such as uneven terrain or restricted access, have increased construction timelines and expenses. In some cases, public opposition to barrier designs has delayed implementation due to visual impact concerns. Maintenance requirements, particularly for barriers exposed to vandalism or severe weather, have added to long-term operational costs. Budget constraints in smaller municipalities and developing countries have limited project approvals despite clear noise mitigation needs. Without cost-effective solutions, streamlined installation processes, and greater community engagement, adoption may remain strongest in well-funded infrastructure programs.

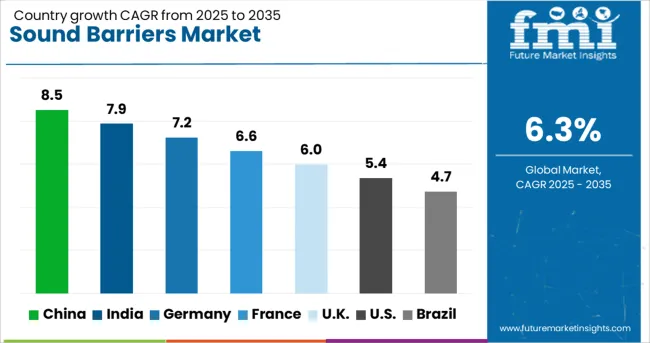

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The sound barriers market is expected to grow at a global CAGR of 6.3% between 2025 and 2035, driven by increasing urban infrastructure projects, rising transportation noise control needs, and stricter environmental regulations. China leads with an 8.5% CAGR, supported by large-scale highway and railway expansion projects. India follows at 7.9%, fueled by rapid urbanization and government investment in noise mitigation infrastructure. Germany, at 7.2%, benefits from advanced engineering solutions and strong environmental compliance standards. The UK, projected at 6.0%, sees growth from urban redevelopment and transport upgrades. The USA, at 5.4%, reflects steady demand from road expansion and residential noise protection initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.5% from 2025 to 2035 in the sound barriers market, supported by large-scale transportation infrastructure projects and urban noise reduction initiatives. Domestic suppliers such as Hebei Jinbiao, Yadong Noise Control, and Qingdao Quietek are producing advanced composite barriers for highways, railways, and industrial sites. Transparent acrylic barriers and absorptive aluminum panel systems are gaining popularity for their durability and visual appeal. Expanding high-speed rail networks and elevated expressways are creating continuous demand for large-scale noise mitigation solutions.

India is forecasted to achieve a CAGR of 7.9% from 2025 to 2035, driven by infrastructure upgrades and regulatory focus on environmental noise control. Key companies such as Envirotech Systems, Everest Composites, and STP Limited are supplying metal, concrete, and polycarbonate barriers for highways, metro lines, and industrial zones. Urban flyover and elevated metro projects are driving demand for lightweight and quick-to-install solutions. The integration of greenery with vertical barriers for aesthetic enhancement is also gaining traction in metropolitan areas.

Germany is projected to post a CAGR of 7.2% from 2025 to 2035, supported by strict environmental noise standards and advanced material engineering. Manufacturers such as Kohlhauer, Rieder Group, and Graepel are developing highly absorptive panels using recycled composites and mineral wool cores. Modular sound barrier systems are being adopted for rapid deployment along autobahns and rail corridors. Research into aerodynamic designs is helping to reduce wind loads and improve structural stability in exposed locations.

The United Kingdom is expected to record a CAGR of 6.0% from 2025 to 2035, driven by highway expansion, urban regeneration projects, and increased rail traffic. Companies such as Jacksons Fencing, IAC Acoustics, and Sound Barrier Solutions are delivering timber, steel, and acrylic barriers tailored for both functional and aesthetic performance. Custom-designed barriers for residential zones are becoming more common to meet community-specific requirements. Local authorities are increasingly specifying barriers with integrated solar panels for dual-purpose applications.

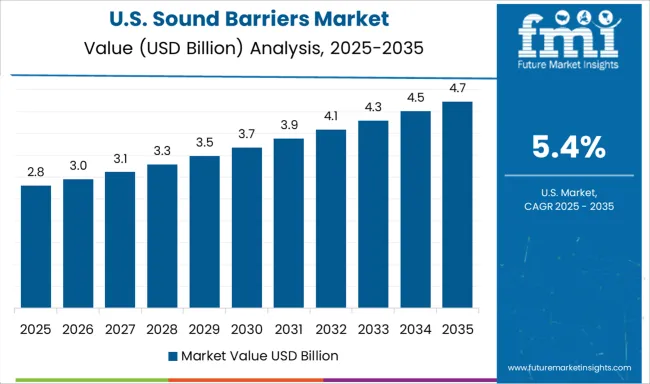

The United States is forecasted to grow at a CAGR of 5.4% from 2025 to 2035, supported by demand from interstate highway projects, airport expansions, and urban rail upgrades. Leading manufacturers such as Valmont Industries, Durisol, and Armtec are producing high-strength concrete and composite barriers with enhanced sound absorption. DOT-funded noise mitigation programs are sustaining steady demand, while architectural-grade barriers are being installed in mixed-use developments to balance noise control with visual design.

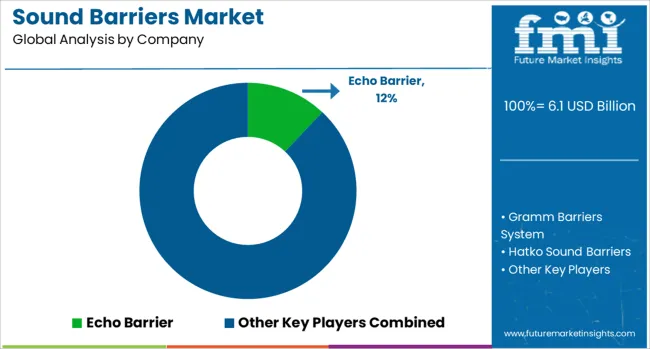

The sound barriers market is led by global construction material companies and specialized acoustic solution providers catering to infrastructure, industrial, and commercial noise control applications. Echo Barrier and Noise Barriers are prominent in supplying portable and temporary noise control systems for construction sites, events, and maintenance projects. Gramm Barriers System, Hering Group, and Kohlhauer focus on permanent highway and railway noise barriers, offering modular designs with materials such as aluminum, steel, and composite panels.

Hatko Sound Barriers and Palram Industries produce polymer-based acoustic panels that combine noise reduction with weather resistance, suitable for urban infrastructure and industrial plants. Rockwool and Saint-Gobain integrate sound-absorbing mineral wool and composite materials into durable barrier systems, often used in large-scale public works. Polymer Technologies and Technicon Acoustics provide customized soundproofing solutions for manufacturing facilities, machinery enclosures, and HVAC applications. RVT Group specializes in temporary acoustic barriers for construction compliance, while Schalltechnische Anlagen and Schutte deliver engineered systems for industrial noise abatement.

Ramo offers lightweight, modular designs for easy installation in both permanent and temporary settings. Key strategies include developing multi-functional barriers that combine noise control with aesthetic design, securing long-term infrastructure contracts, and enhancing portability for rapid deployment in temporary applications. Entry into this market is limited by material engineering expertise, compliance with environmental noise regulations, and established supplier relationships with government and infrastructure developers.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Product Type | Noise reducing panels, Noise blocking walls, Acoustic fences, Soundproof curtains, and Others (noise cancelling systems, etc.) |

| Material | Concrete, Acrylic, Metal, Wood, and Others (composites etc.) |

| End Use | Transportation, Residential, Commercial, Industrial, Construction, Healthcare, Manufacturing, and Others (energy & utilities etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Echo Barrier, Gramm Barriers System, Hatko Sound Barriers, Hering Group, Kohlhauer, Noise Barriers, Palram Industries, Polymer Technologies, Ramo, Rockwool, RVT Group, Saint-Gobain, Schalltechnische Anlagen, Schutte, and Technicon Acoustics |

| Additional Attributes | Dollar sales by barrier material and end‑use application, demand dynamics across transportation (highways, railways, airports), construction/infrastructure, industrial facilities, and residential/commercial buildings, regional trends in concrete vs composite vs transparent acrylic/polycarbonate vs recycled-wood and rubber-based barriers across North America, Europe, and Asia‑Pacific, innovation in eco‑friendly composite panels, transparent aesthetic barriers, solar-integrated and smart sensor-enabled designs, environmental impact of material lifecycle, energy use, recyclability and pollution dispersion effects, and emerging use cases in smart cities, community-acoustic zones, modular prefabricated systems, and integrated noise-energy-harvesting barriers. |

The global sound barriers market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the sound barriers market is projected to reach USD 11.2 billion by 2035.

The sound barriers market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in sound barriers market are noise reducing panels, noise blocking walls, acoustic fences, soundproof curtains and others (noise cancelling systems, etc.).

In terms of material, concrete segment to command 29.0% share in the sound barriers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sound Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Sound Meter Market Size and Share Forecast Outlook 2025 to 2035

Sound Level Measurement Meter Market Size and Share Forecast Outlook 2025 to 2035

Soundproof Drywall Materials Market Size and Share Forecast Outlook 2025 to 2035

Sound Reinforcement Market Size and Share Forecast Outlook 2025 to 2035

Sound Level Meter Market Size and Share Forecast Outlook 2025 to 2035

Sound Sensor Market Analysis by Type, Technology, Specification, and Region Through 2035

Utrasound Doppler Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Ultrasound Imaging Solution Market

Vapor Barriers Market Size and Share Forecast Outlook 2025 to 2035

Teleultrasound Systems Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA