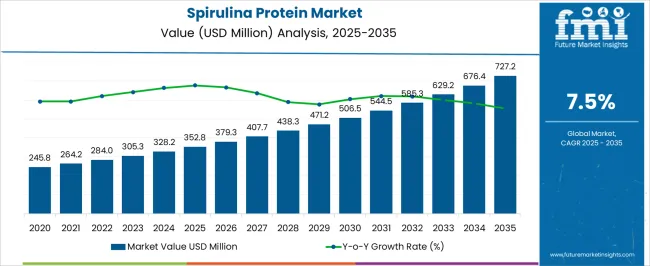

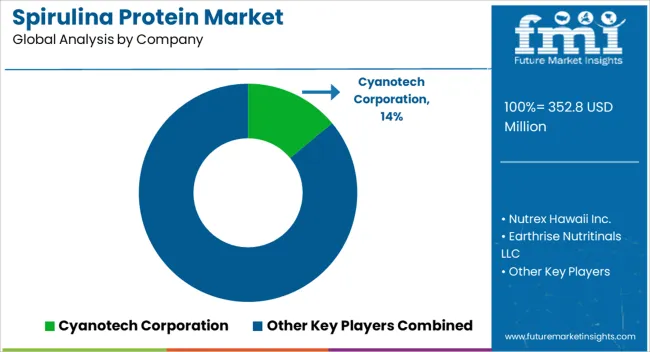

The spirulina protein market is estimated to be valued at USD 352.8 million in 2025 and is projected to reach USD 727.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. The cost structure and value-chain composition of this market reveal a multifaceted distribution of expenditures across cultivation, processing, extraction, formulation, and distribution segments. Cultivation represents a substantial portion of total costs due to the controlled environment required for Spirulina growth, including water management, nutrient supplementation, and energy-intensive monitoring systems.

Processing and extraction contribute significantly, as drying, powdering, and protein concentration involve sophisticated technologies and specialized equipment to ensure product purity and bioavailability. Formulation and packaging costs account for an additional share, particularly in value-added products such as dietary supplements, functional foods, and nutraceutical applications. R&D investments, though smaller in absolute terms, are critical in optimizing yield, improving protein quality, and developing innovative product formats. Distribution and logistics further influence the cost structure, given the sensitivity of Spirulina protein to temperature and humidity, requiring cold chain solutions in some cases.

Over the forecast period, cost allocation is expected to shift toward technology-driven extraction and formulation processes, which are projected to account for an increasing share of overall expenditure. By 2035, extraction and formulation may comprise up to 35–40% of the total value chain cost, reflecting the industry’s emphasis on product differentiation, quality assurance, and enhanced functional performance. This evolving cost structure underscores the strategic importance of operational efficiency and technology integration in driving market competitiveness and profitability.

| Metric | Value |

|---|---|

| Spirulina Protein Market Estimated Value in (2025 E) | USD 352.8 million |

| Spirulina Protein Market Forecast Value in (2035 F) | USD 727.2 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The current landscape reflects a strong consumer shift toward functional foods and nutritional supplements, influenced by rising health awareness and growing concerns around environmental impact from conventional animal protein. Technological advancements in algae cultivation and processing have enabled enhanced purity and scalability, making spirulina protein more commercially viable across industries.

Reports from corporate disclosures and food innovation conferences indicate that manufacturers are focusing on product quality, traceability, and bioavailability to align with regulatory expectations and consumer preferences. Additionally, spirulina’s rich amino acid profile and natural antioxidant properties are driving its adoption across both developed and emerging markets.

The future outlook appears promising as governments and industry bodies promote sustainable food production and as clean-label, vegan, and allergen-free formulations gain greater market acceptance. These factors are expected to support the long-term expansion of the Spirulina Protein market.

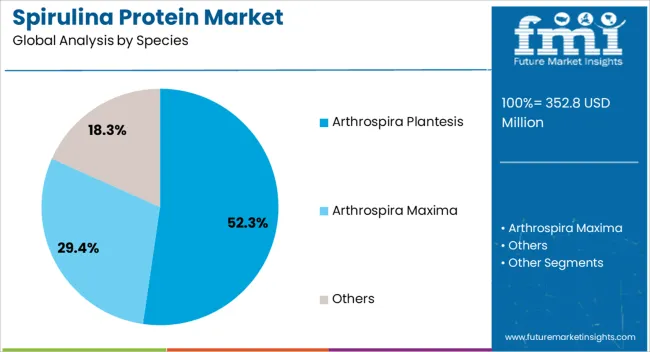

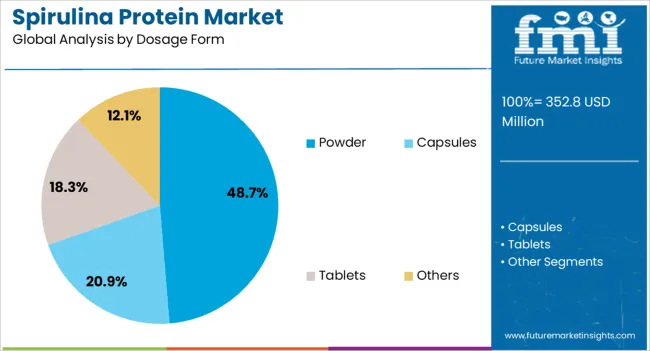

The spirulina protein market is segmented by species, dosage form, application, and geographic regions. By species, the spirulina protein market is divided into Arthrospira Plantesis, Arthrospira Maxima, and Others. In terms of dosage form, the spirulina protein market is classified into Powder, Capsules, Tablets, and Others.

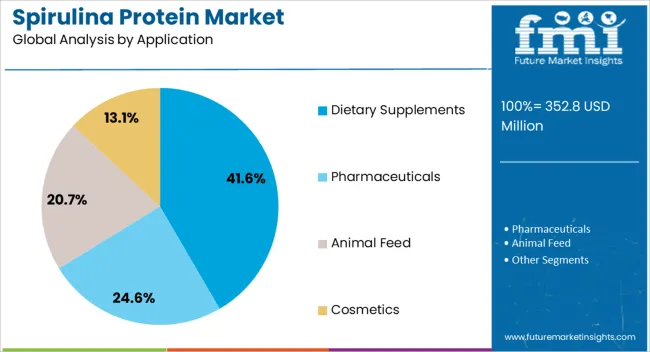

Based on application, the spirulina protein market is segmented into Dietary Supplements, Pharmaceuticals, Animal Feed, Cosmetics, and Others. Regionally, the spirulina protein industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The arthrospira plantesis species segment is projected to account for 52.3% of the Spirulina Protein market revenue share in 2025, making it the leading species used in commercial applications. Its dominant position is attributed to its high protein content, digestibility, and rich nutritional profile, which includes essential amino acids, vitamins, and minerals.

Food science journals and biotechnology company reports have highlighted that arthrospira plantesis is preferred for its efficient cultivation in controlled environments and its adaptability to various production systems. Its application in human nutrition has been supported by its GRAS status and compliance with global food safety regulations.

Moreover, manufacturers have increasingly adopted this species in supplement and food formulations due to its consistent yield and favorable organoleptic properties. The segment’s growth has been reinforced by expanding investment in microalgae farming technologies and increased research into therapeutic benefits, making Arthrospira Plantensis the preferred choice in spirulina protein production.

The powder dosage form segment is expected to contribute 48.7% of the Spirulina Protein market revenue share in 2025, establishing it as the leading form of delivery. This leadership is being driven by its flexibility in formulation, ease of integration into a wide range of food and beverage products, and extended shelf life.

Powdered spirulina is being widely adopted in dietary supplements, smoothies, snack bars, and functional beverages due to its ease of storage, transport, and mixing. Industry sources and product development updates have indicated that manufacturers favor powder form for its stability, high concentration, and ability to maintain nutrient density throughout processing.

The rise of home-based health routines and clean-label demands has further elevated consumer preference for powder over other formats. Additionally, retailers have increasingly stocked powdered spirulina due to its broad usage potential and appeal to health-conscious and vegan consumers, which has sustained its position as the preferred dosage form globally.

The dietary supplements application segment is projected to hold 41.6% of the Spirulina Protein market revenue share in 2025, positioning it as the dominant application area. This growth has been driven by rising consumer demand for plant-based nutritional products that support immunity, energy, and overall wellness.

Health and nutrition trade publications have noted that spirulina is being increasingly included in capsules, tablets, and functional blends aimed at fitness and wellness enthusiasts. The dietary supplements sector has been further supported by expanding retail distribution, e-commerce penetration, and growing awareness of spirulina’s natural antioxidant and anti-inflammatory properties.

Industry reports from supplement manufacturers have emphasized the alignment of spirulina with trending product claims such as organic, non-GMO, and sustainable, all of which resonate with current consumer expectations. The segment’s expansion is also being propelled by its role in personalized nutrition and preventive healthcare, making it the most prominent end-use category within the spirulina protein landscape.

The market has expanded due to increasing demand for nutrient-dense, plant-based protein sources in functional foods, dietary supplements, and beverages. Spirulina is valued for its high protein content, essential amino acids, and bioactive compounds that support immunity, muscle maintenance, and overall wellness. Growth has been driven by health-conscious consumers, rising adoption of vegan and vegetarian diets, and the incorporation of spirulina into nutraceuticals, energy bars, smoothies, and fortified products. Sustainable cultivation methods and advancements in extraction technologies have further reinforced the global adoption of spirulina protein ingredients.

Spirulina protein has been increasingly adopted due to its nutritional density and functional versatility in food and beverage applications. High protein concentration, essential amino acids, and antioxidant compounds allow integration into protein powders, smoothies, energy bars, and dietary supplements. Functional properties such as water-binding, emulsification, and solubility have facilitated incorporation into beverages, baked goods, and fortified snacks without compromising texture or taste. Flavor-masking technologies have been employed to reduce the natural earthy taste, improving consumer acceptance. Nutraceutical products have leveraged bioactive pigments such as phycocyanin for immune support and anti-inflammatory benefits. Continuous product development and formulation innovation have expanded applications, reinforcing spirulina protein as a preferred ingredient for health-focused and functional food products globally.

Consumer awareness of health and wellness trends has significantly influenced spirulina protein adoption. Increasing preference for plant-based proteins, dietary supplements, and functional foods has created a strong market pull. Health-conscious individuals have sought protein sources that support muscle development, weight management, immunity, and antioxidant intake. The vegan and vegetarian population has driven the demand for alternative protein sources, while sports nutrition and fitness-oriented segments have increasingly incorporated spirulina protein for recovery and performance. Nutritional labeling and educational campaigns have enhanced understanding of spirulina’s benefits, contributing to increased adoption in powders, capsules, drinks, and fortified food products. These dietary trends have positioned spirulina protein as a versatile, high-value ingredient within health-focused food and supplement markets worldwide.

The growth of the spirulina protein market has been supported by sustainable cultivation practices and supply chain improvements. Spirulina is primarily cultivated in controlled freshwater and saltwater ponds with high nutrient efficiency, reducing land and water usage compared to conventional protein sources. Advances in algae farming, including photobioreactor technology and optimized nutrient management, have increased yield and quality. Supply chain integration has ensured consistent delivery of high-purity spirulina powder, extracts, and protein concentrates. Partnerships between manufacturers and distributors have facilitated global availability for food, beverage, and nutraceutical applications. Sustainable cultivation practices, coupled with efficient processing and logistics, have strengthened the market by enabling scalable production and aligning with environmental and ethical sourcing expectations of health-conscious consumers globally.

Regulatory frameworks and quality assurance standards have influenced spirulina protein market adoption. Food safety authorities and international standards have established guidelines for purity, heavy metal limits, microbial safety, and labeling to ensure safe consumption. Certifications such as organic, non-GMO, and allergen-free have strengthened consumer confidence in spirulina protein products. Quality testing, traceability, and compliance with dietary supplement regulations have supported commercial deployment in capsules, powders, beverages, and fortified foods. Additionally, health claims related to immunity, antioxidant activity, and nutritional support have been monitored under regulatory guidelines, ensuring accurate marketing practices. Adherence to these regulatory standards has reinforced product reliability and market credibility, promoting sustained adoption of spirulina protein across nutraceutical, functional food, and beverage segments worldwide.

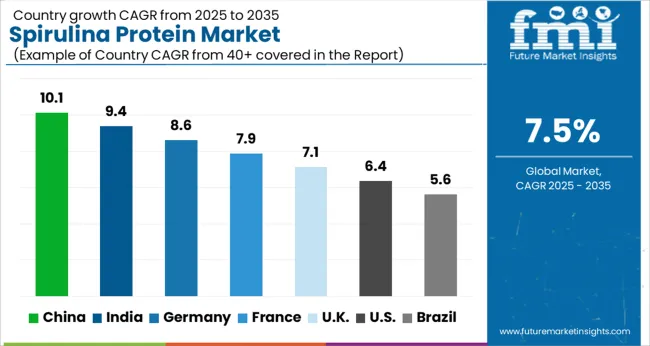

The market is expected to grow at a CAGR of 7.5% between 2025 and 2035, driven by increasing adoption of plant-based proteins, functional foods, and nutraceutical applications. China leads with a 10.1% CAGR, expanding large-scale cultivation and integration into health and food products. India follows at 9.4%, supported by rising consumer awareness and growing production capacities. Germany, at 8.6%, benefits from advanced biotechnology adoption and incorporation in dietary supplements. The UK, growing at 7.1%, focuses on innovation in health-oriented food products. The USA, at 6.4%, sees steady demand from nutraceuticals, supplements, and functional food sectors. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to grow at a CAGR of 10.1% in the market from 2025 to 2035, driven by increasing awareness of plant-based nutritional supplements and functional foods. Spirulina is being incorporated into beverages, protein powders, and fortified foods to meet the demand for high-protein, antioxidant-rich products. Domestic manufacturers are investing in cultivation technology improvements and quality control measures to enhance production efficiency and purity. Strategic collaborations between supplement brands and ingredient suppliers are facilitating wider market penetration and product innovation.

India is anticipated to expand at a CAGR of 9.4% in the industry from 2025 to 2035, supported by rising health awareness and demand for natural nutritional supplements. Spirulina is increasingly used in beverages, fortified foods, and nutraceutical formulations. Startups and established food companies are introducing innovative spirulina-based products, while research on cultivation techniques is enhancing yield and quality. Retail and online channels are broadening availability, ensuring access across urban and semi-urban populations.

Germany is forecast to grow at a CAGR of 8.6% in the market from 2025 to 2035, driven by consumer preference for plant-based and natural health products. Spirulina is increasingly included in protein powders, dietary supplements, and fortified foods. Food manufacturers and nutraceutical companies are adopting sustainable sourcing and high-quality production processes. Collaboration between research institutions and producers is improving extraction efficiency and purity, enhancing the competitiveness of spirulina products in the market.

The United Kingdom is expected to grow at a CAGR of 7.1% in the market from 2025 to 2035, supported by rising health-conscious consumer segments and functional food demand. Spirulina-based products are being integrated into beverages, snacks, and nutritional supplements. Retail and e-commerce channels are expanding product accessibility, while quality certifications and traceability measures are influencing consumer trust. Manufacturers are also emphasizing sustainable cultivation and processing methods.

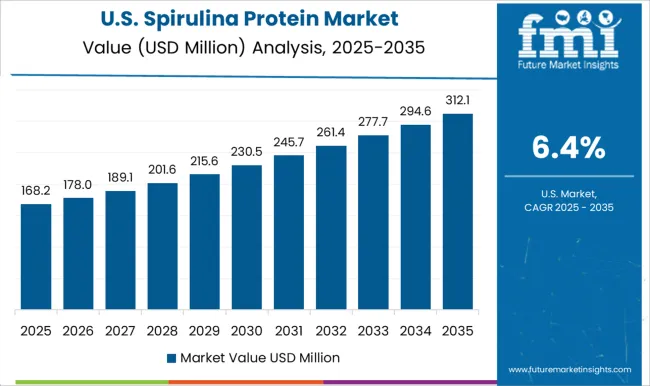

The United States is forecast to expand at a CAGR of 6.4% in the market between 2025 and 2035, driven by high demand in nutraceuticals, protein powders, and fortified foods. Manufacturers are investing in large-scale cultivation facilities, extraction technologies, and product innovation. Consumer preference for clean label and plant-based proteins is shaping market trends. Strategic partnerships between ingredient suppliers and supplement brands are supporting consistent supply and product diversification.

The market is driven by companies specializing in high-quality algae-based protein solutions for nutritional supplements, functional foods, and beverages. Cyanotech Corporation and Nutrex Hawaii Inc. are recognized for their advanced cultivation and processing capabilities, ensuring high purity and consistent protein content in their spirulina products. Earthrise Nutritional LLC emphasizes large-scale production and global distribution, providing powdered and tablet forms for diverse applications in dietary supplements and food fortification. Prolgae Spirulina Supplies Pvt. Ltd. and Far East Bio-Tec Co. Ltd. focus on process optimization and product standardization, enhancing protein concentration and bioavailability for consumer and industrial markets.

Yunna Green A Biological Project Co. Ltd. and E.I.D Parry (India) Ltd. have integrated sustainable cultivation practices and innovative drying techniques to maintain nutrient integrity while expanding production capacity. ENERGYbits Inc. and Allmicroalgae leverage specialized extraction methods and formulation expertise to deliver premium-grade spirulina protein tailored for health-focused applications.

Other participants, including JUNE Group of Companies, Phycom Microalgae, and Fuqing King Dnarmsa Spirulina Co. Ltd., emphasize collaborative research, new product development, and strategic partnerships to broaden market reach. Entry barriers in the market include the need for controlled cultivation environments, high capital investment in processing infrastructure, and adherence to strict quality and safety standards, which collectively limit new entrants and maintain competitive differentiation.

| Item | Value |

|---|---|

| Quantitative Units | USD 352.8 Million |

| Species | Arthrospira Plantesis, Arthrospira Maxima, and Others |

| Dosage Form | Powder, Capsules, Tablets, and Others |

| Application | Dietary Supplements, Pharmaceuticals, Animal Feed, Cosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cyanotech Corporation, Nutrex Hawaii Inc., Earthrise Nutritinals LLC, Prolgae Spirulina Supplies Pvt. Ltd., Far East Bio-Tec Co. Ltd., Yunna Green A biological Project Co. Ltd., E.I.d Parry (India) Ltd., ENERGYbits Inc., Allmicroalgae, JUNE Group of Companies (JUNE Spirulina), Phycom Microalgae, and Fuqing King Dnarmsa Spirulina Co. Ltd |

| Additional Attributes | Dollar sales by product form and end-use application, demand dynamics across dietary supplements, functional foods, beverages, and animal feed, regional trends in cultivation and consumption across Asia-Pacific, North America, and Europe, innovation in extraction techniques, powder and tablet formulations, and enhanced bioavailability, environmental impact of large-scale aquaculture, water usage, and energy consumption, and emerging use cases in plant-based protein products, nutraceuticals, and sustainable animal nutrition. |

The global spirulina protein market is estimated to be valued at USD 352.8 million in 2025.

The market size for the spirulina protein market is projected to reach USD 727.2 million by 2035.

The spirulina protein market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in spirulina protein market are arthrospira plantesis, arthrospira maxima and others.

In terms of dosage form, powder segment to command 48.7% share in the spirulina protein market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spirulina Extract Market Size, Growth, and Forecast for 2025-2035

Spirulina Powder Market Analysis - Growth, Applications & Outlook 2025 to 2035

Spirulina Beverages Market Outlook – Size, Share & Innovations 2025-2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA