The staple fiber market is advancing steadily, driven by the global textile industry's recovery and increased demand for sustainable, performance-based materials. Industry publications and trade reports have pointed to the rising adoption of synthetic and recycled fibers in response to changing consumer preferences and stricter environmental regulations.

Polyester staple fiber, in particular, has gained traction due to its durability, low cost, and versatile blending capabilities across end-use sectors. Manufacturers have expanded production capacities and introduced eco-friendly product lines to meet the growing demand for circular textile materials.

The shift toward fast fashion, coupled with the expanding activewear and athleisure categories, has further supported fiber consumption globally. Technological developments in fiber processing and dyeing efficiency have also contributed to improved product quality and reduced production timelines. Moving forward, market growth is expected to be fueled by investments in fiber recycling technologies, government-led sustainability initiatives, and demand from key applications such as apparel, home furnishings, and nonwovens for hygiene products.

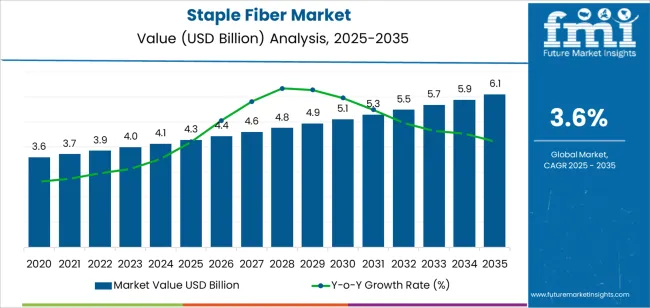

| Metric | Value |

|---|---|

| Staple Fiber Market Estimated Value in (2025 E) | USD 4.3 billion |

| Staple Fiber Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

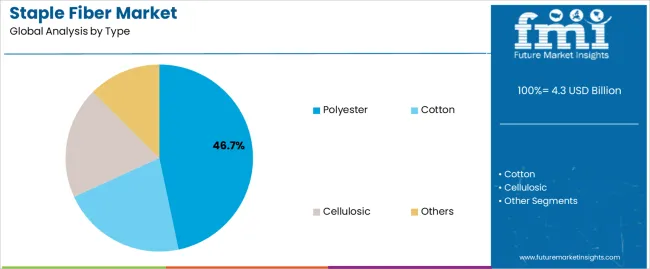

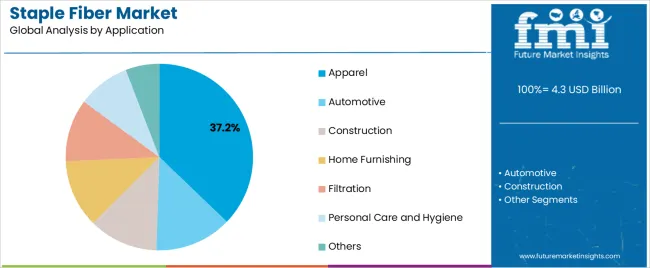

The market is segmented by Type and Application and region. By Type, the market is divided into Polyester, Cotton, Cellulosic, and Others. In terms of Application, the market is classified into Apparel, Automotive, Construction, Home Furnishing, Filtration, Personal Care and Hygiene, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyester segment is projected to contribute 46.7% of the staple fiber market revenue in 2025, maintaining its position as the leading fiber type. Growth in this segment has been driven by polyester’s inherent advantages, including high strength, abrasion resistance, and ease of processing across various textile applications.

The segment has benefited from the wide availability of raw materials and cost-effective manufacturing, enabling mass production for both industrial and consumer markets. Additionally, polyester’s compatibility with blended fabrics has supported its integration into value-added textile products.

Industry reports have highlighted increased investments in recycled polyester staple fibers, which align with global sustainability goals and support circular economy models in the textile sector. The material's dimensional stability and resilience under mechanical stress have made it a preferred choice in applications ranging from apparel to automotive textiles. With the textile industry emphasizing low-cost, high-performance, and eco-conscious solutions, the Polyester segment is expected to retain its dominant share in the global staple fiber market.

The Apparel segment is projected to account for 37.2% of the staple fiber market revenue in 2025, emerging as the dominant application category. This growth has been driven by the continual evolution of fashion trends and the rising global consumption of ready-to-wear and performance-based garments.

Apparel manufacturers have increasingly relied on staple fibers, particularly polyester, cotton blends, and viscose, to meet diverse performance requirements including moisture management, breathability, and comfort. The affordability and ease of processing of staple fibers have supported their widespread use in casualwear, activewear, and children's clothing.

Fashion retail chains have driven large-scale procurement of staple fiber-based fabrics to meet rapid inventory turnover. Additionally, sustainability commitments from apparel brands have led to increased adoption of recycled staple fibers in garment production. The segment’s resilience has also been supported by e-commerce growth, which has expanded product availability and consumer access worldwide. As consumer preferences continue to prioritize comfort, function, and sustainability, the Apparel segment is expected to remain the largest and most dynamic application area in the staple fiber market.

Sustainability and Eco-friendly Fibers to Fuel Demand

There was a growing demand for sustainable and eco-friendly staple fibers driven by increasing environmental consciousness among consumers and regulatory initiatives promoting sustainable manufacturing practices. Fibers derived from renewable sources such as bamboo, hemp, and recycled materials gained popularity as alternatives to traditional petroleum-based fibers.

Innovations in Fiber Technology to Gain Traction

Continuous innovations in fiber technology, including advances in spinning techniques and fiber blends, were driving the development of staple fibers with enhanced performance characteristics such as durability, moisture management, and thermal insulation. Manufacturers were focusing on producing fibers that meet the specific requirements of end-use applications such as apparel, home textiles, and nonwoven products.

Growing Demand for Synthetic Fibers to Surge Sales

Synthetic staple fibers, including polyester, polypropylene, and nylon, continued to dominate the staple fiber market due to their affordability, versatility, and wide range of applications. The demand for synthetic fibers was driven by their superior properties, such as strength, elasticity, and resistance to wrinkles and abrasion, making them ideal for use in various textile and industrial applications.

Raw Material Price Volatility to Impede Growth

Staple fiber production heavily relies on raw materials such as petroleum-based chemicals for synthetic fibers and natural resources like cotton or wool for natural fibers. Fluctuations in the prices of these raw materials due to factors like geopolitical tensions, supply chain disruptions, or changes in global demand can significantly impact production costs and profit margins for fiber manufacturers.

Consumers in the United States were showing a preference for functional staple fibers with added features such as antimicrobial properties, UV protection, and moisture-wicking capabilities. These functional fibers catered to the increasing demand for performance-driven textiles in sectors such as activewear, sportswear, and outdoor apparel.

There was a growing demand for sustainable and eco-friendly staple fibers in the United States, driven by increasing environmental awareness among consumers and regulatory initiatives promoting sustainable manufacturing practices. Fibers derived from renewable sources such as bamboo, hemp, and recycled materials gained popularity as alternatives to traditional petroleum-based fibers.

Continuous innovations in fiber technology were driving the development of staple fibers with enhanced performance characteristics such as durability, softness, and breathability. Manufacturers in the United States were investing in advanced spinning techniques, fiber blends, and finishing processes to meet the evolving needs of the textile industry. There was a growing emphasis on the use of recycled fibers in the United States, driven by initiatives to reduce waste and promote circular economy principles.

Similar to global trends, there was a notable shift towards sustainable and eco-friendly staple fibers in China. Manufacturers and consumers alike were increasingly prioritizing fibers derived from renewable sources, such as bamboo, hemp, and recycled materials, to reduce environmental impact and promote sustainable manufacturing practices.

China's staple fiber market saw a surge in demand for technical fibers with enhanced performance characteristics. These fibers, including those with moisture-wicking, antibacterial, UV-resistant, or flame-retardant properties, cater to various industries such as sportswear, outdoor gear, and automotive textiles, reflecting the growing demand for functional textiles in China.

Manufacturers in China were investing heavily in research and development to innovate new staple fiber technologies and formulations. This push for domestic innovation aimed to enhance product quality, improve production efficiency, and maintain competitiveness in both domestic and global markets.

The staple fiber industry in China was undergoing digital transformation and automation to improve manufacturing processes and enhance operational efficiency. Investments in technologies such as smart manufacturing, robotics, and data analytics enabled Chinese fiber manufacturers to optimize production, reduce costs, and ensure product consistency.

The staple fiber industry in the United Kingdom was embracing digitalization and Industry 4.0 technologies to improve manufacturing processes, enhance product quality, and optimize supply chain management. Automation, data analytics, and predictive maintenance played a crucial role in increasing operational efficiency and reducing production costs for fiber manufacturers.

Compliance with environmental regulations, safety standards, and product certifications remained a key consideration for staple fiber manufacturers operating in the United Kingdom. Stringent regulations governing chemical usage, emissions, and product labeling required companies to invest in compliance measures and sustainability initiatives.

Organic cotton has gained popularity due to its eco-friendly and chemical-free cultivation practices. Consumers concerned about pesticide residues and environmental pollution are opting for products made from organic cotton fibers. This trend has prompted textile manufacturers to seek out organic cotton sources and incorporate them into their product lines.

There's a growing demand for transparency and traceability throughout the cotton supply chain. Consumers want assurance that the cotton used in their products is sourced responsibly, from farm to finished product. As a result, companies are investing in traceability systems and certifications to provide visibility into the origins and production practices of their cotton fibers.

Genetically modified cotton varieties, such as Bt cotton, continue to dominate global cotton production. These GM cotton varieties are engineered to resist pests and reduce the need for chemical pesticides, leading to higher yields and improved fiber quality. However, concerns persist regarding the environmental impact and long-term sustainability of GM cotton cultivation.

Cotton is often blended with other fibers, such as polyester or viscose, to improve the performance and durability of textile products. Blended staple fibers offer advantages such as enhanced strength, wrinkle resistance, and color retention, catering to the diverse needs of consumers across various applications, from apparel to home textiles.

Staple fibers are extensively used in automotive interior textiles, including upholstery, carpets, headliners, and trunk linings. These fibers provide comfort, durability, and aesthetic appeal to vehicle interiors. Key trends in this segment include the demand for soft and luxurious fabrics, innovative designs, and functional features such as stain resistance, UV protection, and flame retardancy.

Staple fibers play a crucial role in automotive acoustic and thermal insulation materials. These fibers are used in the production of sound-absorbing materials for reducing interior noise levels and thermal insulation materials for improving cabin comfort and energy efficiency. Innovations in fiber technology and manufacturing processes are driving the development of lightweight, high-performance insulation materials tailored to the specific requirements of automotive applications.

The shift towards electro-mobility and lightweighting in the automotive industry is driving demand for innovative materials that offer high strength-to-weight ratios and improved energy efficiency. Staple fibers, particularly lightweight and high-performance fibers, play a vital role in light-weighting initiatives by replacing heavier materials and reducing vehicle mass without compromising structural integrity or safety.

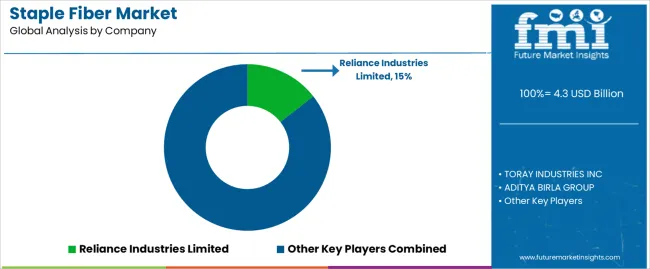

Key companies are investing heavily in research and development to introduce innovative products in the market. The research report provides a comprehensive assessment of the market, including insights, facts, historical data, and industry-validated data.

Companies functioning in the market offer a wide variety of products in different shapes, sizes, and colors. In addition, manufacturers offer customized packaged products to meet customer-specific requirements.

Industry Updates

The industry is segmented into cotton, cellulosic, polyester, and others.

The category is categorized into apparel, automotive, construction, home furnishing, filtration, personal care and hygiene, and others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, and the Middle East and Africa.

The global staple fiber market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the staple fiber market is projected to reach USD 6.1 billion by 2035.

The staple fiber market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in staple fiber market are polyester, cotton, cellulosic and others.

In terms of application, apparel segment to command 37.2% share in the staple fiber market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Staple Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA