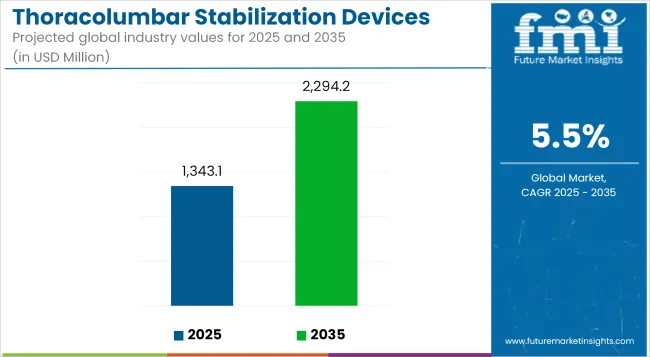

The Thoracolumbar Stabilization Devices Market is anticipated to be valued at USD 1,343.1 million in 2025 and is expected to reach USD 2,294.2 million by 2035, registering a CAGR of 5.5%.

| Metric | Value (USD Million) |

|---|---|

| Industry Size (2025E) | USD 1,343.1 million |

| Industry Value (2035F) | USD 2,294.2 million |

| CAGR (2025 to 2035) | 5.5% |

This market is poised for significant growth, driven by the increasing prevalence of spinal disorders, traumatic injuries, and age-related degenerative conditions. Advancements in minimally invasive surgical techniques, such as robotic-assisted systems and bioengineered materials, are enhancing surgical precision and reducing postoperative recovery times.

The rising demand for these devices is further fueled by the global aging population, leading to a higher incidence of vertebral compression fractures, spinal stenosis, scoliosis, and degenerative disc disease. As healthcare infrastructure improves and awareness of advanced surgical options increases, the market is expected to experience robust growth through 2035.

Posterior Stabilization Devices have been observed to dominate the thoracolumbar stabilization market, accounting for 67.3% of the global revenue share in 2025. This leadership has been attributed to the procedural simplicity and anatomical accessibility provided by posterior surgical approaches.

Due to fewer complications and a broader application in trauma, tumor, and deformity cases, posterior systems are widely preferred by spine surgeons globally. Moreover, enhanced instrumentation systems and the integration of image-guided navigation have improved the precision and safety of posterior stabilization, reinforcing clinical preference.

These devices have also been increasingly adopted in minimally invasive procedures, thereby expanding their utilization across outpatient settings. The posterior approach is also typically favored in multi-level fusion surgeries due to its stability and biomechanical advantages. As a result, procedural standardization and broader training availability among surgeons have further contributed to its dominant share in the market.

Titanium has been identified as the leading material in the thoracolumbar stabilization devices segment, securing 77.8% of total market revenue in 2025. The growth of this segment has been propelled by the material’s excellent strength-to-weight ratio, exceptional biocompatibility, and corrosion resistance.

These properties have made titanium implants the standard of care in spine surgeries, especially for long-term stabilization. Titanium’s compatibility with MRI imaging and its reduced risk of inflammatory response compared to stainless steel has further increased its adoption among healthcare providers.

The growing preference for minimally invasive and robotic-assisted spinal procedures has also favored titanium, as its malleability allows precise shaping without compromising structural integrity. Additionally, long-term performance, reduced incidence of implant-related complications, and strong regulatory approval histories have supported its sustained dominance across geographies.

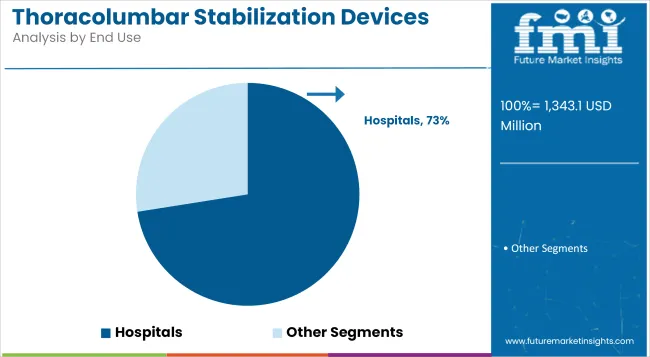

Hospitals have emerged as the leading end-user segment in the thoracolumbar stabilization devices market, commanding 72.5% of the global revenue share in 2025. This dominance has been attributed to the availability of advanced surgical infrastructure, neurosurgical expertise, and comprehensive patient care protocols, which are critical for thoracolumbar interventions.

These healthcare settings are equipped with high-end imaging systems, robotic-assisted surgery platforms, and intensive post-operative care, all of which are essential for managing complex spinal trauma, degenerative conditions, and oncologic procedures.

Furthermore, the presence of multidisciplinary spine care teams and streamlined insurance reimbursement pathways within hospital systems has encouraged patient preference and procedural volume concentration in this segment. As surgical procedures become more specialized, hospitals remain the preferred location for both primary and revision stabilization surgeries, ensuring their sustained market leadership.

Post-Surgical Complications and Implant Failures Is Emerging as The Significant Market Restraint.

There are multiple challenges to hardware utilization in resource-poor environments, which may inhibit broad consideration of thoracolumbar stabilization devices. One of the main barriers is the high cost of implants - especially if advanced materials and robotic-compatible systems are involved - making these stabilization solutions inaccessible to healthcare providers working in developing areas of the world.

Furthermore, the operative interventions associated with thoracolumbar instrumentation are typically complex procedures that necessitate an exceptional degree of surgical acumen and organizational backing. The variables of buffering on the one hand and operating infrastructure on the other create a duality around common outcomes as they split, stagger away from underperforming these areas.

Such inconsistent reimbursement policies - from one part of the world to another - especially with an increasing desire to bring hospitals’ costs down may yet limit access to the newer class of expensive devices.

The Growing Preference for Minimally Invasive Procedures Presents Significant Opportunities for Device Manufacturers.

Despite these challenges, the potential of thoracolumbar stabilization devices market is huge, as the advancements in technology and care delivery systems continue to evolve at a rapid pace. An area of rapid evolution is the utilization of 3D printing and patient-specific implant fabrication, which allows tailored stabilization constructs customized to each patient's spinal anatomy and pathology.

This results in better biomechanical compatibility with both improved outcomes and increases in a surgeon’s confidence. Minimally invasive surgery (MIS) technique is also becoming increasingly popular, allowing for percutaneous device placement with lower intensity, reduced blood loss, and rapid recovery which will have a crucial impact on the outpatient and day-care surgical models.

The onward migration of ASCs and bundled payment models is pushing hospitals and surgeons towards value-based devices that provide optimum performance and safety for the dollar. The surge of innovation within surgical navigation, augmented reality (AR), and intraoperative imaging further fuels precision-based implant positioning with enhanced complication rates.

Minimally Invasive Stabilization

Minimally invasive spinal surgery is changing the ways and methods of thoracolumbar stabilizations by rendering safe and fast alternatives for the traditional surgery. MISS techniques employ percutaneous screws, tubular retractors, and endoscopic visualization to minimize soft-tissue damage, intraoperative blood loss, and hospital stay.All these advantages become relevant in elderly and high-risk patients who may not be able to tolerate conventional open procedure.

Use of MIS stabilization systems is extending to trauma, tumor resection, and deformity correction cases, where preservation of spinal integrity with minimal disruption is crucial. Increasingly, simulation-based training and workshops in these techniques are being offered to surgeons. Manufacturers are developing special implant design for minimal invasive delivery, including low-profile rods and expandable interbody cages.

Biocompatible Materials Innovation

Material innovation is a key focus in the thoracolumbar stabilization devices market in order to improve biocompatibility, mechanical performance, and radiographic visibility. Titanium and titanium alloys are highly biocompatible and widely used in orthopedic implants. But more recent widening use of materials such as polyetheretherketone (PEEK) and carbon fiber-reinforced composites for their radiolucency and modulus of elasticity similar to natural bone could increase in wider use.

Temporary stabilization in select trauma cases using bioresorbable polymers is also being investigated and is an attractive option since the implant would degrade progressively after healing has occurred. They decrease long-term complications and avoid the need for secondary procedures. To increase bonding between the bone and the implant, osseointegration-promoting coatings and surface treatments such as hydroxyapatite, titanium plasma spray, or nano-structured textures are also being used.

AR platforms project preoperative imaging on the surgeon's field of view during an operation, thereby providing real-time information to support the surgical team in implant positioning and anatomical navigation. It enhances decision-making during surgery, minimizes radiation exposure to the patient and the surgical team provided by fluoroscopy, and, most importantly, enhances precision.

AR systems are being developed to interface with robotic platforms and navigation software for seamless planning and execution of complex stabilization cases. The beneficial application of AR is more evident in the minimally invasive approach when visibility is compromised but requires utmost precision.

The global thoracolumbar stabilization devices market held significant growth between 2020 and 2024 due to the growing prevalence of spinal disorders, innovations in surgical techniques, and the rapidly increasing aging of world population susceptible to spinal injuries. This upward trend was fueled by important innovations in device design and materials where device design is engineered for better surgical precision and faster patient recovery.

The filter would then enable the seamless integration of advanced implants into a range of conditions, although challenges due to the cost of even the advanced implants and improving surgical training to embed street medicine in specialized surgical operations would also be factors for broader use.

The upcoming 2025 to 2035 period observes continued growth in the market, aided by the continued technological advancements, improved healthcare facilities, and more medical professionals favouring minimally invasive methods. Next-Generation stabilization systems with improved biocompatibility and durability are going to optimize patient outcomes even further.

In addition, increasing awareness of spinal health and improved accessibility of healthcare services in developing economies are probable to provide new growth such opportunities for market players.

Market Outlook

High healthcare infrastructure development, high prevalence of spinal disorders, and strong presence of leading medical device manufacturers make the USA a lucrative nation for the thoracolumbar stabilization devices market. Demand is being propelled by rising incidences of traumatic spinal injuries, majorly by road traffic accidents, sports, and occupational hazards.

Favorable reimbursement policies and early adoption of the minimally invasive stabilization technique favor market growth. Customization in the implants and robotic-assisted spinal surgeries are other factors generating technological innovations. Increasing geriatric population suffering from degenerative spinal diseases continues to support long-term demand. Strategic partnerships along with FDA approvals serve as key growth enablers in the USA market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

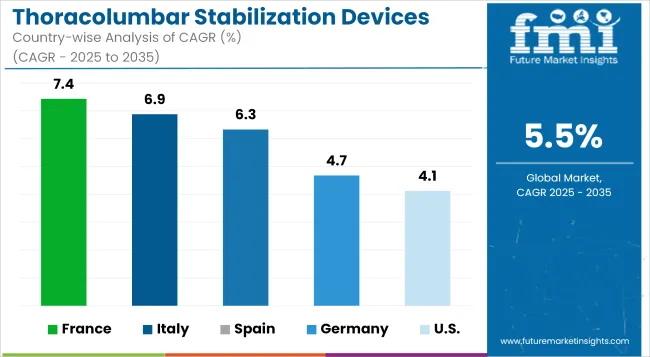

| United States | 1.7% |

Market Outlook

The thoracolumbar stabilization devices market in Europe is dominated by Germany, due to the supportive healthcare facilities and rising elderly population. The country’s healthcare system also focuses on precise surgeries and advanced spinal care, thus supporting the demand for novel stabilization implants and instrumentation. As the number of osteoporotic fractures and spinal deformities among the elderly continues to rise, so does the demand for effective stabilization solutions.

Leading research institutions and medical device companies in Germany are key to the development of innovative products. Government support for healthcare innovation and surgical training initiatives increases procedural volume. The students readily embraced this hands-on opportunity to learn the latest surgical techniques, and patient preference for minimally invasive options only has stoked the fires of adoption.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.6% |

Market Outlook

Japan thoracolumbar stabilization devices market share is largely driven by rapidly growing geriatric population and high rate of degenerative spinal disorders such as lumbar spondylosis and spinal stenosis. With its concentration on precision medicine and advanced surgical techniques, there is also strong demand for innovative stabilization solutions.

Overlapping with this is a major involvement from Japanese manufacturers in creating compact, biocompatible and motion-preserving implants. Increased patient awareness, advancement in diagnostic imaging technologies, and government initiatives for elderly care also contribute to the growth of the market.

In addition, the increasing number of minimally invasive spine surgeries performed in Japanese hospitals and clinics drives device usage. Market expansion is driven by technological sophistication and a quality-centric healthcare model.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

Market Outlook

The market for thoracolumbar stabilization devices is also steadily rising in the United Kingdom, fueled by a rise in cases of spinal injuries caused by old age, stress in the workplace, and other lifestyle conditions. The National Health Service (NHS) encourages access to spinal operations, but budget limitations frequently direct demand towards economical, less invasive options.

The adoption of robotics and 3D-printed titanium in thoracolumbar stabilization in the UK. Biomechanical research in academia as well as clinical validation of spinal implants further support the market. Moreover, a gradual transition to outpatient spine surgeries and the use of rehabilitation protocols propels the early adoption of advanced stabilization systems leading to reduced hospitalization and complications.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.3% |

Market Outlook

The thoracolumbar stabilization devices market in India is rapidly emerging owing to the rising number of road accidents, sports injuries, and spinal disorders especially in the younger and working-age population. An increasing number of neurosurgeons and orthopedic specialists are providing support for surgical volume by adding more private healthcare infrastructure. Introduction:Spinal implants are a vital part of this journey, yet cost sensitivity is a concern.

Local manufacturing and government endeavors (in line with "Make in India")are working towards making affordable spinal implants accessible. One of the key factors driving this increase is the growing trend of medical tourism, with patients from neighboring areas traveling to India for high-quality and cost-effective spine check-ups and surgeries. The market is expected to expand in the future due to technological awareness and increasing investments in minimal invasive spinal procedures.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.6% |

The thoracolumbar stabilization devices market is competitive and expanding due to the rising incidence of spinal disorders, trauma, and the growth in minimally invasive spine procedures. Advances in spinal fixation systems, better biomaterials, and the growth in geriatric populations are driving demand. The market consists of established orthopedic device manufacturers, spine care specialists, and new entrants with innovative stabilization technologies.

Key Development:

Anterior stabilization device, posterior stabilization device and retractors.

Titanium and stainless steel.

Hospitals, clinics and ambulatory surgical centers.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East Africa

The global thoracolumbar stabilization devices industry is projected to witness CAGR of 5.5% between 2025 and 2035.

The global thoracolumbar stabilization devices industry stood at USD 1,273.1 million in 2024.

The global thoracolumbar stabilization devices industry is anticipated to reach USD 2,294.2 million by 2035 end.

China is expected to show a CAGR of 5.0% in the assessment period.

The key players operating in the global thoracolumbar stabilization devices industry are Medtronic plc, DePuy Synthes, Stryker Corporation, Globus Medical, Zimmer Biomet Holdings, NuVasive, Inc., B. Braun Melsungen AG, Orthofix Medical Inc., Alphatec Spine, Inc., Aesculap Implant Systems and Others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spinal Thoracolumbar Implants Market

Soil Stabilization Material Market Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA