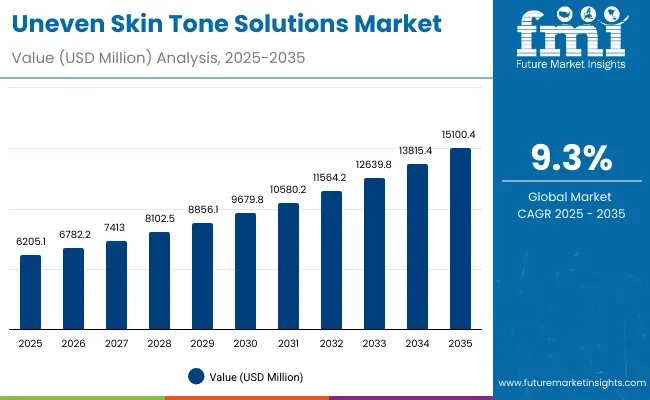

The Uneven Skin Tone Solutions Market is expected to record a valuation of USD 6,205.1 million in 2025 and USD 15,100.4 million in 2035, with an increase of USD 8,895.3 million, which equals a growth of 143% over the decade. The overall expansion represents a CAGR of 9.3% and more than a 2X increase in market size.

Uneven Skin Tone Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Uneven Skin Tone Solutions Market Estimated Value in (2025E) | USD 6,205.1 million |

| Uneven Skin Tone Solutions Market Forecast Value in (2035F) | USD 15,100.4 million |

| Forecast CAGR (2025 to 2035) | 9.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 6,205.1 million to USD 9,679.8 million, adding USD 3,474.7 million, which accounts for nearly 39% of the total decade growth. This phase records steady adoption across women consumers, dermatology clinics, and specialty beauty retail, driven by rising awareness about pigmentation and melasma treatments. Serums dominate this period as they cater to over 48% of consumer applications requiring fast-absorbing formats, while hydroquinone-free claims remain central due to safety and regulatory compliance concerns in key markets such as the USA and Europe.

The second half from 2030 to 2035 contributes USD 5,420.6 million, equal to 61% of total growth, as the market jumps from USD 9,679.8 million to USD 15,100.4 million. This acceleration is powered by widespread deployment of clean-label and vegan-certified products, expansion of AI-based skin diagnosis solutions, and a surge in demand for serums and ampoules/essences in Asia-Pacific. Online-first beauty brands and D2C platforms intensify competition, with e-commerce and subscription models capturing a larger share above 55% by the end of the decade. Digital engagement, personalization, and dermatology-clinic collaborations significantly enhance brand penetration, making claim-based differentiation (hydroquinone-free, dermatologist-tested, vegan) a key growth driver.

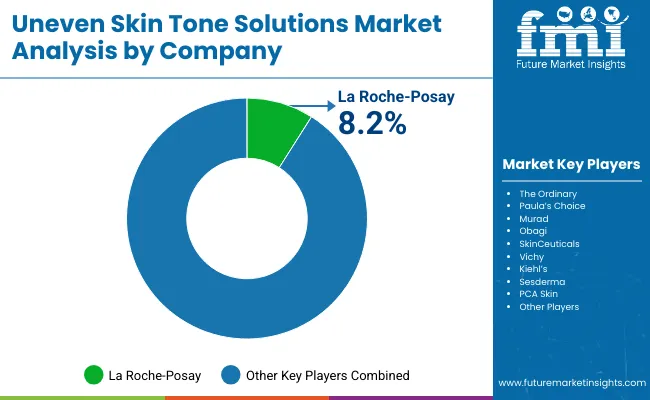

From 2020 to 2024, the Uneven Skin Tone Solutions Market grew steadily, with strong consumer demand in Asia and North America. During this period, the competitive landscape was dominated by leading dermatology-focused brands such as La Roche-Posay and SkinCeuticals, controlling significant market presence in the dermatologist-tested and hydroquinone-free categories. Competitive differentiation relied on clinically proven formulations, premium positioning, and trust in dermatologist-backed efficacy, while mass-market players like The Ordinary and Paula’s Choice leveraged affordability and online-first strategies to capture younger demographics. Clean-label and vegan offerings were in early adoption, contributing less than 15% of the total market value, but set the stage for rapid growth post-2025.

Demand for uneven skin tone solutions will expand to USD 6,205.1 million in 2025, and the revenue mix will shift as clean-label, dermatologist-tested, and vegan claims grow to over 60% share by 2035. Traditional skincare leaders face rising competition from digital-first players offering AI-powered personalized skincare routines, e-commerce subscription packs, and social media-led engagement strategies. Major established brands are pivoting to hybrid models, integrating dermatology-clinic partnerships with online personalization to retain relevance. Emerging entrants specializing in affordable serums, spot correctors, and Asia-specific natural actives (such as licorice extract and tranexamic acid) are gaining share. The competitive advantage is moving away from only ingredient innovation to ecosystem strength, consumer trust, and cross-channel scalability.

Advances in active ingredients such as vitamin C, niacinamide, and tranexamic acid have improved efficacy, allowing consumers to see visible results for pigmentation, melasma, and acne-related marks. Serums and ampoules have gained popularity due to their lightweight texture, fast absorption, and suitability for layering within skincare routines. The rise of hydroquinone-free formulations has contributed to strong adoption, especially in markets like the USA and Europe, where consumer preference is shifting toward safer, dermatologist-recommended products. Clinical testing and evidence-backed claims are driving premium pricing and consumer trust.

Expansion of e-commerce platforms, D2C models, and dermatologist-clinic tie-ups has fueled market growth. Innovations in subscription services, AI-powered virtual skincare consultations, and clean-label product launches are expected to open new application areas. Segment growth is expected to be led by serums in product categories, e-commerce in channel distribution, and hydroquinone-free claims due to regulatory and consumer safety concerns. Growth in Asia-Pacific, particularly China and India, is driven by rising disposable incomes, beauty influencer culture, and rapid urbanization, making the region the fastest-growing hub for global uneven skin tone solutions.

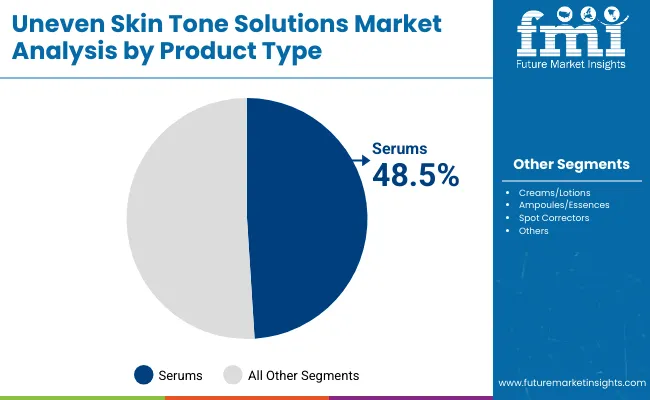

The market is segmented by concern, active ingredient, product type, channel, claim, and region. Concerns include dark spots & hyperpigmentation, dullness & lack of radiance, melasma & hormonal pigmentation, and acne-related marks, highlighting the diverse consumer needs driving product development. Active ingredients include vitamin C, niacinamide, alpha-arbutin, licorice extract, and tranexamic acid, representing a blend of clinically proven and natural options. By product type, the market covers serums, creams/lotions, ampoules/essences, and spot correctors, offering both traditional and innovative application formats.

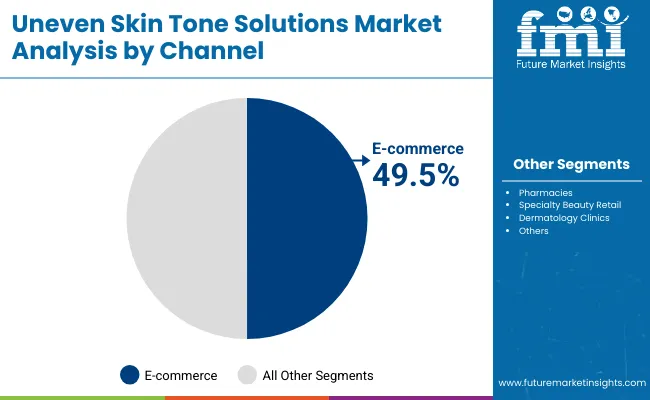

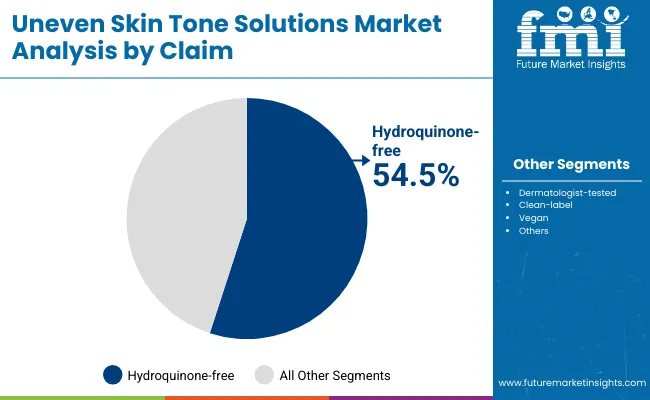

Channels include e-commerce, pharmacies, specialty beauty retail, and dermatology clinics, capturing a broad distribution spectrum. Claims include hydroquinone-free, dermatologist-tested, clean-label, and vegan, which reflect rising consumer demand for safe, sustainable, and transparent skincare solutions. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with strong growth prospects in China, India, Japan, the USA, UK, and Germany.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serum segment is projected to contribute 48.5% of the Uneven Skin Tone Solutions Market revenue in 2025, maintaining its lead as the dominant product category. This dominance is driven by the growing consumer preference for lightweight, fast-absorbing formulations that deliver concentrated active ingredients such as vitamin C, niacinamide, and tranexamic acid directly to targeted areas. Serums are widely perceived as more effective than creams or lotions due to their ability to penetrate deeper skin layers, offering faster results for concerns like dark spots, melasma, and acne-related pigmentation.

The segment’s growth is further supported by the proliferation of innovative serum textures such as water-based, oil-based, and ampoule-inspired formulations. With dermatologists frequently recommending serums for hyperpigmentation treatment, consumer trust and adoption have accelerated. The surge in online beauty platforms has also amplified serum visibility through targeted digital campaigns and influencer-led tutorials. As clinical efficacy and ingredient transparency continue to shape purchase decisions, serums are expected to retain their position as the backbone of the Uneven Skin Tone Solutions Market.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

The e-commerce channel is forecasted to hold 49.5% of the Uneven Skin Tone Solutions Market share in 2025, led by its role in expanding accessibility and offering a wider variety of products. Online channels are favored for their convenience, attractive pricing, and detailed consumer reviews, which are critical in skincare purchase decisions. The ability to directly engage with brands through digital platforms has allowed consumers to make more informed choices, further fueling online sales.

Subscription models, bundled skincare regimens, and personalized product recommendations powered by AI have also driven consumer loyalty in the e-commerce segment. Cross-border e-commerce platforms in Asia-Pacific, especially in China and India, are bringing global brands to wider audiences, thereby accelerating adoption. The segment’s growth is bolstered by social commerce trends on platforms like Instagram, TikTok, and WeChat, where skincare influencers play a central role in shaping purchase behavior. As digital-first strategies and virtual consultations become mainstream, e-commerce is expected to continue its dominance in the Uneven Skin Tone Solutions Market.

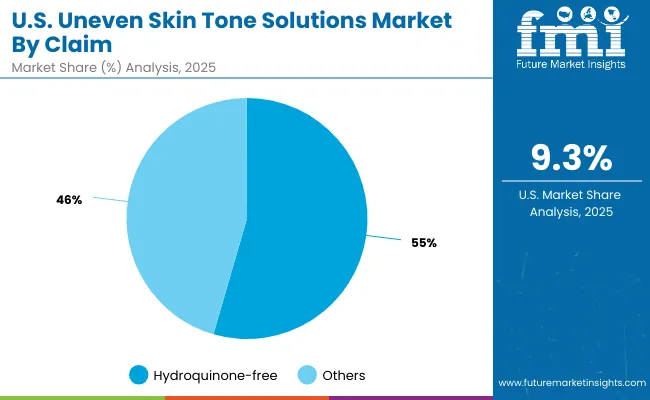

| Claim | Value Share% 2025 |

|---|---|

| Hydroquinone-free | 54.5% |

| Others | 45.5% |

The hydroquinone-free segment is projected to account for 54.5% of the Uneven Skin Tone Solutions Market revenue in 2025, establishing it as the leading claim type. This trend is fueled by rising concerns over the safety and long-term side effects of hydroquinone, prompting both regulators and consumers to shift toward safer alternatives. Hydroquinone-free solutions featuring niacinamide, licorice extract, and alpha-arbutin are widely embraced for their proven ability to reduce hyperpigmentation without irritation, making them popular among sensitive-skin consumers.

The segment’s momentum is also supported by clean beauty trends, where consumers increasingly seek dermatologist-tested, vegan, and non-toxic formulations. Global brands are investing heavily in product lines that highlight hydroquinone-free claims while combining clinical validation with natural actives, thereby balancing efficacy and safety. With regulatory frameworks in Europe and North America discouraging prolonged hydroquinone use, hydroquinone-free products are becoming the industry standard. Given their widespread acceptance and alignment with clean-label movement, hydroquinone-free solutions are expected to maintain their leading role in the Uneven Skin Tone Solutions Market.

Rising Demand for Hydroquinone-Free and Clean-Label Pigmentation Treatments

A major driver is the shift toward hydroquinone-free formulations, which already represent 54.5% of the global market in 2025. Regulatory scrutiny in regions such as the EU and increasing awareness of hydroquinone’s long-term side effects (e.g., ochronosis, irritation) have accelerated consumer demand for safer alternatives. Brands are responding with alpha-arbutin, niacinamide, licorice extract, and tranexamic acid-based solutions that promise efficacy without side effects. This regulatory-led pivot is not only expanding product innovation but also building consumer trust, especially among women who make up the majority user base. The hydroquinone-free movement has effectively repositioned pigmentation solutions as both safer and lifestyle-compliant, giving it long-term traction in both developed and emerging markets.

E-commerce Expansion in Asia-Pacific Driving Market Penetration

E-commerce contributes 49.5% of the global market share in 2025 and is particularly disruptive in Asia-Pacific, where platforms like Tmall, JD.com, and Nykaa are connecting global brands with first-time users in China and India. Unlike traditional retail, these platforms integrate AI-powered recommendations, AR try-on tools, and livestream shopping, which have proven especially effective in converting young consumers. The rapid urbanization and rise of middle-class consumers in India and Southeast Asia are amplifying this channel’s role, making e-commerce not just a sales driver but also a brand education platform. For global players, digital-first distribution is the fastest path to scale in markets where dermatologist clinics and specialty beauty retail are less accessible.

Fragmented Efficacy Standards Across Regions

A significant restraint is the lack of standardized efficacy benchmarks for pigmentation and uneven skin tone solutions. While Western markets demand dermatologist-tested and clinically proven claims, in emerging markets like India and parts of Southeast Asia, consumer expectations are more influenced by cultural perceptions of fairness and radiance. This divergence makes it difficult for global brands to standardize formulations and marketing claims across markets. Products with niacinamide and vitamin C that are highly successful in North America may not resonate the same way in Asia without cultural tailoring. This creates higher costs for R&D, regulatory clearance, and localized product adaptation.

Price Sensitivity in Emerging Markets Limiting Premium Segment Growth

Although premium brands like La Roche-Posay and SkinCeuticals dominate in dermatology clinics and high-income groups, price-sensitive consumers in India, Southeast Asia, and Latin America often opt for lower-priced serums and creams. With a market CAGR of 24.2% in India and 21.1% in China, affordability remains a barrier for global dermatology-led brands to capture wider adoption. Local and domestic players offering affordable niacinamide-based serums or herbal pigmentation creams are increasingly undercutting premium global players. This price-to-value gap restrains high-margin product expansion in markets that are otherwise the fastest-growing.

Shift from Whitening to Radiance and Skin Health Positioning

The market is undergoing a strategic repositioning from "skin whitening" to "skin tone correction and radiance." In markets such as Europe and North America, whitening claims have fallen out of favor due to socio-cultural and ethical considerations, with brands pivoting toward inclusivity and skin health narratives. This repositioning has reshaped marketing strategies, where even in Asia, the language has shifted from fairness to glow, brightness, and radiance. This trend aligns with rising consumer demand for clean-label and dermatologist-tested claims while allowing brands to avoid reputational risks tied to outdated whitening narratives.

Personalization Through AI-Driven Skin Diagnostics

A fast-emerging trend is the integration of AI and mobile-based skin diagnostic tools into uneven skin tone solutions. Companies are leveraging smartphone cameras and dermatology apps to analyze pigmentation levels, melasma patches, and acne marks in real-time, providing consumers with personalized product recommendations. This trend is particularly strong in China, Japan, and South Korea, where tech-enabled beauty routines are mainstream. By integrating AI diagnostics with D2C subscription models, brands can build long-term consumer relationships while also collecting valuable skin health data. This personalization trend is reshaping product portfolios and giving rise to data-driven skincare ecosystems.

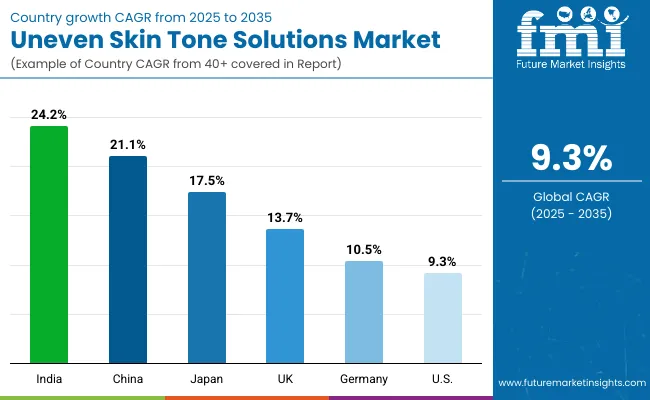

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 21.1% |

| USA | 9.3% |

| India | 24.2% |

| UK | 13.7% |

| Germany | 10.5% |

| Japan | 17.5% |

The Uneven Skin Tone Solutions Market shows strong country-level growth differentials between 2025 and 2035, with India (24.2%) and China (21.1%) emerging as the fastest-growing markets. India’s surge is attributed to the expanding middle-class population, rapid digital adoption, and strong cultural focus on addressing pigmentation and melasma concerns, making serums and affordable niacinamide-based products particularly popular.

China follows closely, benefiting from cross-border e-commerce platforms, influencer-led livestreaming, and rapid adoption of hydroquinone-free formulations. Japan’s CAGR of 17.5% highlights its position as an innovation-driven market, where consumers prefer clinically proven, dermatologist-tested, and premium clean-label products. Together, these three Asian countries represent the most dynamic growth engines for the global market, supported by high digital engagement and evolving beauty preferences.

In comparison, Western markets are experiencing steady but slower growth rates, with the USA expanding at 9.3% CAGR, largely driven by hydroquinone-free and dermatologist-tested formulations, supported by strong dermatology clinic penetration and premium consumer demand. The UK (13.7%) and Germany (10.5%) reflect moderate expansion, with growth tied to clean-label, vegan claims, and stricter regulatory compliance that fosters trust in premium formulations. These European markets are also shifting from whitening narratives toward inclusive skin tone correction and radiance positioning, aligning with cultural changes. Overall, while Asia-Pacific drives high-velocity growth, Western regions maintain a stable foundation built on premiumization, clinical validation, and claim-driven innovation.

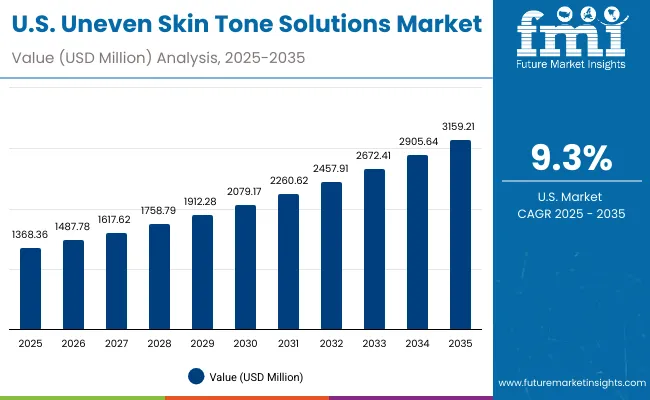

| Year | USA Uneven Skin Tone Solutions Market (USD Million) |

|---|---|

| 2025 | 1,368.36 |

| 2026 | 1,487.78 |

| 2027 | 1,617.62 |

| 2028 | 1,758.79 |

| 2029 | 1,912.28 |

| 2030 | 2,079.17 |

| 2031 | 2,260.62 |

| 2032 | 2,457.91 |

| 2033 | 2,672.41 |

| 2034 | 2,905.64 |

| 2035 | 3,159.21 |

The Uneven Skin Tone Solutions Market in the United States is projected to grow at a CAGR of 9.3%, supported by the strong adoption of hydroquinone-free and dermatologist-tested products. Clinical formulations dominate sales through dermatology clinics, with brands like La Roche-Posay, SkinCeuticals, and PCA Skin capturing loyal consumer bases. E-commerce channels are becoming increasingly influential in shaping consumer preferences, with digital campaigns highlighting serums and spot correctors that target hyperpigmentation and acne-related marks. Rising awareness of melasma among women and hormonal pigmentation management through niacinamide and tranexamic acid solutions is further fueling growth. Premiumization trends, coupled with clinical validation, are expanding the willingness of consumers to spend more on targeted solutions.

The Uneven Skin Tone Solutions Market in the United Kingdom is expected to grow at a CAGR of 13.7%, supported by consumer demand for clean-label, vegan, and dermatologist-tested products. UK consumers are highly receptive to products marketed as safe, sustainable, and inclusive, creating opportunities for serums and ampoules formulated with licorice extract and vitamin C. Specialty beauty retail and pharmacy chains have accelerated the introduction of global and regional brands, while e-commerce remains a dominant channel for younger buyers. Social trends around inclusivity and radiance are driving a clear shift away from traditional whitening claims toward healthy glow and skin health positioning.

India is witnessing rapid growth in the Uneven Skin Tone Solutions Market, which is forecast to expand at a CAGR of 24.2% through 2035, the highest globally. Demand is driven by rising disposable incomes, beauty influencer culture, and widespread concern over acne-related marks and melasma. Affordable serums and creams with niacinamide and licorice extract are gaining traction in tier-2 and tier-3 cities through online platforms like Nykaa, Amazon, and Flipkart. Dermatology clinics in urban areas are also expanding treatments using spot correctors and ampoules as part of pigmentation management routines. Local and international brands are aggressively targeting youth-driven demand for visible radiance and quick results, creating a competitive pricing environment.

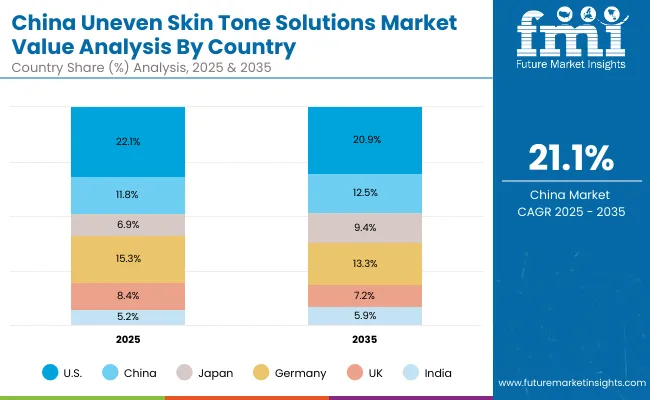

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.8% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.4% |

| India | 5.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.9% |

| China | 12.5% |

| Japan | 9.4% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

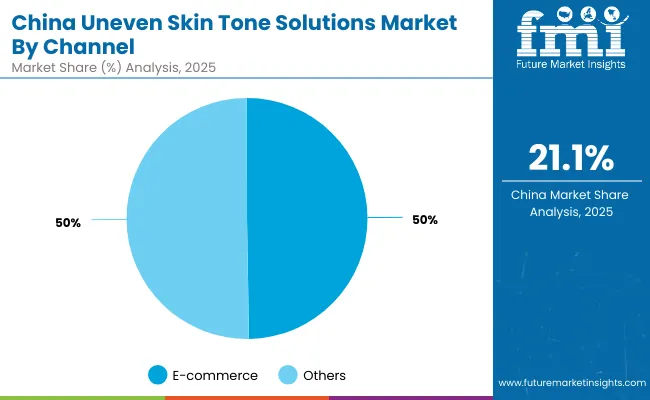

The Uneven Skin Tone Solutions Market in China is expected to grow at a CAGR of 21.1%, one of the fastest among leading economies. Growth is powered by cross-border e-commerce platforms, livestreaming, and competitive innovation from both domestic and international players. Premium brands such as Obagi and Murad are penetrating through dermatology clinics, while mass-market serums and essences from domestic brands dominate digital-first platforms like Tmall and JD.com. Concerns over dark spots and dullness are widespread, and demand for hydroquinone-free solutions is surging due to regulatory guidance and consumer preference for safety. Affordable formulations and influencer-led marketing are driving mass adoption across younger consumers.

| USA by Claim | Value Share% 2025 |

|---|---|

| Hydroquinone-free | 54.5% |

| Others | 45.5% |

The Uneven Skin Tone Solutions Market in the United States is projected at USD 1,368.36 million in 2025. Hydroquinone-free products contribute 54.5%, while other claims hold 45.5%, reflecting a strong consumer shift toward safer and dermatologist-approved options. This dominance is driven by stringent FDA oversight and increasing awareness of potential side effects linked to hydroquinone, pushing both premium and mass-market players to expand clean-label portfolios. Clinical dermatology practices are central to the USA market, where prescription-strength serums and spot correctors anchor growth.

Adoption is reinforced by the rise of dermatologist-tested and vegan-certified solutions, marketed as transparent, science-backed, and lifestyle-friendly. Social media trends, especially TikTok and Instagram, amplify demand for serum layering routines and multi-step solutions targeting melasma and acne marks. As digital personalization tools become mainstream, USA consumers are increasingly influenced by skin diagnostic apps and AI-led product recommendations. These dynamics position hydroquinone-free formulas as the long-term foundation of market expansion.

| China by Channel | Value Share% 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

The Uneven Skin Tone Solutions Market in China is valued at USD 729.94 million in 2025, with e-commerce leading at 49.5%, followed closely by other channels at 50.5%. The dominance of online sales reflects the rapid digitalization of Chinese retail, where platforms like Tmall, JD.com, and Douyin (TikTok China) integrate livestream shopping, influencer-led promotions, and AI-powered skincare consultations. Cross-border e-commerce enables international brands such as La Roche-Posay, Obagi, and Murad to penetrate deeply, while domestic players thrive with competitively priced serums featuring niacinamide and licorice extract.

This advantage positions China as a critical growth hub, with consumer demand focused on dark spot correction and radiance-enhancing serums. Younger demographics drive mass adoption, while professional dermatology clinics reinforce trust in higher-priced ampoules and essences. Regulatory encouragement of hydroquinone-free claims has also accelerated clean-label adoption. By 2035, e-commerce is expected to surpass 55% of distribution, with personalization technologies embedded into shopping experiences.

The Uneven Skin Tone Solutions Market is moderately fragmented, with multinational leaders, clinical specialists, and digital-first brands competing across claims, channels, and product types. La Roche-Posay holds the largest single share at 8.2% in 2025, driven by dermatologist-endorsed serums and strong presence in USA and European clinics. Other premium players such as SkinCeuticals, Murad, and Obagi are focusing on targeted pigmentation treatments and clinical distribution, while The Ordinary and Paula’s Choice dominate affordable e-commerce-driven segments, appealing to younger digital consumers.

Mid-sized innovators including Sesderma, PCA Skin, and Vichy are accelerating adoption with specialized serums, spot correctors, and clean-label offerings. Their strength lies in combining dermatology credibility with retail and online accessibility. Competitive differentiation is shifting from product efficacy alone to ecosystem strength where success depends on digital-first engagement, integration with diagnostic tools, subscription models, and lifestyle-driven positioning. Local players in Asia, particularly in China and India, are expanding aggressively with affordable niacinamide and vitamin C formulations, intensifying competition against global brands.

Key Developments in Uneven Skin Tone Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Concern | Dark spots & hyperpigmentation, Dullness & lack of radiance, Melasma & hormonal pigmentation, Acne-related marks |

| Active Ingredient | Vitamin C, Niacinamide, Alpha-arbutin, Licorice extract, Tranexamic acid |

| Product Type | Serums, Creams/lotions, Ampoules/essences, Spot correctors |

| Channel | E-commerce, Pharmacies, Specialty beauty retail, Dermatology clinics |

| Claim | Hydroquinone-free, Dermatologist-tested, Clean-label, Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | La Roche-Posay, The Ordinary, Paula’s Choice, Murad, Obagi, SkinCeuticals, Vichy, Kiehl’s, Sesderma, PCA Skin |

| Additional Attributes | Dollar sales by product type and channel, adoption trends in hydroquinone-free and clean-label skincare, rising demand for serums and ampoules in pigmentation treatment, sector-specific growth in dermatology clinics and e-commerce, claim-based product innovation (dermatologist-tested, vegan, clean-label), integration with AI-driven diagnostics and personalization platforms, regional trends influenced by cultural beauty preferences, and innovations in active ingredient formulations such as niacinamide, vitamin C, and tranexamic acid. |

The Uneven Skin Tone Solutions Market is estimated to be valued at USD 6,205.1 million in 2025.

The market size for the Uneven Skin Tone Solutions Market is projected to reach USD 15,100.4 million by 2035.

The Uneven Skin Tone Solutions Market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in the Uneven Skin Tone Solutions Market are serums, creams/lotions, ampoules/essences, and spot correctors.

In terms of channel, the e-commerce segment is expected to command 49.5% share in the Uneven Skin Tone Solutions Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA