The UK Calf Milk Replacer market is expected to reach USD 164.6 million in 2025, reaching a total value of USD 426 million by 2035. This represents a compound annual growth rate (CAGR) of 10% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 164.6 million |

| Industry Value (2035F) | USD 426 million |

| CAGR (2025 to 2035) | 10% |

The UK calf milk replacers (CMR) is a vital sector of the agriculture of the whole country, with the major influence of the demand of the efficient dairy farming and livestock rearing practices. Calf milk replacers are a very economical alternative for whole milk, which not only assures that the calves get enough nutrition but also preserves the milk for selling commercially. They are the products made to ensure the initial weight gain, immune system enhancement, and illness reduction in calves.

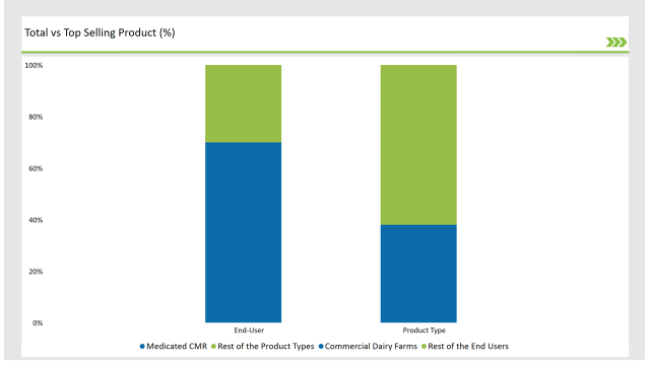

The medicated calf milk replacers make up 38% of this segment of the market, which is primarily used for preventing and treating the most common diseases in calves such as diarrhea and respiratory infections. The end-users in the market are mainly the commercial dairy farmers, who through the mechanization of their operations, and due to the high importance of the nutritional supplements that they supply to the calves, dominate the scene with 70% share.

This segment of the market has the following main participants: Volac International, Arla Foods Ingredients, Nutreco, and Lakeland Dairies which are organizations that make substantial investments in product development and research for maintaining their competitiveness.

The UK animal husbandry sector’s emphasis on being both sustainable and efficient together with the increased acceptance of the use of calf milk replacers has so far, played a significant role in the market expansion. The technological advancements in the animal feed industry, such as high protein and probiotic-enriched feed scholarships have also been important in driving the development of this sector.

The market is also driven by government programs, which promote the adoption of sustainable dairy practices and the use of calf replacers for optimizing farm outputs.

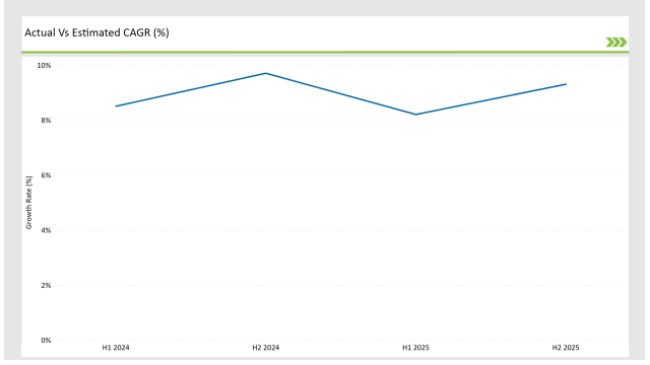

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Calf Milk Replacer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Volac International launched a new range of probiotic-enriched calf milk replacers aimed at improving gut health. |

| May 2024 | Nutreco introduced a medicated formula to reduce respiratory infections in calves, enhancing its product portfolio. |

| August 2024 | Lakeland Dairies opened a new production facility in the UK, increasing capacity for advanced milk replacers. |

| October 2024 | Arla Foods Ingredients partnered with UK dairy farmers to pilot a sustainable calf nutrition program. |

| December 2024 | Volac International expanded its distribution network across the UK to improve product availability for commercial dairy farms. |

Emphasizing the Early Immunity Booster

A realization of the new trend in the UK market is the expansion of special calf milk replacers that are created to increase early immunity. Firms like Nutreco are making use of immune-boosting additives such as colostrum supplements and beta-glucans, which in turn are mixed in with the replacers, so as to boost the calves’ immunity system and keep them free from infections during the early critical weeks of their lives.

Dairy farmers particularly like such methods, as they can cut down on the loss of calves.

Precisely Meeting Nutrition Needs

Precision feeding on dairy farms in the UK is the main trend, which is adapting calf milk replacers exactly to the specific needs of the individual calves. Solutions from Volac International have been created that correlate with the automated feeding system, following the exact nutrient composition in the calf milk replacers.

The trend promotes feed efficiency which leads to a decrease of feed wastage and at the same time a rise in the calf`s overall performance which in the end becomes the reason for it becoming a preferred one for large-scale operations.

Discontinue Antibiotic Formulations

With the emergence of heightened regulatory concern over antimicrobial use in livestock, the industry is shifting its attention to the use of antibiotic-free calf milk replacers. Instead of using antibiotics for the prevention of diseases the products employ natural alternatives like essential oils, prebiotics, and plant extracts. Arla Foods Ingredients has been at the forefront of such product launches that are in line with the UK’s ambition for the promotion of responsible antimicrobial use in farming.

% share of Individual categories by Product Type and Applications in 2025

Medicated calf milk replacers have a 38% share of the market and are substantially important in disease prevention and treatment. They come with an enriched formula containing antibiotics and other additives to deal with the most common health problems like diarrhea and pneumonia.

Businesses are considering medicated CMR the best option because of the emphasis on the need to reduce the rates of calf mortality. Notable companies such as Nutreco are heading this segment with the help of the innovative formulations that provide health benefits while preserving nutritional value.

Commercial dairy farms are a force to contend with in the UK CMR market with a dominating power of 70%, propelled by the sheer scale of their operations, and the hunger for reliable nutrition solutions. They utilize calf milk replacers as a way of ensuring that all calves grow and remain healthy according to the plan, which in turn increases the efficiency of the farm.

Volac International and Lakeland Dairies are both manufacturers that have modified their services to meet the specific needs of dairy farms, which commonly include bulk packaging and customizable formulations.

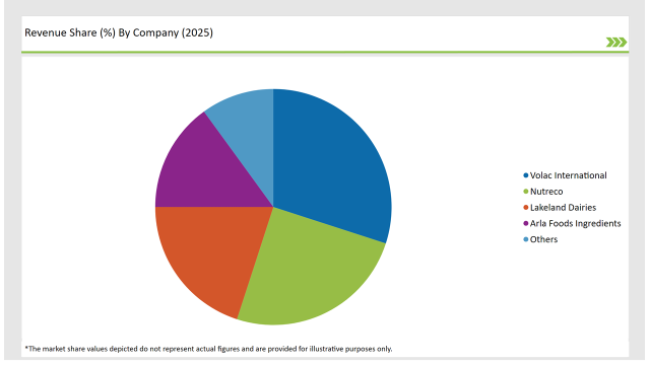

2025 Market share of UK Calf Milk Replacer suppliers

Note: above chart is indicative in nature

The UK calf milk replacers market is moderately concentrated with key players maintaining their dominance through the introduction of innovative products on the market and their extensive distribution networks. Major tier 1 suppliers are Volac International, Nutreco, and Lakeland Dairies who together make up a sizable portion of the sector by leveraging their strong R&D capabilities and partnerships with dairy farms.

On the other hand, tier 2 players, such as Arla Foods Ingredients seek to differentiate themselves through the provision of niche formulations and sustainable solutions.To survive the competitive landscape, the producers have been putting a large emphasis on product innovation such as the introduction of the probiotic-enriched and medicated formulations while expanding the production capacities.

Also, their collaboration with dairy farms and distributors in an upstream scheme, where they provide the raw materials, thus boosting their presence in the market apple. The convergence of sustainability and precision nutrition trends among key players is likely to evolve from comparatively moderate to overt competition thus driving the market.

Medicated CMR and Non-Medicated CMR

Powder CMR, Liquid CMR

Direct Sales/B2B, and Retail/B2C

Commercial Dairy Farms, Individual Farmers, Research & Academic Institutions.

Within the forecast period, the UK Calf Milk Replacer market is expected to grow at a CAGR of 10%.

By 2025, the sales value of the UK Calf Milk Replacer industry is expected to reach USD 426 million.

The UK calf milk replacer market is driven by the growing demand for efficient and cost-effective alternatives to whole milk for calf rearing, as well as the increasing focus on animal welfare and sustainable farming practices. Factors such as the rising cost of raw milk, the need for consistent nutritional profiles, and the adoption of advanced formulations tailored to calf growth and development are propelling the growth of the calf milk replacer market in the UK.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calf Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Analyzing Calf Milk Replacers Market Share & Growth Factors

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Calf Milk Replacer Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

Pet Milk Replacers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Goat Milk Replacer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitten Milk Replacer & Formula Market

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA