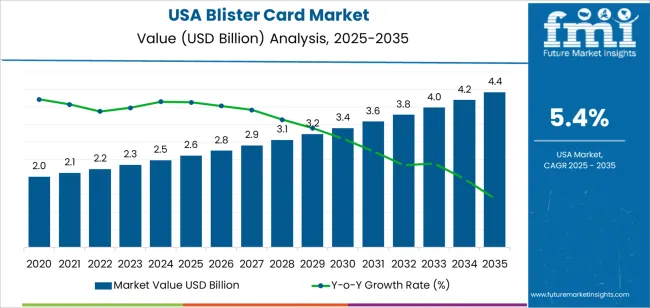

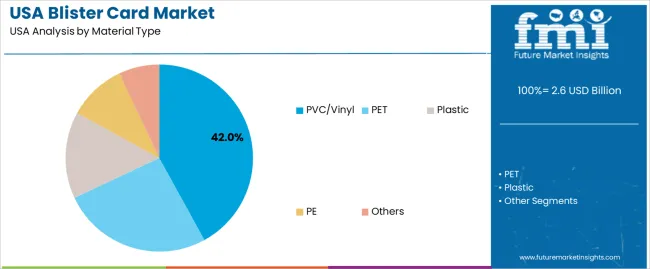

The USA blister card demand is valued at USD 2.6 billion in 2025 and is expected to reach USD 4.4 billion by 2035, reflecting a CAGR of 5.4%. Growth is supported by continued utilization of sealed unit-dose formats in pharmaceuticals, nutraceuticals, and consumer health products, particularly for solid oral dosage forms. Tamper-evident packaging requirements, medication adherence initiatives, and compatibility with high-speed packaging lines reinforce demand across regulated industries. PVC/Vinyl remains the leading material type. Its cost efficiency, thermoformability, and suitability for barrier coatings enable widespread use in both branded and generic drug packaging. Procurement preferences also reflect validated performance records within existing pharmaceutical filling and sealing systems.

West USA, South USA, and Northeast USA maintain the highest adoption levels. These regions host major pharmaceutical manufacturing centers, contract packaging facilities, and distribution hubs that support nationwide supply chains. Retail-driven consumer healthcare segments also contribute to steady purchasing volumes. Key suppliers include SupplyOne, Inc., Rohrer Corp, MARC, Inc., Pharma Packaging Solutions, and Wasdell Group. These companies provide custom blister card formats tailored to dosage protection, compliance communication, and handling efficiency in regulated pharmaceutical and clinical use settings.

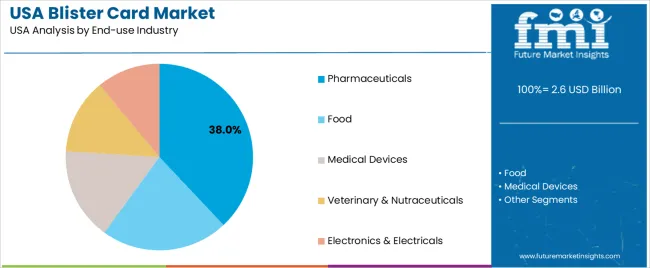

The growth contribution index for blister card packaging in the United States is influenced by its integration across pharmaceuticals, consumer healthcare, and small-format retail goods. Pharmaceuticals contribute the largest share due to regulatory emphasis on tamper evidence, dosage protection, and patient adherence. High prescription volume and expanding OTC product lines reinforce steady contribution from this segment. Child-resistant blister formats strengthen relevance in controlled substances and pain-management categories.

Consumer electronics accessories and hardware supplies add incremental contribution through theft-deterrent packaging advantages and strong retail-shelf visibility. The healthcare and wellness sector is expected to maintain higher value contribution because unit-dose packaging supports traceability and precision dispensing. Ecofriendly blister structures, such as paper-push and recyclable barrier materials, help sustain participation in retail channels responding to environmental compliance pressures.

While plastic-intensive formats face scrutiny, engineering improvements in recyclable PET, reduced-plastic cards, and advanced sealing technologies mitigate substitution risk. Imports and contract packaging services ensure scale efficiency, supporting cost competitiveness for high-volume runs. Growth contribution therefore remains stable and diversified, driven by healthcare demand rigidity, regulatory packaging mandates, and continuous structural upgrades that preserve blister cards’ role within safety-critical packaging in the United States.

| Metric | Value |

|---|---|

| USA Blister Card Sales Value (2025) | USD 2.6 billion |

| USA Blister Card Forecast Value (2035) | USD 4.4 billion |

| USA Blister Card Forecast CAGR (2025-2035) | 5.4% |

Demand for blister cards in the USA is increasing because pharmaceutical, nutraceutical and consumer goods companies require secure and visible packaging that protects individual units during distribution and at retail. In the pharmaceutical sector, blister cards support dose accuracy and tamper resistance for tablets, capsules and over-the-counter medicines, which helps compliance for aging populations and chronic disease treatments. Nutritional supplement brands rely on blister cards to preserve product integrity by limiting exposure to moisture and handling. Retailers prefer carded blister packs for small electronics, hardware accessories and personal care items because they improve shelf presentation and reduce shrinkage. Growth in club stores and dollar retail formats reinforces the need for packaging that separates individual units with clear labeling and UPC placement.

Automation investments in packaging lines also drive adoption, since blister cards support high-speed sealing and inspection without extensive manual labor. Companies introduce recyclable materials and mono-material structures that align with USA ecofriendly goals. Constraints include competition from bottles and flexible pouches for high-volume items, along with higher packaging cost for short production runs. Some brands adjust usage based on environmental messaging priorities.

Demand for blister cards in the United States is supported by strong requirements for tamper-visible packaging, product protection, and retail display suitability. Procurement trends align with durability, sealing integrity, and print compatibility that allows clear product information and traceability. Blister cards enable precise product dosing and reduce risk of contamination, which contributes to widespread usage in healthcare and regulated consumer goods. Shelf-ready packaging requirements in USA retail favor formats that resist pilferage and maintain product visibility.

PVC/Vinyl accounts for 42.0%, based on cost efficiency, seal strength, and widespread compatibility with existing form-fill-seal machinery. PET holds 26.0%, driven by transparency advantages, better recyclability, and growing compliance with ecofriendly expectations. Generic plastic formats represent 15.0%, serving applications requiring flexibility or reduced cost. PE holds 10.0%, used where lightweight and chemical-resistant performance is needed. Others represent 7.0%, mainly in specialty designs requiring enhanced barrier properties or branding. Material selection reflects USA industry reliance on clear product visibility and physical protection while transitioning toward improved recyclability across consumer packaging portfolios.

Key points:

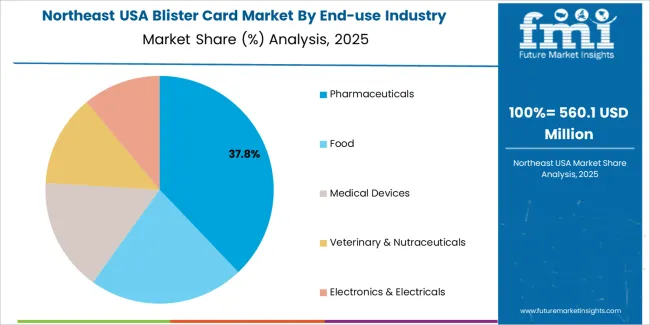

Pharmaceutical end use represents 38.0%, supported by compliance requirements for product authentication, dosage accuracy, and tamper resistance. Food accounts for 22.0%, serving confectionery, portioned snacks, and convenience-packaged goods. Medical devices hold 16.0% with sterile packaging needs for small clinical disposables. Veterinary and nutraceuticals represent 13.0%, leveraging blister formats for controlled dispensing. Electronics and electricals account for 11.0%, driven by protection from moisture and mechanical damage during retail display. USA demand reflects strict regulatory oversight and consistency in unit-dose packaging, where blister cards support extended product shelf life and secure handling across distribution networks.

Key points:

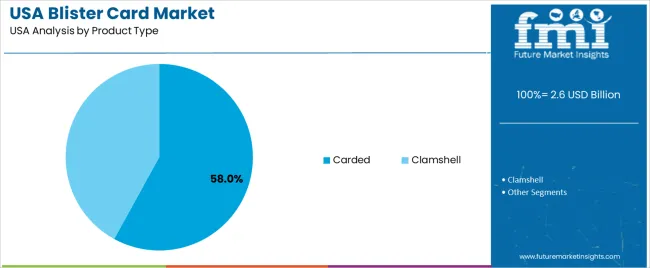

Carded blister products account for 58.0%, based on lightweight construction, printing space for regulatory labeling, and high compatibility with automated sealing technologies. Clamshell formats represent 42.0%, offering enhanced protection, theft deterrence, and suitability for bulkier consumer goods. Carded variants remain favored in pharmaceuticals and smaller household items due to efficient storage and lower material usage. Procurement decisions consider sealing method, transport durability, and ecofriendly initiatives seeking reduced plastic volumes. Retail demand encourages standardization of card-backed displays for ease of shelf stocking and scanning at USA point-of-sale systems.

Key points:

Growth of unit-dose pharmaceutical packaging, increased child-safety requirements and expanding retail distribution of over-the-counter healthcare products are driving demand.

In the United States, blister cards remain a preferred format in pharmaceutical packaging because unit-dose presentation supports medication adherence guidance used by clinicians and pharmacists. OTC pain relievers, allergy medications and nutritional supplements sold through nationwide retail chains rely on blister cards for tamper evidence and clear shelf presentation. Child-resistant and senior-friendly opening mechanisms are mandated for many products, strengthening demand for engineered blister card formats with certified safety features. Food and personal care brands also use blister cards for small accessories, batteries and razor cartridges that require secure packaging in high-traffic stores. E-commerce sellers adopt blister cards to protect items during parcel shipping, reinforcing consistent procurement across distributor networks in health, personal care and household product categories.

Material-cost volatility, ecofriendly pressure on plastic components and automation challenges for slow-changeover lines restrain adoption.

Price fluctuations in PVC and PET raise production costs for converters, especially when resin demand increases in other packaging sectors. Sustainability-conscious retailers and municipalities encourage packaging reduction or replace plastic-based formats with paperboard-forward solutions, which limits growth where environmental expectations are high. Small and mid-sized producers with manual or semi-automatic packaging operations may avoid blister card adoption if changeover time is long or if product variety requires frequent tooling adjustments. These constraints contribute to selective implementation across USA manufacturing segments.

Shift toward recyclable paperboard-forward structures, increased graphics customization for brand visibility and rising adoption in adherence packaging for chronic care define key trends.

Packaging designers emphasize paperboard-forward blister cards that improve recyclability in curbside systems while maintaining cavity protection for sensitive products. Brands use high-quality graphics and QR-coded authentication to improve product visibility in retail aisles and support digital engagement. Pharmacies and healthcare providers expand the use of calendar-based blister card systems for controlled and chronic medications, improving patient adherence and dispensing accuracy. Contract packers introduce automated blister-card lines that reduce labor dependency and improve consistency for high-volume national distribution. These trends indicate steady modernization and diversified demand for blister cards across the United States.

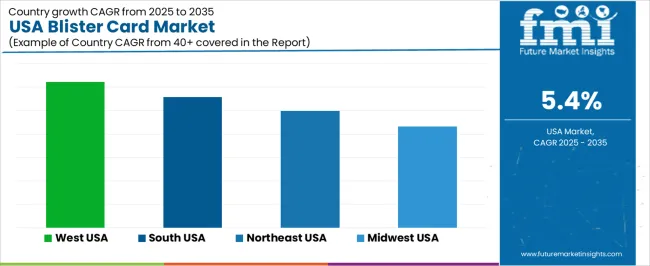

Demand for blister cards in the United States reflects requirement patterns in pharmaceutical packaging, small-format consumer goods, and retail-ready product displays. Stability in prescription medication volumes maintains consistent unit demand, while convenience packaging for electronics, hardware, and personal care contributes incremental growth. West USA leads at 6.2%, followed by South USA (5.6%), Northeast USA (5.0%), and Midwest USA (4.3%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 6.2% |

| South USA | 5.6% |

| Northeast USA | 5.0% |

| Midwest USA | 4.3% |

West USA grows at 6.2% CAGR, supported by robust pharmaceutical distribution networks in California and strong retail channels for personal electronics and household products. Medication blister cards remain widely used in hospital dispensing, long-term care facilities, and retail pharmacy outlets due to adherence tracking and dosage protection advantages. Consumer goods manufacturers rely on blister cards for visibility packaging, especially in convenience and mass-merchant chains. Packaging converters operating near coastal logistics hubs secure steady access to printed substrates and rigid plastics needed for carded packs. Retail security considerations influence packaging formats for theft-prone items, reinforcing blister card use for controlled display. Sustainability-linked initiatives encourage recyclability improvements through updated material structures and reduced plastics per unit, influencing procurement focus among suppliers.

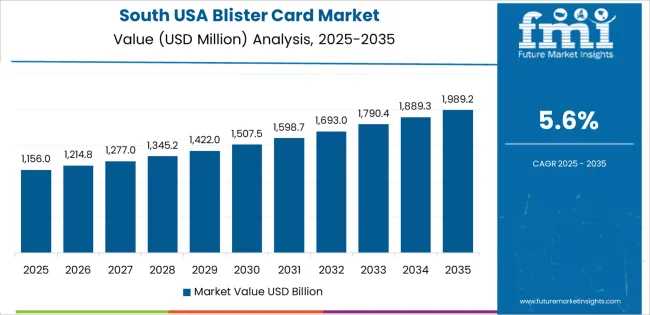

South USA posts 5.6% CAGR, driven by a diverse manufacturing base that includes nutraceutical packaging, over-the-counter medicines, and small household items distributed through big-box retail chains. Growth in suburban populations increases packaging needs linked to consumer staples in multi-store regions. Blister card configurations suit peg-ready display formats common in regional warehouse clubs and value-focused retailers. Healthcare systems across Texas and Florida utilize blister packaging for medication handling efficiency and reduced risk of dispensing mistakes. Distribution hubs maintain consistent packaging flows for high-volume products sourced both domestically and through Gulf Coast import channels. Procurement practices prioritize durability, print clarity, and line-change flexibility for SKUs with frequent seasonal shifts in labeling and presentation.

Northeast USA advances at 5.0% CAGR, shaped by pharmaceutical production concentration in states such as New Jersey and Pennsylvania. Blister cards support regulated packaging requirements for pills, tablets, and unit-dose medicines distributed through hospital networks and specialty pharmacies. Compact residential environments and high transit use promote small-format packaged items sold in convenience retail. Packaging suppliers implement frequent packaging-art cycles to support dense regional retail turnover. Hardware and electronics stores located in urban areas rely on blistered product formats that allow secure hanging display and barcode accessibility in limited-space aisles. Cold-chain distributors handle certain carded therapeutics using protective blister laminates. Sustainability expectations focus on recyclable backing cards, prompting material refinements in regional supply contracts.

Midwest USA grows at 4.3% CAGR, driven by industrial hardware and DIY products that rely on blister cards for structured display, damage limitation, and SKU labeling accuracy. Durable consumer items packaged in molded cavities move through strong distribution networks supporting home improvement retail traffic. Regional pharmaceutical facilities package certain oral medications in blister formats to meet dosage-verification needs in clinical and long-term care environments. Automated packing lines that operate in Illinois and Ohio handle high-run SKUs, reinforcing packaging standardization across manufacturing workflows. Producers prioritize compatibility with existing sealing dies and printed-card feeders when selecting new packaging materials. Retail trends emphasizing organized wall displays in hardware and automotive sections maintain consistent blister card utilization.

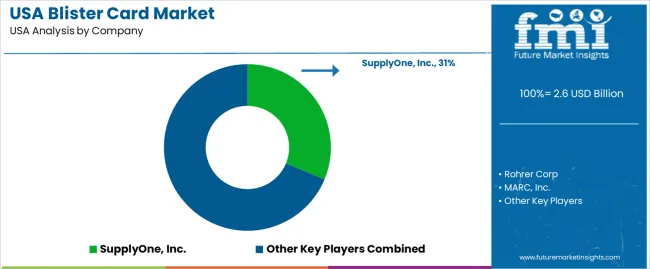

Demand for blister cards in the USA is shaped by packaging converters that supply thermoformed cavities with printed card backings for pharmaceuticals, consumer goods, and hardware products. SupplyOne, Inc. holds an estimated 31.3% share, supported by controlled material-conversion capability, dependable sealing performance, and strong supply relationships with regional contract packagers and brand owners. Its cards demonstrate stable rigidity and consistent print-registration accuracy during sealing operations.

Rohrer Corp maintains strong participation in retail and consumer-product blister cards distributed through national manufacturing networks. Its print and thermoforming processes deliver reliable visual presentation and controlled die-cutting precision suited to high-volume production lines. MARC, Inc. contributes meaningful share through customized blister-card programs that offer steady board-strength characteristics, reliable heat-seal coatings, and predictable formability for various product geometries.

Pharma Packaging Solutions supports USA pharmaceutical operations with blister cards designed for strict traceability and stable protection under regulated storage conditions. Wasdell Group, through USA activity, provides contract-packaging capacity for specialized healthcare and nutraceutical products where consistent sealing and serialization support are required. Competition in the USA centers on seal integrity, print durability, barrier reliability, line efficiency, and nationwide technical support as companies rely on protective packaging that preserves product condition and maintains clear visibility throughout retail and distribution environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | PVC/Vinyl, PET, Plastic, PE, Others |

| End-use Industry | Pharmaceuticals, Food, Medical Devices, Veterinary & Nutraceuticals, Electronics & Electricals |

| Product Type | Carded, Clamshell |

| Technology Type | Thermoforming Technology, Cold Forming Technology |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | SupplyOne, Inc., Rohrer Corp, MARC, Inc., Pharma Packaging Solutions, Wasdell Group |

| Additional Attributes | Includes adoption trends in blister sealing and tamper-resistant packaging for regulated sectors; major usage in drug-dosage packaging, consumer electronics accessories, and small hardware; shift toward recyclable and eco-friendly PET-based blister cards; increased demand for unit-dose packaging formats across USA healthcare supply chains and OTC pharmaceuticals; regional differences driven by manufacturing concentration and retail distribution networks. |

The demand for blister card in USA is estimated to be valued at USD 2.6 billion in 2025.

The market size for the blister card in USA is projected to reach USD 4.4 billion by 2035.

The demand for blister card in USA is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in blister card in USA are pvc/vinyl, pet, plastic, pe and others.

In terms of end-use industry, pharmaceuticals segment is expected to command 38.0% share in the blister card in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

Carded Blister Packaging Market

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Demand for Cardboard Trays in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Ultrasound in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA