The demand for cardboard trays in the USA is expected to grow from USD 2.4 billion in 2025 to USD 3.8 billion by 2035, reflecting a CAGR of 4.8%. Cardboard trays are widely used for packaging and transporting a range of products, including fruits, vegetables, consumer goods, and electronics. The increasing preference for eco-friendly packaging and the growing focus on sustainability are key drivers of market growth. As consumers and businesses alike continue to demand environmentally responsible alternatives to plastic packaging, cardboard trays are positioned to benefit from this shift. These trays are favored for their biodegradability, recyclability, and cost-effectiveness, making them an attractive option for businesses aiming to meet sustainability goals.

The growth of e-commerce and the increasing demand for fresh food deliveries will also contribute to the demand for cardboard trays. As packaging plays a crucial role in protecting products during transport, especially in the food industry, the need for sturdy and reliable trays will continue to rise. Additionally, innovations in design and printing technology will further boost demand, as businesses seek customizable packaging solutions to enhance brand appeal while maintaining functionality.

Between 2025 and 2030, the demand for cardboard trays in the USA will grow from USD 2.4 billion to USD 3.0 billion, adding USD 0.6 billion in value. This phase will experience steady market growth driven by rising consumer demand for sustainable packaging and cost-effective solutions. As industries such as food and beverage, electronics, and retail continue to prioritize environmentally friendly packaging, the demand for cardboard trays will increase. The absolute dollar opportunity in this phase will be largely driven by the expansion of e-commerce and fresh food delivery services, which require efficient and safe packaging for fragile items. The continued push to reduce plastic use will further drive this growth, as businesses increasingly adopt cardboard trays as a sustainable alternative.

From 2030 to 2035, the market will grow from USD 3.0 billion to USD 3.8 billion, contributing an additional USD 0.8 billion in value. As the market matures, demand for cardboard trays will continue to grow, albeit at a slower pace. The focus will shift towards more innovative and customized solutions, as companies seek ways to improve product presentation and brand differentiation while maintaining sustainability. As the market matures, price stability and the ongoing shift to sustainable materials will create an absolute dollar opportunity, further expanding the adoption of cardboard trays in industries such as foodservice, manufacturing, and e-commerce.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.4 billion |

| Industry Forecast Value (2035) | USD 3.8 billion |

| Industry Forecast CAGR (2025-2035) | 4.8% |

Demand for cardboard trays in the USA is rising as foodservice, retail, and e commerce operators shift away from plastics and require lightweight, transport efficient packaging. Cardboard trays offer a viable packaging format for fresh produce, prepared meals, bakery goods, and other consumer items where visibility and ventilation matter. At the same time environmental concerns and regulatory pressure around single use plastics drive brands toward fibre based solutions that align with circular economy objectives.

Another factor is increasing automation in fulfilment centres and retail packing lines which favour trays that can be easily handled, stacked, and integrated with robotic operations. Trays made from paperboard or corrugated board support faster packing rates and lower transport bulk compared with rigid alternatives. Still, cost pressures from raw material price fluctuation and competition from moulded fibre or plastic alternatives present constraints. The combination of convenience, sustainability, and logistics efficiency supports continued growth in demand for cardboard trays in the USA.

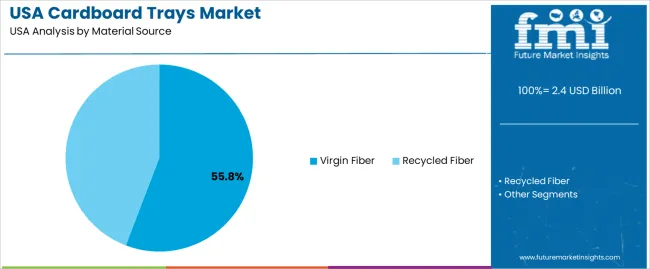

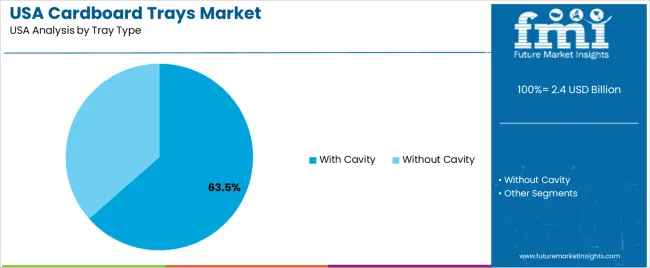

The demand for cardboard trays in the USA is primarily driven by material source and tray type. The leading material source is virgin fiber, which captures 56% of the market share, while the dominant tray type is with cavity, accounting for 63.5% of the demand. Cardboard trays are widely used in various sectors, including food packaging, retail, and logistics, due to their strength, recyclability, and cost-effectiveness. The growing focus on sustainability is contributing to a shift towards recycled fiber, but virgin fiber still holds a significant share of the market due to its superior strength and quality.

Virgin fiber is the leading material source for cardboard trays in the USA, holding 56% of the market share. Virgin fiber is derived from new wood pulp and is valued for its strength, durability, and ability to maintain the structural integrity of the trays. It is widely used in industries that require high-quality, sturdy packaging solutions, such as food packaging, medical products, and electronics, where product protection is a primary concern.

The demand for virgin fiber in cardboard trays is driven by its superior properties, such as its ability to handle heavy loads, maintain shape, and provide moisture resistance. While there is growing interest in sustainable alternatives, virgin fiber remains the preferred choice for applications where quality and performance are crucial. Additionally, the ability to print on virgin fiber trays allows for customized branding and marketing, further boosting its demand. As industries continue to prioritize reliable, high-quality packaging, virgin fiber is expected to remain a dominant material source in the cardboard tray market.

With cavity trays are the leading tray type for cardboard trays in the USA, capturing 63.5% of the demand. These trays are designed with cavities or indentations to securely hold items in place, making them ideal for packaging products such as fruits, vegetables, and packaged food items. The cavity design helps prevent shifting and provides extra protection during handling and transportation, ensuring that goods remain intact.

The preference for with-cavity trays is driven by their functional design, which meets the needs of industries requiring secure and organized packaging. These trays are particularly popular in the food industry, where product stability, hygiene, and ease of handling are critical. As e-commerce and retail distribution networks continue to expand, the demand for with-cavity trays is expected to remain strong, offering the necessary support and protection for a wide range of products. Their practical design and versatility make them a key component in the cardboard tray market in the USA.

Demand for corrugated trays in the United States is driven by growth in e commerce fulfilment, ready to eat food packaging and retail display needs which favour lightweight, strong tray formats. Sustainable packaging initiatives and substitution of plastics support uptake of fiber based trays. At the same time, volatility in raw material costs, supply chain constraints and pressure on profit margins moderate deployment. These factors shape the broader market outlook for corrugated tray type packaging in the USA

What Are the Primary Growth Drivers for Corrugated Tray Demand in the United States?

Several factors support growth. First, the rise of direct to consumer and subscription box models increases demand for sturdy yet lightweight trays for transport and presentation. Second, food service and take out segments favour corrugated tray formats because they provide rigidity, printability and sustainability compared to foam or plastic trays. Third, brand owners seek packaging that conveys premium positioning and environmental credentials, favouring fiber based trays that support brand messaging. Fourth, advances in automation and die cutting allow higher throughput and cost efficient production of corrugated trays for varied formats.

What Are the Key Restraints Affecting Corrugated Tray Demand in the United States?

Despite favourable conditions, several constraints apply. Raw material and resin cost inflation enhances input cost for corrugated board, reducing margin for tray producers. Supply chain limitations in containerboard or die‐cutting capacity may delay new product launches or restrict format innovation. Some applications still favour plastic or foam trays because of moisture resistance or clarity, limiting full substitution by corrugated trays. Additionally, recycling and end of life infrastructure for fiber based packaging may not always support premium disposable usage in all segments.

What Are the Key Trends Shaping Corrugated Tray Demand in the United States?

Key trends include increased adoption of high print, high graphics trays designed for direct display at retail or in unboxing experiences, reflecting brand driven packaging demand. There is growth in mono material corrugated trays designed for easier recycling and alignment with circular economy goals. Hybrid formats that combine corrugated tray bases with fibre based lids or sleeves are gaining traction to improve functionality while retaining fiber credentials. Finally, digital printing and on demand die cutting enable shorter runs and customised tray formats, supporting niche product lines and faster change over.

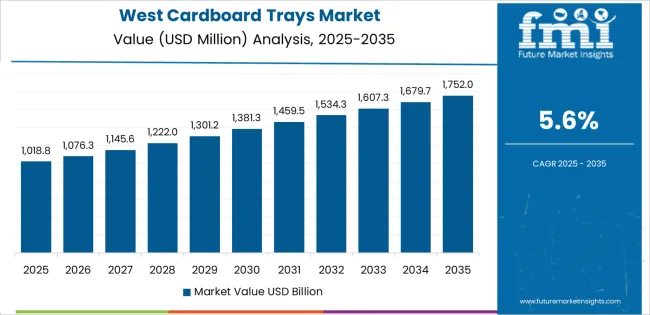

The demand for cardboard trays in the USA demonstrates regional variation, with different growth rates across the country. The West leads with a CAGR of 5.6%, driven by its thriving packaging industry and growing demand for sustainable, eco-friendly products. The South follows closely with a 5% CAGR, supported by its expanding manufacturing and distribution sectors. The Northeast shows a slower growth rate of 4.5%, influenced by a stable, mature packaging market. The Midwest has the lowest growth rate at 3.9%, reflecting more traditional manufacturing and packaging practices. These variations highlight the diverse factors affecting the demand for cardboard trays, such as industrial development, consumer preferences for sustainability, and regional production trends.

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.6% |

| South | 5% |

| Northeast | 4.5% |

| Midwest | 3.9% |

The demand for cardboard trays in the West is projected to grow at a CAGR of 5.6%, driven by the region’s strong packaging industry and increasing consumer demand for sustainable packaging solutions. The West has seen a rise in environmentally conscious consumer behavior, with many businesses shifting towards eco-friendly packaging alternatives like cardboard trays. Additionally, the region’s robust manufacturing and distribution sectors, particularly in states like California and Washington, contribute to the increased demand. The West is also home to many large-scale retailers and e-commerce companies, which drive the need for efficient and sustainable packaging. As environmental concerns continue to shape consumer preferences, the demand for cardboard trays is expected to increase, particularly in sectors like food packaging, electronics, and retail distribution.

In the South, the demand for cardboard trays is expected to grow at a CAGR of 5%, reflecting a vibrant and expanding manufacturing base. The South is home to numerous food processing plants, distribution centers, and packaging manufacturers, all of which contribute to the rising demand for packaging materials like cardboard trays. The region’s relatively lower production costs, coupled with a growing focus on sustainability in packaging, are key factors driving this growth. As industries across the South increasingly adopt eco-friendly packaging practices, the use of cardboard trays as an alternative to plastic and other non-biodegradable materials is on the rise. Additionally, the region’s growing population and consumer market further support the demand for packaging solutions, ensuring that the South remains a critical region for cardboard tray growth.

In the Northeast, the demand for cardboard trays is projected to grow at a CAGR of 4.5%, driven by the region’s established industrial base and ongoing shift toward sustainable packaging solutions. The Northeast has a mature packaging market, with a long history of adopting advanced packaging materials across various sectors, including food and retail. Increasing concerns over plastic waste and the environmental impact of packaging are pushing businesses in the region to adopt more sustainable alternatives, like cardboard trays. However, growth in this region is slower compared to the West and South, as the market is more saturated, and the demand for cardboard trays is stabilizing. Despite this, the region's continued focus on sustainability and the growing preference for eco-friendly packaging ensures steady growth in the demand for cardboard trays.

The demand for cardboard trays in the Midwest is projected to grow at a CAGR of 3.9%, reflecting more traditional manufacturing practices and a slower shift toward sustainable packaging solutions compared to other regions. While the Midwest has a large manufacturing base and significant food production sectors, there is still a reliance on conventional packaging materials, such as plastic and metal, which can impact the growth of cardboard trays. However, as environmental regulations become more stringent and consumer demand for sustainable packaging increases, the Midwest is gradually embracing eco-friendly options like cardboard trays. The region's relatively lower rate of adoption of green packaging alternatives and its focus on cost-effective, traditional methods are factors that contribute to the slower, but steady, growth in cardboard tray demand. As businesses in the Midwest continue to evolve toward more sustainable practices, this demand is expected to rise gradually.

The demand for cardboard trays in the United States is growing as food service, retail and e commerce sectors seek packaging that is recyclable, lightweight and suitable for automation. The global cardboard trays market is projected to increase at a compound annual growth rate of around 5 % or more through the mid 2030s. Key companies in the USA include Smurfit Kappa Group (approximately 25.2% market share), Mondi Group, DS Smith Plc, WestRock Company and International Paper Company. These firms supply corrugated and solid board trays for produce, ready meals and industrial transport.

Competition in the USA cardboard trays industry emphasizes sustainability credentials, material performance and supply chain flexibility. Providers are developing trays made from high recycled content or fully recyclable fibres, aligning with regulatory and retailer demands for reduced plastic use. Another focus is tray design tailored for automated filling lines and improved stacking strength, which supports high throughput operations in retail or food processing contexts. Custom print and branding are also used to differentiate offerings in shelf display applications. Marketing materials tend to highlight load capacity, moisture resistance, material sourcing, and ease of recycling. Companies that combine strong sustainability claims with operational efficiency and regional manufacturing are best positioned to expand in the USA cardboard trays market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Tray Type | With Cavity, Without Cavity |

| End-use | Food & Beverage Industry, Retail Industry, Pharmaceuticals Industry, Personal Care & Cosmetics Industry, Agriculture Industry |

| Key Companies Profiled | Smurfit Kappa Group, Mondi Group, DS Smith Plc, WestRock Company, International Paper Company |

| Additional Attributes | The market analysis includes dollar sales by tray type, end-use, and company categories. It also covers regional demand trends in the USA, particularly driven by the growing use of cardboard trays in food, beverage, and retail industries. The competitive landscape highlights key manufacturers focusing on innovations in packaging solutions and eco-friendly materials. Trends in the increasing demand for sustainable, recyclable, and cost-effective packaging in industries like food & beverage and pharmaceuticals are explored, along with advancements in tray design and functionality. |

The demand for cardboard trays in usa is estimated to be valued at USD 2.4 billion in 2025.

The market size for the cardboard trays in usa is projected to reach USD 3.8 billion by 2035.

The demand for cardboard trays in usa is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in cardboard trays in usa are virgin fiber and recycled fiber.

In terms of tray type, with cavity segment is expected to command 63.5% share in the cardboard trays in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Demand for Cardboard Trays in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA