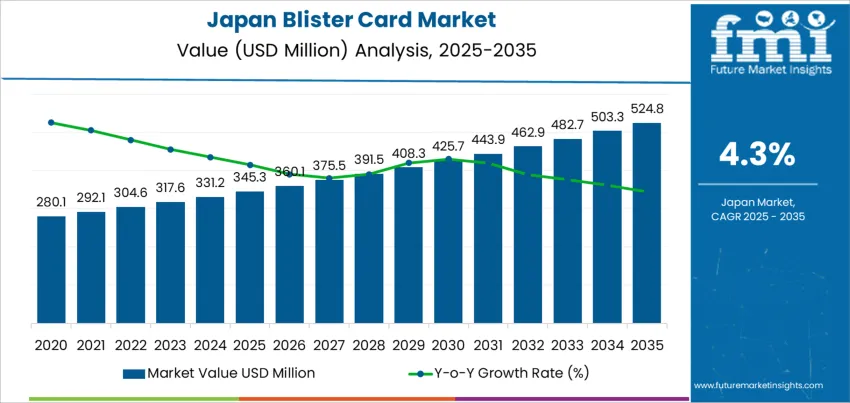

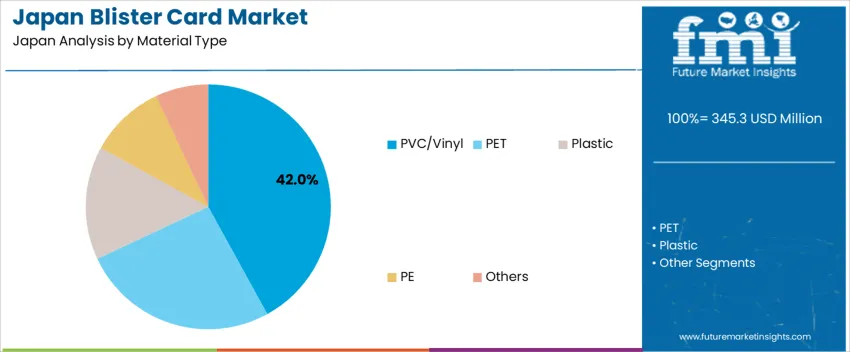

The Japan blister card demand is valued at USD 345.3 million in 2025 and is forecasted to reach USD 524.8 million by 2035, reflecting a CAGR of 4.3%. Demand is supported by increased packaging requirements for prescription and over-the-counter pharmaceuticals, consumer healthcare products, and compact retail-oriented goods. Compliance with child-resistant packaging mandates and traceability standards sustains the use of durable card-and-film structures. PVC/Vinyl represents the leading material type. It offers stability, thermoforming compatibility, and clarity required for accurate product identification in regulated healthcare distribution. Pharmaceutical packaging leads blister-card use due to expanding therapeutic volumes for chronic diseases and continued preference for unit-dose protection. Uptake is influenced by medication adherence programmes and secure dispensing protocols in clinical and retail settings.

Kyushu & Okinawa and Kanto record the highest usage levels due to the presence of pharmaceutical manufacturing sites, distribution hubs, and established print-pack conversion facilities. These regions maintain infrastructure for regulated cold-chain transport, which supports blister-packed treatments. Key suppliers include Dai Nippon Printing Co., Ltd. (DNP), Toppan Inc., Oji F-Tex Co., Ltd., Nissha Co., Ltd., and Kyodo Printing Co., Ltd. Their portfolios include pharmaceutical-grade blister substrates, functional coatings, and serialization-ready formats used in compliance packaging across domestic healthcare supply chains.

Demand for blister cards in Japan follows a phased growth profile shaped by regulated pharmaceutical packaging, medical-device distribution, and retail hygiene standards. Early-period growth remains supported by prescription-medication needs, particularly within aging-population segments. Packaging upgrades linked to dosage safety, tamper resistance, and portability provide steady expansion. Initial demand is also reinforced by strong domestic manufacturing of over-the-counter healthcare products, where blister formats remain a preferred enclosure.

Late-period growth maintains continuity but at a slower trajectory due to high packaging penetration in healthcare systems and disciplined inventory planning within established drug-supply chains. Ecofriendly regulations influence a gradual shift toward recyclable materials and reduced plastic content. These transitions create replacement demand rather than large volume surges. Electronics components contribute incremental gains, though efficiency improvements reduce packaging units per shipment. The curve therefore transitions from healthcare-driven expansion in the early phase to regulatory-aligned and material-innovation growth in the later phase, demonstrating controlled maturity rather than acceleration.

| Metric | Value |

|---|---|

| Japan Blister Card Sales Value (2025) | USD 345.3 million |

| Japan Blister Card Forecast Value (2035) | USD 524.8 million |

| Japan Blister Card Forecast CAGR (2025-2035) | 4.3% |

Demand for blister cards in Japan is increasing because pharmaceutical companies, supplement brands and consumer goods manufacturers require packaging that offers unit protection, clear product visibility and controlled dosing. Blister cards help preserve product quality by reducing exposure to moisture and handling, which is important for temperature-sensitive medicines and nutraceuticals commonly used by Japan’s ageing population. Pharmacies and hospitals also prefer unit-dose packaging because it supports accuracy in daily medication routines and simplifies inventory checks. Retailers use blister cards for small electronics, household items and personal-care accessories to improve presentation on shelves and reduce theft risk in high-traffic stores.

Manufacturers invest in automated sealing and inspection lines, which encourages consistent use of blister cards in production planning. Printed backing cards provide space for multilingual instructions, regulatory information and branding, which aligns with Japan’s strict labelling requirements. Sustainability discussions contribute to material improvements, including recyclable components and reduced plastic content. Constraints include cost pressure compared with bottles or flexible pouches, as well as limited adoption in low-value items where packaging expense must remain minimal. Some brands adjust usage based on environmental goals that prioritize material reduction.

Demand for blister cards in Japan reflects secure packaging requirements in healthcare, retail goods, and regulated consumer product distribution. Users prioritize tamper evidence, unit-dose presentation, and clarity for product identification. Retail environments require packaging that supports display visibility and organized shelf arrangement, while mail-order distribution growth increases the need for protective structures. Adoption aligns with Japan’s domestic focus on precise dosage labeling, compact packaging sizes, and hygiene-compliant sealing.

PVC/Vinyl accounts for 42.0%, driven by strong thermoforming performance, sealing compatibility, and affordable equipment integration in Japan’s pharmaceutical and personal goods packaging lines. PET represents 26.0%, used where recycling alignment and high transparency are required. Generic plastic formats hold 15.0%, supporting mid-cost products needing durable forming properties. PE represents 10.0%, valued in moisture-resistant packaging but used in limited volumes for blister structures. Others total 7.0%, including barrier-enhanced substrates for sensitive products. Material choice reflects Japan’s retail display expectations, moisture-control needs, and supply chain consistency across distributed storage environments.

Key points:

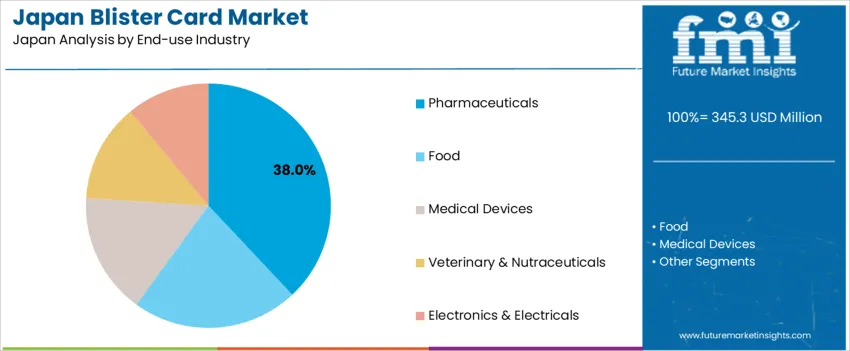

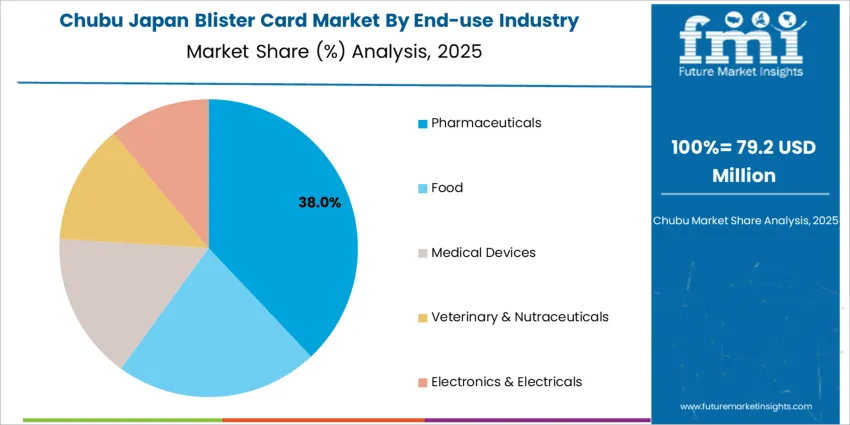

Pharmaceutical applications represent 38.0%, supported by regulated requirements for tamper-visible, unit-dose medication packaging. Food accounts for 22.0%, especially confectionery and small portion-packed snacks. Medical devices hold 16.0%, focusing on sterile handling and secure product presentation. Veterinary and nutraceuticals represent 13.0%, supporting dosage accuracy for supplements and clinical animal care. Electronics and electricals total 11.0%, where blister cards prevent mechanical damage for compact device components. Demand patterns reflect Japan’s centralized healthcare supply network and continued preference for precise single-unit dispensing in consumer and clinical settings.

Key points:

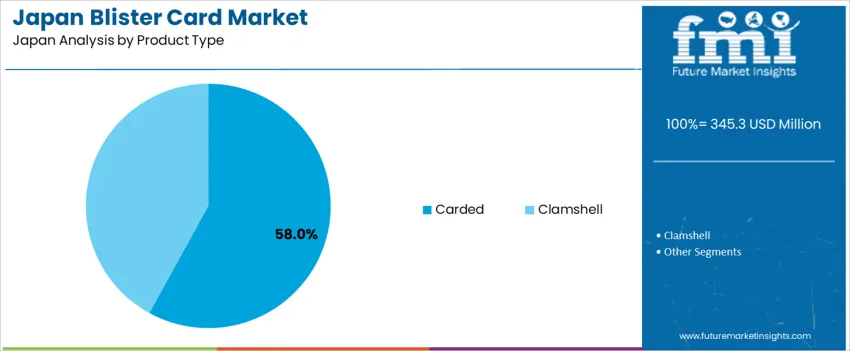

Carded blister products account for 58.0%, supported by lightweight construction, printing area for regulatory information, and compatibility with automated sealing lines used by Japanese manufacturers. Clamshell formats represent 42.0%, providing stronger mechanical protection for electronics and hardware sold in retail stores. Card-backed structures remain preferred in pharmaceuticals and smaller consumer goods due to low material usage and organized presentation. Procurement considerations include product visibility in compact retail layouts, sealing durability in mail delivery, and controlled material use that aligns with domestic sustainability priorities.

Key points:

Growth of over-the-counter product sales, expansion of unit-dose packaging in pharmacies and increased distribution of small accessories in convenience stores are driving demand.

In Japan, blister cards remain an important packaging format as pharmacies and drugstores increase retail sales of OTC medicines, including cold tablets, allergy treatments and supplements commonly purchased without prescriptions. Unit-dose packaging helps support safe usage instructions, particularly for older adults who rely on clear dosing visibility. Convenience stores located near train stations and business districts sell small accessories, batteries and personal care items that require tamper-evident packaging, contributing to continuous use of blister cards. Manufacturers supplying cosmetics and grooming tools also rely on blister cards to display products upright on pegboards, supporting merchandising standards in Japanese retail channels. Seasonal gift promotions and travel-size product kits further sustain procurement throughout the year.

Environmental pressure to reduce plastic components, limited recyclability of multi-material packs and high automation costs for smaller producers restrain adoption.

Government and consumer expectations for plastic reduction influence packaging decisions in major CPG brands, which may replace blister packs with cardboard-forward alternatives when feasible. Many blister cards use plastic cavities attached to printed board, creating recycling challenges because the materials must be separated before disposal, limiting acceptance in local waste streams. Smaller factories with manual or semi-automated lines face higher investment costs for advanced sealing and forming equipment, reducing their willingness to expand blister-pack usage. These constraints create cautious growth conditions as brands balance protection needs with sustainability and cost priorities.

Shift toward paper-forward structures, increased integration of QR-based safety information and rising demand in adherence-focused pharmaceutical packaging define key trends.

Packaging producers are introducing designs that maximize paperboard content to meet municipal recycling rules while minimizing plastic thickness. QR codes printed on blister cards provide access to digital instructions, safety data and allergy information, aligning with Japan’s preference for detailed consumer guidance. Pharmacies and hospitals are adopting calendar-style blister cards for patients managing chronic therapies, supporting better dose tracking in aging populations. Automation upgrades in pharmaceutical contract packaging facilities improve production speed for unit-dose formats used in national drug distribution. These trends support steady, clinical- and retail-focused demand for blister cards in Japan.

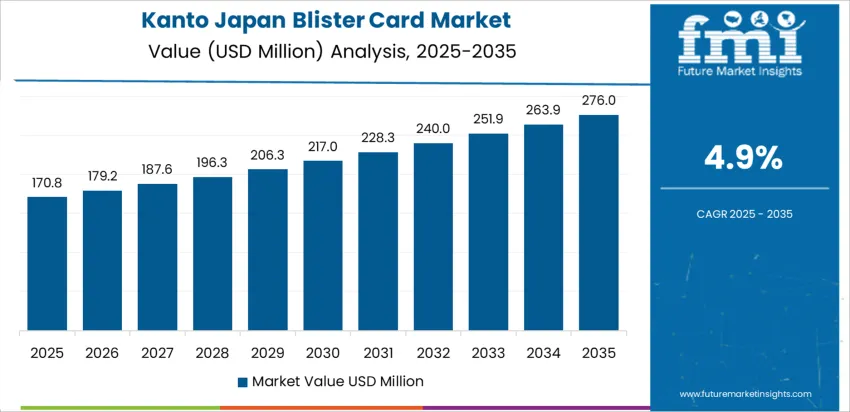

Demand for blister cards in Japan is influenced by pharmaceutical packaging, battery merchandising, small electronics, and hardware retail formats that rely on tamper-evident presentation and secure transport handling. Regional consumption patterns follow manufacturing concentration, convenience retail footprint, and distribution exposure across varied climates. Kyushu & Okinawa leads at 5.3% CAGR, followed by Kanto (4.9%), Kinki (4.3%), Chubu (3.8%), Tohoku (3.3%), and Rest of Japan (3.2%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.3% |

| Kanto | 4.9% |

| Kinki | 4.3% |

| Chubu | 3.8% |

| Tohoku | 3.3% |

| Rest of Japan | 3.2% |

Kyushu & Okinawa records 5.3% CAGR, supported by pharmaceutical distribution, consumer electronics retail, and tourism-related merchandising. Drugstores and hospital-linked pharmacies require blister-carded medication packaging that ensures hygiene protection during stocking and patient handling. Convenience retail zones serving travelers use blister packaging for batteries, personal accessories, and portable electronics that must withstand frequent shelf contact in humid regions. Packaging lines prioritize plastic-paper card integration that maintains sealing security for product display. Clear-view cards help prevent pilferage and improve visual inspection in high-traffic stores. Logistics networks emphasize stable card rigidity to avoid deformation during transport to island industry. Procurement teams evaluate heat-seal compatibility and tear resistance aligned with handling expectations in hospitality and transit retail channels.

Kanto expands at 4.9% CAGR, influenced by dense pharmacy chains and electronics retail volume across Tokyo and neighboring prefectures. Consumer electronics with high turnover depend on blister cards to secure small devices, cables, and accessories. Pharmaceutical packaging follows standards for unit-dose formats compatible with automated distribution in large hospitals. Retailers emphasize clear packaging that supports visible labeling and compact display layouts in limited shelf spaces. Packaging converters located in Kanto maintain short lead times for card customization aligned with promotional cycles. Interest in recyclable structures grows where material simplification supports collection efficiency in urban waste systems.

Kinki posts 4.3% CAGR, driven by consumer hardware and small tool packaging across Osaka commercial corridors. Blister cards maintain structural protection for metal parts and household accessories during retail handling. Retail display systems favor hang-tab card formats supporting rapid product scanning in high-activity environments. Pharmaceutical distribution maintains consistent blister adoption for chronic medication supplies. Buyers prioritize forming compatibility with existing sealing dies to avoid operational disruption. Incremental ecofriendly improvements include reduced card weight while preserving load capacity for heavier contents.

Chubu achieves 3.8% CAGR, supported by manufacturing clusters in Aichi and Shizuoka supplying consumer goods requiring protective card packaging. Automotive tools, accessories, and small replacement components are frequently sold in blister formats to ensure organized handling and visibility. Product catalogs for warehouse stores influence standardized card sizing to fit automated peg-system layouts. Adhesive and sealing consistency is evaluated for stability during transport across long delivery routes. Buyers assess cost reliability with volume runs that align with industrial procurement cycles.

Tohoku reports 3.3% CAGR, supported by distribution of essential household items and pharmaceuticals across wide geographic distances prone to temperature fluctuation. Card rigidity protects product shape during extended logistics. Healthcare facilities favor blister cards for infection-controlled dispensing. Retailers with lower foot traffic maintain product integrity through sealed visibility packaging to reduce handling damage. Procurement decisions incorporate cost stability and card thickness suited for long-route transport.

Rest of Japan grows at 3.2% CAGR, driven by local pharmacy sales, general merchandise stores, and seasonal tourist retail. Blister cards support compact storage and clear product identification in smaller retail footprints. Material choices emphasize affordability and reliable sealing performance without major equipment modification. Buyers explore lower-mass cards compatible with regional recycling channels where infrastructure exists.

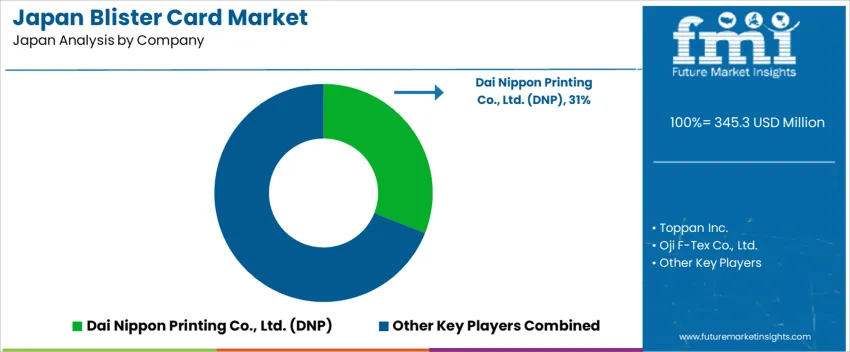

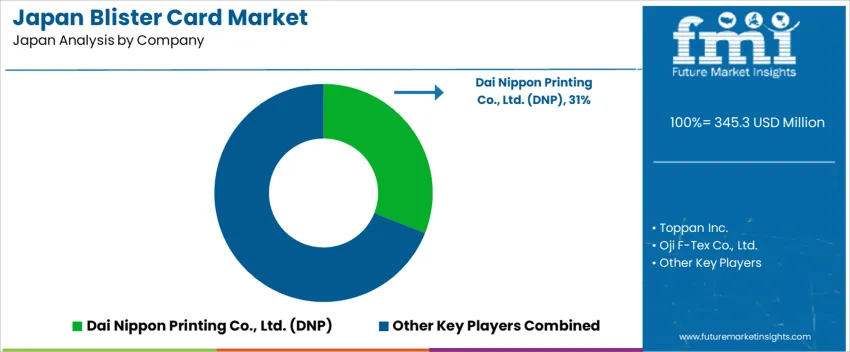

Demand for blister cards in Japan is driven by packaging suppliers supporting pharmaceuticals, consumer electronics accessories, and retail hardware items. Dai Nippon Printing Co., Ltd. holds an estimated 31.0% share, supported by controlled coating technologies and reliable adhesion performance required in regulated healthcare packaging. Its blister cards deliver consistent print accuracy and secure product retention during domestic distribution. Toppan Inc. maintains strong participation through printed card substrates that offer controlled heat-seal properties and excellent graphical detail for point-of-sale presentation. Oji F-Tex Co., Ltd. contributes presence in coated paperboard solutions used in retail blister applications where dimensional stability and predictable sealing efficiency are priorities.

Nissha Co., Ltd. supports demand for electronics and precision goods packaging with blister-compatible substrates designed for clean cavity engagement and durable visibility. Kyodo Printing Co., Ltd. services pharmaceutical and household-goods producers with card materials that maintain coating uniformity and traceable production control. Competition in Japan centers on seal-integrity consistency, barrier performance, print resolution, cavity-fit reliability, and validated supply-chain capability. Demand remains stable as Japanese manufacturers continue using protective card-based blister formats to secure products and maintain visual clarity throughout retail handling in Japan’s distribution channels.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material Type | PVC/Vinyl, PET, Plastic, PE, Others |

| End-use Industry | Pharmaceuticals, Food, Medical Devices, Veterinary & Nutraceuticals, Electronics & Electricals |

| Product Type | Carded, Clamshell |

| Technology Type | Thermoforming Technology, Cold Forming Technology |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Dai Nippon Printing Co., Ltd. (DNP), Toppan Inc., Oji F-Tex Co., Ltd., Nissha Co., Ltd., Kyodo Printing Co., Ltd. |

| Additional Attributes | Increased usage in pharmaceutical packaging due to medication safety standards; demand driven by unit-dose compliance and child-resistant packaging; cold-form blister cards expanding in temperature-sensitive medical products; technological advancements in barrier materials and sustainable substrates; regional demand supported by pharmaceutical hubs in Kanto and Kansai regions. |

The demand for blister card in Japan is estimated to be valued at USD 345.3 million in 2025.

The market size for the blister card in Japan is projected to reach USD 524.8 million by 2035.

The demand for blister card in Japan is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in blister card in Japan are pvc/vinyl, pet, plastic, pe and others.

In terms of end-use industry, pharmaceuticals segment is expected to command 38.0% share in the blister card in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Carded Blister Packaging Market

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Demand for Blister Card in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardboard Trays in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA