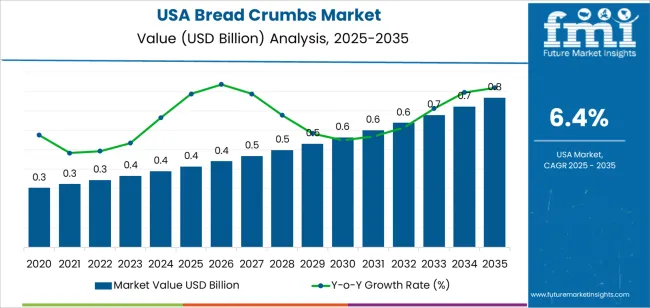

The USA bread crumbs demand is valued at USD 0.4 billion in 2025 and is expected to reach USD 0.8 billion by 2035, reflecting a CAGR of 6.4%. Demand is influenced by consistent utilization of breading and coating ingredients across the food-processing, food-service, and ready-meal sectors. Increased consumption of convenience foods, broader adoption of pre-breaded meat and seafood products, and steady growth in home cooking contribute to sustained requirements for dry and fresh crumb formulations. Product reformulation aligned with clean-label preferences and controlled textural performance also shapes purchasing trends.

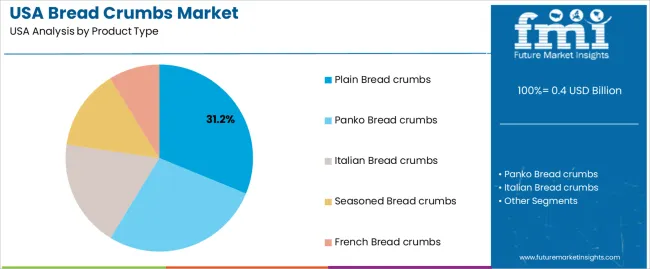

Plain bread crumbs lead the product landscape. This segment is selected for its versatility in binding, coating, and texture enhancement in processed meat, poultry, baked goods, and prepared meals. Its widespread use across industrial bakeries and large-scale food manufacturers supports continuous demand. The segment also benefits from stable pricing, consistent performance, and compatibility with automated coating systems used in high-volume processing.

West USA, South USA, and Northeast USA record the highest utilization levels due to the presence of large food manufacturers, extensive bakery operations, and dense food-service networks. These regions also maintain strong distribution channels for culinary ingredients used in both industrial and retail applications. Key suppliers include Newly Weds Foods, McCormick & Company, Gonnella Baking Co., and Pinnacle Foods Inc. (Conagra Brands). These companies provide plain and speciality crumb products for industrial processing, commercial kitchens, and packaged-food applications.

The Growth Rate Volatility Index is minimal because demand is tied to consistent consumption patterns across food processing, quick-service restaurants, and home cooking. These categories exhibit predictable volume requirements and limited exposure to disruptive substitution cycles, resulting in steady annual increments rather than sharp fluctuations. Volatility remains low in the early period as manufacturers scale production to meet steady institutional and retail demand. Price elasticity is limited because bread crumbs serve as a functional ingredient with stable cost structures and broad application in coatings, fillers, and ready-meal preparation.

Mid-cycle volatility also stays contained, supported by uniform procurement cycles within processed-meat, frozen-food, and bakery industries. Late-cycle variability remains modest because growth is anchored in incremental product diversification, such as gluten-free and clean-label variants, rather than sudden shifts in consumption. Across the full horizon, the index suggests a predictable, smooth expansion curve, with limited swings in annual growth rates and a consistent demand base that stabilizes long-term performance.

| Metric | Value |

|---|---|

| USA Bread Crumbs Sales Value (2025) | USD 0.4 billion |

| USA Bread Crumbs Forecast Value (2035) | USD 0.8 billion |

| USA Bread Crumbs Forecast CAGR (2025-2035) | 6.4% |

Demand for bread crumbs in the USA is rising as food manufacturers, food-service operators and retailers expand offerings of ready-to-cook, convenience and frozen meal products. Bread crumbs are essential for coating, binding and texturing in processed foods such as chicken nuggets, fish fillets, meatballs and bakery items. The growing prevalence of quick-service restaurants (QSRs), frozen food intake and breaded snack formats supports this increased use. Consumer interest in premium textures and international styles, such as Japanese-style panko crumbs, drives growth in higher-value crumb varieties within the USA industry.

Retail channels also benefit from health-oriented variant introductions (e.g., whole-grain, gluten-free, seasoned) which expand usage beyond traditional applications. Constraints include competition from alternative coatings (such as flour, cornmeal or batter mixes), raw-material cost fluctuations (mainly wheat) and the modest growth in traditional cereal or bread-based meal consumption compared with other convenience segments. Some producers may delay adoption of specialty bread crumb formulations until clear consumer demand and premium margins justify investment.

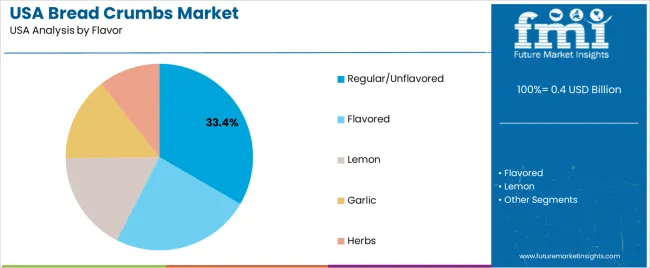

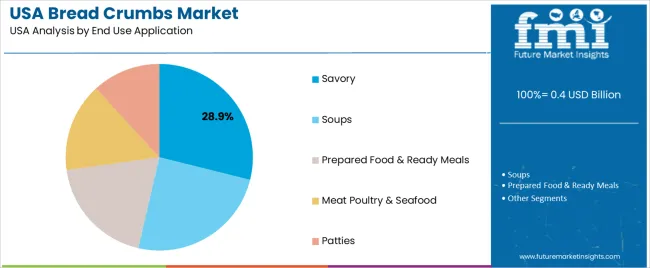

Demand for bread crumbs in the United States reflects their role in coating systems, texture enhancement, and binding applications across home cooking, foodservice operations, and processed-food manufacturing. Product-type preferences correspond to texture expectations, absorption characteristics, and performance in frying or baking environments. Flavor selection is shaped by recipe needs and consumer interest in convenience-oriented seasoning formats. End-use distribution indicates how bread crumbs support savory dishes, soups, ready meals, and meat preparations where structure, crispness, and binding properties are required.

Plain bread crumbs hold 31.2% of national demand and represent the leading product type. Their neutral flavour and adaptable texture support coating, thickening, and binding across a wide range of recipes. Panko bread crumbs account for 27.5%, offering light, airy crispness popular in fried foods. Italian bread crumbs represent 18.6%, serving dishes requiring herb-infused profiles. Seasoned variants hold 13.9%, supporting convenience-driven cooking. French bread crumbs represent 8.8%, offering finer texture options. Product-type distribution reflects recipe versatility, coating performance, and household familiarity, influencing how USA consumers select crumbs for frying, baking, and meal preparation.

Key drivers and attributes:

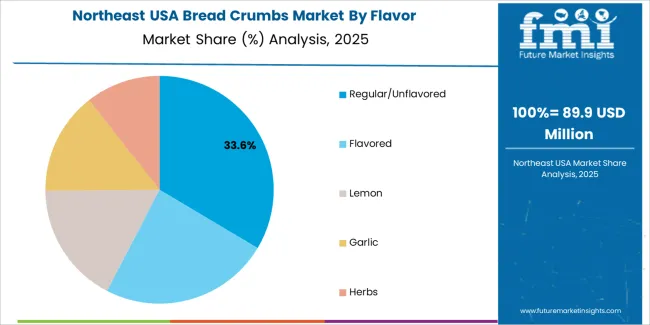

Regular or unflavored crumbs hold 33.4% of national demand and represent the dominant flavor category. These crumbs support multiple cuisines and allow cooks to adjust seasoning manually. Flavored variants account for 24.1%, serving fast-preparation uses. Lemon flavor represents 17.3%, supporting seafood and light poultry dishes. Garlic holds 14.6%, aligning with savory and Mediterranean cooking. Herb-based options represent 10.6%, serving prepared foods requiring aromatic profiles. Flavor distribution reflects recipe preferences, seasoning control, and culinary traditions across USA kitchens where crumbs enhance texture while allowing variable taste profiles.

Key drivers and attributes:

Savory dishes hold 28.9% of national demand and represent the leading application category. Bread crumbs support structure, binding, and browning across casseroles, baked dishes, and coated vegetables. Soups account for 24.7%, using crumbs for thickening and texture improvement. Prepared food and ready meals represent 19.2%, integrating crumbs in binding systems for mass-produced entrées. Meat, poultry, and seafood account for 15.4%, relying on crumbs for breading and moisture retention. Patties represent 11.8%, where crumbs enhance firmness and shape retention. Application distribution reflects texture requirements, stability needs, and processing conditions across USA culinary and manufacturing environments.

Key drivers and attributes:

Rising interest in convenience frozen foods, growth of breaded menu items in food service and increased artisanal baking are driving demand.

In the United States, demand for bread crumbs is increasing as frozen-food manufacturers rely on ready‐to‐use breading for convenience and cost efficiency. The growth of breaded products such as chicken tenders, fish fillets and breaded vegetables in quick-service restaurants (QSR) expands usage in the food-service channel. Artisanal and premium bakeries are also incorporating bread crumbs into stuffing, coating and snack applications, leveraging clean-label and whole‐grain breadcrumb formats. These dynamics support steady consumption of bread crumbs across both industrial and retail segments in the USA

Competition from alternative coating technologies, raw-material cost fluctuation and changing consumer health preferences restrain growth.

Some manufacturers shift away from traditional bread crumbs toward panko, gluten-free or coating systems such as batters and tempura to meet evolving menu trends and dietary preferences. Wheat and flour price volatility may raise manufacturing cost for bread crumbs and constrain margins or product positioning. Some consumers in the USA are reducing consumption of breaded, fried foods due to health concerns about calories and refined carbohydrates, which may limit incremental growth in breadcrumb usage.

Trend toward whole-grain and whole-wheat breadcrumb formats, increased use of gluten-free and plant‐based alternatives and growth of value‐added pre‐battered kits define industry direction.

Manufacturers are launching bread crumbs made from whole-grain wheat or multigrain bread to cater to wellness-oriented USA consumers and meet clean-label expectations. Gluten-free bread crumb alternatives (for example, from rice or corn) are gaining traction in the retail and food-service sectors. Value-added pre-battered kits that include bread-crumb coatings and seasoning blends enable restaurants and consumers to simplify meal preparations. These trends support continued evolution of the breadcrumb industry in the United States.

Demand for bread crumbs in the USA is rising through 2035 as food processors, restaurant chains, institutional kitchens, and household consumers expand their use of crumb-based coatings, binders, and texturizers. Bread crumbs support production in frozen foods, ready-to-cook meals, meat processing, bakery applications, and home-cooking categories. Growth is reinforced by higher consumption of convenience foods, expanding quick-service menus, and broader distribution of panko, fine, and seasoned crumb varieties.

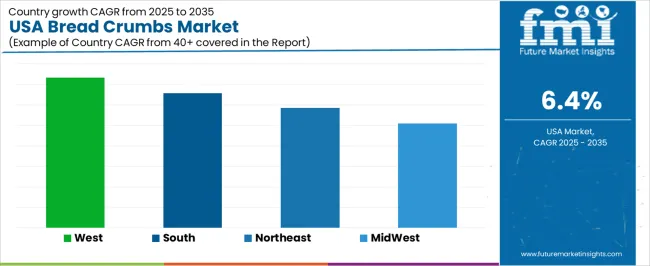

USA manufacturers scale output of wheat-based, gluten-free, and specialty crumb formulations to meet evolving dietary preferences. Regional variation reflects culinary trends, food-processing density, and retail distribution networks. West USA leads at 7.3%, followed by South USA (6.6%), Northeast USA (5.9%), and Midwest USA (5.1%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 7.3% |

| South USA | 6.6% |

| Northeast USA | 5.9% |

| Midwest USA | 5.1% |

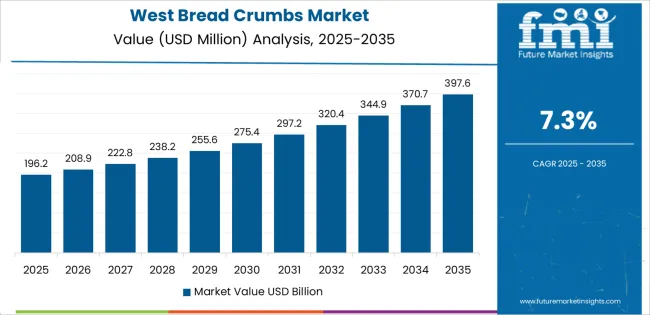

West USA grows at 7.3% CAGR, driven by strong demand from frozen-food producers, restaurant groups, and multicultural food industries across California, Washington, Oregon, Nevada, and Arizona. Food manufacturers in California scale production of breaded appetizers, seafood, poultry, and plant-based items, increasing purchases of panko and fine crumbs. Asian and Mediterranean food businesses throughout the West rely on specialty crumb varieties for coating and texture enhancement. Retailers expand gluten-free and seasoned crumb offerings to meet consumer interest in global cuisine and home-cooking trends. Quick-service restaurants adopt standardized crumb formulations to maintain coating consistency across franchise kitchens.

South USA grows at 6.6% CAGR, supported by strong consumption of breaded poultry, seafood, and fried appetizers across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Regional food processors expand production of frozen chicken products, catfish fillets, shrimp, and ready-to-cook coated items, driving demand for coarse and fine crumbs. Southern cuisine traditions encourage household use of crumbs in fried dishes, meatloaf, casseroles, and stuffing blends. Supermarkets expand private-label crumb offerings as cost-sensitive households purchase bulk and value packs. Restaurant chains across the South use standardized crumb coatings to maintain menu consistency.

Northeast USA grows at 5.9% CAGR, shaped by dense population centers, strong restaurant activity, and significant bakery and prepared-food production across New York, Massachusetts, Pennsylvania, New Jersey, and Connecticut. Food manufacturers produce breaded entrées, crab cakes, stuffed seafood, and frozen Italian dishes requiring specialty crumbs. Retail demand rises for seasoned, Italian-style, and fine crumbs used in home meal preparation. Institutional kitchens in universities and healthcare facilities use consistent crumb coatings for large-volume cooking. Bakery operations repurpose surplus bread into crumb production, supporting regional supply chains.

Midwest USA grows at 5.1% CAGR, supported by extensive food-processing activity, strong meat-production networks, and steady household use across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Meat processors adopt bread crumbs as binders in meatballs, patties, and blended products. Frozen-food plants expand coating lines for breaded chicken, pork, and vegetable items. Retailers promote bulk crumb packs aligned with cost-conscious grocery purchasing patterns. Home cooks use crumbs in casseroles, meatloaf, and oven-baked dishes common in regional meal routines. Grain-processing infrastructure supports raw-material availability for crumb production.

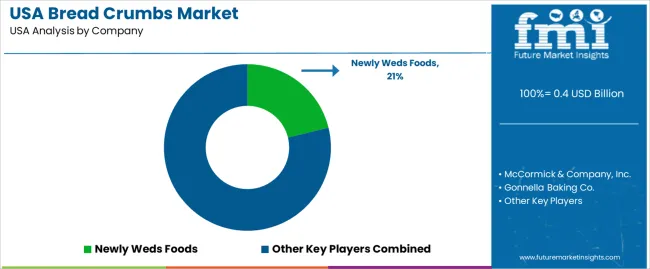

Demand for bread crumbs in the USA is shaped by a group of national food manufacturers supplying commercial foodservice, frozen entrées, meat processors, bakery products, and retail pantry items. Newly Weds Foods holds the leading position with an estimated 21.2% share, supported by controlled crumb-milling processes, consistent particle-size specifications, and strong integration with USA meat, poultry, and prepared-food producers. Its position is reinforced by reliable seasoning consistency and stable performance in large-scale coating and binding applications.

McCormick & Company, Inc. follows as a major participant through retail and foodservice offerings that provide steady flavor uniformity and predictable shelf stability. Its distribution depth across USA grocery channels supports broad availability of panko, traditional, and seasoned crumb varieties. Gonnella Baking Co. maintains a notable presence through bakery-derived crumbs used widely in industrial and foodservice supply chains, offering controlled texture profiles and dependable moisture levels suited to breaded proteins and forming applications.

Pinnacle Foods Inc. (Conagra Brands) contributes additional capability with branded crumb products distributed nationwide, emphasizing consistent granulation, flavor stability, and compatibility with home-cooking and value-added frozen foods. Competition across this segment centers on particle-size control, texture consistency, moisture stability, flavor reliability, and supply performance for large food manufacturers. Demand remains steady as USA processors and households continue to use traditional, panko, and seasoned crumbs in coatings, binders, and ready-to-cook products that require predictable cooking behaviour and stable sensory characteristics.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Plain Bread Crumbs, Panko Bread Crumbs, Italian Bread Crumbs, Seasoned Bread Crumbs, French Bread Crumbs |

| Flavor | Regular/Unflavored, Flavored, Lemon, Garlic, Herbs |

| End Use Application | Savory, Soups, Prepared Food & Ready Meals, Meat Poultry & Seafood, Patties |

| Distribution Channel | Retail, Food Service, HoReCa, Quick Service Restaurants, Travel Retail (Airplanes, Cruise Ships, Others) |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Newly Weds Foods, McCormick & Company, Inc., Gonnella Baking Co., Pinnacle Foods Inc. (Conagra Brands) |

| Additional Attributes | Dollar sales by product type, flavor category, application, and distribution channel; regional consumption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of bread crumb manufacturers; developments in flavored crumbs, clean-label formulations, gluten-free variants, and panko innovations; integration with retail packaged food, HoReCa, QSR chains, prepared meal processing, and travel catering services across the USA. |

The demand for bread crumbs in usa is estimated to be valued at USD 0.4 billion in 2025.

The market size for the bread crumbs in usa is projected to reach USD 0.8 billion by 2035.

The demand for bread crumbs in usa is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in bread crumbs in usa are plain bread crumbs, panko bread crumbs, italian bread crumbs, seasoned bread crumbs and french bread crumbs.

In terms of flavor, regular/unflavored segment is expected to command 33.4% share in the bread crumbs in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Bread Crumbs Market Growth – Baking & Culinary Trends 2025 to 2035

Demand for Bread Crumbs in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA