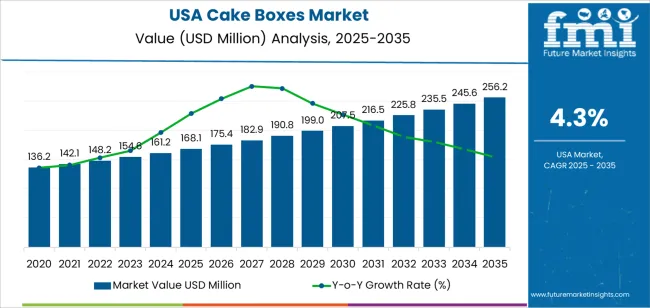

The demand for cake boxes in the USA is projected to increase from USD 168.1 million in 2025 to USD 255.5 million by 2035, representing a compound annual growth rate (CAGR) of 4.30%. As the bakery and dessert sectors continue to expand, the need for quality packaging for cakes and other baked goods will rise. This demand will be driven by the increasing popularity of custom and premium cakes, particularly for special events such as birthdays, weddings, and corporate functions. Consumers’ growing focus on the aesthetics of packaging, as well as the need for secure and practical solutions for transportation, will contribute to the rising demand for cake boxes.

The expansion of e-commerce and online food delivery services will further boost the need for cake boxes, especially as more consumer’s order cakes and other baked goods for home delivery. Cake boxes are essential for ensuring the safe transport of delicate items while maintaining their appearance. As the demand for healthier, high-quality desserts also grows, the need for durable and attractive packaging solutions will increase. The growing emphasis on eco-friendly packaging solutions is expected to contribute to the shift toward eco-friendly materials in cake box production, such as recyclable and biodegradable options.

Between 2025 and 2030, the demand for cake boxes in the USA will increase from USD 168.1 million to USD 175.3 million. This initial phase of growth will be driven by the rising popularity of premium cakes, personalized designs, and the continued growth of the bakery sector. With consumers increasingly preferring custom-made cakes for special occasions, the demand for packaging that meets the specific needs of these products will continue to rise. The trend toward environmentally friendly packaging materials will encourage manufacturers to produce eco-friendly options that meet both functional and aesthetic demands.

From 2030 to 2035, the demand for cake boxes is expected to accelerate, reaching USD 255.5 million. The primary drivers of this growth will include the continued expansion of the custom cake industry, particularly for weddings and other events. Innovations in packaging design, including more attractive and functional solutions, will also help fuel demand. As resource efficiency becomes a more significant focus in packaging design, the demand for eco-friendly cake boxes will grow in tandem with these broader environmental trends. Manufacturers will continue to innovate, focusing on materials that not only meet the durability and safety needs but also align with consumer expectations for resource efficiency and style.

| Metric | Value |

|---|---|

| Demand for Cake Boxes in USA Value (2025) | USD 168.1 million |

| Demand for Cake Boxes in USA Forecast Value (2035) | USD 255.5 million |

| Demand for Cake Boxes in USA Forecast CAGR (2025 to 2035) | 4.30% |

The demand for cake boxes in the USA is growing due to the rise in the bakery, confectionery, and dessert‑delivery sectors. As e‑commerce cake orders, gifting occasions, and celebrations increase, bakeries and online cake retailers need packaging that offers both functionality and aesthetic appeal. Cake boxes are essential in protecting delicate products during transport while also enhancing brand differentiation through attractive designs. This dual-purpose packaging meets the needs of both retailers and end‑consumers.

The shift towards custom and premium offerings in the bakery industry also plays a role in this growth. Customers increasingly seek personalized cakes for special events like birthdays, weddings, and corporate gatherings. Packaging must align with these premium expectations, prompting bakeries and pastry shops to invest in printed, windowed, multi‑tier, or custom cake boxes. These options help elevate the visual appeal and reinforce the consumer experience.

Operational and logistical considerations are important as well. With the rise of online cake‑delivery services and direct‑to‑consumer platforms, packaging that ensures product integrity, ease of handling, and efficient shipping is crucial. Cake boxes that meet these criteria reduce returns, minimize damage during transit, and contribute to customer satisfaction. As packaging suppliers continue to innovate in materials, design, and print techniques, the demand for cake boxes in the USA is expected to grow steadily through 2035. This trend is fueled by the increasing need for reliable, attractive, and functional packaging in the fast‑evolving bakery industry.

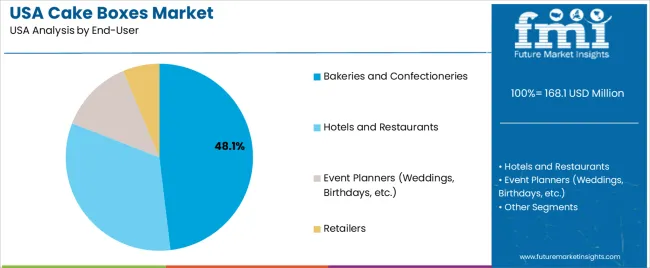

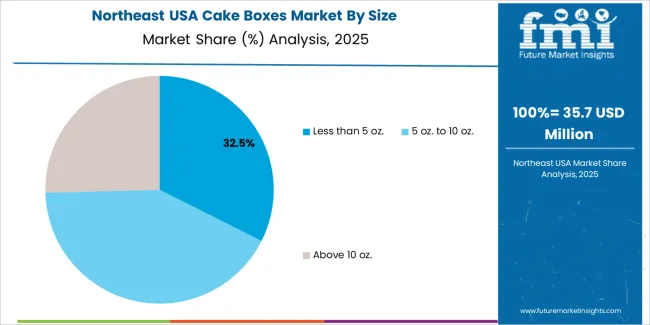

Demand for cake boxes in the USA is segmented by material, end user, size, and printing. By material, demand is divided into paper & paperboard boxes, plastic boxes, and biodegradable materials, with paper & paperboard boxes. The demand is also segmented by end user, including bakeries and confectioneries, hotels and restaurants, event planners (weddings, birthdays, etc.), and retailer., demand is divided into less than 5 oz., 5 oz. to 10 oz., and above 10 oz., with less than 5 oz. Regarding printing, demand is divided into offset printing, flexographic printing, digital printing, and screen printing, with offset printing leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Paper & paperboard boxes account for 50% of the demand for cake boxes in the USA. These materials are favored for their affordability, ease of use, and ability to be customized with various designs and prints, making them ideal for packaging cakes and other baked goods. Paper & paperboard boxes are lightweight, durable, and provide a protective environment for cakes, preventing damage during transport and display. They are also environmentally friendly and easily recyclable, which aligns with increasing consumer demand for eco-friendly packaging options. The versatility of paper & paperboard allows for a wide range of customization, including various sizes, shapes, and printing options, further driving their dominance in the cake box industry. As eco-consciousness continues to grow among consumers and businesses, paper & paperboard boxes are expected to maintain their leading share in the cake box industry.

Bakeries and confectioneries account for 48% of the demand for cake boxes in the USA. These businesses rely heavily on cake boxes to safely transport and present their products to customers. Cake boxes are essential for maintaining the integrity and freshness of cakes, pastries, and other baked goods, ensuring that they reach customers in optimal condition. Bakeries and confectioneries are also the primary producers of cakes, making them the largest consumers of cake boxes. The growing trend of customized cakes for various occasions, such as birthdays and weddings, has further fueled the demand for specialized cake packaging. As more bakeries and confectioneries focus on offering high-quality, aesthetically appealing products, the demand for high-quality, attractive, and functional cake boxes will continue to dominate in this segment. With the expansion of the bakery and confectionery industry, bakeries and confectioneries will remain the largest end users of cake boxes in the USA.

Key drivers include the strong culture of celebrations and gifting which boosts demand for cakes and premium packaging, the growth of bakeries and online cake‑order platforms requiring safe and attractive packaging, the increasing preference for bespoke or customised packaging designs, and rising interest in eco‑friendly materials and printing options that enhance shelf‑impact. Restraints include cost pressures on small bakeries to adopt premium or custom boxes, supply‑chain disruptions for specialty packaging materials, increasing regulatory scrutiny on food‑contact packaging (including recyclability/compostability), and competition from simpler packaging solutions when cost matters most.

Why is Demand for Cake Boxes Growing in USA?

Demand for cake boxes in USA is growing due to the rising popularity of decorated cakes for celebrations such as birthdays, weddings, corporate events, and home parties. Consumers need packaging that both protects the cake and enhances its visual appeal. The rise in online cake delivery and direct-to-consumer services has further increased demand for packaging that ensures safe transport, is visually appealing, and is easy to handle. Smaller artisan bakeries and specialty cake providers are also investing in custom-branded boxes to differentiate themselves in a competitive industry, boosting the adoption of advanced cake-box solutions. These factors contribute to a robust industry for cake boxes, particularly in the premium and online segments.

How are Technological Innovations Driving Growth of Cake Boxes in USA?

Technological innovations are improving the design and functionality of cake boxes in USA by enhancing durability, aesthetics, and usability. Key advancements include digital printing technology for custom branding and artwork on small batch orders. New materials like grease-resistant paperboards and biodegradable options cater to consumer demand for resource efficiency and regulatory compliance. Innovative structural designs make stacking and assembly easier, improving transport efficiency and protecting cakes. Smart inserts or partitions are introduced to securely hold cake tiers and separate accessories, further boosting packaging functionality. These innovations make cake boxes not just a packaging solution but also an integral part of branding and logistics for premium bakers and online cake vendors.

What are the Key Challenges Limiting Adoption of Cake Boxes in USA?

A major issue is the high cost of custom printing, premium materials, and advanced structural designs, which raise per-unit costs and can be prohibitive for small bakeries or low-margin products. The complexity of custom designs and specialized materials also requires minimum order quantities and longer lead times, complicating supply chain management. Packaging must balance aesthetics with functionality to ensure food safety and transport durability. If cake boxes fail during transit whether through damage or collapse it negatively affects the brand’s reputation. Regulatory and environmental pressures to meet recycling or composting standards can also increase costs or limit material choices.

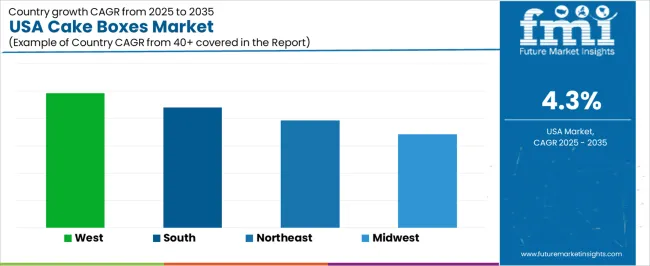

| Region | CAGR (%) |

|---|---|

| West | 4.9 |

| South | 4.4 |

| Northeast | 3.9 |

| Midwest | 3.4 |

The demand for cake boxes in the USA is increasing across all regions, with the West leading at a 4.9% CAGR. This growth is driven by rising consumer demand for bakery products and the increasing popularity of home-based celebrations and events. The South follows with a 4.4% CAGR, supported by the region’s strong bakery industry and growing retail sector. The Northeast shows a 3.9% CAGR, driven by a large concentration of urban areas and high demand for bakery goods. The Midwest experiences moderate growth at 3.4%, as the region sees steady consumer interest in baked goods and more eco-conscious packaging.

The West is experiencing the highest demand for cake boxes in the USA, with a 4.9% CAGR. This growth is driven by the region’s large population that values convenience and high-quality food products. Cities like Los Angeles, San Francisco, and Seattle have robust bakery industries, contributing to a higher demand for cake boxes as baked goods gain popularity for events like celebrations and holidays. The increasing trend of online bakery orders also supports this growth, as consumers require reliable packaging for shipping cakes and pastries. The region has seen a shift towards premium packaging, aligning with consumer preferences for both functionality and visual appeal. As the West continues to focus on quality and effective packaging solutions, the need for cake boxes remains strong. The rising demand from both the retail and e-commerce bakery sectors ensures that the West leads in the expansion of cake box demand in the USA.

The South is seeing strong demand for cake boxes, with a 4.4% CAGR. The growth is largely driven by the region’s expanding bakery sector, especially in states like Texas, Florida, and Georgia, where there is a rising number of special events and celebrations requiring high-quality baked goods. As the demand for cakes, cupcakes, and other baked items increases, so does the need for reliable packaging. The South also has a growing number of health-conscious consumers, who are becoming more selective about the packaging of their food products. This shift has prompted bakeries to focus on better packaging solutions to meet consumer expectations. Retailers and bakeries are investing in improved packaging to align with consumer demand for functionality and aesthetics. With the region’s increasing preference for higher-quality products, the demand for cake boxes continues to expand, driven by both local bakeries and larger chains catering to diverse consumer needs.

The Northeast is seeing steady growth in demand for cake boxes, with a 3.9% CAGR. This increase is attributed to the region's dense population and high concentration of urban areas such as New York City and Boston. These areas have strong demand for bakery goods, which fuels the need for packaging solutions like cake boxes. The region's busy lifestyle, with many home-based events and celebrations, has increased the demand for cakes and other baked goods, further boosting the need for reliable and high-quality packaging. As more consumers choose bakery items for events, the demand for aesthetically pleasing and functional cake boxes rises. Bakeries in the Northeast are responding by offering improved packaging to meet this growing demand. The region’s continued growth is supported by its focus on convenience and access to a wide range of bakery options, positioning cake boxes as an essential part of the bakery industry in these urban centers.

The Midwest is experiencing moderate growth in demand for cake boxes, with a 3.4% CAGR. This growth is driven by the increasing interest in baked goods and the expansion of the bakery industry in cities like Chicago and Detroit. As the Midwest sees a rise in consumer demand for quality cakes and pastries, the need for reliable packaging solutions has become more evident. Local bakeries and larger chains are offering a broader range of bakery products, and with that comes the need for effective and appealing packaging. Although the growth rate in this region is slower than others, there is a steady rise in consumer interest in both the products and packaging. The growing popularity of online ordering also contributes to the demand for cake boxes, as consumers seek products that are packaged securely for delivery. As demand for baked goods continues to rise, so will the need for packaging solutions in the Midwest.

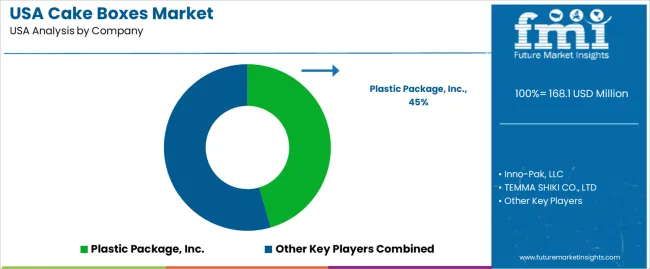

In the USA, demand for cake boxes is fueled by a strong bakery and confectionery sector, widespread celebrations, and a rising interest in premium packaging. The region has a well-established distribution network, with an increasing focus on packaging that protects the product while enhancing its presentation. Leading manufacturers such as Plastic Package, Inc. with a 45.5% share, Inno-Pak, LLC, TEMMA SHIKI CO., LTD, LINDAR Corporation, and Napco National dominate the industry.

Plastic Package, Inc. maintains a leadership position due to its large scale, USA manufacturing footprint, and diverse offering of materials, including both plastic and paperboard options. Other key players differentiate themselves by offering custom sizes, printed branding, specialty finishes, and eco-material options. Since packaging serves both a functional (protection and transport) and promoting (aesthetic) role, companies that combine high quality, flexibility, and cost efficiency are the most successful.

The competitive landscape is influenced by innovations in materials such as biodegradable plastics and paperboard alternatives, as well as increased demand for customization in design (e.g., print design, embossing, and windows). The rise of online cake delivery services has also led to stricter requirements for packaging durability and performance. Smaller players must overcome high capital and tooling costs, as well as supply-chain scale advantages held by larger incumbents. As packaging needs continue to evolve, companies that can offer fast turnaround, responsive design, and premium finishes are poised to gain a competitive advantage.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Material | Paper & Paperboard Boxes, Plastic Boxes, Biodegradable Materials |

| Size | Less than 5 oz., 5 oz. to 10 oz., Above 10 oz. |

| Printing | Offset Printing, Flexographic Printing, Digital Printing, Screen Printing |

| End User | Bakeries and Confectioneries, Hotels and Restaurants, Event Planners (Weddings, Birthdays, etc.), Retailers |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Plastic Package, Inc., Inno-Pak, LLC, TEMMA SHIKI CO., LTD, LINDAR Corporation, Napco National |

| Additional Attributes | Dollar sales by material type, size, printing methods, end-user distribution, and regional trends with a focus on bakeries, restaurants, and event planners. Insights into product demand across various material options and printing techniques in the USA industry. Special attention to biodegradable materials and customizations in cake box design. |

The demand for cake boxes in usa is estimated to be valued at USD 168.1 million in 2025.

The market size for the cake boxes in usa is projected to reach USD 256.2 million by 2035.

The demand for cake boxes in usa is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in cake boxes in usa are paper & paperboard boxes, plastic boxes and biodegradable materials.

In terms of size, less than 5 oz. segment is expected to command 32.2% share in the cake boxes in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cake Boxes Market from 2025 to 2035

Demand for Cake Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Interlocking Boxes in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Foldable Plastic Pallet Boxes in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cake Base Discs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA