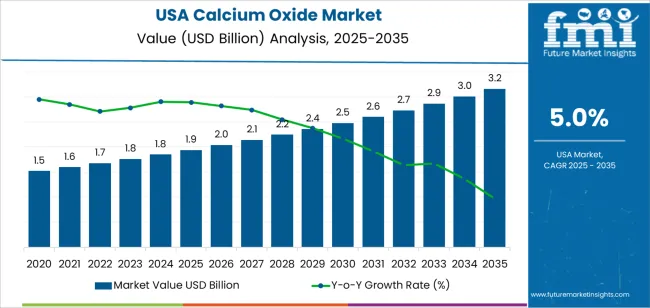

The demand for calcium oxide in the USA is expected to grow from USD 1.9 billion in 2025 to USD 3.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.00%. Calcium oxide, commonly known as quicklime, is an essential material used across industries such as steel manufacturing, construction, agriculture, and water treatment. It plays a critical role in many processes, including the production of steel and cement, environmental applications such as flue gas treatment, and wastewater management. As these industries grow and evolve, particularly with an increased focus on sustainability, the demand for calcium oxide is expected to rise.

The USA’s expanding infrastructure development and industrial activities will contribute significantly to the rising demand for calcium oxide, particularly in steel production and cement manufacturing. The growing emphasis on environmental protection, stricter emissions regulations, and the push for cleaner technologies will lead to higher demand for calcium oxide in environmental remediation applications, such as air pollution control, water treatment, and carbon capture. Calcium oxide’s ability to neutralize acidic compounds and remove impurities makes it a valuable tool in these applications, ensuring its continued importance in meeting regulatory requirements and improving industrial processes.

Between 2025 and 2030, the demand for calcium oxide in the USA will experience steady growth, increasing from USD 1.9 billion to USD 2.0 billion. This moderate increase reflects the ongoing demand for calcium oxide in traditional industries like steel production, construction, and lime-based products. The growth curve during this phase will remain relatively gradual, driven by the continued industrialization and development of infrastructure, coupled with the steady use of calcium oxide in established applications. While the industry for calcium oxide will see consistent demand, the rate of growth will be moderate as these industries expand at a steady pace.

From 2030 to 2035, the demand for calcium oxide is expected to rise significantly, increasing from USD 2.0 billion to USD 3.2 billion. This sharp acceleration in demand is largely attributed to the expansion of environmental applications, which are expected to see increasing adoption due to growing environmental concerns and the implementation of stricter emission standards. As industries such as power generation, manufacturing, and agriculture face rising regulatory pressure to reduce emissions and improve environmental performance, the demand for calcium oxide will increase. In addition, as innovative applications, such as carbon capture technologies, gain traction, calcium oxide will play a critical role in addressing environmental challenges.

| Metric | Value |

|---|---|

| Demand for Calcium Oxide in USA Value (2025) | USD 1.9 billion |

| Demand for Calcium Oxide in USA Forecast Value (2035) | USD 3.2 billion |

| Demand for Calcium Oxide in USA Forecast CAGR (2025-2035) | 5.0% |

The demand for calcium oxide in the USA is growing due to its crucial role in various industrial applications, including steel production, water treatment, and chemical manufacturing. Known as quicklime, calcium oxide is key in processes like flue gas desulfurization, where it helps reduce sulfur dioxide emissions from industrial plants, making it essential for industries to comply with environmental regulations.

The rising need for cleaner energy and effective environmental management is a major driver of demand. As industries adopt stricter pollution control measures and pursue more sustainable practices, calcium oxide’s role in emissions reduction and water purification becomes even more vital. In addition, the construction and infrastructure sectors are expanding, driving increased demand for calcium oxide in cement production and soil stabilization.

Technological advancements in the production of calcium oxide, including more efficient methods and processes, are contributing to its growing adoption. Its versatility and cost-effectiveness in various industrial processes further support this trend. With the increasing focus on sustainability and cleaner production practices, calcium oxide is well-positioned for continued growth in the USA. Its critical applications in environmental management, coupled with the expanding demand in construction and industrial sectors, ensure steady demand for calcium oxide through 2035.

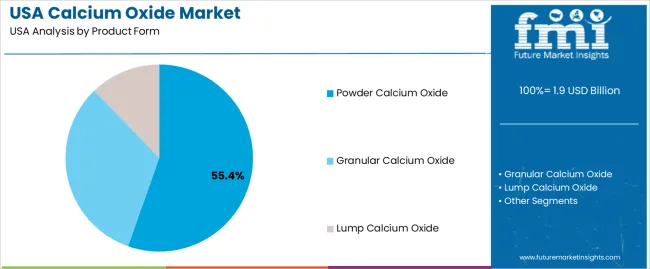

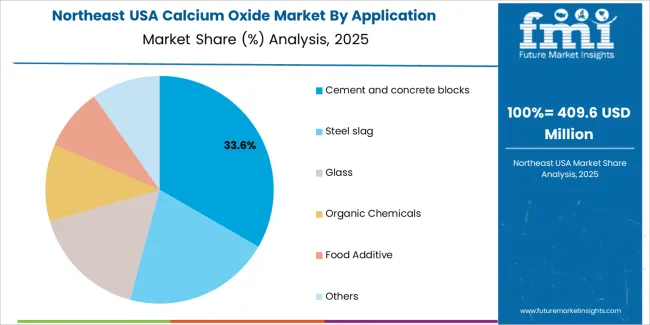

Demand for calcium oxide in the USA is segmented by product form, end use, application, and region. By product form, demand is divided into powder calcium oxide, granular calcium oxide, and lump calcium oxide. The demand is also segmented by end use, including construction, agriculture, food and beverages, chemical industry, mining, and others. In terms of application, demand is divided into cement and concrete blocks, steel slag, glass, organic chemicals, food additive, and others, with cement and concrete blocks leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Powder calcium oxide accounts for 55% of the demand for calcium oxide in the USA. This form is favored due to its versatility and ability to quickly react in a variety of applications, making it suitable for use in industries such as construction, agriculture, and chemicals. Powdered calcium oxide is easily blended with other materials, making it ideal for manufacturing processes that require precise control over composition, such as in the production of cement and concrete.

The fine particle size of powdered calcium oxide also ensures better absorption and more effective chemical reactions in applications like water treatment, steel slag, and glass manufacturing. Its ease of handling and wide range of uses across multiple industries ensure that powdered calcium oxide remains the dominant form in the industry, particularly in high-volume industrial applications.

The construction industry accounts for 52.1% of the demand for calcium oxide in the USA. Calcium oxide, commonly known as quicklime, is a key ingredient in the production of cement and concrete, which are essential for construction projects ranging from residential buildings to large infrastructure developments. The demand for calcium oxide in construction is driven by its use in the manufacturing of cement, which is one of the most widely used building materials in the world.

Calcium oxide helps control the setting time and strength of concrete and is essential for the production of high-performance construction materials. As the construction industry continues to expand, particularly with large-scale infrastructure projects, the need for calcium oxide will remain strong. With increasing urbanization and demand for sustainable construction practices, calcium oxide will continue to play a critical role in modern construction techniques.

Key drivers include growth in the construction sector (cement, concrete, infrastructure) and the steel/metal-refining industries where calcium oxide is used as a flux and impurity remover. Environmental applications such as water treatment, flue-gas desulfurization, and soil stabilization also support demand. Restraints include high energy consumption in calcination (production of CaO), volatility in limestone/raw material supply, and regulatory/environmental pressures on lime-kiln operations which can raise cost and limit capacity expansion.

In the USA demand for calcium oxide is growing because expanding infrastructure and building activity increase requirements for cement and concrete products, where CaO is a key input. Meanwhile, the steel industry continues to rely on CaO for refining and slag treatment, driving steady consumption. Growing regulations on air-emissions and water-treatment standards push more applications of lime and quicklime in environmental remediation. These industrial and regulatory factors together sustain and grow demand for CaO across multiple end-use sectors.

Technological innovations are supporting the calcium oxide segment in the USA by improving kiln efficiency, reducing energy usage, and enhancing product quality (e.g., high-purity lime for specialized applications). Improved processing helps manufacturers meet stricter environmental and industrial requirements at lower cost. The development of modular / smaller-scale calcination units and improved logistics (e.g., handling powdered CaO vs lumps) also make the product more accessible in diverse applications. These advances help broaden the range of sectors using CaO and improve cost-effectiveness, thereby enabling growth.

Despite broad application, adoption and demand growth of calcium oxide in the USA face several challenges. One is the high operational cost associated with calcination (large energy input, emissions control) which reduces margin and limits capacity expansion. Another is supply-chain uncertainty, variability in raw limestone quality, transportation costs, and kiln maintenance can hinder stable supply. Also, in some applications, alternative materials or technologies (e.g., synthetic fluxes in steel, alternative soil-amendments in agriculture) may reduce reliance on CaO. Lastly, regulatory compliance (emission controls, worker-safety) adds cost and may deter smaller producers or limit aggressive expansion.

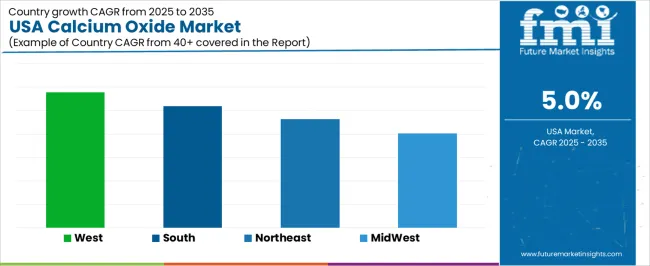

| Region | CAGR (%) |

|---|---|

| West | 5.8% |

| South | 5.2% |

| Northeast | 4.6% |

| Midwest | 4.0% |

Demand for calcium oxide in the USA is growing steadily across all regions, with the West leading at a 5.8% CAGR. This growth is driven by the region’s strong industrial sectors, including construction, water treatment, and chemical manufacturing. The South follows with a 5.2% CAGR, supported by its expanding petrochemical, steel production, and water treatment industries. The Northeast shows a 4.6% CAGR, driven by its manufacturing base and the need for water purification and steel production. The Midwest experiences the lowest growth at a 4.0% CAGR, with demand driven primarily by steel manufacturing and agricultural applications. As industries continue to focus on infrastructure, environmental regulations, and efficient production methods, demand for calcium oxide is expected to rise in all regions.

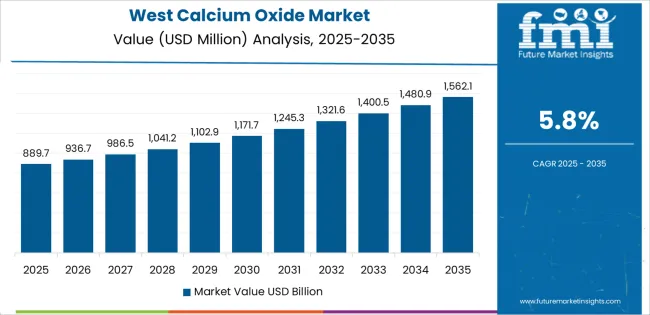

The West is experiencing the highest demand for calcium oxide in the USA, with a 5.8% CAGR. This growth is driven by the region’s robust industrial sectors, including construction, water treatment, and chemical manufacturing. Calcium oxide, commonly used in cement production, water treatment, and as a catalyst in chemical processes, sees significant demand in the West’s thriving construction and infrastructure projects.

States like California and Nevada are leading the way in building and expanding infrastructure, which increases the need for calcium oxide in construction and cement manufacturing. The West’s focus on environmental sustainability, particularly in wastewater treatment, contributes to the growing demand for calcium oxide in water purification processes. As the region continues to invest in large-scale industrial projects and infrastructure, demand for calcium oxide is expected to remain strong.

The South is seeing steady demand for calcium oxide in the USA, with a 5.2% CAGR. The region’s expanding industrial base, particularly in petrochemicals, steel production, and water treatment, is a major driver of this demand. Calcium oxide is widely used in the production of lime for steel manufacturing, water and wastewater treatment, and the petroleum industry. States like Texas, Louisiana, and Alabama are home to significant chemical and petrochemical manufacturing plants, where calcium oxide is crucial for refining and industrial processes.

The South’s growing construction industry also contributes to the demand for calcium oxide, particularly in cement production. As the region continues to focus on improving its infrastructure and water treatment systems, the need for calcium oxide in these applications is expected to rise, supporting continued growth in the region’s demand for this chemical.

The Northeast is experiencing moderate demand for calcium oxide in the USA, with a 4.6% CAGR. The region’s demand is driven primarily by its industrial and manufacturing sectors, where calcium oxide plays a key role in processes like steel production, chemical manufacturing, and water treatment. The Northeast, with its concentration of chemical manufacturing plants and industrial facilities, requires calcium oxide for a variety of applications.

As environmental regulations in the region become more stringent, the demand for calcium oxide in water purification processes has increased. The region’s aging infrastructure and the push for upgrading water treatment facilities further contribute to the need for this chemical. As industries continue to modernize and seek more efficient production methods, calcium oxide will remain an essential component in many industrial applications across the Northeast, ensuring steady demand growth in the coming years.

The Midwest is experiencing the lowest growth in demand for calcium oxide in the USA, with a 4.0% CAGR. The region’s large industrial base, particularly in steel production, agriculture, and chemical manufacturing, supports moderate demand for calcium oxide. It is widely used in lime production, which is essential for steelmaking, and in agricultural applications like soil treatment. States like Ohio, Illinois, and Michigan are key players in steel manufacturing, where calcium oxide is a critical component in the refining process.

The region’s agricultural sector also drives demand for calcium oxide in lime and soil treatment applications. While the growth rate is slower than in other regions, the Midwest’s focus on industrial and agricultural processes ensures steady demand for calcium oxide, particularly as industries seek more efficient and environmentally friendly production methods. As the region continues to modernize its industrial facilities, demand for calcium oxide is expected to remain consistent.

In the USA, demand for calcium oxide (quicklime) is driven by strong activity in construction, steel manufacturing, chemical processing, and environmental treatment applications. Its role as a core ingredient in cement and concrete for infrastructure, as a flux and impurity-remover in steelmaking, and as a treatment agent in water/air pollution control underpins significant consumption across industrial sectors.

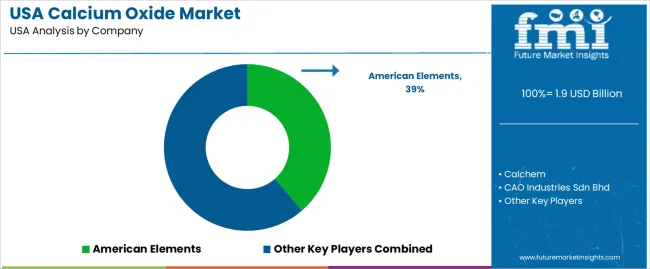

Key players active in supplying calcium oxide in the USA include American Elements with about 38.7% share, Calchem, CAO Industries Sdn Bhd, Graymont, and Heidelberg Cement Group. These firms differentiate through large-scale production capacity, access to high-quality limestone feedstocks, integrated logistics, broad industry end-use coverage, and technical service support.

Competitive dynamics are shaped by several factors. First, the growth of infrastructure investment and expanding production of steel and heavy materials boosts demand for calcium oxide. Second, regulatory pressures on industrial emissions and increasing utilization of lime in environmental remediation and treatment further stimulate uptake. Third, challenges include the high energy intensity and carbon footprint of lime production, fluctuating feedstock and freight costs, and competition from alternative materials or recycling solutions. Suppliers that can provide consistent quality, ensure efficient production and distribution, and address evolving regulations will be best positioned in the USA calcium oxide supply landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Form | Powder Calcium Oxide, Granular Calcium Oxide, Lump Calcium Oxide |

| Application | Cement and Concrete Blocks, Steel Slag, Glass, Organic Chemicals, Food Additive, Others |

| End Use | Construction, Agriculture, Food and Beverages, Chemical Industry, Mining, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | American Elements, Calchem, CAO Industries Sdn Bhd, Graymont, Heidelberg Cement Group |

| Additional Attributes | Dollar sales by product form and application; regional CAGR and adoption trends; demand trends in calcium oxide; growth in construction, agriculture, and chemical industries; technology adoption for industrial processes; vendor offerings including raw materials, services, and solutions; regulatory influences and industry standards |

The demand for calcium oxide in usa is estimated to be valued at USD 1.9 billion in 2025.

The market size for the calcium oxide in usa is projected to reach USD 3.2 billion by 2035.

The demand for calcium oxide in usa is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in calcium oxide in usa are powder calcium oxide, granular calcium oxide and lump calcium oxide.

In terms of application, cement and concrete blocks segment is expected to command 32.8% share in the calcium oxide in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Calcium Propionate Market Insights – Demand, Size & Industry Trends 2025-2035

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Calcium Peroxide Market

GCC Calcium Oxide Market Growth – Trends & Forecast 2025-2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Demand for Calcium Oxide in Japan Size and Share Forecast Outlook 2025 to 2035

Food-Grade Calcium Hydroxide Market Trends – Industry Insights 2025 to 2035

Demand for 4-Propyl-1,3,2-dioxathiolane 2,2-dioxide in USA Size and Share Forecast Outlook 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA