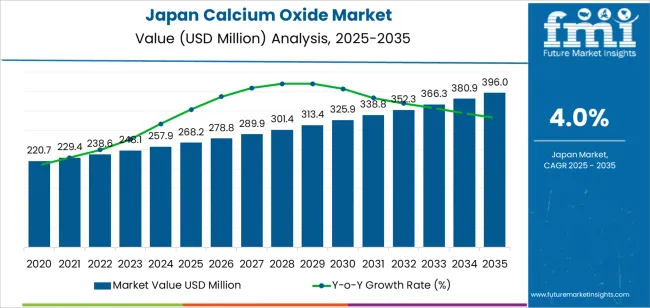

The demand for calcium oxide in Japan is projected to grow from USD 268.2 million in 2025 to USD 396.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.0%. Calcium oxide, or quicklime, is a key material in several industrial processes, including steel manufacturing, construction, water treatment, and agriculture. In steel production, it is used in the refining process to remove impurities, while in the construction industry, it is a key component in cement production. As Japan continues to prioritize sustainability, energy efficiency, and infrastructure development, the demand for calcium oxide is expected to rise due to its integral role in these industries.

The steel industry remains one of the largest consumers of calcium oxide, especially in the blast furnace process. This sector’s steady growth, coupled with Japan’s commitment to reducing emissions and improving energy efficiency, will continue to drive demand for calcium oxide in the coming years. Calcium oxide’s role in environmental applications such as in flue gas treatment and wastewater management will contribute significantly to its demand. With Japan facing increasing regulatory pressure on emissions and sustainability practices, the need for effective environmental solutions, such as those provided by calcium oxide, will continue to rise. Calcium oxide is used in a variety of industrial applications that align with Japan's emphasis on energy-efficient technologies and eco-friendly infrastructure.

Between 2025 and 2030, the demand for calcium oxide in Japan is expected to grow from USD 268.2 million to USD 278.8 million, marking a moderate and steady increase. This growth will be primarily driven by the continued demand for calcium oxide in established sectors such as steel production and cement manufacturing. The industry during this period will remain stable, with a relatively low volatility index. Industries will continue to rely on calcium oxide for its well-established roles in refining, construction, and environmental management. As such, growth will be relatively predictable, with gradual increases in demand.

From 2030 to 2035, the demand for calcium oxide is projected to rise more sharply, reaching USD 396.0 million by 2035. This period will experience a higher growth rate volatility index due to the expanding demand for calcium oxide in emerging sectors, particularly in environmental applications such as flue gas treatment, wastewater management, and energy-efficient technologies. The increase in demand will reflect Japan’s continued shift towards cleaner technologies and increased regulatory pressures. As industries adapt to new environmental standards and incorporate innovations in calcium oxide applications, the industry will experience a more pronounced growth trajectory, contributing to a higher volatility index in this phase.

| Metric | Value |

|---|---|

| Demand for Calcium Oxide in Japan Value (2025) | USD 268.2 million |

| Demand for Calcium Oxide in Japan Forecast Value (2035) | USD 396.0 million |

| Demand for Calcium Oxide in Japan Forecast CAGR (2025-2035) | 4.0% |

The demand for calcium oxide in Japan is rising due to its vital role in various industrial processes, such as steel production, water treatment, and environmental management. Known as quicklime, calcium oxide is essential in applications like flue gas desulfurization, where it helps remove sulfur dioxide from industrial emissions. This is particularly important for Japan to comply with strict environmental regulations and reduce air pollution.

The growing focus on reducing carbon emissions and improving energy efficiency is another key driver. Japan's ongoing efforts to meet its environmental goals, especially in the steel and power generation industries, are contributing to the increasing demand for calcium oxide. Its use in wastewater treatment processes and in the construction sector for cement production and soil stabilization is further boosting demand.

Technological advancements in production processes, along with a heightened emphasis on sustainability, are also influencing the growing adoption of calcium oxide. As industries seek cost-effective and environmentally friendly solutions to meet regulatory requirements, calcium oxide offers a practical and efficient option. Its ability to help in various industrial and environmental applications ensures that it remains a key material for Japan’s long-term development plans. The ongoing transition to eco-friendlier manufacturing practices and stricter environmental standards is expected to continue driving steady growth in the demand for calcium oxide through 2035.

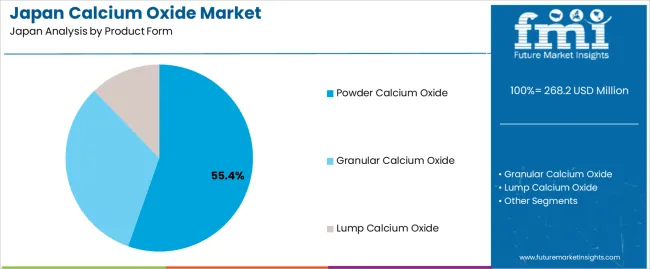

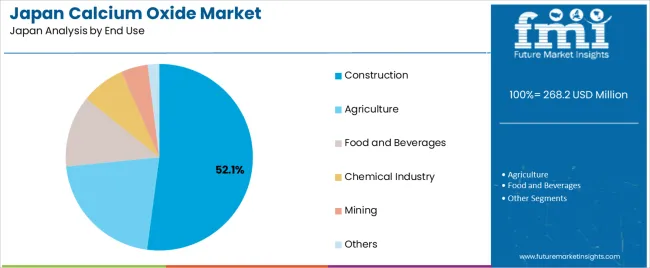

Demand for calcium oxide in Japan is segmented by product form, end use, application, and region. By product form, demand is divided into powder calcium oxide, granular calcium oxide, and lump calcium oxide, with powder calcium oxide holding the largest share at 55%. The demand is also segmented by end use, including construction, agriculture, food and beverages, chemical industry, mining, and others, with construction leading the demand at 52.1%. In terms of application, demand is divided into cement and concrete blocks, steel slag, glass, organic chemicals, food additive, and others, with cement and concrete blocks leading the demand. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Powder calcium oxide accounts for 55% of the demand for calcium oxide in Japan. The powdered form is preferred due to its high reactivity and versatility in a wide range of applications, making it particularly effective in industries such as construction, agriculture, and chemicals. Powder calcium oxide is used extensively in the production of cement and concrete, where it serves as a crucial ingredient for improving strength and durability.

Its ability to react quickly and efficiently with other materials makes it ideal for use in various industrial applications, including in water treatment and chemical manufacturing. The fine particle size of powder calcium oxide also enhances its performance in applications that require precise control over the chemical reactions, contributing to its dominant industry share. As the demand for construction materials and efficient industrial processes continues to grow, powdered calcium oxide will maintain its leadership in the industry.

The construction industry accounts for 52.1% of the demand for calcium oxide in Japan. Calcium oxide, commonly known as quicklime, is a key ingredient in the production of cement and concrete, materials that are essential in the construction of buildings, roads, bridges, and other infrastructure. As the demand for construction materials continues to rise, particularly for urban development and infrastructure projects, the need for calcium oxide in cement production is expected to remain high.

Calcium oxide is used in cement production to improve the quality, durability, and strength of concrete, making it indispensable in modern construction practices. It is used in the treatment of water and soil stabilization in construction projects. As the Japanese construction industry continues to expand, particularly with a focus on urban renewal and large-scale projects, calcium oxide’s role in construction applications will ensure its dominant position in the industry.

Key drivers include infrastructure reconstruction following seismic events and industrial demand for steel manufacturing, where quick-lime (CaO) is used as a flux. Environmental regulations are also increasing CaO usage in water treatment and flue-gas desulfurization. Restraints include high energy and CO₂ costs in calcination, limited limestone/quarry access, and competition from alternative materials and processes that reduce reliance on lime. These factors create challenges in expanding CaO production and adoption in various sectors.

In Japan, demand for calcium oxide is increasing due to the country’s ongoing infrastructure reconstruction efforts, driven by ageing buildings and seismic risks. Calcium oxide (CaO) is a critical component in cement and concrete manufacturing, essential for building and repair. The steel and metallurgy sectors also continue to rely heavily on CaO for slag treatment and impurity removal. Stricter environmental and water treatment regulations are pushing the use of lime-based solutions for water purification, soil stabilization, and flue-gas desulfurization.

These combined factors are supporting sustained demand for CaO across key industries in Japan, particularly in construction, manufacturing, and environmental applications. As the nation works to modernize and improve its infrastructure, the demand for calcium oxide continues to grow steadily.

Technological advancements are fostering the growth of calcium oxide (CaO) use in Japan by improving production efficiency and product quality. Innovations such as more energy-efficient kilns and improved calcination processes help reduce energy consumption and lower emissions during CaO production. Modular, smaller-scale calcination units have increased flexibility in meeting demand and better logistics for transporting and handling powdered versus lump lime.

Furthermore, the development of high-purity quicklime grades has expanded CaO’s use in specialized applications like environmental treatment, wastewater management, and advanced materials manufacturing. These innovations not only make CaO more cost-effective but also increase its versatility and accessibility, encouraging broader adoption in Japan’s industrial, environmental, and manufacturing sectors.

Despite its growing demand, several challenges limit the adoption of calcium oxide (CaO) in Japan. High operational and energy costs associated with lime production are significant barriers to expanding CaO production capacity. The availability of high-quality limestone for CaO production is constrained due to limited suitable deposits and strict quarrying regulations. In some industries, alternative materials, such as synthetic fluxes in steel production, are being adopted, which could reduce the demand for traditional lime-based solutions.

Another challenge is retrofitting or integrating new lime-based systems into existing, older infrastructure, where space constraints or technical limitations may prevent easy upgrades. These factors slow the widespread adoption of advanced CaO solutions in Japan’s various industrial sectors.

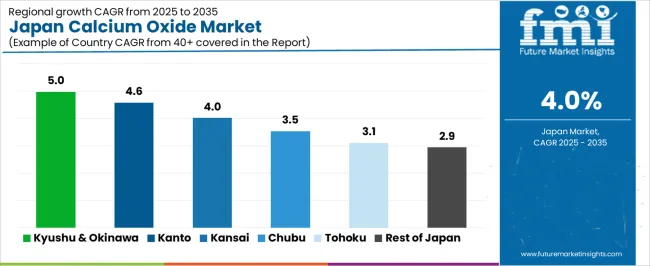

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.0% |

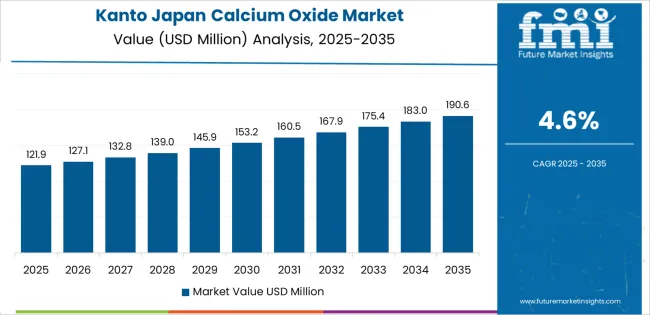

| Kanto | 4.6% |

| Kinki | 4.0% |

| Chubu | 3.5% |

| Tohoku | 3.1% |

| Rest of Japan | 2.9% |

Demand for calcium oxide in Japan is growing across all regions, with Kyushu & Okinawa leading at a 5.0% CAGR. This growth is driven by the region’s industrial base, including chemical manufacturing, cement production, and water treatment. The South follows with a 4.6% CAGR, supported by its industrial sectors like petrochemicals and construction.

Kinki shows a 4.0% CAGR, with demand primarily from steel production, chemical manufacturing, and environmental applications. Chubu experiences a 3.5% CAGR, with demand driven by its manufacturing and agricultural industries. Tohoku shows a 3.1% CAGR, with steady demand from agriculture and light manufacturing. The Rest of Japan experiences the lowest growth at 2.9%, but demand remains steady due to agricultural and regional industrial activities.

Kyushu & Okinawa are experiencing the highest demand for calcium oxide in Japan, with a 5.0% CAGR. This growth is largely driven by the region’s strong industrial sectors, including chemical manufacturing, cement production, and water treatment. Kyushu, in particular, has a high concentration of industrial facilities that rely on calcium oxide for various processes, such as refining and producing lime for steel manufacturing. The region’s agricultural industry also uses calcium oxide in soil treatment and lime production.

Furthermore, the growth of infrastructure development and expanding construction projects in Kyushu & Okinawa continues to drive demand for calcium oxide, especially in cement production. The region's focus on industrial modernization, coupled with the increasing need for cleaner manufacturing processes, supports continued growth in demand for calcium oxide in the coming years.

Kanto is experiencing steady demand for calcium oxide in Japan, with a 4.6% CAGR. The region’s demand is primarily driven by its large industrial base, particularly in chemical manufacturing, construction, and water treatment. Calcium oxide is widely used in the production of lime, which is essential for steel manufacturing, water treatment, and various other chemical processes. Kanto, home to major industrial cities like Tokyo and Yokohama, has a high concentration of industries that rely on calcium oxide for refining, lime production, and waste treatment.

The region's growing focus on environmental regulations and energy efficiency is also driving demand for eco-friendlier and efficient manufacturing methods, which often require calcium oxide. Kanto’s continued expansion of infrastructure projects contributes to the ongoing need for calcium oxide, particularly in cement production, further supporting steady demand in the region.

Kinki is experiencing moderate demand for calcium oxide in Japan, with a 4.0% CAGR. The region’s demand is driven by its strong industrial sectors, particularly in chemical manufacturing, construction, and steel production. Cities like Osaka and Kyoto are key industrial hubs where calcium oxide is used in steel manufacturing, chemical processes, and water treatment. The growing demand for cement in construction projects across Kinki further contributes to the need for calcium oxide, as it is a critical component in cement production.

The region’s chemical industry uses calcium oxide for producing various chemicals and for environmental applications such as waste treatment and neutralization. The Kinki region is also focusing on improving industrial processes to reduce environmental impact, driving the adoption of more energy-efficient technologies, which supports continued demand for calcium oxide. As the region continues to grow industrially, the demand for calcium oxide will remain strong.

Chubu is experiencing moderate demand for calcium oxide in Japan, with a 3.5% CAGR. The region’s demand is largely driven by its manufacturing and agricultural sectors, where calcium oxide plays a vital role in steel production, chemical manufacturing, and soil treatment. The Chubu region, with cities like Nagoya, is home to several steel mills, which require calcium oxide as a fluxing agent in the refining process.

The region’s agriculture industry uses calcium oxide in soil treatment and lime production to improve soil quality. As Chubu’s industrial base continues to expand, particularly in manufacturing and automotive sectors, the demand for calcium oxide is expected to remain steady. Moreover, with the region’s increasing focus on improving environmental sustainability and energy efficiency, calcium oxide will continue to be an essential component in various industrial and environmental applications.

Tohoku is experiencing lower demand for calcium oxide in Japan, with a 3.1% CAGR. The region’s demand is primarily driven by its agricultural industry, where calcium oxide is used for soil treatment and lime production. Tohoku’s focus on agriculture and food production contributes to steady demand for calcium oxide in agricultural applications. The region’s small but growing manufacturing base also uses calcium oxide in chemical processes and water treatment.

While the demand for calcium oxide in Tohoku is not as high as in other regions, the growth rate remains consistent due to the continued need for lime in construction and agriculture. As the region works to modernize its manufacturing and agricultural processes, the adoption of calcium oxide for these applications will continue to grow, though at a slower pace compared to more industrially developed regions.

The Rest of Japan is experiencing the lowest growth in demand for calcium oxide, with a 2.9% CAGR. While this region does not have the same level of industrial activity as other major industrial hubs like Kanto or Kyushu, demand remains steady due to the smaller-scale manufacturing and agricultural operations that rely on calcium oxide. The Rest of Japan’s agricultural activities, particularly in soil treatment and lime production, contribute to the ongoing demand for calcium oxide.

Regional manufacturing facilities, particularly in chemicals and cement, continue to use calcium oxide in various industrial applications. Despite the slower growth compared to more urbanized regions, the Rest of Japan’s demand for calcium oxide remains consistent, supported by the need for efficient manufacturing processes and agricultural improvements. As local industries focus on energy efficiency and eco-friendly practices, demand for calcium oxide will continue to support industrial growth in the region.

In Japan demand for calcium oxide (quicklime) is driven by significant activity in construction, steel manufacturing, chemical processing and environmental treatment applications. Calcium oxide serves as a critical component in cement and concrete production, acts as a flux in steelmaking to remove impurities, and is used extensively in water and flue‑gas treatment to neutralize acids and capture contaminants. Japan’s high standards for industrial and infrastructure applications contribute to steady uptake of this material.

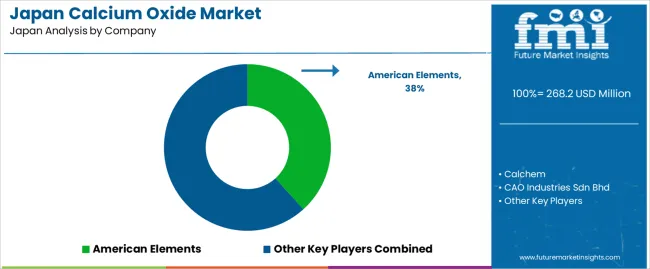

Major suppliers in this segment include American Elements, which holds approximately 38.3% share; Calchem; CAO Industries Sdn Bhd; Graymont; and Heidelberg Cement Group. These companies differentiate through large‑scale production capacity, access to high‑purity limestone feedstocks, efficient logistics suited to Japan’s import and domestic supply chains, and technical service support tailored to Japan’s refractory and environmental specifications. American Elements’ leading position reflects strong supply relationships and ability to meet demanding industrial grade requirements.

Competitive dynamics in the Japanese calcium oxide sector are shaped by several factors. First, construction investment, modernization of infrastructure and ongoing steel plant activity drive demand for quicklime. Second, increasing regulatory pressure on emissions and industrial waste treatment creates demand for calcium‑oxide‑based remediation and abatement solutions. Third, challenges include high energy and operational costs associated with lime production, fluctuating limestone feedstock and logistics costs, and competition from substitute materials or alternative purification technologies. Firms that provide consistent quality, efficient production and distribution, and align with Japan’s regulatory requirements are best positioned to prevail in Japan’s calcium oxide procurement landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Form | Powder Calcium Oxide, Granular Calcium Oxide, Lump Calcium Oxide |

| Application | Cement and Concrete Blocks, Steel Slag, Glass, Organic Chemicals, Food Additive, Others |

| End Use | Construction, Agriculture, Food and Beverages, Chemical Industry, Mining, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | American Elements, Calchem, CAO Industries Sdn Bhd, Graymont, Heidelberg Cement Group |

| Additional Attributes | Dollar sales by product form and application; regional CAGR and adoption trends; demand trends in calcium oxide; growth in construction, agriculture, and chemical industries; technology adoption for industrial processes; vendor offerings including raw materials, services, and solutions; regulatory influences and industry standards |

The demand for calcium oxide in japan is estimated to be valued at USD 268.2 million in 2025.

The market size for the calcium oxide in japan is projected to reach USD 396.0 million by 2035.

The demand for calcium oxide in japan is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in calcium oxide in japan are powder calcium oxide, granular calcium oxide and lump calcium oxide.

In terms of application, cement and concrete blocks segment is expected to command 32.8% share in the calcium oxide in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Calcium Supplement Market Trends – Growth, Demand & Forecast 2025-2035

Calcium Oxide Market Growth - Trends & Forecast 2025 to 2035

Calcium Peroxide Market

GCC Calcium Oxide Market Growth – Trends & Forecast 2025-2035

Food-Grade Calcium Hydroxide Market Trends – Industry Insights 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA