The demand for cold insulation in the USA is expected to grow from USD 3.1 billion in 2025 to USD 6.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.40%. Cold insulation is essential in a wide range of applications, including construction, refrigeration, HVAC systems, and cryogenic processes, where it helps to maintain temperature control, enhance energy efficiency, and reduce environmental impact. As industries focus on sustainability and energy savings, demand for high-performance cold insulation materials, such as foam boards, fiberglass, and spray foam, is expected to rise.

The key drivers of this growth are increasing energy efficiency regulations and heightened awareness of the need for thermal insulation to reduce energy consumption in buildings and industrial processes. The construction industry, particularly in sectors focused on sustainable buildings, will be a major contributor to demand. Industries like food processing, pharmaceuticals, and chemicals, which require temperature-controlled environments, will further support the growing demand for cold insulation products. The increase in cold storage needs, driven by the expansion of food distribution networks and advancements in refrigeration technology, will also contribute to industry growth.

Between 2025 and 2030, the demand for cold insulation in the USA is expected to grow from USD 3.1 billion to USD 3.6 billion. This phase will see steady growth, driven by continued demand from the construction and manufacturing industries for energy-efficient insulation solutions. The expansion of the HVAC industry, coupled with the increasing need for refrigeration and cryogenic systems in food and pharmaceuticals, will also contribute to this growth. The pace of growth will be moderate during this period, reflecting the ongoing trend toward improved energy efficiency and environmental sustainability in industrial and commercial applications.

From 2030 to 2035, however, the demand for cold insulation is projected to accelerate significantly, rising from USD 3.6 billion to USD 6.4 billion. The sharper rise in demand during this phase can be attributed to several factors, including further technological advancements in insulation materials, stricter regulations on energy use, and the increasing adoption of energy-efficient technologies in both the industrial and residential sectors. As industries continue to prioritize sustainability and comply with more stringent environmental standards, the demand for high-performance cold insulation products will increase rapidly. The construction sector’s ongoing focus on energy-efficient building designs and the expansion of the cold storage industry will further drive this acceleration.

| Metric | Value |

|---|---|

| Demand for Cold Insulation in USA Value (2025) | USD 3.1 billion |

| Demand for Cold Insulation in USA Forecast Value (2035) | USD 6.4 billion |

| Demand for Cold Insulation in USA Forecast CAGR (2025-2035) | 7.4% |

The demand for cold insulation in the USA is increasing as industries look to improve energy efficiency and reduce operational costs. Cold insulation is used in a variety of applications, including refrigeration, air conditioning, and cryogenic systems. It helps minimize energy loss, maintain temperature stability, and reduce greenhouse gas emissions, which are key priorities for industries seeking to meet both regulatory standards and sustainability goals.

The growing demand for energy-efficient systems in sectors such as HVAC, food and beverage, and chemicals is driving the adoption of cold insulation. As the USA continues to focus on reducing energy consumption and lowering carbon footprints, cold insulation is becoming a vital solution. The expanding construction of energy-efficient buildings, as well as the increasing focus on sustainable manufacturing practices, further supports the growth of this segment.

Technological advancements in insulation materials, such as the development of more effective, durable, and eco-friendly options, are also contributing to the demand. Stricter environmental regulations related to energy consumption and emissions are pushing industries to adopt better insulation practices. As the trend toward energy efficiency and sustainability continues, the demand for cold insulation in the USA is expected to grow steadily through 2035.

Demand for cold insulation in the USA is segmented by material, end-use industry, application, and region. By material, demand is divided into polyurethane foam, fiberglass, phenolic foam, polystyrene foam, and other materials, with polyurethane foam holding the largest share at 45%. The demand is also segmented by end-use industry, including oil & gas, chemicals, food & beverage, pharmaceuticals, commercial & residential construction, energy & power, and aerospace & defense, with oil & gas leading the demand at 32.4%. In terms of application, demand is divided into HVAC systems, refrigeration, cryogenic applications, plumbing, industrial equipment, and other applications, with HVAC systems leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Polyurethane foam accounts for 45% of the demand for cold insulation in the USA. It is widely favored for its excellent thermal insulation properties, ease of application, and versatility in various applications. Polyurethane foam is highly efficient at minimizing heat transfer, making it ideal for applications in the food and beverage, HVAC, and refrigeration industries, where maintaining consistent temperatures is essential. Its ability to be sprayed or molded into different shapes allows it to fit complex and irregular surfaces, making it a preferred choice for insulation in both commercial and industrial sectors. Polyurethane foam is lightweight, moisture-resistant, and durable, which adds to its appeal for long-term use in various insulation projects. With its superior performance in reducing energy consumption and its broad range of applications, polyurethane foam will continue to dominate the cold insulation industry in the USA.

The oil & gas industry accounts for 32.4% of the demand for cold insulation in the USA. Cold insulation is essential in this sector to maintain the integrity of pipelines, storage tanks, and other infrastructure that handle liquids and gases at low temperatures. The oil and gas industry requires reliable insulation solutions to ensure efficient transportation and storage of products like liquefied natural gas (LNG) and crude oil, which need to be kept at controlled temperatures. Cold insulation helps prevent the loss of thermal energy, reduces the risk of condensation, and maintains the desired temperature of materials during transit. As the oil and gas industry continues to expand, particularly with growing demand for LNG and offshore drilling operations, the need for high-quality cold insulation will remain strong. The oil & gas sector’s reliance on effective thermal management drives its leadership in the cold insulation industry in the USA.

Key drivers include growth in refrigerated warehousing, food & beverage cold chain expansion, and rising requirements for cryogenic and low‐temperature process insulation (e.g., LNG, chemicals) in USA. The push for energy efficiency and regulatory requirements around reducing heat gain/loss also support uptake of cold insulation materials and systems. Restraints include higher costs of specialised cold insulation materials versus standard thermal insulation, installation and maintenance challenges in retrofit or cramped industrial sites, and competition from simpler insulation solutions or alternative technologies for moderate temperature applications.

Why is Demand for Cold Insulation Growing in USA?

In USA the demand for cold insulation is growing because industries such as food & beverage, pharmaceuticals, and logistics are expanding their cold‑chain infrastructure, requiring insulation that can maintain low temperatures reliably and efficiently. Process industries (chemicals, LNG, cryogenics) also need high‑performance insulation to reduce heat ingress, improve safety and cut operating costs. Regulatory and energy‑efficiency pressures encourage facility owners to upgrade insulation in new and existing assets. These trends are driving the adoption of cold insulation materials and systems across industrial and commercial settings in the USA.

How are Technological Innovations Driving Growth of Cold Insulation in USA?

Technological innovations are helping drive growth of cold insulation in USA by improving material performance, durability and ease of installation. Advances include new foam and composite materials with better low‑temperature thermal resistance and moisture/vapour management, modular insulation panels or jackets for retrofit use, and smart insulation solutions that integrate sensors for monitoring performance or condition. These innovations boost reliability in cryogenic or sub‑zero operations, reduce maintenance requirements, and support stringent thermal control standards making cold insulation systems more attractive for USA industrial, logistics and process applications.

What are the Key Challenges Limiting Adoption of Cold Insulation in USA?

Despite the strong demand potential, adoption of cold insulation in USA faces several challenges. One is cost: specialised materials and systems for low‑temperature insulation is more expensive than standard thermal insulation, which limits uptake in cost‑sensitive projects. Another is technical complexity: installing and maintaining cold insulation for cryogenic or sub‑zero conditions demands skilled labour, precise design (vapour barrier, condensation control) and rigorous quality assurance. Also, existing infrastructure in many facilities may not easily accommodate retrofit of advanced insulation, and supply‑chain or material‑availability issues (especially for specialty foams or composites) can delay deployments.

| Region | CAGR (%) |

|---|---|

| West | 8.5 |

| South | 7.6 |

| Northeast | 6.8 |

| Midwest | 5.9 |

Demand for cold insulation in the USA is growing steadily across all regions, with the West leading at an 8.5% CAGR. This growth is driven by the region’s large industrial base, including petrochemical and manufacturing sectors, which require cold insulation for temperature control and energy efficiency. The South follows with a 7.6% CAGR, supported by its expanding petrochemical, refining, and energy industries. The Northeast shows a steady 6.8% CAGR, driven by growing demand in commercial, industrial, and energy-efficient buildings. The Midwest experiences the lowest growth at 5.9%, with demand primarily driven by the region’s manufacturing and food processing industries that require cold insulation for refrigeration and storage. As industries continue to focus on energy efficiency and reducing operational costs, demand for cold insulation is expected to rise in all regions.

The West is experiencing the highest demand for cold insulation in the USA, with an 8.5% CAGR. This growth is driven by the region’s significant industrial base, including the oil and gas, petrochemical, and manufacturing sectors, which require cold insulation to maintain operational efficiency and ensure temperature control. States like California, Texas, and Washington are home to large refineries, chemical plants, and manufacturing facilities that rely on cold insulation in applications such as cryogenic storage, pipelines, and refrigeration systems. The West's focus on energy efficiency and environmental sustainability supports the growing demand for cold insulation in both industrial and commercial buildings. The region's expansion of renewable energy infrastructure, such as wind and solar power plants, is also contributing to the need for cold insulation, especially in the transportation of liquefied natural gas (LNG). As the region continues to grow industrially and invest in energy-efficient solutions, the demand for cold insulation is expected to remain strong.

The South is seeing strong demand for cold insulation in the USA, with a 7.6% CAGR. The region's expanding industrial and manufacturing sectors are key drivers of this demand. States like Texas, Louisiana, and Alabama are home to some of the largest petrochemical and refining facilities in the country, which require cold insulation to protect pipelines, tanks, and other equipment that handle low-temperature materials. The demand is also driven by the region’s growing focus on energy-efficient building designs, which use cold insulation to maintain temperature control in both residential and commercial properties. The rise in transportation and storage of liquefied natural gas (LNG) and other cryogenic materials is contributing to the demand for cold insulation in the South. As the region continues to invest in infrastructure and focus on reducing energy consumption, cold insulation will play a vital role in improving operational efficiency and supporting sustainable energy practices.

The Northeast is experiencing moderate demand for cold insulation in the USA, with a 6.8% CAGR. This growth is driven by the region's strong focus on energy efficiency, building insulation, and the expansion of industries like food and beverage, pharmaceuticals, and chemicals, where cold insulation is essential for maintaining temperature-sensitive operations. Major cities like New York, Boston, and Philadelphia have a high concentration of commercial and industrial facilities that rely on cold insulation to ensure proper refrigeration and temperature control. The Northeast’s growing demand for energy-efficient building solutions is driving the adoption of cold insulation in both commercial and residential properties. With stricter environmental regulations pushing industries toward more energy-efficient practices and the growing need for better cold storage solutions, the demand for cold insulation is expected to remain steady. The region’s focus on maintaining operational efficiency and reducing energy costs will continue to support growth in cold insulation adoption.

The Midwest is experiencing the lowest growth in demand for cold insulation in the USA, with a 5.9% CAGR. The region’s demand for cold insulation is primarily driven by its industrial base, particularly in sectors like manufacturing, food processing, and agriculture. States like Illinois, Ohio, and Michigan have a high concentration of food processing facilities, warehouses, and factories that require cold insulation for refrigeration and temperature-sensitive storage. The region’s chemical and petrochemical industries also use cold insulation in their operations to control temperatures in storage tanks, pipelines, and other equipment. While the growth rate in the Midwest is slower compared to other regions, the steady demand from these key industrial sectors ensures a continuous need for cold insulation. As the region continues to focus on improving energy efficiency and reducing operational costs, the demand for cold insulation is expected to grow modestly, driven by the need for better temperature control in various industrial and commercial applications.

In the USA, demand for cold insulation is expanding as industries like refrigeration, cryogenic storage, low-temperature processing, and cold‑chain logistics seek improved thermal management solutions. Cold insulation is essential in preventing heat ingress, maintaining low temperatures, improving energy efficiency, and reducing condensation or frost buildup in critical applications such as LNG storage tanks, industrial gas systems, and chemical pipelines.

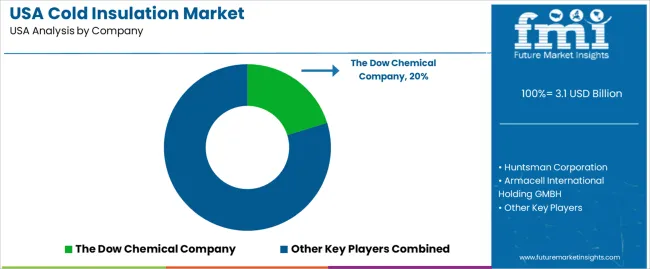

Key players in the USA cold insulation industry include The Dow Chemical Company, holding a 20.2% share, Huntsman Corporation, Armacell International Holding GMBH, Evonik Industries, and Pittsburgh Corning Corporation. These companies differentiate themselves by offering specialized materials like rigid foams, aerogels, cellular glass, and polyurethane-based insulations, each engineered for low-temperature applications. These firms also provide technical specification support and comprehensive distribution networks, which are crucial for meeting the varied needs of the cold insulation industry.

The competitive landscape is shaped by several key drivers. First, the growing emphasis on energy efficiency across industries, coupled with stricter insulation standards, is boosting the demand for high-performance insulation systems. Second, the continued growth of cold‑chain logistics, food storage, and industrial gas applications heightens the need for reliable cold insulation to maintain product integrity and reduce energy consumption. Third, technological innovations in insulation materials such as low‑thermal conductivity foams, aerogels, and composite materials are differentiating companies in this industry.

The sector faces several challenges, including the high cost of advanced insulation materials, installation expenses, and competition from alternative insulation technologies. proper installation and maintenance are crucial for ensuring the long-term effectiveness of cold insulation systems, adding to the complexity of industry entry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material | Polyurethane Foam, Fiberglass, Phenolic Foam, Polystyrene Foam, Other Materials |

| Application | HVAC Systems, Refrigeration, Cryogenic Applications, Plumbing, Industrial Equipment, Other Applications |

| End Use Industry | Oil & Gas, Chemicals, Food & Beverage, Pharmaceuticals, Commercial & Residential Construction, Energy & Power, Aerospace & Defense |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | The Dow Chemical Company, Huntsman Corporation, Armacell International Holding GMBH, Evonik Industries, Pittsburgh Corning Corporation |

| Additional Attributes | Dollar sales by material and application; regional CAGR and adoption trends; demand trends in cold insulation; growth in oil & gas, food & beverage, and construction sectors; technology adoption for thermal insulation; vendor offerings including insulation materials, services, and solutions; regulatory influences and industry standards |

The demand for cold insulation in usa is estimated to be valued at USD 3.1 billion in 2025.

The market size for the cold insulation in usa is projected to reach USD 6.4 billion by 2035.

The demand for cold insulation in usa is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in cold insulation in usa are polyurethane foam, fiberglass, phenolic foam, polystyrene foam and other materials.

In terms of application, hvac systems segment is expected to command 30.0% share in the cold insulation in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Demand for Cold Insulation in Japan Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA