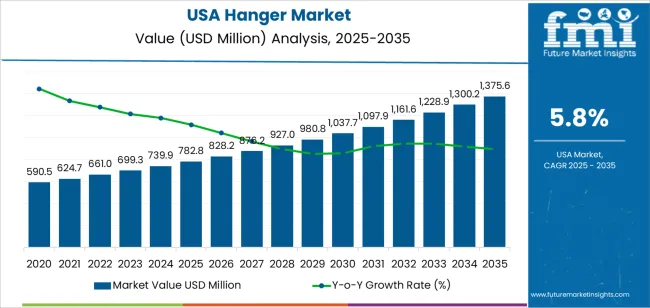

The demand for hangers in the USA is expected to grow from USD 782.8 million in 2025 to USD 1,375.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. This growth indicates an overall industry gain, with demand steadily increasing across a range of industries, such as retail, hospitality, and residential sectors. Factors such as the increasing consumption of clothing and growing retail sectors contribute to the industry's expansion. The demand for hangers is expected to rise due to ongoing product innovation, which addresses consumer preferences for durable, eco-friendly, and multifunctional products.

As the industry expands, certain dynamics might contribute to industry share shifts. The demand for eco-friendly, sustainable hangers is likely to grow as consumers and companies continue to shift towards environmentally conscious products. Companies that offer eco-friendly options could capture a larger share of the industry, creating a potential gain in industry share for manufacturers who adapt to these trends. However, competition in the industry is expected to intensify, with lower-cost plastic or metal alternatives potentially eroding the share of premium-priced, eco-friendly products. Over the next decade, companies offering advanced designs and premium materials could gain industry share, while those relying on traditional production methods and materials might face declining demand.

Between 2025 and 2030, the demand will grow from USD 782.8 million to USD 1,037.4 million, reflecting a CAGR of 6.0%. This phase will experience moderate growth driven by the continued expansion of the retail and residential sectors. As consumers increasingly invest in high-quality storage solutions and the demand for organized living spaces rises, hangers will see growing use in both households and retail environments. The demand for durable, aesthetically pleasing, and functional hangers will be central to this early growth phase.

From 2030 to 2035, the growth rate is expected to slow slightly to 5.5% CAGR, but the demand will accelerate significantly. This phase will be characterized by a shift towards premium and eco-friendly hangers as consumer preferences evolve toward sustainable and durable products. Retailers will increasingly favor high-quality, multifunctional hangers that can cater to diverse garment needs and maximize space efficiency. The demand for space-saving and advanced designs will gain momentum, particularly in homes with limited storage or in commercial spaces that prioritize organization and functionality. As the demand for premium, environmentally-conscious products rises, the hanger industry in the USA will experience an enhanced pace of growth, driven by changing consumer behaviors and ongoing innovation.

| Metric | Value |

|---|---|

| Demand for Hanger in USA Value (2025) | USD 782.8 million |

| Demand for Hanger in USA Forecast Value (2035) | USD 1,375.0 million |

| Demand for Hanger in USA Forecast CAGR (2025 to 2035) | 5.80% |

The demand for hangers in the USA is increasing as the apparel and retail industries continue to grow, driven by the rise in e-commerce and the fast-fashion sector. Retailers and consumers require efficient and reliable storage and display solutions for clothing, propelling demand for high-quality hangers. The surge in online apparel sales also contributes to the need for hangers that are suitable for both supply chain logistics and home storage.

Consumer behavior changes, such as frequent wardrobe updates and the rise of clothing rentals and subscription services, are further boosting the turnover of garments and associated accessories. This creates a greater need for hangers that can accommodate various types of clothing, from outerwear and activewear to specialty garments. Retailers are responding by investing in durable, stylish, and eco-friendly hanger designs that align with growing consumer demands for sustainability and functionality.

Innovations in materials and designs such as hangers made from recycled plastics, wood alternatives, and metal blends are driving the demand for more efficient storage solutions. Hangers offering space-saving or multi-functional features are also becoming increasingly popular. With growing attention on reducing waste and improving organization, both consumers and retailers are opting for higher-quality hangers, contributing to the steady growth of this industry in the USA through 2035.

Demand for salon chairs in the USA is segmented by chair type and functionality. By chair type, demand is divided into all-purpose salon chairs, modern salon chairs, conventional salon chairs, antique/vintage salon chairs, and others, with all-purpose salon chairs holding the largest share. In terms of functionality, the industry is categorized into electric, reclining, hydraulic, heavy duty, and others, with electric chairs leading the demand. This segmentation highlights the variety of salon chairs used across different salon types and customer preferences in the USA.

All-purpose salon chairs account for 32% of the demand for salon chairs in the USA. These chairs are designed to accommodate a variety of services in salons, from haircuts to styling, coloring, and other beauty treatments. Their versatility and adaptability make them a go-to choice for many salons, especially those that offer a broad range of services. The demand for all-purpose salon chairs is driven by the need for flexible, functional seating that can accommodate different treatments and a variety of customer needs.

These chairs typically feature adjustable height, reclining options, and comfortable cushioning, allowing salons to provide a high level of service to a wide range of clients. As salons aim to optimize space and improve service efficiency, all-purpose salon chairs continue to be favored due to their ability to serve multiple functions, making them an essential fixture in both small and large salons. The continued trend toward multifunctional, space-saving furniture further drives their demand in the industry.

Electric salon chairs account for 39% of the demand for salon chairs in the USA. These chairs are equipped with electric motors that allow for smooth and effortless adjustments, such as reclining and height adjustments, making them highly convenient and efficient for both salon staff and customers. Electric salon chairs are particularly popular in high-end salons that focus on providing superior customer experiences, where comfort and convenience are prioritized.

The demand for electric salon chairs is driven by the increasing focus on automation, customer comfort, and the need to speed up service in busy salon environments. With features like easy adjustability and precision positioning, electric chairs improve both the quality of service and operational efficiency in salons. As salons continue to prioritize customer experience and streamline their operations, the demand for electric salon chairs is expected to rise, making them a dominant feature in modern salons.

Hydraulic salon chairs remain a popular choice in the salon chair industry due to their reliable and durable functionality. These chairs use a hydraulic pump mechanism to adjust the height, providing stability and ease of use. Hydraulic chairs are favored for their simplicity and cost-effectiveness, making them an excellent option for a wide variety of salon types.

Despite the rise in demand for electric chairs, hydraulic salon chairs continue to hold a strong position in the industry due to their lower initial cost and long-lasting durability. Their ease of maintenance and straightforward functionality make them ideal for high-traffic salons, where reliability and efficiency are essential. The continued need for reliable, low-maintenance salon equipment ensures that hydraulic chairs remain a staple in the salon chair industry, especially for budget-conscious salons and those seeking straightforward, functional seating solutions.

Consumers and retailers increasingly value higher‑quality, sustainable, and multifunctional hanger designs such as slim-profile velvet hangers, wooden premium hangers, and eco‑friendly plastic alternatives. Drivers include growth in apparel retail (including online clothing sales), rising housing turnover and closet‑organisation trends, and increased focus on premium finish‑ings in luxury and boutique stores. On the flip side, restraints include raw‑material cost volatility (plastic resins, coated wires, wood), strong competition from low‑cost imports which puts pressure on domestic manufacturing margins, and a relatively mature replacement cycle in households where hangers are a low‑value product with limited innovation pressure.

Why is Demand for Hangers Growing in USA?

Demand is growing because consumers are investing more in home organisation and wardrobe aesthetics, and retailers are seeking better display and storage solutions. The rise of fast‑fashion and online apparel means more items arriving, more turnover in wardrobes, and a need for effective hanging/storage solutions. Retailers (clothing stores, boutique outlets) also require quality hangers for presentation and brand image, which bolsters demand for premium hangers. The increasing housing industry activity (moving homes, renting) leads to increased hanger purchases. Sustainability concerns are pushing brand owners and consumers to look for eco‑friendly hanger alternatives, creating a growth niche. These factors together support increasing volumes and values of hanger usage.

How are Technological and Product Innovations Driving Growth of Hangers in the USA?

Innovations are contributing to hanger demand by offering improved materials, more ergonomic and space‑efficient designs, and greener credentials. Examples include hangers made from recycled plastics, biodegradable materials, zero‑waste wood hangers, velvet‑coated slim profiles to maximise closet space, and modular hanger sets for small apartments. For retailers and hospitality (hotel closets, uniform storage), there are heavier‑duty steel/wood hangers with custom branding or integrated clips. Packaging and logistics improvements (flat‑pack sets, bulk‑retail packs) make them more accessible and cost‑efficient. These enhancements allow hanger brands to differentiate beyond the commodity level and justify higher price points, driving growth in premium segments.

What are the Key Challenges Limiting Adoption of Premium Hangers in the USA?

Despite growth opportunities, several challenges remain. A key barrier is pricing: hangers are generally a low‑cost item, so convincing buyers (households or retailers) to upgrade from commodity plastic to premium or eco‑friendly alternatives can be difficult. Also, the replacement frequency is quite low in many households, limiting volume growth outside new home moves or large wardrobe changes. Supply‑chain risks such as fluctuations in plastic resin costs, tariffs on imported materials, or sourcing of sustainable wood pressurise margin. Lastly, strong competition from low‑cost imports means domestic producers must differentiate via quality or sustainability, which involves higher cost and risk.

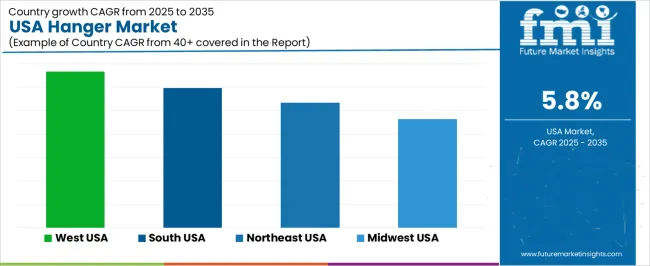

| Region | CAGR (%) |

|---|---|

| West | 6.7% |

| South | 6.0% |

| Northeast | 5.3% |

| Midwest | 4.6% |

The demand for hangers in the USA is growing across all regions, with the West leading at a 6.7% CAGR. This growth is driven by the expanding retail and fashion industries, along with increasing consumer interest in home organization. The South follows with a 6.0% CAGR, fueled by the rise in retail stores and e-commerce platforms. The Northeast shows a 5.3% CAGR, influenced by its strong retail sector and high consumer spending. The Midwest experiences moderate growth at 4.6%, with demand rising in both urban and suburban areas as consumer awareness of home organization increases.

The West is experiencing the highest demand for hangers in the USA, with a 6.7% CAGR. This growth is driven by the region’s strong fashion industry, particularly in cities like Los Angeles, San Francisco, and Seattle, where the retail and e-commerce industries are flourishing. With an emphasis on high-quality, durable hangers for effective clothing display and storage, demand is rising. Furthermore, the West’s focus on home organization, especially in space-constrained urban environments, is contributing to the increased use of hangers for efficient storage solutions. The demand for specialty hangers, such as eco-friendly and tailored designs for specific clothing types, is also on the rise. As the region continues to lead in fashion trends, retail expansion, and home organization, the demand for hangers is expected to remain strong, ensuring the West’s continued leadership in the industry.

The South is seeing strong demand for hangers, with a 6.0% CAGR. The region’s expanding retail sector, especially in cities like Atlanta, Dallas, and Miami, is a major driver of growth. With an increasing number of retail stores and e-commerce platforms, demand for hangers is rising, particularly for product display and organization purposes. The region's growing focus on home organization, especially in closets and laundry rooms, is also contributing to increased hanger usage. The rise of fast fashion in the South, which leads to more frequent clothing purchases, further drives the need for hangers. Retailers are investing in high-quality hangers to enhance product presentation and improve customer experiences. As consumers continue to prioritize fashion, home organization, and convenience, the South’s demand for hangers is expected to grow steadily, reflecting broader trends in retail and consumer behavior.

The Northeast is experiencing steady growth in demand for hangers, with a 5.3% CAGR. This is due to the region’s high retail density, particularly in fashion-centric cities like New York, Boston, and Philadelphia, where there is a consistent demand for hangers in both retail settings and for home organization. The region’s focus on convenience and efficient use of space also contributes to this demand, as consumers seek to organize their wardrobes and optimize storage. With more people looking for innovative storage solutions, specialized hangers that improve organization are becoming increasingly popular. As the retail sector continues to thrive and consumers place greater emphasis on home organization, the Northeast's demand for hangers will continue to rise. This growth is driven by urban living, the prominence of fashion, and an increasing preference for functional, space-efficient products.

The Midwest is seeing moderate growth in demand for hangers, with a 4.6% CAGR. The region’s steady growth in retail businesses, particularly in cities like Chicago and Detroit, is contributing to the increasing need for hangers. As the retail infrastructure continues to expand and e-commerce platforms grow, the demand for hangers, both for in-store display and at-home storage, rises. The region’s growing focus on home organization, particularly in residential areas, is driving demand for specialized hangers designed to improve storage efficiency and closet organization. While growth in the Midwest is slower compared to the West and South, the rising interest in home decor and fashion is sustaining demand for hangers. As consumer spending on fashion and home goods continues to rise, the Midwest is expected to see continued growth in hanger demand, driven by both retail expansion and a focus on organizational solutions.

The demand for hangers in the United States continues to expand, driven by growth in apparel retail, increasing household incomes, and rising interest in home‑organisation solutions. With more consumers investing in quality closets and wardrobe systems, demand for durable, aesthetically pleasing hanger options spanning plastic, wood, metal, and specialty materials is growing. The rise of e‑commerce and rapid returns in apparel retail mean more accessories like hangers are keeping pace with wardrobe and retail supply‑chain needs.

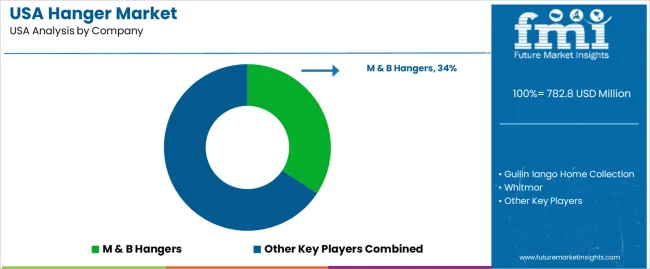

Within the USA demand landscape, M & B Hangers holds an estimated share of approximately 34.3%, reflecting its strong domestic manufacturing presence, brand recognition among dry‑cleaning and retail sectors, and entrenched distribution networks across the country. Other notable suppliers supporting hanger demand include Guilin Iango Home Collection, Whitmor, MAWA & Mainetti, Bend & Hook, and Henry Hanger, all of which cater to segments ranging from everyday household use to premium wardrobe solutions and retail fixture providers.

Key drivers of demand include the strong presence of hospitality and retail sectors requiring large volumes of hangers, consumers’ growing focus on home‑organisation ecosystems, and trends toward premium materials and eco‑friendly designs in hangers. While import competition, raw‑material cost fluctuations, and sustainability pressures (such as plastic bans) pose challenges, the overall outlook for hanger demand in the USA remains positive, underpinned by ongoing apparel retail activity and consumer investment in home storage solutions.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Application | Personal Use, Commercial Use |

| Type | Metal Hangers, Wooden Hangers, Plastic Hangers, Other Hanger Types |

| Sales Channel | Hypermarkets/Supermarkets, Specialty Stores, Department Stores, Convenience Stores, Online Retailers, Other Sales Channels |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | M & B Hangers, Guilin Iango Home Collection, Whitmor, MAWA and Mainetti, Bend and Hook, Henry Hanger |

| Additional Attributes | Dollar sales by application, type, sales channel, and regional trends with a focus on the retail sector, catering to both personal and commercial uses. Key drivers include increasing demand for high-quality hangers in retail and home sectors. |

The global demand for hanger in USA is estimated to be valued at USD 782.8 million in 2025.

The market size for the demand for hanger in USA is projected to reach USD 1,375.6 million by 2035.

The demand for hanger in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in demand for hanger in USA are personal use and commercial use.

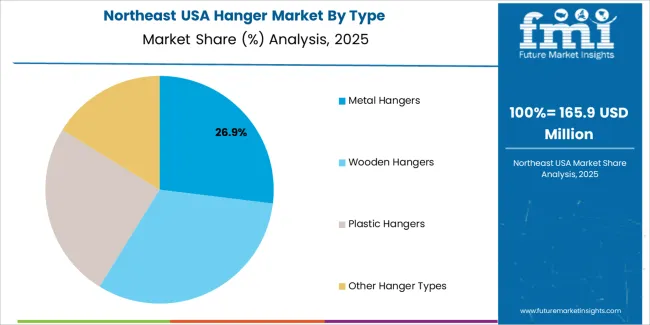

In terms of type, metal hangers segment to command 26.9% share in the demand for hanger in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hanger Market Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Liner Hanger Market

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hanger in Japan Size and Share Forecast Outlook 2025 to 2035

Music Speed Changer Market Size and Share Forecast Outlook 2025 to 2035

Plate Heat Exchanger Market Growth - Trends & Forecast 2025 to 2035

Brewery Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Automotive Heat Exchanger Market

Brazed Plate Heat Exchangers Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

High Pressure Heat Exchanger Market

Plate and Frame Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Electric Clothes Drying Hanger Market Trends – Growth & Demand 2025 to 2035

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

CDU Heat Exchanger Anti-foulant Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA