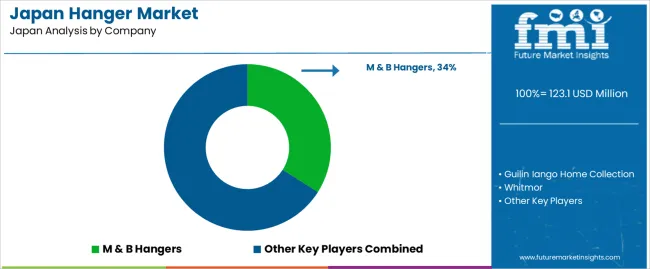

The demand for hangers in Japan is valued at USD 123.1 million in 2025 and is projected to reach USD 192.6 million by 2035, reflecting a compound annual growth rate of 4.6%. Growth is influenced by steady activity across apparel retail, household organization products and commercial laundry services. As clothing assortments diversify and storage preferences shift toward more space-efficient solutions, demand for durable and specialized hangers continues to rise. Wood, plastic and metal formats each maintain relevance, with premium and anti-slip designs gaining traction in both residential and professional use. Expanding e-commerce channels also contribute to product visibility and availability, allowing manufacturers to reach broader consumer groups and support consistent growth over the forecast period.

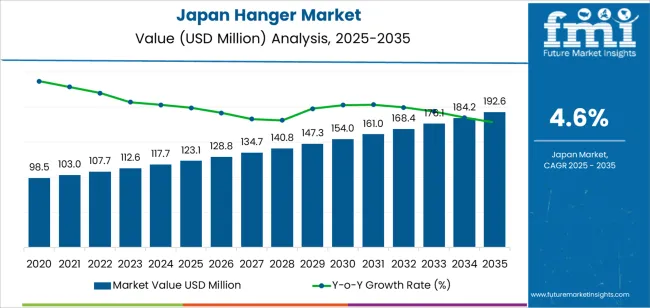

The growth curve shows a smooth, upward trajectory with regular annual increments, beginning at USD 98.5 million in earlier years and moving to USD 123.1 million in 2025 before progressing toward USD 192.6 million by 2035. Year-to-year growth remains steady, with values rising from USD 128.8 million in 2026 to USD 134.7 million in 2027 and continuing at similar intervals throughout the timeline. This pattern reflects stable demand tied to wardrobe expansion, increased garment care awareness and ongoing replacement cycles across households and businesses. As product designs evolve with improved strength, reduced bulk and enhanced functionality, hanger use remains firmly embedded in both domestic organization habits and commercial apparel handling systems across Japan.

Demand for hangers in Japan is projected to rise from USD 123.1 million in 2025 to USD 192.6 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.6 %. Starting at USD 98.5 million in 2020, demand increases steadily to USD 117.7 million by 2024 and USD 123.1 million in 2025. Between 2025 and 2030, demand is expected to move from USD 123.1 million to approximately USD 154.0 million. From 2030 to 2035, demand continues toward USD 192.6 million. Growth is driven by factors such as rising apparel consumption, expansion of retail store fleets, increasing demand for premium and eco friendly hanger formats, and growth in home organisation trends within Japanese households.

Over the forecast period the value uplift of USD 69.5 million (from USD 123.1 million in 2025 to USD 192.6 million in 2035) is supported by both volume growth and improved per unit value. In early years, volume growth dominates as more households adopt multiple wardrobe systems and retail display upgrades become common. In later years, value growth becomes more significant as manufacturers introduce advanced hanger materials (aluminium, bamboo, recycled plastics), premium finishes, custom branded retailer formats and smart organisation features allowing higher average selling prices. These shifts, combined with increased replacement cycles and renovation of retail spaces, help drive the steady upward trend toward USD 192.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 123.1 million |

| Forecast Value (2035) | USD 192.6 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

Demand for hangers in Japan is supported by the growth of apparel retail, home organisation trends, and e-commerce expansion. Japan’s dense urban households often prioritise efficient use of space and aesthetic presentation, encouraging selection of hanger types that conserve closet room and match interior styling. Retail chains and fashion stores frequently replace or update fixture-level hangers to improve garment display and customer perception, which further adds to hanger demand. In addition, direct-to-consumer and subscription-box clothing services raise demand for packaged wardrobe accessories including hangers-both as part of new store set-ups and home-delivery models.

Another factor influencing hanger demand in Japan is the shift toward higher value and sustainable materials. Consumers increasingly view closet accessories as part of overall lifestyle and design aspirations rather than purely functional items. This has led to growth in wood-, metal- and specialty-coated hangers that enhance retail signage or premium home interiors. At the same time, manufacturers face pressures from import competition and cost of materials for decorative finishes, but the combination of premiumisation and household space constraints means demand for hangers in Japan is likely to remain stable or grow modestly in coming years.

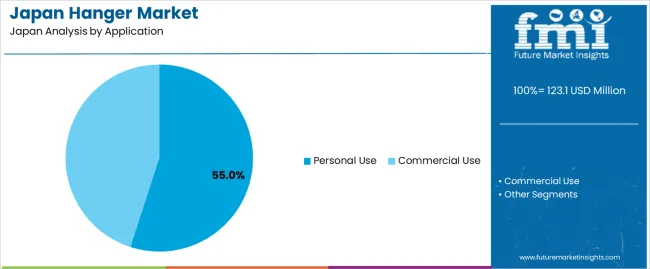

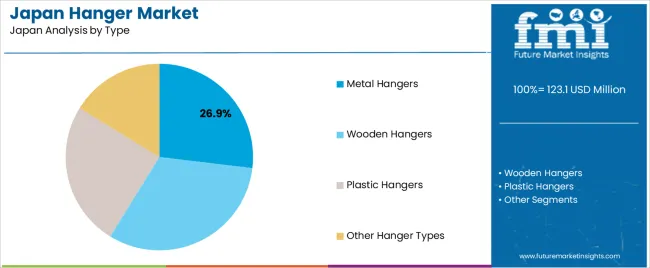

The demand for hangers in Japan is shaped by the distinction between personal and commercial use and the variety of hanger types available. Personal use includes household wardrobes, small storage areas and everyday clothing organization, while commercial use covers apparel retailers, laundry services and hospitality operations that require durable and uniform hanging solutions. Hanger types include metal, wooden, plastic and other specialty forms, each offering different strength, appearance and space-saving benefits. These segments reflect how storage needs, clothing care habits and interior preferences influence purchasing patterns across Japanese households and businesses that seek dependable organization tools.

Personal use accounts for 55% of total hanger demand in Japan. This strong share reflects the way households prioritize efficient clothing storage within limited residential spaces. Many homes require lightweight, easy-to-organize hangers that support daily wardrobes. Personal use emphasizes affordability, ease of handling and compatibility with closets of varying sizes. Consumers also look for hangers that reduce garment creasing and support delicate fabrics commonly worn in everyday settings. These needs guide consistent purchasing of basic and multipurpose hanger designs that fit routine clothing care habits.

Growth in personal use is also influenced by increasing attention to home organization and long-term garment maintenance. Japanese households often refresh hangers to match seasonal wardrobe changes or improve closet layout. Demand increases further as consumers adopt coordinated hanger sets to achieve tidy visual presentation and maximize storage density. As residential environments continue to prioritize order and functional design, personal use remains the most influential category shaping overall hanger demand in Japan.

Metal hangers represent 26.9% of total demand across hanger types in Japan. Their popularity is linked to strength, slim profiles and resistance to deformation, making them practical for both lightweight and structured garments. Metal hangers support long-term use and help maximize closet capacity by reducing bulk. Their simple form suits a wide range of clothing categories, which encourages households and commercial users to rely on them for consistent performance. The ability to handle frequent handling also reinforces metal hangers as a dependable option.

Demand for metal hangers is also supported by their role in commercial settings such as fashion retailers and laundry services that require uniform and durable storage tools. Metal hangers maintain shape under repeated use and provide stable support during steaming or transport. Their clean aesthetic aligns with minimalist retail preferences in Japan. As users seek hangers that balance durability with space efficiency, metal hangers continue to hold an important place in both personal and commercial applications.

Demand for hangers in Japan is influenced by growth in apparel retail, rising e-commerce activity and increasing interest in organised wardrobe systems. Consumers value durability, uniformity and space-efficient designs, prompting demand for slim, non-slip and visually appealing hangers. At the same time, sustainability concerns push interest in recycled or biodegradable materials. Barriers include cost pressure on manufacturers, competition from alternative storage solutions and high Japanese consumer expectations for product quality. These conditions shape how hanger demand evolves across retail and residential environments in Japan.

Apparel retailers in Japan rely on hangers for display consistency, backroom organisation and product protection, especially as fast-fashion and outlet chains expand. The parallel rise in online shopping increases the need for hangers in fulfilment and logistics operations. In households, smaller living spaces and a preference for minimal, tidy wardrobes drive interest in slim, non-slip and uniform hangers that optimise closet space. These combined trends reinforce steady demand for hangers that support efficient storage and stylistic cohesion in Japan.

Opportunities are expanding in premium segments where fashion brands, boutiques and hospitality operators seek high-quality wooden, metal or custom-designed hangers. Demand is also rising for eco-friendly options that use recycled plastics or biodegradable materials. Growth in subscription wardrobe services and direct-to-consumer apparel packaging further opens avenues for specialised hangers. Suppliers that offer design differentiation, branding options and durable materials are well positioned to engage both retail and residential customers across Japan.

Cost-competitive basic hangers face pressure from low-priced imports, while premium hangers must justify higher prices in a cautious purchasing environment. Manufacturers also need continuous innovation in materials and design to meet Japanese standards for durability, stain resistance and shape retention. Alternative storage systems such as multi-tier racks or collapsible organisers compete with traditional hangers in compact homes. These obstacles slow rapid expansion, particularly in mass-market segments where functionality and cost control dominate decision-making in Japan.

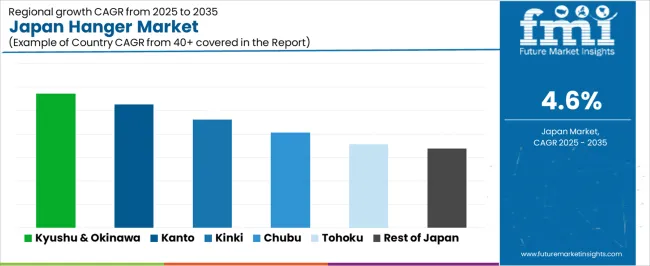

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.7% |

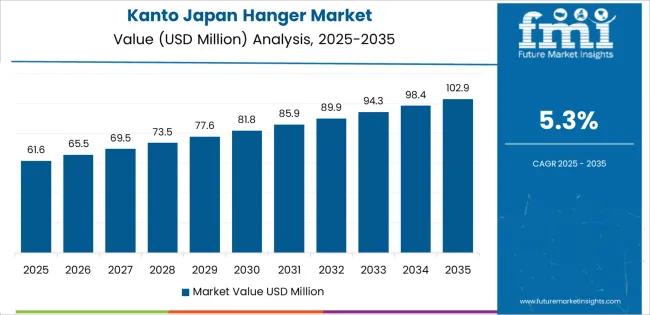

| Kanto | 5.3% |

| Kinki | 4.6% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

Demand for hangers in Japan is rising across regions, with Kyushu and Okinawa leading at 5.7%. Growth in this region reflects steady expansion of apparel retail and increased household purchases. Kanto follows at 5.3%, supported by dense consumer markets and strong demand from clothing stores and laundries. Kinki records 4.6%, shaped by active retail centers and consistent replacement cycles in commercial facilities. Chubu grows at 4.1%, influenced by regional manufacturing and household consumption trends. Tohoku reaches 3.6%, where adoption increases with the expansion of retail outlets. The rest of Japan posts 3.4%, indicating gradual but stable demand across smaller cities and towns.

Kyushu & Okinawa is projected to grow at a CAGR of 5.7% through 2035 in demand for hangers. The region’s households, retail stores, and laundry services, particularly in Fukuoka, are adopting hangers for clothing storage, display, and organization. Rising consumer preference for durable, space-saving, and multipurpose hangers drives adoption. Manufacturers in Kyushu & Okinawa are producing plastic, wooden, and metal hangers to meet residential and commercial demand. The expansion of retail stores, online sales, and growing awareness of organized storage solutions further supports steady growth in hanger demand across the region.

Kanto is projected to grow at a CAGR of 5.3% through 2035 in demand for hangers. As Japan’s economic and urban hub, including Tokyo, the region leads in adopting hangers for households, retail displays, and laundry services. Rising awareness of efficient storage solutions and demand for durable, multipurpose products drives adoption. Manufacturers provide innovative hangers that save space, improve organization, and suit diverse clothing types. Retailers and e-commerce channels ensure wide product availability. Kanto’s high population density, urban lifestyle, and growing household spending on organizational products further support steady hanger market growth in the region.

Kinki is projected to grow at a CAGR of 4.6% through 2035 in demand for hangers. The region’s urban centers, including Osaka and Kyoto, are increasingly using hangers in households, retail stores, and laundry services for clothing display and organization. Rising awareness of storage efficiency and multifunctional design drives adoption. Manufacturers in Kinki focus on producing wooden, metal, and plastic hangers suitable for different clothing types. Retailers and online channels provide convenient access for consumers. Urban lifestyle trends, retail expansion, and consumer focus on organized living spaces support steady growth of hanger demand in Kinki.

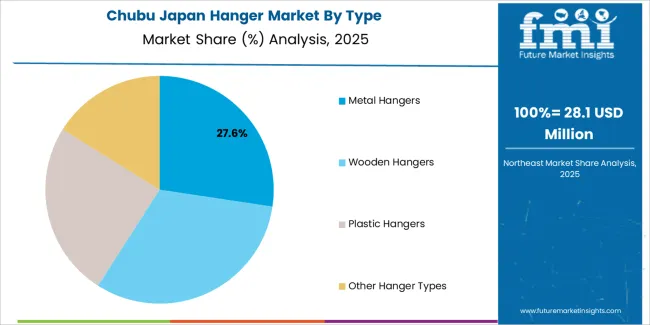

Chubu is projected to grow at a CAGR of 4.1% through 2035 in demand for hangers. The region’s households, retail establishments, and laundry services, particularly in Nagoya, increasingly adopt hangers for organization, display, and storage. Consumer demand for durable, versatile, and space-saving products drives adoption. Manufacturers are producing multifunctional hangers in plastic, wood, and metal variants to meet residential and commercial needs. Retail and e-commerce distribution ensures widespread availability. The combination of urbanization, household focus on organization, and commercial demand in Chubu supports steady growth in hanger adoption across both urban and semi-urban areas.

Tohoku is projected to grow at a CAGR of 3.6% through 2035 in demand for hangers. The region’s households, small retail stores, and laundry services are gradually adopting durable and multifunctional hangers for clothing storage and display. Rising consumer awareness of organization, hygiene, and convenience drives adoption. Manufacturers provide space-saving, lightweight, and sturdy hangers suitable for Tohoku’s smaller urban and semi-urban areas. Retailers and distributors expand access to meet local demand. These trends ensure steady growth in the adoption of hangers across Tohoku’s residential and commercial markets.

The Rest of Japan is projected to grow at a CAGR of 3.4% through 2035 in demand for hangers. Smaller towns and rural areas are gradually adopting plastic, wooden, and metal hangers for households, retail stores, and laundry services. Rising awareness of organization, convenience, and durability drives adoption. Manufacturers are providing affordable, multifunctional, and space-saving hangers suitable for these areas. Retail and e-commerce channels support product availability across less urbanized regions. Steady adoption of organized storage solutions, combined with regional retail expansion, continues to drive growth in hanger demand across the Rest of Japan.

The demand for hangers in Japan is influenced by growth in the apparel and retail sectors, rising consumer interest in home organisation, and the proliferation of e-commerce logistics requiring efficient storage solutions. Japanese consumers value premium finishes, compact storage designs and multi-functional items suited to smaller living spaces. Retailers and wardrobe-furnishing suppliers therefore increasingly seek hangers that combine aesthetic appeal, durability and space-saving features. At the same time, sustainability concerns and material innovation motivate shifts toward recycled plastics, slim profiles and non-slip coatings. These factors support steady demand for both household and commercial hangers across Japan.

Key firms active in Japan’s hanger segment include M & B Hangers, Guilin Iango Home Collection, Whitmor, MAWA/Mainetti, Bend and Hook and Henry Hanger. These companies supply a range of hanger formats from standard plastic and wood to specialty velvet-coated, metal and space-saving designs serving Japanese homes, retail stores and hospitality customers. Their competitive edge comes from offering customised solutions (logo embossing, colour options) and efficient supply chains that reach Japanese distributors. Through partnerships with home-organisation brands and retail furniture chains they shape the selection criteria and adoption patterns for hanger products in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Application | Personal Use, Commercial Use |

| Hanger Types | Metal Hangers, Wooden Hangers, Plastic Hangers, Other Hanger Types |

| Sales Channels | Hypermarkets/Supermarkets, Specialty Stores, Department Stores, Convenience Stores, Online Retailers, Other Sales Channels |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | M & B Hangers, Guilin Iango Home Collection, Whitmor, MAWA/Mainetti, Bend and Hook, Henry Hanger |

| Additional Attributes | Dollar by sales by type, application, and sales channel; regional CAGR and adoption trends; personal vs commercial use segmentation; premium, space-saving, and multifunctional hanger uptake; growth in retail display and home organization; eco-friendly and recycled material formats; replacement cycles and seasonal refresh; e-commerce penetration; branded or customized hangers for retail and hospitality use. |

The demand for hanger in Japan is estimated to be valued at USD 123.1 million in 2025.

The market size for the hanger in Japan is projected to reach USD 192.6 million by 2035.

The demand for hanger in Japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in hanger in Japan are personal use and commercial use.

In terms of type, metal hangers segment is expected to command 26.9% share in the hanger in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA