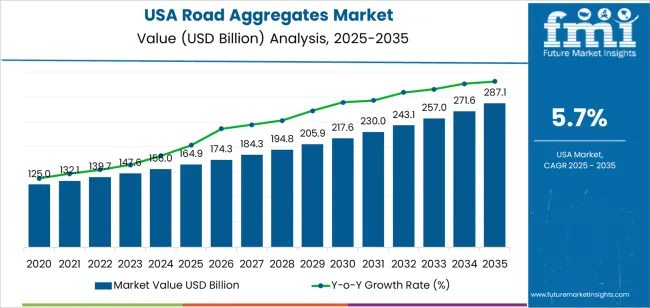

The demand for road aggregates in USA is valued at USD 164.9 billion in 2025 and is projected to reach USD 287.1 billion by 2035, reflecting a compound annual growth rate of 5.7%. Growth is shaped by steady expansion in road construction, resurfacing programs and transportation network upgrades. Aggregates remain essential for base layers, asphalt mixes and concrete structures that support durability and load distribution across highways and local roads. As federal and state infrastructure budgets prioritize maintenance and new corridor development, procurement of crushed stone, gravel and sand increases in line with project activity. These recurring requirements sustain a strong upward trajectory across the forecast period.

The growth curve shows a consistent rise beginning at USD 125.0 billion in earlier years and reaching USD 164.9 billion in 2025 before advancing toward USD 287.1 billion by 2035. Annual values increase at predictable intervals, progressing from USD 174.3 billion in 2026 to USD 184.3 billion in 2027 and continuing through USD 230.0 billion in 2031 and USD 257.0 billion in 2033. This pattern reflects steady demand tied to long-term infrastructure cycles and regular resurfacing needs. As construction firms expand capacity and regional agencies increase road rehabilitation commitments, aggregate consumption maintains strong momentum. The curve highlights a mature but expanding sector driven by sustained public investment and continuous structural maintenance across USA’s transportation network.

Demand in USA for road aggregates is projected to rise from USD 164.9 billion in 2025 to USD 287.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.7%. Starting from USD 125.0 billion in 2020, the value gradually climbs through USD 156.0 billion in 2024 and reaches USD 164.9 billion in 2025. Between 2025 and 2030 the demand is expected to increase significantly toward around USD 217.6 billion, and from 2030 to 2035 it continues robustly to reach USD 287.1 billion. Growth is driven by sustained investment in highway and infrastructure rehabilitation, higher usage of aggregates in road construction and maintenance, and expansion of related transport and logistics infrastructure.

Over the forecast period, the total value uplift from USD 164.9 billion to USD 287.1 billion an increase of USD 122.2 billion is underpinned by both volume growth and rising per unit value. In the early years, volume growth dominates as more miles of highways, bridges and rural roads are upgraded and constructed. In later years’ value growth becomes increasingly important as higher specification aggregates, recycled materials and premium logistics solutions allow suppliers to capture higher revenue per tonne. Market participants focusing on efficient supply chains, sustainability credentials, and high performance aggregate grades are best positioned to benefit from the substantial opportunity through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 164.9 billion |

| Forecast Value (2035) | USD 287.1 billion |

| Forecast CAGR (2025–2035) | 5.7% |

The demand for road aggregates in USA has historically been supported by robust infrastructure development, particularly in the mid-20th to early-21st centuries when highway expansion, urban sprawl and heavy manufacturing sectors drove large-scale construction of roads, bridges and supporting infrastructure. During that period, rising vehicle ownership, new suburban developments and industrial growth required extensive base and sub-base materials (crushed stone, gravel and sand) for road and pavement layers. Maintenance and resurfacing of ageing infrastructure also contributed consistent aggregate consumption as highways, interstates and local roads were upgraded or reconstructed.

Looking ahead, future growth in demand for road aggregates in USA is being shaped by renewed infrastructure investment, freight-logistics expansion and sustainability trends. Federal and state funding for road, bridge and transport-network upgrades is increasing, encouraging the procurement of high-quality aggregate materials for durable and heavy-use surfaces. Growth of e-commerce and heavy-vehicle freight traffic also increases demand for robust pavement structures, which depend on larger volumes of aggregates. At the same time, environmental regulations drive interest in recycled aggregates and optimised material use. Although substitute materials and regional quarry constraints remain headwinds, the alignment of infrastructure renewal, logistic load-growth and material-performance demand points to a steady upward trajectory for road aggregate demand in USA.

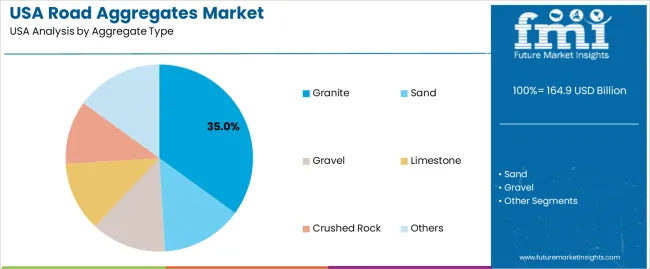

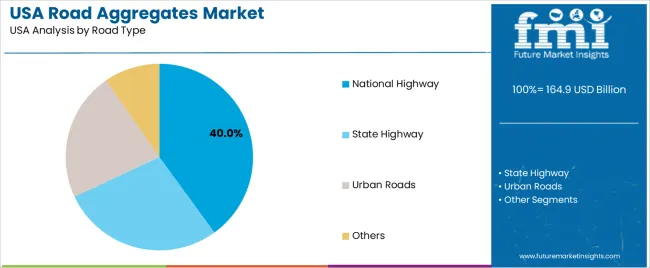

The demand for road aggregates in USA is shaped by the aggregate types required for construction performance and the road categories that determine load-bearing expectations. Aggregate types include granite, sand, gravel, limestone, crushed rock and other locally sourced materials, each offering different strength, abrasion resistance and compaction properties. Road types such as national highways, state highways, urban roads and others rely on aggregates that support durability under traffic variation. As agencies and contractors prioritize long-term pavement stability and predictable construction outcomes, the combination of aggregate characteristics and roadway requirements guides material selection across USA.

Granite accounts for 35% of total demand across aggregate type categories in USA. Its leading share reflects the material’s high compressive strength and resistance to weathering, which support reliable pavement layers in regions exposed to heavy traffic and variable climate conditions. Granite provides consistent mechanical performance that helps maintain stable road surfaces over extended service periods. Contractors value its predictable compaction characteristics and strong performance under repeated loading. These traits contribute to steady adoption across large infrastructure projects requiring dependable aggregate behavior.

Demand for granite aggregates increases as national and regional construction programs emphasize materials that balance durability with manageable processing. Granite supports uniform gradation and maintains structural integrity during mixing, transportation and placement. Its compatibility with asphalt and concrete formulations enhances performance across multiple pavement layers. Facilities appreciate the reduced deformation risk associated with granite under heavy axle loads. As highway agencies continue specifying aggregates with strong long-term performance, granite remains central to material use across USA.

National highways account for 40.0% of total demand across road type categories in USA. Their leading position reflects the extensive material requirements associated with high-capacity corridors that connect major regions. These routes support heavy commercial traffic and require aggregates that deliver strong load distribution and reliable surface stability. Construction teams rely on high-quality materials to meet performance standards related to safety, durability and long-term maintenance intervals. National highway projects consistently draw large aggregate volumes due to multi-layer pavement structures and broad roadway widths.

Demand for aggregates in national highway construction grows as expansion and rehabilitation programs address aging infrastructure. These corridors require materials that support repeated freeze-thaw cycles, sustained loading and varied climatic conditions. Contractors depend on aggregates that maintain predictable friction levels and support uniform compaction across high-volume lanes. The scale and frequency of national highway projects ensure continuous aggregate use. As long-term investment continues shaping transportation priorities, national highways remain the dominant driver of aggregate demand in USA.

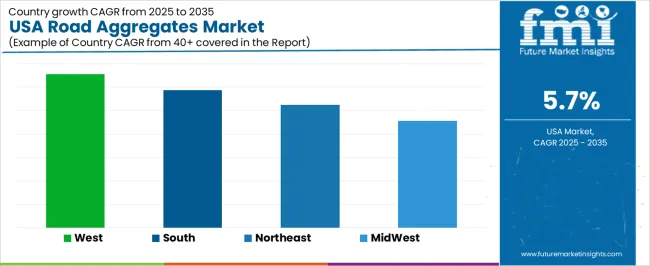

Demand for road aggregates in the USA continues to rise as federal and state infrastructure programs accelerate highway upgrades, bridge rehabilitation and regional freight-corridor improvements. Urban congestion, freight-route expansion and climate-resilience projects in coastal states further sustain large construction volumes. Regional variations shape demand, with the West and South showing stronger growth due to population expansion and broader transportation spending. At the same time, permitting delays, haul-distance cost pressures and local sourcing constraints influence how consistently aggregates are supplied across the country.

How Are Regional Infrastructure Priorities Influencing Aggregate Use in the USA?

Infrastructure programs driven by state DOTs and the federal Infrastructure Investment and Jobs Act increase demand for aggregates in states prioritizing highway resurfacing, bridge strengthening and storm-resistant road bases. The West sees strong demand due to seismic-resilient road work, while the South accelerates multi-lane highway expansion to support population growth. The Northeast focuses on urban reconstruction and aging bridge repair. These region-specific priorities keep aggregates essential across varied climates and geographies in the United States.

Where Are Expansion Opportunities Emerging for Road Aggregates in the USA?

Opportunities grow in regions experiencing rapid municipal development, logistics network expansion and coastal resilience programs. The West and South benefit from new industrial parks, rail-connected distribution hubs and widening projects on freight-heavy corridors. Renewable-energy access roads and rural connectivity upgrades in the Midwest also contribute. Producers offering consistent supply near project clusters or investing in rail-served distribution yards can capture stronger demand in these expanding zones.

What Factors Are Constraining Broader Growth of Road Aggregate Demand in the USA?

Constraints include stricter environmental permitting for new quarries, community resistance to blasting activities and increased transportation costs when aggregates must be hauled long distances. Weather-related disruptions and limited local quarry availability in dense urban regions also create supply bottlenecks. Smaller contractors may delay purchases when asphalt or concrete project schedules shift. These constraints influence availability and cost patterns across the USA aggregate market.

| Region | CAGR (%) |

|---|---|

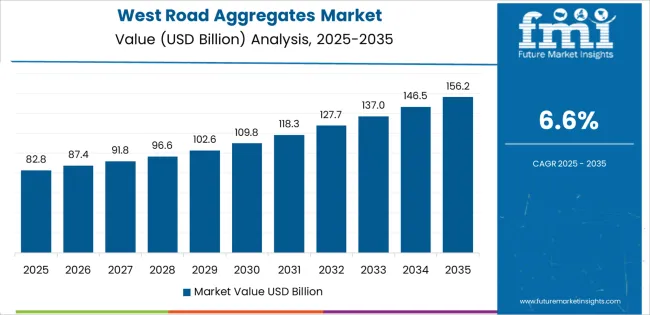

| West USA | 6.6% |

| South USA | 5.9% |

| Northeast USA | 5.2% |

| Midwest USA | 4.6% |

Demand for road aggregates in the USA is increasing across all regions, with the West leading at 6.6%. Growth in this region reflects active road construction, highway rehabilitation, and infrastructure upgrades supported by ongoing public investment. The South follows at 5.9%, driven by extensive transportation projects and steady urban expansion. The Northeast records 5.2%, shaped by continual maintenance needs across dense transit corridors and older road networks. The Midwest grows at 4.6%, where regional construction firms rely on aggregates for resurfacing, rural road improvement, and municipal projects. These regional patterns indicate strong nationwide dependence on aggregates as transportation infrastructure programs continue to advance.

West USA is projected to grow at a CAGR of 6.6% through 2035 in demand for road aggregates. California, Washington, and surrounding regions are increasingly using aggregates for highway construction, road resurfacing, and civil engineering projects. Rising focus on infrastructure development, transportation network expansion, and material durability drives adoption. Manufacturers supply crushed stone, gravel, and sand suitable for highways and local roads. Distributors ensure availability across urban, semi-urban, and industrial construction sites. Expansion in road construction, civil projects, and municipal infrastructure supports steady adoption of road aggregates in West USA.

South USA is projected to grow at a CAGR of 5.9% through 2035 in demand for road aggregates. Texas, Florida, and neighboring regions are increasingly adopting aggregates for highways, road resurfacing, and civil engineering projects. Rising demand for durable materials, transportation infrastructure, and urban development drives adoption. Manufacturers supply high-quality sand, gravel, and crushed stone suitable for multiple road applications. Distributors ensure accessibility across urban, semi-urban, and industrial construction sites. Expansion in highway construction, municipal projects, and road infrastructure supports steady adoption of road aggregates across South USA.

Northeast USA is projected to grow at a CAGR of 5.2% through 2035 in demand for road aggregates. New York, Pennsylvania, and surrounding regions are gradually adopting aggregates for highway construction, resurfacing, and civil engineering projects. Rising focus on urban development, road durability, and infrastructure expansion drives adoption. Manufacturers provide crushed stone, gravel, and sand suitable for highways, streets, and local roads. Distributors ensure availability across urban and semi-urban construction sites. Expansion in road construction, civil projects, and municipal infrastructure supports steady adoption of road aggregates across Northeast USA.

Midwest USA is projected to grow at a CAGR of 4.6% through 2035 in demand for road aggregates. Illinois, Ohio, and surrounding regions are gradually adopting aggregates for highways, local roads, and civil engineering projects. Rising demand for durable materials, infrastructure expansion, and transportation projects drives adoption. Manufacturers supply sand, gravel, and crushed stone suitable for highways and local roads. Distributors ensure availability across urban, semi-urban, and industrial construction facilities. Growth in municipal road projects, highway construction, and civil infrastructure supports steady adoption of road aggregates across Midwest USA.

Demand for road aggregates in USA continues to rise as highway rehabilitation, bridge upgrades and urban road maintenance accelerate under long term federal and state infrastructure programs. Projects involving resurfacing, drainage improvements and pavement strengthening rely heavily on crushed stone, gravel and sand. Population growth in metropolitan regions increases traffic loads and prompts wider use of aggregates for new lane additions, interchange redesigns and local road expansions. Aggregates also play a central role in concrete and asphalt production, which supports industrial construction, warehousing development and public transit projects. Weather related degradation and aging road networks further elevate routine aggregate consumption. Together these factors create sustained nationwide demand across agencies, contractors and material producers operating in both urban and rural settings.

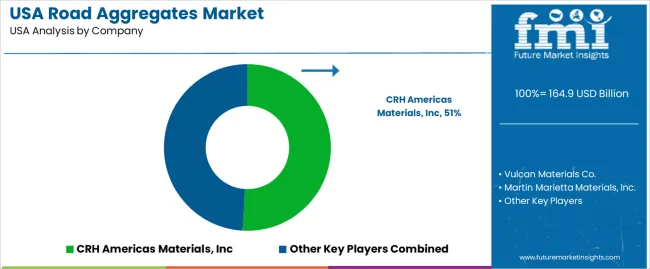

Key players shaping USA’s road aggregates landscape include large vertically integrated producers and regional suppliers with strong distribution networks. CRH Americas Materials, Inc operates through quarries and asphalt plants that supply state and municipal projects. Vulcan Materials and Martin Marietta Materials maintain extensive aggregate reserves and long hauling capabilities that support consistent regional availability. Heidelberg Materials contributes through quarry assets and integrated cement operations. Knife River Corp serves multiple states with aggregates, asphalt and construction services aligned with local contractor needs. The combination of national scale and regional specialization ensures reliable supply, logistical flexibility and alignment with varied project specifications. Companies compete on quality consistency, transportation efficiency and long term contracting relationships with public and private infrastructure developers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Aggregate Type | Granite, Sand, Gravel, Limestone, Crushed Rock, Others |

| Road Type | National Highway, State Highway, Urban Roads, Others |

| Application | Road Base & Sub-base, Bituminous Mixing, Concrete, Railroad Ballast, Others |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | CRH Americas Materials, Inc., Vulcan Materials Co., Martin Marietta Materials, Inc., Heidelberg Materials, Knife River Corp. |

| Additional Attributes | Dollar by sales by aggregate type, road type, and application; regional CAGR and growth trends; demand by infrastructure investment type; influence of federal and state road funding; contribution of recycled vs. natural aggregates; logistics and haulage considerations; seasonal construction impacts; regional quarry availability; specification and quality standards; competition from alternative materials; supplier contracts and distribution networks; role in asphalt, concrete, and railway applications; sustainability and recycled-material adoption trends. |

The demand for road aggregates in usa is estimated to be valued at USD 164.9 billion in 2025.

The market size for the road aggregates in usa is projected to reach USD 287.1 billion by 2035.

The demand for road aggregates in usa is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in road aggregates in usa are granite, sand, gravel, limestone, crushed rock and others.

In terms of road type, national highway segment is expected to command 40.0% share in the road aggregates in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Demand for Road Aggregates in Japan Size and Share Forecast Outlook 2025 to 2035

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA