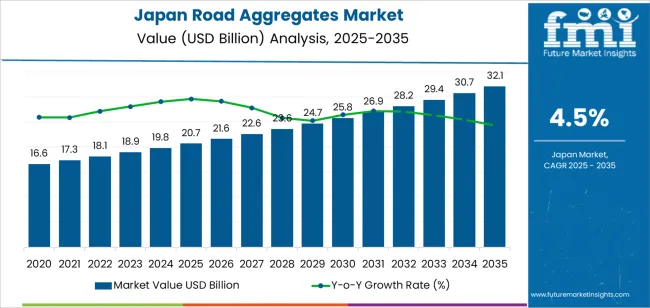

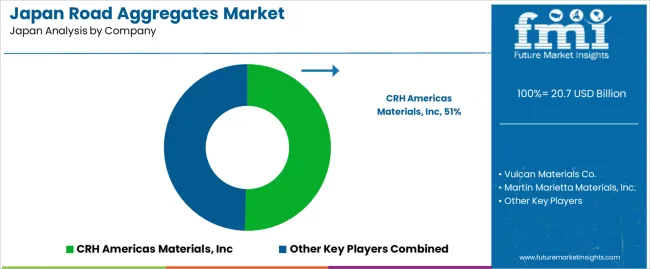

The demand for road aggregates in Japan is projected to grow from USD 20.7 billion in 2025 to USD 32.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.5%. Road aggregates are essential materials used in the construction and maintenance of roads, highways, and other infrastructure projects. As Japan continues to invest in its infrastructure and urban development, the demand for road aggregates will grow steadily, driven by both new construction projects and the need for ongoing road repairs and upgrades.

The road construction sector is the primary driver of demand for aggregates, with substantial investments in infrastructure projects such as highway expansions, urban development, and public transportation systems. The increasing need for road maintenance, particularly in older urban areas and along aging road networks, will support consistent demand. With Japan's focus on improving transportation efficiency and safety, the use of high-quality aggregates for durable and green road construction is becoming increasingly important.

The ongoing push for durability in construction materials will also contribute to the growth of road aggregates, as innovations in material usage and recycling techniques help reduce environmental impact while maintaining construction quality.

Between 2025 and 2030, the demand for road aggregates in Japan is expected to grow from USD 20.7 billion to USD 21.6 billion, reflecting a steady increase of USD 0.9 billion. This gradual growth will be driven by consistent investments in infrastructure and urban development, along with the ongoing demand for road repair and maintenance projects. Japan’s aging infrastructure, particularly in urban areas, will continue to require significant investment to maintain and upgrade road systems. As the country focuses on improving transportation networks and enhancing road safety, the demand for high-quality road aggregates will remain stable throughout this period.

From 2030 to 2035, the demand for road aggregates is projected to increase sharply, growing from USD 21.6 billion to USD 32.1 billion, a substantial increase of USD 10.5 billion. This rapid rise will be driven by large-scale infrastructure projects, including highway construction, urban expansion, and the development of transportation systems. The continued need for road maintenance will contribute significantly to this growth. The compound absolute growth during this phase will be influenced by government policies and economic factors aimed at stimulating infrastructure development, which will lead to a surge in demand for aggregates.

| Metric | Value |

|---|---|

| Demand for Road Aggregates in Japan Value (2025) | USD 20.7 billion |

| Demand for Road Aggregates in Japan Forecast Value (2035) | USD 32.1 billion |

| Demand for Road Aggregates in Japan Forecast CAGR (2025 to 2035) | 4.5% |

The demand for road aggregates in Japan is increasing due to the growing need for infrastructure development and maintenance. Road aggregates, which include materials like sand, gravel, and crushed stone, are essential in the construction and maintenance of roads, highways, and other transportation infrastructure. As Japan continues to invest in both new infrastructure projects and the maintenance of existing roads, the demand for road aggregates is expected to rise steadily.

The expansion of urban areas and the focus on improving transportation networks to support economic growth are key drivers of this demand. Japan’s aging infrastructure is also contributing to the growing need for road repair and upgrades, further boosting the consumption of road aggregates. The government’s focus on enhancing the resilience of transportation networks to natural disasters, such as earthquakes and heavy rainfall, is driving the adoption of higher-quality road aggregates in construction.

Technological advancements in construction methods and the increasing use of green practices are also influencing the demand for road aggregates. As Japan seeks to balance environmental concerns with infrastructure development, there is a rising emphasis on using recycled aggregates and reducing the environmental impact of construction materials. With ongoing investments in infrastructure and a focus on durability, the demand for road aggregates in Japan is expected to grow steadily through 2035.

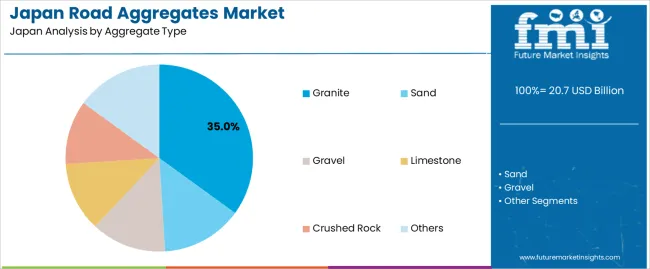

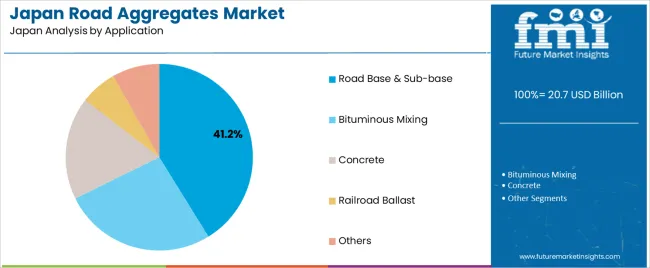

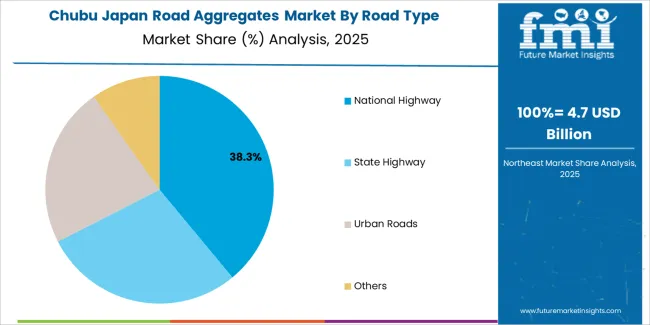

Demand for road aggregates in Japan is segmented by aggregate type, application, road type, and region. By aggregate type, demand is divided into granite, sand, gravel, limestone, crushed rock, and others, with granite holding the largest share at 35%. The demand is also segmented by application, including road base & sub-base, bituminous mixing, concrete, railroad ballast, and others, with road base & sub-base leading the demand at 41.2%. In terms of road type, demand is divided into national highways, state highways, urban roads, and others, with national highways leading the demand. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Granite accounts for 35% of the demand for road aggregates in Japan. This material is highly valued for its exceptional strength, durability, and resistance to weathering, which make it ideal for road construction. Granite is particularly suited for high-quality aggregates used in road base and sub-base applications, where its ability to withstand heavy traffic loads and harsh environmental conditions is crucial. It plays a vital role in ensuring the structural integrity and longevity of roads, particularly on national highways and urban roads. Granite’s consistency in quality, combined with its widespread availability and cost-effective processing, contributes to its dominance in the road aggregates industry. As Japan continues to focus on infrastructure development and maintenance, particularly for roads with high traffic volumes, the demand for granite aggregates will remain strong. This durable material will continue to be the preferred choice for high-traffic road applications, ensuring its sustained leadership in the industry.

Road base & sub-base accounts for 41.2% of the demand for road aggregates in Japan. These materials are essential in road construction, as they provide the necessary structural support for roads, ensuring their longevity and stability, especially under heavy traffic conditions. Road base materials form the foundational layer, while the sub-base provides additional stability and helps prevent shifting or settling. Aggregates like granite and crushed rock are commonly used for these layers due to their strength, durability, and compaction properties, making them ideal for creating stable and lasting road foundations. As Japan continues to expand and maintain its extensive road infrastructure, particularly for highways and urban roads, the demand for high-quality road base and sub-base aggregates remains strong. The role of these materials in ensuring the safety and durability of road surfaces drives their continued dominance in the industry, making them crucial to infrastructure development.

Demand is driven by infrastructure renewal—Japan’s aging road networks and seismic‑resilience upgrades boost the use of crushed stone and gravel for pavement layers. Growth of expressways, bridge refurbishments and urban road expansions also raise aggregate demand. On the restraint side, Japan faces challenges in quarry land availability due to mountainous terrain and strict environmental regulations on extraction. Transportation and logistics costs for aggregate delivery in remote or rugged regions increase supply cost. Competition from recycled aggregates and alternative materials (e.g., industrial by‑product fillers) means traditional road‑aggregate demand growth may be moderating.

In Japan the demand for road aggregates is growing because the nation emphasises maintenance and reconstruction of its extensive road network, which includes national highways, expressways and local roads vulnerable to seismic or weather damage. The government’s infrastructure investment programmes and renewal of ageing assets require large volumes of crushed rock, sand and gravel. Also, new road or tunnel construction to enhance connectivity and regional revitalisation further raises material needs. Because aggregates form the base layers and structural core of road construction, their demand closely follows road‑infrastructure development and refurbishment activity in Japan.

Technological innovations support the road-aggregate sector in Japan by improving quarrying efficiency, aggregate processing and quality assurance. New mobile crushing and screening systems allow more flexibility in remote or constrained sites, reducing transport of large boulders. Advances in material testing and digital monitoring ensure aggregates meet durability and gradation standards for road construction under Japanese seismic and climate conditions. Innovations in recycled‑aggregate processing (e.g., concrete rubble reuse) help integrate green materials into road base layers, supporting reduction of raw‑material consumption. These developments help suppliers deliver higher‑quality or lower‑cost road‑aggregates, encouraging uptake in infrastructure projects.

Despite steady demand, the road‑aggregate industry in Japan faces several challenges. One major issue is land and permit constraints: suitable quarrying sites are limited and regulatory requirements for extraction and rehabilitation are strict, raising costs. Logistics pose another challenge Japan’s mountainous geography and island nature force high freight costs and complex transport routes for raw material delivery. Cost pressure is also felt when recycled or alternative materials compete, weakening traditional aggregate demand. Labour shortages and ageing workforce in quarrying and crushing operations raise operational risk and may limit capacity expansion in the road‑materials sector.

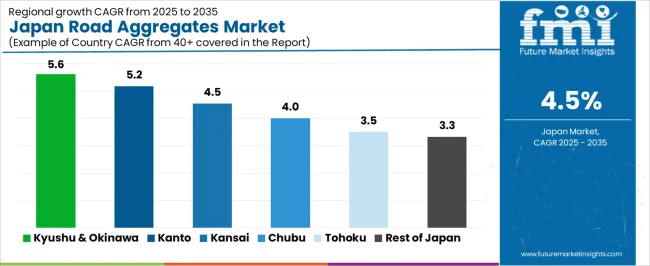

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.6% |

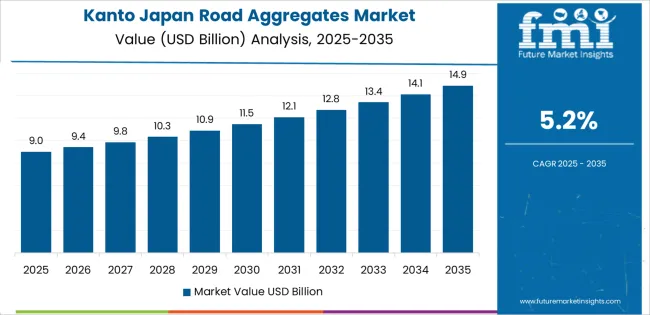

| Kanto | 5.2% |

| Kinki | 4.5% |

| Chubu | 4.0% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

Demand for road aggregates in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 5.6% CAGR. Kanto follows closely with a 5.2% CAGR, supported by the region's large-scale urbanization and ongoing road construction projects in metropolitan areas. Kinki shows a 4.5% CAGR, with demand primarily driven by the need for road maintenance and the region's strong manufacturing base. Chubu experiences a 4.0% CAGR, where its growing industrial and automotive sectors continue to rely on improved road infrastructure. Tohoku shows a 3.5% CAGR, with demand driven by infrastructure rebuilding and rural development. The Rest of Japan experiences the lowest growth at 3.3%, with steady demand supported by local construction and road maintenance projects.

Kyushu & Okinawa are experiencing the highest demand for road aggregates in Japan, with a 5.6% CAGR. This growth is largely driven by the region’s substantial infrastructure development projects, especially in the construction of new roads, highways, and bridges. As the region continues to urbanize and expand its transportation networks, the demand for road aggregates like sand, gravel, and crushed stone remains strong. The rapid development of Okinawa’s infrastructure to support tourism and population growth also contributes to increased demand. Kyushu’s large industrial sector, including manufacturing and agriculture, depends on reliable transportation networks, further boosting the need for road aggregates. Government investments in regional transportation and road maintenance projects ensure the steady growth of demand for aggregates. As Kyushu & Okinawa continue to focus on modernizing infrastructure and improving connectivity, the demand for road aggregates is expected to grow steadily in the coming years.

Kanto is seeing strong demand for road aggregates in Japan, with a 5.2% CAGR. The region’s demand is driven by its large-scale infrastructure development projects, particularly in the metropolitan areas like Tokyo and Yokohama. Kanto’s heavy focus on urbanization and expansion of public transport systems, including new roads and highways, continues to fuel the demand for road aggregates. As the region’s population grows and industries expand, the need for reliable and efficient transportation networks increases, leading to the continued use of aggregates for new infrastructure and road maintenance. Kanto's commitment to upgrading and expanding its aging road infrastructure also contributes to this demand. The region’s increasing focus on durability and energy-efficient transportation solutions has led to a rise in green construction, which further boosts the need for aggregates. As Kanto continues to lead in urban development, demand for road aggregates will remain strong.

Kinki is experiencing steady demand for road aggregates in Japan, with a 4.5% CAGR. The region’s demand is supported by its robust construction and industrial sectors. Cities like Osaka and Kyoto are key urban hubs where ongoing development and infrastructure projects are driving the need for road aggregates. The region’s expanding transportation networks, including highways, bridges, and urban roadways, require large quantities of aggregates for their construction and maintenance. Kinki’s manufacturing industries, particularly in automotive and chemicals, rely on efficient road systems to support their supply chains, further increasing demand for aggregates. The region’s focus on improving urban infrastructure to accommodate its growing population also contributes to the increasing need for road aggregates. As Kinki continues to invest in public works and transportation systems, the demand for aggregates will remain steady, supported by the region’s ongoing urban expansion and infrastructure modernization.

Chubu is seeing moderate demand for road aggregates in Japan, with a 4.0% CAGR. The region’s demand is primarily driven by the construction of new roads and the maintenance of existing infrastructure to support its manufacturing and industrial base. Chubu’s automotive industry, particularly in cities like Nagoya, relies heavily on efficient road networks to facilitate the transportation of goods and materials. The demand for road aggregates is also supported by the region’s focus on enhancing its transportation systems to improve regional connectivity. As the region continues to modernize its infrastructure and support its manufacturing and logistics sectors, the need for aggregates remains steady. Chubu’s growing urbanization, combined with its strong industrial sector, ensures that the demand for road aggregates will continue to rise. The region’s infrastructure projects, including new highways and bridges, will continue to drive demand for aggregates in the coming years.

Tohoku is experiencing moderate demand for road aggregates in Japan, with a 3.5% CAGR. The demand in the region is largely driven by ongoing infrastructure development and road maintenance projects aimed at improving transportation networks in both urban and rural areas. Tohoku’s relatively smaller industrial base compared to other regions means that its demand for road aggregates is supported primarily by public works projects, including the construction of new roads and the repair of existing ones. The region’s agricultural sector also contributes to this demand, as improved road infrastructure is essential for transporting goods and materials. Tohoku’s efforts to rebuild and modernize infrastructure in the aftermath of natural disasters, such as earthquakes and tsunamis, further boost the demand for road aggregates. As the region continues to focus on improving its transportation systems, the demand for aggregates will grow at a moderate rate.

The Rest of Japan is experiencing the lowest growth in demand for road aggregates, with a 3.3% CAGR. While this region does not have the same level of large-scale infrastructure projects as major industrial hubs like Kanto or Kyushu & Okinawa, there is still steady demand for road aggregates in smaller-scale public works and local construction projects. The demand is primarily driven by regional road maintenance, rural development, and agricultural improvements. The Rest of Japan’s focus on enhancing local connectivity and improving road conditions to support regional economic activities ensures consistent demand for road aggregates. As smaller municipalities invest in upgrading and expanding their infrastructure, the need for aggregates in these projects will continue to rise. While the growth rate is slower compared to other regions, steady infrastructure development and rural economic growth ensure that demand for road aggregates remains stable.

In Japan, demand for road aggregates is influenced by steady investment in infrastructure maintenance, seismic resilience programmes, and urban renewal efforts. Road aggregates-typically crushed stone, gravel, and sand play a critical role in pavement base layers, drainage systems, and highway construction. Given Japan’s dense infrastructure and high standards for construction, reliable supply of aggregates remains a key factor in road‑building and repair projects.

Major suppliers active in this segment include CRH Americas Materials, Inc. with a 50.5 % share, Vulcan Materials Co., Martin Marietta Materials, Inc., Heidelberg Materials and Knife River Corp.. These firms differentiate through large‑scale quarry operations, efficient logistics networks, material consistency, and global supply‑chain reach. CRH Americas Materials’ leading position reflects its ability to serve large infrastructure and road‑contracting clients with reliable shipments and quality aggregate specifications.

Competitive dynamics are shaped by a few major forces. First, Japan’s emphasis on road resilience and lifecycle maintenance drives demand for high‑quality aggregates that meet strict durability and performance standards. Second, supply‑chain factors such as quarry location, transport cost, and regulations around extraction influence cost and availability of aggregates.

Third, challenges include limited domestic quarry expansion due to land scarcity, strict environmental and mining regulations, and competition from recycled or alternative materials that may offer cost advantages. Suppliers that combine strong production efficiency, effective logistics, and compliance with Japanese standards will be best positioned to maintain a competitive edge in the road‑aggregates supply chain in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Aggregate Type | Granite, Sand, Gravel, Limestone, Crushed Rock, Others |

| Road Type | National Highway, State Highway, Urban Roads, Others |

| Application | Road Base & Sub-base, Bituminous Mixing, Concrete, Railroad Ballast, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | CRH Americas Materials, Inc, Vulcan Materials Co., Martin Marietta Materials, Inc., Heidelberg Materials, Knife River Corp. |

| Additional Attributes | Dollar sales by aggregate type and application; regional CAGR and adoption trends; demand trends in road aggregates; growth in infrastructure, construction, and transportation sectors; technology adoption for road construction; vendor offerings including aggregates, construction services, and solutions; regulatory influences and industry standards |

The demand for road aggregates in japan is estimated to be valued at USD 20.7 billion in 2025.

The market size for the road aggregates in japan is projected to reach USD 32.1 billion by 2035.

The demand for road aggregates in japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in road aggregates in japan are granite, sand, gravel, limestone, crushed rock and others.

In terms of road type, national highway segment is expected to command 40.0% share in the road aggregates in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Marking Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA