The demand for silver powder and flakes in USA is valued at USD 2.2 billion in 2025 and is expected to reach USD 3.4 billion by 2035, reflecting a compound annual growth rate of 4.7%. Growth is shaped by increasing use of conductive silver materials across electronics manufacturing, photovoltaic cell production and advanced joining applications. As device miniaturization continues and circuit designs require high-conductivity pathways, manufacturers rely on consistent supplies of fine silver particulates. Broader applications in conductive inks, pastes and solder substitutes also reinforce procurement patterns across industrial users. These ongoing material requirements support a steady upward trajectory throughout the forecast horizon.

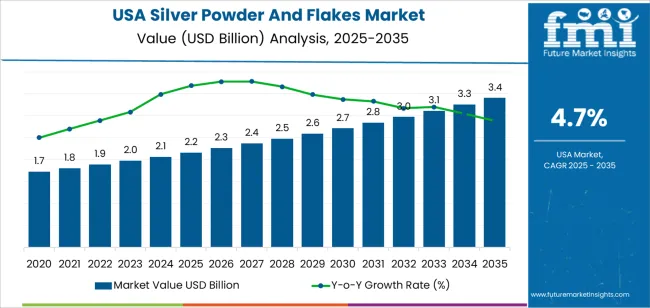

The growth curve shows a gradual rise beginning at USD 1.7 billion in earlier years and reaching USD 2.2 billion in 2025 before progressing toward USD 3.4 billion by 2035. Annual values increase at regular intervals, moving from USD 2.3 billion in 2026 to USD 2.4 billion in 2027 and continuing through USD 2.8 billion in 2031 and USD 3.1 billion in 2033. This pattern reflects a mature but steadily expanding material segment driven by routine industrial consumption and broader integration within electronics and renewable energy systems. As manufacturers enhance formulation precision and refine conductive component performance, demand maintains consistent momentum across USA’s technology and materials landscape.

Demand in USA for silver powder and flakes is projected to grow from USD 2.2 billion in 2025 to USD 3.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.7%. Starting at USD 1.7 billion in 2020, the value rises steadily USD 2.1 billion by 2024 and USD 2.2 billion in 2025. From 2025 to 2030 demand is expected to increase to around USD 2.7 billion, and by 2035 it is forecast to reach USD 3.4 billion. Growth is driven by the expanding role of silver powder and flakes in electronics, conductive inks, photovoltaics and advanced industrial applications, underpinned by higher purity requirements and miniaturisation of electronic components.

Over the forecast period the total uplift amounts to USD 1.2 billion (from USD 2.2 billion to USD 3.4 billion). In the early years of the period growth is predominantly volume led as more units are deployed in established applications and new areas open. In the latter half of the decade value growth becomes increasingly significant as product innovation such as finer particle silver powders, higher conductivity flakes, specialised grades for demanding applications and premium materials command higher prices. Suppliers focusing on advanced performance specifications, customised silver grades and sustainability credentials will be best positioned to capture the enlarged opportunity toward USD 3.4 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.2 billion |

| Forecast Value (2035) | USD 3.4 billion |

| Forecast CAGR (2025–2035) | 4.7% |

Demand for silver flakes and powders in USA has historically been fueled by the growth of the electronics manufacturing and automotive sectors. As circuit boards, sensors and connectors became more advanced, producers required high-conductivity materials and turned to silver-based powders and flakes for conductive pastes and coatings. Traditional uses in jewellery, silver plating and decorative finishes also added stable volume. These combined industrial demands provided a steady base of consumption through the 2010s and early 2020s, especially as USA manufacturing relied on high-purity silver materials for critical applications.

Looking ahead, future growth is expected to be driven by new application areas such as electric vehicles (EVs), solar photovoltaics (PV), 5G infrastructure and printed electronics. In EVs, silver flakes are used in battery connections, sensors and lightweight wiring systems. The expansion of solar arrays in USA supports demand for conductive silver materials in PV cells. The rollout of 5G and IoT devices increases the need for high-performance conductive inks and advanced packaging. Environmental sustainability drives demand for recycled silver powders and lower-waste production methods. Although silver-price volatility and supply-chain risk remain constraints, the shift towards electrification and digitalisation supports sustained growth in demand for silver flakes in USA.

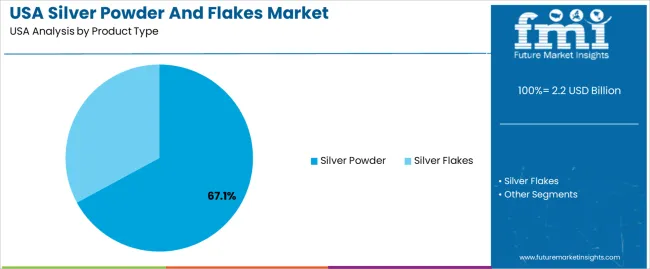

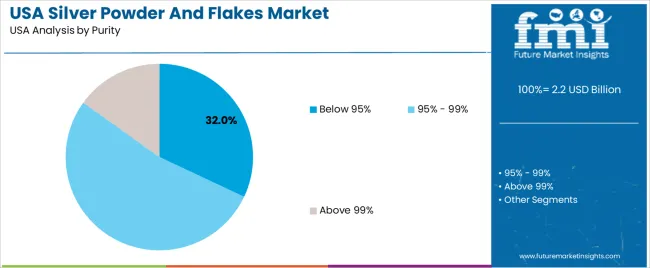

The demand for silver powder and flakes in USA is shaped by the differences in product type and the purity levels required across electrical, industrial and specialty applications. Product types include silver powder and silver flakes, each supporting distinct conductivity, particle structure and formulation needs. Purity categories such as below 95%, 95% to 99% and above 99% align with varied performance expectations in electronics, coatings and metallurgical processes. As manufacturers focus on predictable electrical behavior, stable dispersion and reliable processing characteristics, the combination of product form and purity requirement guides material selection across USA’s industrial sectors.

Silver powder accounts for 67% of total demand across product type categories in USA. Its leading position reflects broad applicability in conductive pastes, thick-film electronics and metallization processes that require fine particle distribution. Manufacturers rely on silver powder for its strong conductivity, predictable sintering behavior and compatibility with printing and coating systems. The material supports stable performance in applications ranging from circuit components to photovoltaic connections. These traits reinforce steady adoption across facilities seeking reliable conductive solutions that integrate well with existing production lines.

Demand for silver powder continues to grow as electronic assemblies and sensor technologies expand across consumer and industrial markets. The powder’s fine particle size supports uniform application and helps maintain consistent electrical pathways. Its manageable handling characteristics fit both high-volume production and specialized technical uses. Users value the powder’s adaptability when modifying formulations for varied substrates. As sectors emphasize conductive materials that balance reliability and processing efficiency, silver powder maintains its dominant share in USA.

Below 95% purity accounts for 32.0% of total demand across purity categories in USA. Its leading share reflects suitability for applications that do not require ultra-high-purity silver but still benefit from dependable conductivity and stable processing. Industries adopt these grades for coatings, adhesives, decorative finishes and general conductive uses where cost efficiency and adequate performance align. The category supports broad industrial activity by offering functional conductivity at manageable material cost, which suits operations balancing performance requirements with budget constraints.

Demand for below 95% purity grades also increases as manufacturers prioritize materials that fit routine production without the specialized handling associated with higher purity categories. These grades provide consistent particle behavior and predictable blending characteristics across common formulations. Their compatibility with diverse binders and solvents supports use in flexible production environments. As sectors continue integrating conductive materials into varied product designs, the below 95% purity category remains a practical and frequently selected option across USA.

Demand for silver powder and flakes in the USA is shaped by growth in domestic electronics manufacturing, printed circuitry production, conductive pastes for semiconductors and expansion of solar module assembly. Federal incentives supporting reshoring of chip and component supply chains strengthen local consumption. At the same time, exposure to metal-price volatility and uneven downstream demand across electronics and photovoltaics create planning challenges. These forces together influence how reliably USA manufacturers adopt silver-based conductive materials across high-precision applications.

How Are Shifts in USA Electronics and Semiconductor Activity Influencing Material Trends?

Silver powder and flakes benefit from rising USA investment in chip fabrication, sensor production, power-device packaging and printed electronics. Conductive pastes used in advanced packaging, multilayer ceramic capacitors and flexible circuitry depend on stable supplies of high-purity silver materials. Growth in domestic solar-cell assembly also supports demand for silver pastes. These trends reflect the country’s push to expand local manufacturing capacity and reduce reliance on imported electronic components.

Where Are New Avenues of Demand Emerging for Silver Powder and Flakes in USA?

Opportunities are expanding in additive manufacturing, hybrid electronics, next-generation automotive components and advanced battery research. USA producers of wearables, medical devices and aerospace electronics are testing finer particle sizes and improved dispersion grades to support reliability needs. Federal programmes encouraging domestic production of clean-energy technologies also help create pathways for greater use of silver-based conductive materials. Suppliers offering consistent quality and application-specific formulations stand to benefit.

What Factors Are Restraining Broader Adoption of Silver Powder and Flakes in USA?

High silver prices and cost fluctuations remain the strongest restraint, especially for producers sensitive to material input costs. Some USA electronics manufacturers substitute with copper-based or hybrid conductive formulations to manage expenses. Environmental and occupational-safety requirements add compliance overhead for facilities handling fine powders. In addition, uneven investment cycles in solar, consumer electronics and chip packaging can limit steady growth. These constraints moderate adoption across cost-sensitive segments.

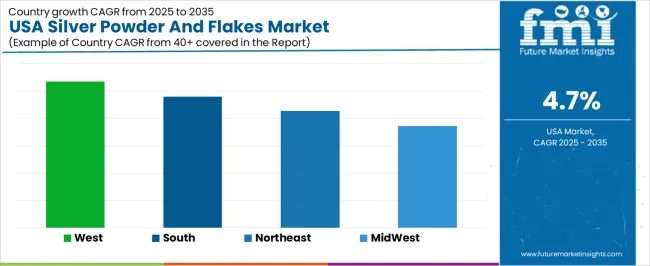

| Region | CAGR (%) |

|---|---|

| West USA | 5.4% |

| South USA | 4.8% |

| Northeast USA | 4.3% |

| Midwest USA | 3.7% |

Demand for silver powder and flakes in the USA is rising across regions, with the West leading at 5.4%. Growth in this region reflects steady activity in electronics manufacturing, where silver-based conductive materials support circuit production and component assembly. The South follows at 4.8%, supported by expanding industrial operations that use silver materials in soldering, photovoltaics, and specialized coatings. The Northeast records 4.3%, shaped by strong participation in medical device production and electronics assembly work. The Midwest grows at 3.7%, where regional manufacturers rely on conductive pastes and metallization materials for industrial applications. These regional patterns indicate broad national use of silver powder and flakes as producers maintain consistent demand for conductive and functional materials.

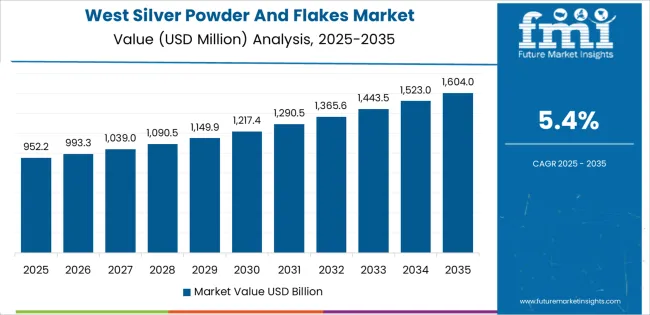

West USA is projected to grow at a CAGR of 5.4% through 2035 in demand for silver powder and flakes. California, Washington, and surrounding industrial regions are increasingly using silver powders in electronics, conductive inks, and solar applications. Rising focus on electronic device manufacturing, photovoltaic cells, and conductive materials drives adoption. Manufacturers provide high-purity silver powders and flakes suitable for industrial and commercial applications. Distributors ensure accessibility across electronics manufacturers, solar panel producers, and industrial suppliers. Expansion in electronics, renewable energy, and conductive materials production supports steady adoption of silver powders and flakes in West USA.

South USA is projected to grow at a CAGR of 4.8% through 2035 in demand for silver powder and flakes. Texas, Florida, and surrounding industrial hubs are increasingly adopting silver powders for electronics, solar cells, and conductive inks. Rising focus on electronic manufacturing, renewable energy, and material conductivity drives adoption. Manufacturers provide powders and flakes compatible with industrial, commercial, and research applications. Distributors ensure accessibility across manufacturers, solar panel producers, and industrial facilities. Expansion in electronics, photovoltaic production, and conductive material usage supports steady adoption of silver powders and flakes across South USA.

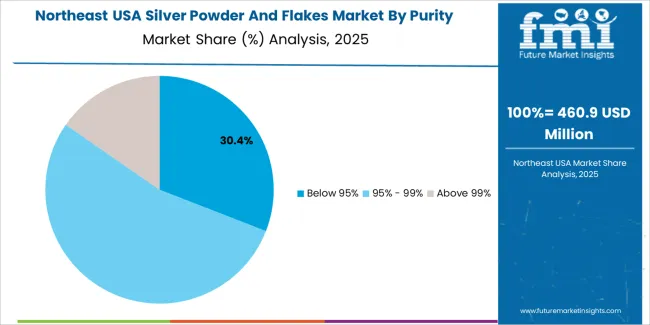

Northeast USA is projected to grow at a CAGR of 4.3% through 2035 in demand for silver powder and flakes. New York, Pennsylvania, and surrounding regions are gradually adopting silver powders for electronics, solar panels, and conductive inks. Rising focus on industrial manufacturing, electronic device production, and renewable energy drives adoption. Manufacturers provide high-quality silver powders and flakes suitable for multiple industrial applications. Distributors ensure availability across electronics producers, solar manufacturers, and industrial suppliers. Growth in electronics, solar energy, and conductive materials production supports steady adoption of silver powders and flakes across Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.7% through 2035 in demand for silver powder and flakes. Illinois, Ohio, and surrounding regions are gradually adopting silver powders for electronics, solar cells, and conductive applications. Rising demand for industrial efficiency, electronic manufacturing, and renewable energy materials drives adoption. Manufacturers supply high-purity silver powders and flakes suitable for diverse industrial uses. Distributors ensure accessibility across manufacturing plants, solar producers, and industrial facilities. Growth in electronics, photovoltaic production, and industrial material use supports steady adoption of silver powders and flakes across Midwest USA.

Demand for silver powder and flakes in USA is rising as electronics, photovoltaics and advanced materials manufacturers require conductive components with consistent purity and particle performance. Producers of multilayer ceramic capacitors, thick-film pastes, sensors and flexible circuits rely on silver powders for stable conductivity and fine line resolution. Growth in automotive electronics and renewable-energy systems increases consumption of conductive materials suited to high-frequency and high-temperature applications. Additive manufacturing and printed-electronics developers also adopt silver-based formulations for prototyping and low-volume production. As companies aim for improved device reliability and tighter process control, they prioritise powders and flakes that balance flow, packing density and oxidation resistance, supporting greater demand within industrial and research environments across the United States.

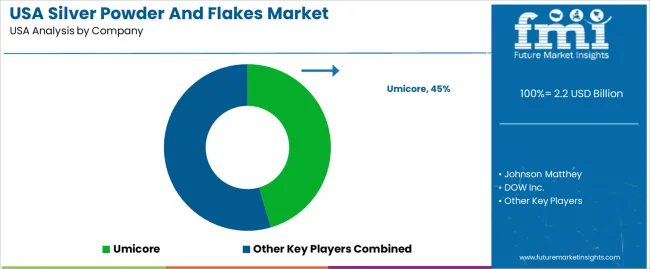

Key players shaping USA’s silver-powder and flake landscape include multinational producers and regionally active materials suppliers. Umicore provides engineered silver materials used in electronic pastes and functional coatings. Johnson Matthey supports specialty applications with refined precious-metal powders tailored to device manufacturing. DOW Inc. participates through conductive-materials technologies used in electronics and energy components. Mitsubishi Materials Corporation contributes to advanced material inputs, including powders required in high-reliability electronics. To reflect the USA structure more accurately, domestic distributors and processors ensure purification, packaging and technical support for local manufacturers. This combination of global metallurgy expertise and USA-based handling capacity shapes how silver powders and flakes are specified, qualified and integrated into production workflows across electronics and industrial applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Silver Powder, Silver Flakes |

| Purity | Below 95%, 95%–99%, Above 99% |

| End-Use Industry | Electronics and Semiconductors, Renewable Energy, Healthcare, Automotive, Aerospace and Defense, Others (Textiles, Coatings, etc.) |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Umicore, Johnson Matthey, Dow Inc., Mitsubishi Materials Corporation |

| Additional Attributes | Dollar by sales by product type, purity and end-use; regional CAGR and growth trends; demand by electronics, renewable energy, and industrial applications; influence of domestic semiconductor and photovoltaic expansion; particle-size and dispersion requirements; high-purity vs standard grades; cost and price volatility; additive manufacturing and printed-electronics applications; supply chain and distribution networks; recycling and sustainability practices; performance metrics for conductivity, sintering, and stability; technical support and processing guidance; role in EV, aerospace, and industrial electronics applications. |

The demand for silver powder and flakes in usa is estimated to be valued at USD 2.2 billion in 2025.

The market size for the silver powder and flakes in usa is projected to reach USD 3.4 billion by 2035.

The demand for silver powder and flakes in usa is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in silver powder and flakes in usa are silver powder and silver flakes.

In terms of purity, below 95% segment is expected to command 32.0% share in the silver powder and flakes in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Demand for Silver Powder and Flakes in Japan Size and Share Forecast Outlook 2025 to 2035

USA Potato Flakes Market Growth – Innovations, Trends & Forecast 2025-2035

USA Superfood Powder Market Report – Trends, Demand & Outlook 2025-2035

Demand for Boride Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Powder Injection Molding in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Silver Food Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA