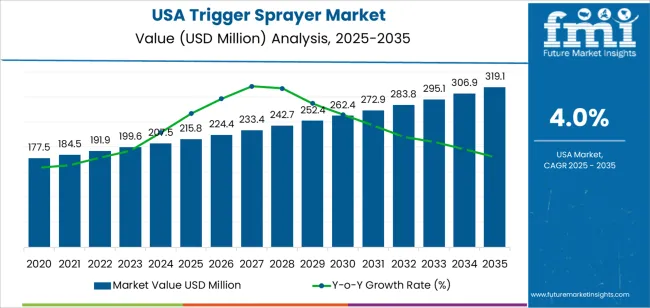

The USA trigger sprayer demand is valued at USD 215.8 million in 2025 and is projected to reach USD 319.1 million by 2035, reflecting a CAGR of 4.0%. Demand is influenced by steady procurement from household cleaning, surface disinfectant, automotive care, and lawn-and-garden product manufacturers, each requiring consistent dispensing performance for liquid formulations. Increased use of refillable packaging formats and growing reliance on ergonomic dispensing components in institutional cleaning also support long-term consumption patterns across distribution channels.

Conventional trigger sprayers hold the leading position due to their mechanical reliability, compatibility with a wide range of viscosities, and broad acceptance among consumer-packaged goods producers. Their suitability for cleaning agents, sanitisers, and general-purpose chemical solutions reinforces continued adoption within manufacturing and commercial facilities. The West, South, and Northeast account for the strongest demand, supported by dense clusters of chemical formulators, packaging converters, distribution hubs, and brand owners. These regions maintain established supply chains for plastic components, moulding operations, and assembly units that drive continuous equipment and component sourcing.

Berry Global, Silgan Dispensing Systems, AptarGroup, Mr. Nozzle, Cole-Parmer Instrument Company, and Frapak are the primary suppliers. Their offerings include adjustable nozzles, sprayer heads, dip tubes, and precision moulded components designed to ensure consistent spray patterns, leak resistance, and durability under varied chemical loads.

The acceleration and deceleration pattern shows a modest early-period rise from 2025 to 2029, supported by stable demand across household cleaning, lawn-and-garden care, automotive detailing, and institutional sanitation. Growth during these years is reinforced by steady consumption of surface-cleaning products and continued adoption of ergonomic, adjustable-nozzle sprayers designed to improve dispensing accuracy and user comfort. Incremental upgrades in polymer durability and leak-resistant construction contribute to this early acceleration.

From 2030 to 2035, the segment shifts into a controlled deceleration phase as procurement aligns with predictable replacement cycles and established packaging formats. Demand remains positive but becomes more stable, shaped by routine replenishment among consumer-goods manufacturers and institutional suppliers. Broader use of refillable packaging systems and concentrated cleaning formulations may also moderate annual unit growth, though baseline consumption persists due to the sprayer’s role in everyday maintenance applications. The overall pattern reflects a transition from a modest early-cycle uplift to a mature phase defined by steady utilisation, long product lifecycles, and consistent integration of trigger sprayers across USA household and commercial cleaning workflows.

| Metric | Value |

|---|---|

| USA Trigger Sprayer Sales Value (2025) | USD 215.8 million |

| USA Trigger Sprayer Forecast Value (2035) | USD 319.1 million |

| USA Trigger Sprayer Forecast CAGR (2025 to 2035) | 4.0% |

Demand for trigger sprayers in the USA is rising as consumer and industrial users increasingly require convenient, efficient dispensing solutions for cleaning, personal care, garden and chemical applications. These sprayers offer manual control of spray pattern, mist or stream delivery and usability in a wide range of bottle formats that suit both retail-packaged goods and institutional products. Growth in e-commerce and direct-to-consumer product models supports packaging volumes that leverage trigger sprayers as value-added accessory components. Sustainability considerations drive use of refill-able bottles, recyclable plastics and no-aerosol dispensing formats.

Heightened hygiene awareness, home improvement trends and growth in professional cleaning services increase demand across residential and commercial segments. Constraints include material cost fluctuations for plastics and additives, competition from alternative dispensing methods like aerosol cans or pump dispensers in some categories, and driving regulations or consumer pressure pushing for reduced single-use plastics. Some brands may delay transitioning to specialised sprayer formats until cost or design justification is clear.

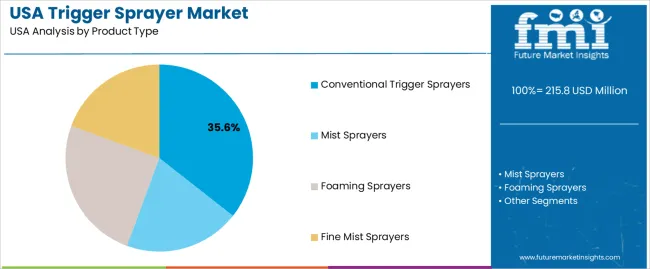

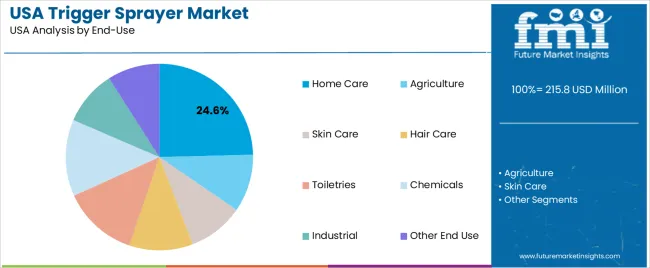

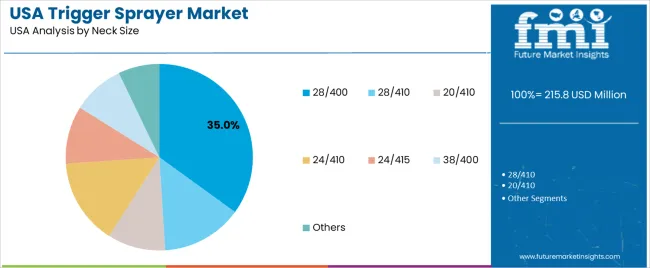

Demand for trigger sprayers in the United States reflects requirements across household cleaning, personal care, agriculture, and industrial applications. Product-type adoption varies by spray pattern, viscosity compatibility, and dispensing precision. End-use distribution is shaped by packaging formats used across consumer and commercial formulations. Neck-size preferences reflect bottle compatibility, filling-line design, and brand-standard packaging. These patterns show how trigger sprayers support consistent dispensing performance across varied liquid products.

Conventional trigger sprayers hold 35.6% of national demand and form the leading product-type category. Their mechanical action provides a consistent stream pattern suitable for cleaners, surface treatments, and multipurpose formulations. Foaming sprayers represent 25.0%, serving thicker or surfactant-based liquids that require expanded foam application. Mist sprayers account for 20.0%, offering wider dispersion for air-fresheners and disinfectant sprays. Fine-mist sprayers hold 19.4%, supporting personal care, cosmetics, and delicate surface applications. Product-type distribution reflects the need for adjustable spray patterns, liquid handling compatibility, and packaging preferences across consumer and industrial sectors.

Key drivers and attributes:

Home-care applications hold 24.6% of national demand and form the largest end-use category. Trigger sprayers are widely used for surface cleaners, disinfectants, glass cleaners, and multipurpose liquids. Chemicals account for 13.3%, covering industrial cleaners and solvent-based products requiring durable sprayer components. Toiletries represent 13.0%, followed by hair-care products at 11.0%, both relying on lighter-dispersion formats. Agriculture holds 10.0%, supporting nutrient sprays and small-scale crop treatments. Skin care accounts for 9.6%, industrial applications represent 9.5%, and other uses contribute 9.0%. End-use distribution reflects formulation viscosity, dispensing requirements, and packaging consistency across consumer and commercial sectors.

Key drivers and attributes:

The 28/400 neck size holds 35.0% of national demand and represents the leading packaging dimension for trigger sprayers in the USA. Its wide compatibility across home-care, chemical, and industrial bottles makes it a common standard on filling lines. The 24/410 format accounts for 14.9%, serving personal-care and lighter liquid applications. Both 28/410 and 20/410 hold 14.0% and 10.0%, respectively, supporting smaller-format bottles. The 24/415 size also represents 10.0%, used in mid-range cosmetic and toiletry products. The 38/400 dimension holds 9.0%, typically used for heavy-duty cleaners. The remaining 7.1% includes specialty sizes for niche packaging.

Key drivers and attributes:

In the United States, demand for trigger sprayer systems is increasing as consumers and businesses seek convenient spray-and-wipe packaging for disinfectant solutions, surface cleaners and speciality horticulture sprays. The rise in home improvement and gardening activities supports usage of trigger sprayers for plant care, outdoor cleaning and pest control. Manufacturers of cleaning solutions prefer trigger systems because they offer adjustable spray patterns, controlled dosing and user-friendly designs. The growth in online retail and do-it-yourself chemical and garden product distribution further supports adoption of trigger sprayers across multiple consumer segments.

Trigger sprayers face margin pressure because plastic raw-material prices vary and many end-users seek low-cost packaging. Regulations limiting single-use plastics and concerns about recycling or refill systems may impact choice of spray packaging formats or require material innovation. Some consumers and businesses may prefer alternative formats such as aerosol sprays, pump sprays or bag-in-box dispensers for certain applications, which can reduce growth potential for traditional trigger systems.

Manufacturers are launching trigger sprayer bottles designed for reuse or refill programmes to align with sustainability goals and reduce plastic waste. New designs emphasise ergonomic trigger shapes, adjustable spray heads, variable flow rates and lock-out features that improve usability and safety for both consumer and commercial users. Demand is increasing in commercial cleaning services, institutions and automotive detailing sectors for heavy-duty trigger sprayers suited to professional use. These trends support continuing demand growth for trigger sprayer packaging solutions in the United States.

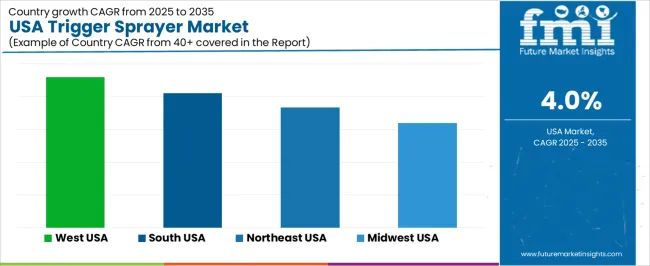

Demand for trigger sprayers in the USA is rising through 2035 as manufacturers, packaging suppliers, and consumer-goods companies expand usage across home-care cleaners, surface disinfectants, automotive detailing fluids, lawn and garden treatments, and cosmetic formulations. Growth is shaped by the need for controlled dispensing, compatibility with diverse liquid chemistries, and consumer preference for refillable and ergonomically designed packaging. Industrial users employ trigger sprayers for maintenance chemicals and workshop solutions, while retailers rely on standardized packaging formats for private-label products. Regional differences reflect household-cleaning consumption, retail distribution networks, and manufacturing concentration. The West leads with a 4.6% CAGR, followed by the South (4.1%), the Northeast (3.7%), and the Midwest (3.2%).

| Region | CAGR (2025 to 2035) |

|---|---|

| West | 4.6% |

| South | 4.1% |

| Northeast | 3.7% |

| Midwest | 3.2% |

The West grows at 4.6% CAGR, supported by high usage of home-care cleaners, eco-friendly surface sprays, and gardening chemicals across California, Washington, and Oregon. Packaging suppliers work with consumer-goods companies to produce sprayers compatible with plant-based cleaning formulations and concentrated refill systems. Automotive-care brands use trigger sprayers for detailing fluids, interior cleaners, and water-based protection products. Retailers maintain broad assortments of spray-bottle products aligned with strong household demand for multipurpose cleaners and disinfectants. Landscaping and gardening activities, especially in suburban industries, increase use of sprayers suited for foliar treatments and pest-control liquids. Consistent consumer demand and strong regional manufacturing capacity reinforce steady growth.

The South grows at 4.1% CAGR, supported by widespread consumption of household cleaners, agricultural chemicals, automotive products, and janitorial supplies across Texas, Florida, Georgia, and neighboring states. Manufacturers and distributors supply trigger sprayers for large-volume cleaning products used in residential and commercial facilities. Automotive-care brands rely on durable sprayer heads for waxes, degreasers, and interior-cleaner formulations. Lawn-care and garden-supply retailers drive additional uptake through pesticide sprays, plant nutrients, and moisture-control treatments. Hospitality and facility-maintenance sectors use trigger sprayers for disinfectants and odor-control products. Regional expansion of contract packaging supports consistent equipment procurement.

The Northeast grows at 3.7% CAGR, supported by demand for household cleaners, commercial janitorial products, and specialty chemical formulations across New York, Massachusetts, Pennsylvania, and surrounding states. Consumer-goods companies package disinfectants, degreasers, and multipurpose cleaners in trigger-spray formats preferred for controlled application in apartments and office buildings. Institutional cleaning contractors use sprayers for surface-care workflows and odor-control products. Automotive-care retailers maintain steady sales of sprayer-packaged interior cleaners and glass-care solutions. Packaging distributors supply ergonomic sprayers suited to cold-climate storage stability. Although growth is moderate, recurring demand across dense urban centers sustains consistent regional usage.

The Midwest grows at 3.2% CAGR, supported by household-cleaning needs, workshop chemicals, agricultural inputs, and manufacturing-sector maintenance products across Illinois, Michigan, Ohio, and Minnesota. Hardware stores and agricultural suppliers sell sprayer-packaged pesticide mixes, plant treatments, and small-farm chemical solutions. Automotive workshops and industrial facilities use trigger sprayers for degreasers, lubricants, and cleaning fluids during routine maintenance tasks. Residential use remains stable, driven by multipurpose cleaners and disinfectant sprays. Regional manufacturing sites also rely on trigger sprayers for packaging maintenance chemicals and industrial-grade solutions. While growth is slower than in coastal regions, essential cleaning and workshop needs maintain steady demand.

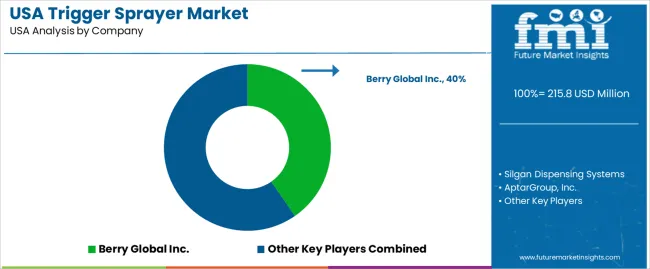

Demand for trigger sprayers in the USA is shaped by a concentrated group of packaging and dispensing-system manufacturers supplying household cleaners, personal-care products, industrial chemicals, and horticultural solutions. Berry Global Inc. holds the leading position with an estimated 40.4% share, supported by large-scale injection-moulding capacity, controlled component tolerances, and long-term supply agreements with major consumer-goods producers. Its position is reinforced by consistent spray-pattern reliability and dependable performance across high-volume household and industrial applications.

Silgan Dispensing Systems and AptarGroup, Inc. follow as major participants, offering trigger sprayers designed for viscosity-variable formulations and repeated-use environments. Their strengths include stable actuator performance, durable pistons and springs, and predictable compatibility with cleaning chemicals, disinfectants, and personal-care liquids. Mr. Nozzle Inc. maintains a specialised role through trigger and spray devices tailored to industrial and commercial settings requiring robust construction and controlled flow characteristics.

Cole-Parmer Instrument Company, LLC. contributes capability with laboratory-grade and chemical-resistant sprayers used in research, sanitation, and controlled-dispensing applications. Frapak supports additional demand with lightweight and recyclable trigger designs suited to mid-scale consumer and institutional products.

Competition across this segment centers on spray-pattern accuracy, chemical compatibility, component durability, leakage resistance, actuator ergonomics, and reliable performance under repeated use. Demand remains strong as USA producers of household cleaners, industrial chemicals, and personal-care formulations prioritize consistent dispensing quality, material compatibility, and scalable supply reliability across high-volume product categories.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Conventional Trigger Sprayers, Mist Sprayers, Foaming Sprayers, Fine Mist Sprayers |

| End-Use | Home Care, Agriculture, Skin Care, Hair Care, Toiletries, Chemicals, Industrial, Other End Use |

| Neck Size | 28/400, 28/410, 20/410, 24/410, 24/415, 38/400, Others |

| Material Type | Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Glass, Other Material Type |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Berry Global Inc., Silgan Dispensing Systems, AptarGroup, Inc., Mr. Nozzle Inc., Cole-Parmer Instrument Company, LLC., Frapak |

| Additional Attributes | Dollar sales by product type, end-use, neck size, and material categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of dispensing and packaging component manufacturers; advancements in recyclable plastics, ergonomic trigger designs, and precision spray mechanisms; integration with home care, agriculture, personal care, industrial chemicals, and commercial cleaning product formats in the USA. |

The global demand for trigger sprayer in USA is estimated to be valued at USD 215.8 million in 2025.

The market size for the demand for trigger sprayer in USA is projected to reach USD 319.1 million by 2035.

The demand for trigger sprayer in USA is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in demand for trigger sprayer in USA are conventional trigger sprayers, mist sprayers, foaming sprayers and fine mist sprayers.

In terms of end-use, home care segment to command 24.6% share in the demand for trigger sprayer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trigger Sprayer Market Growth – Trends & Forecast 2025-2035

Demand for Trigger Sprayer in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Trigger Spray Bottle Market Size, Share & Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA