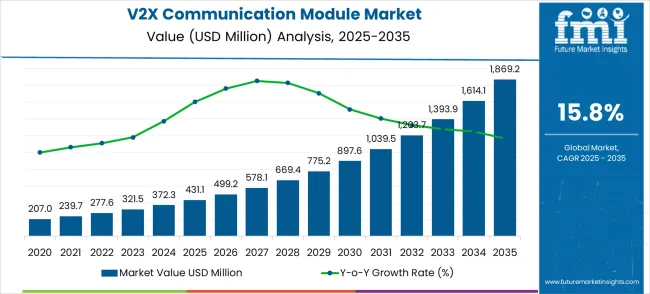

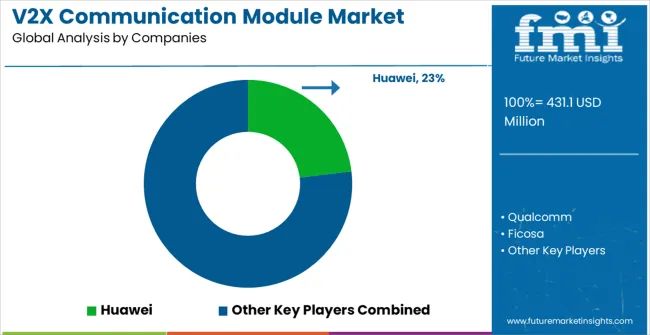

The V2X communication module market is valued at USD 431.1 million in 2025 and is anticipated to reach USD 1,869.2 million by 2035, reflecting a strong CAGR of 15.8% over the forecast period. The market trajectory demonstrates a significant upward trend driven by increasing adoption of connected vehicle technologies, regulatory support for intelligent transportation systems, and growing demand for vehicular safety and traffic efficiency solutions. The initial market value, projected value, and CAGR highlight the substantial expansion potential within the V2X segment, positioning it as a critical component in the evolution of smart mobility infrastructure globally.

Short-term forecast analysis indicates steady growth from USD 431.1 million in 2025 to USD 578.1 million by 2027, representing the early adoption phase of V2X modules. This phase is characterized by gradual deployment across testbeds, pilot projects, and early adopter regions, which establishes a foundation for market penetration. Annual YoY growth in this period averages around 15–16%, reflecting consistent but cautious expansion as manufacturers optimize supply chains and automotive OEMs integrate V2X solutions in limited vehicle models.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 431.1 million |

| Market Forecast Value (2035) | USD 1,869.2 million |

| Market Forecast CAGR (2025–2035) | 15.8% |

Long-term projections show accelerated growth beyond 2028, with the market reaching USD 1,039.5 million by 2030 and USD 1,614.1 million by 2034. The compounding effect of increasing regulatory mandates, urban traffic congestion management needs, and enhanced vehicle-to-infrastructure and vehicle-to-vehicle communication capabilities contributes to heightened market growth. The mid-to-late period represents peak growth phases where adoption widens across passenger cars, commercial vehicles, and intelligent transport systems, demonstrating a strong correlation between technology readiness levels and market expansion.

Scenario analysis further emphasizes market potential under varying assumptions. In a base-case scenario, the market progresses steadily in line with the 15.8% CAGR, achieving USD 1,869.2 million by 2035. An optimistic scenario, factoring in accelerated regulatory adoption and technological advancements, could elevate market size beyond USD 2 billion, while a pessimistic scenario, accounting for delays in infrastructure rollout or slower OEM integration, may constrain the market to approximately USD 1.6 billion. The market exhibits robust long-term growth prospects, driven by technological adoption, regulatory incentives, and rising demand for connected vehicle safety solutions.

Market expansion is being supported by the rapid increase in connected vehicle adoption worldwide and the corresponding need for advanced communication modules that provide superior vehicle-to-everything connectivity performance and autonomous driving support capabilities. Modern automotive systems rely on consistent real-time communication and data exchange to ensure optimal vehicle safety including autonomous vehicle operations, intelligent traffic management, and connected transportation services. Even minor communication delays can require comprehensive safety protocol adjustments to maintain optimal transportation efficiency and accident prevention performance.

The growing complexity of autonomous driving requirements and increasing demand for connected vehicle infrastructure solutions are driving demand for V2X communication modules from certified manufacturers with appropriate automotive capabilities and connectivity expertise. Automotive manufacturers are increasingly requiring documented communication reliability and system interoperability to maintain vehicle safety and operational efficiency. Industry specifications and automotive standards are establishing standardized vehicle-to-everything communication procedures that require specialized V2X technologies and trained automotive professionals.

The V2X Communication Module market is entering a phase of explosive growth, driven by demand for connected vehicle technology, autonomous driving expansion, and evolving smart transportation and connectivity standards. By 2035, these pathways together can unlock USD 820-1,050 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- On-Board Unit Leadership (Connected Vehicle Integration) The OBU segment already holds the largest share due to its central role in vehicle connectivity and autonomous driving systems. Expanding connected vehicle production, autonomous driving features, and vehicle integration can consolidate leadership. Opportunity pool: USD 280-360 million.

Pathway B -- 5G Technology Innovation (Ultra-Low Latency Connectivity) 5G modules account for the majority of demand. Growing automotive focus on real-time communication and autonomous driving capabilities will drive higher adoption of advanced 5G V2X communication systems. Opportunity pool: USD 220-290 million.

Pathway C -- Smart Infrastructure & RSU Growth Roadside unit deployments and smart city infrastructure are expanding rapidly, especially in intelligent transportation system initiatives. Modules optimized for infrastructure use (reliable, weatherproof, scalable) can capture significant growth. Opportunity pool: USD 150-200 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present enormous growth potential due to rapid automotive industry development and smart city initiatives. Targeting automotive manufacturers and infrastructure developers will accelerate adoption. Opportunity pool: USD 100-140 million.

Pathway E -- Autonomous Vehicle Commercial Deployment With advancing autonomous vehicle technology, there is opportunity to develop specialized modules for commercial AV fleets, robotaxis, and autonomous delivery vehicles requiring enhanced connectivity. Opportunity pool: USD 80-110 million.

Pathway F -- High-Precision Applications Modules with advanced positioning, mapping integration, and centimeter-level accuracy offer premium positioning for autonomous driving and precision transportation applications. Opportunity pool: USD 60-80 million.

Pathway G -- Fleet & Commercial Vehicle Integration Connected fleet management and commercial vehicle optimization create opportunities for specialized modules serving logistics, public transportation, and freight sectors. Opportunity pool: USD 40-50 million.

Pathway H -- Cross-Platform & Multi-Modal Integration Integration with smart city platforms, traffic management systems, and multi-modal transportation creates high-value ecosystem opportunities. Opportunity pool: USD 30-40 million.

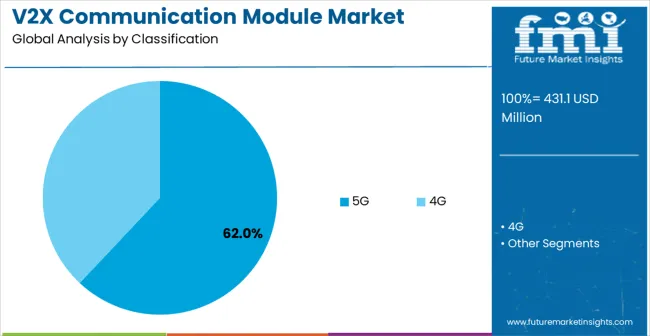

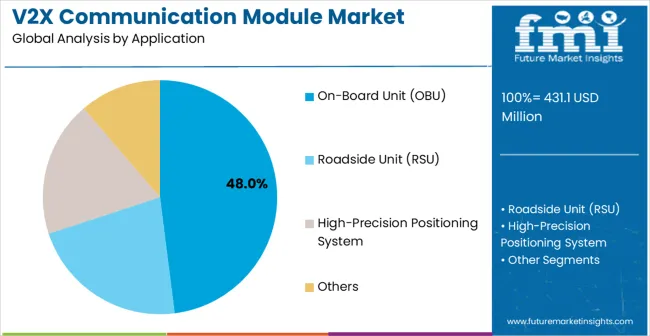

The market is segmented by technology, application, and region. By technology, the market is divided into 4G and 5G. Based on application, the market is categorized into on-board unit (OBU), roadside unit (RSU), high-precision positioning system, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

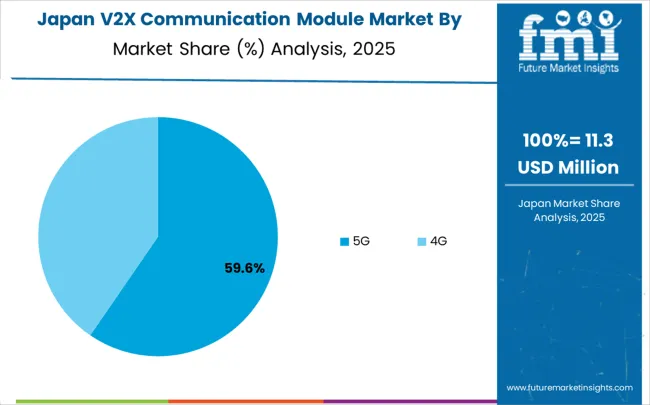

In 2025, the 5G V2X communication module segment is projected to capture around 62% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of next-generation cellular technologies that provide superior connectivity performance and ultra-low latency communication capabilities, catering to a wide variety of autonomous driving applications. The 5G communication module is particularly favored for its ability to deliver high-speed data transmission with enhanced reliability and massive device connectivity, ensuring advanced automotive system performance. Autonomous vehicle manufacturers, smart transportation systems, connected vehicle platforms, and intelligent traffic management centers increasingly prefer 5G modules, as they meet demanding real-time communication requirements without imposing excessive latency or bandwidth limitations. The availability of well-established 5G network infrastructure deployments, along with comprehensive automotive standards and technical support from leading telecommunications equipment manufacturers, further reinforces the segment's market position. This technology type benefits from consistent demand across regions, as it is considered an essential solution for automotive manufacturers requiring next-generation vehicle-to-everything communication capabilities. The combination of connectivity excellence, performance reliability, and autonomous driving readiness makes 5G V2X communication modules a preferred choice, ensuring their continued dominance in the connected vehicle technology market.

The on-board unit (OBU) segment is expected to represent 48% of V2X communication module demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the fundamental role of on-board communication systems in connected vehicle operations, where direct vehicle-to-everything communication and real-time data processing are essential to automotive safety and autonomous driving functionality. OBU applications often require sophisticated communication modules that enable comprehensive vehicle connectivity throughout various driving scenarios and traffic conditions, requiring reliable and high-performance communication equipment. V2X communication modules are particularly well-suited to on-board unit environments due to their ability to provide continuous connectivity with other vehicles, infrastructure, and cloud services while processing real-time data for autonomous driving decisions, even during high-speed travel and complex traffic situations.

As connected vehicle production continues to expand globally and automotive manufacturers emphasize improved autonomous driving capabilities and vehicle safety standards, the demand for V2X communication modules continues to rise. The segment also benefits from increased investment within the automotive industry, where manufacturers are increasingly prioritizing connected vehicle features and autonomous driving readiness as differentiators to achieve competitive advantages and regulatory compliance. With connected vehicles requiring comprehensive communication infrastructure and autonomous driving capabilities, V2X communication modules provide an essential solution to maintain effective vehicle connectivity while enabling advanced transportation automation. The growth of autonomous vehicle testing and deployment programs, coupled with increased focus on vehicle safety and traffic optimization initiatives, ensures that on-board unit applications will remain the largest and most stable demand driver for V2X communication modules in the forecast period.

The market is advancing rapidly due to increasing autonomous vehicle development and growing recognition of vehicle-to-everything communication advantages over conventional automotive safety systems. The market faces challenges including higher technology integration costs compared to traditional vehicle systems, need for comprehensive network infrastructure deployment, and varying regulatory frameworks across different automotive markets. Technology standardization efforts and connectivity advancement programs continue to influence module development and market adoption patterns.

The growing development of advanced 5G vehicle-to-everything communication systems is enabling superior connectivity performance with improved latency characteristics and enhanced network capacity for autonomous driving applications. Enhanced 5G technologies and optimized network architectures provide reliable vehicle-to-infrastructure communication while maintaining ultra-low latency data transmission requirements. These technologies are particularly valuable for automotive manufacturers who require consistent connectivity performance that can support demanding autonomous driving applications with real-time communication results and safety-critical decision making.

Modern V2X communication module manufacturers are incorporating advanced autonomous driving features and artificial intelligence capabilities that enhance vehicle safety and autonomous operation effectiveness. Integration of advanced sensor fusion algorithms and intelligent decision-making systems enables superior autonomous vehicle performance and comprehensive connected transportation capabilities. Advanced autonomous features support deployment in diverse driving environments while meeting various safety requirements and automotive specifications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 21.3% |

| India | 19.8% |

| Germany | 18.2% |

| Brazil | 16.6% |

| United States | 15.0% |

| United Kingdom | 13.4% |

| Japan | 11.9% |

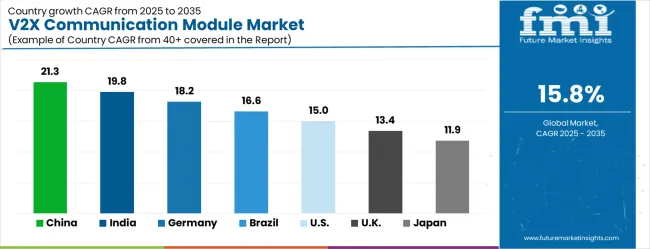

The global market is estimated to grow at a CAGR of 15.8% between 2025 and 2035, driven by increasing adoption of connected and autonomous vehicle technologies and rising demand for intelligent transportation systems. China leads with 21.3% growth, supported by government initiatives promoting smart mobility, rapid deployment of connected vehicle infrastructure, and strong automotive manufacturing expansion. India follows at 19.8%, reflecting growing investments in vehicle connectivity solutions and rising adoption of advanced driver-assistance systems. Germany records 18.2%, driven by robust automotive R&D and integration of V2X modules in smart vehicles. Brazil is projected at 16.6%, supported by gradual adoption of connected vehicle technologies. The United States grows at 15.0% with strong automotive innovation, while the United Kingdom expands at 13.4% and Japan at 11.9%, reflecting steady implementation of V2X solutions and advanced mobility initiatives.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is anticipated to grow at a CAGR of 21.3% between 2025 and 2035, emerging as the largest market for V2X communication modules due to government initiatives promoting smart transportation and autonomous vehicles. Automotive manufacturers and technology companies are integrating V2X modules into new vehicles to improve traffic safety, reduce congestion, and enable vehicle-to-infrastructure communication. Investments in smart city projects and 5G-enabled networks are accelerating adoption across urban corridors and expressways. Domestic suppliers are collaborating with international technology providers to enhance module functionality and compliance with national communication standards. Regulatory support for connected vehicle testing and pilot projects is fostering innovation. Increasing consumer awareness regarding connected mobility and safety applications is further driving adoption across commercial and private vehicle segments.

India is projected to expand at a CAGR of 19.8% from 2025 to 2035, supported by rising demand for intelligent transport systems and connected vehicle solutions. V2X modules are being implemented in urban traffic management, fleet monitoring, and collision avoidance systems. Domestic and international automotive manufacturers are equipping vehicles with communication modules for vehicle-to-vehicle and vehicle-to-infrastructure interoperability. Government-backed smart mobility programs and infrastructure modernization are accelerating market penetration. Adoption is also driven by rising awareness of road safety and connected mobility solutions. Collaborations between tech startups and automotive OEMs are fostering development of low-latency, cost-effective modules. India’s market growth is fueled by smart city initiatives, increasing EV adoption, and strategic partnerships in the automotive technology sector.

Germany is expected to grow at a CAGR of 18.2% from 2025 to 2035, driven by adoption of connected and autonomous vehicles in the automotive sector. V2X communication modules are widely implemented for vehicle-to-vehicle, vehicle-to-infrastructure, and vehicle-to-network systems to enhance traffic safety and enable intelligent mobility. German automotive manufacturers focus on integrating high-performance modules compatible with 5G and C-V2X standards. Research institutions and OEMs collaborate on testing modules in real-world scenarios, promoting innovation. Regulatory frameworks support deployment in smart highways and urban environments. Adoption is further reinforced by increasing EV penetration, autonomous vehicle trials, and development of cooperative intelligent transport systems. The country is positioning itself as a leader in automotive communication technology.

Brazil is projected to expand at a CAGR of 16.6% from 2025 to 2035, driven by urban traffic modernization and smart mobility initiatives. Vehicle-to-infrastructure communication modules are being increasingly deployed in buses, commercial fleets, and urban transport networks. Adoption is supported by government investment in intelligent transport systems and public-private collaborations to improve road safety. Domestic suppliers are partnering with international technology providers to enhance reliability and coverage of communication modules. Growth is also influenced by rising EV adoption, fleet management modernization, and pilot smart city projects. Market penetration is accelerated by training programs for transport authorities and fleet operators in V2X technology implementation.

The United States is projected to grow at a CAGR of 15.0% from 2025 to 2035, supported by increasing adoption of connected vehicles and autonomous driving technologies. V2X modules are widely implemented in passenger cars, commercial fleets, and public transport for real-time traffic management and safety improvements. Domestic manufacturers focus on compliance with C-V2X standards and integration with 5G networks. Collaborations between tech companies and automotive OEMs facilitate innovation and deployment at scale. Government-backed connected vehicle projects and smart highway pilot programs are boosting adoption. Consumer demand for advanced safety and driver-assistance technologies is further accelerating market growth, with early adoption observed in urban and high-traffic regions.

The United Kingdom is expected to grow at a CAGR of 13.4% during 2025–2035, driven by rising adoption of intelligent transport systems and connected vehicle technologies. V2X communication modules are being deployed in fleet management, urban traffic networks, and autonomous vehicle trials. Manufacturers focus on integration with 5G networks, low-latency communication, and compliance with EU-connected mobility standards. Government initiatives supporting smart city programs and connected infrastructure are accelerating module adoption. Partnerships between automotive OEMs, tech startups, and research institutions facilitate innovation and real-world testing. Growth is further supported by increasing EV adoption and rising awareness of road safety solutions among consumers and fleet operators.

Japan is projected to grow at a CAGR of 11.9% from 2025 to 2035, reflecting steady adoption of V2X modules in connected and autonomous vehicles. Vehicle-to-vehicle and vehicle-to-infrastructure communications are widely integrated in urban transportation networks and smart mobility projects. Domestic manufacturers are focused on high-quality, reliable, and low-latency communication modules compatible with C-V2X and 5G networks. Government initiatives for intelligent transport systems and smart highways facilitate market penetration. Adoption is further enhanced by EV integration, autonomous vehicle trials, and pilot projects in urban areas. Research collaborations with automotive OEMs and technology firms strengthen product development and ensure market readiness for advanced mobility solutions.

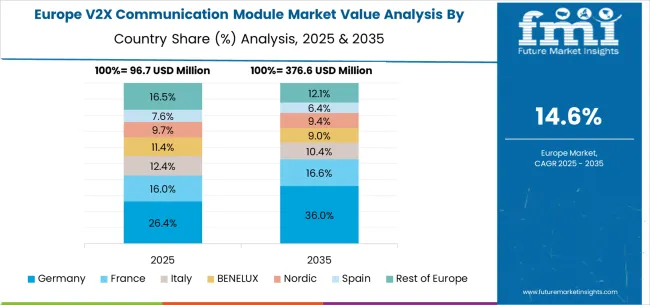

The V2X communication module market in Europe is forecast to expand from USD 115.5 million in 2025 to USD 501.0 million by 2035, registering a CAGR of 15.8%. Germany will remain the largest market, holding 36.0% share in 2025, easing to 35.5% by 2035, supported by strong automotive infrastructure and advanced connected vehicle systems. The United Kingdom follows, rising from 28.0% in 2025 to 28.5% by 2035, driven by automotive innovation and autonomous vehicle initiatives. France is expected to decline slightly from 22.0% to 21.5%, reflecting automotive industry consolidation. Italy maintains stability at around 10.0%, supported by automotive facilities and transportation technology centers, while Spain grows from 3.5% to 4.0% with expanding connected vehicle and intelligent transportation demand. BENELUX markets ease from 0.4% to 0.3%, while the remainder of Europe hovers near 0.1%--0.2%, balancing emerging Eastern European growth against mature Nordic markets.

The market is highly competitive, driven by the need for low-latency, high-reliability connectivity for intelligent transportation systems. Huawei and Qualcomm dominate with large-scale deployments, advanced chipsets, and global expertise in 5G and C-V2X technologies. Their competitive advantage stems from integration capabilities, robust testing, and turnkey solutions that enable seamless vehicle-to-vehicle and vehicle-to-infrastructure communication. Brochures highlight high-speed data transfer, multi-standard support, and compatibility with automotive safety protocols, making them preferred suppliers for global OEMs and smart city projects.

Ficosa, Quectel Wireless, Fibocom, and Autotalks compete by offering modular, flexible solutions tailored to regional and small-scale deployments. Ficosa focus on hardware-software integration for real-time traffic management, while Autotalks focuses on secure, low-latency communication modules for connected and autonomous vehicles. Quectel and Fibocom differentiate through cost-effective modules with compact design, wide operating temperature ranges, and high interoperability with existing automotive platforms.

Bosch, Genvict, Murata, and CICT Connected and Intelligent Technologies target system-level reliability and specialized applications. Bosch leverages its automotive expertise to provide robust, high-performance modules integrated with vehicle sensors and ADAS platforms. Genvict and Murata focus on localized manufacturing and rapid deployment capabilities, while CICT focuses on innovative solutions for urban mobility and intelligent roadside infrastructure. Competition in this market is defined by data transmission reliability, global standard compliance, and integration flexibility. Leading firms invest in R&D, edge computing, and multi-standard V2X modules, while regional players leverage affordability and specialized support to capture niche applications, shaping the competitive landscape in connected vehicle communications.

| Item | Value |

|---|---|

| Quantitative Units | USD 431.1 Million |

| Technology | 4G, 5G |

| Application | On-Board Unit (OBU), Roadside Unit (RSU), High-Precision Positioning System, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Huawei, Qualcomm, Ficosa, Quectel Wireless, Fibocom, Autotalks, Bosch, Genvict, Murata, CICT, Continental, NXP Semiconductors, Cohda Wireless, Lear Corporation, Harman International |

| Additional Attributes | Dollar sales by technology and application segment, regional demand trends across major markets, competitive landscape with established automotive technology manufacturers and emerging V2X communication providers, customer preferences for different technology types and automotive applications, integration with connected vehicle and autonomous driving systems, innovations in V2X communication effectiveness, and adoption of smart transportation features for improved connected mobility workflows. |

The global V2X communication module market is estimated to be valued at USD 431.1 million in 2025.

The market size for the V2X communication module market is projected to reach USD 1,869.2 million by 2035.

The V2X communication module market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in V2X communication module market are 5G and 4g.

In terms of application, on-board unit (obu) segment to command 48.0% share in the V2X communication module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

V2X Test Scenario Editor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vehicle-to-Everything (V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Communication Platform as a Service (CPaaS) Market Analysis - Size, Share & Forecast 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Rich Communication Services (RCS) Messaging Market Size and Share Forecast Outlook 2025 to 2035

Audio Communication Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Japan Communications Platform as a Service Market Growth - Trends & Forecast 2025 to 2035

Cloud Communication Platform Market Analysis – Growth & Forecast 2017 to 2027

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Mobile Communication Antenna Market Size and Share Forecast Outlook 2025 to 2035

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Unified Communications and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Defense Communication System Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Unified Communication as a Service (UCaaS) Market by Solution, Enterprise Size, Vertical & Region Forecast till 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA