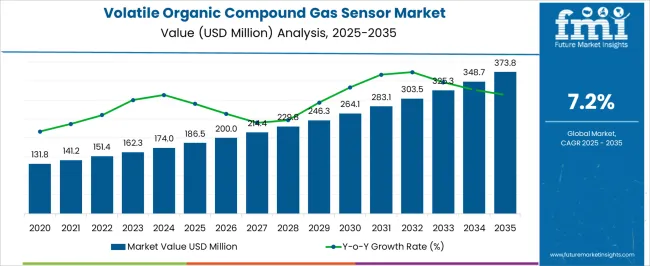

The volatile organic compound gas sensor market is estimated to be valued at USD 186.5 million in 2025 and is projected to reach USD 373.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. During the early adoption phase from 2020 to 2024, demand was primarily driven by pilot deployments in industrial facilities, environmental monitoring stations, and laboratory research to detect volatile organic compounds for safety and compliance purposes. Entering the scaling phase in 2025, adoption expands across manufacturing plants, commercial buildings, and air quality monitoring networks. Manufacturers increase production, strengthen distribution channels, and offer integrated sensor solutions, supporting broader market penetration and recurring demand.

From 2030 to 2035, the market enters the consolidation phase, reaching USD 373.8 million by 2035 while maintaining a CAGR of 7.2%. Leading suppliers consolidate positions through long-term contracts, strategic partnerships, and global distribution agreements. Smaller players either specialize in niche applications or exit the market. Adoption stabilizes as most industrial and environmental users integrate VOC gas sensors into standard safety and monitoring protocols. Companies focus on reliability, accuracy, and lifecycle support. By 2035, the market will demonstrate predictable growth, mature competition, and standardized deployment practices, forming a well-structured industry landscape.

| Metric | Value |

|---|---|

| Volatile Organic Compound Gas Sensor Market Estimated Value in (2025 E) | USD 186.5 million |

| Volatile Organic Compound Gas Sensor Market Forecast Value in (2035 F) | USD 373.8 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The VOC gas sensor market is driven by diverse end-use segments, each contributing to overall growth. Industrial Manufacturing leads with approximately 30% of the market, including chemical, pharmaceutical, and petrochemical plants where continuous monitoring of VOCs ensures safety and regulatory compliance. Environmental Monitoring & Air Quality Networks account for 20%, deploying sensors in urban and industrial regions to track pollution levels and detect hazardous emissions. Commercial Buildings contribute 15%, integrating sensors into HVAC and building management systems for air quality control. Laboratories and Research Facilities represent 12%, using VOC sensors for experiments and process monitoring.

Oil & Gas Facilities hold 8%, where sensors monitor leaks and emissions across refineries and pipelines. Automotive & Transportation contributes 5%, incorporating VOC detection in cabin air quality systems and emission testing. Consumer Electronics account for 4%, including portable air quality monitors and indoor safety devices. Smaller segments, such as Healthcare & Hospitals and Food Processing Units, represent the remaining 6%, applying VOC sensors for safety and process control. Revenue distribution aligns with sector adoption, increasing from USD 131.8 million in 2020 to USD 186.5 million in 2025 and projected to reach USD 373.8 million by 2035, reflecting a CAGR of 7.2%. Industrial manufacturing and environmental monitoring remain key growth drivers, while commercial and niche applications steadily expand the market footprint.

The volatile organic compound gas sensor market is expanding steadily due to growing regulatory emphasis on air quality monitoring, industrial safety, and environmental compliance. Rising concerns over occupational health hazards and the harmful effects of prolonged VOC exposure are driving adoption across industries.

Technological advancements such as enhanced sensitivity, wireless connectivity, and miniaturized sensor designs are broadening application scope in both fixed and portable formats. The integration of smart monitoring systems and IoT-enabled platforms is enabling real-time tracking and predictive maintenance, further supporting market growth.

Stricter emission control norms in sectors such as oil and gas, chemicals, and manufacturing are reinforcing the demand for accurate VOC detection solutions. The market outlook remains positive as industries prioritize sustainable operations, worker safety, and adherence to evolving environmental regulations.

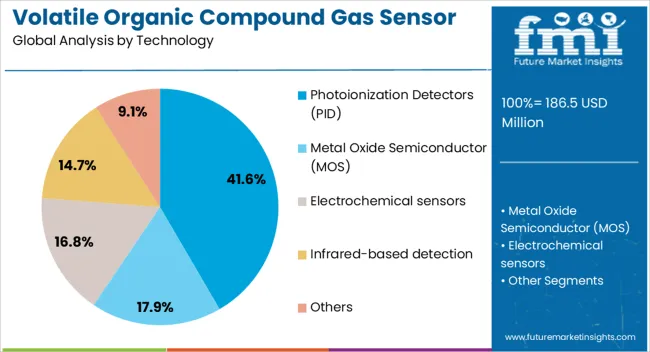

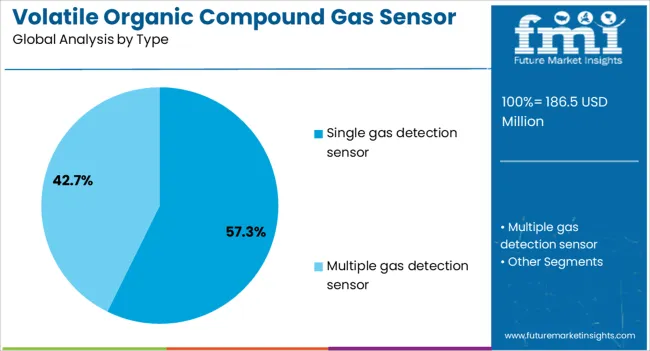

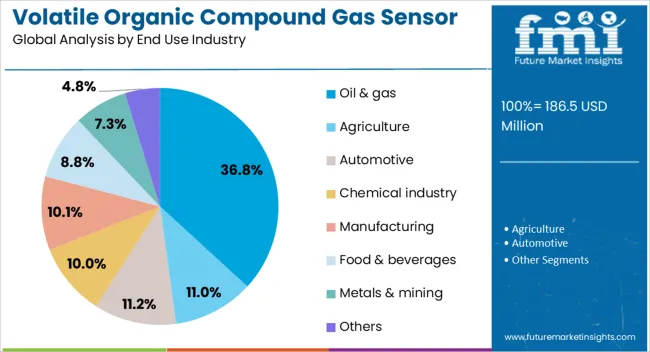

The volatile organic compound gas sensor market is segmented by technology, type, end use industry, and geographic regions. By technology, volatile organic compound gas sensor market is divided into Photoionization Detectors (PID), Metal Oxide Semiconductor (MOS), Electrochemical sensors, Infrared-based detection, and Others. In terms of type, volatile organic compound gas sensor market is classified into Single gas detection sensor and Multiple gas detection sensor. Based on end use industry, volatile organic compound gas sensor market is segmented into Oil & gas, Agriculture, Automotive, Chemical industry, Manufacturing, Food & beverages, Metals & mining, and Others. Regionally, the volatile organic compound gas sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The photoionization detectors segment is projected to hold 41.60% of the total market revenue by 2025 within the technology category, making it the leading segment. Its dominance is attributed to the high sensitivity of PID technology in detecting low concentrations of VOCs across a wide range of compounds.

The ability to deliver rapid and accurate measurements without extensive sample preparation has strengthened its adoption in both industrial safety and environmental monitoring. Additionally, the versatility of PIDs in handling diverse VOC profiles and their integration into portable and fixed systems have supported widespread use.

Continuous improvements in lamp life, calibration stability, and durability have further consolidated the position of this technology as the preferred choice for VOC detection.

The single gas detection sensor segment is expected to contribute 57.30% of total market revenue by 2025 in the type category, establishing itself as the most prominent segment. This is due to its targeted detection capability, cost-effectiveness, and reliability in mission-critical environments.

Single gas sensors are valued for their simplicity, ease of maintenance, and suitability for applications where monitoring of a specific hazardous gas is required. Their deployment in personal safety devices and confined space monitoring has grown considerably, particularly in industries with stringent safety protocols.

As industries focus on minimizing false alarms and enhancing operational safety, single gas detection sensors continue to maintain a strong market presence.

The oil and gas segment is projected to account for 36.80% of the total market revenue by 2025 under the end use industry category, making it the largest segment. This growth is driven by the high risk of VOC emissions during exploration, drilling, refining, and transportation activities.

Stringent regulatory frameworks governing emission control and workplace safety have compelled operators to implement robust gas detection systems. The need for continuous monitoring in hazardous zones and the prevention of fire or explosion incidents have further reinforced adoption.

Additionally, the integration of VOC sensors into automated monitoring networks has improved response times and operational efficiency, solidifying oil and gas as the dominant end use industry in the market.

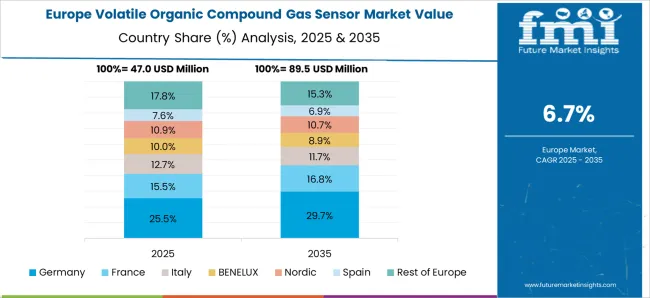

The volatile organic compound (VOC) gas sensor market is expanding due to increasing air quality monitoring, industrial safety requirements, and regulatory enforcement of emission standards. North America and Europe lead with high-precision, multi-sensor systems for industrial, environmental, and indoor applications. Asia-Pacific shows rapid growth driven by urbanization, industrialization, and smart building initiatives. Manufacturers differentiate through sensitivity, response time, and IoT-enabled integration. Regional variations in pollution levels, safety regulations, and adoption of smart monitoring solutions strongly influence market growth, deployment, and competitive positioning globally.

Adoption of VOC gas sensors is driven by the growing need for air quality monitoring and regulatory compliance. North America and Europe implement sensors in industrial plants, urban air monitoring networks, and indoor environments to detect harmful organic emissions and maintain health standards. Asia-Pacific markets adopt cost-effective sensors in densely populated urban areas, manufacturing hubs, and commercial buildings. Differences in air pollution intensity, environmental regulations, and compliance requirements affect sensor type, deployment density, and calibration frequency. Leading suppliers offer high-precision, low-detection-limit sensors with continuous monitoring and reporting capabilities, while regional manufacturers focus on affordable, practical solutions. Monitoring and compliance contrasts shape adoption, safety assurance, and market competitiveness globally.

Sensor performance, including sensitivity and response time, significantly influences VOC gas sensor adoption. North America and Europe prioritize sensors capable of detecting trace-level VOCs in complex environments with minimal latency for industrial safety and smart building automation. Asia-Pacific markets adopt robust sensors with moderate sensitivity for large-scale monitoring in urban or semi-industrial settings. Differences in detection thresholds, response speed, and environmental adaptability affect operational efficiency, alert accuracy, and reliability. Leading suppliers offer sensors with advanced nanomaterials, fast signal processing, and multi-compound detection, while regional players focus on reliable, cost-effective devices. Sensitivity and response-time contrasts shape adoption, accuracy, and competitiveness in the global VOC gas sensor market.

Integration with IoT, cloud monitoring, and smart building systems drives VOC sensor adoption. North America and Europe emphasize sensors connected to automated ventilation, predictive maintenance, and real-time data analytics for enhanced operational safety and energy efficiency. Asia-Pacific markets prioritize scalable IoT-compatible sensors for industrial and urban applications while balancing affordability. Differences in digital infrastructure, connectivity protocols, and software support affect deployment, monitoring capabilities, and decision-making. Leading suppliers provide IoT-enabled, cloud-integrated sensors with real-time alerts, while regional manufacturers offer simpler, network-ready systems. Integration contrasts shape adoption, operational intelligence, and market competitiveness globally.

VOC gas sensors see growing demand in industrial and environmental applications, including chemical plants, manufacturing facilities, and air quality monitoring networks. North America and Europe focus on multi-sensor systems integrated with safety automation and environmental reporting tools. Asia-Pacific markets emphasize rugged, cost-effective sensors for high-volume industrial plants and urban monitoring programs. Differences in operational conditions, pollutant types, and data reporting requirements affect sensor specifications, durability, and calibration needs. Leading suppliers provide highly reliable, environment-adapted sensors with long service life, while regional players deliver practical, affordable solutions. Application demand contrasts shape adoption, reliability, and competitiveness globally.

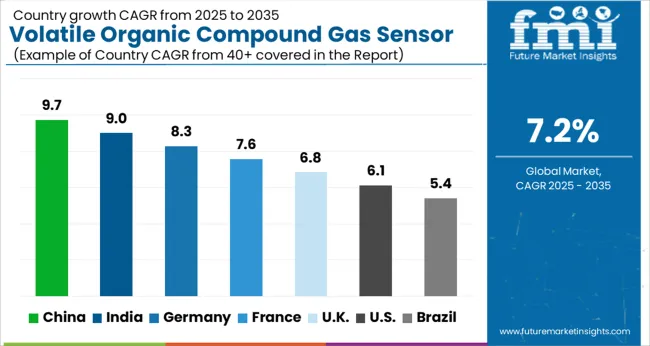

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global volatile organic compound (VOC) gas sensor market is projected to grow at a 7.2% CAGR through 2035, driven by demand in environmental monitoring, industrial safety, and air quality management. Among BRICS nations, China led with 9.7% growth as large-scale production and deployment in industrial and municipal applications were carried out, while India at 9.0% growth expanded installations across commercial and regulatory monitoring projects. In the OECD region, Germany at 8.3% maintained steady adoption under strict compliance frameworks, while the United Kingdom at 6.8% implemented VOC sensors across commercial and public infrastructure. The USA, growing at 6.1%, advanced utilization across industrial, environmental, and safety applications in line with federal and state regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The volatile organic compound gas sensor market in China is projected to grow at a CAGR of 9.7%, driven by increasing air quality monitoring initiatives and industrial safety requirements. Adoption is being encouraged by sensors that provide accurate detection, real time monitoring, and high sensitivity to hazardous gases. Manufacturers are being urged to supply durable, high performance, and technologically advanced sensors. Distribution is being strengthened through environmental agencies, industrial suppliers, and safety equipment providers. Research in miniaturization, wireless connectivity, and long term stability is being conducted. Rising environmental regulations, industrial expansion, and growing awareness of air pollution are considered key factors supporting the volatile organic compound gas sensor market in China.

The volatile organic compound gas sensor market in India is expected to grow at a CAGR of 9.0%, driven by rising demand for workplace safety and air quality monitoring in industrial environments. Adoption is being strengthened by sensors that enable real time detection, improve safety compliance, and reduce environmental risks. Manufacturers are being encouraged to provide cost effective, reliable, and accurate solutions suitable for diverse industrial applications. Distribution through industrial suppliers, safety equipment providers, and environmental monitoring companies is being expanded. Training programs and awareness campaigns are being conducted to promote proper usage and sensor maintenance. Increasing industrialization, stricter safety regulations, and growing environmental awareness are recognized as primary drivers of the volatile organic compound gas sensor market in India.

Germany is witnessing steady growth in the volatile organic compound gas sensor market at a CAGR of 8.3%, supported by industrial automation and environmental monitoring initiatives. Adoption is being encouraged by sensors that offer high sensitivity, accuracy, and integration with monitoring systems. Manufacturers are being urged to supply technologically advanced, long lasting, and reliable sensors. Distribution through industrial contractors, environmental monitoring agencies, and authorized suppliers is being maintained. Research in wireless communication, sensor calibration, and miniaturization is being pursued. Increasing industrial safety requirements, environmental regulations, and smart factory adoption are considered key factors driving the volatile organic compound gas sensor market in Germany.

The volatile organic compound gas sensor market in the United Kingdom is projected to grow at a CAGR of 6.8%, due to increasing industrial monitoring needs and air quality compliance requirements. Adoption is being emphasized for sensors that provide reliable detection, real time data reporting, and high sensitivity to hazardous compounds. Manufacturers are being encouraged to supply accurate, durable, and efficient sensor solutions. Distribution through industrial suppliers, environmental monitoring companies, and safety equipment distributors is being strengthened. Demonstrations and awareness programs are being conducted to improve adoption in factories and public facilities. Rising government regulations, environmental standards, and industrial safety initiatives are recognized as major factors supporting the volatile organic compound gas sensor market in the United Kingdom.

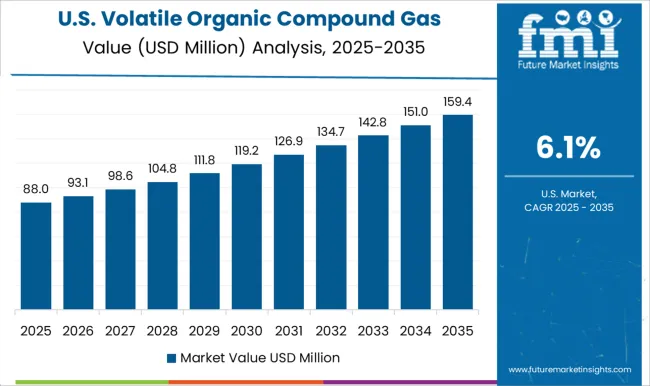

The volatile organic compound gas sensor market in the United States is projected to grow at a CAGR of 6.1%, supported by increasing industrial safety measures and air quality monitoring initiatives. Adoption is being encouraged by sensors that provide real time monitoring, precise detection, and integration with automation systems. Manufacturers are being urged to deliver durable, high performance, and technologically advanced sensors. Distribution through industrial suppliers, environmental agencies, and safety solution providers is being maintained. Research in improved sensitivity, miniaturization, and wireless connectivity is being conducted. Growing regulatory requirements, rising industrialization, and heightened environmental awareness are considered key drivers of the volatile organic compound gas sensor market in the United States.

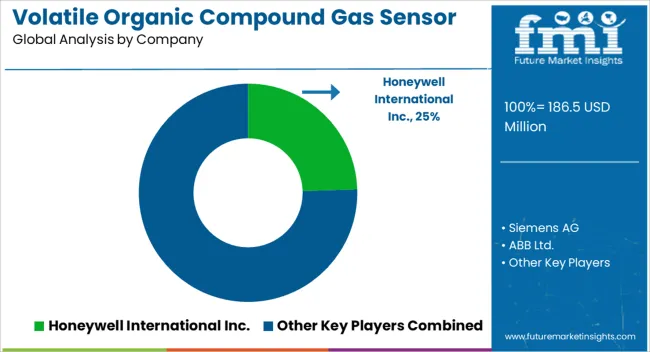

The volatile organic compound (VOC) gas sensor market is shaped by a combination of global sensor manufacturers, specialized gas detection solution providers, and regional electronics companies. Leading players such as Honeywell International, Figaro Engineering Inc., Amphenol Advanced Sensors, and Bosch Sensortec maintain strong positions by offering diversified portfolios of electrochemical, metal oxide semiconductor (MOS), and photoionization-based VOC sensors for applications in industrial safety, environmental monitoring, automotive, and smart building systems. Competitive differentiation is driven by sensor sensitivity, response time, durability, calibration stability, and compatibility with IoT and wireless monitoring platforms. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective, compact, and energy-efficient sensors tailored to local market requirements.

Strategic partnerships with industrial automation companies, HVAC system integrators, and environmental monitoring service providers help expand market reach and technical support capabilities. Innovation in miniaturization, multi-gas detection, and AI-enabled analytics enhances competitive positioning. Companies prioritizing product reliability, regulatory compliance, and robust after-sales support are well-positioned to capture significant shares as demand for VOC detection grows across industrial, residential, and commercial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 186.5 Million |

| Technology | Photoionization Detectors (PID), Metal Oxide Semiconductor (MOS), Electrochemical sensors, Infrared-based detection, and Others |

| Type | Single gas detection sensor and Multiple gas detection sensor |

| End Use Industry | Oil & gas, Agriculture, Automotive, Chemical industry, Manufacturing, Food & beverages, Metals & mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Siemens AG, ABB Ltd., Bosch Sensortec GmbH, and Figaro Engineering Inc |

| Additional Attributes | Dollar sales vary by sensor type, including metal oxide, photoionization, electrochemical, and infrared sensors; by application, such as air quality monitoring, industrial safety, automotive, and smart buildings; by end-use industry, spanning environmental monitoring, manufacturing, healthcare, and consumer electronics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising air quality concerns, industrial safety regulations, and smart building adoption. |

The global volatile organic compound gas sensor market is estimated to be valued at USD 186.5 million in 2025.

The market size for the volatile organic compound gas sensor market is projected to reach USD 373.8 million by 2035.

The volatile organic compound gas sensor market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in volatile organic compound gas sensor market are photoionization detectors (pid), metal oxide semiconductor (mos), electrochemical sensors, infrared-based detection and others.

In terms of type, single gas detection sensor segment to command 57.3% share in the volatile organic compound gas sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Volatile Corrosion Inhibitor Bags Market Analysis by Zipper Bags, Gusset Bags and Flat Bags Through 2035

Volatile Organic Compound (VOC) Detector Market Size and Share Forecast Outlook 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA