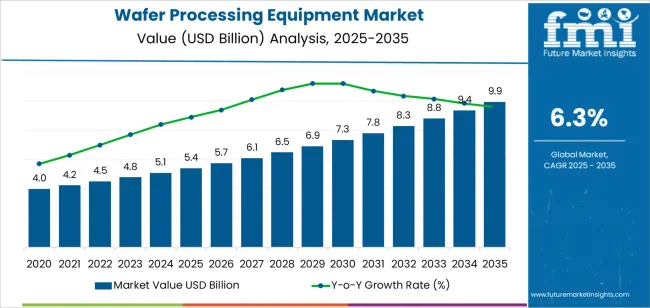

The wafer processing equipment market is projected to grow from USD 5.4 billion in 2025 to USD 10 billion by 2035, reflecting a CAGR of 6.3%. Wafer processing equipment is crucial in the semiconductor industry, where it is used in the manufacturing of semiconductor wafers for various electronic devices, such as smartphones, computers, automobiles, and consumer electronics. The wafer processing equipment market growth is driven by the increasing demand for advanced semiconductor devices, the expansion of 5G networks, and the growing need for high-performance computing and IoT technologies.

As the semiconductor industry continues to evolve, the demand for wafer processing equipment will grow steadily, with more sophisticated technologies and miniaturization driving new innovations. The increasing demand for chips in automotive, AI, and data center applications will continue to propel growth in the wafer processing market. Moreover, advancements in semiconductor manufacturing technologies such as multi-layered chips and 3D wafer stacking will further drive demand for more advanced processing equipment. The continued global reliance on technology and the expansion of 5G infrastructure will continue to influence the wafer processing equipment market over the next decade.

The Growth Rate Volatility Index (GRVI) for the wafer processing equipment market measures the fluctuations in growth rates over the 10-year forecast period, highlighting potential acceleration or deceleration in market dynamics. The CAGR of 6.3% reflects relatively steady growth in the market, with moderate volatility expected over the forecast period.

From 2025 to 2030, the market will experience gradual but consistent growth, expanding from USD 5.4 billion to USD 7.4 billion. The growth during this phase will likely remain stable, with mild fluctuations due to factors such as market competition, economic cycles, and supply chain disruptions that occasionally affect semiconductor production. However, the demand for next-generation semiconductor devices will likely keep the market on a positive trajectory, with YoY growth steadily increasing, albeit at a manageable pace.

From 2030 to 2035, the market will continue to expand, growing from USD 7.8 billion to USD 10 billion. While the overall growth will remain positive, the volatility may increase slightly as the market matures. The need for innovative processing equipment to meet the evolving demands of advanced semiconductor production could introduce temporary periods of higher growth rates as new technologies are adopted. These phases of increased demand for cutting-edge equipment will likely introduce more fluctuation into the market as industries adjust to new manufacturing requirements. Despite this, the overall growth trajectory will remain stable, indicating continued expansion with mild volatility across the forecast period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5.4 billion |

| Market Forecast Value (2035) | USD 10 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The wafer processing equipment market is experiencing robust growth as semiconductor fabrication becomes more critical across multiple sectors including consumer electronics, automotive systems, telecommunications, and data center hardware. This growth is linked to rising demand for advanced chips that support technologies such as artificial intelligence, 5G, and the Internet of Things (IoT). In particular, equipment used for processes such as etching, deposition, and cleaning is increasingly in demand because it plays a foundational role in achieving smaller process nodes, higher yields, and better performance of semiconductor wafers. The market is expected to increase significantly over the coming years with compound annual growth rates in the mid-single digits.

Another driver is the geographic shift in manufacturing with more production capacity being added in Asia-Pacific in countries like China, South Korea, and Japan, which boosts demand for wafer processing tools in those regions. Governments in several countries are also investing in domestic semiconductor supply chains, which stimulates equipment purchases for new fabrication plants and upgrades of existing lines. Meanwhile, innovation in tool design, such as more precise control, higher throughput, and support for thinner wafers, is enabling faster and more cost-efficient production of semiconductors. However, the market must navigate challenges, including the high cost of advanced equipment, supply chain constraints for critical components, and the rapid pace of change in semiconductor standards that can shorten the useful life of existing tool installations.

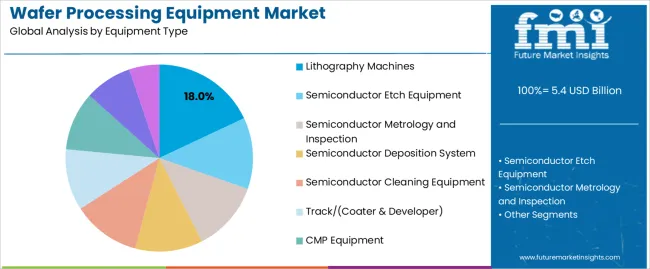

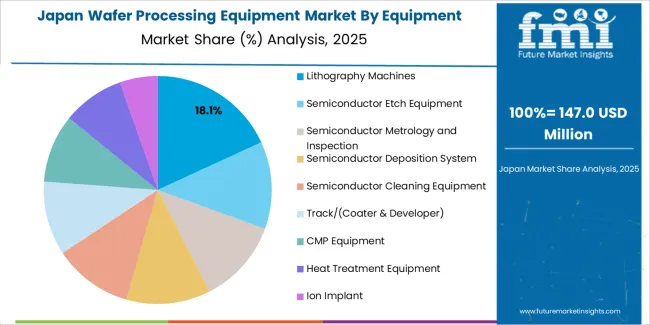

The wafer processing equipment market is segmented by equipment type and application. The leading equipment type is lithography machines, holding 18% of the market share, while the dominant application segment is 300 wafer, accounting for 60% of the market. These segments are key drivers of market growth, fueled by the continued demand for advanced semiconductor manufacturing processes and the scaling of wafer sizes to meet the requirements of modern electronics.

Lithography machines lead the wafer processing equipment market with an 18% share. Lithography is a critical step in semiconductor manufacturing, where patterns are transferred onto a wafer surface to create circuits for microchips. These machines are essential for producing high-resolution patterns required in advanced semiconductor devices, including integrated circuits used in everything from smartphones to high-performance computing systems.

The dominance of lithography machines is driven by the ongoing trend of miniaturization and the increasing demand for high-performance semiconductors. With the transition to smaller process nodes, advanced photolithography machines are vital in enabling the production of smaller and more powerful chips. As the semiconductor industry continues to evolve, the importance of lithography equipment in wafer processing remains central to enabling innovations in electronics, ensuring its continued leadership in the market.

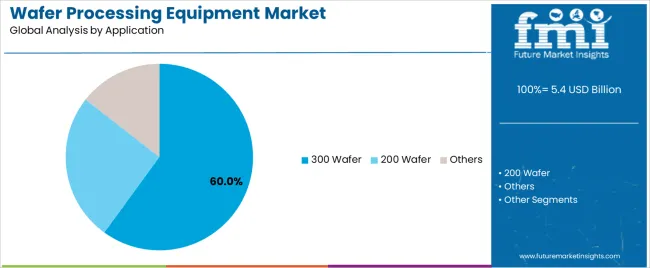

The 300 wafer application segment holds the largest share in the wafer processing equipment market, accounting for 60% of the market share. The 300mm wafer size is the standard in semiconductor manufacturing for advanced nodes, as it allows for higher yields and better cost-efficiency compared to smaller wafer sizes. With the increasing demand for semiconductors in consumer electronics, automotive systems, and industrial applications, the use of 300mm wafers is expected to continue growing.

As semiconductor manufacturers continue to scale their production capacity and strive for higher performance chips, the demand for 300 wafer processing equipment will remain strong. The ability to process larger wafers efficiently leads to increased throughput, making it a preferred choice in high-volume semiconductor production. This trend ensures that the 300 wafer segment remains the dominant application in the wafer processing equipment market as the industry advances toward next-generation technologies.

The wafer processing equipment market is driven by the growing demand for advanced semiconductor devices used in applications such as artificial intelligence, high performance computing, 5G communications, and electric vehicles. As device nodes shrink and wafer sizes increase, manufacturers require more sophisticated equipment for deposition, etching, cleaning, and inspection. The global market was valued at around USD 9.2 billion in 2024 and is projected to reach approximately USD 12.9 billion by 2030. At the same time, macro economic factors such as capital investment cycles, supply chain disruptions, and regional policy incentives affect the pace and geography of growth.

What Are The Primary Growth Drivers For The Wafer Processing Equipment Market?

Key triggers for market growth include the expansion of semiconductor fabrication capacity globally as chipmakers ramp up production to meet demand for data centres, smartphones, and automotive electronics. The transition to advanced technology nodes (for example, 3 nm and 5 nm) increases the complexity and cost of equipment, thereby elevating spending on wafer processing tools. Additionally, the shift towards larger wafer diameters (300 mm or beyond) and the need for higher throughput are expanding demand for high end processing systems. Moreover, government incentives and regional manufacturing programmes (particularly in Asia Pacific) encourage local production and equipment investment, further driving the market forward.

What Are The Key Restraints In The Wafer Processing Equipment Market?

Despite favourable conditions, the market faces significant restraints. The high cost of equipment and long lead times for procurement and installation can delay return on investment for fab operators. Volatility in end market demand, such as slower consumer electronics or memory cycles, can result in under utilisation of expensive processing equipment. Supply chain disruptions and concentration of critical material sources create risk in manufacturing planning. In addition, rapid technological shifts mean that equipment may become obsolete quickly, increasing risk for manufacturers and buyers, and complicating just in time or modular purchasing strategies.

What Are The Emerging Trends In The Wafer Processing Equipment Market?

Several trends are shaping the future of this market. One major trend is the increasing integration of digital technologies such as real time analytics, machine learning, and process automation into wafer processing equipment, which enables higher yield, lower defect rates, and predictive maintenance. Another trend is the rise of capacity expansion in emerging regions, with Asia Pacific taking a leading share of global demand and new fabs being established outside traditional hubs. A further trend is the development of equipment tailored for heterogeneous integration and advanced packaging, as device architectures evolve. Finally, sustainability considerations are becoming increasingly important, with equipment manufacturers focusing on energy efficient systems, reduction of chemical usage, and extended tool life to support greener semiconductor manufacturing.

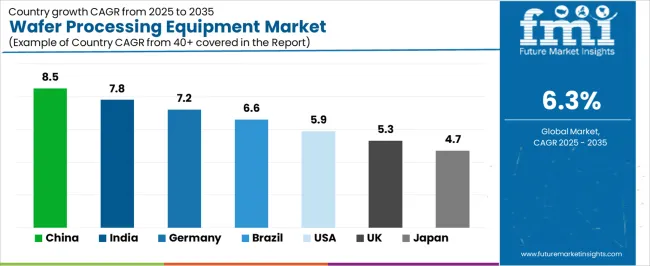

The wafer processing equipment market is growing steadily, driven by the increasing demand for semiconductor devices, which are essential for a wide range of applications including consumer electronics, automotive, telecommunications, and industrial equipment. Wafer processing equipment plays a key role in semiconductor fabrication, as it is used in various stages such as etching, deposition, and cleaning of semiconductor wafers. The rapid advancements in technology and the growing need for high-performance microchips are fueling demand for wafer processing equipment. Emerging markets like China and India are seeing rapid growth in the semiconductor manufacturing sector, while developed economies such as the USA and Germany continue to invest heavily in semiconductor production and technological advancements. This analysis explores the factors driving the growth of the wafer processing equipment market across various countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.8% |

| Germany | 7.2% |

| Brazil | 6.6% |

| USA | 5.9% |

| United Kingdom | 5.3% |

| Japan | 4.7% |

China leads the wafer processing equipment market with a robust CAGR of 8.5%. The country has become a global leader in semiconductor manufacturing, driven by its increasing demand for semiconductors in consumer electronics, automotive, telecommunications, and computing. China’s significant investment in its semiconductor industry and growing number of semiconductor manufacturing plants is driving demand for wafer processing equipment.

The Chinese government has made substantial investments in the development of its semiconductor sector as part of its broader goal to reduce reliance on foreign semiconductor suppliers. This push for domestic production of semiconductors is further boosting the demand for advanced wafer processing technologies. Additionally, the rapid growth of 5G infrastructure and IoT devices in China is increasing the need for more microchips and semiconductors, which in turn accelerates the demand for wafer processing equipment. As China continues to expand its semiconductor capabilities, the market for wafer processing equipment is expected to grow at a fast pace.

India’s wafer processing equipment market is growing at a CAGR of 7.8%. The Indian government has placed a strong emphasis on developing the domestic semiconductor manufacturing industry to support the country’s digital transformation. As part of the India Semiconductor Mission (ISM), significant investments are being made in the semiconductor sector, which is expected to drive growth in the wafer processing equipment market.

India’s growing electronics manufacturing industry, fueled by the increasing demand for smartphones, consumer electronics, and electric vehicles, is driving the need for high-quality semiconductor components. As India continues to develop its semiconductor manufacturing capabilities, the demand for wafer processing equipment to support chip production will increase. The country’s focus on digitalization, combined with its efforts to become a global semiconductor hub, will continue to propel market growth.

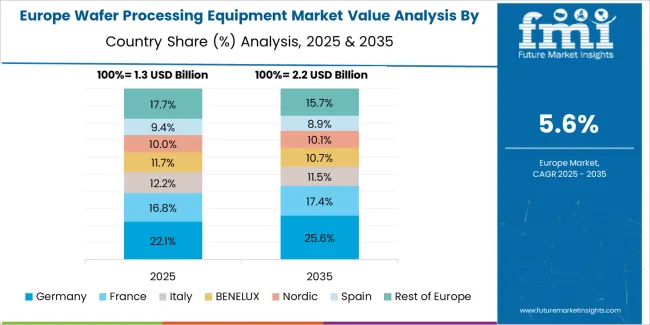

Germany’s wafer processing equipment market is projected to grow at a CAGR of 7.2%. Germany is a leading player in Europe’s semiconductor industry, with significant investments in semiconductor manufacturing and research. The demand for wafer processing equipment in Germany is driven by the country’s strong industrial base, which includes automotive electronics, telecommunications, and industrial automation, all of which require high-performance semiconductors.

Germany’s commitment to sustainability and digital transformation is driving the demand for advanced technologies, including semiconductor devices. The country’s leadership in automotive and manufacturing industries further contributes to the demand for wafer processing equipment. As Germany continues to advance its technological infrastructure, including the development of 5G and electric vehicles, the need for high-performance semiconductors will continue to fuel growth in the wafer processing equipment market.

Brazil’s wafer processing equipment market is expected to grow at a CAGR of 6.6%. Brazil’s growing electronics and telecommunications industries are driving the demand for semiconductors, creating a need for wafer processing equipment. As Brazil continues to expand its digital infrastructure, including the rollout of 4G and 5G networks, the demand for semiconductor devices used in communication systems is increasing.

Brazil is also focusing on growing its domestic manufacturing capabilities, including the development of smart technologies and electric vehicles, all of which require high-performance chips. As these industries continue to evolve, the demand for wafer processing equipment to support semiconductor production will rise. The country’s growing focus on technology and digitalization will contribute to steady growth in the wafer processing equipment market.

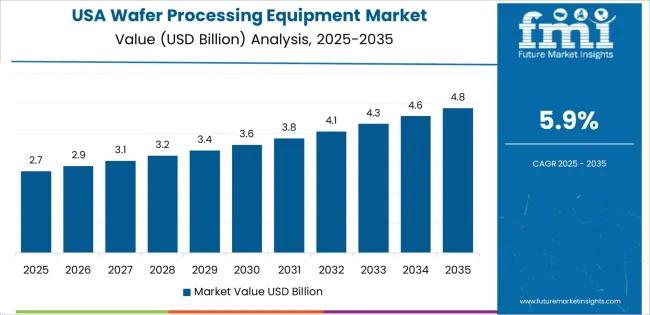

The United States has a projected CAGR of 5.9% for the wafer processing equipment market. The USA remains a global leader in semiconductor manufacturing, with significant investments in research, development, and production technologies. The demand for wafer processing equipment in the USA is driven by the increasing use of semiconductor devices in various sectors, including consumer electronics, defense, healthcare, and automotive industries.

The USA government’s recent initiatives to strengthen its domestic semiconductor industry, such as the CHIPS Act, are likely to further drive demand for wafer processing equipment. As the demand for microchips increases due to innovations like AI, 5G, and autonomous vehicles, the USA semiconductor market will continue to grow, ensuring that the wafer processing equipment market remains strong.

The United Kingdom’s wafer processing equipment market is projected to grow at a CAGR of 5.3%. The UK is seeing increased demand for semiconductors, driven by the expansion of industries such as telecommunications, consumer electronics, and automotive, all of which require advanced semiconductor technologies. The demand for wafer processing equipment in the UK is largely driven by the country’s growing focus on digital infrastructure and technological advancements.

The UK’s investments in digitalization and sustainable energy solutions, particularly in the development of electric vehicles and renewable energy technologies, are further driving the need for semiconductor devices. As these industries continue to grow, the market for wafer processing equipment will continue to see steady demand. The country’s emphasis on innovation and technology in various sectors ensures continued growth in this market.

Japan’s wafer processing equipment market is expected to grow at a rate of 4.7%. Japan is one of the largest markets for semiconductor devices, particularly in sectors such as automotive, telecommunications, and industrial equipment. The demand for wafer processing equipment is supported by Japan’s continued investment in advanced semiconductor manufacturing and its leadership in industries that rely on high-performance chips.

The Japanese government’s focus on technological innovation, including the development of AI, robotics, and smart infrastructure, is driving the need for more semiconductor devices, which in turn drives the market for wafer processing equipment. Japan’s semiconductor industry remains crucial to its economy, and as demand for next-generation electronics continues to rise, the market for wafer processing equipment will grow steadily.

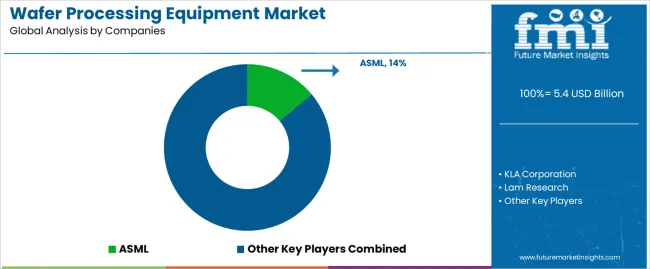

In the wafer processing equipment market, major companies such as ASML (holding approximately 14% share), KLA Corporation, Lam Research, ASM International, Kokusai Electric, Applied Materials, Inc. (AMAT), Nikon Precision Inc, Ebara Technologies, Inc. (ETI), and many others compete intensely. The market is projected to grow from around USD 9.2 billion in 2024 to about USD 12.9 billion by 2030, with a compound annual growth rate (CAGR) near 5.9%. Growth is being driven by rising demand for advanced logic and memory chips, miniaturisation trends, and expansion of end-use segments such as AI, 5G, and EVs.

These companies adopt a mix of strategies to maintain or grow their market position. First, technological leadership is emphasised: firms invest in next-generation tools that support finer process nodes, higher throughput, and lower cost of ownership. Second, supply-chain and service differentiation matter: given the high capital intensity of fabs, equipment vendors offer bundling of installation, qualification, maintenance, and spare-parts support to secure long-term customer relationships. Third, geographic and process-segment breadth enters strategy: vendors expand into emerging markets, provide tools for diverse wafer tasks (etch, deposition, cleaning, CMP), and build partnerships or acquisitions to extend capability. By aligning equipment features (yield enhancement, flexible process support), ecosystem service, and global presence with fab-customer priorities, these companies aim to strengthen their competitive position in the wafer processing equipment market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Equipment Type | Lithography Machines, Semiconductor Etch Equipment, Semiconductor Metrology and Inspection, Semiconductor Deposition System, Semiconductor Cleaning Equipment, Track/(Coater & Developer), CMP Equipment, Heat Treatment Equipment, Ion Implant |

| Application | 300 Wafer, 200 Wafer, Others |

| Key Companies Profiled | ASML, KLA Corporation, Lam Research, ASM International, Kokusai Electric, Applied Materials, Inc. (AMAT), Nikon Precision Inc, Ebara Technologies, Inc. (ETI), Axcelis Technologies Inc, Canon, TEL (Tokyo Electron Ltd.), ULVAC, SCREEN, DISCO Corporation, Hitachi High-Tech Corporation, SEMES, Onto Innovation, PSK Group, NuFlare Technology, Inc., Wonik IPS, Eugene Technology, Jusung Engineering, TES CO., LTD, Veeco, Oxford Instruments, Samco Inc., Lasertec, SUSS Group, NAURA, AMEC, Skyverse Technology, Hwatsing Technology, ACM Research, Piotech, Inc, PNC Technology Group, KINGSEMI Co., Ltd, Beijing E-Town Semiconductor Technology, Shanghai Micro Electronics Equipment (SMEE), Camtek, ZEUS Co., Ltd., Shibaura Mechatronics, KCTech Co., Ltd. |

| Additional Attributes | The market analysis includes dollar sales by equipment type and application categories. It also covers regional adoption trends across major markets. The competitive landscape focuses on key manufacturers in the wafer processing equipment market, with innovations in semiconductor fabrication technologies such as lithography, etching, metrology, and deposition systems. Trends in the growing demand for advanced wafer processing equipment in semiconductor manufacturing are explored, along with advancements in equipment efficiency, material handling, and yield optimization. |

The global wafer processing equipment market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the wafer processing equipment market is projected to reach USD 9.9 billion by 2035.

The wafer processing equipment market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in wafer processing equipment market are lithography machines, semiconductor etch equipment, semiconductor metrology and inspection, semiconductor deposition system, semiconductor cleaning equipment, track/(coater & developer), cmp equipment, heat treatment equipment and ion implant.

In terms of application, 300 wafer segment to command 60.0% share in the wafer processing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wafer Batch Aligner Market Size and Share Forecast Outlook 2025 to 2035

Wafer Level Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wafer Inspection Market Size and Share Forecast Outlook 2025 to 2035

Wafer Testing Service Market Growth – Trends & Forecast 2024-2034

Wafer Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Wafer Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

InP Wafer Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Manual Wafer Aligner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fan-Out Wafer Level Packaging Market Size and Share Forecast Outlook 2025 to 2035

Silicon Epi Wafer Market Size and Share Forecast Outlook 2025 to 2035

Solar Silicon Wafer Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Wafer Market – Forecast through 2025 to 2035

Solar Photovoltaic Wafer Market

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA