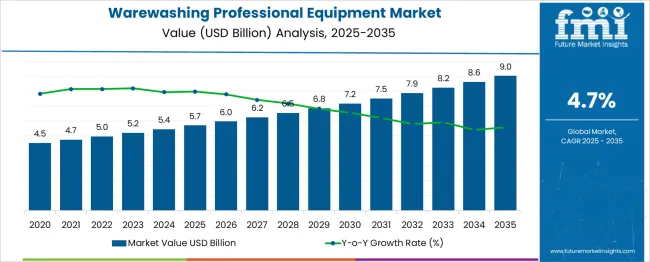

The Warewashing Professional Equipment Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. A Peak-to-Trough Analysis reveals a steady growth pattern with a slight deceleration in the latter half of the forecast period. Between 2025 and 2030, the market grows from USD 5.7 billion to USD 7.2 billion, contributing USD 1.5 billion in growth, with a CAGR of 5.0%. This early-phase acceleration is driven by the increasing demand for efficient and automated warewashing solutions in the foodservice and hospitality industries, as businesses focus on improving operational efficiency and meeting higher hygiene standards.

The first peak occurs at USD 7.2 billion in 2030, followed by a deceleration from 2030 to 2032, where the market moves from USD 7.2 billion to USD 7.5 billion, contributing USD 0.3 billion in growth, with a slower CAGR of 2.0%. This slowdown indicates the market is nearing maturity, where initial high demand stabilizes as the technology becomes more widely adopted. From 2032 to 2035, the market grows from USD 7.5 billion to USD 9.0 billion, adding USD 1.5 billion in growth, with a CAGR of 6.3%. This final acceleration reflects the continued need for advanced warewashing equipment driven by growth in commercial establishments and the adoption of eco-friendly, energy-efficient models.

| Metric | Value |

|---|---|

| Warewashing Professional Equipment Market Estimated Value in (2025 E) | USD 5.7 billion |

| Warewashing Professional Equipment Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The warewashing professional equipment market is experiencing robust growth, fueled by rising demand from foodservice establishments and institutional kitchens globally. Efficiency, hygiene compliance, and operational speed have become critical factors shaping purchasing decisions, as restaurants, cafes, and catering services prioritize equipment that delivers consistent cleaning performance while minimizing water and energy consumption.

Technological advancements in automation, water recycling, and detergent dosing have further enhanced the appeal of professional warewashing solutions. The market outlook is being positively influenced by increasing health and safety regulations, which necessitate the use of professional-grade dishwashing systems in commercial kitchens.

Additionally, the rise in food delivery services and quick-service restaurants is expected to sustain the demand for efficient warewashing equipment. Growing investments in upgrading kitchen infrastructure, especially in emerging economies, are creating further opportunities for market expansion, supported by innovations in user-friendly interfaces and connectivity features enabling remote monitoring and maintenance.

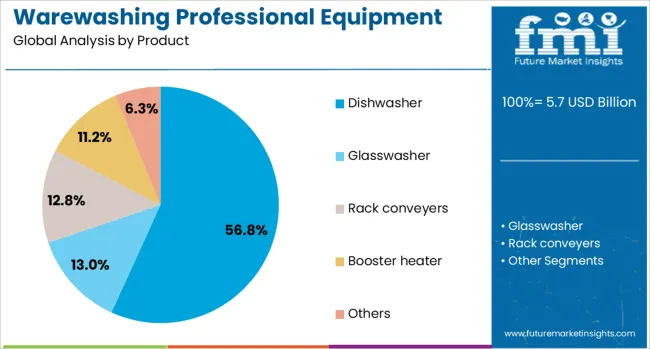

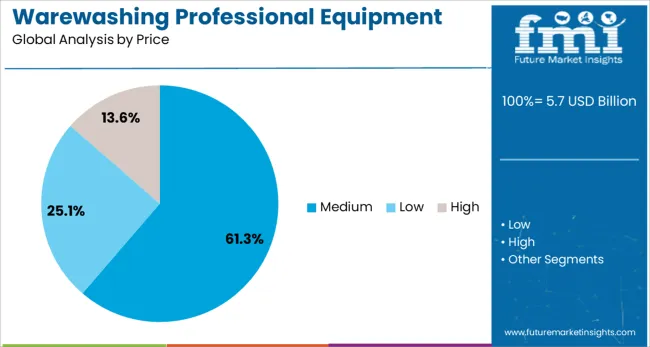

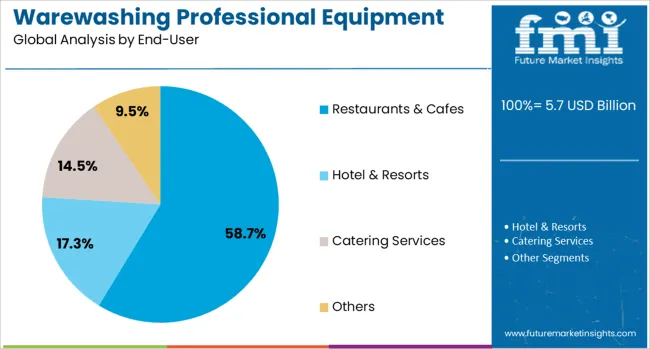

The warewashing professional equipment market is segmented by product, price, end-user, distribution channel, and geographic regions. By product, the warewashing professional equipment market is divided into Dishwasher, Glasswasher, Rack conveyers, Booster heaterOthers. In terms of price, the warewashing professional equipment market is classified into Medium, LowHigh. Based on end-user, the warewashing professional equipment market is segmented into Restaurants & Cafes, Hotel & Resorts, Catering ServicesOthers. By distribution channel, the warewashing professional equipment market is segmented into OfflineOnline. Regionally, the warewashing professional equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Dishwashers are anticipated to hold 56.8% of the revenue share in the warewashing professional equipment market by 2025, representing the largest product segment. This dominance is attributed to the growing preference for automated cleaning solutions that enhance throughput and maintain stringent hygiene standards.

Dishwashers offer consistent and repeatable washing cycles that reduce manual labor and improve operational efficiency in busy kitchens. The segment’s growth is supported by continuous innovation in cycle optimization, energy and water savings, and the integration of smart sensors that adapt washing parameters based on load type and soil levels.

The flexibility of dishwasher configurations, ranging from undercounter to conveyor models, also meets diverse kitchen size requirements. Increasing demand from large-scale foodservice providers, coupled with government incentives promoting eco-friendly equipment, has further solidified dishwashers’ leadership in the product category.

The medium price segment is expected to account for 61.3% of the total market revenue share in 2025, reflecting widespread adoption among small to medium-sized foodservice operators. This segment offers a balanced combination of cost-efficiency, performance, and durability, appealing to restaurants and cafes aiming to optimize operational expenses without compromising on cleaning quality.

Medium-priced warewashing equipment typically includes advanced features such as energy-saving modes, programmable cycles, and robust construction materials, delivering value over extended usage periods. The affordability and scalability of medium-priced models have driven their acceptance in emerging markets and established economies alike.

Support from service networks and availability of spare parts in this segment have further boosted buyer confidence, facilitating ongoing maintenance and longevity of equipment, which is critical for continuous kitchen operations.

Restaurants and cafes are projected to constitute 58.7% of the warewashing professional equipment market revenue by 2025, emerging as the dominant end-user segment. The growth in this segment is propelled by the rapid expansion of dining establishments worldwide, driven by changing consumer lifestyles and increased eating out trends.

The demand for efficient and reliable warewashing equipment is heightened by the need to maintain hygiene standards, speed up table turnover, and reduce labor costs. Software-enabled warewashing systems that offer remote monitoring and diagnostics are gaining traction in this segment, enabling operators to minimize downtime and optimize resource usage.

Furthermore, the surge in quick-service restaurants and specialty cafes has intensified competition, prompting investments in modern kitchen appliances that support operational excellence. The focus on sustainability and adherence to food safety regulations continue to encourage restaurants and cafes to upgrade their warewashing equipment to professional-grade solutions.

The warewashing professional equipment market is experiencing significant growth driven by the increasing demand for high-efficiency and hygienic dishwashing solutions in commercial settings such as restaurants, hotels, and hospitals. These machines, designed to clean and sanitize large volumes of dishes quickly, offer advantages like water and energy savings, improved cleanliness, and reduced labor costs. With the growing focus on hygiene and operational efficiency, especially in the foodservice and healthcare sectors, warewashing equipment continues to see increased adoption. Despite challenges like high initial investment and maintenance costs, innovations in energy-efficient models and smart technologies are driving the market forward.

The primary driver of the warewashing professional equipment market is the increasing demand for efficient, hygienic, and cost-effective dishwashing solutions across various commercial sectors. With businesses focusing on improving operational efficiency and maintaining hygiene standards, the adoption of automated dishwashing equipment has become essential. Professional warewashing machines offer faster cleaning cycles, improved hygiene levels, and lower water and energy consumption. These benefits are especially critical in the foodservice industry, where cleanliness and efficiency are paramount. The stricter sanitation regulations and the need to maintain high hygiene standards in healthcare and hospitality sectors are pushing the demand for advanced warewashing solutions, driving market growth.

A significant challenge in the warewashing professional equipment market is the high initial cost of purchasing and installing advanced dishwashing systems. While these machines provide long-term savings in labor, water, and energy costs, the upfront investment can be prohibitive, particularly for small and medium-sized businesses. Regular maintenance and servicing are required to ensure optimal performance, adding to the operational costs. The complexity of integrating these machines with existing kitchen infrastructure, along with the need for specialized technicians for installation and repairs, can also slow down the adoption of professional warewashing systems, especially in developing regions.

Significant opportunities exist in the warewashing professional equipment market due to ongoing technological advancements and the expansion of commercial sectors. Innovations such as energy-efficient models, smart sensors for monitoring and controlling cleaning processes, and IoT integration for remote diagnostics are creating new growth prospects. The rise of cloud-based solutions for fleet management and predictive maintenance is further enhancing the appeal of these systems. As demand grows in emerging markets, especially in the foodservice and hospitality sectors, opportunities for suppliers to introduce advanced warewashing equipment in these regions are expanding. Increasing adoption of automation and digital technologies across industries presents long-term opportunities for market growth.

A key trend in the warewashing professional equipment market is the growing adoption of energy-efficient and smart warewashing solutions. With the increasing emphasis on sustainability and reducing operational costs, many commercial establishments are opting for machines that consume less water and energy. These energy-efficient models help businesses save on utility bills while maintaining the required hygiene standards. The integration of smart technologies, such as sensors and IoT-based solutions, allows for remote monitoring, real-time data analytics, and predictive maintenance, enhancing the overall efficiency and performance of warewashing systems. This trend toward smarter, greener equipment is shaping the future of the industry, particularly in large-scale commercial kitchens.

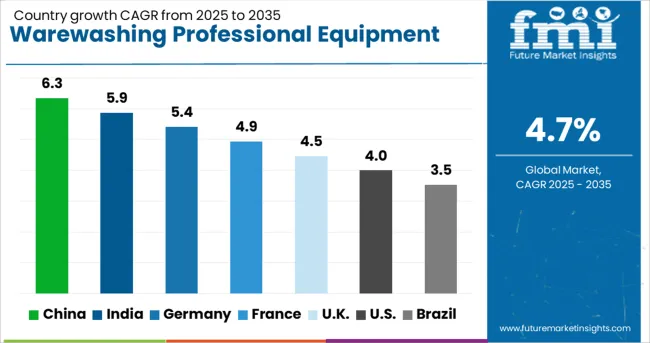

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The warewashing professional equipment market is experiencing steady growth globally, with a global CAGR of 4.7%. China leads the market with a growth rate of 6.3%, followed by India at 5.9%. Germany records a growth rate of 5.4%, while the UK and USA show growth rates of 4.5% and 4.0%, respectively. The increasing demand for automated and energy-efficient warewashing equipment in commercial kitchens, hotels, and restaurants is a key driver of market growth. The market is further supported by advancements in technology, including IoT-enabled machines and water-saving solutions, which are making warewashing equipment more efficient and environmentally friendly. The analysis includes over 40+ countries, with the leading markets detailed below.

The warewashing professional equipment market in China is growing at a CAGR of 6.3%. The country’s booming foodservice industry, driven by increasing urbanization and rising disposable incomes, is fueling this growth. As more restaurants, hotels, and commercial kitchens open to meet the rising demand for dining, the need for efficient and modern warewashing solutions grows. China’s large manufacturing base, coupled with a growing emphasis on environmental standards, has led to a rise in the adoption of energy-efficient equipment in commercial kitchens. The push for sustainability and cost-effective solutions drives the demand for automated, high-performance systems.

The warewashing professional equipment market in India is projected to grow at a CAGR of 5.9%. The expanding foodservice industry, especially in urban areas, is driving the demand for efficient and reliable warewashing solutions. With increasing disposable incomes and the rise of fast-food chains, QSRs, and modern cafes, the demand for automated, high-performance dishwashing equipment is increasing. Furthermore, India’s focus on sanitation and hygiene standards in commercial kitchens, coupled with government initiatives to boost the hospitality sector, is expected to drive the market. As foodservice establishments adopt more green practices, water- and energy-efficient equipment are gaining popularity.

The warewashing professional equipment market in France is growing steadily at a CAGR of 6.0%. The increasing demand for efficient warewashing solutions is primarily driven by the growing number of restaurants, hotels, and catering services in the country. France’s high standards for foodservice hygiene and cleanliness are pushing establishments to invest in high-quality warewashing equipment. The adoption of energy-efficient and water-saving technologies is becoming a priority as businesses seek to reduce operational costs. With a significant rise in demand for eco-friendly solutions,

The UK warewashing professional equipment market is projected to grow at a CAGR of 4.5%. With a growing demand for commercial kitchens and foodservice outlets, the need for high-performance warewashing solutions is rising. The UK foodservice industry’s emphasis on sustainability, energy efficiency, and cost reduction is driving the adoption of eco-friendly and automated warewashing systems. The rise of casual dining chains, cafes, and food delivery services is also boosting the demand for modern, efficient dishwashing equipment.

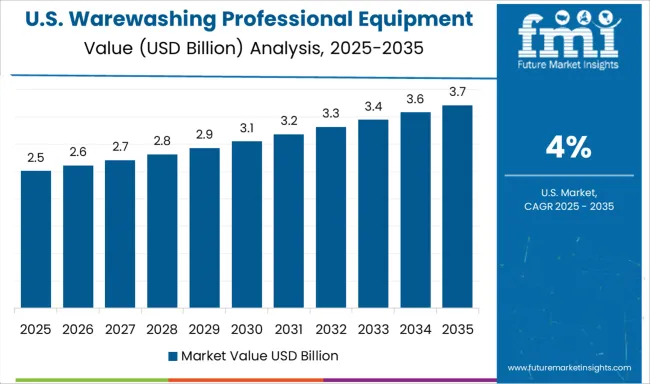

The USA market for warewashing professional equipment is expected to grow at a CAGR of 4.0%. The increasing number of foodservice establishments, such as restaurants, hotels, and catering services, is driving the demand for efficient and reliable warewashing solutions. The need to maintain high hygiene standards and streamline kitchen operations further contributes to market growth. The growing popularity of sustainable practices in the USA is pushing commercial kitchens to adopt energy-efficient and water-saving warewashing equipment. As businesses focus on improving operational efficiency, the demand for automated and high-performance dishwashing systems continues to rise.

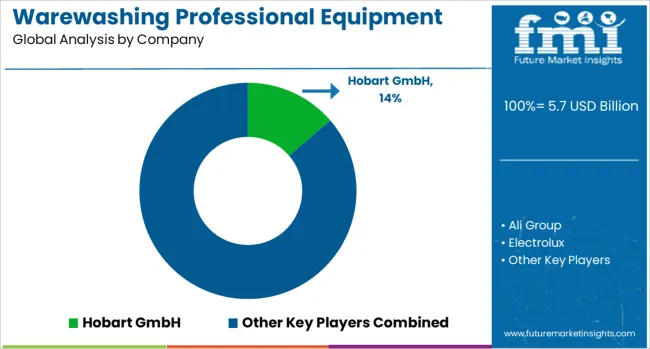

The warewashing professional equipment market is shaped by global leaders, diversified equipment manufacturers, and regional specialists catering to high-volume commercial kitchens in foodservice, hospitality, and healthcare. Hobart GmbH maintains a dominant position with machines recognized for reliability, automation, and energy efficiency, enabling operators to meet high throughput requirements while controlling operational costs. Ali Group operates through multiple brands, offering versatile, durable solutions for large-scale operations and emphasizing performance consistency under heavy use. Electrolux leverages innovation to optimize cleaning performance and reduce water and energy consumption, providing differentiated offerings across commercial segments.

Comprehensive solutions providers such as Ecolab Inc. integrate detergents and sanitation products with warewashing systems, delivering a value-added approach to hygiene management. Whirlpool, Middleby Corporation, and Samsung focus on advanced automation, smart interfaces, and productivity-enhancing features, targeting operational efficiency and cost reduction. MEIKO Maschinenbau GmbH & Co. KG emphasizes technological differentiation through hygiene-focused machine design and improved water and energy usage. Consumer electronics brands LG Electronics and Haier provide energy-efficient, user-friendly solutions suited for mid-to-large commercial kitchens. Jackson WWS and Miele & Cie. KG combine speed, durability, and advanced control systems to serve premium segments, ensuring minimal downtime and consistent output.

Market competition is shaped by technological differentiation, regional distribution networks, and product-service integration. Companies are expanding in emerging markets, forming partnerships with local distributors, and developing smart, connected machines to enhance operational intelligence. Regulatory compliance, energy and water efficiency, and lifecycle cost optimization remain central to strategic positioning and competitive advantage in the global warewashing professional equipment ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Product | Dishwasher, Glasswasher, Rack conveyers, Booster heater, and Others |

| Price | Medium, Low, and High |

| End-User | Restaurants & Cafes, Hotel & Resorts, Catering Services, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hobart GmbH, Ali Group, Electrolux, Ecolab Inc., Whirlpool, The Middleby Corporation, Samsung, MEIKO Maschinenbau GmbH & Co. KG, LG Electronics, Haier, Jackson WWS, Miele & Cie. KG, Dover Corporation, Illinois Food Equipment Group, Bisch, and ADLER s.p.a. |

| Additional Attributes | Dollar sales by equipment type (undercounter washers, conveyor washers, door-type washers, hood-type washers) and end-use segments (restaurants, hotels, hospitals, educational institutions, food processing). Demand dynamics are driven by the increasing need for energy-efficient and high-performance cleaning systems, the growing trend of automation in commercial kitchens, and rising hygiene standards across the foodservice industry. |

The global warewashing professional equipment market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the warewashing professional equipment market is projected to reach USD 9.0 billion by 2035.

The warewashing professional equipment market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in warewashing professional equipment market are dishwasher, glasswasher, rack conveyers, booster heater and others.

In terms of price, medium segment to command 61.3% share in the warewashing professional equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Professional Potting Soil Market Size and Share Forecast Outlook 2025 to 2035

Professional Services Automation Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Professional Cleaning Products Market Size and Share Forecast Outlook 2025 to 2035

Professional Gear Bags Market - Trends, Growth & Forecast 2025 to 2035

Professional Hair Care Market Insights & Forecast 2025 to 2035

Professional Hair Clipper Market Trends & Forecast 2024-2034

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA