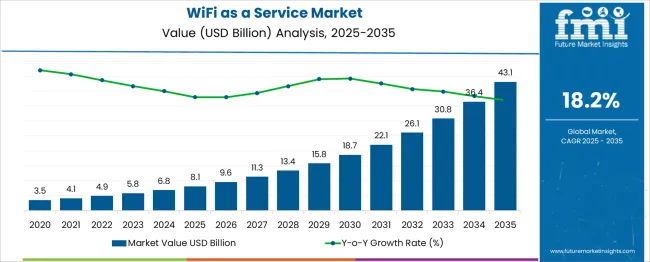

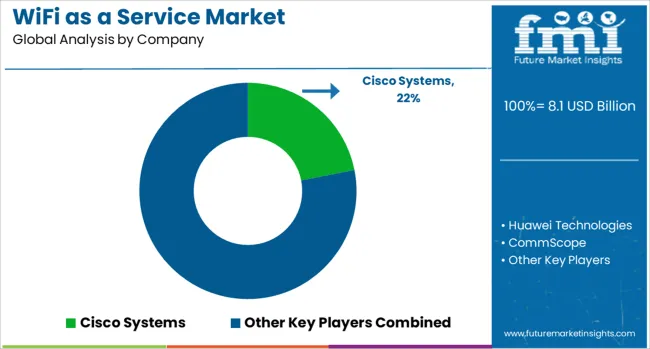

The WiFi as a Service Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 43.1 billion by 2035, registering a compound annual growth rate (CAGR) of 18.2% over the forecast period.

| Metric | Value |

|---|---|

| WiFi as a Service Market Estimated Value in (2025 E) | USD 8.1 billion |

| WiFi as a Service Market Forecast Value in (2035 F) | USD 43.1 billion |

| Forecast CAGR (2025 to 2035) | 18.2% |

As a result of the easy management of wireless infrastructure over cloud services, WiFi as a service market is experiencing rapid growth.

Managed over the cloud, the rise in adoption of WiFi as a service allows enterprises to operate wireless networks from anywhere.

Network administrators can remotely manage WiFi infrastructure issues using cloud-based centralized management, saving both time and money by performing the work from a remote location.

Commercial applications have long made use of dial-up access. Thanks to advancements in technology, even residential customers can now have reasonably priced high-speed Internet access. This is leading to a rapid rise in the adoption of WiFi as a service and development of the global industry.

As per WiFi as a service market analysis, WaaS is a service that provides access to the internet from the cloud. Cloud platforms have enabled various corporate tasks, such as marketing, R&D, and production, to become more efficient and make operations and data maintenance considerably easier.

When security fails in an enterprise, business-critical processes are at risk. This results in an overall failure of operations and adds a restraint to the WiFi as a service market future trends.

A loss of privacy may harm certain management and control capabilities in distant networks as well. As a result, the WiFi as a service market's growth is limited by minor cloud challenges and data security concerns.

WiFi networks are becoming increasingly popular among end-user businesses across the globe due to their cost-effectiveness, flexibility, scalability, and automation. Thus, organizations are increasing their adoption of WiFi as a service and Software as a Service (SaaS) based wireless fidelity models, which enable them to take advantage of continuous Internet access despite limited budgets and resources.

A surge in demand for WiFi as service services has resulted from the increasing adoption of public and private SaaS models. SaaS services are being used by organizations to safeguard and transmit data in a secure manner using WiFi. A number of WiFi as a service model projects are being developed by leading WiFi as a service market player.

WiFi as a service market is segmented by services, solution, organization size, location type, vertical, and region.

Between 2025 and 2035, the largest companies are expected to account for the majority of sales of WiFi as a service. Businesses are increasingly adopting WiFi as a service to solve problems such as privacy, data security, and cloud connectivity failures.

Additionally, infrastructures in the government and public sector store critical data for which WiFi as a service can be used to construct specialized networks. WAAS can also create routes through which different sectors of the industry communicate.

Location types are the leading application category in the WiFi as a Service Market, with an expected CAGR of 18.0%. Indoor and outdoor market shares are segmented according to location. Outdoors is likely to hold the dominant market share through 2035.

The WiFi as a service market analysis points out that the most common places to deploy these access points are at public events, stadiums, retail malls, and so on. During deployment, wireless fidelity users in heavily populated areas and busy locations are most likely to use this deployment style.

The most advanced network connectivity is provided by outdoor access points built with advanced engineering and scalable technology. Because the centralized administration console works both for point-to-point and multi-point applications, indoor access points are well suited for these types of applications. This is leading to the wide adoption of WiFi as a service.

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States | 18.1 % |

| United Kingdom | 17.3 % |

| China | 17.5% |

| Japan | 16.4% |

| South Korea | 15.9% |

As the United States is a key hub for technical advancements and an early adopter of new technologies, it holds the largest market size of USD 9.1 billion for WiFi as a Service Market.

With the early adoption of advanced technology and the presence of significant WiFi as a service market players, North America is forecast to dominate the market share. As the regional leaders in sales of WiFi as a service, they constantly innovate to improve the technology's application scope. Aside from these factors, consumers' willingness to adopt the latest technology is expected to support regional WiFi as a service market growth.

There is a significant investment in cloud-based WaaS services for smart cities in Europe. WIFI@DB, for example, will be available in September 2024. It is projected to include WiFi coverage at the operator's ICE fleet, through 100 DB stops, all DB lounges, and on certain regional trains and buses.

China, India, South Korea, and Japan are the top countries for WiFi as a service market growth in the Asia Pacific. Due to its fast growth, this regional WiFi as a service market is expected to experience the highest rate of growth due to rising digitalization in various sectors, including manufacturing, automotive, healthcare, and others.

As per the WiFi as a service market trends, as a result of the ongoing digital transformation, the need for managed IT services is expanding. The mobile workforce trend and BYOD trend are gaining traction in the Asia Pacific, as broadband and mobile infrastructure develop across SMEs.

In recent years, the WiFi as a Service market has developed a competitive edge.

The industry includes Juniper Networks Inc., Cisco System Inc., HPE (Aruba), Extreme Networks, Huawei Technologies Co Ltd, Fortinet, Ruckus Networks, Arista Networks, D-Link Corporation, TP-Link, and others.

Companies are using mergers and acquisitions to strengthen their positions in light of the increasing competition in the WiFi as a service market.

In May 2024, Aruba launched its wireless fidelity 6E access point solution. WiFi in the 6 GHz band will support up to seven 160 MHz channels and will offer an aggregate data rate of 3.9 Gbps to users.

The global wifi as a service market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the wifi as a service market is projected to reach USD 43.1 billion by 2035.

The wifi as a service market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types in wifi as a service market are professional services, _advisory and implementation, _support and maintenance, _training and managed services.

In terms of organization size, large enterprises segment to command 61.3% share in the wifi as a service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

WiFi Alarm System Market Size and Share Forecast Outlook 2025 to 2035

WiFi Extenders Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Aseptic IBC Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Liquid Packaging Boards Market Size and Share Forecast Outlook 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA