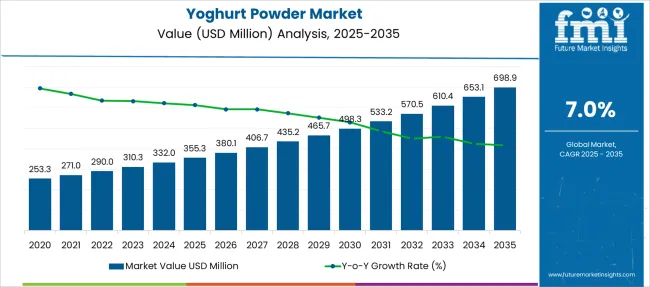

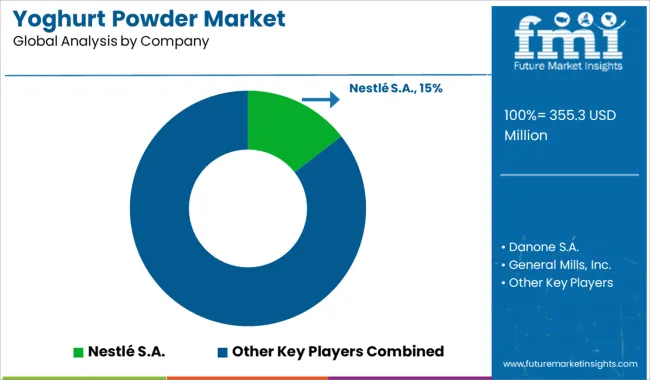

The Yoghurt Powder Market is estimated to be valued at USD 355.3 million in 2025 and is projected to reach USD 698.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Yoghurt Powder Market Estimated Value in (2025 E) | USD 355.3 million |

| Yoghurt Powder Market Forecast Value in (2035 F) | USD 698.9 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The yoghurt powder market is expanding steadily due to increasing demand for shelf-stable dairy alternatives in both foodservice and retail sectors. As consumers become more health-conscious and seek convenient nutritional options, yoghurt powder offers a viable solution with extended shelf life and ease of storage. Its application across bakery, confectionery, beverages, and infant nutrition has supported consistent market performance.

The growing preference for clean-label, preservative-free ingredients further accelerates the shift toward powdered yoghurt, especially in emerging markets where cold chain infrastructure is limited. Rising adoption of sports nutrition and protein-rich diets also contributes to its market visibility.

With sustained innovation in processing technology and product diversification, the outlook for yoghurt powder remains positive, particularly as global dietary trends shift toward functional and fortified foods. Continued investments in packaging, formulation, and flavor customization are expected to drive long-term growth.

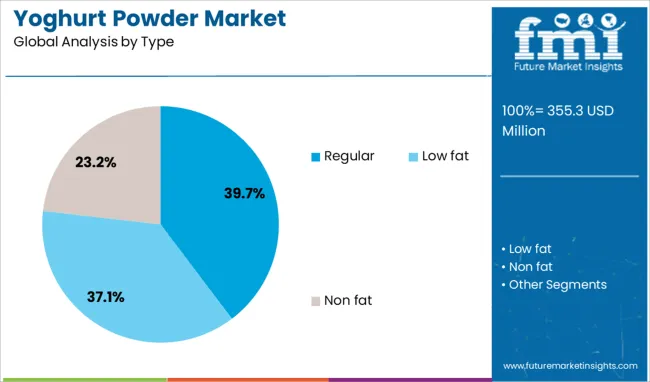

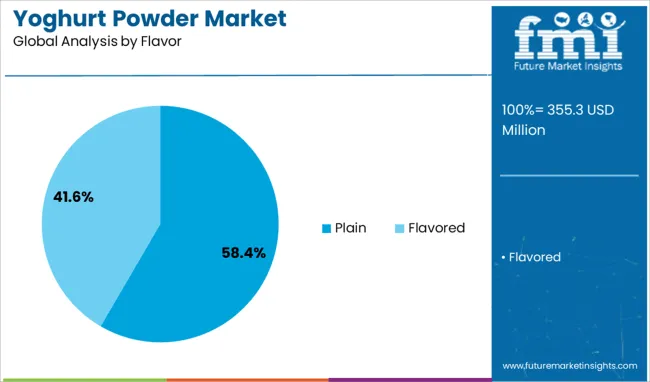

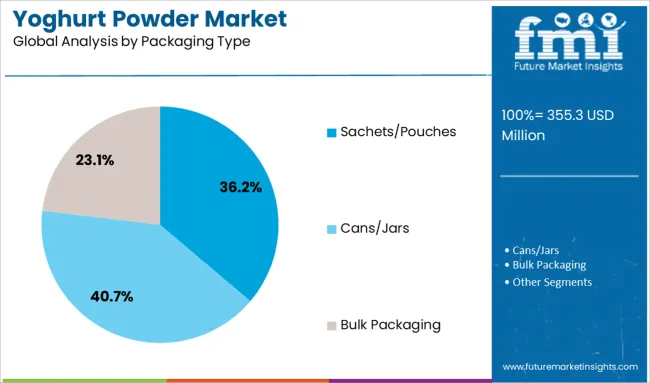

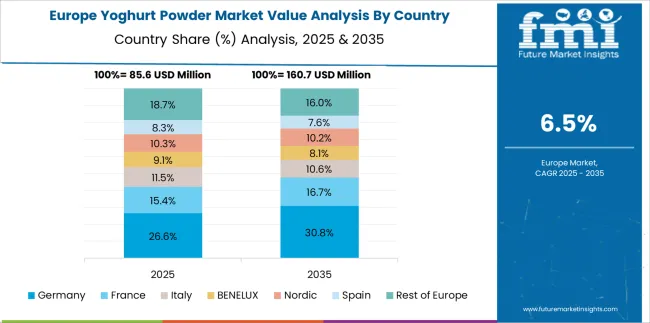

The yoghurt powder market is segmented by type, flavor, packaging type, application, distribution channel and geographic regions. The yoghurt powder market is divided by type into Regular, Low-fat, and Non-fat. In terms of flavor, the yoghurt powder market is classified into Plain and Flavored. Based on the packaging type, the yoghurt powder market is segmented into Sachets/Pouches, Cans/Jars, and Bulk Packaging. By application, the yoghurt powder market is segmented into the Food and Beverage Industry, Nutraceuticals and Dietary Supplements, and Cosmetics and Personal Care Products. The yoghurt powder market is segmented by distribution channel into Supermarkets and Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, and Others. Regionally, the yoghurt powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular segment dominates the type category with a 39.70% market share, largely due to its compatibility with a broad range of end-use applications and favorable cost profile. Regular yoghurt powder is widely utilized in processed food formulations where consistent taste and texture are critical, including sauces, snacks, and baked goods.

Its ease of solubility, neutral flavor profile, and nutritional retention make it a preferred choice among food manufacturers and formulators. This segment benefits from economies of scale and high-volume demand, especially in institutional and bulk food production.

Moreover, the ability to deliver a balance of creaminess and acidity without refrigeration makes regular yoghurt powder highly attractive in emerging markets and remote regions. Its sustained relevance in functional food production and catering services is likely to preserve its lead within the market over the forecast period.

The plain flavor segment commands a leading 58.40% share in the flavor category, driven by its versatility and widespread adoption in both savory and sweet applications. Plain yoghurt powder is favored for its neutral taste, allowing seamless incorporation into customized recipes without conflicting with other ingredient profiles.

It is extensively used in salad dressings, bakery mixes, dips, health drinks, and nutraceutical formulations. The flavor's ability to serve as a base for further customization aligns with the growing trend of personalized nutrition and product diversification.

Additionally, the lack of added sugars or artificial ingredients appeals to health-conscious consumers and formulators seeking clean-label attributes. Continued demand from industrial food processing and emerging applications in the functional food segment are expected to reinforce the plain flavor’s dominance in the global yoghurt powder market.

Sachets and pouches lead the packaging type segment with a 36.20% market share, attributed to their cost-effectiveness, portability, and extended product preservation capabilities. This packaging format is especially popular in developing regions and among on-the-go consumers who prioritize convenience and hygiene.

Sachets and pouches offer efficient portion control and are lightweight, making them suitable for retail and institutional distribution alike. Manufacturers are increasingly opting for flexible packaging solutions that reduce material usage and transportation costs while maintaining product integrity.

In addition to consumer convenience, sachets and pouches also support brand differentiation through innovative designs and resealable features. As sustainability gains prominence in packaging decisions, the development of recyclable and biodegradable pouch formats is expected to further elevate this segment’s appeal and growth in the global yoghurt powder market.

Yoghurt powder is a powdered dairy ingredient produced by dehydrating yoghurt via spray drying or freeze drying. It is used in nutritional supplements, infant formula, bakery mixes, beverages, and foodservice applications. Demand is driven by the need for convenient probiotic delivery, extended shelf life, and easy transport. Manufacturers supplying products with live culture viability, consistent flavor profile, and low moisture content have been well positioned. Formats offering rehydration ease, blend compatibility, and clean ingredient profiles continue to shape procurement decisions among food formulators, supplement producers, and beverage manufacturers.

Adoption of yoghurt powder has been influenced by consumer interest in probiotic-rich formulations and portable nutrition options. Food and beverage processors value the ingredient for its ability to deliver dairy-based benefits within dry blends such as instant drinks, cereal bars, and meal replacements. Shelf stable storage in ambient conditions without refrigeration has supported uptake in regions with limited cold chain. Nutritional advantages such as protein content and live culture activity reinforce appeal among health aware consumers. Demand has been supported by growth in on‑the-go nutrition and convenience food formats. Industrial formulators and delicatessen lines have integrated yoghurt powder to enhance texture, taste and functional value of final products.

Market expansion has been constrained by difficulty in preserving live culture viability during drying and storage. Variability in microbiological stability across batches has impacted shelf life reliability. Ingredient cost has been elevated due to complex drying equipment and energy usage. Regulatory requirements for bacterial count labeling and food safety audits have added compliance overhead for suppliers. Consumer concerns regarding allergen declarations and dairy origin traceability have increased transparency demands. Moisture control during transport and handling is critical to maintain powder quality. Supply chain continuity has been affected by fluctuations in fresh yoghurt availability and seasonal milk supply variations in upstream production.

Opportunities are emerging in development of encapsulated probiotic powders for enhanced culture protection and delivery. Collaboration with nutritional supplement brands and functional food manufacturers allows creation of custom yoghurt powder blends with added vitamins or flavor agents. Expansion into infant formula and clinical nutrition sectors presents high-value pathways. Industrial use in bakery premises, dessert mixes, and snack production lines offers scale potential. Private label partnerships with health food chains and ingredient distributors support recurring procurement. Innovative formats like sachets, instant drink pods, or ready-to-mix cups are gaining traction among on‑the‑go consumers. Product extensions with low‑sugar or plant‑based blends are being explored to address dietary preferences.

The trend toward encapsulation technology has gained momentum to protect bacterial cultures during high-temperature processing and prolong viability. Clean label formulations with minimal additives and clear ingredient sourcing information are increasingly favored. Portable portion sachets and single-serve formats are being used to support home and travel consumption. Development of blends combining yoghurt powder with fiber or protein isolates is influencing functional product design. Supplier traceability certification, batch-level lab validation, and culture strain disclosures are being adopted to build trust with formulators. Nutritional profiling enhancement through fortification with calcium, vitamin D or prebiotics is becoming standard among new offerings. Emphasis on microbiological stability and consumer transparency continues to shape supplier offerings.

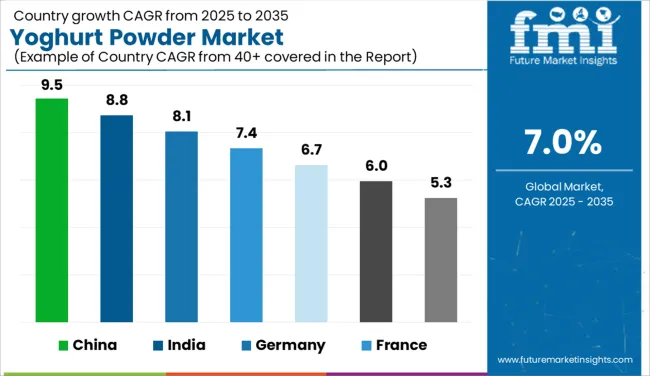

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The yoghurt powder market is projected to grow at a CAGR of 7.0% between 2025 and 2035, driven by demand from functional foods, beverages, and convenience-based formulations. BRICS economies dominate growth, with China leading at 9.5% CAGR, supported by infant nutrition and fortified snacks, and India following at 8.8%, emphasizing long-shelf-life formulations for both urban and rural markets. Among OECD nations, Germany posts 8.1%, focusing on sports nutrition and clean-label bakery mixes, while the United Kingdom records 6.7%, driven by foodservice and home baking demand. The United States grows at 6.0%, supported by ready-to-drink shakes, flavored dairy powders, and functional snacks. The analysis includes over 40 countries, with the top five detailed below.

China is projected to record 9.5% CAGR, driven by strong demand in infant nutrition, functional snacks, and ready-to-drink dairy blends. Yoghurt powder is widely used in instant beverage mixes, confectionery coatings, and bakery fillings due to its versatility and shelf stability. Leading dairy manufacturers are introducing fortified yoghurt powders enriched with vitamins and minerals to attract health-conscious buyers. Online marketplaces, such as major e-commerce platforms, have boosted accessibility for both domestic and imported premium products. The growing popularity of high-protein and low-fat variants among younger consumers is pushing innovation in the segment. The collaborations between domestic dairy producers and global ingredient suppliers have accelerated the development of clean-label and flavored yoghurt powders, expanding their application in beverages, health foods, and packaged snacks.

India is forecast to achieve an 8.8% CAGR, supported by a growing preference for convenience foods and functional nutrition products. Yoghurt powder adoption is expanding in packaged dessert mixes, bakery formulations, and flavored beverages targeted at health-conscious consumers. Manufacturers are emphasizing probiotic-rich and protein-enriched formulations to attract premium buyers. Affordable, long-shelf-life yoghurt powders are gaining traction in rural areas where cold chain limitations restrict fresh dairy options. Quick-service restaurants and cafes are leveraging yoghurt powder for standardized sauces and dips in value menus. Domestic brands are focusing on innovative flavors infused with regional spices to differentiate products in competitive retail markets.

Germany is projected to post an 8.1% CAGR, driven by high demand for protein-enriched food and clean-label bakery products. Yoghurt powder is extensively used in sports nutrition products, functional drinks, and ready-to-mix beverages for athletes and active consumers. Manufacturers are introducing lactose-free and organic-certified variants to cater to evolving dietary requirements. Premium yoghurt powders with improved solubility are being integrated into nutritional bars and meal replacement formulas. The bakery and confectionery sectors are adopting yoghurt powder to enhance texture and flavor in premium dessert lines. Retailers and e-commerce platforms are expanding assortments for home baking kits and fitness-focused ingredients.

The United Kingdom is expected to grow at a 6.7% CAGR, driven by the adoption of yoghurt powder in bakery mixes, ready-to-mix dessert bases, and convenience foods. Health-conscious consumers are influencing innovation in low-fat and reduced-sugar yoghurt powder formulations for retail and foodservice applications. Food manufacturers are using yoghurt powder to enhance flavor and shelf stability in snacks and beverages. Restaurants and cafes rely on yoghurt powder for consistent preparation of sauces, dips, and frozen dessert bases. E-commerce platforms and supermarkets are expanding access to private-label and premium international brands.

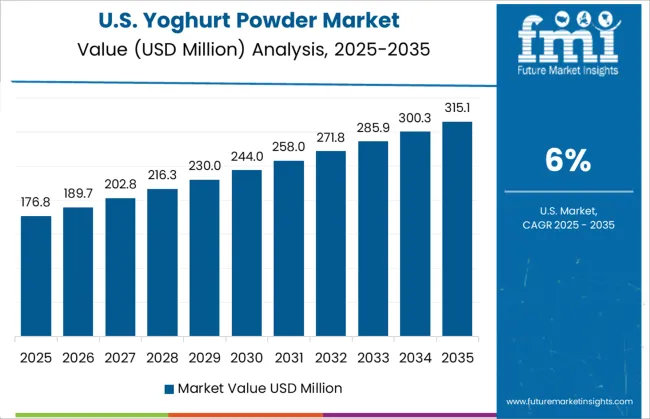

The United States is projected to grow at a 6.0% CAGR, supported by strong demand for protein-rich snacks, flavored beverage powders, and meal replacements. Yoghurt powder is widely utilized in ready-to-drink shakes, functional smoothies, and high-protein bars catering to active lifestyles. Manufacturers are introducing clean-label and probiotic-enriched variants to align with consumer preferences for health and transparency. Hybrid dairy-plant blends are gaining traction among flexitarian consumers. Direct-to-consumer brands are adopting subscription-based models for premium functional ingredient blends, including yoghurt powder.

The yoghurt powder market is dominated by multinational dairy and ingredient companies such as Nestlé S.A., Danone S.A., General Mills, Inc., Yakult Honsha Co., Ltd., FrieslandCampina N.V., The Kraft Heinz Company, Chobani, LLC, Lactalis Group, Kerry Group plc, Agrana Beteiligungs-AG, Morinaga Milk Industry Co., Ltd., Alpro (part of Danone), Schreiber Foods Inc., Almira Holding A., and Chr. Hansen Holding A/S. Leading players like Nestlé, Danone, and FrieslandCampina maintain strong positions through extensive product portfolios and global distribution networks, offering yoghurt powder for beverages, snacks, bakery, and instant food formulations.

Kerry Group and Agrana emphasize functional and flavor-enhanced yoghurt powders designed for applications in health-focused and fortified foods. Chr. Hansen contributes by providing specialized cultures and ingredients that enhance the quality of yoghurt-based powders, while Yakult Honsha and Chobani leverage their expertise in probiotics to develop powders with digestive health benefits. Market competition is characterized by high entry barriers due to regulatory compliance, advanced drying technologies, and stringent quality standards for dairy powders.

Differentiation is driven by factors such as protein content, solubility, heat stability, and flavor retention during processing. Strategic initiatives by leading firms include capacity expansion, introduction of organic and plant-based variants, and partnerships with food manufacturers for innovative product applications. Future competitiveness will focus on low-fat and sugar-reduced yoghurt powders, probiotics integration, and premium clean-label offerings to meet evolving consumer preferences. Companies investing in advanced spray-drying technologies, flavor encapsulation, and supply chain optimization are expected to gain a significant edge in this market.

The yogurt powder market has experienced significant advancements driven by demand for convenient, shelf-stable dairy ingredients with high nutritional value. Manufacturers are introducing flavored and functional variants to cater to food, beverage, and dietary supplement applications. Innovations in spray-drying and freeze-drying technologies are improving nutrient retention, flavor stability, and solubility. Growing adoption in regions with expanding food processing industries is accelerating market growth. Additionally, developments in powder processing techniques are enhancing product consistency and versatility, making yogurt powder a preferred choice for applications in bakery, confectionery, sports nutrition, and instant beverage formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 355.3 Million |

| Type | Regular, Low fat, and Non fat |

| Flavor | Plain and Flavored |

| Packaging Type | Sachets/Pouches, Cans/Jars, and Bulk Packaging |

| Application | Food and Beverage Industry, Nutraceuticals and Dietary Supplements, and Cosmetics and Personal Care Products |

| Distribution Channel | Supermarkets and Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., Danone S.A., General Mills, Inc., Yakult Honsha Co., Ltd., FrieslandCampina N.V., The Kraft Heinz Company, Chobani, LLC, Lactalis Group, Kerry Group plc, Agrana Beteiligungs-AG, Morinaga Milk Industry Co., Ltd., Alpro (Part of Danone), Schreiber Foods Inc., Almira Holding A., and Chr. Hansen Holding A/S |

| Additional Attributes | Dollar sales by product type (full-fat, low-fat, skimmed, probiotic-enriched) and end-use application (bakery, confectionery, beverages, snacks, dietary supplements), with demand driven by convenience, nutritional fortification, and functional food trends. Regional dynamics indicate strong growth in North America and Europe due to health-conscious consumer behavior, while Asia-Pacific leads in volume consumption driven by rising dairy-based product demand. Innovation trends include probiotic-fortified yoghurt powders, organic variants, and instant-soluble formulations tailored for on-the-go functional foods and beverages. |

The global yoghurt powder market is estimated to be valued at USD 355.3 million in 2025.

The market size for the yoghurt powder market is projected to reach USD 698.9 million by 2035.

The yoghurt powder market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in yoghurt powder market are regular, low fat and non fat.

In terms of flavor, plain segment to command 58.4% share in the yoghurt powder market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA