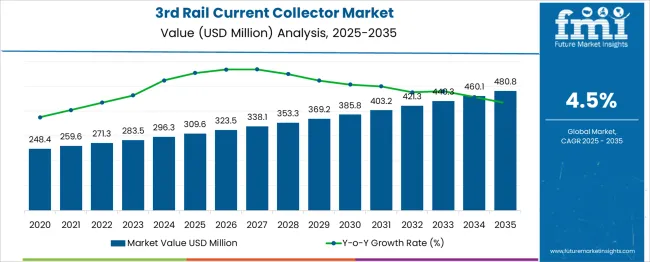

The 3rd Rail Current Collector Market is estimated to be valued at USD 309.6 million in 2025 and is projected to reach USD 480.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

From 2025 to 2030, the market increases to USD 385.8 million, registering a five-year gain of USD 76.2 million. Year-over-year growth remains steady: +4.5% in 2026 (USD 323.5 million), 2027 (USD 338.1 million), 2028 (USD 353.3 million), 2029 (USD 369.2 million), and 2030 (USD 385.8 million).

Growth is driven by the steady expansion of mass transit networks in urban corridors where third rail systems provide compact, high-reliability power transfer for metros and suburban trains. Beyond numerical growth, the market benefits from upgrades to collector technology and regulatory standardization. According to the IEEE Transportation Electrification journal, operators are transitioning from traditional steel-carbon shoes to composite materials that minimize arcing and wear.

UIC-compliant systems with integrated condition monitoring are gaining traction due to rising operational safety requirements. Innovations in self-lubricating and low-friction shoegear reduce maintenance downtime. Governments in Europe and Asia are increasingly prioritizing electrified transit to meet decarbonization goals, which positions third rail systems and by extension, current collectors—as durable, long-term investments in high-density transportation infrastructure.

| Metric | Value |

|---|---|

| 3rd Rail Current Collector Market Estimated Value in (2025 E) | USD 309.6 million |

| 3rd Rail Current Collector Market Forecast Value in (2035 F) | USD 480.8 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

In the 3rd Rail Current Collector market, manufacturers differentiate themselves by targeting quantifiable performance outcomes and operational cost savings. For instance, collectors with an average service life exceeding 1.2 million kilometers before replacement are favored by transit agencies aiming to reduce lifecycle costs by up to 30%. Low-friction materials and optimized contact forces typically maintained between 80 to 120 N are engineered to minimize wear on both the collector and the rail, directly reducing maintenance frequency by 20–25% compared to standard systems.

Customization also plays a central role; over 60% of procurement contracts specify non-standard configurations tailored to rail geometry, climate resilience, and voltage variation (commonly ranging from 750V DC to 1,500V DC). Market leaders often secure multi-year contracts valued between $10M–$50M, bundling supply with technical support, training, and predictive maintenance solutions.

Integration of sensor-based diagnostics has become more widespread, with an estimated 40% of new installations now including real-time monitoring capabilities, which can cut unplanned downtime by up to 40%. Furthermore, regional diversification strategies, especially in Asia-Pacific, which accounts for over 35% of new rail infrastructure investments, allow manufacturers to capture demand surges while mitigating dependence on mature Western markets. These data-driven strategies form the backbone of competitive positioning in this niche, which is a crucial rail component market.

The 3rd rail current collector market is advancing steadily due to increasing global investments in railway electrification, particularly across metropolitan transit and urban rapid transit systems. Governments and railway authorities are prioritizing upgrades to aging infrastructure while expanding mass transit capabilities, which has amplified demand for reliable current collection systems.

The adoption of third rail systems is being reinforced by their compact design, cost efficiency, and adaptability in underground and elevated rail configurations. Innovations in material science and power transfer efficiency, along with growing emphasis on passenger safety, are further promoting next-generation collector systems.

As rail operators seek to reduce maintenance intervals and enhance energy efficiency, the integration of real-time monitoring and improved contact performance in current collectors is gaining traction. With the global rail sector targeting sustainability and operational optimization, the 3rd rail current collector market is expected to see continued growth through smart electrification projects, public-private collaborations, and the rollout of new metro corridors across both developed and emerging regions.

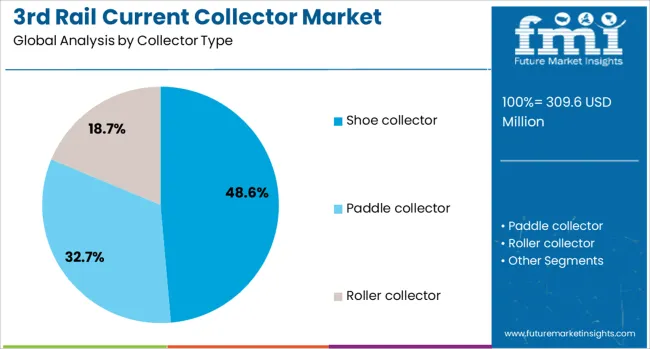

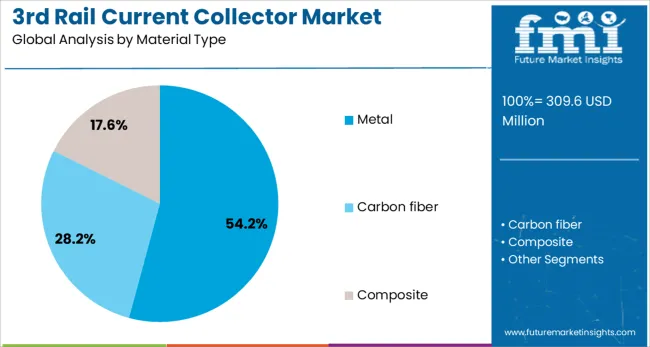

The 3rd rail current collector market is segmented by collector type, material type, rail contact position, speed category, sales channel, application type, end user, and geographic regions. By collector type, the 3rd rail current collector market is divided into Shoe collector, Paddle collector, and Roller collector. In terms of material type, the 3rd rail current collector market is classified into Metal, Carbon fiber, and Composite.

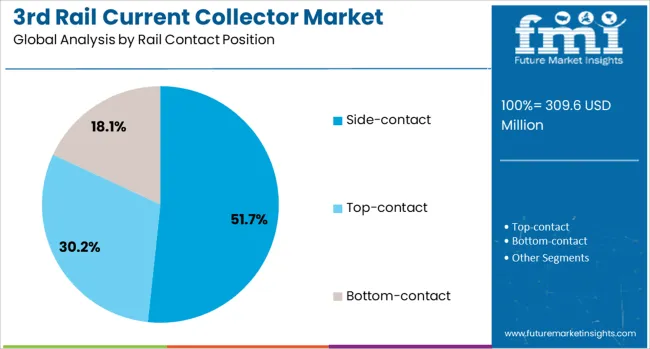

Based on the rail contact position of the 3rd rail current collector, the market is segmented into Side-contact, Top-contact, and Bottom-contact. By speed category, the 3rd rail current collector market is segmented into Medium-speed vehicles (50-100 km), Low-speed vehicles (up to 50 km), and High-speed vehicles (Above 100 km). The sales channel of the 3rd rail current collector market is segmented into OEM and Aftermarket. By application type, the 3rd rail current collector market is segmented into Subway/metro system, Light rail system, Commuter rail network, and Industrial application.

End user segments the 3rd rail current collector market into Public transportation authorities, Private rail operators, and Industrial users. Regionally, the 3rd rail current collector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shoe collector segment is projected to hold 48.6% of the revenue share in the 3rd rail current collector market in 2025, reflecting its foundational role in third rail power delivery. This dominance is being driven by the proven mechanical simplicity and durability of shoe-based systems, which continue to be the preferred solution for established metro and suburban networks.

Shoe collectors are valued for their consistent contact with the power rail under various environmental and speed conditions, which enhances power transfer reliability. Advancements in wear-resistant contact materials and adaptive mounting technologies have improved the service life of shoe collectors while supporting easier integration into both new and retrofitted trainsets.

The low maintenance requirements and operational stability provided by shoe collectors are key factors supporting their widespread adoption. Their compatibility with traditional third rail infrastructure, along with favorable cost-performance characteristics, has allowed operators to prioritize this segment for electrification projects across Asia, Europe, and North America.

The metal segment is expected to contribute 54.2% of the overall revenue in the 3rd rail current collector market in 2025. This segment's leadership is supported by the superior conductivity, thermal resistance, and mechanical strength of metallic materials, which are critical for consistent power transmission in high-load rail systems. Metal collectors have demonstrated prolonged operational reliability in demanding environments, particularly where fluctuating temperatures and mechanical vibrations are common.

Enhanced corrosion resistance and structural durability have allowed metal components to meet the safety and lifespan expectations of public rail operators. Recent developments in alloy composition and surface treatments have further optimized current flow efficiency and minimized electrical losses.

These advancements have made metal the material of choice for systems requiring stable, long-duration service with minimal risk of performance degradation. As the global rail sector continues its shift toward durable and maintenance-efficient components, the dominance of metal materials in current collector applications is anticipated to remain firmly intact.

The side contact segment is projected to account for 51.7% of the 3rd rail current collector market’s revenue share in 2025, highlighting its growing preference across urban rail networks. This segment’s growth has been influenced by its enhanced safety profile, reduced exposure to debris, and stable power collection under various environmental conditions.

Side contact designs are particularly well-suited to confined rail corridors and urban infrastructure, where vertical clearance is limited and top contact designs pose a greater risk of contamination or mechanical wear. Improvements in side-mounted insulation, wear monitoring, and shock resistance have contributed to the increased reliability of these systems.

The ability to maintain consistent power connectivity despite rail misalignments or track variations has positioned side contact collectors as a robust choice for new transit line installations. Moreover, the modular design and ease of maintenance associated with side contact systems have strengthened their appeal for operators looking to minimize downtime and lifecycle costs.

Metro rail expansion and replacement of legacy electrification systems continue to push demand for 3rd rail current collectors. Product enhancements in contact design and materials support broader adoption across modern transit systems.

Rail operators are steadily expanding and modernizing urban metro systems, directly increasing the need for reliable third rail power collection. 3rd rail current collectors ensure uninterrupted power transmission across high-frequency service routes, making them essential for new installations and maintenance cycles. Many transit authorities are phasing out aging components, replacing them with newer collector units compatible with aluminum and composite third rails. These upgrades support lower energy loss and reduced system downtime. Shoe-type collectors remain preferred due to their operational simplicity and compatibility with both elevated and underground rail networks. Rail networks in Asia and Europe are showing particular interest in side and bottom contact systems that support safer and more compact infrastructure. Collectors with robust arc resistance and minimal wear outperform traditional options, especially in high-traffic applications. This growing focus on reliability and longevity directly fuels investment in advanced collector assemblies.

Suppliers are refining collector systems by focusing on both materials and contact mechanisms. Steel shoes with composite or graphite inserts help minimize wear and ensure consistent power flow across long service intervals. These improvements are especially important in high-speed or high-frequency transit routes where performance stability matters. Side-contact and bottom-contact collectors gain popularity where environmental exposure or passenger safety rules require shielded systems. Manufacturers are offering modular collector packages that combine mounting arms, insulators, and replacement parts for easy installation or retrofitting. Some operators now specify lighter, corrosion-resistant units that reduce strain on rail components and simplify maintenance. These performance-focused upgrades give operators greater control over cost and reliability, especially during system expansions or technology shifts. The market benefits from this hands-on approach to product development, where operational needs directly shape collector system design.

Urban rail systems operating frequent trains place high mechanical and electrical stress on third rail current collectors. Contact shoes wear rapidly under heavy load and repeated engagement, which increases replacement intervals and raises maintenance costs. In networks where trains operate at headways under two minutes, regular shoe replacement and alignment checks become operational burdens. In fair-weather climate zones, abrasion accelerates degradation. Without advanced materials or self-lubricating shoe designs, rail authorities face unexpected downtime. Poor contact also increases sparking and energy loss. Consistency in spring tension and precise shoe alignment across all cars is essential for uninterrupted power transfer. Inadequate design or material limits impact reliability and can trigger service disruptions creating operational challenges for transit agencies seeking uninterrupted commuter service and tighter scheduling compliance.

Advancements in prime conductor materials and embedded diagnostics are reshaping third rail collector performance expectations. New collector shoe materials incorporating copper-graphite composites, carbon modules, or self-lubricating polymers enhance wear resistance, reduce sparking, and ensure lower contact resistance under variable rail pressure. Spring-loaded mechanisms and articulated mounting improve alignment stability across dynamic track conditions. At the same time, smart collectors integrate IoT sensors capable of tracking wear rates, arcing events, and alignment status in real time. These analytics-driven maintenance systems improve uptime by enabling predictive replacements before failure. In cold or icy climates, engineered heating and ice-scraping shoe designs ensure uninterrupted service. These technology upgrades broaden adoption among transit systems, prioritizing reliability, energy efficiency, and maintenance transparency.

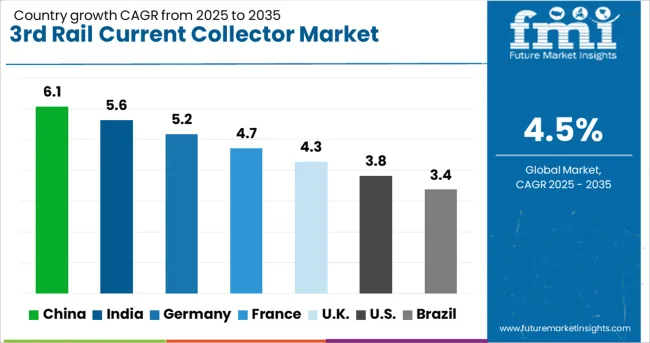

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global 3rd Rail Current Collector Market is projected to grow at a steady CAGR of 4.5% through 2035, driven by increased deployment in metro rail networks, suburban transit systems, and electric rail infrastructure. Among BRICS nations, China leads with 6.1% growth, supported by large-scale railway expansions and sustained investment in public transit. India follows at 5.6%, where regional rail corridors and urban transport upgrades have accelerated procurement activity.

In the OECD region, Germany shows 5.2% growth, aided by modernization of electrified rail systems and standardization in collector designs. France, growing at 4.7%, has benefited from long-term infrastructure maintenance programs and steady component replacement cycles. The United Kingdom, at 4.3%, reflects consistent retrofitting activity across legacy systems and gradual system upgrades. Market shifts have been shaped by rolling stock replacement rates, safety standards, and procurement schedules in state-led rail programs. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The 3rd rail current collector market in China is expanding at a CAGR of 6.1%, supported by metro rail additions, test line development, and continuous upgrades to intercity connections. Dual-arm collector heads are being installed in new rail vehicles to enable consistent current pickup under varying rail geometries. Abrasion-resistant materials are being specified in collector shoes to address accelerated wear caused by high-frequency service patterns. Modular mounting systems have been supplied to allow faster integration during carriage assembly.

Sliding contact interfaces with reduced spark emission are being adopted in dense city routes. Regional rail agencies have ordered standardized collector types to simplify maintenance logistics. Trainsets operating in coastal provinces are being equipped with sealed collector enclosures to avoid corrosion exposure. Domestic firms have been tasked with producing region-specific collector assemblies designed to match environmental and voltage parameters in newly electrified sections.

In India, the 3rd rail current collector market is advancing at a CAGR of 5.6%, driven by mass transit deployments across Tier 1 and Tier 2 cities and retrofits of aging suburban EMUs. Collector arms with reinforced joint mechanisms are being deployed in metros where curve radii and alignment shifts are frequent. Shoegear designs with high-wear contact plates are being selected to extend service intervals in busy urban corridors. Compatibility with regenerative braking units has been mandated in newer collector specifications issued by metropolitan transport bodies.

Workshops managed by public transit corporations have been authorized to conduct part replacement and refurbishment. Testing facilities have introduced vibration and wear simulations to assess collector fatigue under elevated temperature and dust exposure. Local fabricators have begun assembling collector modules with fast-change features to reduce track downtime during operational hours.

3rd rail current collector market in Germany is being developed at a CAGR of 5.2%, aided by commuter train refurbishments, light metro extensions, and tunnel system upgrades. Collector heads with thermal-buffered housings are being supplied to reduce performance shifts caused by ambient temperature variation. Stainless steel shoes are being selected for their ability to maintain contact stability over prolonged duty cycles. Maintenance divisions have initiated condition-monitoring trials using vibration and arc frequency data from in-service collector units.

Retrofit programs have targeted regional networks in older districts where replacement of full electrical infrastructure has not yet been prioritized. Train control systems are being calibrated to adapt current draw based on collector shoe health and contact angle. Suppliers have responded by offering collector heads with adjustable spring force settings to better suit line-specific requirements.

France is observing a CAGR of 4.7% in its 3rd rail current collector market, supported by enhancements in metro rolling stock, suburban line automation, and regional modernization plans. Collector units with compact footprints are being adopted to meet clearance constraints in aging underground tunnels. Wear-resistant inserts have been installed on collector shoes operating in wet-weather and high-contamination zones. Energy transmission faults caused by intermittent rail contact have been addressed using multi-point current pickup designs.

Waterproofing features are being applied to collector arms positioned near trackside drainage systems. Provincial transit authorities have selected collector formats that enable rapid shoe exchange with limited undercarriage access. Testing has been conducted to assess reliability across platforms with high-speed entries and exits. Several transit units have been retrofitted using collector configurations with reinforced lateral guides to prevent derailment under lateral force.

The 3rd rail current collector market in the United Kingdom is progressing at a CAGR of 4.3%, with emphasis placed on legacy commuter networks, Southern and Southeastern rail lines, and regional modernization programs. Collector assemblies featuring spring-loaded shoe mechanisms are being retrofitted to maintain consistent rail engagement along older curved alignments.

Corrosion-resistant coatings are being applied to collector brackets and shoe plates used in coastal routes. Replacement cycles have been shortened due to increased train frequency across key commuter segments. Transit authorities have issued design guidelines requiring improved electrical arc resistance and simplified mounting compatibility. Components with modular construction are being installed to minimize overhaul time. Domestic refurbishment depots have received authorization to test shoe conductivity and spring tension as part of inspection protocols.

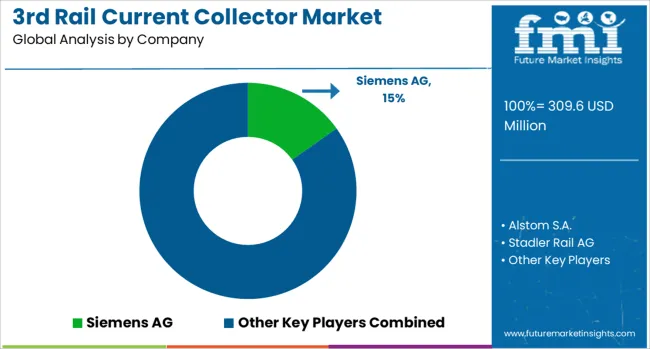

The 3rd rail current collector market plays a critical role in the electrification of rail transit systems, particularly within high-density urban and suburban networks. It is composed of a mix of global OEMs, specialist component manufacturers, and system integrators, categorized by their technological capabilities and application focus.

Tier 1 suppliers, including Siemens AG, Alstom S.A., and Stadler Rail AG, dominate the market by offering fully integrated third rail systems—combining current collectors with power rails, insulation, and mounting hardware. Their products are widely used in metro, light rail, and commuter lines worldwide, favored for their proven reliability, long lifecycle performance, and compatibility with advanced signaling and control systems.

These companies often work closely with transit authorities to deliver turnkey electrification solutions optimized for high-capacity, high-frequency operation in challenging environments. Supporting these systems are Tier 2 suppliers like Kawasaki Heavy Industries, Ltd., The Schunk Group, and Mersen Group, which specialize in durable contact shoes, spring assemblies, and other critical components that ensure stable power transfer under various speeds and climate conditions.

Their engineering-grade materials and expertise in arc resistance, wear mitigation, and current continuity are essential in both new installations and retrofits. Tier 3 companies such as Pandrol (Delachaux Group), Morgan Advanced Materials, Balfour Beatty plc, RENK Group AG, and HALL Industries, Inc. contribute through tailored assemblies, rail-mounted hardware, and regional project support. Their adaptability in customizing collectors to fit diverse rail geometries and electrification standards makes them valuable partners in maintaining and expanding existing networks.

On September 23, 2024, Siemens Mobility launched Signaling X at InnoTrans 2024, a cloud-based signaling platform offering 30% energy savings and 20% efficiency gains via ATO over ETCS, as mentioned in Siemens's Press Release.

| Item | Value |

|---|---|

| Quantitative Units | USD 309.6 Million |

| Collector Type | Shoe collector, Paddle collector, and Roller collector |

| Material Type | Metal, Carbon fiber, and Composite |

| Rail Contact Position | Side-contact, Top-contact, and Bottom-contact |

| Speed Category | Medium-speed vehicles (50-100 km), Low-speed vehicles (up to 50 km), and High-speed vehicles (Above 100 km) |

| Sales Channel | OEM and Aftermarket |

| Application Type | Subway/metro system, Light rail system, Commuter rail network, and Industrial application |

| End User | Public transportation authorities, Private rail operators, and Industrial users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens AG, Alstom S.A., Stadler Rail AG, Kawasaki Heavy Industries, Ltd., Schunk Group, Mersen Group, Pandrol (Delachaux Group), Morgan Advanced Materials, Balfour Beatty plc, RENK Group AG, and HALL Industries, Inc. |

| Additional Attributes | Dollar sales by collector type show shoe collectors leading due to durability and metro compatibility, followed by paddle and roller variants. Demand is highest in subway systems, especially across Asia-Pacific. Growth is fueled by rail electrification, smart transit integration, and innovations in self-lubricating, weather-resistant, and sensor-enabled current collection systems. |

The global 3rd rail current collector market is estimated to be valued at USD 309.6 million in 2025.

The market size for the 3rd rail current collector market is projected to reach USD 480.8 million by 2035.

The 3rd rail current collector market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in 3rd rail current collector market are shoe collector, paddle collector and roller collector.

In terms of material type, metal segment to command 54.2% share in the 3rd rail current collector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA