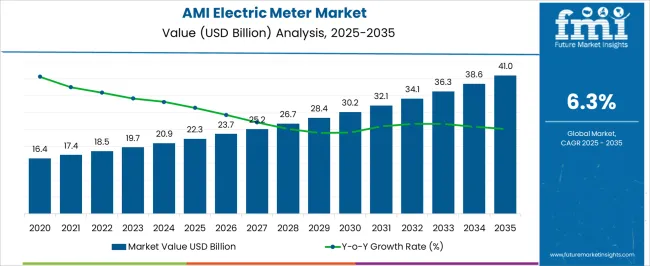

The AMI electric meter market is estimated to be valued at USD 22.3 billion in 2025 and is projected to reach USD 41.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The absolute dollar opportunity over this period is USD 18.7 billion, representing the additional revenue potential from 2025 to 2035. This growth reflects increasing adoption of advanced metering infrastructure and rising demand for efficient electricity management solutions. Companies can capitalize on this opportunity by expanding production capacity, strengthening distribution networks, and targeting high-growth regions. The substantial market expansion provides a clear financial incentive for strategic investment and long-term planning. From a business perspective, the USD 18.7 billion absolute dollar opportunity highlights significant revenue potential for both established players and new entrants.

With the market gradually increasing from USD 22.3 billion in 2025 to USD 41.0 billion in 2035 at a CAGR of 6.3%, firms can plan phased investments and scale operations strategically. By focusing on key regions, optimizing supply chains, and improving product accessibility, stakeholders can capture incremental revenue. This predictable growth trajectory allows companies to strengthen market positioning, expand customer base, and achieve sustained profitability over the ten-year period.

| Metric | Value |

|---|---|

| AMI Electric Meter Market Estimated Value in (2025 E) | USD 22.3 billion |

| AMI Electric Meter Market Forecast Value in (2035 F) | USD 41.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

A breakpoint analysis for the AMI electric meter market highlights key thresholds where growth accelerates or strategic adjustments are needed. With the market valued at USD 22.3 billion in 2025 and projected to reach USD 41.0 billion by 2035 at a CAGR of 6.3%, early breakpoints occur around USD 26.7–28.4 billion. These levels represent the initial phase of significant market expansion, driven by growing demand for advanced metering solutions. Recognizing these breakpoints allows companies to prioritize investments, expand production capacity, and strengthen distribution networks to capture incremental revenue during periods of accelerated growth. Later-stage breakpoints appear between USD 34.1–38.6 billion as the market approaches maturity and competition intensifies.

Surpassing these thresholds may require businesses to refine pricing strategies, optimize operational efficiency, and enhance customer engagement to sustain growth momentum. Monitoring these breakpoints ensures companies can anticipate shifts in market dynamics and adjust production, marketing, and distribution strategies accordingly. By aligning strategic actions with these critical thresholds, stakeholders can maximize revenue potential, reinforce market positioning, and navigate the steady growth trajectory from 2025 to 2035 with informed precision.

The market is witnessing substantial growth driven by the increasing demand for smart grid technologies and enhanced energy management solutions. Growing urbanization, rising electricity consumption, and the global push toward energy efficiency have significantly contributed to market expansion.

Investments in modernizing utility infrastructure and government initiatives supporting smart metering are also shaping the market's future outlook. The integration of advanced communication technologies and real-time data analytics in electric meters is enabling utilities to improve operational efficiency, reduce energy losses, and enhance customer engagement.

Additionally, increasing consumer awareness about energy conservation and the growing adoption of renewable energy sources are creating further growth opportunities The market is expected to continue evolving with innovations focused on interoperability, cybersecurity, and scalable deployments in both urban and rural settings.

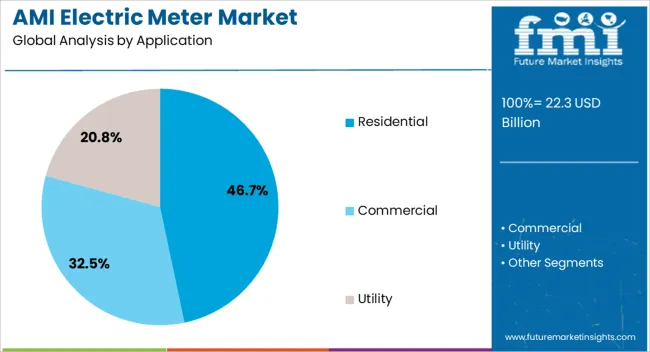

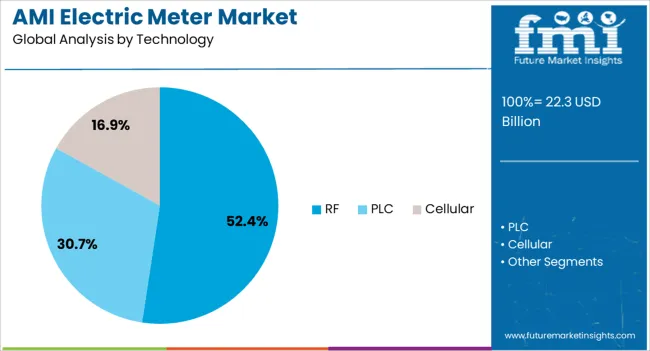

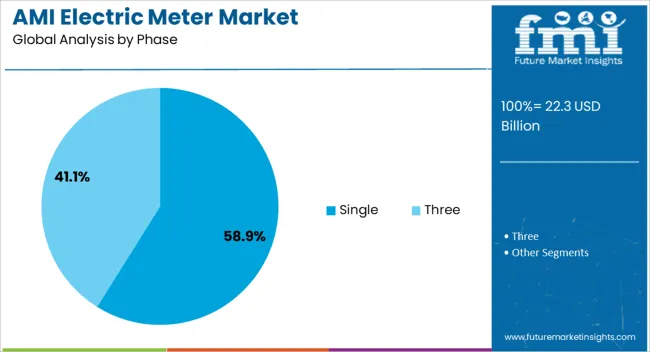

The ami electric meter market is segmented by application, technology, phase, and geographic regions. By application, ami electric meter market is divided into residential, commercial, and utility. In terms of technology, ami electric meter market is classified into RF, PLC, and cellular. Based on phase, ami electric meter market is segmented into single and three. Regionally, the ami electric meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The residential application segment is projected to hold 46.7% of the AMI electric meter market revenue share in 2025, making it the largest application segment. This prominence is primarily attributed to the growing adoption of smart meters by households aiming to monitor and manage electricity consumption more effectively.

Increasing urbanization and expanding residential infrastructure in emerging economies have driven demand in this segment. The ability to provide real-time consumption data and support dynamic pricing models has enhanced consumer awareness and promoted energy-saving behaviors.

Additionally, government policies encouraging smart grid deployments and utility-led programs targeting residential consumers have accelerated market penetration The focus on reducing electricity theft and improving billing accuracy in the residential sector has further reinforced the growth of this segment.

The RF technology segment is expected to account for 52.4% of the overall market revenue share in 2025, establishing it as the leading technology segment. This dominance is owed to RF’s reliability in wireless communication, ease of deployment, and scalability in smart metering networks.

RF technology facilitates efficient data transmission over wide areas, enabling utilities to monitor and control meters remotely without the need for extensive physical infrastructure. Its compatibility with various network architectures and ability to support large numbers of endpoints make it highly suitable for both urban and rural implementations.

The growing emphasis on real-time data acquisition and remote diagnostics in smart grid initiatives has further propelled the adoption of RF technology The cost-effectiveness and maturity of RF communication systems have also contributed to their leading position in the market.

The single phase segment is anticipated to hold 58.9% of the market revenue share in 2025, positioning it as the dominant phase segment. This leading share is primarily driven by the widespread use of single phase electric meters in residential and small commercial applications, where power requirements are relatively lower compared to three phase systems.

The simplicity, cost efficiency, and ease of installation associated with single phase meters have encouraged their preference in expanding urban and suburban residential areas. Additionally, the increasing deployment of smart meters for household energy monitoring and demand response programs has boosted demand in this segment.

The compatibility of single phase meters with renewable energy sources, such as rooftop solar, and their ability to provide accurate consumption data are further factors supporting their growth in the market.

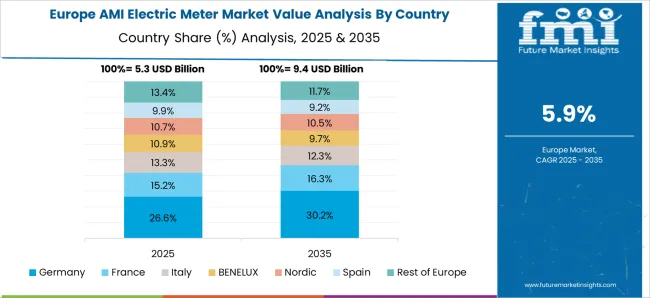

The AMI electric meter market is expanding due to growing smart grid initiatives, rising electricity consumption monitoring, and regulatory mandates for energy efficiency. North America and Europe lead with advanced meters integrating real-time data, remote reading, and predictive analytics. Asia-Pacific shows rapid growth driven by expanding electrification, smart city programs, and utility modernization projects. Manufacturers differentiate through communication protocols, accuracy, durability, and cybersecurity features. Regional variations in regulatory frameworks, network readiness, and consumer adoption influence deployment strategies, pricing, and competitiveness globally.

AMI electric meters vary in measurement precision, data communication technology, and compatibility with utility networks. Europe and North America emphasize high-accuracy meters with two-way communication, IoT integration, and secure remote monitoring, supporting reliable billing and energy management. Asia-Pacific markets often adopt cost-effective, standardized meters compatible with expanding smart grid networks. Differences in communication protocols and accuracy affect operational efficiency, data reliability, and adoption speed. Leading suppliers provide advanced, network-integrated meters with predictive analytics, while regional manufacturers offer affordable, functional solutions. These contrasts influence regional deployment, utility confidence, and competitive positioning in mature and emerging markets.

AMI meter deployment is closely tied to smart grid integration, including automated demand response, outage detection, and analytics platforms. North America and Europe prioritize meters that seamlessly connect with utility management systems for real-time monitoring and grid optimization. Asia-Pacific adoption focuses on large-scale deployment and compatibility with basic grid automation, often prioritizing affordability over advanced features. Differences in integration capabilities impact energy management, operational efficiency, and return on investment. Suppliers offering fully integrated, scalable solutions gain competitive advantages, whereas regional providers deliver simplified systems for cost-sensitive markets. Integration contrasts determine adoption rates, project feasibility, and long-term smart grid success across regions.

Government regulations, energy efficiency standards, and utility policies heavily affect AMI meter adoption. Europe and North America have stringent mandates for smart meter deployment, data security, and energy monitoring compliance. Asia-Pacific regulations vary, with incentives and targets encouraging adoption primarily in urban and industrial areas. Differences in regulatory frameworks impact meter selection, project approvals, and financing models. Suppliers ensuring compliance gain access to high-value contracts, while regional manufacturers target budget-conscious municipal and utility clients. Regulatory contrasts shape adoption speed, market accessibility, and competitive positioning in global and regional energy management markets.

AMI electric meters are deployed through direct OEM sales, utility contracts, distributors, and integrators. North America and Europe rely on long-term utility partnerships, turnkey solutions, and service agreements for smooth installation and maintenance. Asia-Pacific markets utilize regional distributors, local suppliers, and government-supported deployment programs to expand coverage. Differences in distribution strategies affect market penetration, installation efficiency, and post-sale support. Leading suppliers leverage multi-channel approaches with training and technical support, while regional providers focus on accessible, cost-effective deployment. Distribution contrasts directly influence adoption rates, customer satisfaction, and regional competitiveness in smart meter implementation.

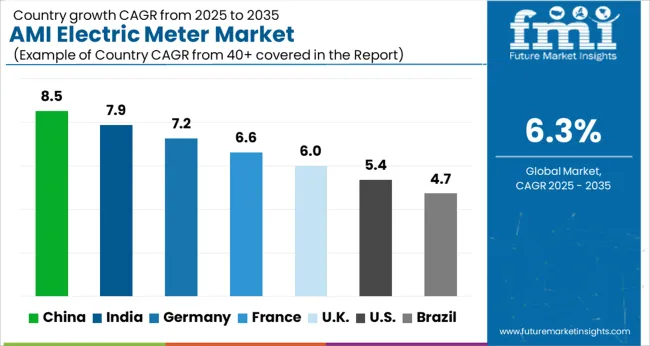

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global AMI (Advanced Metering Infrastructure) electric meter market was projected to grow at a 6.3% CAGR through 2035, driven by demand in smart energy management, utility monitoring, and residential and commercial metering applications. Among BRICS nations, China recorded 8.5% growth as large-scale production and deployment facilities were commissioned and compliance with electrical and safety standards was enforced, while India at 7.9% growth saw expansion of manufacturing units to meet rising regional adoption of smart metering solutions. In the OECD region, Germany at 7.2% maintained substantial output under strict industrial and utility regulations, while the United Kingdom at 6.0% relied on moderate-scale operations for smart electricity management projects. The USA, expanding at 5.4%, remained a mature market with steady demand across residential, commercial, and municipal segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

AMI electric meter market in China is growing at a CAGR of 8.5%. Between 2020 and 2024, growth was driven by rising urbanization, smart grid initiatives, and government policies promoting digital energy management. Utilities adopted advanced metering infrastructure to improve billing accuracy, reduce losses, and enable real-time monitoring. Manufacturers focused on high-precision, durable, and IoT-enabled meters. In the forecast period 2025 to 2035, growth is expected to accelerate with deployment of smart, connected, and cloud-integrated meters across urban and industrial areas. Expansion of renewable energy projects, energy efficiency programs, and rising industrial electricity demand will further support market growth. China remains a leading market due to rapid urban development, large power distribution networks, and government-backed smart grid initiatives.

AMI electric meter market in India is growing at a CAGR of 7.9%. Historical period 2020 to 2024 saw growth supported by rising urban and industrial electricity demand, smart grid programs, and government initiatives for energy efficiency. Manufacturers focused on cost-effective, reliable, and remotely monitored meters for residential, commercial, and industrial applications. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of IoT-enabled, cloud-integrated, and automated metering solutions. Expansion of smart city initiatives, industrial electrification, and renewable energy integration will further boost adoption. India is projected to maintain strong growth due to rapid urbanization, industrial development, and increasing electricity consumption.

AMI electric meter market in Germany is growing at a CAGR of 7.2%. Between 2020 and 2024, growth was supported by modernization of electrical grids, renewable energy integration, and high-quality standards. Manufacturers focused on durable, high-precision, and energy-efficient smart meters with remote monitoring and automated billing. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of IoT-integrated, predictive maintenance-enabled, and cloud-connected meters. Increasing sustainability initiatives, regulatory support, and focus on energy efficiency will further drive market adoption. Germany remains a key European market due to advanced electrical infrastructure, renewable energy policies, and industrial electricity consumption.

AMI electric meter market in the United Kingdom is growing at a CAGR of 6.0%. During 2020 to 2024, adoption was driven by smart grid programs, residential and industrial metering upgrades, and energy efficiency initiatives. Manufacturers focused on accurate, durable, and remotely monitored meters with advanced data reporting capabilities. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of smart, cloud-connected, and IoT-enabled metering solutions integrated with renewable energy management. Expansion of utility modernization projects, regulatory compliance, and urban electrification will further support growth. The United Kingdom market demonstrates stable growth with emphasis on accuracy, reliability, and sustainability.

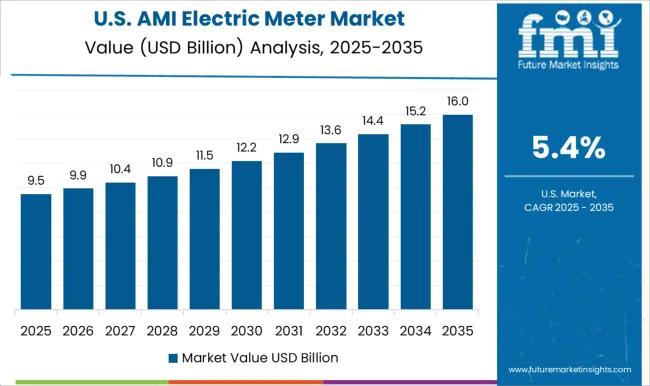

AMI electric meter market in the United States is growing at a CAGR of 5.4%. Historical period 2020 to 2024 saw growth fueled by smart grid initiatives, industrial electrification, and increasing adoption of digital metering solutions. Manufacturers focused on high-performance, durable, and remotely monitored meters with automated billing capabilities. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of IoT-enabled, predictive maintenance, and cloud-integrated metering systems. Expansion of renewable energy integration, energy efficiency programs, and smart city projects will further support market adoption. The United States market demonstrates consistent growth with emphasis on technology integration, reliability, and energy efficiency.

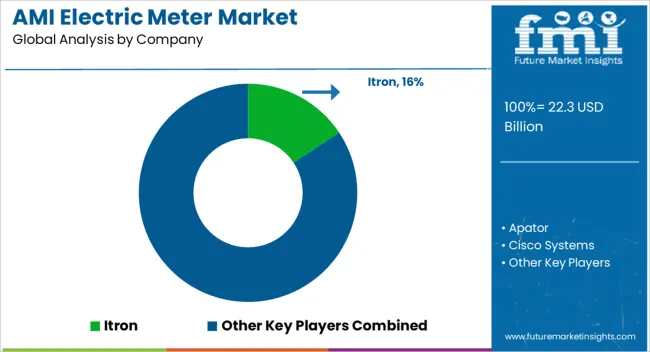

The AMI electric meter market is supplied by Itron, Apator, Cisco Systems, General Electric, Honeywell International, Kamstrup, Landis+Gyr, Larsen & Toubro, Mitsubishi Electric, Schneider Electric, Sensus, Siemens, and Trinity Energy Systems. Competition is driven by meter accuracy, communication protocols, interoperability, and advanced data analytics. Itron and Kamstrup brochures highlight smart meters with real-time monitoring, remote diagnostics, and cloud integration. Landis+Gyr and Schneider Electric datasheets detail modular designs, two-way communication capabilities, and automated outage detection. Observed industry patterns include adoption of IoT-enabled solutions, cybersecurity compliance, and energy consumption tracking features.

Supplier strategies focus on expanding digital solutions, enhancing customer service, and targeting utility-scale deployments. Honeywell International and Siemens emphasize scalable smart metering networks with software analytics for load management and predictive maintenance. General Electric and Mitsubishi Electric prioritize integration with grid management systems and supporting demand response programs. Apator and Trinity Energy Systems invest in interoperability with legacy infrastructure, advanced AMI software, and performance-based service contracts. Observed practices include collaboration with utilities, multi-site monitoring solutions, and investment in R&D for improved metering precision and reliability. Product brochures provide technical details including voltage range, current rating, communication interfaces, data logging, and environmental certifications. Itron and Kamstrup datasheets include advanced encryption standards, remote firmware update capabilities, and power quality monitoring.

Landis+Gyr and Schneider Electric highlight modular installations, compatibility with smart grid systems, and user-friendly dashboards. Honeywell International and Siemens provide performance curves, accuracy classes, and network configuration options. Verified technical information enables utilities, energy service providers, and system integrators to select AMI meters optimized for operational efficiency, regulatory compliance, and scalable deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.3 billion |

| Application | Residential, Commercial, and Utility |

| Technology | RF, PLC, and Cellular |

| Phase | Single and Three |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Itron, Apator, Cisco Systems, General Electric, Honeywell International, Kamstrup, Landis+Gyr, Larsen & Toubro, Mitsubishi Electric, Schneider Electric, Sensus, Siemens, and Trinity Energy Systems |

| Additional Attributes | Dollar sales vary by meter type, including smart meters, prepayment meters, and interval meters; by communication technology, such as RF, PLC, and cellular; by application, spanning residential, commercial, and industrial electricity monitoring; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by smart grid adoption, energy management initiatives, and rising demand for real-time consumption monitoring. |

The global AMI electric meter market is estimated to be valued at USD 22.3 billion in 2025.

The market size for the AMI electric meter market is projected to reach USD 41.0 billion by 2035.

The AMI electric meter market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in AMI electric meter market are residential, commercial and utility.

In terms of technology, rf segment to command 52.4% share in the AMI electric meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Based Carbon Capture Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Amino Resin Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amino Acids Premixes Market

Amine Additives in Paints and Coatings Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

AMI Water Meter Market Size and Share Forecast Outlook 2025 to 2035

Laminar Airflow Trolley Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Gaming Laptop Market Size and Share Forecast Outlook 2025 to 2035

Laminar Airflow Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Gaming Console Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA